Markets

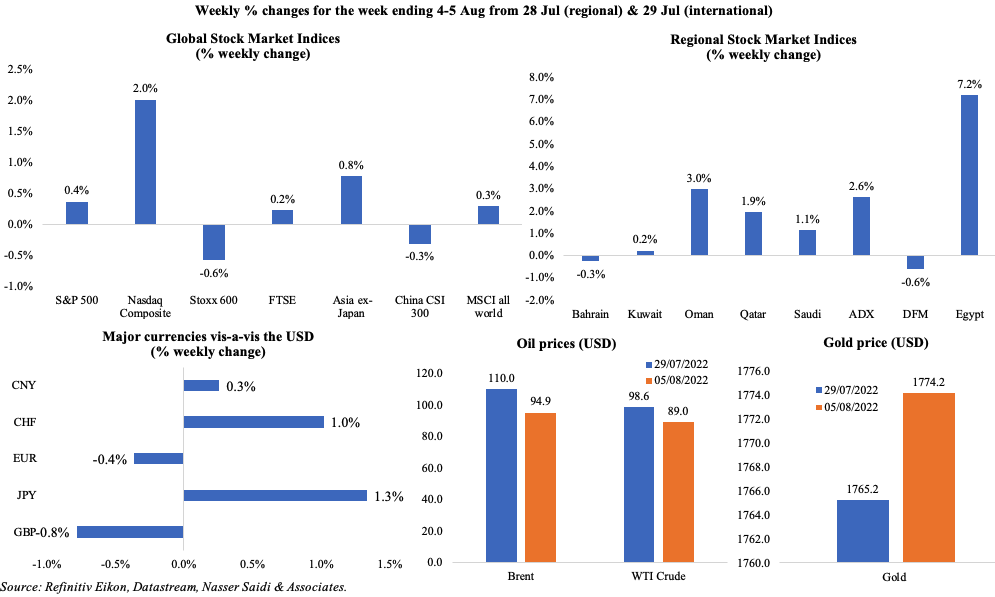

Global equity markets were mixed, with Nasdaq advancing by 2.2% and others posting marginal gains (S&P 500, Asia Pacific ex-Japan, FTSE). Regional markets were mostly up (Egypt was the biggest gainer) while UAE’s DFM was down by 0.6% from a week before. The US dollar gained after the unexpected strong jobs reading: it was up 1.3% vis-à-vis the yen, while the BoE rate hike led the GBP to slip by 0.8%. Growing recession fears and supply shortages concerns led to a decline in oil prices – Brent down by 13.7% to USD 94.9 and WTI by 9.7% to USD 89 – while the gold price inched up by 0.5%.

Global Developments

US/Americas:

- Non-farm payrolls increased by 528k in Jul (Jun: 398k), indicating the strength of the labour market, raising bets of another large rate hike at the next Fed meeting; average hourly earnings grew by 0.5% mom and 5.2% yoy. Labour force participation rate slipped to 62.1% (Jun: 62.2%). Unemployment rate eased to the pre-pandemic level of 3.5% in Jul (Jun: 3.6%).

- Job openings in the US slipped to 9-month low of 10.698mn in Jun (May: 11.303mn): this decline was the largest since Apr 2020. At least 4.2mn workers quit jobs voluntarily and the jobs-workers gap fell to 2.9% of the labour force (May: 3.3%).

- Initial jobless claims increased to 260k in the week ended Jul 29th, up from a downwardly revised 254k a week ago, raising the 4-week average to 254.75k. Continuing jobless claims also rose to 1.416mn in the week ending Jul 22nd from 1.368mn.

- Factory orders inched up by 2% mom in Jun (May: 1.8%), stronger than the preliminary estimate, with non-defence capital goods orders rising by 0.7% (vs initial estimate of 0.5%).

- Manufacturing PMI in the US clocked in at 52.2 in Jul, the lowest factory growth since Jul 2020, with output falling for the first time since Jun 2020. Services PMI slipped to 47.3 in Jul, from Jun’s 52.7 – the sharpest fall since May 2020, also leading to a decline in composite PMI (47.7 in Jul, from 52.3 in Jun).

- ISM manufacturing PMI edged down slightly to 52.8 in Jul (Jun: 53), the lowest reading since Jun 2020, with new orders and employment sub-indices slipping declining to 48 (May: 49.2) and 49.9 respectively while prices paid eased (to 60 from 78.5).

- ISM services PMI rebounded to 56.7 in Jul (Jun: 55.3), with new orders rising to 59.9 (from 55.6) and prices inching lower (to 72.3 from 80.1, the biggest drop since 2017).

- Trade deficit narrowed to a 6-month low of USD 79.6bn in Jun (May: USD 84.9bn), thanks to an uptick in exports (1.7% to record-high USD 260bn) amid imports slight 0.3% decline.

Europe:

- The Bank of England raised interest rates by 50 bps to 1.75%, in its 6th consecutive hike, also warning that inflation would likely rise to 13% by end of this year. The Bank also expects a looming recession lasting more than a year, but less severe than the 2008-09 financial crisis one. Unemployment is forecast to rise sharply from under 4% to more than 6% by early 2025.

- Eurozone’s manufacturing PMI fell below-50 to 49.8 in Jul (Jun: 52.1), the first contraction since Jun 2020: new orders fell for the 3rd straight month while input cost and output prices slipped to 17 and 15-month lows. Services PMI for Jul was revised up to 51.2 (prelim reading: 50.6), but incoming new business fell (for the first time since Apr 2021) and new export orders fell the most since Mar 2021. Composite PMI contracted in Jul, the first since Feb 2021, falling to 49.9 and business confidence was the lowest since H1 2020.

- Producer price index in the eurozone increased by 1.1% mom and 35.8% yoy in Jun, underscoring higher prices and potential decline in demand in the coming months.

- Retail sales in the eurozone fell by 1.2% mom and 3.7% yoy in Jun, with the biggest drop recorded in non-food products (-2.6% mom). By country, the sharpest declines were seen in Denmark (-3.8% mom) and the Netherlands (-3.4%).

- Manufacturing PMI in Germany slipped to 49.3 in Jul (Jun: 52), falling below-50 for the first time in 25 months, as new orders shrank the most in over two years; output inflation slowed to the lowest in 15 months while business expectations were the lowest since May 2020. Services PMI also fell to below-50, down to 49.7 in Jul, the first contraction since Dec. Composite PMI came in at 48.1, almost unchanged from the preliminary reading of 48, falling below 50 for the first time since Dec.

- Exports from Germany grew for a 3rd consecutive month, rising by 4.5% mom to a record level in Jun while imports increased by 0.2%, pushing the seasonally adjusted trade surplus to EUR 6.4bn (May: upwardly revised to a surplus of EUR 0.8bn).

- Industrial production in Germany unexpectedly rose by 0.4% mom in Jun, supported by the production of capital goods (+1% mom). In yoy terms though, IP fell by 0.5%.

- German factory orders fell by 9% yoy and 0.4% mom in Jun (May: -0.2% mom and -3.2% yoy). The drop in orders was attributed to a 4.3% mom decline in orders from non-euro area as new orders from the eurozone grew by 3.4% and domestic orders rose by 1.1%.

- Germany’s retail sales declined by 1.6% mom and 8.8% yoy in Jun – this was the largest yoy decrease since the series began in 1994. Food retail sales posted a decline of 1.6% mom in real times.

- Unemployment rate in the eurozone stood unchanged at 6.6% in Jun. Unemployment was highest in Spain and Greece at 12.6% and 12.3% respectively.

- UK manufacturing PMI fell to a 25-month low of at 52.1 in Jul (Jun: 52.8), with output falling for the first time since May 2020. Services PMI stood at 52.6 (Jun: 54.3), lower than the preliminary estimate of 53.3 – this was the softest expansion in 17 months. Composite PMI was 52.1 in Jul, down from Jun’s 53.7; pace of inflation eased to a 10-month low.

Asia Pacific:

- China’s Caixin manufacturing PMI eased to 50.4 in Jul (Jun: 51.7), with output and new orders growing at a softer rate while employment fell for the 4th consecutive month.

- Caixin services PMI in China inched up to 55.5 in Jul (Jun: 54.5), posting the sharpest pace of expansion since Apr 2021; while new orders rose the most since Oct 2021, new export orders fell for the 7th consecutive month.

- China exports increased by 18% yoy in Jul (the fastest pace recorded this year) while imports edged up by only 2.3%, resulting in a record trade surplus of USD 101.26bn.

- Overall household spending in Japan increased by 3.5% yoy in Jun (May: -0.5%), rising for the first time in 4 months. Spending by households with two or more people stood at an average of JPY 276,885 (USD 2070) in Jun.

- Jibun Bank services PMI for Japan slipped to 50.3 in Jul (lower than the preliminary estimate of 51.2 and Jun’s 54): employment rose for the 6th straight month and the pace of inflation is easing.

- Japan’s preliminary leading economic index edged lower to 100.6 in Jun (May: 101.2) – the lowest since Feb. Coincident index increased to 99 from 94.9.

- The Reserve Bank of India raised the repo rate to 5.4% while leaving the reverse repo rate unchanged at 3.35%. The governor stated that there were signs of inflation moderating, though it remains higher than RBI’s upper target of 6% (official forecast stands at 6.7% for 2022-23). The RBI has hiked rates by 140bps in 3 months.

- Retail sales in Singapore grew by 14.8% in Jun (May: 17.8%), thanks to a 59.1% surge in sales of food and beverages services. There is also a low base effect given that in Jun 2021, international travel restrictions were still in place. Retail sales however slipped by 1.4% in mom terms (May: +1.8%).

Bottom line: Focus this week will be on US inflation (focus on core inflation to understand persistence) as well as the UK GDP data (likely to show a recession, in line with the BoE downgrade last week). Two data updates last week indicate possible easing of price inflation going forward: NY Fed’s global supply chain stress eased to an 18-month low in Jul and FAO’s global food prices posted the steepest decline in 14 years (though the UN warns of uncertainties related to future supply). A similar scene played out at the OPEC+ meeting: agreement was to raise Sep output only by a minimal 100,000 barrels per day, citing “severely limited availability” of spare capacity and that it needed to be reserved for “severe supply disruptions”. With worries of a global recession looming, global bond funds saw net purchases of USD 14.4bn (the biggest weekly inflow in 9 months) while money market funds saw an inflow of USD 7.03bn (+66% from the week before), according to Refinitiv Lipper data. Lastly, Pelosi’s visit to Taiwan has led to a flaring of China-Taiwan tensions, raising geopolitical risks in the region.

Regional Developments

- Bahrain announced the launch of Bahrain Private Market, a new one-stop-shop platform for closed shareholding companies, with services to be provided by Bahrain Clear (subsidiary of Bahrain Bourse) as of 18 Using this, closed shareholding companies will be able to access, connect, manage and execute their transactions in an efficient and effective manner.

- Egypt’s PMI remained below-50 for the 20th straight month: employment stabilised and rate of declines for sub-indices slowed, but respondents highlighted weakening demand and raw material shortages as constraints. Inflation remains an issue given prices for raw materials, fuel, and foodstuff, but the sub-index for overall input prices eased to 64.1 from Jun’s 72.

- Asharq reported that Egypt needs less than USD 15bn from the IMF to help support its financial needs, citing the finance minister.

- Non-governmental bank deposits in Egypt increased by 11.6% (from end-Dec 2021) to EGP 4.986trn as of end-Jun. The central bank also stated that volume of domestic liquidity in the banking sector rose to EGP 6.611trn in June 2022 (Dec 2021: EGP 5.822trn).

- Saudi Arabia’s PIF launched the Saudi Egyptian Investment Company in Egypt to drive investment and improve access for PIF and its portfolio companies. The firm will invest in various sectors including infrastructure, real estate development, health care, financial services and food and agriculture among others.

- The Suez Canal reported a record-high revenue for the month of July, amounting to USD 704mn. It also recorded the largest monthly net tonnage of 125.1mn tons in Jul (Jul 2021: 105.8mn tons), with 2103 ships transiting from both directions (Jul 2021: 1670).

- Egypt announced an increase in train and metro fares by up to 25% by end-Aug: this is to reduce the debt of the Railway and Subway Authority, which still owes EGP 5bn (USD 262.8mn+) to the Ministry of Petroleum and Mineral Resources, spent to upgrade lines. The 3 metro lines carry 4.6mn passengers daily, while other trains take 1.1mn passengers every day.

- Remittances into Egypt inched up by 2.1% yoy to USD 29.1bn in Jul 2021-May 2022. In May alone, remittances were down by 7.7% yoy to USD 2.4bn.

- Passenger car sales in Egypt declined by 8.3% yoy to 92,261 cars in H1 2022, as per a report from the Automotive Information Council. In Jun, sales plunged by 35.2% to 12,346.

- Egypt aims to double oil storage capacity at the Al Hamra Port to 5.3mn barrels of crude oil within 3 years, reported Asharq.

- The capacity of renewable energy projects under development in Egypt has doubled during the fiscal year 2021/2022 to 3,570 MW, according to the New and Renewable Energy Authority. FDI into the sector has amounted to USD 3.5bn.

- Kuwait dissolved Parliament last week, with Parliamentary elections scheduled for Oct. This delays the approval of state budget for the fiscal year 2022-23, which estimates spending at KWD 23.65bn (vs. KWD 23.48bn in the 2021-22 budget).

- PMI in Lebanon jumped to the highest reading since Jun 2013 (while staying below-50) linked to summer seasonality.

- The World Bank, in its report on global food insecurity, highlighted that Lebanon topped the food price inflation list globally (for the period between Mar-Jun 2022), with nominal food inflation at 332% yoy and real food inflation (food inflation minus overall inflation) at 122%.

- Oman announced a budget surplus of OMR 784mn (USD 2.04bn) in H1 2022: public spending rose by 8.6% to OMR 5.94bn while revenues surged by 54.2% to OMR 6.724bn. Net oil revenues were up by 40.1% while gas revenues surged by 137.8%. Total public debt was down by OMR 2.2bn from end-Dec to OMR 18.6bn.

- Foreign reserves in Qatar grew by 2.79% yoy to QAR 211.325bn (USD 57.74bn) in Jul.

- The Qatar Fund for Development signed a deal with the GCC Interconnection Authority to build and connect the regional electrical system to the southern Iraq network, with the establishment of a new 400 KV transformer substation in the Wafra district of Kuwait.

- Startups in the MENA region raised USD 105mn in Jul from 44 deals, revealed Wamda: investment is down 84% yoy and 68% mom. This could be partly read as due to the summer slowdown but is also reflective of similar trends globally. Egypt was the only country in the region where start-ups recorded a rise in investments (+72%).

- MENA IPO market saw 24 issuances raising USD 13.5bn in proceeds in H1 2022, according to EY. Saudi Arabia and UAE dominate IPO activity, with a healthy pipeline of candidates. In Q2, the number of IPOs fell by 40% qoq to 9, though proceeds more than doubled to around USD 9bn.

- The eight largest Middle Eastern SWFs have more than USD 3trn in combined total assets, according to Preqin, and recent high oil prices have given these funds fresh capital to increase allocations to alternatives. In a report titled “Fundraising from the Middle East: A guide to raising capital”, Preqin reveals that Adia increased its target allocation bands for private equity from 2-8% to 5-10%, and for infrastructure from 1-5% to 2-7%. Furthermore, 63% of family offices in the Middle East cite China as the market presenting amongst the best opportunities in the next 12 months.

- Mastercard’s New Payments Index 2022 found that 85% of consumers in the MENA region have used at least one emerging payment methods in the last year (including BNPL, mobile wallets, biometrics etc.). Factors affecting the decision of which payment method to use are ease of use, security, as well as rewards and promotions. About 73% of consumers were using open banking to meet their daily financial needs while 64% agreed that using biometrics rather than a card or device makes payments easier.

- According to the Gulf Statistics Centre, remittances from the GCC increased by 9.2% yoy to USD 127.2bn in 2021. Remittances from the UAE, Saudi Arabia and Kuwait clocked in at USD 47.5bn, USD 39.8bn and USD 18.3bn respectively.

- According to UNWTO, tourist arrivals in the Middle East could recover to about 50-70% of pre-pandemic levels by end-2022.

- The US approved the potential sale of missile defense systems to the UAE and Saudi Arabia in separate deals worth USD 5.3bn: Terminal High Altitude Area Defense missile interceptors will be supplied to the UAE and Patriot missile interceptors to Saudi Arabia.

- A 2-month truce has been renewed in Yemen, with negotiations underway to reach an expanded agreement (which could also allow for payment of public sector salaries, opening of roads, flights and regular flow of fuel).

Saudi Arabia Focus

- PMI in Saudi Arabia eased to 56.3 in Jul (Jun: 57), dipping below the series average of 56.8. Output sub-index also slipped to 59.9 in Jul, down from Jun’s 61.8 and below the series average of 61.4. However, employment sub-index inched up to 51.3 from 50.7 – the fastest rate of expansion since Sep 2019 and staff wages increased at the fastest rate since Feb 2018.

- Saudi Arabia closed 49 investment deals worth more than USD 925mn in Q2, and this is expected to create over 2000 jobs, according to a report from the Ministry of Investment. Separately, a Saudi Investment Marketing Authorityhas been established to promote investment in the country and meet the objectives of the National Investment Strategy (attract USD 3trn+ in investments by 2030). The agency will be responsible for marketing and attracting investments into the country.

- Total assets of commercial banks in Saudi Arabia have exceeded SAR 3.5trn (USD 933bn) for the first time, up 13.32% from Jun 2021.

- Budget surplus in Saudi Arabia increased to SAR 77.9bn (USD 20.8bn) in Q2: revenues were up by 49% yoy to SAR 370.4bn (supported by a 89% surge in oil revenues to SAR 250.4bn) while spending grew by 16% to SAR 292.5bn (education and health sectors accounted for 39% of the expenditures). Public debt increased to SAR 966.5bn as of Jun 2022, from SAR 958.6bn at end-Mar.

- Deposits at Saudi commercial banks rose by 2.8% mom to SAR 53.5bn (USD 14.2bn) in Jun: this was the fastest monthly uptick since Jan 2014. Money supply (M3) grew by 8.9% yoy to SAR 2.44trn, the highest increase since Jul 2021. Consumer spending increased by 13.4% yoy in Jun, supported by a 19% rise in PoS transactions. Remittances from Saudi Arabia edged down by 0.19% yoy to SAR 149mn in H1 2022.

- SAMA has granted licenses to two new payment financial technology companies: Enjaz Payments Services Co. received a license to provide electronic wallet service and Marta Financial Co. to provide payment services through points of sales.

- JODI data showed that Saudi Arabia’s refinery output inched lower by 0.35% mom to 2.88mn barrels per day (bpd) in May; oil product exports grew by 3.7% mom to 1.53mn bpd.

- Reuters reported that Saudi Arabia raised crude oil prices for Asian buyers (by 50 cents a barrel) to record high levels (of USD 9.8 a barrel over Oman/ Dubai quotes) in Sep despite falling refining margins.

- Bloomberg reported that seaborne shipments from Saudi grew to about 7.5mn barrels per day in Jul (Jun: 6.6mn bpd) from tanker-tracking data. Shipments to India topped 1mn barrels a day for the first time since Apr 2020 while crude exports to China jumped to an average of 1.65mn daily barrels last month.

- Saudi Arabia’s General Authority for Competition approved 43 applications for mergers and acquisitions in Q2 2022, up by 23% yoy: of these, 37 were for acquisitions. Information and communication sector accounted for 30% of total applications in Q2, followed by manufacturing and wholesale and retail trade.

- Saudi’s National Industrial Development and Logistics Program invested a total around SAR 378bn (USD 100bn) from 2019-2021 focusing on four main sectors industry, energy, mining and logistics.

- A total of 466 mining licenses were issued during H1 2022: Feb saw the highest number with 100, while in Jun 84 new mining licenses were issued (51 exploration licenses, 26 building materials quarries, three surplus mineral ores, two exploitation licenses and two reconnaissance licenses).

- Tourism spending in Saudi Arabia surged by 52% yoy to SAR 95.6bn (USD 25.5bn) in 2021. Domestic tourism grew by 86.6% to SAR 80.9bn; holidays and shopping alone contributed 58.2% of domestic tourism, totaling SAR 47.1bn.

- King Abdullah Port reported a 6.69% increase in container shipping, handling 1,502,720 TEUs in H1 2022.

- Residential real estate prices in Saudi Arabia inched up by 1.9% yoy in Q2, according to GASTAT. This resulted in a 0.7% increase in overall real estate prices.

- Saudi Grains Organization deposited SAR 90.5mn (USD 24mn) with 140 local wheat farmers for the purchase of 52,159 tons.

- Saudi Arabia unveiled water projects worth SAR 13.105bn (USD 3.48bn) as part of a five-year plan to meet rising demand.

- The number of “Made in Saudi” products touched over 128k, accounting for about 70% of the total space in retail stores.

UAE Focus![]()

- UAE PMI inched up to 55.4 in Jul (Jun: 54.8): this was the fastest pace of growth this year, supported by a jump in output sub-index to 62.5 (Jun: 60.7). Output inflation accelerated to the second-highest reading in 4.5 years, but firms “opted to absorb additional cost burdens and cut their prices”: the trend is likely to reverse in the near-term as firms look to profits, probably one of the reasons why sentiment fell to a 10-month low.

- FDI into the UAE increased by 116% in the past decade, rising to USD 20.7bn last year, according to a Ministry of Economy report.

- The third auction of UAE’s AED-denominated treasury bonds (AED 1.5bn offering, distributed in two tranches of 2- and 3-year notes) was oversubscribed 5.1 times, attracting bids worth AED 7.6bn (USD 2.06bn), according to the finance ministry.

- UAE Cabinet approved the formation of the Higher Committee for Government Digital Transformation: the plan is to supervise the UAE’s digitisation plans and enhance the readiness, competitiveness and flexibility and alignment between projects and the digital systems of federal agencies.

- Dubai announced the launch of the Strategic Plan 2026 to achieve “financial sustainability to proactively support the leading position of Dubai through the fair and efficient distribution of the emirate’s resources”.

- UAE bank deposits inched up by 1.6% mom to AED 2.04trn (USD 655bn) at end-May, according to central bank data. While monetary aggregates M2 and M3 increased, M1 fell slightly by 2.8% mom to AED 710bn (given declines in both monetary deposits and currency in circulation).

- The UAE disclosed plans to invest USD 1bn in Pakistani companies, with a mandate to expand bilateral economic relations: it will “explore new investment opportunities and areas for cooperation in projects across various sectors”.

- Dubai Financial Market (DFM) revealed that during Jan-Jul 2022, brokerage firms added 20,552 new investor accounts (+287% yoy). During this period, over 1.41mn deals were executed by 27 firms in the DFM, trading 40bn shares worth AED 98.25bn (USD 26.7bn).

- Ajman emirate posted a 16% rise in new licenses (to 2637) issued in H1 2022: top activities being licensed were restaurants, tailoring clothes, as well as building and import activities.

- Bloomberg reported that UAE healthcare firm Burjeel Holdings was planning an IPO later this year, with an aim to raise USD 750mn. A dividend payout of 40-70% of 2023’s net income is being considered for when it is listed on ADX.

- Dubai received 7.12mn international overnight visitors in H1 2022, up by 183% yoy (and compares to 8.36mn in H1 2019), placing it on track to meet its 2022 tourism targets.

Media Review

The resilience myth: fatal flaws in the push to secure chip supply chains

https://www.ft.com/content/f76534bf-b501-4cbf-9a46-80be9feb670c

The Post-Inflation Economy That Could Be

Lebanon’s ordeal: from civil strife to economic collapse

https://www.reuters.com/world/middle-east/lebanons-ordeal-civil-strife-economic-collapse-2022-08-01/

Saudi Arabia targets USD 3.3trn of cumulative investments till 2030: MISA deputy minister

https://www.arabnews.com/node/2137966/business-economy

Crisis in Iraq tests its stability and Iran’s sway

https://www.reuters.com/world/middle-east/crisis-iraq-tests-its-stability-irans-sway-2022-08-02/