Markets

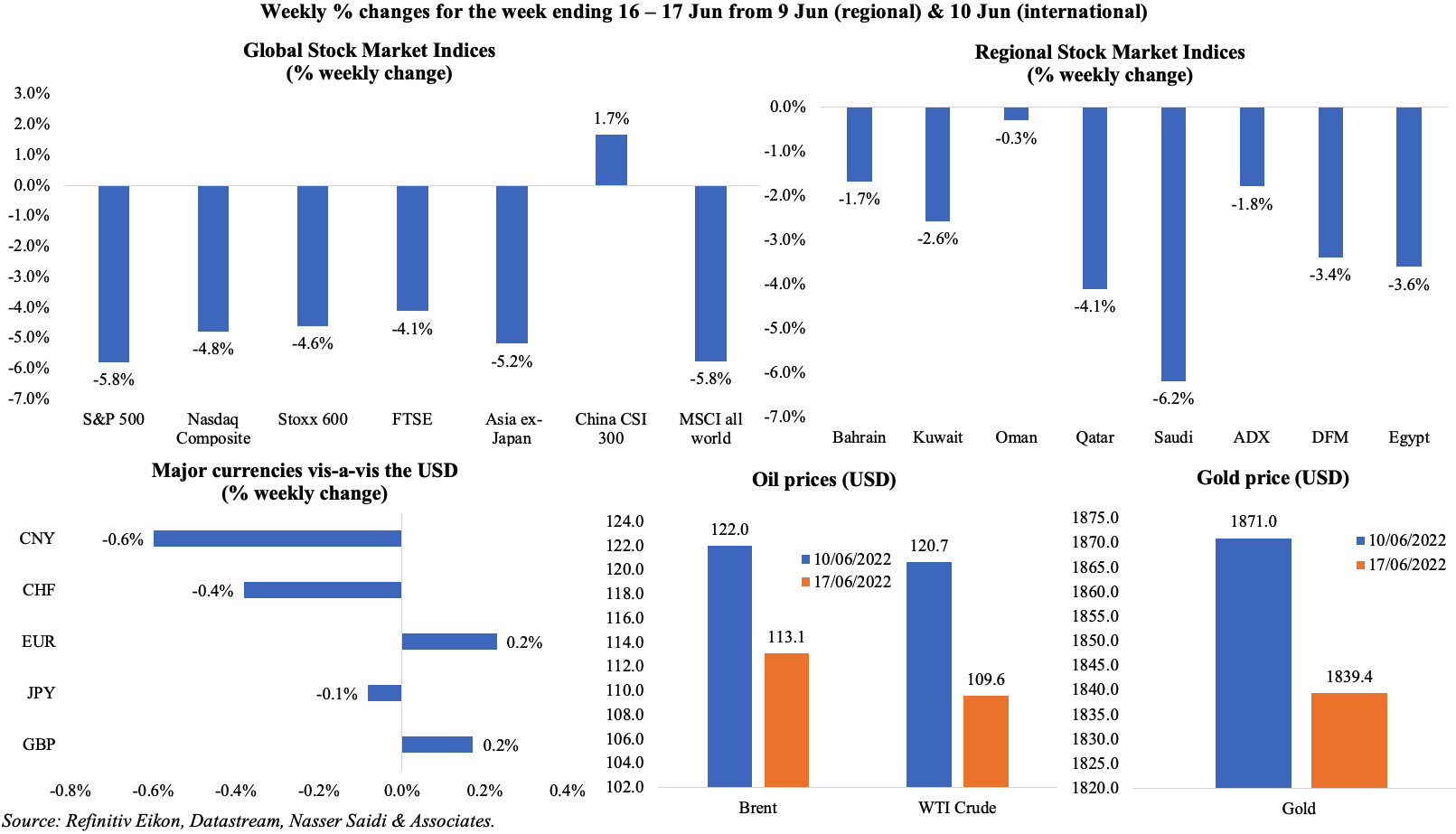

US stocks posted their biggest weekly decline in two years, as global equity markets tumbled on fears of recession (and lower corporate earnings) amid monetary policy tightening to rein in inflation. Chinese markets were slightly up last week, thanks to the efforts to support recovery post-lockdowns. Regional markets mirrored the global sentiment and were down as well, with Saudi posting the biggest drop; both UAE markets declined on growth concerns. Among currencies, the yen lost ground after the BoJ remained ultra-accommodative. Oil prices fell on concerns that slower growth could curtail demand; gold price also fell from a week ago.

Global Developments

US/Americas:

- US Fed hiked its benchmark interest rates by 75bps last week, its biggest hike since 1994. Fed Chair indicated that a similar hike was possible at the next meeting, but unlikely to be “common”. GDP forecasts for 2022 was downgraded to a 1.7% gain (Mar’s estimate: 2.8%).

- US industrial production inched up by 0.2% mom in May (Apr: 1.4%), the weakest gain this year, as manufacturing posted its first decline since Jan (-0.1% in May). Capacity utilisation rose marginally to 79% from 78.9% in Apr.

- Producer price index increased to 10.8% yoy in May (Apr: 10.9%), with wholesale gasoline prices rebounding 8.4% after Apr’s 3% decline. Excluding food, energy and trade services components, core PPI rose to 6.8% yoy.

- Philadelphia Fed manufacturing index declined to -3.3 in Jun (May: 2.6), turning negative for the first time in 2 years. New orders index slipped to -12.4 in Jun (May: +22.1) while producers 6-month outlook, at -6.8, sank to the lowest since Feb 2008.

- Retail sales in the US unexpectedly edged down by 0.3% mom in May (Apr: 0.7%), the first decline this year, and raising fears of a recession. Auto sales posted the biggest decline (-4%) while sales at electronic stores and non-store retailers fell (by 1.3% and 1% respectively).

- Building permits in the US fell by 7% mom to 1.695mn in May, the lowest level since Sep 2021. Housing starts plunged by 14.4% mom to 1.549mn, a 13-month low. The 30-year fixed rate mortgage ticked up by 55bps to a 13 and a half year high of 5.78% last week.

- Initial jobless claims stood at 229k in the week ended June 10th, down from an upwardly revised 232k a week ago, taking the 4-week average higher to 218.5k. Continuing jobless claims inched up by 3k to 1.312mn in the week ending Jun 3rd.

Europe:

- Industrial production in the eurozone grew by 0.4% mom in Apr, rebounding from Mar’s 1.4% mom drop, though registered a decline of 2% in year-on-year terms (the biggest fall since Oct 2020).

- Trade deficit in the eurozone widened to EUR 32.4bn in Apr, almost doubling from the EUR 16.4bn reported in Mar. Separately, eurozone posted its first current account deficit in a decade in Mar: the reading stood at a deficit of EUR 1.57bn, thanks to a small trade deficit and an outflow of secondary incomes, and following Feb’s EUR 15.73bn surplus.

- Wholesale price index in Germany eased to 22.9% in May, slowing slightly from Apr’s record-high 23.8%, pushed up by prices of raw materials, energy and food.

- The ZEW survey showed an improvement in the current economic situation in Germany, with the reading up 8.9 points to -27.6 in Jun. Economic sentiment indicator also climbed, to -28 in Jun from -34.4 the month before. For the eurozone, economic sentiment rose by 1.5 points to -28 while the situation indicator was up 8.6 points to -26.4.

- German current account surplus narrowed to EUR 7.4bn in Apr (Mar: EUR 18.7bn; Apr 2021: EUR 23bn), largely as the services account posted a deficit of EUR 0.7bn.

- The Bank of England raised interest rates by 25bps to 1.25%; three MPC members who called for a 50bps hike were outvoted.

- UK GDP shrank by 0.3% mom in Apr, following a 0.1% drop in Mar, led by a 0.3% contraction in the services sector; construction also fell by 0.4%.

- Industrial production in the UK fell for a 3rd consecutive month in Apr, down by 0.6% mom (Mar: -0.2%), with manufacturing declining by a larger 1% (Mar: -0.2%).

- Unemployment rate in the UK inched up to 3.8% in the 3 months to Apr from 3.7% in the previous month. Average earnings including bonus increased by 6.8% in the 3 months to Apr, but with prices rising at a much faster pace than wages living standards are falling.

- The Swiss central bank raised its policy interest rate for the first time since Sep 2007, increasing its rate by 50bps, though remaining in negative territory, to -0.25% from -0.75%. This move was “aimed at preventing inflation from spreading more broadly”. The central bank also raised its inflation forecast to 2.8% this year (from 2.1% estimated in Mar).

Asia Pacific:

- Initial signs of recovery in China: industrial production rebounded in May, rising to 0.7% in May following a 2.9% drop in Apr. Fixed asset investment grew by 6.2% yoy in Jan-May (Jan-Apr: 6.8%). Retail sales improved, falling by 6.7% in May after recording a 11.1% decline the month before.

- FDI into China grew by 17.3% yoy in Jan-May (Jan-Apr: 20.5%); inflows into the high-tech industries surged by 42.7% yoy.

- The Bank of Japan left interest rate unchanged, in contrast to all other major central banks that met last week and pledged to guide the 10Y government bond yield around 0%. The BoJ also expects to keep borrowing costs at “present or lower” levels.

- Industrial production in Japan fell by 1.5% mom and 4.9% yoy in Apr (Mar: 0.3%): this was the first mom drop since Jan.

- Machinery orders in Japan unexpectedly surged by 19% yoy in Apr (Mar: 7.6%). In mom terms, orders were up by 10.8%, and business investment also grew at the fastest pace in 18 months, in spite of supply chain disruptions and a weak yen.

- Japan’s exports grew by 15.8% yoy in May (Apr: 12.5%) but were outpaced by imports which grew by 48.9% (thanks to high commodity prices and a weakening yen). Trade deficit widened to JPY 2384.7bn (Apr: JPY 842.8bn) – the biggest deficit since Jan 2014.

- India’s consumer price inflation eased to 7.04% yoy in May from Apr’s 8-year high of 7.79%, remaining above the RBI’s target range (2-6%) for the 5th consecutive month. Food prices remained high (7.84%) but other sectors also reported increases including transportation and communication (9.54%) and clothing (8.53%).

Bottom line: Last week, rate hikes were announced by major developed nations’ central banks: Swiss National Bank (50bps); the Fed (75bps); Bank of England (25bps); the National Bank of Hungary (50bps). The Bank of Japan remains the only major central bank with an ultra-accommodative policy stance, citing the current cost-push inflation as temporary, even as core CPI rose 2.1% yoy in Apr (exceeding the BoJ’s target). More than the rate hikes, the unwinding of central bank balance sheets is important given its more direct impact on market liquidity. The ECB pledged to create a “new anti-fragmentation instrument” to tackle fears of a widening gap in the cost of borrowing between stable and more vulnerable nations (and a looming debt crisis). This week’s preliminary PMI readings will be ones to watch: will higher borrowing costs have affected business sentiment? Both US and Europe readings have been in the expansionary territory (50+) all this year (vs. China’s Covid struggles and sub-50 readings during lockdowns).

Regional Developments

- Bahrain’s King, in a cabinet reshuffle, changed 17 of the 22 ministers, with appointments including 4 female ministers. Appointments included the deputy PM, ministers for oil and environment, industry and commerce as well as tourism among others.

- Bloomberg reported that Aluminum Bahrain, already listed on the Bahrain stock Exchange, was considering a second listing on Saudi Tadawul, either by end of this year or early 2023. However, in a Bourse filing, the company stated that “takes its disclosure obligations very seriously” and will make statements based “on well-established facts and not on speculation”.

- Egypt’s finance minister revealed that higher oil and wheat prices would cost an additional USD 7.2bn and USD 3bn, putting further strain on the budget amid pressure on the EGP.

- The Suez Canal extended rebates on canal tolls for LNG & liquefied petroleum gas (LPG) carriers from July until end-2022.

- Iran’s currency fell to a record low of 332,000 to the dollar last Sunday (12 Jun) amid uncertainty about the nuclear deal and sanctions but recovered slightly following a dollar injection into the market.

- Iraq’s oil minister stressed the country’s commitment to the OPEC+ agreement and disclosed that oil exports ceiling will reach 3.8mn barrels per day (bpd) in Jun and 3.85bpd in Jul.

- In a bid to alleviate the electricity shortage during summer, Iraq has begun setting up electricity interconnection stations with Saudi Arabia. The country also has supply agreements with Turkey, Jordan and other GCC nations.

- Kuwait awarded 235 tenders worth USD 5.9bn last year, according to the Central Agency for Public Tenders; the ministry of electricity, water and renewable energy accounted for the largest share, awarding 50 contracts worth USD 353.7mn.

- Lebanon is gearing up to sign a “final” agreement on gas imports from Egypt on June 21st, reported Reuters, citing the former’s energy ministry. If the deal goes through, it could increase the nation’s power supply to up to 10 hours a day.

- The IMF expects Oman to grow by 4.5% this year and record a budget surplus of 5.5%, thanks to higher oil prices and the slew of fiscal reforms. It expects central government debt to shrink to 45% of GDP this year (2021: 63% of GDP).

- The Oman Investment Authority revealed plans to exit 6 national assets: this would include listing at the Muscat Stock Exchange two assets of the state energy company OQ and a manufacturing asset. The OIA also plans full and partial exits from a “number” of Omran (Oman Tourism Development Company) hotels and resorts as well as two projects of Asyad (an integrated logistics service provider).

- Qatar expects to handle 34-36mn passengers at the Hamad International Airport this year. During the World Cup (which runs mid-Nov to mid-Dec), an estimated 3.5-4.1mn passengers will pass through in Nov and 3.4-4.7mn are expected in Dec.

- Qatar, which has fewer than 30k hotel rooms, will offer 1000 “Bedouin style” tents in the desert during the World Cup, of which 200 will be luxurious. In addition, non-hotel accommodation has been boosted and two cruise ships moored in Doha will also support overnight lodging.

- Qatar Energy signed an agreement with Eni on the North Field East expansion, close on the footsteps of a deal with TotalEnergies announced earlier this month. Reuters reported that China’s oil firms are in discussions with Qatar about investing in the North Field East expansion, in addition to buying the fuel under long-term contracts. Qatar was China’s largest LNG supplier after Australia in Jan-May 2022.

- According to an APICORP (Arab Petroleum Investments Corporation) report, energy investments in the MENA region will grow by 9% to USD 879bn by 2026; this will be led by Saudi, Iraq, Egypt and the UAE.

- GCC central banks raised its benchmark interest rates, following the Fed’s 75bps rate hike: Bahrain, Qatar and the UAE increased its key rates by 75 bps (though Qatar’s lending rate and UAE’s rate applicable to borrowing short-term liquidity by only 50bps); Kuwait raised its discount rate by 25bps to 2.25% and Saudi raised repo and reverse repo rates only by 50bps.

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia eased in May, thanks to deceleration in miscellaneous goods, transport as well as clothing and footwear prices; transport category has benefitted partly from the cap on petrol prices. Overall, inflation has averaged just 1.9% this year.

- Wholesale prices in Saudi Arabia posted a double-digit increase for the 14thstraight month in May, up by 10.2% yoy and averaging 11.4% in 2022.

- NEOM awarded two contracts for “The Line”, to build two tunnels with a length of 28km for high-speed transportation and freight services.

- Saudi Arabia will increase levies on 99 commodities, in line with WTO rules, with an aim to promote domestic industries and products. The increase of rates on 575 commodities two years ago resulted in an increase in investments in related factories (by 2% to SAR 374bn).

- Saudi Aramco is planning to merge its two energy trading units ahead of a potential IPO: Motiva Trading will be absorbed by Aramco Trading Co to allow for simplified financial reporting.

- Saudi Ports Authority signed a SAR 500mn deal with DP World to create a new smart logistics park in Jeddah. When completed, the park will be able to handle 250,000 TEUs containers with a warehouse area of over 100,000 square meters.

- The tourism sector in Saudi Arabia has been given a SAR 300mn boost: a joint-financing program by the state-owned tourism fund and Arab National Bank will support SMEs with financing, with initial approval coming within 48 hours of submitting the application. The loans need to be repaid within a period of up to 5 years.

- NEOM subsidiary ENOWA signed an agreement to develop a desalination plant in OXAGON, powered by 100% renewable energy: when completed in 2025, the plant is expected to have a production capacity of 500k cubic meters of desalinated water per day (~30% of total water demand in NEOM).

- Saudi Arabia has lifted all Covid19 related protective measures including the mask mandate; the latter however still stands in the Grand Mosque and the Prophet’s Mosque.

UAE Focus![]()

- UAE’s federal government will increase spending by AED 1.23bn in the 2022 budget, revealed the Federal National Council; amount will come from the federal government’s general reserves. Revenues are estimated to rise by AED 374.98mn.

- UAE’s President pledged an additional USD 50bn investment to scale up climate action across the globe.

- Inflation in the UAE increased to 3.35% yoy in Q1, according to the FCSA. Prices rose across transportation (22%), restaurants and hotels (6.87%), food and soft drinks (5.4%) and tobacco (4.07%) among others.

- The second auction of UAE’s federal treasury bonds with a target value of AED 1.5bn (USD 408mn) will be held today (June 20).

- This year the Abu Dhabi Securities Exchange expects to exceed the number of listings in 2021 and disclosed that it has a “good pipeline” of IPOs. The exchange plans to add more single-stock futures on its derivatives market, introduce 3-5 futures and launch a tradeable version of the FTSE FADX 15 Index.

- Dubai government will implement its pension plan for expatriates in Dubai government entities starting July 1st.

- Export and re-exports of Dubai Chamber of Commerce members increased by 28% to AED 23bn (USD 6.26bn) in May: this was the highest reported value since Aug 2018. In Jan-May, this grew by 16% to AED 104.3bn.

- Bilateral non-oil trade between UAE and Germany exceeded AED 478bn between 2012-2021. Last year, bilateral trade grew by 12% yoy to AED 35.3bn.

- UAE announced a four-month suspension in exports and re-exports of wheat and wheat flour originating from India; however, exports of wheat from India for domestic consumption has been approved.

- Bahrain-based Coinmena, a Shariah compliant crypto assets trading platform, received a provisional virtual assets license to operate in Dubai.

- Electric vehicle company NWTN plans to set up a manufacturing base in Kizad: the first phase, to be completed in Q4 2022, will have 24000 square meters of manufacturing, testing, inventory and storage space with an annual capacity of 5000 to 10000 units.

Media Review

People’s inflation expectations are rising

Central banks and markets share a secular awakening

https://www.ft.com/content/77665e8d-e3bb-4fc7-8547-b368c8b90f47

Iran, Russia cargo to India via a new trade corridor

‘There’s So Much Fear’: Crypto Winter Descends on Traders

How Crypto and CBDCs Can Use Less Energy Than Existing Payment Systems