Weekly Insights 9 Sep 2022: Will inflation abate in the Middle East amid economic recovery signals?

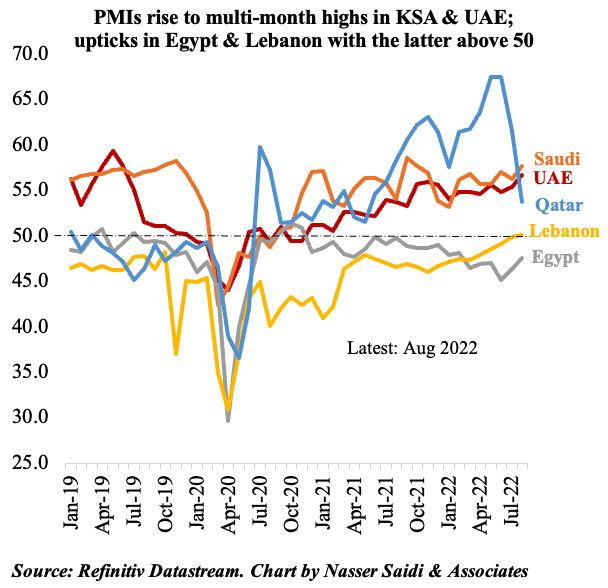

1. PMIs signal economic recovery in the Middle East, alongside easing of input costs from recent highs

- Non-oil economic activity in both Saudi Arabia and UAE ticked up in Aug (highest since Oct 2021 and Jun 2019 respectively), thanks to strong domestic demand; export orders are still relatively muted

- Businesses are cautious in passing on costs to consumers (in UAE & KSA), with most firms absorbing hikes and offering extra discounts (as cost pressures eased)

- Qatar’s PMI softened to 53.7 in Aug (Jul: 61.5): both output and new orders rose, but at a moderate pace; while firm cut headcounts, optimism grows underpinned by the World Cup megaevent this year

- Lebanon and Egypt also saw increases in PMI, with the former crossing the 50-mark (probably an impact from the summer holiday season). Input costs inched up at a much softer rate in both nations, offering some relief. But sentiment remains weak given Lebanon’s political uncertainty and high inflation and supply worries in Lebanon

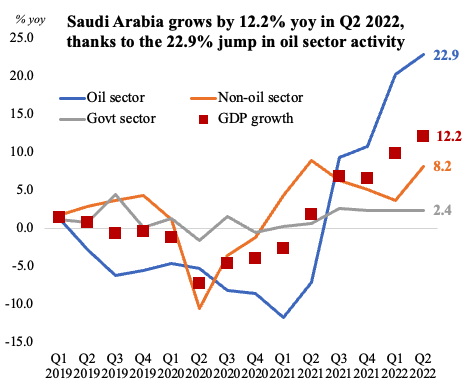

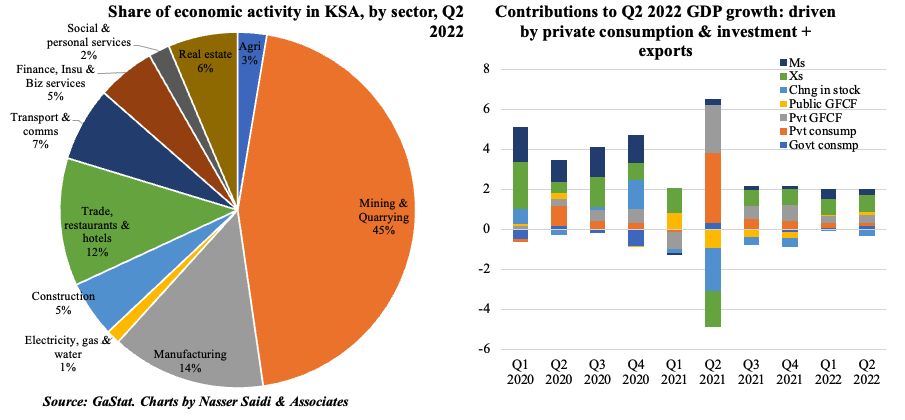

2. Saudi GDP reaffirms the growth story, with non-oil sector growing by 4.5% qoq

- Saudi GDP grew by 12.2% yoy in Q2, the highest growth rate since Q3 2011, and higher than Q1’s 9.9% expansion

- While the oil sector grew by a rapid 22.9% yoy and 4.4% qoq, non-oil sector also impressed, rising by 8.2% yoy (highest since Q2 2021) and 4.5% qoq (the highest in 3 years)

- Among the non-oil sector, wholesale & retail trade, restaurants & hotels notched up the highest gains (16.4% yoy & 19% qoq) followed by construction (8.8% yoy & 8% qoq, not surprising given the mega projects in NEOM and Riyadh)

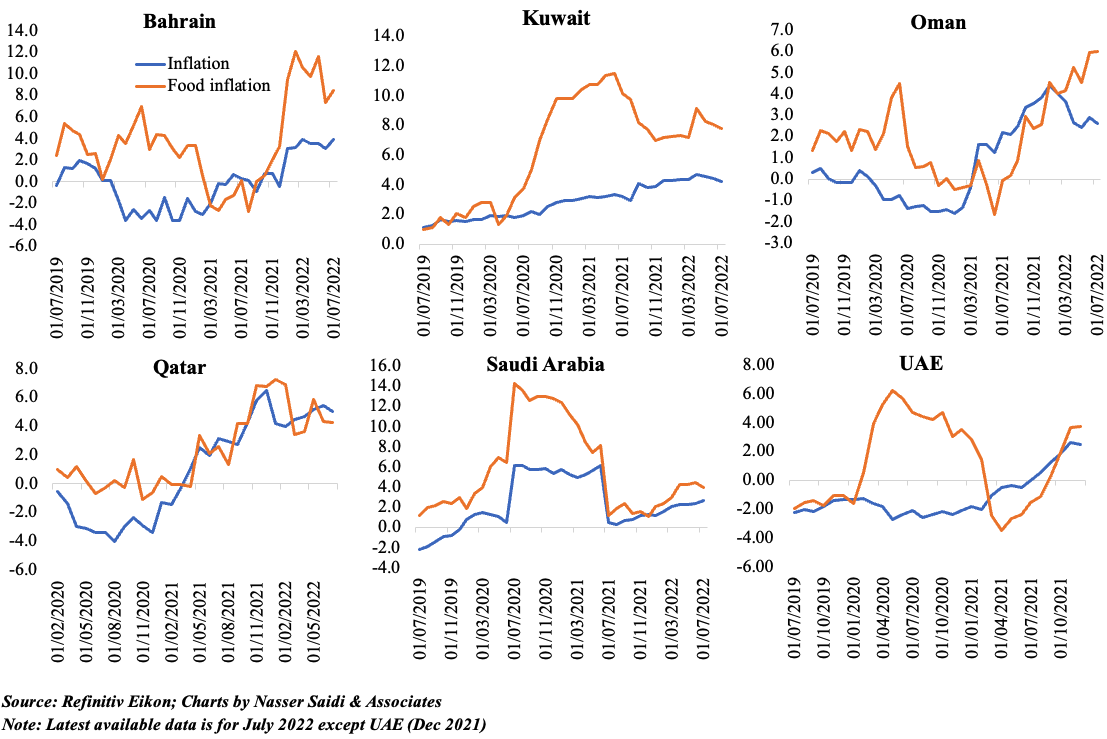

3. Overall inflation is relatively muted in the GCC… though food inflation is a concern

4. But is Double Digit in Egypt & Triple-Digit in Lebanon

- Egypt’s annual urban inflation rose to 14.6% in Aug (Jul: 13.6%) – the highest since Nov 2018, also much above the upper limit of the central bank target of 5-9%. Food and beverage costs grew (23.1%), but core inflation also inched up (16.7% from 15.6%)

- Weaker EGP + import restrictions + fuel price rises (3X this year) : unlikely that inflation has peaked yet

- Currently, overnight deposit and lending rates stand at 11.25% and 12.25%. We believe that after holding interest rates steady at last 2 meetings, the CBE will have to raise rates before year-end – more a question of by how much, under the new central bank governor

- However, given its “too-big-to-fail” stature, Egypt has received financial support from the UAE, Saudi Arabia and Qatar, in addition to investments in development projects

- Inflation in Lebanon stood at 168.4% yoy in Jul, the lowest since Sep 2021 and easing from Jun’s 210%. However, transport and food and beverages costs continue at very high levels (353.85% and 240.2% respectively in Jul). Triple-digit headline inflation levels have been in place for 25 straight months & largely a result of the LBP depreciation on the parallel market as well as supply shortages

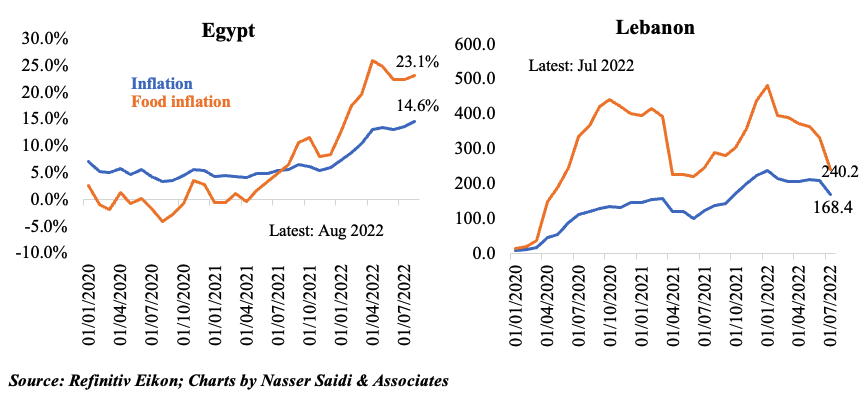

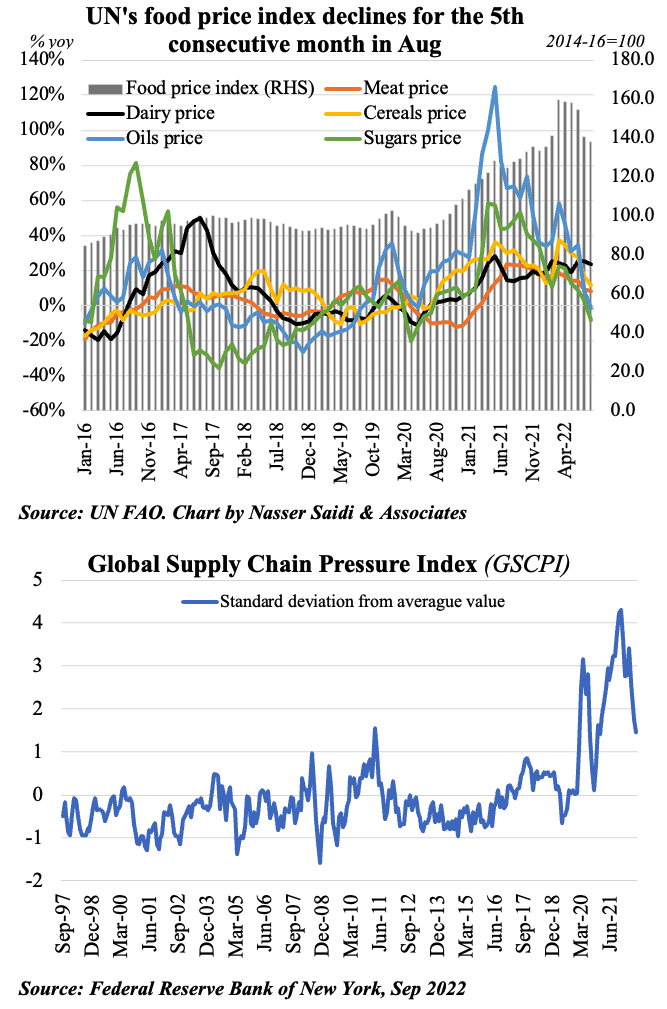

5. UN food price index falls for the 5th consecutive month, but other constraints will keep prices high in the near-term

- The UN FAO’s global food price index fell for the 5th month in a row, with the index lower in Aug (138) than it was pre Russia-Ukraine conflict (135.6 in Jan 2022): partly due to the deal agreed to re-open ports in Ukraine (resulting in lower cereal prices) and also given prospects for strong harvests in the US, Canada, Russia

- The pass-though of this decline into countries’ inflation readings will be slow, given the below factors:

- Fertiliser prices are rising after Russia limited its exports (accounts for 14% of global fertiliser exports)

- While FDNY’s GSCPI shows that global supply chain pressures have been declining for the past 4 months, it is still near historical highs;

- Cost of processing, transportation & logistics remain high following the pandemic;

- Strong USD also affects purchasing power of many developing nations

- UN estimates that food prices could rise an additional 8.5% from current levels by 2027 (worst-case scenario)

- Food security could become a serious risk, especially with spending on food reaching ~60% of monthly income among low-income households=> potential social unrests