Markets

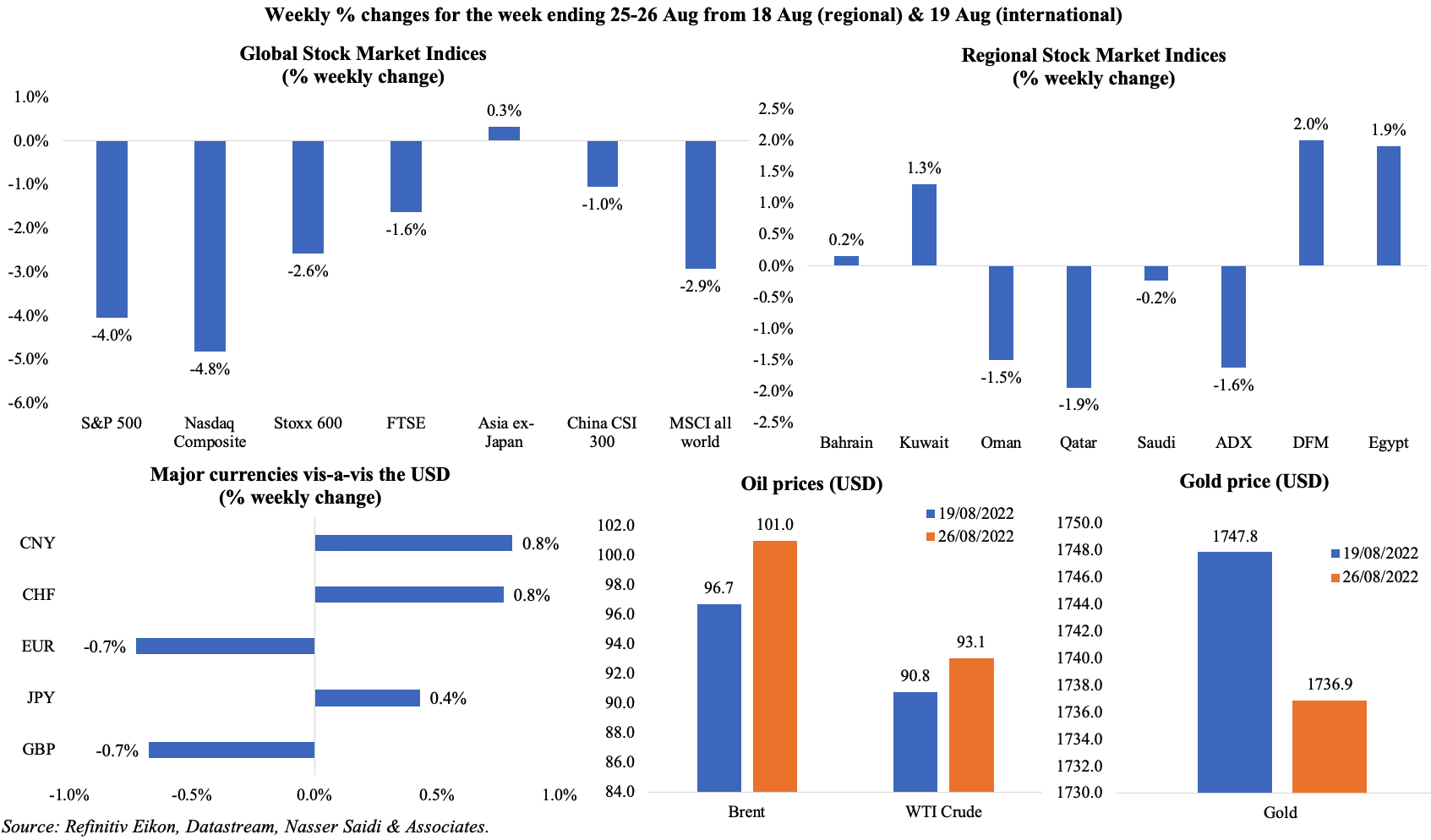

Global equities had a bad week, given the Fed’s hawkish message at the Jackson Hole conference: MSCI’s gauge of global stocks fell by 2.47% on Fri – its worst day in more than 2 months; pan-European STOXX 600 fell by 2.6% from a week before, after flash PMI readings disappointed. Regional markets were mixed, with many markets tracking oil gains. The GBP and EUR posted weekly losses after the dollar gained post-Powell’s speech (with the euro tumbling to a 20-year low near USD 0.99). For oil markets, the week started with Saudi minister’s comments suggesting a potential cut in output (next OPEC+ meeting is on Sep 5th) and prices remained volatile on concerns about supply tightness and fears of economic and geopolitical uncertainty; gold price fell by 1%+ on Friday alone, and posted a 0.6% weekly loss.

Global Developments

US/Americas:

- GDP in the US fell by a 0.6% annualised pace in Q2, revised down from the previous estimate of -0.9%, and better than Q1’s 1.6% decline. Consumer spending grew by 1.5% (from previous estimate of 1%).

- Personal income increased by 0.2% mom in Jul while spending was up by 0.1%. PCE price index dropped by 0.1% in Jul, the first drop since Apr 2020, while core PCE rose by 0.1% mom, the weakest since Feb 2021, and by 4.6% yoy in Jul (Jun: 0.6% mom and 4.8% yoy).

- At the Jackson Hole Symposium, Powell maintained a hawkish tone, stating that “restoring price stability will take some time” and that the Fed intends to use its tools to “forcefully” restore inflation to its 2% target.

- Durable goods orders remained unchanged in Jul after rising by 2.2% in Jun; non-defence capital goods orders excluding aircraft increased by 0.4% mom (Jun: 0.9%).

- Richmond Fed manufacturing index slipped to -8 in Aug from a reading of zero in Jul, with the indices for shipments and volume of new orders tumbled. Kansas Fed manufacturing activity declined to a 2-year low of -9 in Aug (Jul: 7).

- Chicago Fed National Activity Index rebounded to 0.27 in Jul from an upwardly revised Jun reading of -0.25.

- Michigan consumer sentiment index was revised upwards to 58.2 in Aug, from a preliminary reading of 55.1, as both expectations and current conditions sub-indices were revised higher to 58 and 58.6 (from 47.3 and 58.1 respectively).

- US manufacturing PMI slipped to 51.3 from 52.2 in Jul, posting the lowest growth in activity since Jul 2020, as output contracted and new export orders fell amid weaker customer demand. Services PMI plunged to 44.1 in Aug (Jul: 47.3), the sharpest fall since May 2020.

- Goods trade deficit in the US narrowed to USD 89.1bn in Jul (Jun: USD 99.5bn), the smallest since Oct, after imports fell by 2.5% to USD 270bn. Consumer goods shipments fell the most since at least 1992, down by 10% to USD 67.5bn.

- New home sales decreased for the second straight month, down by 12.6% mom to 511k in Jul – the lowest sales since Jan 2016. Pending home sales declined by 1% mom and 19.9% yoy in Jul. The 30-year fixed-rate mortgage declined to 5.30% at end-Jul (mid-Jun: 5.78% and early-Jan: 3.22%).

- Initial jobless claims declined by 2k to 243k in the week ended Aug 19th, placing the 4-week average to 247k. Continuing jobless claims also fell by 19k to 1.415mn in the week ending Aug 12th. Both indicators confirming a continuing strong labour market.

Europe:

- GDP in Germany grew by 0.1% qoq and 1.7% yoy in Q2, supported by household (+0.8% qoq) and government spending (+2.3% qoq), reaching pre-pandemic levels again.

- The preliminary manufacturing PMI for Germany inched up to 49.8 in Aug (Jul: 49.3) – export sales fell the most in over 2 years, while new orders shrank. Services PMI slipped down to 48.2 from 49.7 the month before – the largest decline since Feb 2021.

- Eurozone’s manufacturing PMI reading for Aug edged down to 49.7 from Jul’s 49.8 – the biggest decline since Jun 2020. Services eased to 50.2, down a point from Jul, posting the 4th consecutive month of slowdown in activity.

- Germany’s IFO business climate index dropped for the 3rd consecutive month in Aug, though easing by a minimal 0.2 points to 88.5. Current assessment and expectations fell by 0.2 and 0.1 points to 97.5 and 80.3 respectively. Separately, the Ifo institute’s index of exporter expectations fell to -2.7 in Aug from -0.4 points in Jul.

- Consumer confidence in the eurozone bounced back to -24.9 in Aug (Jul: -27) while in the EU sentiment inched up by 1 point to -26.

- GfK consumer confidence in Germany plunged to a record low of -36.5 in Sep (Aug: -30.9), with consumers stating that spare cash was being set aside for anticipated higher energy bills come winter.

- UK manufacturing PMI slipped to 46 in Aug (Jul: 52.1) – the first below-50 reading since May 2020, affected by lower demand from consumers, high costs, delayed input delivery and labour shortages among others. Services PMI edged down only slightly to 52.5 in Aug (vs 52.6 in Jul), helping composite PMI stay above-50 (50.9 in Aug). The UK is heading into recession in the coming quarter.

Asia Pacific:

- China lowered its 1-year and 5-year loan prime rates to 3.65% (from 3.7%) and 4.3% (from 4.45%) respectively. This followed a previous surprise MLF rate cut earlier this month.

- Inflation in Tokyo inched up to 2.9% yoy in Aug (Jul: 2.5%) while core CPI posted the fastest gain since Oct 2014 – rising to 2.6% (Jul: 2.3%). Excluding food and energy, CPI rose to 1.4% (Jul: 1.2%).

- Japan’s preliminary manufacturing PMI slipped to 51 in Aug (Jul: 52.1), with output contracting for a 2nd consecutive months and new orders shrank faster. Services PMI slipped into contractionary territory (49.2 in Aug from 50.3 in Jul), given weaker domestic demand.

- The Bank of Korea raised its benchmark policy rate by 25 bps to 2.5% to combat inflation (which is at an almost 24-year high). Separately, in an interview with Reuters, the central bank governor revealed that the apex bank could not stop its tightening before the Fed and will depend on the pattern of inflation (More: https://www.reuters.com/markets/asia/bank-koreas-rhee-says-rates-rise-until-inflation-defeated-2022-08-28/).

- Inflation in Singapore inched higher to 7% yoy in Jul (Jun: 6.7%), driven by an increase in prices of food, electricity, and gas. Core inflation rose to 4.8% (Jun: 4.4%), recording its fastest pace in more than 13 years.

- Singapore’s industrial production declined by 0.6% yoy in Jul, dragged down by the electronics and biomedical manufacturing sectors; IP fell by 2.3% mom in Jul (Jun: -8%).

Bottom line: Last week saw the release of disappointing flash PMI numbers and a few business/ consumer confidence indices. According to S&P’s flash PMI data, output contracted to a degree that – excluding the initial pandemic lockdowns – was the steepest since the global financial crisis in 2009. A similar sentiment is likely to be evident in official PMI data from China, due this week. While economic uncertainty is rising, upcoming inflation numbers (in Europe) and US non-farm payrolls report will be closely watched by major central banks. While still early to call, recession probabilities are rising, with the UK leading the way.

Regional Developments

- Saudi Energy Minister, in an interview with Bloomberg, stated that OPEC+ could cut output to correct the recent decline in oil prices. Various other ministers have supported this or made similar statements supporting OPEC+ efforts to maintain stability including from Sudan, Oman, Bahrain, Iran, Algeria, Libya and Congo among others; Reuters reported that UAE was also aligned with this thinking. The Saudi minister also highlighted that “very thin liquidity and extreme volatility” in the oil futures market was taking the focus away from spare capacity issues. Without giving any details, he hinted at a new OPEC+ agreement beyond 2022.

- Reuters reported that the OPEC+ nations produced 2.892mn barrels per day below their targets in Jul; compliance with production targets stood at 546% (Jun: 320%, when supply gap was 2.84mn bpd). More: https://www.zawya.com/en/business/energy/mena-weekly-crude-oil-exports-assessed-at-1513-mln-barrels-refinitiv-ylcdxo5l

- Value of Bahrain-origin exports grew by 29% yoy to BHD 421mn (USD 1.17bn) in Jul. Saudi Arabia, US and UAE were the top three export destinations, importing products worth BHD 87mn, BHD 74mn and BHD 53mn respectively.

- Egypt grew by 6.6% in the 2021-22 fiscal year (that ended on Jun 30th), from the previous year’s 3.3% and higher than the Cabinet’s earlier estimate of 6.2%. Growth in Q4 eased to 3.2% from 7.8% in Jul 2021-Mar 2022. Growth was supported by expansions in the restaurants and hotels sector (+45%) and communications (+16.3%).

- Egypt’s central bank increased cash withdrawal limits (to up to EGP 150k from EGP 50k previously) and removed restrictions on the amount that could be deposited.

- Bilateral trade between Bahrain and Egypt touched USD 917.2mn in 2021, up 128.7% yoy. Egypt’s exports to Bahrain surged by 223.5% to USD 450.7mn. However, Bahraini investments in Egypt declined by 8.2% to USD 160.4mn last year.

- In the first 6 months of 2021-22, UAE invested a total of USD 1.9bn in Egypt, surging by 169.1%. Bilateral trade between Egypt and UAE inched up by 1.4% yoy to USD 1.2bn in Q1 2022. Exports to the UAE grew by 69.5% to USD 576.7mn while imports from the UAE fell by 19% to USD 642.9mn.

- Moody’s expects Egypt to gradually devalue its currency to counteract the increase in inflation. Egypt’s exposure to GCC exceeded USD 25.9bn in liquid foreign exchange reserves at end-Jul. The rating firm rates Egypt at B2 (below investment grade) with a negative outlook.

- Egypt’s supply ministry disclosed the direct purchase of 240,000 tonnes of Russian wheaton a cost and freight basis, with payment via 180-day letters of credit. Separately, the supply minister disclosed that the agreement to buy wheat from India still holds (180k tons at a price of USD 400 per ton) though timing of the shipment is unclear. Total purchases this year stands at 1.8mn tonnes of imported wheat with strategic reserves at 7 months’ worth.

- Egypt signed initial agreements with seven global firms to implement green hydrogen projects in the Ain Sokhna industrial zone. The fuel will be used for export purposes and ship catering services.

- Talks between Iran and Saudi Arabia (the 5th round of which was held in Apr) are separate from the ongoing negotiations related to the 2015 nuclear pact, and such cooperation could help restore regional peace and security, following the reappointment of Ambassadors to Iran by the UAE and Kuwait.

- Iraq’s foreign currency reserves crossed USD 80bn and will likely reach USD 90bn by end of the year, according to the deputy governor of the central bank. Gold reserves have increased by 30 tonnes to more than 131 tonnes.

- Kuwait will hold parliamentary elections on Sep 29th to elect a new 50-sear assembly, reported KUNA.

- Inflation in Kuwait increased to 4.24% in Jul, with prices of food and beverages rising by a faster 7.75% and education up by 19.05%.

- Kuwait increased oil production to meet its OPEC+ commitment of 2.81mn barrels per day, disclosed the deputy PM and minister of oil.

- Producer price index in Oman ticked up to 40.7% yoy in Q2 2022, largely due to the 48.7% uptick in price of oil and gas products, according to NCSI data.

- About 23,271 Omani citizens were given employment in H1 2022, of whom 55% were employed in the private sector. The government plans to provide 35k job opportunities in the full year 2022.

- Oman’s government settled outstanding loans of 1169 SME owners and individuals, valued at OMR 2.45mn, also cancelling related prison sentences and property seizures.

- FIFA estimates that returns from the Qatar World Cup 2022 could reach USD 6bn; of the 3.2mn tickets available, one-third was issued to sponsors and carriers. The best-selling match tickets were for Mexico-Argentina and Saudi Arabia-Argentina, both sold out.

- Qatar Investment Authority aims to invest USD 3bn in Pakistan’s “various commercial and investment sectors”.

- Two major solar projects announced in Qatar – at Mesaieed and Ras Laffan – will more than double its solar energy output to 1.67 gigawatts by end-2024. The nation targets 5 GW of solar energy capacity by 2035.

- Saudi Arabia’s project market, valued at USD 1.35trn as of Aug 5th, constitutes almost half of Gulf Projects Index total value, according to MEED. Value of projects in UAE and Iraq follow at USD 515bn and USD 287bn respectively.

- IBM Security’s annual Cost of a Data Breach report indicated that average cost of data breaches in the Middle East stood at USD 7.45mn between Mar 2021-Mar 2022, up 7.6% from USD 6.93mn in the same period a year ago. The financial sector was most affected by data breaches, followed by health and energy sectors.

Saudi Arabia Focus

- Non-oil exports from Saudi Arabia grew by 31% yoy and 9.7% qoq to SAR 86.2bn (USD 22.9bn) in Q2. Chemical and allied industries which accounted for 35.3% of non-oil exports in Q2; oil exports accounted for 79.7% of the total. China, Japan and India were the top export destinations while imports came from China, US and the US.

- Saudi Arabia’s trade with the GCC grew by 11% to SAR 71.59bn (USD 19bn) in H1 2022. Among GCC states, UAE was the largest trade partner, accounting for 63.32% of total trade.

- Russia retained its rank as China’s top oil supplier for the 3rd month in July, with Saudi at second place with 6.56mn tons or 1.5mn barrels per day. In Jan-Jul 2022, Saudi oil exports to China stands at 49.84mn ton (-1% yoy) compared to Russia’s 48.45mn tons (+4.4%).

- Fuel imports into Saudi Arabia jumped by 60% yoy to 307k barrels per day in Jun, given increase in energy demand during the summer months. According to JODI, this is the highest yoy change since Nov 2020. About 34.3% of Jun imports came from Egypt, with another 25.5% and 21.1% from UAE and Estonia respectively.

- Saudi Tadawul approved the listing of SAR 3.09bn worth government debt instruments.

- SAMA granted permits to two fintech startups – Lean Technologies and Mod5r – bringing the total number of companies in the sandbox to 38.

- The Ministry of Commerce in Saudi Arabia issued 10 licenses to export cement in Jan-Jul 2022, reported Al Eqtisadiah. Total licenses inched up to 112 since a ban was lifted in 2016.

- A new tourism law approved by the Saudi Cabinet includes streamlined licensing procedures, crisis management measures, financial guarantees, an information database as well as strengthening the relation between investors, tourists and relevant authorities.

- Upon completion, the Rua Al Madinah Project is expected to add SAR 140mn (USD 37.25mn) to Saudi GDP; the project, spanning 1.5mn sqm (63% open spaces), will feature 47k hotel rooms and is estimated to create 93k direct and indirect jobs.

- Residential real estate transactions in Saudi Arabia surged by 21.4% yoy to SAR 36bn (USD 9.58bn) in Q2 2022, according to a CBRE report. Volume of transactions fell by 19.9% to over 44k deals in the quarter.

- Car imports into Saudi Arabia touched some 320k in H1 2022: this compares to 562k cars imported in 2021 (+2.9% yoy), reported Al Eqtisadiah, citing the Zakat, Tax and Customs Authority.

- Saudi Arabia finalized regulatory procedures for electric vehicle charging stations: this will support the move towards EVs and achieve Riyadh’s target of 30% EVs by 2030.

- International passenger traffic through Saudi airports more than tripled to 16.6mn in H1 2022 and have recovered to approximately 70% of pre-pandemic levels. A reduction in airport charges for airlines (between 10-35%) is likely to be introduced in Q4, making it more attractive. The goal is to triple annual passenger traffic to 330mn by 2030.

- Europe’s budget airline Wizz Air is considering a Saudi operating license, Reuters reported, citing the CEO. The airline announced 20 new routes to Saudi destinations (Riyadh, Jeddah and Dammam) with a capacity of 1mn new seats.

- Saudi Arabia plans to invest USD 1bn in Pakistan, reported the Saudi state TV.

UAE Focus![]()

- UAE’s non-oil trade increased by 17% yoy to AED 1.058trn (USD 288.06bn) in H1 2022. Non-oil exports grew by 8% to around AED 180bn during the period, accounting for 17% of non-oil trade. Imports and re-exports rose to AED 580bn (+19% yoy) and AED 300bn (+20% yoy) respectively.

- DP World signed an agreement to build a USD 80mn logistics park at Egypt’s Sokhna Port. The 300k sqm park is expected to create about 600 direct and indirect jobs, and will focus on logistics, trading, distribution, value-added, and light industrial activities.

- In H1 2022, Dubai officially submitted about 200 bids and proposals to host international business events. While several bids are still pending, the emirate clocked in 99 successful bids – these confirmed events are expected to welcome around 77k delegates and account for about 330k hotel room nights.

- Abu Dhabi’s Department of Economic Development is offering discounted plots of land to firms implementing sustainable business practices: under the plan, land will be sold at rates as low as USD 1.4 per sqm.

- Abu Dhabi Airports reported that 6.3mn passengers passed through in H1 2022, thanks to an increase in demand for travel and 94% yoy rise in number of scheduled passenger flights. Top 5 nations in terms of passenger volumes were India, Pakistan, UK, Saudi Arabia, and Egypt while top 5 destination airports were Heathrow, Delhi, Mumbai, Cochin, and Cairo.

- Bloomberg reported that the money exchange firm Al Ansari Exchange plans to list and trade its shares on Dubai Financial Market in Q1 2023.

- UAE healthcare firm Burjeel, ahead of its potential IPO later this year, announced plans to expand into Saudi Arabia with an investment of up to USD 1bn by 2030 (as part of an MoU with the Ministry of Investment). The Saudi investments will likely be financed with project debt, reported Reuters, citing the CEO.

- Mobile app downloads in the UAE increased by 23% in H1 2022, with finance related apps seeing the most demand (+183% yoy), according to data from AppsFlyer. Interestingly, in line with the rising footfall in malls, retail app downloads have seen a decline.

Media Review

Stop berating central banks and let them tackle inflation

https://www.ft.com/content/5d020eb0-eace-4654-907c-b88498056bcd

How the Ukraine-Russia war rattled global financial markets

Achieving Net-Zero Emissions Requires Closing a Data Deficit

https://blogs.imf.org/2022/08/23/achieving-net-zero-emissions-requires-closing-a-data-deficit/

The missing pandemic innovation boom

https://www.economist.com/finance-and-economics/2022/08/28/the-missing-pandemic-innovation-boom