Markets

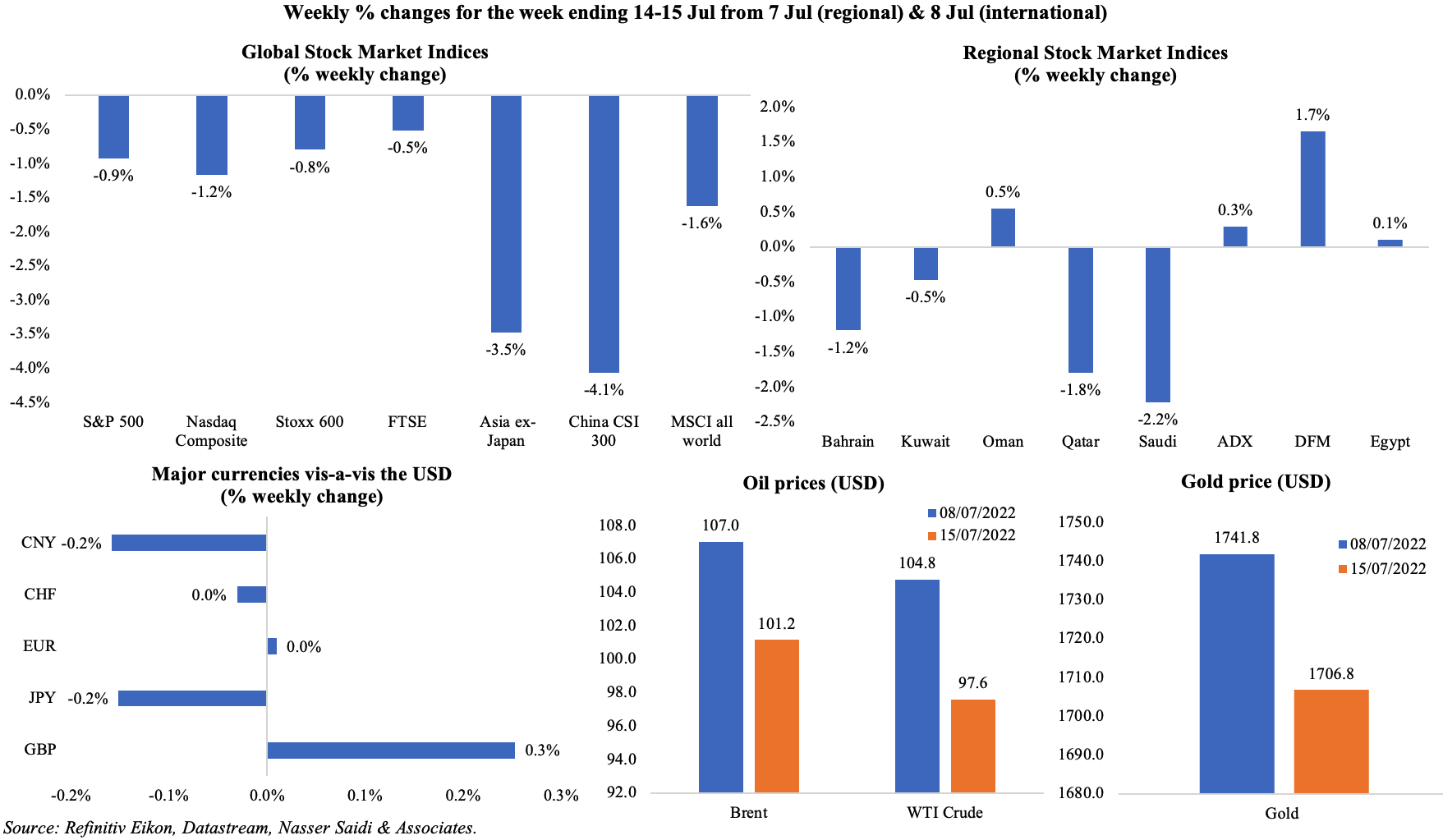

Most global equity markets declined last week: overall, rising inflation, interest rate hikes and recessionary fears are weighing on investor sentiment, with emerging markets having to also deal with the stronger dollar; Chinese markets are grappling with fresh outbreaks and lockdowns. Regional markets showed a mixed picture, with Saudi and Qatar posting declines (the former hitting a 6-month low and wiping out this year’s gains) while UAE’s DFM gained. The safe-haven dollar rose to a 20-year high while the euro fell to parity with the dollar for the first time since 2002. Oil prices fell given expectations of a decline in consumer demand following rate hikes. Gold price settled at more than 15-month low amid strong dollar performance.

Global Developments

US/Americas:

- Inflation in the US jumped to a new 40-year high of 9.1% in Jun, thanks to a 7.5% increase in the energy index; core inflation stood at 5.9%. The worrying sign is the increase in services inflation, which excluding energy, climbed by 0.7% mom and 5.5% yoy.

- Producer price index in the US increased to a near-record 11.3% yoy in Jun (May: 10.9%), as energy costs surged. Excluding energy, food and trade service prices, core PPI eased to 6.4% (May: 6.8%). Some signs of respite came from prices of chicken eggs (-30.2%) while iron and steel scrap prices fell by 10.4%.

- Fed’s Beige book disclosed signs of slowdown amid substantial rise in inflation (especially in food, commodities and energy); three quarters of respondents noted moderation in prices for construction inputs such as lumber and steel.

- Monthly budget statement showed a narrowing of fiscal deficit to USD 89bn in Jun (Jun 2021: USD 174bn), as revenues increased (+3% to USD 461bn, a new June record) amid a slowdown in pandemic-related spending (12% to USD 550bn).

- NY Empire State manufacturing index increased to a 3-month high of 11.1 in Jul (Jun: -1.2), thanks to an expansion in shipments and a marginal increase in new orders. However, in a rare turn, firms turned pessimistic about the 6-month outlook.

- Retail sales in the US rebounded by 1% mom in Jun (May: -0.1%), with sales at gasoline stations posting the largest increase (+3.6%), followed by non-store retailers’ sales (2.2%). Core retail sales inched up by 0.8% following a 0.3% decline in May. Retail sales increased 8.4% yoy and are 18% above their pre-pandemic trend.

- Industrial production in the US declined by 0.2% mom in Jun, for the first time this year, after a flat reading in May. Manufacturing output declined 0.5% in Jun, largely due to weakness in consumer goods production. Excluding autos, total industrial output fell 0.1%.

- Michigan consumer sentiment index increased to 51.1 in Jul (Jun: 50), supported by an improvement in the current economic conditions subindex though the expectations gauge declined further to 47.3, the lowest since May 1980.

- Initial jobless claims increased to 244k in the week ended Jul 8th (the highest since the Nov. 20, 2021), down from 235k a week ago, taking the 4-week average rising higher to 235.75k. Continuing jobless claims fell by 41k to 1.331mn in the week ending Ju1 1st.

Europe:

- Industrial production in the eurozone increased by 0.8% mom in May, accelerating from Apr’s 0.5% monthly gain, thanks to upticks across the board: non-durable consumer goods (2.7% from 1.5%), durable consumer (1.4%) and capital goods (2.5% from a 0.6% drop).

- ZEW survey economic sentiment index in the eurozone collapsed to -51.1 in Jul (Jun: -28). The situation indicator fell to a new level of -44.4 points, down by 18 points vs to Jun.

- German ZEW economic sentiment index plunged to -53.8 in Jul (Jun: -28) while the current situation fell to 0-45.8 from -27.6 the month before. Both values are below those recorded at the beginning of the Covid crisis (Mar 2020).

- Wholesale price index in Germany eased slightly in Jun, to 21.2% yoy from May’s 22.9% uptick. Costs are being pushed by mineral oil products (62%), solid fuels (80.9%), grains, seeds etc (38.6%) and metals (25.4%) among others.

- UK GDP increased by 0.5% mom in May (Apr: -0.3%), thanks to a surge in holiday bookings and GP appointments amid a decline in consumer facing services (falling retail sales, slump in sports activities and recreation). Industrial production rebounded by 0.9% mom in May (Apr: -0.1%) while manufacturing grew at a faster pace of 1.4% (Apr: -0.6%).

- Like-for-like retail sales volumes in the UK fell by 1.3% yoy in Jun (May: -1.5%); this was above the 3-month average decline of 1.5% and below the 12-month average growth of 1%.

Asia Pacific:

- China’s GDP grew by 0.4% yoy in Q2 (Q1: 4.8%), the worst quarterly performance since Q1 2020; in qoq terms, GDP shrank by 2.6%. This brings H1 growth to 2.5%, below the 5.5% annual target set by the government.

- Industrial production in China increased by 3.9% yoy in Jun (May: 0.7%). Retail sales rebounded by 3.1% yoy in Jun, helped by a boost in car sales (given pent-up demand and support for electric vehicles). Fixed asset investment increased by 6.1% during H1 2022. Youth unemployment touched a new record high of 19.3% in June.

- China’s exports grew by 17.9% yoy in Jun (the fastest growth since Jan) and imports were up by just 1% resulting in a widening of the trade surplus to USD 97.94bn in Jun.

- Money supply in China increased by 11.4% yoy in Jun (May: 23.7%). New loans jumped to CNY 2.8trn in Jun (USD 418.89bn), higher than the CNY 1.89trn disbursed the month before. Additionally, newly added total social financing for June rose to CNY 5.17trn from CNY 2.79trn in May.

- Japan machinery orders dropped by 5.6% mom in May (Apr: 10.8%), the first drop in 3 months.

- Industrial output in India expanded by 19.6% yoy in May, following Apr’s 7.1% gain, after remaining subdued most of the year; manufacturing production was up by 20.6%.

- Consumer price inflation in India rose to 7.01% yoy in Jun (May: 7.04%), staying above the RBI’s target range of 2-6% for the 6th consecutive month. WPI inflation eased to 15.18% yoy in Jun (May: 15.88%), though remaining in double digits for the 15th straight month.

- Bank of Korea surprised markets by raising rates by a historic 50bps to 2.25%, in a bid to fight inflation, following the 25bps hike in May. Separately, Philippines central bank rolled out an out-of-cycle 75bps hike.

- Preliminary GDP in Singapore grew by 4.8% yoy in Q2, faster than the revised 4% growth in Q1; in qoq terms, GDP was unchanged from the 0.9% expansion in Q1.

- Singapore surprised markets by tightening monetary policy for the fourth time in the past 9 months. The central bank projected core inflation to range between 3-4% for the year (from 2.5-3.5% before). It also expects GDP growth to come in at the lower half of the 3-5% forecast.

Bottom line: Last week saw multiple emerging market central banks hiking interest rates aggressively to combat inflationary pressures. This week sees ECB and BoJ policy meetings – the former is expected to raise rates by 25bps (eyes will be on details related to the ECB’s “anti-fragmentation” tool); the BoJ is likely to maintain its ultra-loose policy as even though inflation is ticking up, it remains much lower than elsewhere, plus wage growth remains quite tepid. Finally, flash PMIs for Jul will be released this week – while last month’s readings were still in expansionary territory in both Europe and the US, this week’s data might show some softening in consumer demand (we are yet to see visible signs of weakening inflation following rate hikes). PMI, consumer confidence and economic indicators presage a global slowdown by Q4. On the one hand, higher inflation and inflation expectations are weighing on total demand in the backdrop of global monetary tightening led by US, while on the other there’s a constrained supply side (given lack of investment during Covid and continuing lockdowns, ongoing Russia-Ukraine war) and growing global geopolitical tensions. Need to be prepared for a recession in Q3 in the EU and onset of recession in the US in Q4.

Regional Developments

- Bahrain’s national-origin exports increased by 43% yoy to BHD 1.351bn (USD 3.59bn) in Q2; while Saudi Arabia, US and the UAE were the top 3 destinations, the top 10 together accounted for 71% of the value of exports. Imports rose by 28% to BHD 1.598bn in Q2, with China, Brazil and Australia the top source nations.

- Egypt’s fuel pricing committee announced a hike in domestic fuel prices: prices were raised by EGP 0.50 for 80-octance (to EGP 8 or USD 0.4244) and 92-octane (to EGP 9.25) while raised by EGP 1 for 95-octane (EGP 10.75). Prices will apply till Sep 2022. Separately, the PM disclosed that Egypt was subsidizing diesel at a cost of nearly USD 3bn annually.

- Trade between Egypt and the GCC nations grew by 21.7% yoy to USD 16.1bn in 2021. The value of Egypt’s exports to the GCC declined by 16.8% to USD 4.5bn during last year. Value of GCC investments in Egypt inched up by 1.9% yoy to USD 3.9bn; of this UAE accounted for the largest amount (USD 2.8bn), followed by Saudi Arabia (USD 622mn) and Kuwait (USD 217.8mn).

- An additional EGP 6bn has been allocated in the budget for 2022-23 to support export development, according to Egypt’s minister of finance. Furthermore, EGP 5bn has been allocated to support reducing electricity prices for the industrial sector.

- The value of remittances from Egyptians abroad grew by 7.7% yoy to USD 11.1bn in Jan-Apr. Separately, remittances from the GCC increased by 11.1% yoy to USD 20.9bn during FY 2020-21, according to CAPMAS. Saudi Arabia, Kuwait and UAE sent the most – at USD 11.2bn, USD 4.4bn and USD 3.4bn respectively.

- Egypt’s petroleum sector has adopted measures to enhance energy efficiency in 31 petroleum companies, which together is expected to save EGP 813mn annually.

- Iraq’s central bank has no plans to change the exchange rate of the dinar – to do so either now or in the next 3-5 years, according to the deputy central bank governor.

- Delays in pumping station upgrades would lead to delays in Iraq’s plans to boost oil export capacity at its Gulf ports. The nation could potentially miss out on exporting an additional 150k barrels per day of oil exports in Q3.

- The GCC Interconnection Authority signed a contract with Iraq’s Ministry of Electricity to interconnect GCC grids.The new lines are likely to be constructed in 24 months and will have a total transmission capacity of 1800 MW.

- Oman Investment Authority approved the “exit plan” submitted by OQ Group with divestments totaling between OMR 1.5-2bn. No details were provided on the OQ assets lined up for either a full or partial divestment.

- Remittances from Jordanians working in Qatar grew by 5% to USD 200mn in H1 2022. Given recent initiatives by Qatar’s emir to provide job opportunities for Jordanians in Qatar, the community has grown to more than 70k personsfrom about 60k three years ago.

- IATA reported a 11.6% yoy drop in cargo volumes in the Middle East in May (Apr: -11.9%) while capacity was 7.6% higher in yoy terms.

Saudi Arabia Focus

- Biden’s visit to Saudi Arabia saw 18 agreements being signed in fields of energy, communications, space and healthcare. While no pledge was made regarding boosting oil output, the US committed USD 1bn in new acute near- and long-term food security assistance to the MENA region. Another positive move was that Saudi Arabia would open its airspace to all air carriers including overflights to and from Israel. Separately, Saudi foreign minister stated that he was unaware of any discussions related to a Gulf-Israeli defence alliance, and that the Kingdom was not involved in any such talks.

- Addressing a US-Arab Summit last week, the Saudi Crown Prince called for more investment in fossil fuel and clean energy technologies to meet global demand. He also announced raising production capacity to 13mn barrels per day (bpd) by 2027 from a capacity of 12mn now.

- Consumer prices in Saudi Arabia by 2.3% yoy in Jun(May: 2.24%), the highest in a year, driven by food and beverages (4.41% from May’s 4.25%), housing & utilities (1.02% from 0.5%), recreation (3.45% from 2.4%) and restaurants (4.87% from 4.13%). It seems likely that inflation focus shifts to the services sector (recreation, hospitality); transport costs eased (2.47% from 4.05%). CPI averaged 1.95% in H1 2022.

- Wholesale price inflation in Saudi Arabia eased to single digit in Jun (8.07%), slowing for the 3rdconsecutive month. Food products, beverages and tobacco and textiles posted an increase (9.24% from 8.3% in May) amid easing among other sub-groups. WPI averaged 10.82% in H1 2022.

- Saudi Arabia’s industrial production grew by 24% yoy in May: this is the 3rd highest rise in last 3 years. This increase has been driven by mining and quarrying (which includes oil production) after growth turned positive in May 2021. In May 2022, manufacturing grew at a faster pace (28.8% yoy) than mining and quarrying (23.3%); this is in line with the uptick in PMI and recent data on volume of investment in Saudi manufacturing facilities.

- Reuters reported that Saudi Arabia more than doubled the amount of Russian fuel oil (to 647k tons) it imported in Q2: this was needed to feed power stations to meet the demand for summer cooling, while freeing up the country’s crude for export.

- Saudi Arabia will boost oil production only if there is a supply shortage in the market, and decisions will be made in coordination with OPEC+ members, stated the Saudi Minister of State for Foreign Affairs.

- The difference between Saudi bank deposits and credit turned negative for the first time at least since 2013. In May 2022, the balance of total bank credit disbursed in Saudi Arabia exceeded the balance of total bank deposits by SAR 14.5bn (and compares to a shortfall of SAR 5.4bn in Apr).

- Tadawul launched its first Sharia-compliant index will track the performance of Sharia-compliant companies listed on the Saudi stock exchange under the supervision of an independent Sharia Advisory Committee.

- Saudi Arabia’s ports posted a 16.1% yoy increase in cargo throughput volumes to 27.1mn tons (through the 9 ports managed by the Saudi Ports Authority) in Jun, largely due to the increase in general cargo (+55.7% to 790,500 tons).

- Saudi PIF will become the 2nd largest shareholder of Aston Martin, with a 16.7% stake.

- Hotels in Riyadh reported an occupancy rate of 56.5% in Jun, according to STR Global. Average daily rates in June touched SAR 580.61 (USD 154.6), while the revenue per available room, or RevPAR, stood at SAR 328.17. All three indicators are higher than pre-pandemic.

UAE Focus![]()

- The UAE President, in his first televised address, stated that the economy was “thriving and continues to grow at an impressive rate” while underscoring the need to diversify further. He also stressed the value of human capital and the pursuit of science and technology.

- UAE launched an AED 3bn fund to support its space programme and a new initiative to develop radar satellites.

- Dubai PMI climbed to a 3-year high of 56.1 in Jun (May: 55.7), thanks to the surge in travel and tourism. New business volumes grew, with growth accelerating to the highest since Jul 2019. While the fuel price increase added to the rise in input costs (highest recorded since Jan 2018), firms continued to reduce their output charges (rate of discounting quickened to the fastest since Aug 2020).

- Dubai attracted 58 FDI projects in the financial services sector in 2021, totalling AED 926.2mn (USD 252.19mn) in value, according to a report published by Dubai FDI. The report also stated that between 2017 and 2021, Dubai attracted 184 FDI projects worth Dh5.2bn and created approximately 5,727 jobs in the financial services sector.

- UAE pledged USD 2bn to support the development of “food parks” in India, that will allow it to tackle food security issues. The 4 countries India, Israel, UAE and US also agreed to work to advance renewable energy projects in India.

- France and UAE will sign an accord today (as part of UAE President’s visit to Paris) that will see UAE guarantee diesel supplies to France.

- Reuters reported that the UAE is planning to send an envoy to Tehran, as it looks to resolve issues with Iran through political means (and not via confrontation).

- Dubai ranked top shipping centre in the Arab world and the fifth best globally according to the Xinhua-Baltic International Shipping Centre Development Index (in a list topped by Singapore, London and Shanghai).

- Industrial and Commercial Bank of China Limited, the world’s largest bank by assets, listed five-tranche carbon-neutrality-themed bonds on Nasdaq Dubai last week, valued at AED 9.84bn (USD 2.68bn).

- Ras Al Khaimah posted a 14% increase in non-oil foreign trade to AED 16.83bn in 2021, with Asian non-Arab nations accounting for 36% of the emirates trace volume, followed by the GCC (18%) and Europe (15%).

- Abu Dhabi citizens receive housing benefits worth AED 1.5bn: the payout announced by the UAE President covers more than 1100 beneficiaries.

- Dubai real estate residential transactions grew by 33.3% yoy in Jun, driven by off-plan (+46.7%) and secondary market (24.4%) sales, according to CBRE. Year-to-date, total transaction volumes reached 38,901, the highest recorded since 2009.

- OKX, a Seychelles-based crypt exchange, disclosed that it has been granted a provisional virtual assets license to provide services to qualified investors and financial service providers.

- Female entrepreneurship in the UAE grew by 68% after the pandemic hit, versus an 46% increase in male entrepreneurship, according to LinkedIn data. Women entrepreneurship rose 54% in the educational sector, followed by wellness and fitness (50%), and healthcare (44%).

Media Review

Gender parity is not recovering; will take another 132 years to close the global gender gap

https://www.weforum.org/reports/global-gender-gap-report-2022/

https://www.weforum.org/reports/global-gender-gap-report-2022/digest

Reuters: Documents dispute Lebanon central bank chief’s ‘audit’ claim

A Voyage to Nowhere: What does the Middle East offer America?

https://www.economist.com/middle-east-and-africa/2022/07/12/what-does-the-middle-east-offer-america

The fall of Celsius

https://www.ft.com/content/4fa06516-119b-4722-946b-944e38b02f45

https://www.cnbc.com/2022/07/17/how-the-fall-of-celsius-dragged-down-crypto-investors.html

Six ways to improve global supply chains

https://www.brookings.edu/research/six-ways-to-improve-global-supply-chains/