The below article was published as a post in the OECD’s Development Matters blog on 1st July 2022. The original post can be accessed directly at: https://oecd-development-matters.org/2022/07/01/a-new-global-economic-diversification-index/

A new global economic diversification index

By Aathira Prasad, Director, Macroeconomics and Nasser Saidi, President, Nasser Saidi & Associates

“My dear, here we must run as fast as we can, just to stay in place. And if you wish to go anywhere you must run twice as fast as that.”

Lewis Carroll, Alice in Wonderland

The well-known “natural resource curse” comes from the observation that economic growth in nations with an abundance of natural resources tends to be lower and more volatile. A number of empirical regularities characterise these countries: (a) resource-abundant countries tend to underperform their resource-poor counterparts, with evidence of a negative relationship between real GDP growth per capita and resource exports; (b) resource-based economies’ exposure to adverse external shocks leads to macroeconomic instability and higher economic risks; (c) non-resource based activities get crowded out; and (d) institutions tend to be weak and anarchic.

Economic diversification – a key to addressing economic risks, macroeconomic stability, volatile economic growth and sustainable development issues – has become an everyday term in the policy lexicon of natural resource dependent countries. Although many diversification policies have been implemented over the past several decades, there has been little effort to assess if they have been successful. The majority of existing research focuses on trade diversification.

The Global Economic Diversification Index (EDI) aims to fill this gap. The EDI examines economic diversification from a multi-dimensional angle, exploring activity, trade and government revenue diversification. Some of the main findings from the inaugural edition of the EDI are as follows.

- For the least diversified nations, overdependence on commodity production and exports has meant growth volatility and a long path to catch up with top performers.

- Seven nations have consistently ranked among the top ten countries in the EDI from 2000 to 2019, with China joining this cohort from 2008 onwards. Service-led nations stand out among the top-ranked (UK, Ireland, Singapore and Switzerland), highlighting the growing importance of the services sector (and adoption of new technologies) and its pivotal role in enabling a “catch-up” with highly industrialised nations.

- At the other extreme, seven nations have remained in the bottom ten, including four oil-producing nations (two from the Gulf Co-operation Council – GCC) and two low-income and agriculture-dependent countries.

- Between 2000 and 2019, the nations that have improved their EDI scores the most include China, the US, Saudi Arabia, Germany and Oman. The GCC nations (except Bahrain) are among the top 20 nations to have improved EDI scores over that period.

- Low and lower-middle income nations among the commodity producing nations have the lowest EDI scores overtime. Oman and Kuwait (part of the GCC) rank poorly, but the former has embarked on a diversification path, while the latter, due to ongoing political gridlock, has not undertaken economic reforms.

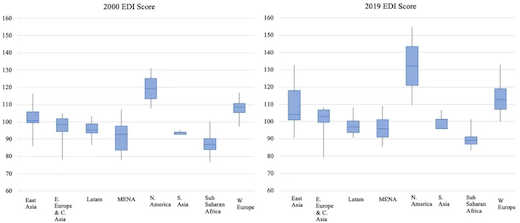

- In regional terms, North America is the best performer and the Sub-Saharan Africa region is the worst performer on a comparative basis (even though their average scores have improved over time) across overall EDI. The fastest pace of improvement in the EDI has been within the MENA region.

Figure 1. Regional disparities in EDI scores (2000 vs 2019)

- There is a positive correlation between the EDI and GDP per capita. UAE and Norway are examples of nations in the process of diversification that are inching closer to the mean EDI score in 2019. By 2019, almost all countries’ resource rents readings had declined (versus the level in 2000), and many had improved on their EDI scores. This only shows correlation and not causation.

Figures 2. EDI across commodity producers, by region

The MENA region has lagged behind its regional peers with respect to diversification yet it has caught up relatively fast. This has been supported by diversification strategies introduced by many oil-producing nations in recent years, including the introduction of non-oil taxes (excise, customs and value added taxes to name a few), alongside various liberalisation measures ranging from rights to establishment to trade facilitation measures, and improvements to hard and soft infrastructure.For resource-dependent countries, economic diversification (activity, trade and government revenue) is a strategic imperative given their demographics and job creation requirements, as well as their need to achieve sustainable development and to mitigate the macroeconomic risks of volatile commodity prices and markets. The Global EDI aims to provide guidance for countries, policy makers and analysts to design successful diversification strategies and policies, turning resource rents into an engine of growth rather than a barrier to economic development and thereby avoiding the “resource curse”.

The MENA region has lagged behind its regional peers with respect to diversification yet it has caught up relatively fast. This has been supported by diversification strategies introduced by many oil-producing nations in recent years, including the introduction of non-oil taxes (excise, customs and value added taxes to name a few), alongside various liberalisation measures ranging from rights to establishment to trade facilitation measures, and improvements to hard and soft infrastructure.For resource-dependent countries, economic diversification (activity, trade and government revenue) is a strategic imperative given their demographics and job creation requirements, as well as their need to achieve sustainable development and to mitigate the macroeconomic risks of volatile commodity prices and markets. The Global EDI aims to provide guidance for countries, policy makers and analysts to design successful diversification strategies and policies, turning resource rents into an engine of growth rather than a barrier to economic development and thereby avoiding the “resource curse”.