Weekly Insights 22 Jul 2022: Expect Sustained Increase in Non-Oil Economic Recovery in the UAE

1. Key Indicators point to sustained increase in non-oil Economic Recovery in the UAE

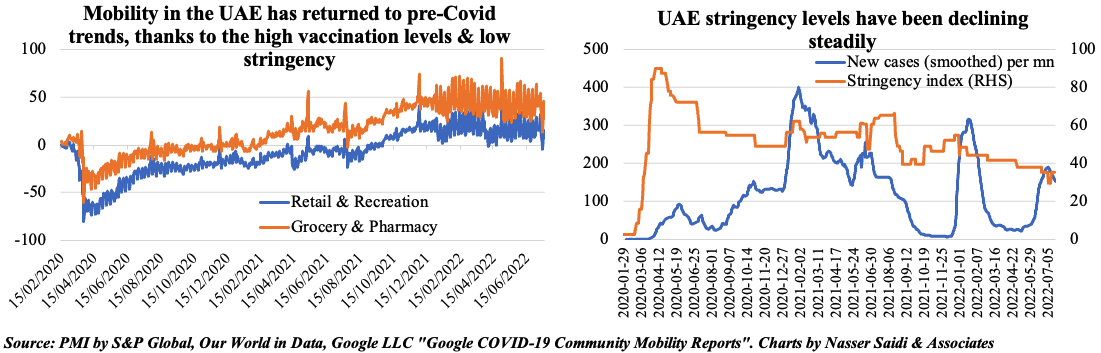

- UAE is benefitting from a recovery in both oil and non-oil sector activity this year, also supported by high vaccination rates and low levels of restrictions.

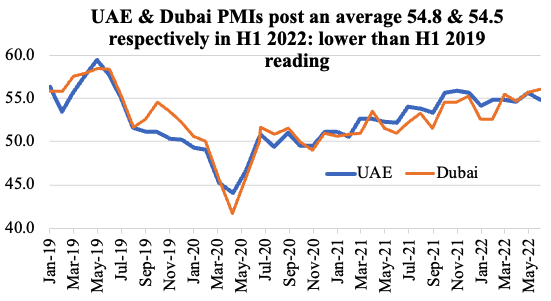

- UAE and Dubai PMIs are rising, supported by domestic orders and in recent months, foreign as well.

- The central bank estimates GDP growth at 8.2% in Q1, with a forecast of 5.4% for the full year.

- Mobility in UAE has been increasing and is now higher than baseline rates seen pre-Covid. Having high vaccination rates have resulted in very low deaths even with a slight increase in cases in recent weeks.

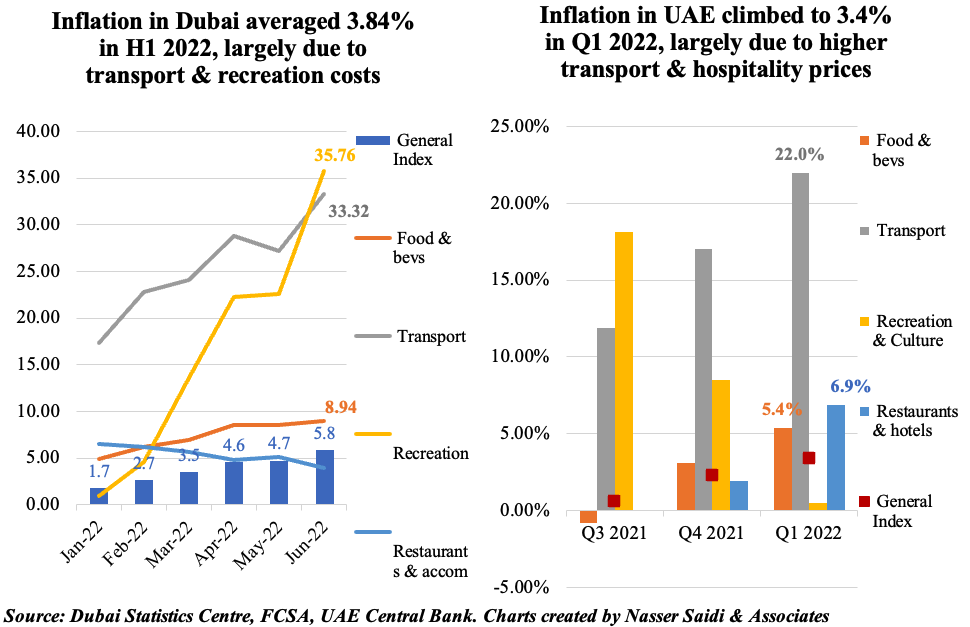

2. Cost of living nudges up in the UAE

- Inflation is on the rise, in both Dubai and the wider UAE, mirroring the increase in input costs (from PMI data). A point to highlight, especially in the context of Dubai, is that firms have been reluctant in passing on the costs fully to the customer – opting for discounting to boost sales. But, should global prices continue to rise, it will affect business profits causing firms to reconsider strategy – which might see another round of price hikes.

- For now, fuel prices contributes the most to rise in inflation – at both Dubai and UAE level. Recreation costs have also risen significantly in Dubai (35.8% yoy in Jun)

- The UAE government has rolled out a USD 7.6bn package to support low-income families with the sharp increase in cost of living, while also announcing that prices of certain basic commodities need approval for any further hikes.

- While consumers adjust to price increases by reducing purchases (of clothing & at F&B outlets, as per a YouGov survey), there are also indications of an increase in wages. Official ministry data show a 5% yoy increase in wages of private sector employees in Q1 2022; UAE PMI data states average wages rose to their highest in 4 years in Jun.

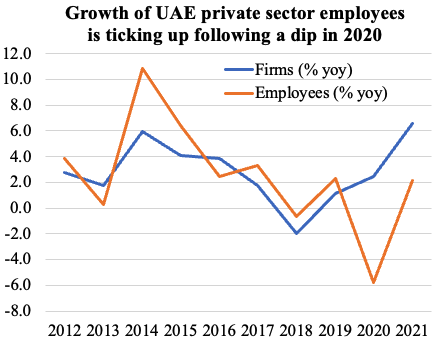

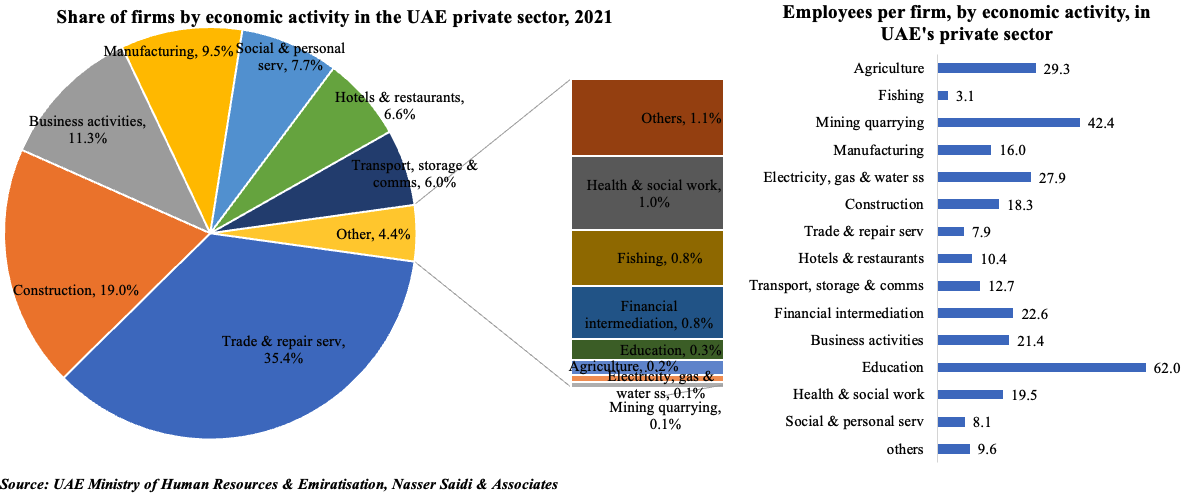

3. UAE’s private sector firms & employment rise in 2021

- Data from UAE’s Ministry of Human Resources & Emiratisation show a 6% increase in number of private sector firms (to ~380k) in 2021 while employees grew by 2.2% yoy to close to 5mn (2020: -5.8%).

- Trade & repair services and construction together accounted for about 55% of total firms registered with the Ministry.

- Employees per firm was highest in the education sector (62 per firm, much higher than recorded in 2019) and mining & quarrying (42.4)

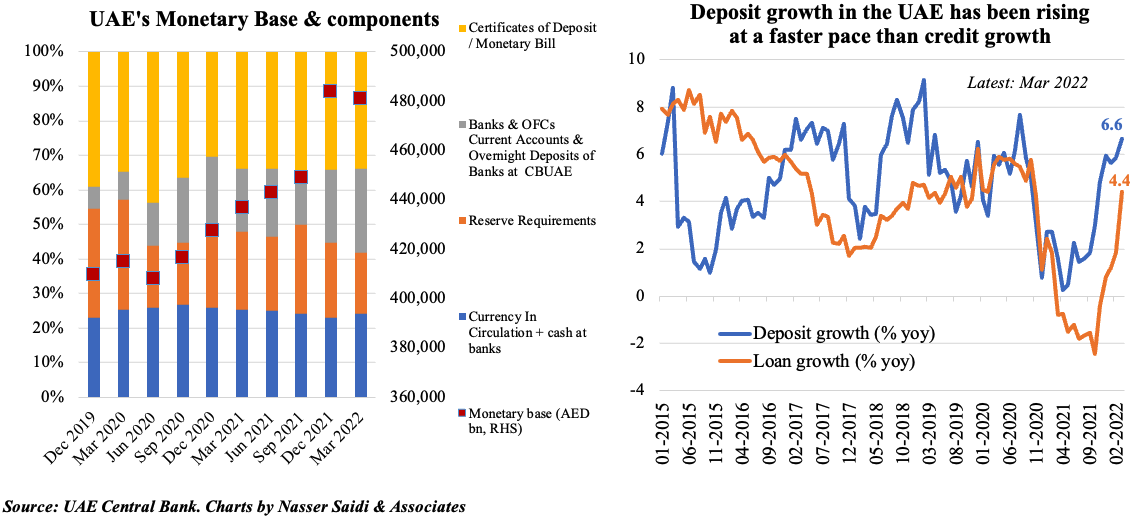

4. UAE’s Monetary Aggregates Expand; bank lending rebounds and total deposits grow

- All monetary aggregates in the UAE M1, M2 and M3 inched up by 3.7% qoq, 1.9% qoq and 1.5% qoq as of end-Mar 2022; the uptick in M3 happened despite of a decline in government deposits by 0.6%. UAE’s monetary base narrowed by 1.2% mom and 0.6% qoq in Mar 2022, largely as the declines in reserve requirements and certificates of deposit/ monetary bills more than offset the expansion in Banks & OFC’s Excess Reserves (24.1% of monetary base).

- Bank lending rebounded in the UAE (4.4% yoy as of end-Mar 2022) while total bank deposits grew by 6.6%. Residents’ deposits grew by 6.8% yoy as of Mar 2022, thanks to increases across multiple categories (including corporates at 14.2% and NBFIs at 9.4%) except for GREs (-2.8%).

5. UAE credit growth driven by lending to GREs and private corporate & retail customers

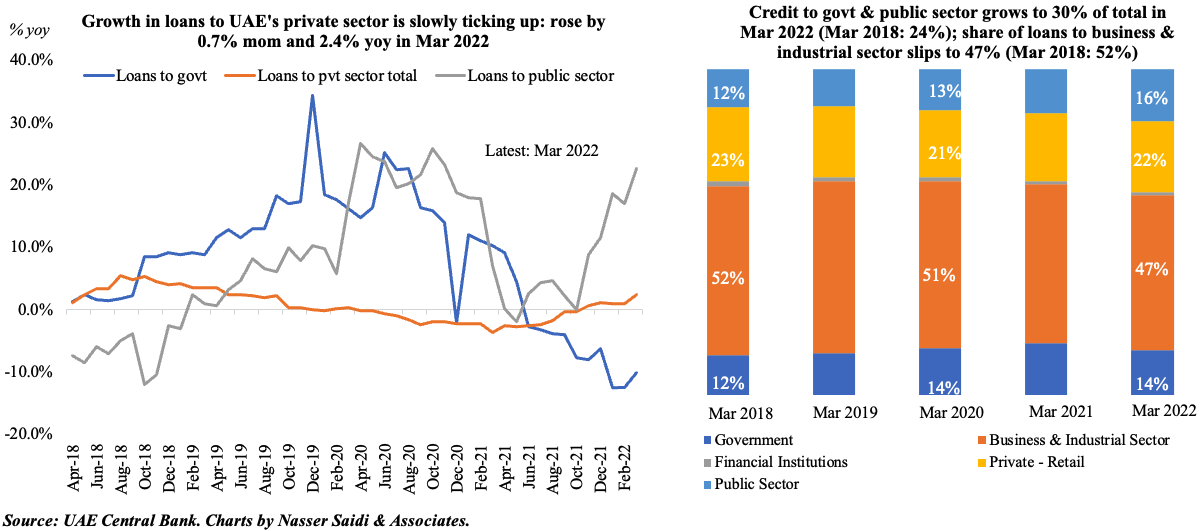

- Credit disbursed by UAE banks grew by an average 1.7% in Q1 2022; loans to the public sector surged at the fastest pace (average 19.4% in Q1) among all groups including private sector (1.4%) while loans to government declined (-11.7%).

- The share of lending to the government and public sector increased to 30% of the total as of end-Mar 2022, from just 24% in Mar 2018; share of loans to the business and industrial sector slips to 47% this Mar (Mar 2018: 52%).

- Lending to the business and industrial sector rebounded after 20 months of declines, rising by 0.2% yoy to AED 776.2bn in Mar. This was also reflected in the Credit Sentiment Survey for Q1 – highlighting both increase in banks’ credit appetite & demand for loans from both businesses & households (the latter the highest quarterly increase since 2014).

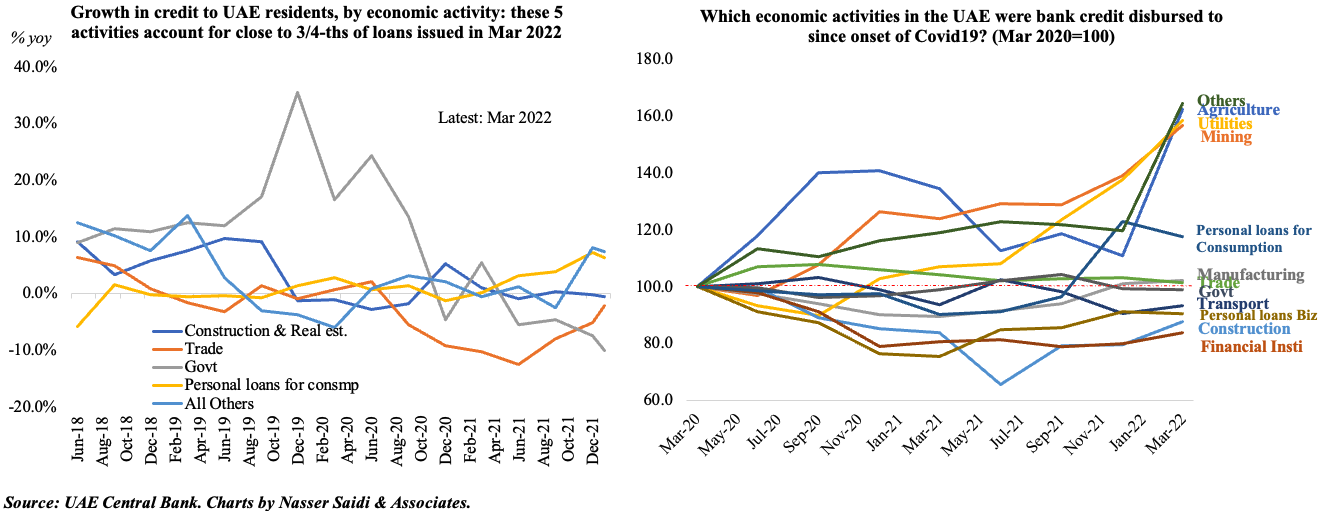

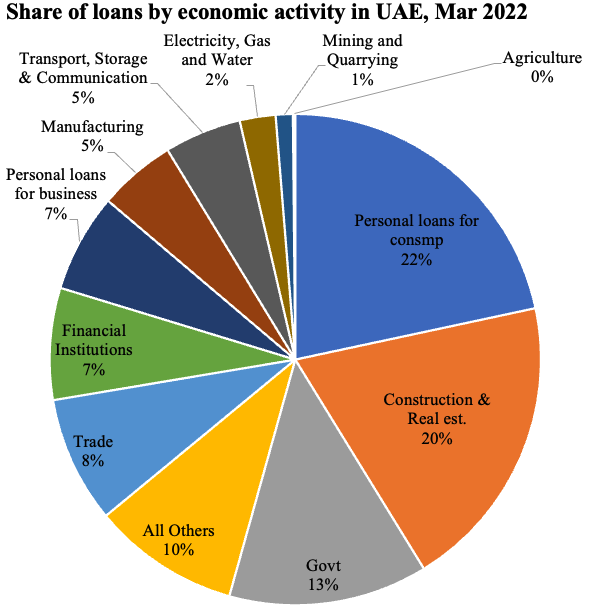

6. UAE credit growth by economic activity in line with strategic focus

- Construction & real estate, government, trade, “others” and personal loans for consumption together accounted for 72% of total lending to UAE residents. Of these, lending to the government has been steadily declining.

- In line with focus on specific sectors like agriculture (for food security) and manufacturing (given industrial strategy and related initiatives), credit to these have been on the rise since Covid. The increase in lending to the mining sector is also unsurprising. Note that construction sector is seeing an uptick in recent months, in line with rising demand.