Markets

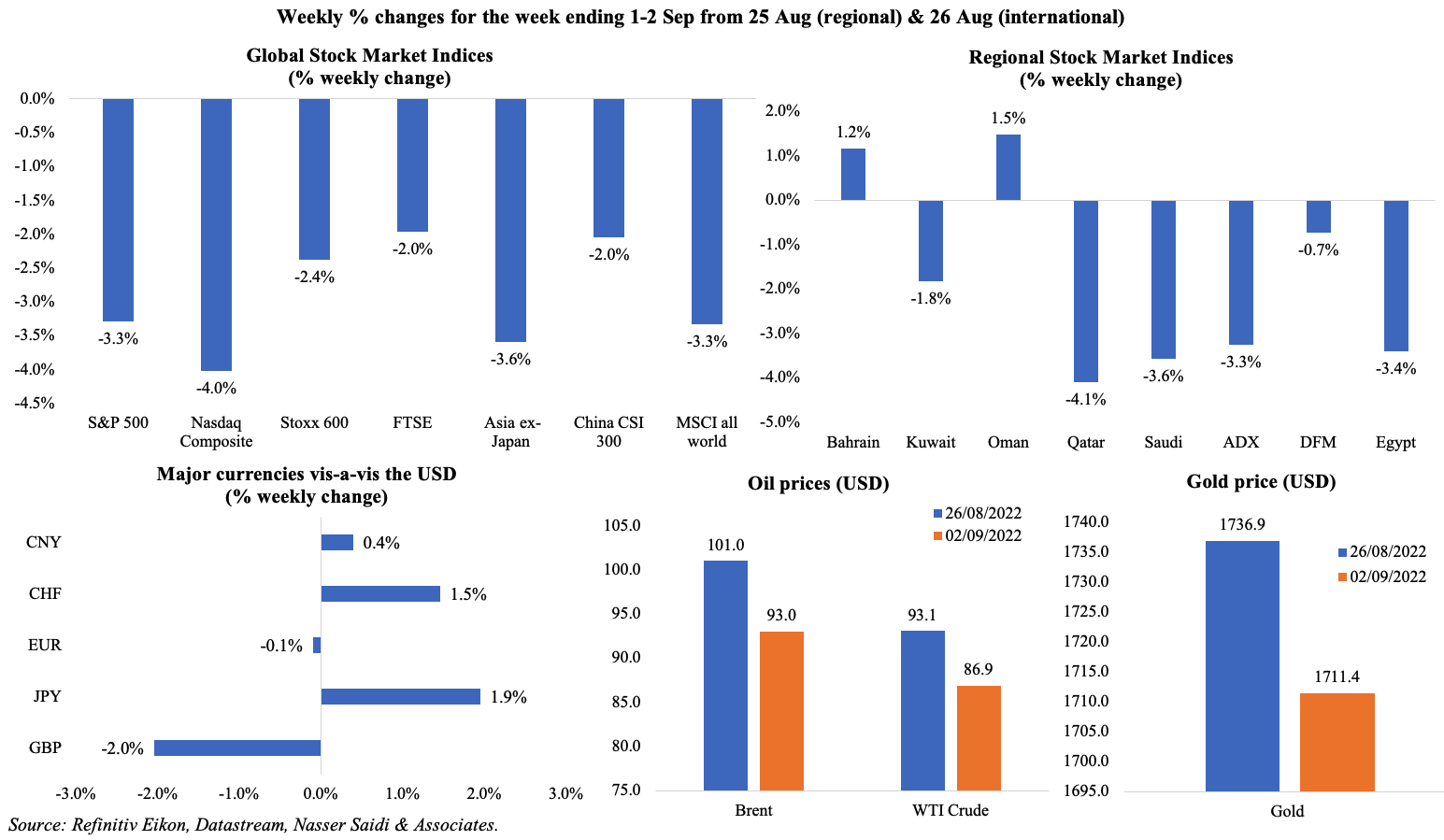

Global equity markets had a disappointing week, with most major markets ending in the red: US markets and the MSCI world index posted their 3rd consecutive week of losses while the European markets hit a six-week low before edging higher on Fri. Regional markets reflected the lower oil price movement and reported losses last week: Saudi Arabia posted its biggest intraday fall in 2 months on Wednesday; interest rate hikes and recessions fears are playing out in the market. Among currencies, the dollar touched a fresh 24-year high vis-à-vis the yen and the dollar index recorded a 20-year high vs a basket of 6 currencies. Both oil and gold prices fell compared to a week before, though oil climbed on Fri on output cut expectations from today’s OPEC+ meeting.

Global Developments

US/Americas:

- Non-farm payrolls increased by 315k in Aug, much lower than Jul’s 526k and the lowest monthly gain since Aug 2021. Professional and business services led payroll gains (+68k), with health care and retail sectors following closely behind (48k and 44k respectively). Unemployment rate rose to 3.7% (Jul: 3.5%), as labour force participation rate improved to 62.4% (Jul: 62.1%) while the average hourly earnings remained unchanged at 5.2% yoy.

- Private sector employment increased by 132k jobs in Aug, declining from Jul’s reading of 270k. Services-related industries added the most positions (+110k).

- Initial jobless claims declined by 5k to 232k in the week ended Aug 26th, the lowest level since Jun 25th, lowering the 4-week average to 241.5k. Continuing jobless claims rose by 26k to 1.438mn in the week ending Aug 19th.

- JOLTS job openings increased to 11.239mn in Jul (Jun: 10.475mn): this was nearly double the total pool of available workers, which stood at 5.67mn.

- Non-farm productivity fell by 4.1% in Q2 (revised higher than the preliminary reading of a 4.6% drop) while unit labour costs was revised down to 10.2% (earlier estimate: 10.8%). In Q2 2021, productivity declined by 2.3% and unit labour costs rose by 9.4%.

- Factory orders fell by 1% mom in Jul (Jun: +1.8%), falling across both durables (-0.1%) and non-durables (-1.9%).

- Dallas Fed manufacturing business index improved to -12.9 in Aug, better than Jul’s 20.2 reading, with the new orders index remaining negative for the 3rd consecutive month.

- Chicago PMI inched up to 52.2 in Aug, slightly higher than Jul’s 23-month low of 52.1.

- ISM manufacturing PMI remained unchanged at 52.8 in Aug: both new orders and employment indices moved up from below-50 (to 51.3 and 54.2 respectively) while production slowed (to 50.4 from 53.5 in Jul) prices paid fell to 52.8 from Jul’s 60.

- S&P Global US manufacturing PMI was revised up to 51.5 in Aug, the lowest since Jul 2020, from a preliminary reading of 51.3. Output contracted for a 2nd consecutive month, new orders fell for a 3rd straight month amid weak client demand and new export orders fell at the 2nd-sharpest pace in 27 months.

- S&P Case Shiller home price indices rose by 18.6% yoy in Jun, weaker than May’s 20.5% gain. Prices are softening due to rising mortgage rates, but these growth rates are “at or above the 95th percentile of historical experience”.

Europe:

- The flash estimate of inflation in the eurozone inched up to a record high 9.1% in Aug (Jul: 8.9%); while energy prices decelerated in Aug, it was up 38.3% yoy. Core inflation increased to 4.3% from 4% the month before.

- Producer price index in the eurozone rose further to a new record high 37.9% yoy in Jul (Jun: 36%), with the largest pressure from energy prices (+97.2%).

- Harmonised index of consumer prices in Germany rose to a record-high 8.8% yoy in Aug. Separately, the government unveiled a EUR 65bn package (including benefit hikes and a public transport subsidy), following two previous packages totalling EUR 30bn; this decision came after a Russian announcement that it was suspending some gas deliveries indefinitely.

- Manufacturing PMI for Germany stayed below-50 for the second consecutive month in Aug, at 49.1 (Jul: 49.3) – with lower new domestic and export orders. Though inflationary pressures have eased, increased energy prices keep the overall costs near historic highs.

- Eurozone’s manufacturing PMI reading for Aug edged down to a 26-month low of 49.6 from Jul’s 49.8, with output and new orders falling sharply. Price pressures eased, with input cost and output charge inflation slowed to 19- and 16-month lows respectively.

- Euro area’s business climate index eased to 0.83 in Aug (Jul: 1.14). Consumer confidence improved to -24.9 from Jul’s record low of -27. Economic sentiment indicator edged down to 97.6 in Aug (Jul: 98), the lowest reading since Feb 2021.

- Germany’s exports and imports fell by 2.1% and 1.5% mom respectively, causing the trade surplus to narrow to EUR 5.4bn from the previous month’s EUR 6.2bn. Germany’s exports to Russia dropped 15.1% to EUR 1bn, while imports declined by 17.4% to EUR 2.9bn.

- Retail sales in Germany rebounded in Jul, rising by 1.9% mom (Jun: -1.5%): this is the largest increase since Jun 2021, thanks to food and online sales (2.1% and 9.2% respectively).

- Germany’s unemployment rate rose to 5.5% in Aug (Jul: 5.4%), with the numbers rising due to the increase in Ukrainian refugees in the labour market. Unemployment rate in the eurozone eased to a record low of 6.6% in Jul (Jun: 6.7%), with the number of jobless people dropping by 77k in the month.

- UK manufacturing PMI slipped to 47.3 in Aug, the first below-50 reading since May 2020, from Jul’s 52.1 but higher than the flash estimate of 46, affected by lower demand from both domestic and overseas consumers. Output, new businesses and export orders contracted amid delayed input delivery and labour shortages among others.

Asia Pacific:

- China’s NBS manufacturing PMI improved in Aug, but stayed below-50, clocking in 49.4 (Jul: 49.2): output, new orders and export sales stayed under the 50-mark (at 49.8, 49.2 and 48.1 respectively). Non-manufacturing PMI declined to a 3-month low of 52.6 in Aug (Jul: 53.8): though new orders, export sales and employment sub-indices improved in Aug, it remained below the 50-mark.

- China’s Caixin manufacturing PMI unexpectedly slipped to 49.5 in Aug (Jul: 50.4), the first contraction since May. Input costs fell for the first time since May 2020.

- Railway travel in China touched an 8-year low during the summer season: only 440mn trips were taken during the period Jul 1st to Aug 31st. With new lockdowns, trips this year was down by 4.8% compared to the same period in 2021 and 3.5% lower than in Jul-Aug 2020 (during the height of the pandemic).

- India’s GDP grew by 13.5% yoy in Apr-Jun 2022 (Q1: 4.1%), with the main driver being domestic demand while gross fixed capital formation as a % of GDP stood at 34.7% – the highest Q1 reading in a decade.

- Manufacturing PMI in India edged down slightly to 56.2 in Aug (Jul: 56.4), but demand conditions supported growth of output and new orders (to the strongest since Nov) while input costs eased to a year low.

- Infrastructure output in India grew by 4.5% in Jul (Jun: 13.2%), with coal and electricity sector expanding by 11.5% yoy in Apr-Jul.

- Japan’s coincident index stood at 98.6 in Jun, down from a preliminary reading of 99 (May: 94.9): this was the highest reading since Sep 2019. The leading economic index slipped to 100.9 in Jun from May’s 101.2 – this was the lowest reading since Mar.

- Industrial production in Japan inched up by 1% mom in Jul (Jun: 9.2%), supported by increases in production of motor vehicles (12%), general-purpose and business-oriented machinery (8.6%) and production machinery (5.9%). In yoy terms, IP fell for the 5th straight month, down by 1.8% and following a 2.8% drop the month before.

- Japan’s preliminary manufacturing PMI slipped to 51.5 in Aug (Jul: 52.1), partly due to a decline in new orders while the backlogs of work decreased for the first time in 18 months.

- Unemployment rate in Japan remained unchanged at 2.6% in Jul, for the 3rd consecutive month. Jobs to applicants’ ratio inched up to 1.29 (Jun: 1.27) – the highest since Apr 2020.

- Retail trade in Japan rebounded by 0.8% mom in Jul (Jun: -1.3 %); in yoy terms, sales expanded by 2.4%, posting the 5th consecutive month of increase.

- Singapore PMI stood at 50 in Aug (Jul: 50.1), the 26th straight month of expansion. Electronics sector PMI fell to 49.6 in Aug (Jul: 50.5), after 2 years of above-50 readings.

Bottom line: Global manufacturing PMI fell to a 26-month low of 50.3 in Aug (Jul: 51.1), with declines across output and new order intakes; a silver lining was the easing of both input costs and output price inflation. The outlook is not too promising what with Europe already bracing for a harsh winter, with high energy costs (Russia halting Nord Stream has already sent EU gas prices high, up about 400% versus a year ago), while in China fresh lockdowns being reported are igniting fresh worries about growth amid hawkish comments from the Fed. We believe that when the ECB meets on policy this week, it stands likely to opt for a higher-than-expected hike (of 75bps instead of the 50bps) if the latest PMI and inflation readings are anything to go by. Another key event is the OPEC+ meeting today to decide on production – the Wall Street Journal reported (citing sources) that Russia does not support an oil production cut and chances were that the output would be kept unchanged. Oil prices have been reined in by the subdued fuel demand and interest rate hikes from major central banks (to combat inflation).

Regional Developments

- Bahrain plans to restructure the board of the sovereign wealth fund Mumtalakat, reported the state news agency. The SWF has USD 18bn+ in assets under management.

- The Central Bank of Egypt revealed that Arab nations’ deposits at the apex bank increased to USD 13bn at end-Mar 2022. UAE and Saudi Arabia deposited USD 5bn each and Qatar placed USD 3bn while USD 2.8bn was deposited under the currency swap agreement with the People’s Bank of China. The ratio of short-term debt to net international reserves jumped to 71.3% in Mar 2022 from 33.8% at end-Jun 2021.

- Egypt’s finance minister disclosed that the government will relaunch its IPOs programme; the nation also plans to issue CNY-denominated bonds worth more than USD 500mn.

- Stock market capitalization of Egypt’s exchange grew by a record EGP 51.8bn (USD 2.7bn) in Aug, or up 8.2% mom to EGP 685bn. A bourse report indicated that Egyptians contributed 82.8% of the value traded in listed stocks, foreigners 11.9%, and Arabs 5.3%.

- Egypt’s Financial Regulatory Authority issued its first Islamic micro-financing license to Egyptian Microfinance Co., known as Maksab. With this, the number of firms authorized to engage in micro-financing reached 19.

- Reuters reported citing sources that Egypt likely bought 120k tonnes of Russian wheat via direct talks. The nation has resorted to buying wheat via private direct talks with global companies than its previous practice of issuing international purchasing tenders.

- Egypt’s President announced an increase in the exceptional bonus to state subsidy cards to EGP 300 (USD 15.62) from 100. Additionally, allocations for the bread subsidy program was also increased by EGP 32bn.

- Oil production in Iraqi Kurdistan could almost halve by 2027 if there is no new exploration or major investment, reported Reuters citing government documents. If investment is fully optimized, oil output could rise to 580k barrels per day in 5 years, implying 530k bpd would be available for exports.

- Cash transactions via ATMs accounted for only 11% of total transactions by Kuwait residents while online payments share stood at 28% in H1 2022, with the rest direct payments through PoS. Overall, total transactions grew by 37.5% yoy to 392.94mn in H1 2022.

- Lebanon’s banking secrecy law is a “substantial reform” but has not resolved “key deficiencies”, according to an IMF assessment. The IMF called for providing more government departments with access to banking data including for administrative functions (not limited to part of criminal investigations, as the current draft mentions).

- Oman’s Islamic banking sector assets grew by 9.6% yoy to OMR 6.2bn in Jun: this accounted for 15.9% of total banking sector assets, according to the central bank.

- The Oman Tax Authority confirmed that goods and services supplied via the e-commerce sector would be subject to VAT.

- The volume of imported goods via Oman’s seaports grew by 28.4% yoy to 15.7mn tonnes in Jan-May 2022; the value of such goods increased by 37.4% to OMR 4.1bn.

- Qatar’s central bank issued its first license for digital payments services: to iPay by Vodafone Qatar and Ooredoo Money.

- Qatar plans to build the world’s largest “blue” ammonia plant: this plant is expected to come online in Q1 2026 and produce 1.2mn tons per year, according to the chief executive of QatarEnergy. The facility will cost USD 1.156bn to build and capture and sequester 1.5 million tons of carbon dioxide a year through the manufacturing process.

- A Reuters survey found that OPEC oil output rose to 29.58mn barrels per day (bpd) in Aug 2022, the highest since Apr 2020 and up 690k bpd from Jul. Output in Libya clocked in the largest increase (400k bpd) while the second largest was from Saudi Arabia (100k bpd).

Saudi Arabia Focus

- Non-oil sector PMI in Saudi Arabia improved in Aug, rising to 57.7 in Aug (Jul: 56.3), the highest level since Oct 2021, with expansions recorded across multiple sub-indices including output, new orders, stocks of purchases and employment.

- Saudi Arabia’s net foreign assets climbed by 2% yoy to SAR 1.67trn in Jul though it dropped by 0.6% monthly. Total assets of the central bank exceeded SAR 2trn (USD 535bn) for the first time since Feb 2017.

- Money supply (M3) in Saudi Arabia increased by 8.1% yoy in Jul, slightly lower than Jun’s 8.9%. Private sector loans grew by 13.8% yoy to SAR 2.2trn in Jul, slower than the previous months 14.1% pace; it edged up by just 0.3% mom terms, the slowest rate since May 2020.

- Total assets of Saudi Arabia’s investment funds dropped by SAR 23.2bn (USD 6.2bn) in the Q2 2022, according to SAMA: this was the steepest decline since Q2 2006.

- Foreign ownership in Saudi Tadawul slipped down to SAR 354bn (USD 94bn) at end-Jun from SAR 392bn at end-Mar. Ownership of qualified foreign investors touched SAR 284bn by end-Jun, after clocking in the highest level of SAR 340bn in Apr 2022.

- Remittances from Saudi Arabia declined by 7.3% yoy and 12% mom to SAR 11.6 (USD 3.09bn) in Jul.

- The number of registered SMEs in Saudi Arabia touched 892,063 at end-Jun, up by 25.6% from Q4 2021, according to Monsha’at quarterly report titled SME Monitor. Riyadh and Makkah accounted for 35.4% and 21% of total SMEs; interestingly, 45% of SMEs are now headed by women. The food and beverages sector in Saudi Arabia grew by 6.3% yoy in H1 2022 (Monsha’at), with startups in the sector attracting USD 187mn in venture capital investments during H1(MAGNiTT).

- Saudi Arabia launched a new tourist visa scheme, easing entry for GCC residents as well as residents of the UK, US and EU – allowing them to apply for an e-visit visa online.

- The value of demand for tourism sector services in Saudi Arabia jumped by 105% yoy to SAR 4.1bn (USD 1bn) during H1 2022. Al Watan newspaper reported that total value of reservations surged by 108% yoy to SAR 2.5bn in Q2 2022.

- The Saudi Arabian Mining Co. (Ma’aden) signed four initial agreements aimed at doubling imports of its phosphate products and ammonia to India in 2023.

- With the entry of three new international cinema operators in the Saudi market – UAE’s Reel Cinemas, South Africa’s Nu Metro and Lebanon’s Grand Cinemas – the number of screens will likely rise to 2500 over the next 5 years, according to the General Commission for Audiovisual Media.

- Saudi Arabia’s Public Investment Fund (PIF) launched the National Real Estate Registration Services Co. to digitize and develop the local real estate sector. Aimed to enhance transparency, the platform will help build a comprehensive digital database of all public, residential, commercial, and agricultural properties in the country.

UAE Focus![]()

- UAE PMI surged to 56.7 in Aug (Jul: 55.4), posting the highest reading since Jun 2019, supported by strong domestic sales (export business meanwhile only inched up slightly) and employment rising to the strongest in a year. Stock levels rose at the fastest pace since Aug 2020.

- Gross assets of UAE banks inched up by 0.2% mom to AED 3449bn (USD 939bn) at end-Jun, according to central bank data.

- UAE’s monetary aggregates M2 & M3 increasedin Jun; currency in circulation inched up by 1.8% mom in Jun, but the monetary base contracted by 1.5% to AED 470.7bn.

- Total bank deposits in the UAE grew by 2.5% mom to AED 2,092bn in Jun. Deposit growth outpaced loans & advanced in 2022: 4.8% year-to-date (ytd) vs 4% ytd. In Jun alone, domestic credit declined by 0.6% momand credit to the private sector fell by 1.2%.

- Dubai-based school operator Taaleem plans to proceed with its IPO, after having received approval from its shareholders. The firm will first be converted to a public entity from a PJSC.

- Fuel prices in the UAE were lowered to a 6-month low in Sep, with prices per litre reduced by 62 fils (AED 0.62 or USD 0.17) from Aug. Further to the announcement, authorities in the emirates of Sharjah and Ajman have announced a reduction in taxi fares.

- UAE’s minister of state for foreign trade disclosed that the free trade deal with Turkey will be finalised in the coming weeks – around 4 months since negotiations launched. This will follow deals already signed with India, Israel and Indonesia.

- Dubai Diamond Exchange traded USD 19.8bn worth of diamonds in H1 2022, up by 24.7% yoy, according to the head of DMCC.

- Around 219k female citizens in the UAE invested AED 34.6bn (USD 9.4bn) at the Abu Dhabi bourse from Jan to mid-Aug 2022, according to the Abu Dhabi Securities Exchange. This is a substantial increase of 74.7% compared to last year. As of mid-Aug, Emirati women accounted for 89.8% of all women trading on the Exchange.

- ADNOC sent the first-ever shipment of low-carbon ammonia from the UAE to Germany last week.

- Emirates Airlines disclosed that it had carried over 10mn passengers over the summer months, operating nearly 35k flights to about 130 destinations. The airline is currently at 74% of its pre-pandemic network capacity and plans to increase this to 80% by end -2022.

- Banking sector employees in the UAE inched up to 34,332 as of end-Jun, up 2.51% from end-Dec 2021. Licensed banks totalled 60 in H1 2022, including 23 national banks, 2 digital banks and 37 foreign banks.

Media Review

Factbox: Europe’s alternatives if Russia shuts off gas supply

Will the Dollar’s Surge End in Whiplash?

Can a huge, former World Expo site be turned into a city?

https://m.youtube.com/watch?v=bUv_UbkLum4

Should Public Transit be Free? Freakonomics Podcast

https://freakonomics.com/podcast/should-public-transit-be-free/

Currency tops list of challenges for Egypt’s new central bank governor