Markets

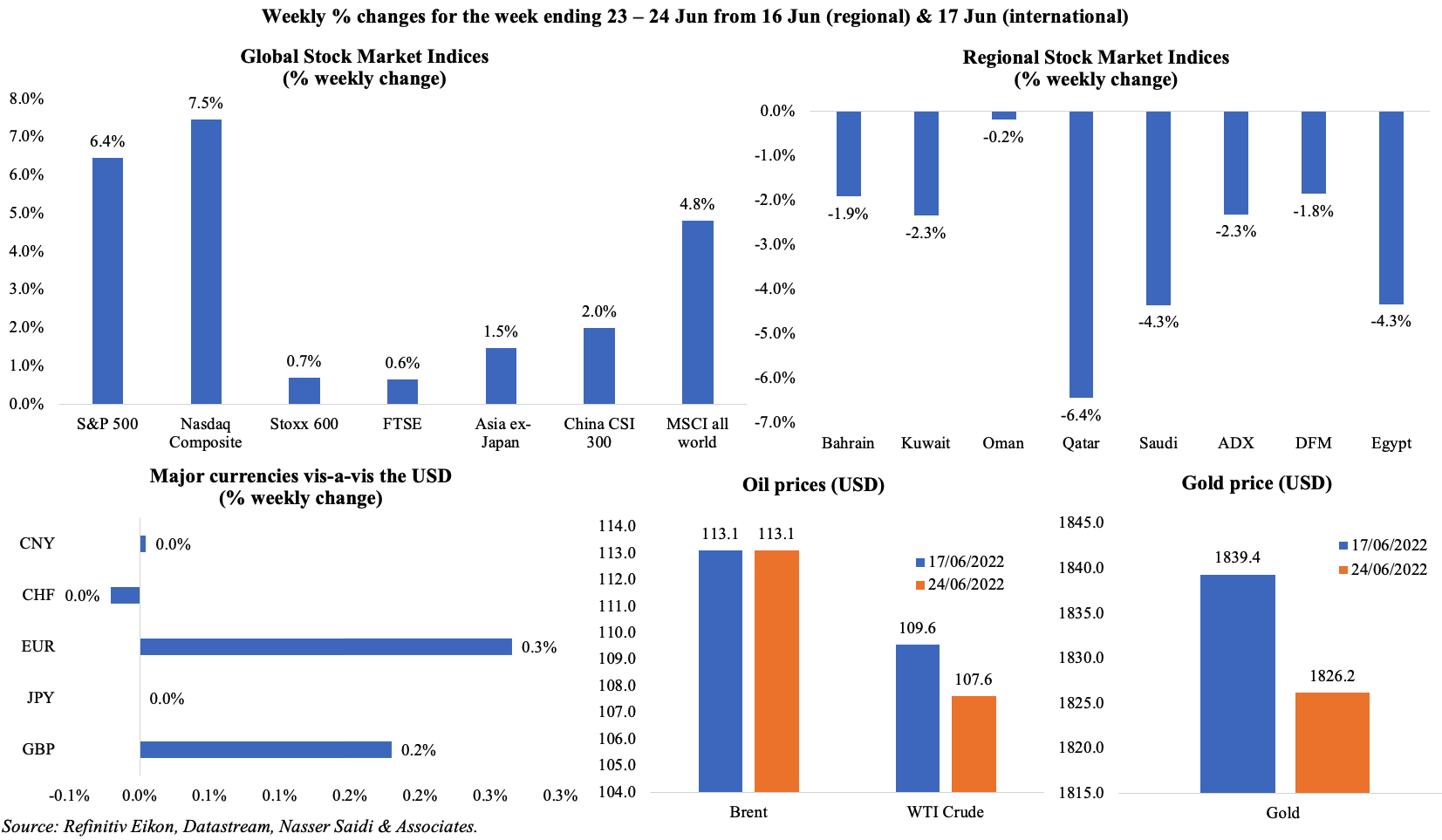

A rally on Friday supported major stock markets post a weekly gain last week, as worries about inflation and rate hikes eased: S&P posted its biggest daily gain since May 2020, Stoxx and FTSE were up and MSCI global index gained after 3 weeks of declines. Regional markets moved against the tide, with all markets falling from a week ago, as price of oil slipped; both UAE indices posted a third consecutive week of declines while Qatar’s index posted its biggest weekly drop since Mar 2020. Last week, the dollar fell while the Russian rouble climbed to its strongest in 7 years. Among commodities, industrial metal prices fell (weekly copper price fell the most since Mar 2020) as did oil prices; Brent price has fallen by about 10% in Jun, and is likely to record the biggest monthly fall since Nov.

Global Developments

US/Americas:

- Chicago Fed national activity index slipped to an 8-month low of 0.01 in May (Apr: 0.4), with the contribution of personal consumption and housing category falling to -0.11 from 0.10.

- Kansas Fed manufacturing activity plunged to -1 in Jun (May: 19), posting the lowest level since May 2020, largely due to the decline in activity at durable goods plants.

- Michigan consumer sentiment index fell to a record low of 50 in Jun, 0.2 points down from the preliminary reading. Inflation expectations for the 12-month ahead stood at 5.4% while the 3-year inflation outlook rose to 3.1%.

- Existing home sales fell for a 4th straight month, down by 3.4% mom to 5.41mn in May – this was the lowest since Jun 2020. New home sales increased by 10.7% mom to 696k in May. Rising mortgage rates and low supply levels is likely to lead to further declines in home sales.

- Preliminary manufacturing PMI in the US slowed to 52.4 in Jun, a 23-month low (May: 57), as new orders and output slipped. Services PMI eased to 51.6 (May: 53.4), also driven by a decline in new orders. Composite PMI hence fell to 51.2 (May: 53.6) amid weak client demand as well as increases in both input costs and output charges.

- Initial jobless claims slipped to 229k in the week ended June 17th, down from an upwardly revised 231k a week ago, taking the 4-week average higher to 223.5k. Continuing jobless claims increased by 5000 to 1.315mn in the week ending Jun 10th.

Europe:

- Preliminary estimates of Germany’s PMI showed a decline: manufacturing PMI declined to a 23-month low of 52 in Jun from 54.8 the month before, as manufacturing output contracted for the 2nd time in past 3 months and new orders saw a steep and accelerated decline. Services PMI slipped to 52.4 from 55 in May and composite PMI fell for the 4th month in a row to 51.3 on weak inflows of new business.

- Preliminary readings for Eurozone PMI slipped sharply across the board: manufacturing PMI fell to a 22-month low of 52 in Jun (May: 54.6), with manufacturing output contracting for the first time in 2 years (49.3 vs May’s 51.3). Services PMI slowed to a 5-month low of 52.8 (May: 56.1) and composite PMI tumbled to a 16-month low of 51.9 from 54.8 the month before, on weak inflows of new business.

- Ifo business climate indicator in Germany slipped to 92.3 in Jun (May: 93). The current assessment and expectations declined by 0.3 and 1.1 points to 99.3 and 85.8 respectively.

- Producer’s price index in Germany for industrial products increased by 1.6% mom and 33.6% yoy in May (Apr: 33.5%). Prices of intermediate goods rose by 25.1%.

- Current account balance in the Eurozone moved into a deficit of EUR 5.4bn in Apr (non-seasonally adjusted), thanks to the goods account switching to a deficit given the surge in fuel costs due to the Ukraine-Russia war.

- Euro area consumer confidence in Jun dropped to -23.6 (May: -21.2), just short of the all-time low registered in Apr 2020. In the EU, consumer sentiment slipped by 1.9 points to -24.

- Inflation in the UK ticked up to a fresh high of 9.1% yoy in May (Apr: 9%), with food price inflation at 8.7% yoy – the highest since 2009. Core consumer prices eased (for the first time since Sep) to 5.9% from 6.2% the month before. The BoE has forecast inflation to reach a high of 11% this year before falling to around 2% by 2024.

- Producer price index (input costs) in the UK jumped to 22.1% yoy in May (Apr: 20.9%), the biggest increase since records began, while output prices were up 1.6% mom and 15.7% yoy. Retail price index rose by 0.7% mom and 11.7% yoy.

- UK’s preliminary PMI readings for Jun showed a drop in manufacturing PMI to a 23-month low of 53.4 from May’s 54.6, with the new order index dropping to 50.8 from May’s 53.8. Services and composite PMI meanwhile stood unchanged at 53.4 and 53.1 (a 15-month low) respectively. Both manufacturers and service providers reported the lowest degree of business optimism since May 2020.

- Retail sales in the UK fell by 0.5% mom and 4.7% yoy in May, with sales in food stores declining (-1.6%) while non-food store sales were unchanged. Excluding fuel, sales were lower by 0.7% mom and 5.7% yoy

- GfK consumer confidence index fell to a new record low of -41 in Jun (May: -40), with the sharpest fall registered in consumers’ short-term outlook about their personal finances.

Asia Pacific:

- The People’s Bank of China (PBoC) left rates unchanged last week: one-year loan prime rate at 3.7% and 5-year at 4.45%. Separately, the PBoC signed an agreement with the BIS to set up a Renminbi Liquidity arrangement to provide support to participating central banks (including Indonesia, Malaysia, Hong Kong, Singapore and Chile).

- Inflation in Japan remained unchanged at a 7-year high of 2.5% in May, staying above the BoJ’s long-term inflation target of 2%, with inflation reading excluding food and energy prices at 1.8%. Excluding fresh food prices were up by 2.1%.

- Japan preliminary manufacturing PMI eased to 52.7 in Jun (May: 53.3), as new orders contracted for the first time in 9 months. Services PMI climbed to 54.2, the strongest pace since Oct 2013, from 52.6 in May.

- India posted a current account deficit of 1.2% of GDP in the 2021-22 financial year compared to a surplus of 0.9% in the previous year, as trade deficit widened to USD 189.5bn.

- Inflation in Singapore inched up to 5.6% yoy in May (Apr: 5.4%), with food inflation rising to 4.5% (Apr: 4.1%). Core inflation stood at 3.6% yoy, the highest level in more than 13 years.

- Industrial production in Singapore accelerated by 10.9% mom and 13.8% yoy in May, as electronics cluster and semiconductor output grew by 33.6% and 45.7% respectively given strong global demand. Excluding biomedical manufacturing, IP grew by 18%.

Bottom line: Recession talk is gaining ground, with the latest set of preliminary readings for manufacturing PMI posting declines across the US, Europe and Asia; also, Citi’s Economic Surprise Index has plunged for both US and Europe. This has raised hopes that central banks might not take an aggressive route as inflation nears its peak. Reuters reported that Beijing would reopen schools and resume physical classes while Shanghai declared victory over Covid after zero new local cases were reported after 2 months. If this week’s Chinese PMI shows an expansion, it will be a breath of fresh air as the economy tries to put the Covid meltdown behind it.

Regional Developments

- Bahrain GDP grew by 5.5% yoy in Q1 2022 (Q4: 4.3%), supported by non-oil sector activity: non-oil sector GDP grew by 7.8% yoy in Q1 2022(Q4: 4.2%), while oil sector activity declined by 4.7% (Q4: +4.7%). Recovery in the non-oil sector was supported by hotels and restaurants sector (+26.6% yoy) and transportation and telecommunications sector (+15.8%), both of which had plunged as the pandemic hit.

- Bahrain’s sovereign wealth fund Mumtalakat expects McLaren to IPO in two to three years; the fund has a 60% stake in the supercar maker. The fund’s chief executive also disclosed that a second listing for Alba (Aluminium Bahrain) on Saudi bourse was also one of the initiatives being looked at.

- Egypt’s central bank left interest rates unchanged at the latest meeting: lending rate at 12.25% and deposit rate at 11.25%. The apex bank disclosed that the “elevated” inflation rate will be “temporarily tolerated” given supply shocks and that activity is expected to expand at a slower rate going forward given spillovers from the war.

- The 2022-23 budget has been approved by Egypt’s parliament: expenditure will rise by 15% to EGP 2.07trn (USD 111bn) while deficit is forecast to widen by 14.5% to EGP 558.2bn (equivalent to 6.1% of GDP).

- During the Saudi Crown Prince’s trip to Egypt, Saudi and Egypt signed 14 investment deals worth USD 7.7bn, with a focus on infrastructure and green energy. Separately, ACWA Power announced an investment worth USD 1.5bn in a wind power plant (in the Gulf of Suez) in Egypt.

- Qatar’s Emir arrived in Cairo late last week on an official visit to meet Egypt’s President: this is the first trip after the boycott was ended last year.

- Egypt’s finance minister disclosed at a conference that the nation’s green bond issuance cost more than a traditional Eurobond, while calling for incentives to make issuing green debt more attractive.

- Saudi Crown Prince also visited Jordan and met with the King, stating his interest “to push relations to a new phase”: this has raised hopes for investments to flow into Jordan either via the PIF or via stalled investment projects committed to in recent years (about USD 3bn worth).

- Kuwait’s crown prince dissolved the parliament (last time this was done was in 2016), and called for early elections.

- The head of Kuwait Petroleum Corporation stated that it is investing to meet any future demand/ increase in allocations. In this regard, the KPC received its first offshore rig a week prior and will be ready to drill “soon”, he stated without given any further specifics. He was also quoted stating that USD 30 per barrel was added to overall production costs due to the war, and that there are “no indications of destruction of demand”.

- Kuwait Airways is expecting a fourfold passenger rise in 2022 compared to a year ago, according to the CEO. The airline is also planning to introduce 17 new routes this summer in addition to the 56 direct routes currently.

- Lebanon’s Mikati has been named PM, with the main objective to secure the IMF deal. However, forming a government is likely to be an uphill task given the multiple factions vying for cabinet posts and also given Presidential election when the current term ends in Oct.

- Foreign currency reserves in Lebanon has dropped by USD 2.2bn to about USD 11bn in 2022, according to the governor; this compares to more than USD 30bn when the crisis started. He also disclosed being in favour of maintaining the banking secrecy law – which the IMF has recommended be “reformed” to bring in line with best practices.

- The Association of Banks in Lebanon labelled the IMF’s draft staff-level agreement “unlawful” and “unconstitutional”. However, multiple banks and members of the Association have come forward to state being unaware that such a letter was being sent.

- A forensic audit of Lebanon’s central bank is supposed to begin from June 27th, with a team from the US-based auditor Alvarez & Marsal arriving in Lebanon on that date.

- Lebanon and Egypt signed the agreement to import Egyptian gas through Syria to a plant in northern Lebanon. However, a guarantee that these nations will not be targeted by US sanctions (given the Caesar Law imposed on Syria) has not yet been obtained.

- About 92% of Oman’s Duqm refinery project, an estimated USD 7bn project, has been completed, according to the energy holding company OQ. The Duqm refinery project is expected to have the capacity to refine 230,000 barrels a day of crude.

- Oman’s revenues touched OMR 11.2bn in 2021, up 26.9% compared to the approved budget, with non-oil revenues accounting for 26.4% of the total revenues. Supported by oil prices and revenues, overall deficit stood at OMR 1.2bn, 45.4% lower versus the approved budget deficit.

- Oman is offering to purchase several of its outstanding bonds (excluding accrued interest) for cash up to a total of USD 1.75bn, as part of its proactive debt management strategy.

- The World Cup is forecast to add USD 17bn to Qatar’s economy, according to the CEO of FIFA World Cup Qatar 2022. About 1.2mn visitors are expected to visit during the event which starts on Nov 17th.

- ExxonMobil is the latest to join Qatar’s North Field East expansion, following agreements signed previously with TotalEnergies, Eni and ConocoPhillips. Exxon will own a 25% stake in the joint venture formed with these companies.

- Qatar Airways Group CEO disclosed that it has tied up with flydubai, Kuwait Airways, Oman Air and Saudia to provide “Match Day shuttle” flights.

- Bloomberg reported that the Qatar Stock Exchange plans to introduce short selling and securities lending and borrowing from next quarter, in a bid to attract more investors.

- Abu Dhabi’s Investment Authority and holding firm ADQ along with Kuwait’s Investment Authority signed a deal with Africa Sovereign Investors Forum, a platform bringing together sovereign funds of 9 nations Angola, Djibouti, Egypt, Ethiopia, Gabon, Ghana, Morocco, Nigeria and Rwanda.

- UK’s trade minister began trade deal discussions with the GCC region which together is equivalent to UK’s 7th largest export market. This follows other post-Brexit trade discussions with India and Mexico. Saudi Arabia and the UAE are the UK’s major trade partners within the GCC. The agreement targets mutual investment, tariff reductions, and knowledge transfer.

- Bloomberg reported that oil refiners in the Middle East are expected to process 8.8mn barrels per day (bpd) of crude in 2023, 1mn bpd more than output in 2019. This will help ease the forecasted diesel crunch in Europe.

Saudi Arabia Focus

- In addition to stops in Egypt and Jordan, Saudi Crown Prince also visited Turkey for talks with the President, in a bid to fully normalise ties. Discussions centred around trade and cooperation in sectors like defence, energy and tourism among others.

- The IMF forecasts Saudi Arabia to grow by 7.6% yoy in 2022 and non-oil growth to rise by 4.2%, after completing its latest Article IV mission and consultation. Inflation is projected to be 2.8% on average while current account surplus is forecast to rise to 17.4% (highest since 2013). More: https://www.imf.org/en/News/Articles/2022/06/17/saudi-arabia-staff-concluding-statement-of-the-2022-article-iv-mission

- Oil exports from Saudi Arabia hit a 25-month high of 7.38mn barrels per day in Apr, according to data from the Joint Organisations Data Initiative. Separately, Reuters reported that China’s crude oil imports from Russia soared 55% yoy to a record level in May, displacing Saudi Arabia as the top supplier.

- Saudi Arabia’s non-oil exports grewby 34.2% yoy to SAR 22.7bn in Apr 2022 but accounted for just 17% of total exports. China, India, South Korea, Japan and the US were the main destinations for Saudi exports, together accounting for more than 50% of total exports in Apr 2022.

- A new national strategy plans to increase threefold the number of fintech firms in Saudi Arabia by 2025 (from 82 to 230). The fintech sector’s contribution to GDP is expected to rise to SAR 4.5bn, also creating nearly 6k jobs.

- Tadawul plans to launch single stock futures on July 4, with the underlying stocks selected from the largest and most liquid listed firms.

- Saudi Arabia stopped the privatisation of Saline Water Conversion Corp (SWCC) – the world’s largest desalination firm – and moves its assets to a PIF owned company Water solutions Co. This assets transfer is likely to take upto 3 years, according to the head of SWCC.

- Number of SMEs in Saudi Arabia grew by 15.7% to 752,560 in Q1 2022, according to Monsha’at’s “SME Monitor” report; Riyadh accounted for 31.8% of total SMEs in the country as of Mar 2022. Total value of financing exceeded SAR 100.2bn in Q1 2022. (More: https://monshaat.gov.sa/sites/default/files/2022-06/Monshaat%20Q1%202022%20-.pdf)

- Saudi Arabia plans to invest USD 3.4bn in the vaccine and biomedical drugs sector, revealed the minister for industry and mineral resources who heads the new committee for vaccines and biopharmaceutical industry.

- Saudi Makkah and Madinah will likely see 110,000 rooms added by 2030 to cater for Hajj pilgrims, according to a report by Colliers International.

- Retal Urban Development Co, which raised SAR 1.44bn (USD 384mn) via an IPO, will list on Tadawul today (June 27th).

UAE Focus![]()

- UAE raised AED 1.5bn in its second local currency federal treasury bonds last week. The sale of the two-year and three-year tranches, each at AED 750mn, attracted AED 9.7bn in offers.

- The UAE also closed its offering of a dollar denominated dual-tranche sovereign bonds, comprising a 10-year tranche and 30-year Formosa portion, with a value of USD 3bn: the demand topped USD 15bn and the size doubled from the initial target of USD 1.5bn. Bonds will offer investors 100bps over USD for 10Y and 175bps over UST for the Formosa notes.

- The UAE Ministry of Finance disclosed that revenues stood at AED 11.3bn (USD 3.08bn) in Q1 and expenditures slightly higher at AED 11.35bn. Public service sector accounted for 21.4% of total spending, while public order and safety and social protection accounted for 18.7% and 17.7% of total respectively.

- Dubai’s GDP grew by 5.9% yoy to AED 102bn in Q1 2022; this follows a full year growth of 6.2% in 2021.

- TECOM Group’s IPO was 21 times oversubscribed, with demand crossing AED 35bn, making it the most oversubscribed in DFM’s history: it raised AED 1.7bn (USD 463.2mn) from the IPO. UAE retail offer alone was 40 times oversubscribed and the final offer price was set at the top of the price range.

- Abu Dhabi Securities Exchange launched the FADX 15 futures contracts trading on its derivatives platform.

- Adnoc identified AED 70bn (USD 19bn) worth of products with local manufacturing potential in its procurement pipeline, and to this end has signed agreements worth AED 21bn. The company is among 11 national champion firms that has opened up more than 300 products in 11 priority sectors for local manufacturers.

- Abu Dhabi National Energy Co (TAQA) and Adnoc have together acquired a 67% stake in total from UAE’s Masdar.TAQA will now have the right to own at least a 40% share in Abu Dhabi’s renewable energy and green hydrogen projects going forward.

- UAE plans to build Red Sea port in Sudan as part of a USD 6bn investment package, reported Reuters, citing DAL group chairman (a partner in the deal). This includes a free trade zone, a USD 300mn deposit at the central bank and a large agricultural project.

- Dubai International Airport expects passenger traffic to touch 58.7mn this year, after recording 13.6mn travellers in Q1. About 2.4mn passengers are expected to travel over the summer break and Eid Al Adha holidays.

Media Review

Chapters from BIS Annual Report 2022

Inflation: a look under the hood: https://www.bis.org/publ/arpdf/ar2022e2.htm

The future monetary system: https://www.bis.org/publ/arpdf/ar2022e3.htm

Crypto feels the shockwaves from its own ‘credit crisis’

https://www.ft.com/content/032b95dc-7feb-4a2d-8eac-c71235643c07

Why inflation looks likely to stay above the pre-pandemic norm

Why is there a worldwide oil-refining crunch?

https://www.reuters.com/markets/commodities/why-is-there-worldwide-oil-refining-crunch-2022-06-22/