Weekly Insights 10 Jun 2022: Accelerating economic activity in the GCC, but inflation starting to bite

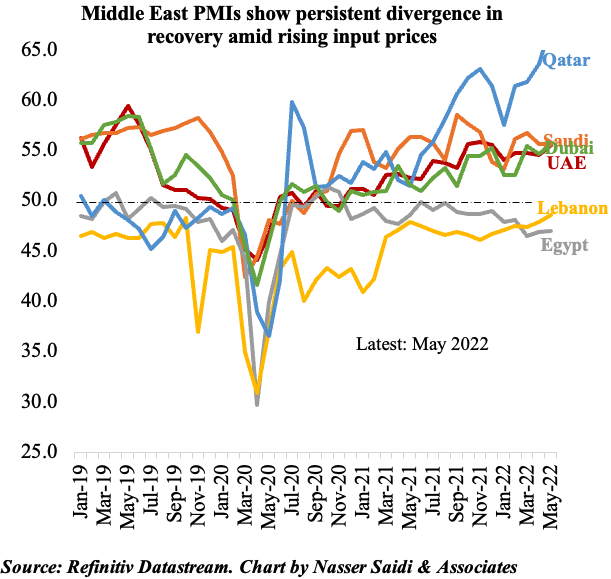

1. PMIs highlight increased activity, new orders in the GCC; inflation on the rise across the Middle East

- Divergence in PMI readings in the GCC and rest of the Middle East continues: Qatar expanded for the 23rd straight month in May, UAE and Saudi 21 & Dubai’s 18 while Egypt’s readings have been sub-50 for ~1.5 years

- Egypt and Lebanon have seen slight improvements in recent months, but overall situation continues to be worrisome (new orders in Egypt fell the most since Jun 2020; exchange rate woes in Lebanon add on to slow pace of increase in output, new orders). However, expectations remain pessimistic given runaway inflation (in both nations) and economic/ political reform (in Lebanon)

- Businesses across the Middle East are confronted with rising input costs. Buying levels have slowed as firms prefer to draw down on inventories. UAE remains an outlier where more firms prefer not to pass on higher input costs to customers (increasing competition, but affecting firms’ profits)

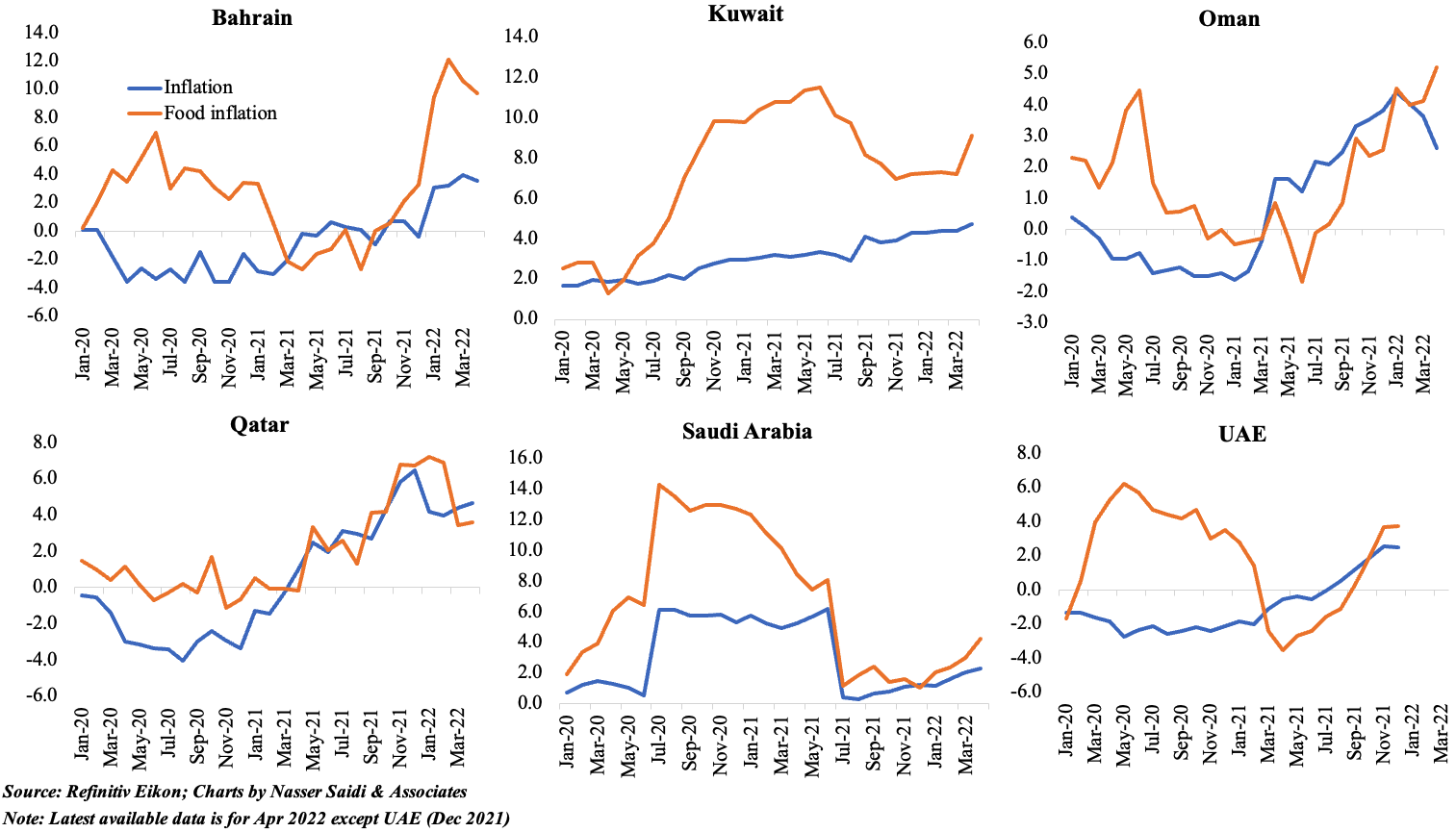

2. Inflation rates rising across the GCC; fuel prices have surged by 50%+ in the UAE since end-2021 (costs double vs Oman)

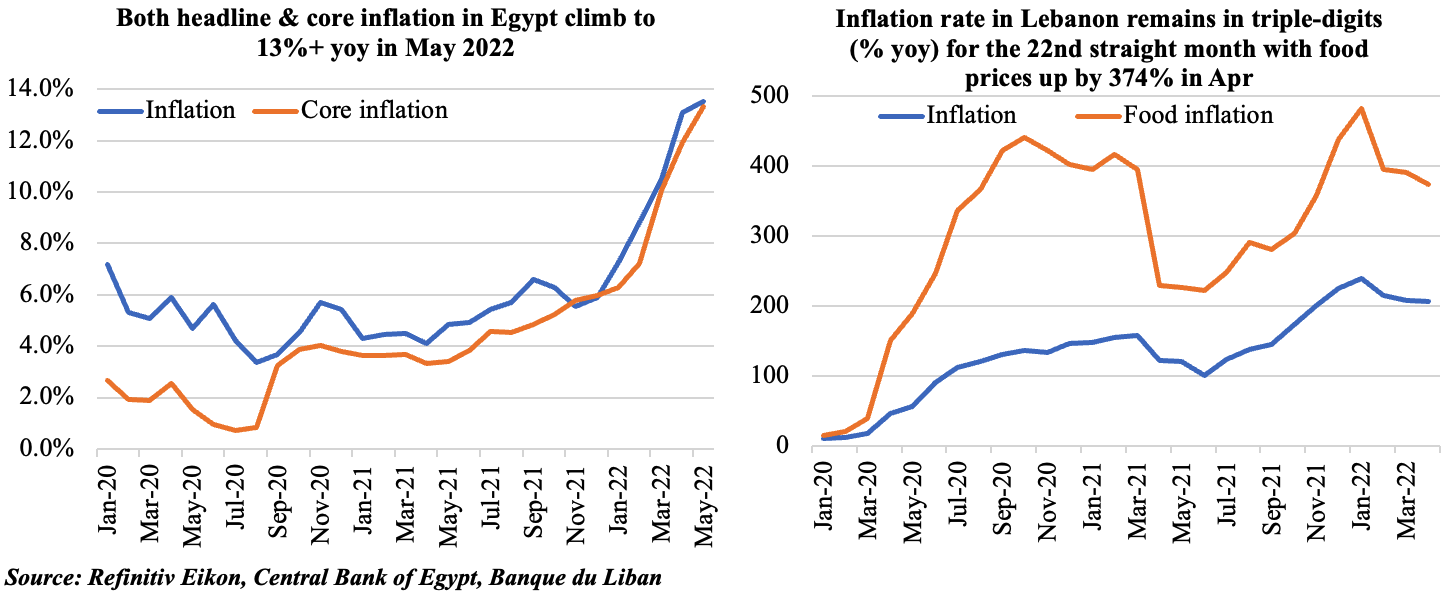

3. Severe inflation concerns in Egypt & Lebanon, given size of imports & exchange rate depreciation

- Egypt’s inflation climbed to 13.5% yoy in May – the highest in 3 years, driven by a surge in food and beverages prices (24.8%) and the recent devaluation. Core inflation also touched 13.3% in May (Apr: 11.9%). With the central bank’s inflation target at 7% (±2%), a rate hike seems almost certain at the meeting on June 23

- Lebanon saw a slight moderation in Apr inflation in yoy terms – to the lowest level since Nov; however, in mom terms, prices rose by 7.1% (Mar: 6.1%). Inflation & exchange rate depreciation act as a tax on income (reducing real wages) and a massive wealth tax. In the absence of implementation of reforms (to receive a support package from the IMF), the economic crisis seems to be dragging on; further increases in the costs of living will put pressure on the population => increase in poverty, food poverty & inequality

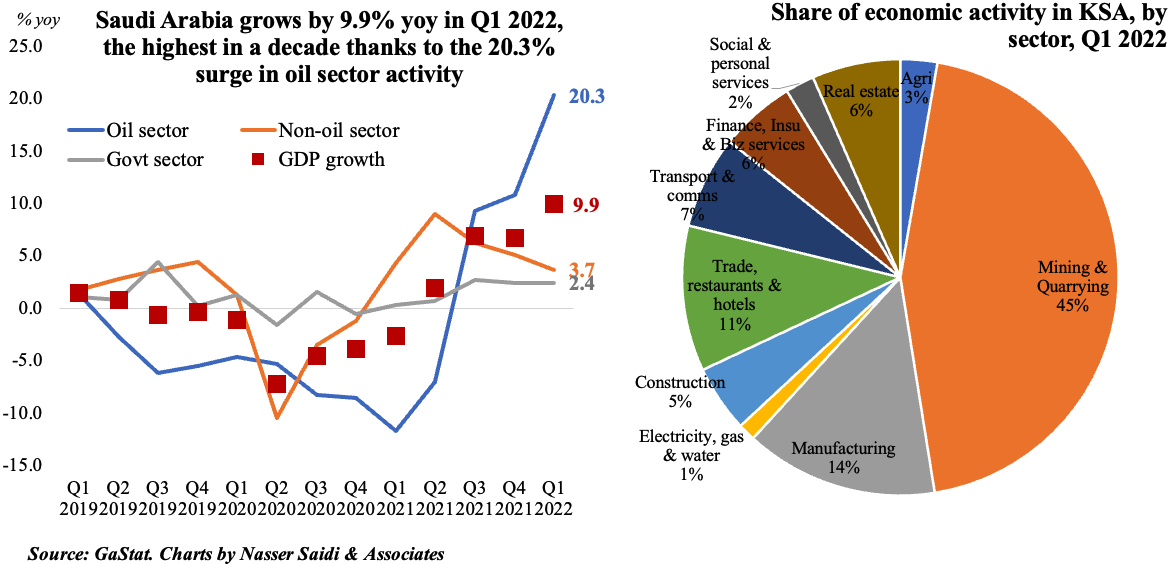

4. Saudi Arabia’s GDP soared by 9.9% in Q1 2022, the fastest in a decade

- Q1 GDP growth in Saudi Arabia, at 9.9% yoy, was the highest since Q3 2011, and driven by increase in oil sector activity (20.3%). Non-oil sector also expanded, though at 3.7%, it is growing much slower pace compared to previous quarters

- In yoy terms, the maximum gains accrued in the mining & quarrying sector. However, growth was also recorded across manufacturing (8%), trade and transportation (6% each) and finance (4%)

- Private investment and exports supported GDP growth (by expenditure), rising by 20% and 22.1% respectively in Q1 while private consumption grew by just 7.1%

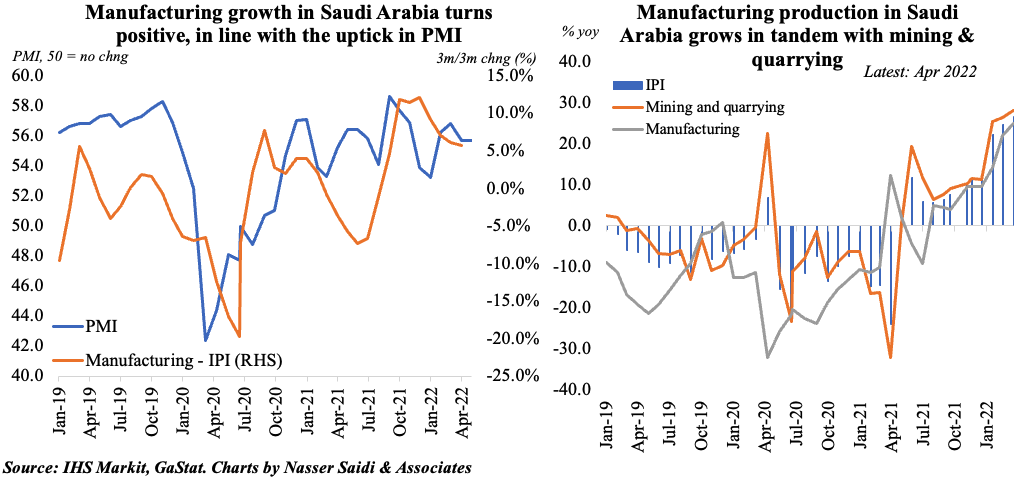

- Apr’s Industrial Production Index, at 130.2, was the highest level recorded since Apr 2020. Higher mining and quarrying production (+28.3% yoy) led to a 26.7% surge in overall industrial production in Apr 2022. In March, Saudi had increased oil production to 10.3mn barrels per day (bpd), the highest in about 2 years

- The manufacturing component within the IPI (22% weight in overall index) also increased in tandem with oil production, up by 25.1% (Mar: 22%), supported by recovery in trade and exports. This seems consistent with the non-oil sector PMI, which expanded for a 21st straight month in May (55.7), supported by an uptick in new export orders for the 3rd consecutive month

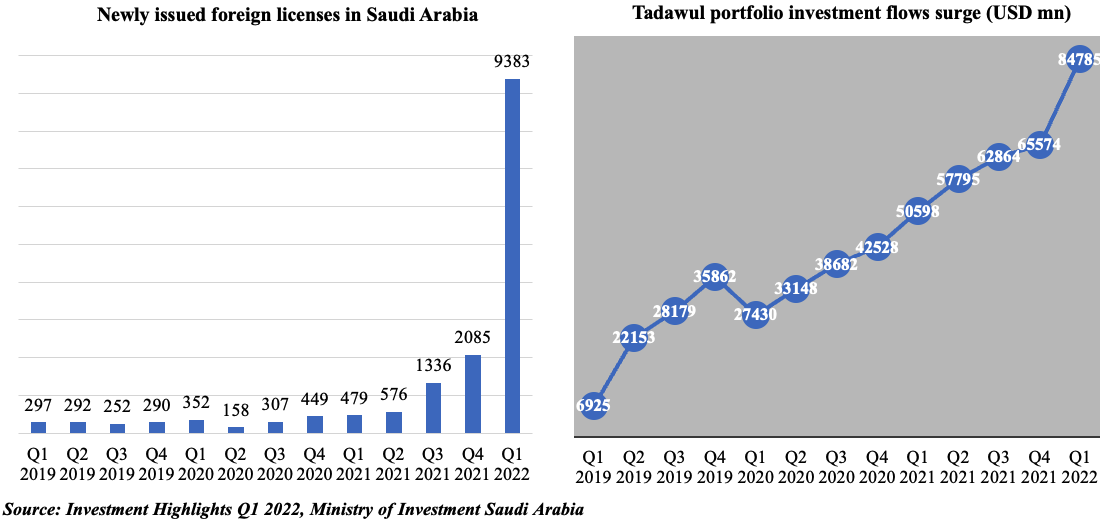

6. Q1 2022 investment developments in Saudi Arabia look promising

- A record breaking number of new licenses in Q1 2022: It was up 350% qoq & 19 times higher than Q1 2021. Wholesale and retail trade licenses accounted for the lion’s share (64.1%) while construction (12%), manufacturing (7.1%) and accommodation and food (6%) were the other prominent sectors

- Industrial investments increased in Q1 2022 (in line with IP data): 299 new factories started production in the quarter, 176 new licenses were issued, and the capital of newly licensed factories exceeded USD 1.1bn

- Ownership by qualified foreign investors grew by 29.3% qoq in Q1 2022; their investments grew to USD 84.8bn in Q1 2022, rising for the 8th consecutive quarter

- Ministry of Investment signed 101 deals in Q1 2022, with estimated investments of USD 4bn+, including with EV manufacturer Lucid to open a plant. About 6k jobs are likely to be created

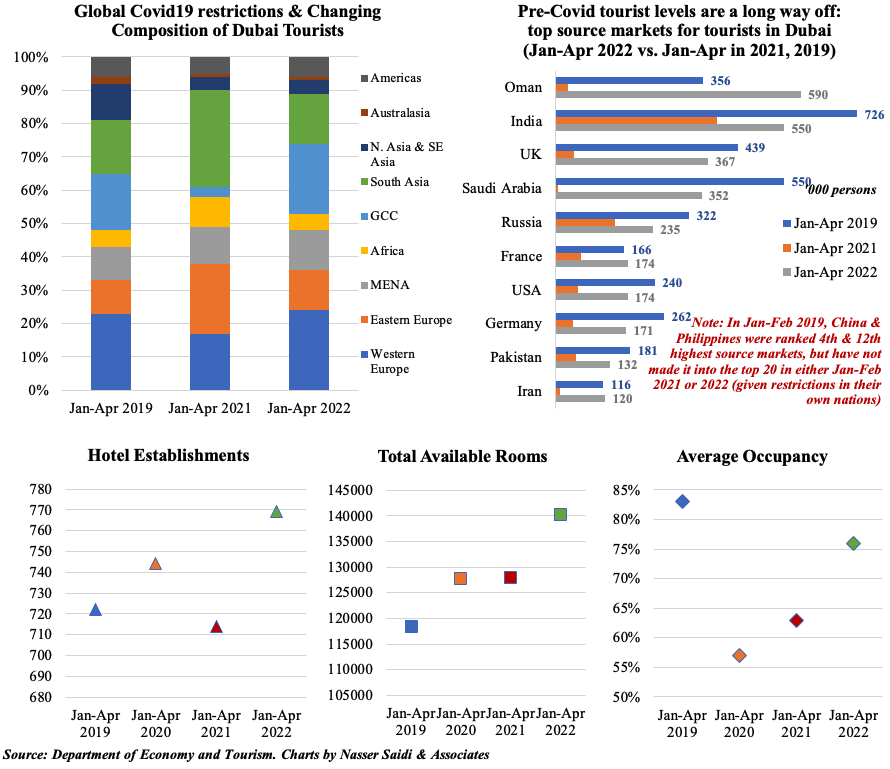

7. Dubai Tourism continues to improve, though not yet at pre-Covid levels… recovery evident in Dubai PMI readings

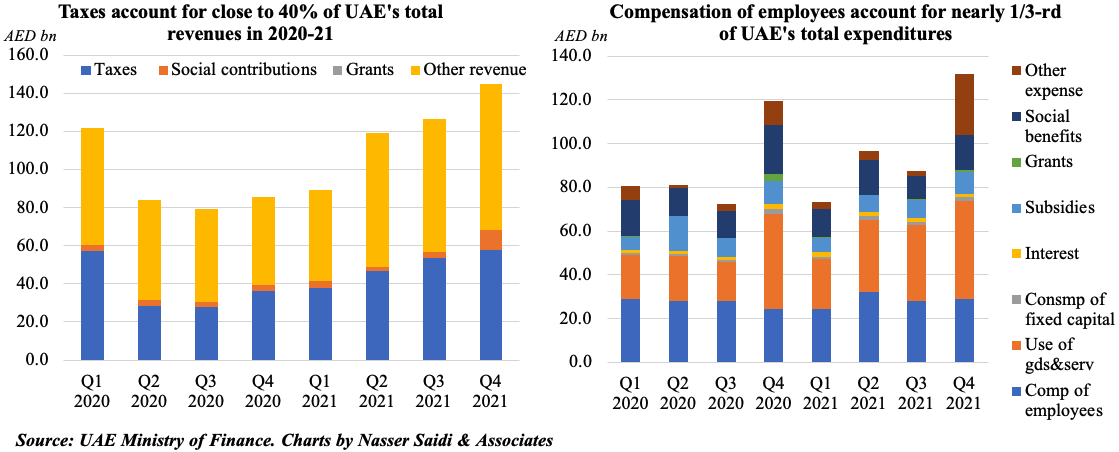

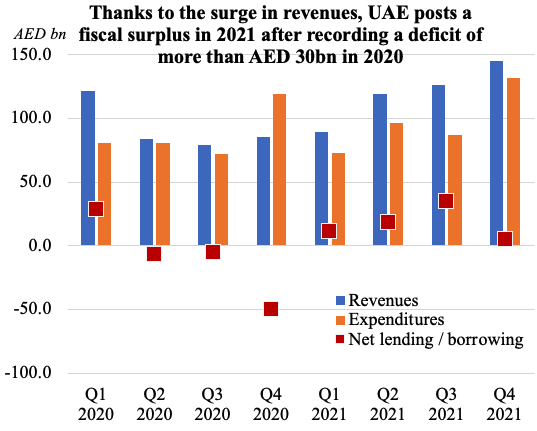

8. UAE posts a fiscal surplus in 2021, after a deficit year in 2020

- With growth in revenues outpacing spending, UAE posted a fiscal surplus of close to AED 70bn in 2021

- Taxes are contributing more towards UAE’s overall revenues (~40%), reducing dependence on oil revenues

- Compensation of employees and subsidies together account for about 40-45% of overall spending in the UAE

- Capital spending, measured by the net acquisition of non-financial assets, declined by 56% yoy to AED 21.9bn in 2021