Weekly Insights 15 Jul 2022: GCC PMIs remain expansionary amid cost pressures; services recovery drives inflation costs

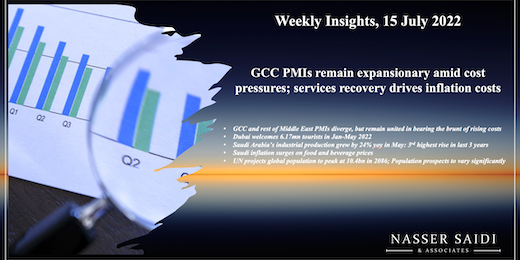

1. GCC and rest of Middle East PMIs diverge, but remain united in bearing the brunt of rising costs

- GCC nations continue to record expansionary PMI readings, supported by recovery in non-oil domestic economy. Saudi and the UAE posted upticks in both new orders & overseas demand.

- Input cost inflation bites: UAE’s surge in fuel prices saw input costs rise at the fastest in 11 years; firms reported average wages rising at the fastest pace for over 4 years.

- While Saudi continues to pass along higher costs to customers, in the UAE output prices fell for the 2nd straight month and by the most since late 2020. Despite offering price discounts, sales growth in the UAE was the weakest since Jan.

- Egypt posted the 19th straight month of sub-50 readings, with rising inflation and tightening monetary policy measures weighing on sentiment. Both output & new orders fell most since Q2 2020; input cost inflation rose to a near 4-year high.

- Lebanon saw a strong uptick in Jun PMI reading (a 77-month high of 49.1) on post-elections and in anticipation of the summer tourism season. Employment also increased – at the strongest level since Feb 2018.

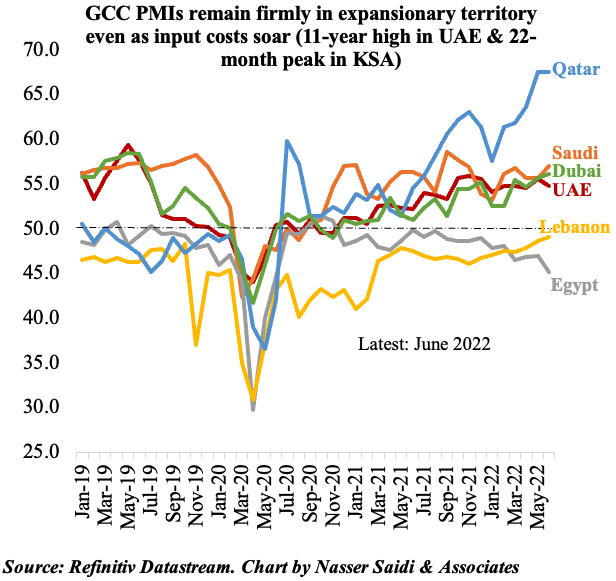

2. Dubai welcomes 6.17mn tourists in Jan-May 2022

- Dubai’s PMI recovery has been driven partly by the tourism sector

- However, even with uptick in tourists in 2022 (almost 3X compared to Jan-May 2021), it has not recovered to the 7.16mn guests recorded in Jan-May 2019

- Occupancy levels are inching closer to 2018 and 2019 levels though the composition of tourists has undergone a change. Visits from the rest of the GCC nations have surged, with both Oman and Saudi featuring among the top 3 source nations this year

- With travel restrictions in place from China and Philippines, the share of N. & SE Asia stand at just 4% of total (vs 12% in 2019)

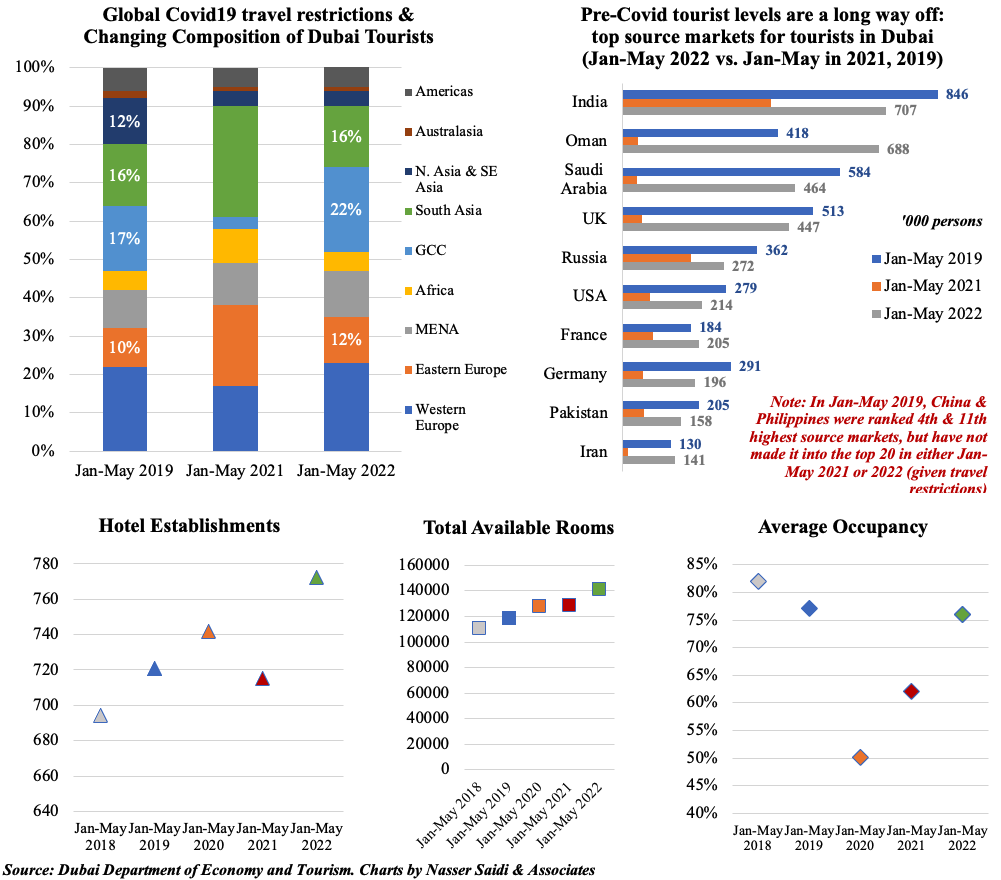

3. Saudi Arabia’s industrial production grew by 24% yoy in May: 3rd highest rise in last 3 years

- Industrial production in Saudi Arabia has been driven by mining and quarrying (which includes oil production) after growth turned positive in May 2021.

- In May 2022, manufacturing grew at a faster pace (28.8% yoy) than mining and quarrying (23.3%); this is in line with the uptick in PMI and recent data on volume of investment in Saudi manufacturing facilities (Ministry of Industry and Mineral Resources licensed 79 new factories in May, with investments exceeding SAR 1bn (USD 266.5mn).

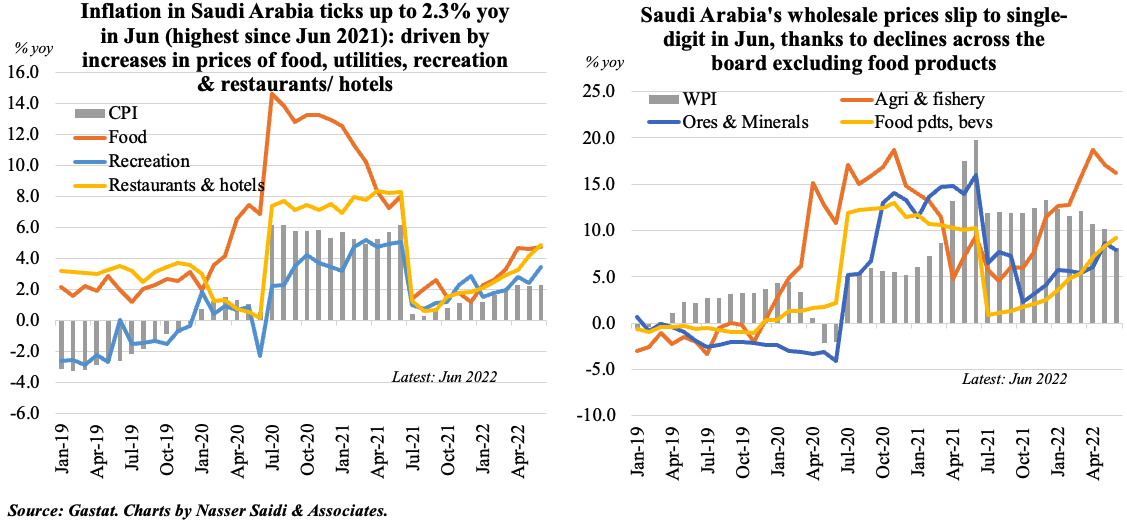

4. Saudi inflation surges on food and beverage prices

- Consumer prices in Saudi Arabia by 2.3% yoy in Jun (May: 2.24%), the highest in a year, driven by food and beverages (4.41% from May’s 4.25%), housing & utilities (1.02% from 0.5%), recreation (3.45% from 2.4%) and restaurants (4.87% from 4.13%). It seems likely that inflation focus shifts to the services sector (recreation, hospitality); transport costs eased (2.47% from 4.05%). CPI averaged 1.95% in H1 2022

- Wholesale Price Inflation slipped to single digit in Jun (8.07%), slowing for the 3rd consecutive month. Food products, beverages and tobacco and textiles posted an increase (9.24% from 8.3% in May) amid easing among other sub-groups. WPI averaged 10.82% in H1 2022.

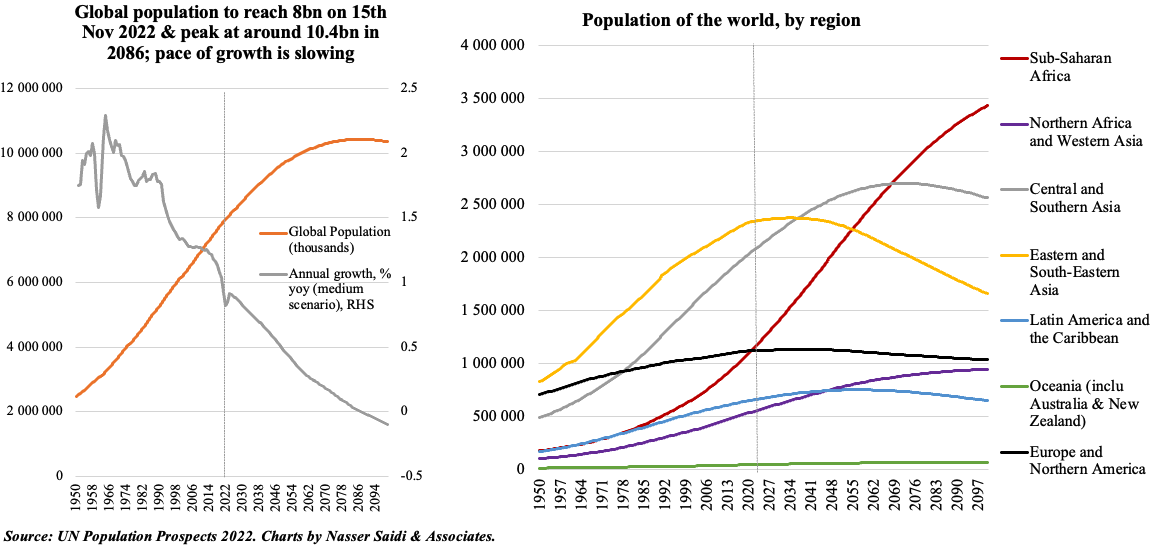

5. UN projects global population to cross 8bn in 2022 and peak at 10.4bn in 2086

- Global population is expected to cross 8bn this year and reach 8.5bn, 9.7bn and 10.4bn in 2030, 2050 and 2100 respectively. India and China are home to more than 1.4bn persons each and located in two most populous regions in Asia (Central and Southern Asia with 2.1bn persons, or 26% of total population, and Eastern and South-Eastern Asia with 2.3bn, or 29% of the total)

- Looking ahead, sub-Saharan Africa will continue growing through 2100, and also contribute more than half of the global population increase anticipated through 2050.

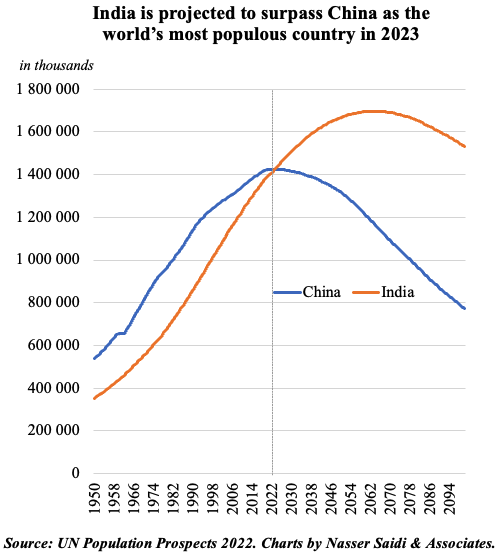

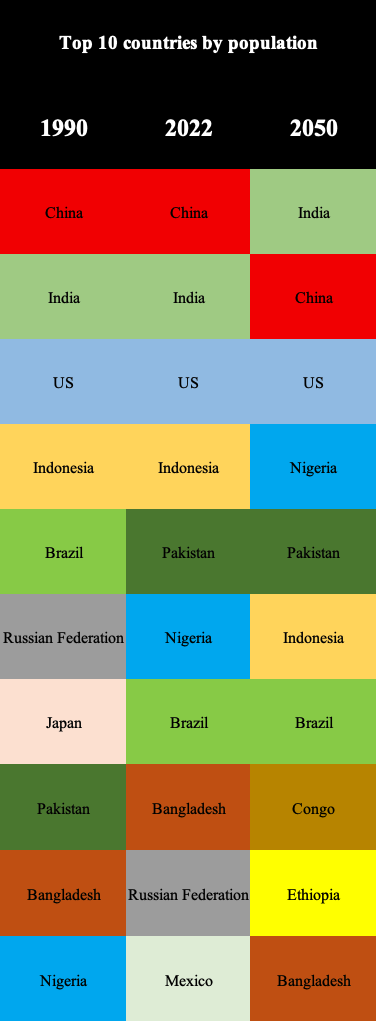

6. Country population prospects expected to vary significantly

- With the decline in China’s fertility rate, India is expected to take over the mantle of most populous country as early as next year.

- More than half of the projected increase in global population up to 2050 will be concentrated in just 8 nations: Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, Philippines and Tanzania. Congo & Tanzania are expected to grow by 2-3% per year over the period 2022-50.

-

Differences in population growth rates will see the list of top 10 countries change slightly. Japan will fall to 11thlargest in 2022 from 7th in 1990; Russia will climb down to 14th in 2050 from 9th in 2022; Ethiopia moves up from 12th in 2022 to 9th in 2050.