Weekly Insights 2 Sep 2022: Global headwinds: lower global trade volumes amid inflation & cargo costs; oil exporters gain

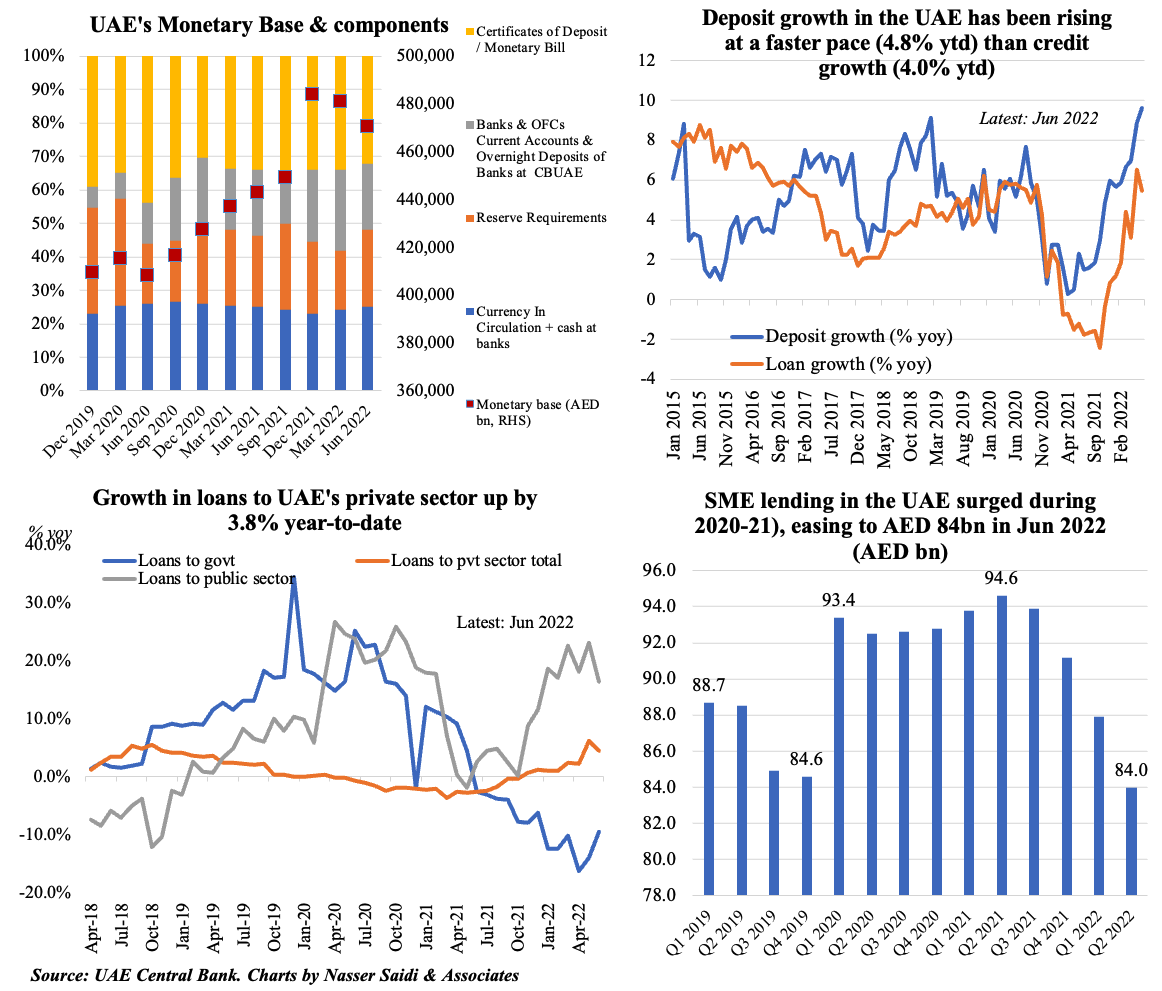

1. WTO’s Goods Trade Barometer stays stable in Jun; components point to stagnating trade growth in Q2, Q3

- According to the WTO, global merchandise trade volume slowed to 3.2% yoy in Q1 2022 (Q4: 5.7%), largely due to the economic uncertainty stemming from the Ukraine crisis and Covid19-related lockdowns in China.

- The Goods Trade Barometer stood at 100 in Jun 2022, same as the baseline value, but below the merchandise trade volume => trade growth to slow in Q2 (though remaining positive).

- Among the drivers, export orders has slightly declined as has air freight and electronic components sub-indices. The largest positive was seen in the container shipping index, outperforming all others in Jun.

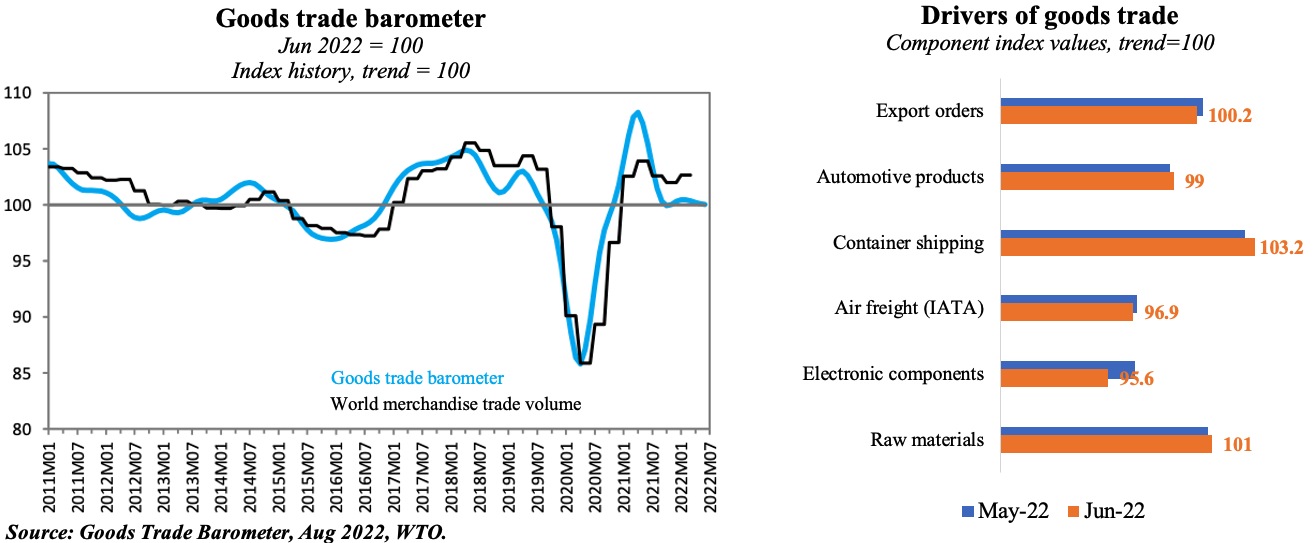

2. Potential trade slowdown also reflects global pain points

- A surge in global food prices (UN FAO) drove inflation, feeding into consumer demand & spending patterns. But pressures are abating.

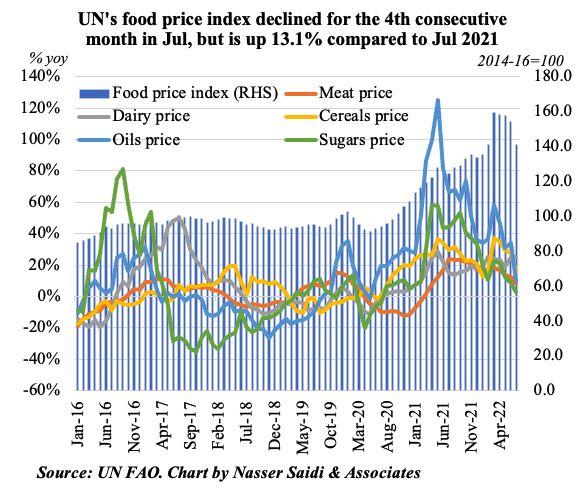

- Fed’s GSCPI shows that though global supply chain pressures have eased in recent months, it remains at historically high levels

- While the cost of shipping raw materials is declining (Baltic Dry Index), container-ship charter rates (tracked by Harpex Shipping Index) are still high vs pre-pandemic levels (due to port congestions, availability of vessels etc.). The high shipping costs also add on to rising inflationary pressures

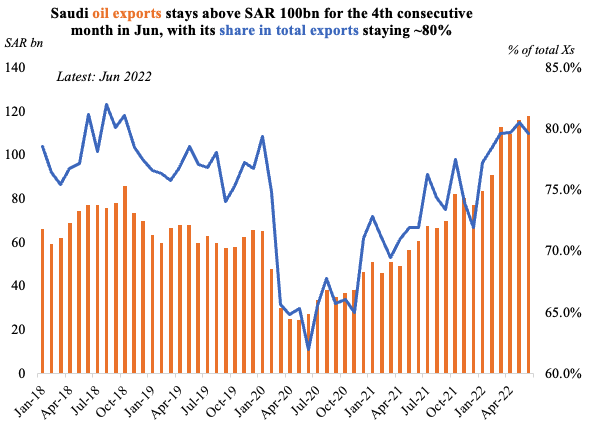

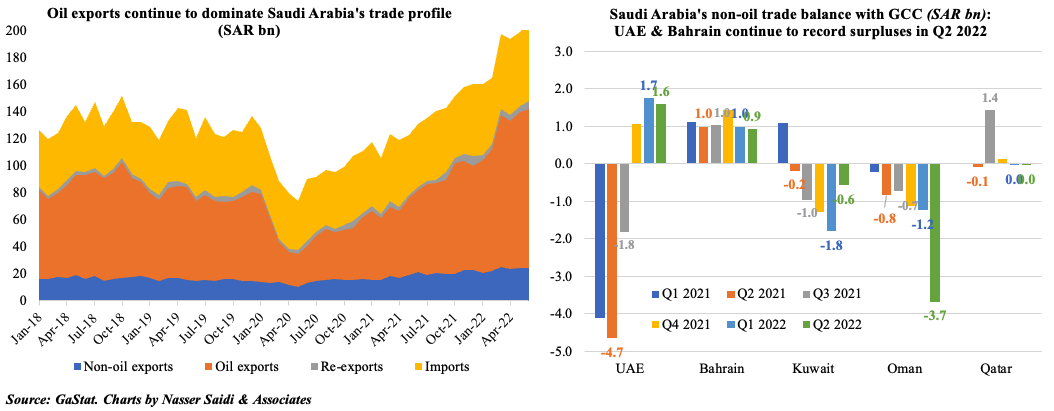

3. Saudi oil exports more than doubles in H1 2022 (vs H1 2021); non-oil exports grow by 30%

3. Saudi oil exports more than doubles in H1 2022 (vs H1 2021); non-oil exports grow by 30%

- Oil exports are the main driver of Saudi trade; it has averaged close to 80% of total exports in H1 this year

- Non-oil exports are also rising, thanks to an uptick in chemical products and plastics (7% and 6% of total exports respectively)

- As of Jun 2022, almost half of Saudi exports went to Asian non-Arab non-Islamic nations, followed by the EU (14%) and the GCC (9%)

- Among the GCC nations, both UAE and Bahrain continue to register trade surpluses with Saudi; Oman’s deficit widened in Q2 2022

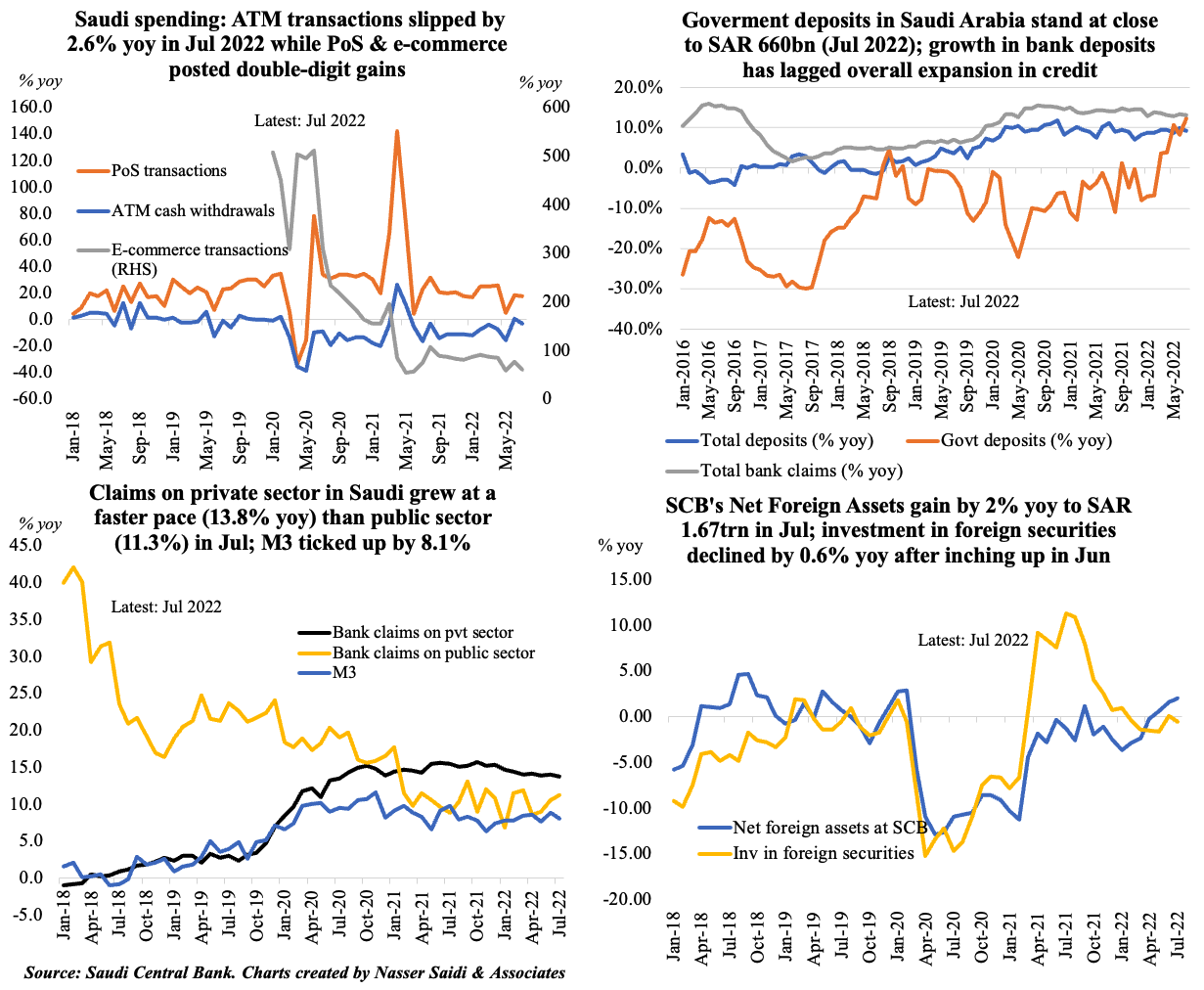

4. Key findings from Saudi monthly statistics

- Saudi consumer spending continues to rise in Jul; ATM transactions resumed its decline in Jul

- Net foreign assets climbed to SAR 1.67trn in Jul

- Total demand deposits grew (thanks to higher govt deposits), but still lags growth in bank claims

- New residential mortgages for individuals declined by 23.4% yoy in Jul, following a rebound in Jun

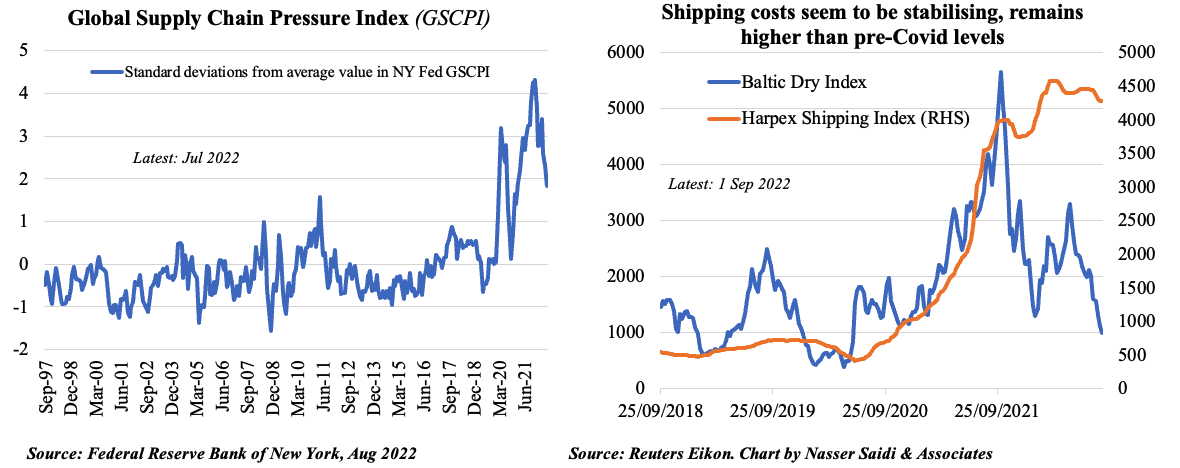

5. UAE released banking indicators for Jun 2022

- Monetary aggregates M2 & M3 increased in Jun; currency in circulation inched up by 1.8% mom in Jun, but the monetary base contracted by 1.5% to AED 470.7bn

- Deposit growth outpaced loans & advanced in 2022: 4.8% year-to-date (ytd) vs 4% ytd.

- In Jun alone, domestic credit declined by 0.6% mom & credit to the private sector fell by 1.2%.

- Lending to SMEs has been falling: it is down by 7.9% ytd