Weekly Insights 12 Aug 2022: Big Shift – Oil exporters are shying away from procyclical fiscal policy

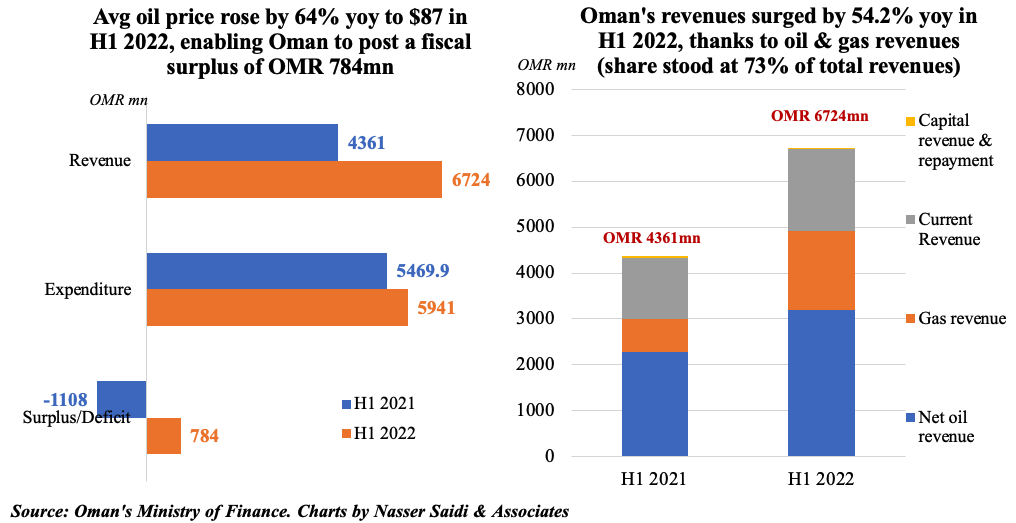

1. Building credibility: despite uptick in oil revenues, Oman stays on track with fiscal consolidation

- Despite rising oil prices, Oman has been avoiding procyclical fiscal policy; consolidation measures continue to be implemented. In H1 2022, average oil price stood at USD 87 (way higher than the budget estimate of USD 50), enabling revenues to reach 64% of estimates for the full year

- Dependence on oil & gas for overall revenues continues to be quite high, with its share at 73% in H1. Net oil revenues grew by 40% yoy while gas revenues more than doubled to OMR 1.7bn in Q1

- Spending increased by 8.6% in H1 (49% of estimates for full year); given inflationary pressures, government subsidy amounted to OMR 314mn (for oil products) and OMR 11mn (for basic food subsidy) as of end- H1

- Public debt amounted to OMR 18.6bn at end-Jul, down from OMR 19.7bn at end-Apr, and OMR 20.8bn at end-2021

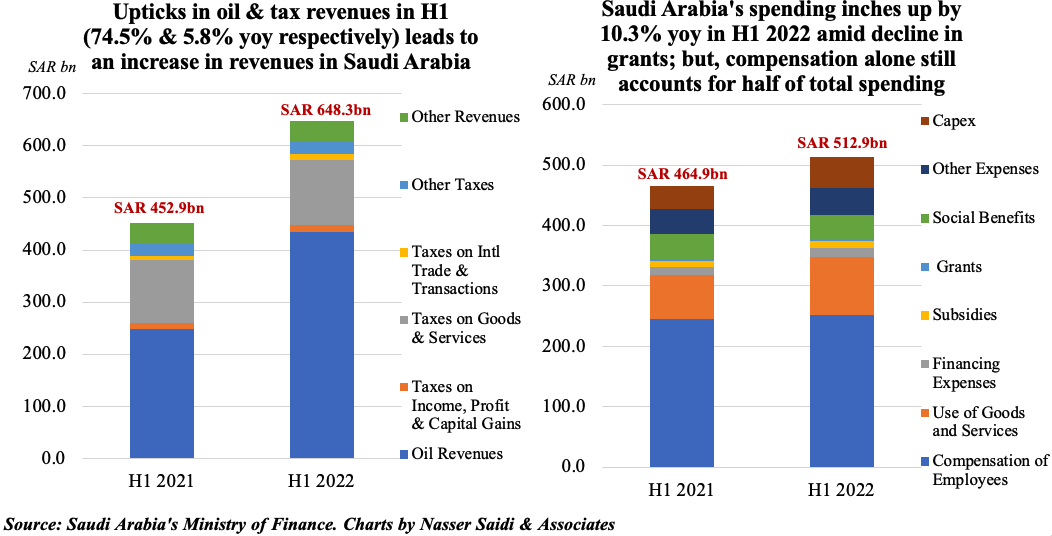

2. Saudi Arabia sticks to fiscal consolidation plans; oil windfall to support ambitious megaprojects

- Saudi Arabia posted a budget surplus of SAR 77.9bn in Q2 2022, aided by the acceleration in oil revenues. Surplus stood at SAR 135.4bn in H1 2022 versus a deficit of SAR 12.1bn in H1 2021

- Oil revenues surged by 74.5% yoy to SAR 434.1bn in H1 2022; this windfall is being partially used to fund PIF & its megaprojects

- Taxes accounted for 80% and 26% of non-oil & overall revenues in H1 2022. Non-oil revenues have doubled to 12.8% of GDP over the past 4 years

- Compensation of employees, which accounted for ~50% of overall spending in H1, inched up by just 2.2% yoy; capex and subsidies ticked up by 38.0% and 19.9% respectively while grants almost halved to SAR 1.7bn

- Despite the recently announced food subsidies and targeted social safety nets, Saudi is expected to post a surplus of 5.6% of GDP in 2022 after 8 years of running deficits (IMF, Jun 2022)

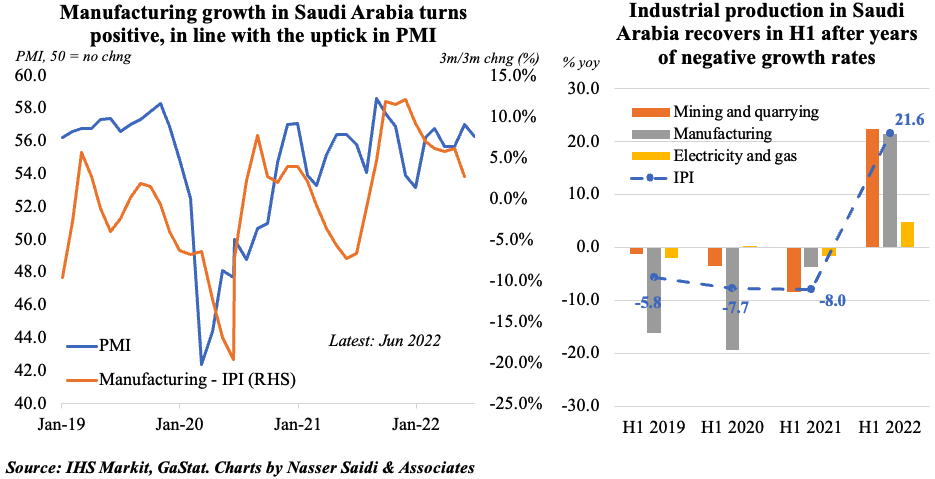

3. Saudi industrial production recovery supported by both manufacturing & mining

- Industrial production in Saudi Arabia recovered in H1 2022, after years of posting negative growth rates; in H1, mining & quarrying grew by an average 22.4% while manufacturing was close behind (21.5%)

- In Jun, when oil production rose to its highest level of 10mn+ barrels per day, the mining and quarrying component grew by 19.2% yoy;

- As in the past few months, manufacturing grew at a faster pace in Jun (29.3% yoy) compared to mining and quarrying (19.2%). Caveat: recent PMI data suggest some volatility in the period ahead.

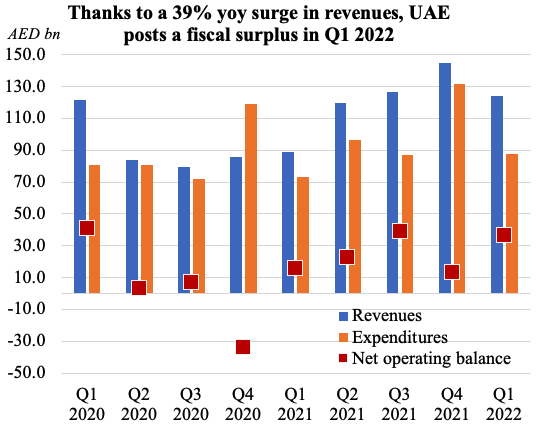

4. UAE posts Q1 Federal fiscal surplus

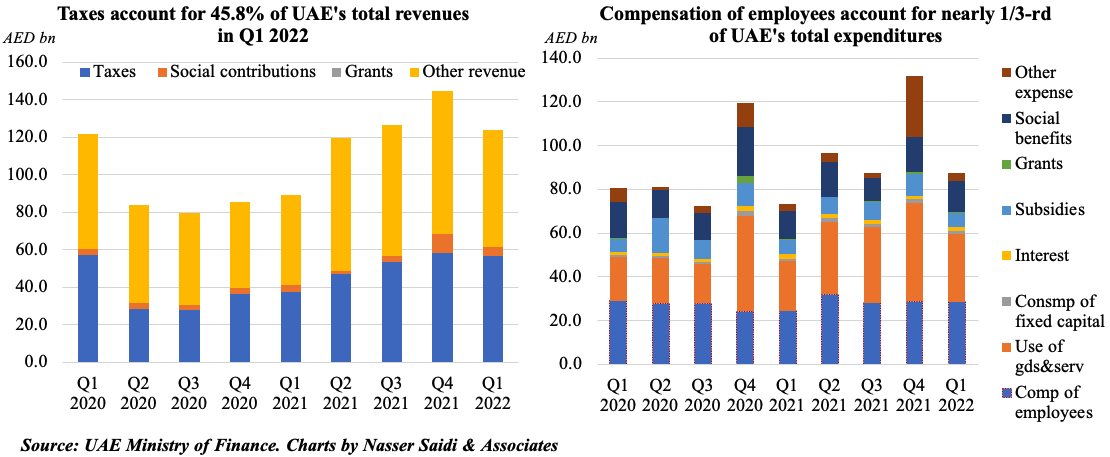

- Federal revenues grew by 39% yoy to AED 123.8bn and spending rose by 20% to AED 87.4bn => net operating balance surged by 129% to AED 36.4bn in Q1 2022

- Tax revenues grew by 51% to AED 56.7bn in Q1, but accounted for only 45.8% of total revenues. This is likely to tick up, once corporate tax is rolled out next year

- Compensation of employees (33% of overall expenditure) expanded by 17% while subsidies declined slightly by 5% to AED 6.4bn

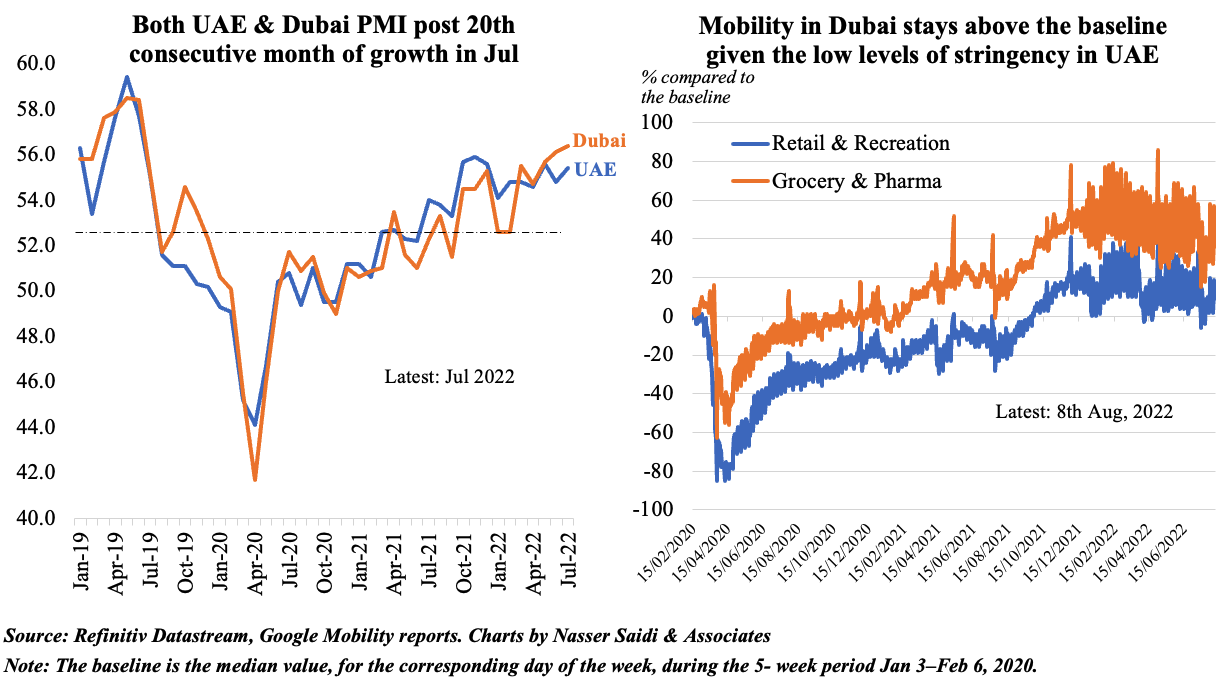

5. Dubai PMI supported by strong demand recovery; signs emerge of firms raising prices

- A broad-based recovery in wholesale & retail, travel & tourism and construction sectors resulted in Dubai PMI rising to 56.4 in Jul – best since Jun 2019. Input cost pressures eased in Jul, but remain high; travel & tourism reported the fastest rise in prices charged (since Mar 2017): cost push is being passed on to consumers

- Demand continues to rise: mobility shows a consistent improvement, staying higher than the baseline (in line with low stringency levels: 29.63 for vaccinated persons)

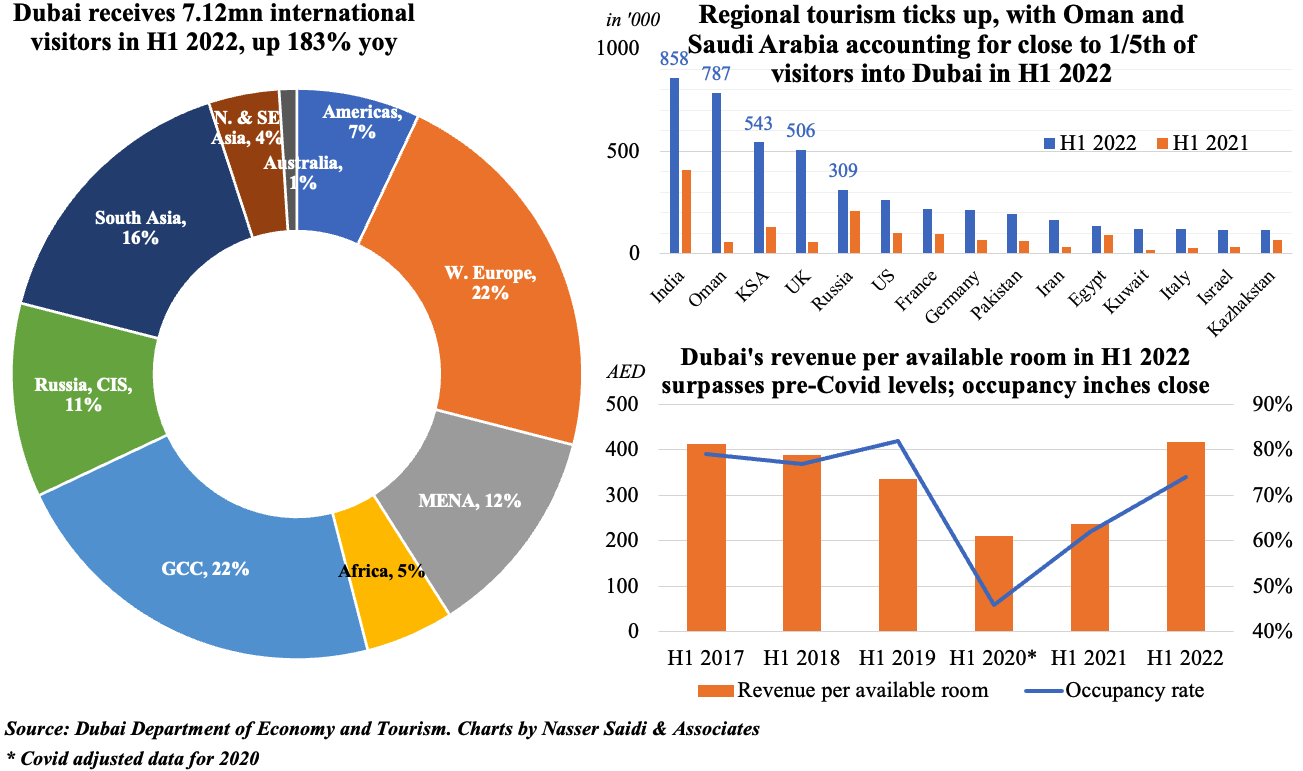

6. Dubai tourism rebound evident in H1 2022: visitors more than double (vs H1 2021), supported by regional tourism. Qatar World Cup visitors to lend support in Q4

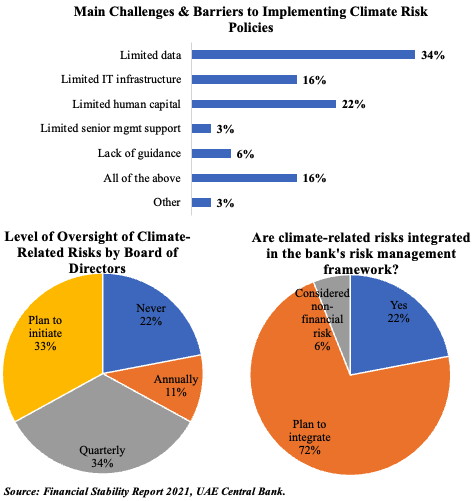

7. UAE Central Bank’s climate risk survey

- As part of the Financial Stability report, the UAE central bank revealed the banking sector’s attitude to climate-related risk

- Respondents identified lack of data and human capital as top 2 constraints in implementing climate risk policies

- While it heartening to know that at least 45% of banks’ boards discuss climate change risks either quarterly or annually, it is important to also note that this topic needs widespread communication and clear guidelines. For example, note that 6% of respondents considered this to be a non-financial risk!