Markets

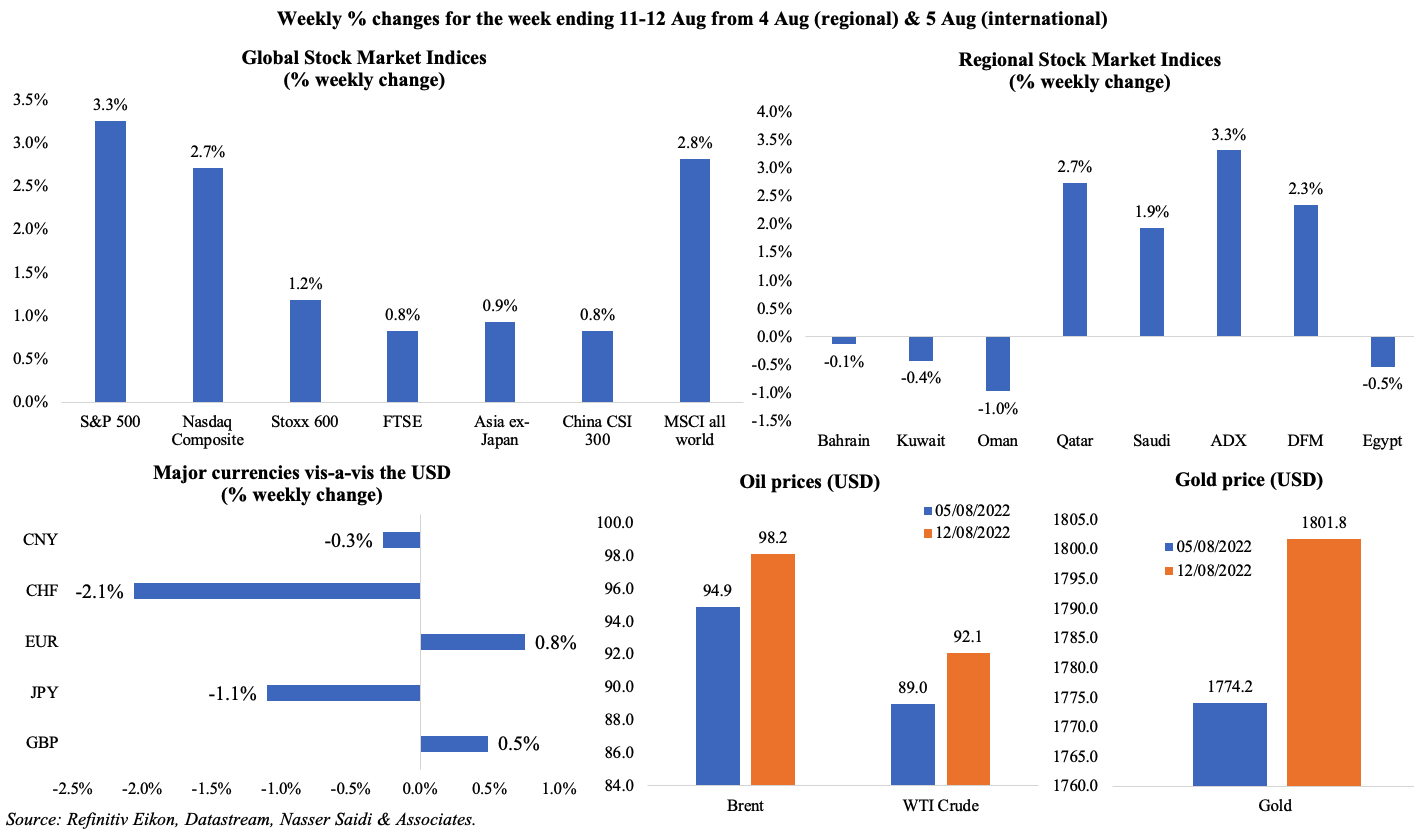

Equities had a good week, with most major markets closing in the green last week: the slight easing of inflation supported investor sentiment and US markets posted a 4th straight week of gains (the longest since late 2021); on a weekly basis, Stoxx 600 and MSCI all world indices were up by 1.2% and 2.8% respectively. Regional markets showed a mixed picture with Qatar, Saudi and UAE posting gains – Abu Dhabi Index touched a record peak on Wednesday (though retreated later in the week). The dollar posted a weekly drop, despite having rallied on Fri while the CHF bounced off the 4-month low touched earlier in the week. Both Brent crude and WTI closed at a 3.4% gain last week despite oil prices declining on Fri given recessionary fears (feeding into a lower demand outlook), while gold price ticked up by 0.7% from a week ago.

Global Developments

US/Americas:

- Inflation in the US eased in Jul, clocking in at 8.5% from 9.1% in Jun, thanks to lower petrol prices. Excluding food and energy, inflation stayed unchanged at 5.9% yoy. In mom terms, prices remained flat, for the first time following 25 straight months of increases. Hotel costs fell by 2.7% mom, airfares by 7.8%, rental car prices by 9.5% and gasoline by 8%.

- Producer price index in the US dropped to 9.8% yoy in Jul (Jun: 11.3%), the lowest since Oct 2021. On a monthly basis, wholesale prices fell by 0.5%, the first decline since Apr 2020. Excluding food and energy, producer price inflation was down to 7.6% yoy (Jun: 8.4%).

- US import and export prices tumbled by 1.4% mom and 3.3% in Jul, by the most since Apr 2020, another sign that inflationary pressures might be fading.

- Preliminary estimates of non-farm labour productivity growth fell an annualised 4.6% in Q2 (Q1: -7.4%). Unit labour costs grew by 10.8% in the quarter compared to 12.7% rise in Q1: output fell by 2.1%, hours worked grew 2.6% (i.e. a plunge in output per hour) and reflects a 5.7% increase in hourly compensation, however, represents a 4.4% inflation-adjusted pay cut.

- Michigan consumer sentiment index increased to 55.1 in Aug (Jul: 51.5). The current economic conditions fell unexpectedly to 55.5 (Jul: 58.1), but the 16% mom increase in consumer expectations to 54.9 (largest % rise since 2009) supported the overall index uptick.

- US budget deficit widened to USD 211bn in Jul from Jun’s USD 89bn, bring the total deficit to USD 726bn since the fiscal year began in Oct.

- Initial jobless claims increased by 14k to 262k in the week ended Aug 5th, near the highest since Nov 2021, placing the 4-week average to 252k. Continuing jobless claims also rose by 8k to 1.428mn in the week ending Jul 29th.

Europe:

- Industrial production in the eurozone jumped up by 0.7% mom in Jun (May: 2.1%): production increased in capital goods (2.6% mom) and energy (0.6%) while it fell for both durable (-1.1%) and non-durable (-2.3%) goods.

- Sentix investor confidence in the eurozone improved slightly to -25.2 in Aug (Jul: -26.4). The index on the current situation was up to -16.3 in Aug (Jul: -16.5) and the expectations index rose to -33.8 (close to the lowest reading since Dec 2008).

- French inflation posted an increase to 6.8% yoy in Jul, while in Spain, prices were up 10.8% – the highest since 1984.

- Q2 UK GDP contracted by 0.1% qoq (Q1: 0.8%), driven by a decline in services output while the household consumption fell by 0.2% qoq alongside a positive contribution from net trade. Monthly estimates showed that GDP dropped by 0.6% mom in Jun (May: 0.4%). Industrial production and manufacturing slipped by 0.9% and 1.6% in Jun.

- UK’s like-for-like retail sales rebounded in Jul, inching up by 1.6% yoy (Jun: -1.3%), rising for the first time in 5 months.

Asia Pacific:

- China unexpectedly lowered 2 key rates this morning: the rate on the one-year medium-term lending facility (MLF) was cut by 10bps to 2.75% and the 7-day reverse repo rate was reduced to 2% from 2.1%. The PBoC also withdrew liquidity from the banking system by issuing CNY 400bn of MLF funds, only partially rolling over the CNY 600bn of loans maturing this week.

- Inflation in China increased to 2.7% yoy in Jul (Jun: 2.5% yoy) – the fastest rise since Jul 2020 thanks to food prices (6.3%); prices were up by 0.5% mom- the most in 5 months. Producer price inflation eased to a 17-month low in Jul, rising by 4.2% (Jun: 6.1%); in mom terms, PPI fell by 1.3%, the first decline since Jan.

- China’s money supply grew by 11% in Jul (Jun: 11.4%). New loans slowed to CNY 679bn (Jun: CNY 2.81trn).

- Japan’s current account posted a deficit of JPY 132.4bn in Jun, after running surpluses for 5 months. Value of imports surged by 49% yoy (due to higher oil and coal prices), more than offsetting the 20% rise in exports value.

- Machine tool orders in Japan increased by 5.5% yoy in Jul (Jun: 17.1%).

- India’s inflation eased to 6.71% yoy in Jul (Jun: 7.01%), largely due to a moderation in food inflation (to 6.75% vs Jun’s 7.75%).

- Industrial output in India increased by 12.3% yoy in Jun (May: 19.6%), with the manufacturing sector growing by 12.5% (May: 20.6%). The IIP index grew by 12.7% in Apr-Jun 2022 versus a growth of 44.4% in the same period a year ago.

Bottom line: Data releases last week showed some signs of easing inflationary pressures, in sync with PMI readings from earlier this month (probably also due to a slowing of demand growth). UK inflation release is this week: will it inch closer to the BoE’s 13.3% peak forecast for Oct, thereby lowering standards of living and consumer confidence? Following the PBoC rate cut this morning, New Zealand and Norway central bank meetings are on this week – both likely to raise rates to counteract multi-decade high inflation readings. Will central banks be able to engineer a soft landing over the next quarters?

Regional Developments

- Urban inflation in Egypt inched up to 13.6% in Jul (Jun: 13.2%), the highest reading since May 2019, given an increase in food and transport prices (22.7% and 17% respectively). In mom terms, prices were up by 1.3%, from Jun’s 0.1% decline. Overall headline annual inflation jumped to 14.6% in Jul (Jun: 13.2%) and more than double in Jun 2021.

- Egypt’s balance of payments touched a deficit of USD 7.3bn in Jul 2021-Mar 2022; current account deficit remained almost unchanged at USD 13.6bn during this period despite a widening of the trade deficit (by USD 3bn). Net inflows declined by 36.6% to only USD 10.8bn in the Jul-Mar period.

- Net international reserves in Egypt declined slightly to USD 33.143bn in Jul (Jun: USD 33.375bn) while gold reserves declined by USD 253mn to USD 7.061bn.

- The deputy governor of Egypt’s central bank stated that the nation’s foreign currency gap (difference between foreign currency needs and current holdings) narrowed to USD 400mn in Jul, from USD 3.9bn in Feb, mainly due to recent decisions related to “imports regulation”, aimed at lowering imports.

- Bloomberg reported that Egypt is in preliminary talks with regional and international banks to raise USD 2.5bn to relieve growing economic pressures. The country needs about USD 41bn to pay for its current account deficit and maturing debt by end-2023.

- Egypt’s non-oil exports rose by 20% yoy to USD 19.353bn in H1 2022, with chemicals and fertilizers and building materials accounting for 22% and 19% respectively of non-oil exports.

- Bilateral trade between Egypt and Spain jumped by 29% yoy to USD 2.851bn in 2021.

- Tourism in Egypt is likely to restore less than 70% of its pre-Covid tourism numbers by end-2022, statedthe former chairperson of the Egyptian Tourism Federation.

- Egypt’s Suez Canal set a record for the highest daily transits of the canal on Saturday 6th Aug: 89 vessels passed through the canal, more than double the average transit rate a few years ago, carrying a total net tonnage of 5.2mn tonnes.

- Egypt’s cabinet approved a plan to reduce gas consumption to meet the objective of generating foreign currency from gas exports. Shops and malls will be required to limit use of strong lights and keep AC at no cooler than 25 deg Celsius and government offices will switch off lights at end of working hours among other measures. The PM had earlier stated that the government hoped to reduce the amount of gas used to generate electricity by 15%.

- The Saudi Egyptian Investment Co disclosed that it had acquired a stake in 4 publicly listed Egyptian firms, with the total deal amount at around USD 1.3bn. These companies operate in sectors including fintech, logistics and fertilizer among others.

- Lebanon’s caretaker PM disclosed Iraq government’s agreement to continue supplying the electricity company with heavy fuel oil for another year in exchange for in-kind services, a barter deal.

- Oman posted a budget surplus of OMR 784mn (USD 2.04bn) at end-Jun 2022, largely due the rise in oil revenues. In H1 2022, average oil price stood at USD 87 (higher than budget estimate of $50), enabling overall revenues to reach OMR 6.7bn (+54% yoy). Dependence on oil & gas for overall revenues continues to be quite high, with its share at 73% in H1. Net oil revenues grew by 40% yoy while gas revenues more than doubled to OMR 1.7bn. While expenditures grew by 8.6% in H1, public debt declined to OMR 18.6bn at end-Jul,from OMR 19.7bn at end-Apr and OMR 20.8bn at end-2021.

- The Qatar World Cup will begin a day earlier than initially planned on Nov 20th: the host nation will play in the tournament’s first game.

- EY’s MENA M&A Insights report disclosed that 359 deals were signed in H1 2022 worth USD 42.6bn. UAE topped the list, with 105 deals worth USD 14.2bn while Egypt (65 deals, USD 3.2bn) and Saudi Arabia (39 deals, USD 2.8bn) followed.

Saudi Arabia Focus

- Industrial production in Saudi Arabia grew by 20.8% yoy in Jun (May: 24%): manufacturing grew at a faster pace (29.3% yoy) compared to mining and quarrying (19.2%). In H1, mining & quarrying grew by an average 22.4% while manufacturing was close behind (21.5%). Separately, it was disclosed that foreign or joint capital represents around 39% of the total investments in the industrial sector.

- The Saudi Ministry of Industry and Mineral Resources issued 90 new industrial licenses in Jun, bringing the total this year to 501. The number of existing and under construction factories reached 10,675 at end-Jun, with investments totalling SAR 1.361 trn (USD 361bn).

- Saudi Aramco is ready to raise oil production to 12mn barrels per day (bpd) when the government asks, stated the company’s CEO during the press conference after reporting a 90% jump in Q2 profit. The company also plans to add significant output capacity from 2025 to reach 13mn bpd.

- SAMA launched a point-of-sale service link between the national payment network Mada and the Qatari national network, starting Aug 1st.

- Saudi banks’ total profits amounted to SAR 33.63bn in H1 2022, reported Okaz/ Saudi Gazette. Together, profits of the Saudi National Bank and Al-Rajhi Bank amounted to about SAR 19.82bn (or 58.93% of the profits of all banks).

- A Saudi Central Bank study showed that digital payments exceeded cash transactions in Saudi Arabia for the first time in 2021. In terms of volume, use of electronic payments increased to 62% last year from 44% in 2019.

- Bloomberg reported that Saudi Arabia is planning to renew its USD 3bn deposit for Pakistan this week. Additionally, it plans to support by providing USD 100mn per month in petroleum products for 10 months.

- Saudi Electricity Co. obtained USD 568mn in financing to fund the Saudi-Egypt electricity interconnection project. This USD 1.8bn interconnection project to exchange 3000 MW of electricity between the two nations.

- Visa disclosed that 9 out of 10 transactions in Saudi Arabia were made with contactless cards or The adoption of contactless payments grew to 94% at end-2020 (2017: 4%), placing Saudi first overall in MENA and globally above the EU average.

- The Saudi Citizen Account program deposited SAR 3.6bn (USD 960mn) for 10.9mn beneficiaries during Aug. This brings the total amount disbursed since inception of the Program to more than SAR 127bn.

UAE Focus![]()

- UAE’s federal revenues grew by 39% yoy to AED 123.8bn in Q1 2022, and spending rose by 20% to AED 87.4bn leading to a 129% surge in net operating balance to AED 36.4bn. Tax revenues grew by 51% to AED 56.7bn in Q1 but accounted for only 45.8% of total revenues.

- Dubai PMI rose to 56.4 in Jul (Jun: 56.1), the highest reading since Jun 2019, thanks to a broad-based recovery in wholesale & retail, travel & tourism and construction sectors. Input cost pressures eased slightly in Jul, from Jun’s 53-month high. Travel & tourism reported the fastest rise in prices charged (since Mar 2017): cost push is being passed on to consumers.

- The UAE Financial Stability 2021 report disclosed that the Targeted Economic Support Scheme (TESS, launched in response to the pandemic) benefitted more than 322k bank customers (309k individuals, 10k SMEs and close to 2k private corporates) and supported up to 15% of total bank loans/ financing. Phase 3 of the TESS Exit Strategy is in place now, and includes the reduced reserve requirements, decreased down-payment requirement for new mortgage loans and the prudential filter.

- Bloomberg reported that Dubai government is planning to raise USD 1bn in Salik’s IPO. The government is expected to retain a 60% stake in the company (when it goes public, likely in Sep). Sources disclosed that Salik took out a USD 1.1bn loan from Emirates NBD to pay a special dividend to the government (similar loans were taken out by other candidates as well). The road toll operator Salik was turned into a public joint stock company in Jun.

- Non-oil trade in Abu Dhabi grew by 12% yoy to AED124bn (USD 33.7bn) in H1 2022. Total exports were up by 26% to AED 49.5bn while imports grew by 4% to AED 51.5bn and re-exports stood at AED 23bn (+6% yoy). Saudi Arabia was the largest trade partner (AED 6bn), followed by Switzerland (AED 9.5bn), US (AED 9.3bn) and China (AED 5.95bn).

- Abu Dhabi’s IHC (the most valuable company on ADX, with a market cap of around USD 167bn) plans to increase takeover activity, focusing on listed companies in growth markets like India, Turkey, South America and Indonesia, according to the company’s CEO.

- Dubai tourism rebound evident in H1 2022: visitors more than doubled to 7.12mn in H1 2022 (up by 183% yoy from a low base and compares to 8.36mn in H1 2019), supported by regional tourism (share of GCC and MENA visitors stood at 22% and 12% of total respectively while Oman and Saudi Arabia together accounted for almost 20% of total visitors). Dubai’s revenue per available room, at AED 417, surpassed pre-Covid levels while occupancy rate stood at 74% (same period in 2019 was 82%).

- As part of the Financial Stability report, the UAE central bank revealed the banking sector’s attitude to climate-related risk. Respondents identified lack of data and human capital as top 2 constraintsin implementing climate risk policies. About 72% of banks have yet to integrate climate risk into their risk registers and risk management frameworks.

- The UAE government disbursed inflation allowances to 47,300 low-income Emirati families. This covers food, electricity and water (monthly subsidy of 50% for electricity and water consumption less than 4k kilowatts and 26k gallons respectively) and fuel subsidies (monthly subsidy of 85% of the fuel price increase over AED 2.1 per litre).

- The “State of the UAE Retail Economy” report released by Majid Al Futtaim showed a 22% rise in overall spending in H1 2022, driven by growth in both retail (+16%) and non-retail (+31%) sectors. Footfall in MAF’s shopping malls is 6% below 2019 levels, e-commerce spending surged by 41% yoy in H1 and online sales accounted for 11% of the overall retail economy. An interesting shift in spending pattern is that purchases have shifted towards lower value and higher frequency, with the average transaction value down by 12% yoy in H1 2022. (The report can be accessed via: https://www.majidalfuttaim.com/en/media-centre/trends-and-insights)

- DIFC plans to launch a new hub for global and regional family-owned businesses, UHNWIs and private wealth from Sep 1st, with services ranging from business accreditation, advisory and concierge services, education and training, and outreach and high-end networking among others.

- ACWA Power announced that the USD 797mn Umm Al-Quwain desalination plant in the UAE, with a capacity to generate 682k cubic meters per day of desalinated potable water, was now operational. ACWA Power holds a 40% stake in the project.

- UBS’s investor sentiment survey revealed that about 45% of high-net-worth investors in the UAE are holding off on big purchases, while 72% are concerned about the long-term impact on retirement savings and funds for future generations. Furthermore, nearly half of business owners also expect to raise prices in the next six months, considering the uptick in materials costs and wage inflation concerns.

- In a bid to combat money laundering and terrorism financing, all real estate agents, brokers and law firms are required to file reports to the UAE’s Financial Intelligence Unit on the purchase and sale transactions of freehold properties that involve three methods of payment (whether for a portion or the entirety of the property value) – single or multiple cash payments equal to or above AED 55k, payments involving the use of a virtual asset, and payments where the funds used in the transaction were derived from a virtual asset.

Media Review

Central Banks Hike Interest Rates in Sync to Tame Inflation Pressures

From Great Moderation to Great Stagflation

Was Lebanon the world’s biggest Ponzi scheme? (with Dr. Nasser Saidi’s views)

https://www.arabnews.com/node/2138591/middle-east

Debt defaults start to loom more over markets

https://www.ft.com/content/1a9b97c1-082d-4b85-ba11-622b63503a78

Iran’s nuclear deal: outstanding issues

Crypto and the US Government Are Headed for a Decisive Showdown

https://www.wired.com/story/crypto-web3-securities-ripple-sec-lawsuits/