Markets

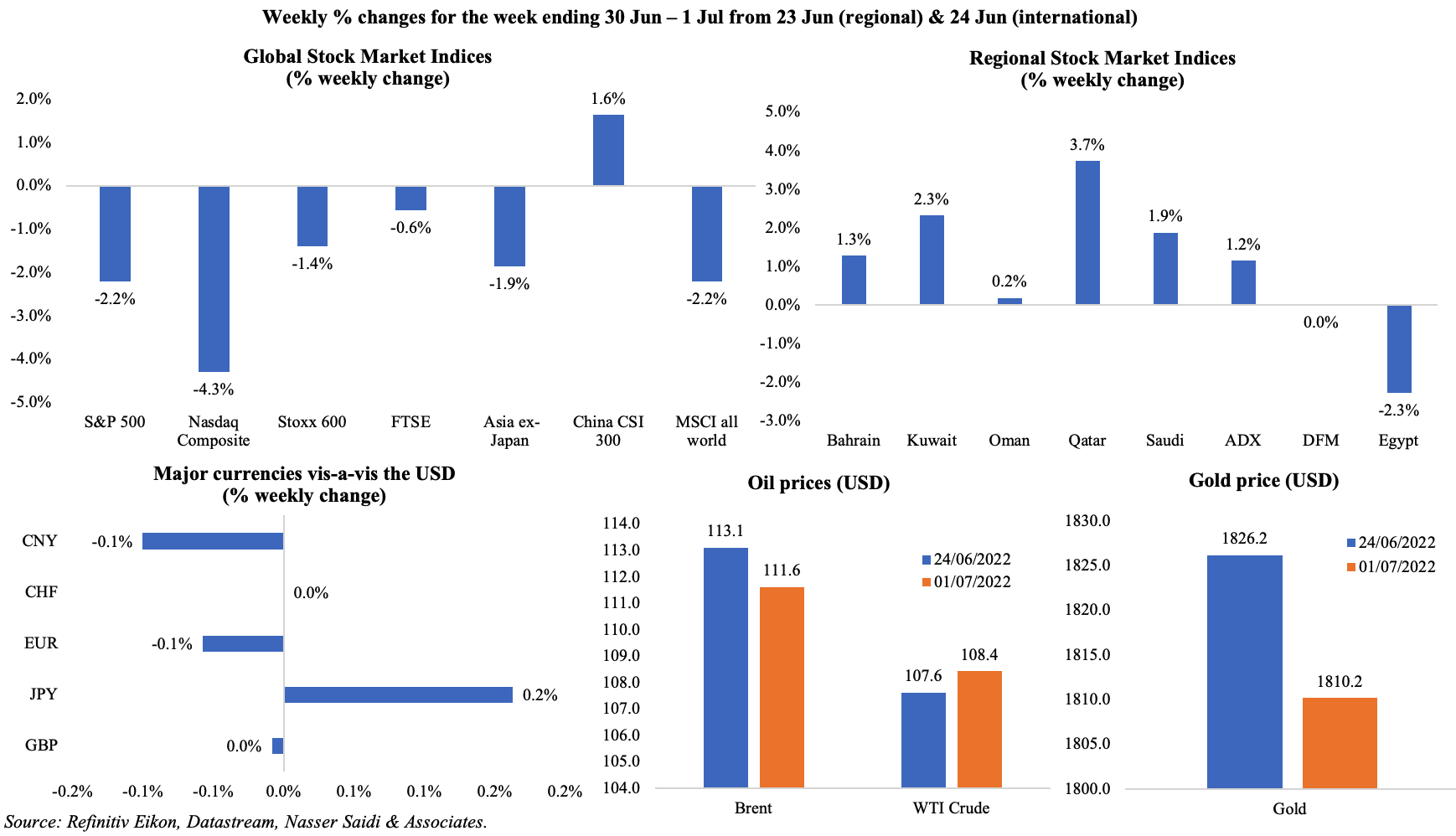

Most global equity markets ended the week lower: the S&P 500 and MSCI’s world stocks index posted the worst H1 performance since 1970 and 1990 respectively. Regional markets gained in week-on-week terms (except for Egypt), but closed lower towards end of the week on worries about slowing growth. Saudi Tadawul lost almost 12% in Q2, clocking in its worst performance since the pandemic. Among currencies, the dollar posted its best quarter since 2016 while the yen hit a 24-year low to the dollar on Wednesday and sterling touched a 2-week low. Oil markets are grappling with tight supply amid outages on one hand and worries of recession leading to lower demand on the other. Oil prices declined in Jun, for the first time since Nov; but, compared to a week ago, Brent lost ground while WTI gained. Gold price slipped last week while major other metal prices also tumbled including copper price which fell to the weakest in almost 18 months.

Global Developments

US/Americas:

- GDP growth in the US declined to a 1.6% annualised rate in Q1, according to the third estimate after consumer spending was revised lower (1.8% instead of 3.1%) and inventories higher amid a record-high trade deficit. GDP was 2.7% above its level in Q4 2019.

- PCE stayed unchanged at 6.3% yoy in May, though up 0.6% mom; core PCE inched up by 4.7% yoy and 0.3% mom.

- Personal income in the US increased by 0.5% in May while spending was up by 0.2%. Real personal spending, which excludes price changes, fell by 0.4% in May (Apr: +0.3%). Personal saving as a percentage of disposable income rose to 5.4% (Apr: 5.2%).

- Durable goods orders in the US climbed by 0.7% mom in May (Apr: 0.4%). Orders for new cars and trucks rose 0.5% in May and offset a 1.1% decline in commercial airplanes. Non-defence capital goods excluding aircraft ticked up by 0.5%.

- Dallas Fed manufacturing business index plummeted to -17.7 in Jun (May: -7.3), as the production index fell to 2.3 (May: 18.8), both the lowest readings since May 2020. New orders fell into negative for the first time in 2 years: to -7.3 from 3.2 in May.

- Richmond Fed manufacturing index declined to -11 in Jun (May: -9), the lowest reading since May 2020. Both new orders and shipment sub-indices fell further into negative territory, declining to -38 and -29 respectively (from May’s -16 and -14).

- Chicago PMI softened to 56 in Jun (May: 60.3), posting the lowest reading since Aug 2020, after new orders sub-index weaking to 49.9 (down by 9.8 points) and order backlogs falling to a 19-month low of 55.2.

- S&P manufacturing PMI improved to 52.7 in Jun, from a preliminary reading of 52.4, but it was lower than May’s 57: new orders fell while employment increased and input price inflation eased to a 3-month low.

- ISM manufacturing PMI slipped to 53 in Jun (May: 56.1), the lowest since Jun 2020, with both new orders and employment index falling to contractionary territory (at 49.2 and 47.3 respectively); prices paid eased to 78.5 in Jun (May: 82.2)

- Goods trade deficit narrowed to USD 104.3bn in May (-2.2% mom) as imports dropped by 0.1% alongside a 1.2% rise in exports.

- Pending home sales surprisingly inched up by 0.7% mom in May, breaking six consecutive months of declines: this could be partially due to the decline in average on the 30-year fixed mortgage rate from 5.64% in the first week to 5.25% by end of the month. In yoy terms, pending home sales were down by 13.7%.

- S&P Case Shiller home prices edged up slightly to 21.2% yoy in Apr (Mar: 21.1%); only 9 cities out of the 20 saw monthly gains.

- Initial jobless claims slipped to 231k in the week ended June 24th, down from an upwardly revised 233k a week ago, taking the 4-week average rising higher to 231.75k (the highest since Dec). Continuing jobless claims fell by 3,000 to 1.328mn in the week ending Jun 17th.

Europe:

- Inflation in the eurozone increased to a record-high 8.6% yoy in Jun (May: 8.1%), largely due to higher costs of energy (42%) and food (8.9%); only Netherlands and Germany posted a slower pace. Core CPI eased to 3.7% from 3.8% the month before.

- Preliminary harmonised index of consumer prices in Germany eased to 8.2% in Jun (May: 8.8%), driven by transport and electricity subsidies.

- Manufacturing PMI in Germany stayed unchanged at the preliminary reading of 52 in Jun (the slowest since Jul 2020), with new orders falling for the 3rd month and input price inflation easing to a 16-month low. Meanwhile, theeurozone manufacturing PMI stood at 52.1 in Jun (May: 54.6), the slowest growth since Aug 2020.

- Economic sentiment indicator in the euro area dropped to 104 in Jun (May: 105), with employment expectations indicator declining by 1.7 points to 110.9. Industrial confidence improved to 7.4 (May: 6.5) and services sentiment increased to 14.8 (May: 14.1).

- The euro area business climate indicator improved to 1.47 in Jun (May: 1.28). Consumer confidence fell to -23.6 in Jun, down 2.4 points from May.

- Retail sales in Germany rebounded in May, rising by 0.6% mom (from a decline of 5.4% in Apr), supported by a 2.9% jump in non-food sales; it however fell by 3.6% yoy in May.

- Unemployment rate in Germany unexpectedly rose to 5.3% in Jun (May: 5%). Separately, in the wider euro area unemployment fell to a record low of 6.6% in May.

- The German Gfk consumer confidence survey dipped to a new record low of -27.4 in Jul (Jun: -26.2), with the increase in cost of living weighing on consumer sentiment and income expectations falling to a 20-year low of -33.5 points.

- UK GDP increased by an unrevised 0.8% qoq in Q1, supported by an increase in services output (0.6% from previous estimate of 0.4%); the level of real quarterly GDP remains 0.7% above its pre-Covid level in Q4 2019.

- UK manufacturing PMI slipped to a 2-year low of 52.8 in Jun, from a preliminary reading of 53.4 and May’s 54.6; new orders contracted for the first time in 17 months.

Asia Pacific:

- NBS manufacturing PMI in China moved into expansionary territory in Jun, posting a reading of 50.2 (May: 49.6): this was the first headline expansion since Feb, with output, new orders and buying levels growing for the first time in 4 months. Non-manufacturing PMI improved to 54.7 in Jun (May: 47.8), the strongest growth since May 2021, with new orders and new export orders returning to expansion.

- Caixin manufacturing PMI increased to 51.7 in Jun (May: 48.1), posting the steepest upwards pace since May 2021. Output grew the most in one and a half years while employment fell for the 3rd consecutive month.

- Inflation in Tokyo slipped to 2.3% in Jun (May: 2.4%); core inflation expanded to 2.1% yoy, a 7-year high, following a 1.9% gain in May.

- Unemployment rate in Japan unexpectedly inched up to 2.6% in May (Apr: 2.5%); the jobs-to-application ratio edged up to a 25-month high of 1.24 in May (Apr: 1.23).

- Tankan large manufacturing index dropped to 9 in Q2 (Q1: 14), the lowest level since Q1 2021, while the outlook improved to 10 (Q1: 9). Large companies expect to increase capex by 18.6% this year (ending Mar 2023) from just 2.2% in the Mar survey.

- Japan’s leading economic index increased to 102.9 in Apr (Mar: 100.8), the highest reading since last Dec, and the coincident index remained unchanged at 96.8.

- Jibun Bank manufacturing PMI was unchanged from the preliminary reading of 52.7 in Jun, but lower than May’s 53.3. Input cost inflation eased while output cost inflation accelerated at a record pace.

- Industrial production in Japan fell by 7.2% mom and 2.8% yoy in May, with motor vehicles contributing significantly to the decline (-8.0% mom).

- Retail sales in Japan increased by 3.6% yoy in May (Apr: 3.1%), the third consecutive month of increase and the steepest pace since May 2021. Large retailer sales accelerated at a faster pace of 8.5% in May (Apr: 4%).

- India’s fiscal deficit stood at INR 2.04trn (USD 25.84bn) in Apr-May, standing at 12.3% of the full year budget target. Net tax receipts stood at INR 3.08trn during the period while total spending was INR 5.86trn.

- Core sector output in India surged by 18.1% yoy in May (Apr: 8.4%), a 13-month high, thanks to increased production in cement, coal, fertilizers and electricity industries.

- South Korea’s Minimum Wage Commission announced an increase in its minimum wage by 5% to KRW 9,620 (USD 7.41) an hour in 2023, as inflation hit 14-year highs.

Bottom line: The global manufacturing PMI edged down to 52.2 in Jun, the lowest since Aug 2020, despite an improvement in China’s readings. Growth of new orders (a proxy for demand) deteriorated across major nations; price pressures eased as China opened after weeks of pandemic-related restrictions though energy prices continue to add pressure to costs. OPEC+ decided to add another 648,000 barrels per day in Aug (same as Jul) and refrained from discussing moves for Sep. Major releases this week include global services PMI data alongside US Fed minutes (for an insight into the monetary policy path, especially given recent hawkish comments at the ECB forum) and US payrolls (for wage inflation and labour market movements).

Regional Developments

- Bahrain’s central bank has announced that the Covid-related bank loan deferrals will be discontinued by June 30th.

- Tourism surged in Bahrain in Q1, with the country welcoming 1.7mn visitors (vs 152k in Q1 2021), and revenues from tourism growing by 875% yoy to BHD 292mn (USD 774mn).

- Egypt’s finance minister emphasized that boosting FDI was the way forward as compared to foreign purchases of treasuries to finance budget, given the multiple episodes of hot money flows. He also disclosed that the nation was in talks with investors in the Gulf (negotiations are underway for Qatar’s new investment of up to USD 3bn in Egypt), in addition to exploring concessional borrowing from international banks and also look to non-traditional funding (panda bonds are being considered, with an issuance likely in H1 of the 2022-23 fiscal year).

- Bloomberg reported that Egypt’s General Authority for Supply Commodities bought 815,000 tonnes during the slump in the price of wheat: this is the single largest acquisition of wheat since 2012. Earlier in the week, it also contracted to buy 180,000 tonnes of wheat from India. Separately, the World Bank announced it was providing USD 500mn in development funding to support food security.

- Bilateral trade between Egypt and Oman increased by 7.2% yoy to USD 586.2mn in 2021. Exports from Egypt into Oman fell by 4.1% to USD 163.3mn. Meanwhile, Omani investments in Egypt surged by 334.8% in fiscal year 2020-2021 to USD 68.8mn.

- About 35 fintech and e-commerce startups in Egypt raised USD 269.1mn in funding in H1 2022, reported Daily News Egypt.

- Abu Dhabi Ports Group reached an agreement to acquire a 70% equity stake in International Associated Cargo Carrier BV, which wholly owns two Egypt-based maritime companies, according to Asharq Alwsat. The transaction, which amounts to AED 514mn (USD 140mn), will be fully funded by the Group’s existing cash reserves.

- Reuters reported that Qatar pledged USD 60mn to “support members of the [Lebanese] army”, though salaries were not specifically mentioned.

- The Qatar Financial Centre pledged USD 100mn for creating a new platform to recover distressed assets: the platform aims a first close in 2022 and a final close in 2023.

- The CEO of the Qatar Investment Authority disclosed that the sovereign wealth fund was not interested in crypto investments, but is exploring blockchain opportunities.

- Planned solar and wind projects in the MENA region could raise capacity to about 73GW (from 12.1GW currently) over the next 8 years, according to a report from the Global Energy Monitor. Currently, Egypt, UAE and Morocco have the highest renewables capacity (at 3.5GW, 2.6GW and 1.9GW respectively).

- Fixed income issuances in the GCC declined by 40% yoy to USD 37.2bn in Jan-May 2022, according to a report from Kamco Invest. The outlook remains bleak this year, given the better fiscal position of governments, higher interest rates and fundraising in equity markets.

- MEED reported a 42% yoy increase in GCC real estate sales in 2021 to USD 137.4bn, driven by Dubai (where sales surged by 86%) and Saudi Arabia (+25%).

- The real estate sector in Dubai is the most transparent in the MENA region, according to JLL’s Global Real Estate Transparency Index. Dubai is ranked 31st in the global list while Abu Dhabi and Saudi Arabia are ranked as 45th and 49threspectively (semi-transparent markets).

Saudi Arabia Focus

- Saudi Arabia approved a new Companies Law which allows the formation of a Simplified Joint Stock Company (that promotes entrepreneurship and venture capital growth), reduces legal requirements for SMEs and simplifies procedures for establishing companies among others.

- Saudi Arabia announced priorities for R&D and innovations for the next 2 decades: it is expected that annual spending on the sector will reach 2.5% of GDP by 2040, adding SAR 60bn to GDP and creating thousands of jobs in science, technology and innovation. Four key priorities were identified including human health, environmental sustainability and basic needs, leadership in energy and industry and future economies.

- The Saudi Central Bank injected SAR 50bn (USD 13bn) in cash to provide relief to commercial lenders that are facing a severe liquidity crunch (worst in over a decade). This resulted in a slight decline in SAIBOR (down about 17bps to 3.13% on Sun, 26th June). Bloomberg Intelligence report estimates that the lenders still need to raise about SAR 160bn to finance loan books.

- FDI into Saudi Arabia grew by 9.5% yoy to SAR 7.4bn (USD 1.97bn) in Q1 2022, tweeted the investment ministry.

- Monetary statistics published by the Saudi central bank show that: net foreign assets of the central bank remained unchanged at SAR 1.63trn (USD 435.5bn) in May; M3 money supply grew by 7.8% yoy to SAR 2.38trn in May –the slowest growth since Dec 2021.

- Unemployment rate for Saudi Arabia’s citizens declined to 10.1% in Q1 2022 (Q4: 11%) and compares to a peak of over 15% during the pandemic. The gap between male and female unemployment rates persists: 5.1% for male Saudis versus 20.2% for female citizens. Further, labour force participation slipped in Q1 2022 to 33.6% for Saudi women (Q4: 35.6%) & 66% for men (Q4: 66.8%).

- Saudi Arabia will launch futures trading on single stocks from today: this is the second derivatives product after index futures were launched in late 2020.

- Two new IPOs approved: Saudi-based Arabian Drilling Co. received approval for an IPO of 26.7mn shares (or 30% of the firm’s capital) on Tadawul; Arabian Plastic Industrial Co. received approval for an IPO of 1mn shares (20% of share capital) on Nomu. Separately, mall operator Abdullah Al Othaim Markets Company revealed that their IPO plans had been scrapped (no reason was provided).

- The ministry of industry and mineral resources issued 79 new factory licenses in May, with their investments exceeding SAR 1bn (USD 266.5mn). About 62 industrial facilities began actual production in May, with investments of SAR 1.3bn.

- The PIF launched an aircraft leasing company called AviLease: it plans to initially focus on scaling through purchase-and-lease-back transactions with airlines, portfolio acquisitions and direct orders from aircraft manufacturers.

- Japan’s imports of Saudi crude oil amounted to 27.1mn barrels (or 33.5% of the total) in May: this compares to Apr’s 38.49mn barrels (or 43.9% of total). Five countries – UAE, Saudi Arabia, Qatar, Kuwait and Oman – together accounted for a record high 94.5% of Japan’s oil imports of 80.81mn barrels in May.

- Saudi Arabia has identified 50 mining sites to offer to investors, according to the minister of industry and mineral resources. With spending on exploration of metals expected to triple over the next 3 years, mineral wealth is likely to cross previous estimates of USD 1.3trn.

- Saudia plans to meet the rising demand for travel during the summer season by providing 6.5mn seats on 30k flights in Jul-Aug. As of end-Jun, the airline carrier is offering 765,600 seats weekly, a 30% increase from summer of 2021.

- Travel bookings in Saudi Arabia exceeds pre-pandemic levels: it was higher by 28% in Jun (compared to Jun 2019), according to Almosafer (an omni-channel travel brand). Domestic tourism bookings rose by 7%, with bookings in Abha (capital of Asir region) witnessing a 125% rise.

- Saudi Arabia is in early talks to take a stake in Aston Martin, potentially worth GBP 200mn, reported FT.

- Riyadh has fallen out of the top 100 most expensive cities for expats, to 103 dropping from 29 last year, according to Mercer’s Cost of Living Index. Dubai and Abu Dhabi are the most expensive among Arab cities, ranked at 31 and 61 respectively.

- Companies operating in Saudi Arabia’s contracting sector has crossed 165,000, with small to large enterprises employing 3 million workers, reported the Saudi Press Agency. Value of projects in the sector over the past 5 years have totalled SAR 20trn (USD 5.3trn).

- Saudi Arabia’s Agricultural Development Fund approved SAR 1.4bn (USD 373mn) in loans and credit facilities: this includes development loans for small farmers, financing loans for the sectors of vegetable production in greenhouses, poultry breeding and production and fish farming.

- Population in Saudi Arabia declined by 2.6% to 34.1mn by mid-2021, according to a GaStat report, largely due to a decline in the non-Saudi population (-8.6%). Saudis constituted 63.6% of total population.

UAE Focus![]()

- UAE approved 22 policies to support the transition to a circular economy, with the focus on four main sectors manufacturing, food, infrastructure and transport. Eight relevant trends were highlighted including waste-to-resource, reuse, artificial intelligence, remanufacturing, bio-based materials and repair work.

- Indonesia and the UAE signed a free trade agreement: removing or reducing duties on most goods traded between the two nations. The deal could increase bilateral non-oil trade to USD 10bn within five years (up from around USD 3bn last year) and estimated to create 55,000 highly skilled jobs in the UAE by 2030. The UAE Minister of State for Foreign Trade disclosed that a deal with Colombia is “almost done” and that one with Turkey could be reached before end of the year.

- The Abu Dhabi government plans to invest AED 10bn (USD 2.72bn) to double the size of its manufacturing sector (to AED172bn) by 2031. This investment is expected to increase non-oil exports by 148% to AED 178.8bn and create 13,600 jobs, particularly for UAE nationals, by 2031. This will also be supported by a new circular economy regulatory framework, being developed to ensure that the industry is operating on a sustainable basis.

- Abu Dhabi Exports Office (Adex) signed a trade finance agreement with the Ecowas Bank for Investment and Development (EBID) to enhance the volume of trade between the UAE and the lender’s member states in West Africa. Adex will open a USD 20mn line of credit to EBID.

- The UAE energy minister disclosed that oil production in the country is near to maximum capacity based on current OPEC+ production baseline, which is 3.168mn barrels per day. Separately, speaking at a conference, he highlighted that hydrogen would play a critical role in UAE’s transition to net-zero by 2050.

- UAE increased fuel prices in Jul, for the fifth time this year: diesel price ticked up by 15% mom to AED 4.76 while Super 98 and 95 were up by 11.5% and 12.1% to AED 4.63 and AED 4.52 respectively. Fuel costs three times more than in Kuwait and is more than double the average in GCC members. As a result of the increase in fuel prices, taxi rides in Sharjah and Dubai as well as Uber rides in UAE have announced fare hikes.

- Union Coop, a supermarket chain in the UAE, plans to list on DFM on 18th Jul 2022. It was revealed that its existing shareholders would be offered ten shares in the listing for each share held, with the share price to be determined on the first day of trading.

- The DIFC generates more than 12% of Dubai’s GDP, disclosed the governor. He stated that “over 20% of the UAE’s financial services balance sheet is held by DIFC-based entities and the market size of DIFC activities totals more than USD 700bn”. Of the 3650 firms in the free zone, over 500 are innovation firms (+67% yoy) employing over 2,000 persons.

- Dubai Multi Commodities Centre (DMCC) disclosed a 19% increase in new businesses in H1, with at least 1469 new companies registering in the free zone. About 40% of new companies are from Europe and South America, with another 20% from India and China.

- First Abu Dhabi Bank is committed to lend, invest, and facilitate business over USD 75bn by 2030 as part of its support for energy transition plans in the Middle East.

- Dubai plans to increase the share of renewables in its energy mix to 14% by end-2022 (from 11.5% currently), disclosed the chief executive of DEWA.

Media Review

Global inflation: Japan faces a moment of truth

https://www.ft.com/content/136af78b-dee2-446f-8ba8-21d25ce74ff8

Can companies pay their debts as interest rates climb & the economy cools?

How Crypto and CBDCs Can Use Less Energy Than Existing Payment Systems

Political and banking deadlock may plunge Lebanon deeper into crisis