Markets

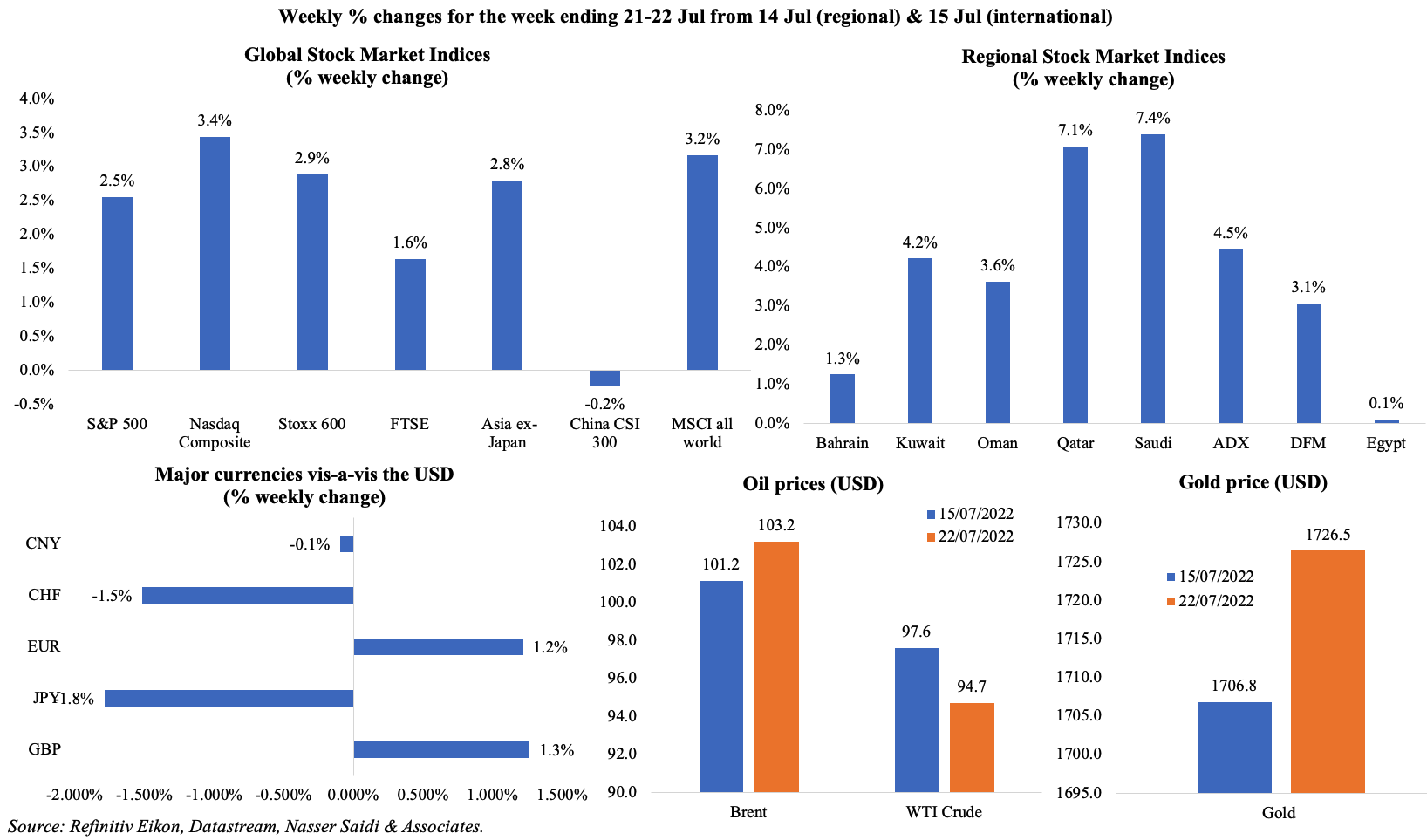

Global equity markets advanced last week, thanks to some better-than-expected earnings results, while Europe’s performance was also partly due to easing concerns related to the energy crisis. Regional markets closed on a high note last week: Saudi Arabia posted its 1st weekly gain in 3 weeks, and Egypt in five weeks. Ahead of the Fed meeting and decision this week, the dollar slipped from the week before (also given the disappointing PMI data) and gold price gained; GBP touched a high of USD 1.2064 versus the dollar, its highest level in nearly three weeks. WTI slipped below USD 95 last week while in contrast Brent ticked up (on evidence of stronger demand from Asia, especially India). Even as Libya’s oil production resumed, slightly easing supply constraints, there is still concern that aggressive rate hikes could dampen demand further this year.

Bottom line: Last week’s contraction in business activity indicators across US and Europe alongside weakness in Asia highlights an upcoming slowdown even as central banks try to rein in inflation aggressively. The Bank of Japan and China’s PBoC are the exceptions for now (underscoring priority for growth concerns vis-à-vis inflation woes), with the Fed and the BoE largely expected to raise rates by 75bps and 50bps this week and next respectively. Furthermore, global equity funds last week witnessed their biggest weekly outflow since June 15th, after investors offloaded a net USD 13.79bn worth funds; bond funds suffered a sixth weekly outflow of USD 2.13bn.

Global Developments

US/Americas:

- Philadelphia Fed manufacturing survey fell sharply to -12.3 in Jul (Jun: -3.3), the lowest since Dec 1979. The new orders dropped 12.4 points to -24.8 in Jul while the future capital expenditures index fell 7 points to 4.4, its lowest reading since Mar 2013.

- Building permits declined by 0.6% mom to 1.685mn in Jun with permits for single-family homes down by 8% to 967k – the lowest since Jun 2020. Housing starts fell by 2% mom to a 9-month low of 1.559mn, with single-family housing starts falling by 8.1% to 982k (below the 1mn mark for the first time in 2 years).

- Existing home sales fell for a 5th consecutive month, down by 5.4% mom to 5.12mn in Jun – the lowest level since Jun 2020. Sales fell by 14.2%, bringing June’s sales rate to below the pre-pandemic pace. However, the median existing house price increased by 13.4% yoy (the 23rd consecutive month of double-digit increases) to an all-time high of USD 416k in Jun.

- S&P Global flash manufacturing PMI in the US slowed to 52.3 in Jul (Jun: 52.7), posting the slowest growth in 2 years. Services PMI tumbled to below-50, with the reading down to 47 from 52.7 the month before.

- Initial jobless claims increased to 251k in the week ended Jul 15th (highest weekly level since mid-Nov), up from 244k a week ago, raising the 4-week average to 240.5k. Continuing jobless claims inched up to 1.384mn in the week ending Jul 8th (highest since Apr 23rd).

Europe:

- The ECB increased interest rates by 50bps, in its first hike in 11 years, and moving away from negative rates. The deposit rate now stands at 0%, the main refinancing operations rate is 0.5% and the marginal lending facility is at 0.75%.

- Inflation in the eurozone was confirmed at 0.8% mom and 8.6% yoy in Jun, with almost half the inflation resulting from the surge in energy prices while food prices and services came in as second and third factors. Core inflation stood at 3.7% yoy and 0.2% mom.

- Preliminary manufacturing PMI in the eurozone fell below-50 in Jul, with the reading down to 49.6 (Jun: 52.1). Services PMI also slipped, down to 50.6 in Jul (Jun: 53), causing the composite PMI to slip into contractionary territory (49.4 in Jul from Jun’s 52).

- Current account deficit in the euro area widened to EUR 15.4bn in May, largely on account of higher import costs, the biggest deficit since Jan 2020; the goods account recorded a surplus of EUR 0.6bn and the services account a EUR 12.2bn surplus.

- Flash consumer confidence in the euro area tumbled to -27 in Jul (Jun: -23.8), touching the lowest level on record. In the EU, consumer sentiment declined by 3 points to -27.3.

- Germany’s preliminary manufacturing and services PMI fell to 49.2 in Jul, resulting in the overall composite PMI slipping to 48 (Jun: 51.3).

- Producer price index in Germany increased by 0.6% mom and 32.7% yoy in Jun (May: 1.6% mom and 33.6% yoy), largely due to the ongoing uptick in energy prices.

- Inflation in the UK climbed further to a new 40-year high of 9.4% yoy in Jun (May: 9.1%), thanks to higher food and energy prices; core inflation eased slightly to 5.8% (May: 5.9%). The Bank of England expects inflation to peak at around 11% later in the year.

- Producer price index in the UK increased on both the input side (to 24% in Jun from May’s 22.4%) and output side (to 16.5% from 15.8%). Metals and non-metallic minerals, and food products accounted for the largest contributions to rates of input and output inflation, respectively. Retail price index also edged up, rising to 11.8% yoy in Jun (May: 11.7%).

- Preliminary manufacturing PMI in the UK eased slightly to 52.2 in Jul (Jun: 52.8) while the services PMI eased by 1 point to 53.3. Employment rose at the slowest pace in 16 months.

- UK average earnings excluding bonuses grew by 4.3% yoy in the 3 months to May (Apr: 4.2%). Real regular pay (wages adjusted for prices once bonus payments have been stripped out) was 2.8% yoy lower in the 3 months to May – this was the sixth monthly decline in a row and the biggest drop since modern records began in 2001. Unemployment rate remained unchanged at 3.8%.

- Retail sales in the UK fell by 0.1% mom and 5.8% yoy in Jun. Excluding fuel sales, retail sales were declined by 5.9% yoy. In Apr-Jun, sales volumes were down by 1.2%.

- GfK consumer confidence in the UK stood unchanged at the record low of -41 in Jul.

Asia Pacific:

- The PBoC left interest rates unchanged, with the one-year loan prime rate (LPR) was kept at 3.70%, and the five-year LPR was unchanged at 4.45%. The apex bank recently signalled a less accommodative monetary policy in H2 2022.

- The Bank of Japan left policy rates unchanged, with the governor stating he had “absolutely no plan” to raise rates. The Bank expects core prices to rise by 2.3% this fiscal year (from 1.9% before), while growth is forecast at 2.4% as the JPY is pushed near a 24-year low.

- Inflation in Japan eased to 2.4% yoy in Jun (May: 2.5%). Core CPI (excluding just fresh food) was up by 2.2% (May: 2.1%), remaining higher than the central bank’s target for the 3rd consecutive month. Excluding food and energy, prices ticked up to 1% (May: 0.8%), the sharpest increase since Feb 2016.

- Japan’s exports grew by 19.4% yoy in Jun while imports surged by 46.1%, causing trade deficit to touch JPY 1.383trn (USD 10bn) – this was the biggest for Jun since 2014. Overall trade deficit for H1 stood at JPY 7.92trn given higher oil prices and a weaker yen.

- Preliminary manufacturing PMI in Japan edged down to 52.2 in Jul (Jun: 52.7), as output returned to contractionary territory and new orders shrank amid an increase in both energy and wage costs. Services PMI also slowed down to 51.2 from 54 the month before.

Regional Developments

- Egypt’s GDP is expected to reach EGP 9.2trn (USD 485bn) during the fiscal year 2022-23, up 16.1% yoy. Investments are estimated to rise by 16.7% yoy to EGP 1.4trn during the current fiscal year.

- Paving the way for the next round of privatisations, Egypt approved pre-listing procedures for petrol stations operator Wataniya and water company Safi: currently, both these entities are owned by the Egyptian army. No additional information was provided on the timing of the listings though.

- Hotel occupancy rates in Cairo almost doubled to 60% during Jan-May 2022, according to a report from JLL MENA.

- Iraq’s energy minister, in an interview with Bloomberg, expects oil to trade at over USD 100 a barrel for the rest of 2022.

- S&P raised Kuwait’s future outlook to “stable” from negative” while maintaining the sovereign credit ratings at A+.

- Oman’s crude oil production increased by 9.7% yoy to 189.6mn barrels during H1 2022. Exports of LNG grew by 8% to around 5.9mn tons during the same period.

- The total number of SMEs registered at Oman’s Authority for Small and Medium Enterprises surged by 46.9% yoy to 78,089 at end-May 2022. A new strategy is being prepared for the SME sector, with the aim to provide a supportive environment and strengthen the integration of all entities related to the sector.

- Reuters reported that Qatar Energy sold two cargoes of al-Shaheen crude loading in Sep at the highest premiums in four months.

- Libya resumed oil exports last week, after months of closures at several fields which had resulted in a drop in daily output by two-thirds. Production was at 1.2bn barrels per day earlier.

- About 127,397 hotel rooms are under construction in the Middle East, according to STR Global. Saudi Arabia accounts for the largest share with some 37,654 rooms being built in the country, followed by the UAE (31,671 rooms).

- Arabs accounted for about 30% of the USD 100bn spent on medical tourism globally, disclosed the president of the Arab tourism Organisation. He also stated that the market is expected to grow to more than USD 200bn over the next decade.

- Total value of projects awarded in the GCC increased by 11.7% yoy to USD 22.8bn in Q2, according to data from Kamco. The bulk of projects were awarded in Saudi Arabia (USD 16.5bn), driven by NEOM-based projects. However, UAE posted a 46.4% fall in projects (to USD 3.1bn) while Bahrain and Kuwait projects plunged by 83.9% and 67.9% (to USD 228mn and USD 521mn respectively).

- The value of the GCC Projects Index dropped by 1.5% between June to Jul, according to MEED Projects. This was largely due to a 3% drop in Saudi market (which has about USD 1.34trn in projects) and a 1.9% drop in UAE (with USD 626bn in ongoing and planned projects). Qatar and Oman posted increases of 5% and 3% respectively in this period.

Saudi Arabia Focus

- Saudi Arabia’s Ministry of Industry and Mineral Resources revealed plans to automate some 4000 factories. Separately, the Smart Industry Readiness Index methodology was being adopted to assess the operational readiness of factories.

- Weekly point-of-sales data from SAMA shows a decline in value for the sixth consecutive week: in the week ending Jul 16th, about SAE 8bn was spent via 123mn transactions. Sales decreased in restaurants and cafes by 13.2%, food and beverages by 24.5%, and miscellaneous goods and services by 38.2% over the last week.

- Venture capital investments in Saudi Arabia surged to a record high of USD 584mn (+244%) from 79 deals (+36%) in H1 2022, according to MAGNiTT. Fintech had the highest number of transactions with 17 deals, followed by logistics which had 12 deals, and e-commerce with eight deals, in H1 2022.

- Total assets of Saudi finance companies grew by 26% yoy to SAR 67bn (USD 17.8bn) in 2021; aggregate capital expanded by 37% to SAR 19.6bn in 2021 while net profits surged by 114% to SAR 1.9bn.

- China imported 5.06mn tons (or 1.23mn barrels per day) of oil from Saudi Arabia in Jun, down from 1.84mn bpd in May and 30% yoy. This enabled Russia to retain its spot as the top oil supplier to China (with 1.77mn bpd) for the second straight month. Year-to-date, imports from Russia stood at 41.3mn tons versus Saudi’s 43.3mn tons.

- Saudi Arabia’s import volumes of empty containers expanded by 231% to 69,429 TEUs between Jan-May, according to the Saudi Ports Authority.

- Hotel occupancy rates in Makkah and Madinah is expected to rise by 10.5 and 17 percentage points in 2022, according to Colliers Jul report.

- As part of the privatisation of the sector and with the aim to receive more passengers, Saudi Arabia plans to reduce its airport charges by as much as 35% later this year, reported Bloomberg.

UAE Focus![]()

- The UAE central bank estimated GDP growth at 8.2% in Q1, with a forecast of 5.4% for the full year. Non-oil GDP is expected to rise by 5.4% and 4.2% in 2022 and 2023 respectively.

- As part of the UAE President’s visit to France, several agreements and MoUs were signed including in energy, higher education, climate change and lunar exploration among others. Furthermore, Abu Dhabi National Oil Co. entered a strategic partnership with TotalEnergies to collaborate in areas including gas growth, carbon capture utilization and storage trading and product supply.

- Dubai’s Crown Prince announced the launch of the Dubai Metaverse Strategy, which aims to add AED 4bn to the economy and support 40k virtual jobs in the next 5 years. He also disclosed that there were over 1000 Dubai-based firms operating in the metaverse and blockchain sector, contributing USD 500mn to the economy. Key pillars of the strategy are extended reality (combining the physical and virtual worlds), augmented reality, virtual reality, mixed reality, and digital twins (a virtual representation of an object or system).

- Inflation in Dubai rose to 5.84% yoy in Jun, driven by prices of recreation (35.76%), transport (33.32%) & food & beverages (9%).

- UAE’s monetary aggregates in the UAE M1, M2 and M3 inched up by 3.7% qoq, 1.9% qoq and 1.5% qoq as of end-Mar 2022; the uptick in M3 happened despite of a decline in government deposits by 0.6%. UAE’s monetary base narrowed by 1.2% mom and 0.6% qoq in Mar 2022, largely as the declines in reserve requirements and certificates of deposit/ monetary bills more than offset the expansion in Banks & OFC’s Excess Reserves (24.1% of monetary base).

- Credit disbursed by UAE banks grew by an average 1.7% in Q1 2022; loans to the public sector surged at the fastest pace (average 19.4% in Q1) among all groups including private sector (1.4%) while loans to government declined (-11.7%). Lending to the business and industrial sector rebounded after 20 months of declines, rising by 0.2% yoy to AED 776.2bn in Mar.

- fDi Markets data from the FT revealed that Dubai was the top FDI destination for tourism in 2021 attracting AED 6.4bn (USD 1.7bn) in FDI across 30 projects.

- Reuters reported that Russia was seeking payment in AED for oil exports to some Indian customers, in a bid to shield itself from sanctions.

- Energy demand in Dubai increased by 6.3% yoy to 23,096 GWh in H1 2022, according to the CEO of DEWA. DEWA’s capacity reached 14,117 megawatts of electricity and 490mn imperial gallons of desalinated water per day.

- Dubai recorded a 25% yoy growth in new business licenses issued to 45,653 in H1 2022; professional and commercial licenses accounted for 55% and 45% of the total respectively.

- Dubai Chamber of Commerce witnessed a surge in membership growth in H1 2022, growing by 21k firms (or 80% yoy) to 308,000. Firms are forecast to reach 330k by end-2022. Exports and re-exports of Chamber’s members grew by 18% yoy to AED 129.4bn in H1 2022.

- Case volume in DIFC Courts grew by 10% yoy in H1 2022, handling cases worth AED 1.9bn in total value.

- Dubai issued Decree No 22 of 2022, introducing incentives for property investment funds in the emirate. The law provides for the establishment of a Real Estate Investment Funds Register at the Dubai Land Department and the establishment of a ‘Committee for Property Investment Funds’ (its purpose is to identify areas and properties that funds are allowed to invest in, either through full ownership or lease, for a period not exceeding 99 years).

- The world’s largest vertical farm, called Bustanica, was opened close to the Al Maktoum International Airport in Dubai. Backed by an investment of USD 40mn, the hydroponic facility is designed to produce more than 1mn kilograms of high-quality leafy greens each year and a result of a joint venture between Emirates Flight Catering and Crop One Holdings.

- The number of French tourists visiting UAE grew by 59% yoy to 311,570 in 2021, according to the FCSA. Ahead of the President’s visit to France, it was also disclosed that there were over 30k French citizens living in the UAE and over 600 French firms operating in the country.

- Moody’s downgraded the government of Sharjah’s long-term foreign and local currency issuer ratings to Ba1 from Baa3, citing the deterioration of fiscal strength.

- The value of real estate transactions in Abu Dhabi increased to more than AED 22.51bn (USD 6.1bn) in H1 2022, from 7474 transactions.

Media Review

Syria: what is Turkey’s grand plan?

https://www.ft.com/content/a14241de-8dbf-4a69-b064-2991f5992503

Gulf bond hopefuls wait in the wings after first-half plunge in volumes

DEWA’s investment focus on renewables, power distribution & Hassyan complex

Why it is too early to say the world economy is in recession

The Problem with the Current Russia Sanctions Regime

The 53 fragile emerging economies

https://www.economist.com/finance-and-economics/2022/07/20/the-53-fragile-emerging-economies