Markets

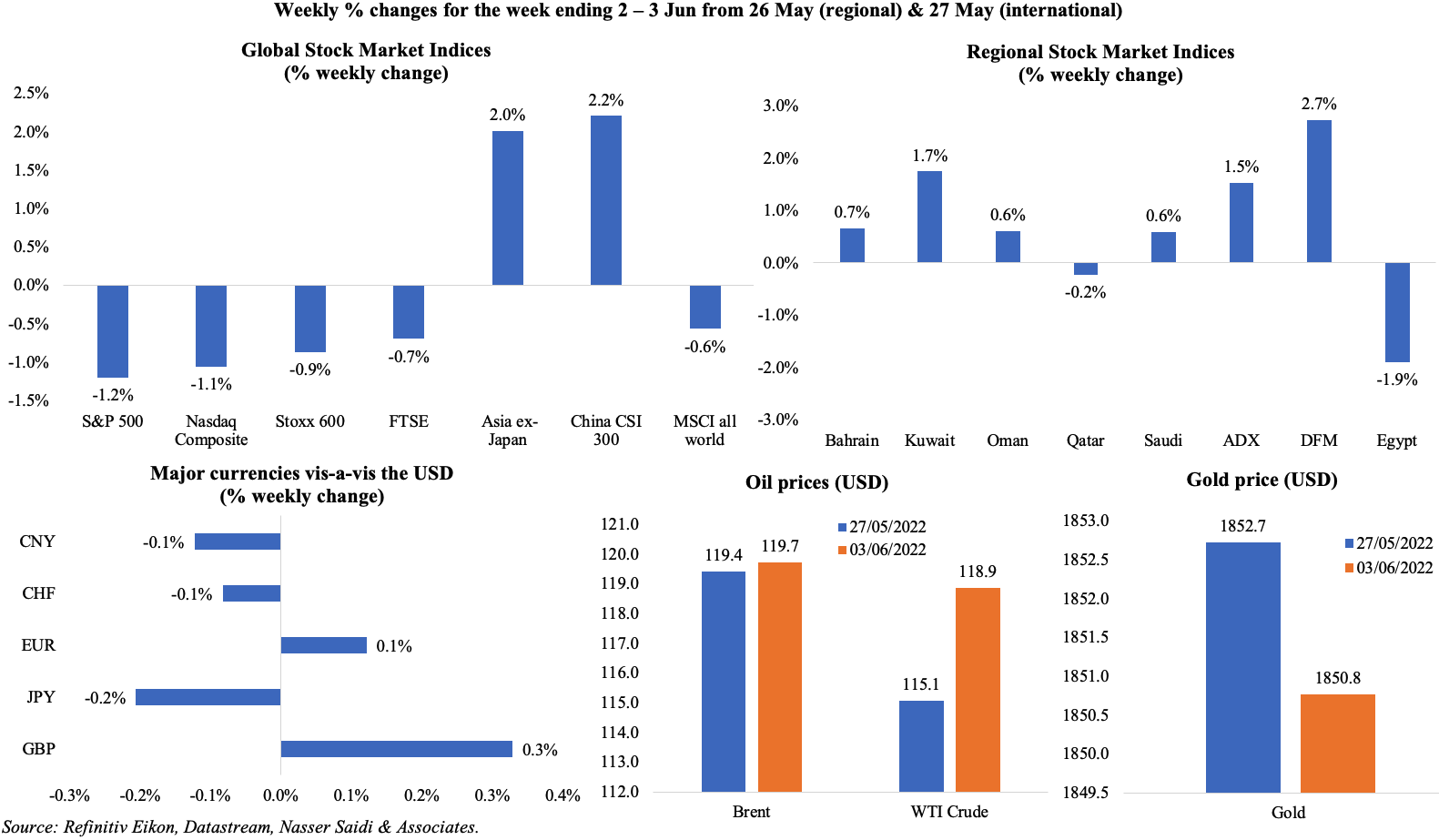

Markets are dancing to the tune of monetary tightening: signs of a tight labour market in the US sent equity markets lower last Friday, with money markets now fully pricing in 50bps rate hikes by the Fed in June and July. European equities also ended the week lower, as the latest higher inflation data strengthens the case for ECB rate hikes. Asian stocks picked up as China relaxed Covid lockdowns and announced stimulus measures to lift sentiment. Regional markets were mostly up. The dollar index edged higher, while also rising to a more than 3-week high vis-à-vis the yen. Oil prices closed higher compared to a week ago, with the Brent just shy of USD 120 a barrel, given the OPEC+ agreement to boost crude output and on news of a higher-than-expected decline in US crude inventories. Gold prices rose towards the end of the week supported by payrolls data though it slipped by a meagre 0.1% from a week ago.

Global Developments

US/Americas:

- US Fed Beige book stated that a majority of the Fed Districts indicate “slight or modest growth” while prices were increasing at a “strong or robust” pace.

- Non-farm payrolls increased by 390k in May (Apr: 436k), the smallest increase in two years, also partly due to shortages of workers. Unemployment rate held steady at 3.6% (lowest since Dec 1969) while average hourly earnings grew by 5.2% yoy in May (Apr: 5.5%).

- Labour force participation rate increased to 62.3% but is still 1.1 percentage points below pre-Covid Feb 2020.

- Non-farm productivity in the US declined by a 7.35% annualised rate in Q1, the most since Q3 1947 (previous estimate: -7.5%; Q4: 6.3%). Unit labour costs gained by 12.6% in Q1 (previous estimate: 11.6%; Q4: 3.9%).

- ADP employment report showed that only 128k jobs were created in the private sector in May (Apr: 202k) – this was the smallest gain since Apr 2020 (just immediately after Covid lockdowns).

- JOLTS job openings stood at 11.4mn at end-Apr, down by 455k from Mar, though staying near record highs; the jobs-workers gap stood at a high 3.3% in Apr, though lower than March’s 3.6%.

- Initial jobless claims fell to 200k in the week ended May 27th(prev: 211k), while the 4-week average slipped to 206.5k. Continuing jobless claims declined by 34k to 1.309mn in the week ending May 20th – the lowest since Dec 1969.

- Factory orders gained by 0.3% mom in Apr (Mar: 1.8%); shipments of manufactured goods gained 0.2% after accelerating 2.2% in Mar while orders for electrical equipment, appliances and components fell 0.2%.

- S&P Case Shiller home price index grew by 21.2% yoy in Mar (Feb: 20.3%); the average rate on the 30-year fixed mortgage ended Mar at 4.67% from 3.29% at the start of Jan.

- Chicago PMI improved to 60.3 in May (Apr: 56.4) while Dallas Fed manufacturing business index tumbled to -7.3 in May (Apr: 1.1), the lowest reading since May 2020; new orders and growth rate of orders indices declined to near 2-year low levels.

- S&P manufacturing PMI in the US was revised down to 57 in May from a preliminary estimate of 57.5, and this stands much lower than April’s final reading of 59.2. Production and new orders eased while cost inflation accelerated to a 6-momnth high. Furthermore, business confidence fell to the lowest level since Oct 2020.

- ISM manufacturing PMI unexpectedly increased to 56.1 in May (Apr: 55.4), supported by gains in the new orders index (55.1 from 53.5) and production (54.2 from 53.6) while employment index contracted (to 49.6, for the first time sinc Nov 2020) and prices paid eased (82.2 from 84.6).

Europe:

- Inflation in the eurozone surged to a new record of 8.1% in May (Apr: 7.4%), driven by energy costs (39.2%) and food, alcohol and tobacco costs (7.5%). Core inflation inched up to 3.8% from 3.5% in the previous month. The highest rate of inflation in the eurozone was 20.1% in Estonia, while the lowest was 5.6% in Malta. Harmonised index of consumer prices in Germany inched up to 8.7% yoy in May (Apr: 7.8%), the highest reading since Dec 1973. Energy prices surged by 38.3% while food prices posted a 11.1% increase.

- Producer price index in the eurozone jumped to 37.2% yoy in Apr, up from Mar’s then all-time high of 36.9%. Wholesale prices for non-durable consumer goods (e.g. food and drinks) rose 11.2%, its first-ever double-digit percentage increase, while prices of durable consumer goods ticked up by 8.5%.

- Manufacturing PMI in the eurozone was revised up to 54.6 in May from an initial estimate of 54.4 (lower than Apr’s 55.5): as new orders fell for the first time since Jun 2020 and the headline reading was the lowest since Nov 2020. Inflationary pressures and supply disruptions remain (though the latter saw some limited easing).

- Manufacturing PMI in Germany increased to 54.8 in May (Apr: 54.6), as output levels picked up slightly, as did employment. However, there was a further decline in new orders on the back of multiple factors including higher prices/ costs, China’s lockdowns and economic uncertainty in general.

- Germany’s exports rebounded by 4.4% mom in Apr, while imports grew by 3.1%, taking the trade surplus higher to EUR 3.5bn in Apr (Mar: EUR 1.9bn). Exports from Germany to Russia dropped 10% in Apr after plunging by 60% in Mar.

- Germany’s unemployment rate stood unchanged at 5% in May, with the number of unemployed declining by 4k to 2.285mn. In the eurozone, unemployment stood unchanged at 6.8% in Apr.

- Business climate in the EU slipped to 1.26 in May (Apr: 1.98). Consumer confidence however eased slightly to -21.1 from -22 the month before. The Economic Sentiment Indicator in the euro area inched up to 105 from 104.9.

- Retail sales in Germany dropped by 5.4% mom and 0.4% yoy in Apr, affected both by higher prices and supply constraints. Grocery retailers reported sales decline by 7.7% in Apr – the biggest mom drop since 1994. Retail sales in the euro area declined by 1.3% mom in Apr: sales declined by 2.6% for food, drinks and tobacco and 0.7% for non-food products, while it increased by 1.9% for automotive fuels.

- UK’s manufacturing PMI slipped to 54.6 in May (Apr: 55.8), the slowest since Jan 2021, given decline in domestic demand, supply chain disruptions and cost pressures (also due to exchange rate fluctuations). Business confidence also declined to a 17-month low.

Asia Pacific:

- China’s NBS manufacturing PMI increased to 49.6 in May, from Apr’s 26-month low of 47.4. While the headline index remained in contractionary territory for the 3rd straight month, output, new orders and new export orders indices improved from Apr’s readings (albeit still below-50).

- Non-manufacturing PMI in China also surged to 47.8 in May (Apr: 41.9): new orders contracted at a softer rate (44.1 vs Apr’s 37.4), while both new export orders (42.8 vs 42.7) and employment (45.3 vs 45.4) continued to decline further.

- China’s Caixin manufacturing PMI increased to 49.1 in May (Apr: 46): output and new orders, though below-50, increased compared to Apr while export orders and employment posted further declines.

- China announced last Tuesday a package of 33 measures covering fiscal, financial, investment and industrial policies to support its economic recovery after Covid-related extended lockdowns. These include accelerating local government special bond issuances, support for infrastructure and major projects (also using REITs as a funding tool), supporting domestic firms to list in Hong Kong, tax credit rebates to more sectors, allowing firms to defer social security payments and halve purchase tax for small-engine cars among others.

- Industrial production in Japan fell by 1.3% mom and 4.8% yoy in Apr (Mar: -1.7% yoy). Declines were recorded across electronic parts and devices (-6.6% from 2% in Mar), production machinery (-2.7% from 3.9%), and motor vehicles (-0.6% from 6%).

- Unemployment rate in Japan declined to 2.5% in Apr, the lowest reading since Mar 2020 and lower than Mar’s 2.6%. Jobs to applicant ratio improved to 1.23 from 1.22 in MAr.

- Japan’s retail trade improved significantly, rising by 2.9% yoy in Apr (Mar: 1.7%), supported by stronger demand after lower Covid19 cases. Large retailer sales grew by 4% in Apr (Mar: 1.5%).

- Japan’s manufacturing PMI stood at 53.3 in May, slightly lower than April’s final reading of 53.5: export orders fell at the sharpest pace since Jul 2020 while employment gained for the 4th consecutive month.

- India’s GDP grew by 4.1% yoy in Jan-Mar 2022 (Q4: 5.4%), bringing the full year growth in the financial year 2021-22 to 8.7%. For the full year all sectors except trade, hotels and communication services were above the pre-pandemic levels of FY20. In Jan-Mar, manufacturing contracted by 0.2% compared to the 0.3% gain in the previous quarter.

- Fiscal deficit in India stood at 6.71% of GDP in the financial year 2021-22 (compared to the budget estimate of 6.9%), thanks to higher revenues and lower capital spending.

- Retail sales in Singapore grew by 1.2% mom in Apr (Mar: 7.4%), with gains recorded in wearing apparel and footwear (17.4%), food and alcohol (14.2%), department stores (13.2%) as well as recreational goods (8.8%) among others.

Bottom line: The uptick in inflation continues to be the main story, with last week’s record high readings from Europe. EU’s partial ban on Russian oil imports is likely to further lift inflation rates. If the ECB does not raise rates soon enough, it risks falling “behind the curve” in comparison to every major central bank – the only question remains as to how big the rate hike in July needs to be. In the meantime the OPEC+ agreement to accelerate oil production in July and August by 650k barrels per day (from earlier planned increase of 400k bpd) remains quite modest and accounts for just over 0.4% of global demand over the two months – for now it is unlikely to be sufficient to calm oil markets and drive down prices. China’s PMI readings for May (when it started to open up cautiously,) showed some respite though it still remains in contractionary territory: what remains to be seen is how fast the logistical issues can be resolved and more importantly whether there will be any deviation from the zero-Covid policy stance followed so far (risks remain that the nation could head into further lockdowns if cases increase). Elsewhere, the rhetoric remains the same: supply chain disruptions (owing to Russia-Ukraine war, raw material shortages, and China’s lockdown) and inflationary pressures are hurting business sentiment. Weaker consumer demand and easing of supply chain pressures could potentially tame inflation in the coming months; for now, housing, food and energy prices seem likely to remain relatively high.

Regional Developments

- Bahrain’s latest issue of treasury bills worth BHD 70mn brings the total outstanding value of the government’s treasury bills to BHD 2.01bn.

- Bahrain-based GFH Financial Group made its secondary listing on Abu Dhabi Securities Exchange. This is the 4th listing for GFH in the region, after being listed and traded on Bahrain Bourse, Boursa Kuwait and the Dubai Financial Market.

- ACWA Power started operations at the USD 1.1bn independent water and power plant located at Al Dur in Bahrain.The plant has the capacity to generate 1,500 megawatts of power and 227,000 cubic meters per day of desalinated water.

- Bahrain received 11 pre-qualification bids for the first phase of the Bahrain metro: this phase will include 2 lines (29kms), 20 stations and 2 interchanges.

- Egypt’s PMI contracted for the 18th straight month in May: it inched up to 47 in May (Apr: 46.9). Declines were registered across both output (45 from Apr’s 45.3) and new orders (44.6 from 45.3) sub-indices. The future output expectations sub-index declined to 55.2, its second lowest reading while input cost inflation sped to the highest in 6 months.

- Money supply (M2) in Egypt grew by 23.7% yoy in Apr. Net foreign assets fell for a 7th consecutive month, dropping by EGP 14.8bn to a negative EGP 234.4bn: this compares to a positive EGP 186.3bn recorded at end-Sep.

- Egypt’s net external debt grew to USD 145.5bn as of Dec 2021 (Sep: USD 137.4bn), according to the central bank. Foreign debt increased to 33.2% of GDP by Dec (Sep: 32.6%).

- Budget deficit in Egypt touched EGP 410.8bn in the first 10 months of the 2021-22 fiscal year – this represents 5.17% of GDP. Revenues grew by 9.8% yoy to EGP 918.5bn in Jul-Apr, thanks to a 79% surge in tax revenues; expenditures were up by 10.2% to EGP 1.33trn.

- Egypt’s PM revealed that the country aims to double exports to USD 100bn in the next 3 years and also increase the strategic stockpile of major commodities to last up to 6 months. Separately, bilateral trade between Egypt and UAE increased to USD 3.623bn in 2021, according to the minister of trade and industry.

- Suez Canal estimates to clock in USD 3.5bn in revenues in H1 this year, revealed the Chairman of the Suez Canal Authority. Revenues grew by 23% yoy to USD 657mn in May.

- Dubai’s Al-Futtaim Group plans to invest USD 700mn-USD 1bn in Egypt over the next three years, according to a cabinet statement from Egypt.

- Iran’s energy export revenue grew by 60% yoy in the first two months of the Iranian year (March 21 to May 21), revealed an official from the oil ministry.

- Kuwait will increase its oil output to 2.768mn barrels per day in Jul following the OPEC+ decision to further boost output, disclosed the oil ministry.

- Oman’s central bank governor stated that work is underway to develop its own digital currency and open banking services.

- Oman’s new oil discoveries will raise its production by 50,000 to 100,000 barrels in the coming two to three years, according to the energy and minerals minister. Currently oil reserves stand at 5.2bn barrels and gas reserves at 24trn cubic feet.

- Tourists into Oman surged by 488.3% yoy in Mar, bringing total number of visitors in Q1 to 415k. In March, GCC residents accounted for 37.8% of total visitors, followed by Indians (13.2%) and Germans (4%).

- Qatar’s GDP is forecast to grow 3.5% in 2022, stated the central bank governor at a conference. He also disclosed that the nation plans to start licensing FinTech firms soon.

- UK-based independent consultancy in oil and gas field water management, Oil Plus, announced winning 2 produced water-related projects in Qatar (worth USD 450k).

- GCC states, by developing into “tech champions”, can add USD 255bn to the region’s GDP and add 600k tech jobs by 2030, according to a Strategy& report. Of this, USD 119bn will be generated in Saudi Arabia. More: https://www.strategyand.pwc.com/m1/en/strategic-foresight/sector-strategies/technology/tech-champions.html

Saudi Arabia Focus

- Saudi Arabia’s non-oil sector PMI held steady at 55.7 in May: while this is below the series average of 56.8, it is the 21st consecutive month of above-50 readings. Output sub-index inched down slightly to 59.3 in May (Apr: 59.7) and input costs rose at the second quickest pace in the past 1.5 years.

- Saudi Ministry of Industry and Mineral Resources issued 72 industrial licenses with an investment worth SAR 5.2bn (USD 1.3bn) in Apr, with small establishments accounting for 83% of the licenses issued in the month. About 3968 jobs were created in the 59 factories that started operations in Apr, bringing the total number of factories to 10,561 by end-Apr.

- Saudi Arabia’s property developer Retal Urban Development Co’s IPO, priced at SAR 120 (USD 32) per share implying a market cap of SAR 4.8bn, was oversubscribed by 62 times generating an order book of SAR 90.3bn. The company will raise SAR 1.44bn in the IPO, selling 30% of existing shares.

- Foreign ownership in Saudi Arabia’s stock exchange more than doubled in two years to SAR 450bn (USD 120bn) by end-Q1 2022: up from SAR 259bn and SAR 145bn in Q1 2021 and 2020 respectively. GCC ownership surged to SAR 60.6bn, up 85% from Q1 2020.

- Value of assets held by 533 private investment funds in Saudi Arabia grew to SAR 355bn in Q1 2022, according to a report from the Capital Market Authority. Funds were up 14% from a year ago while the assets’ value surged by 30%. Separately, the value of Saudi Arabia public mutual funds’ assets declined by 5.06% qoq to SAR 215.7bn in Q1, largely due to a drop in value of funds’ investment in money market instruments.

- Saudi Public Investment Fund (PIF) revealed its intention to buy a 23.97% stake in Jordan’s Capital Bank Group, one of the largest banking groups in Jordan, Iraq and MENA region: it will pay USD 185mn for owning 63mn new shares of the bank.

- Money supply (M3) in Saudi Arabia increased by 8.7% yoy in Apr, the highest rise in nine months, and by 1.0% mom: it is rising at a slower pace compared to overall credit growth.

- Totalbank claims on the private sector grew by 14.2% yoy in Apr 2022; credit to the public sector increased by 8.6% yoy, following two months of 11%+ in Feb-Mar. Separately, Saudi central bank’s net foreign assets inched up by 0.2% mom to SAR 1.63trn in Apr.

- Tourism’s direct contribution to Saudi Arabia’s GDP declined to 1.7% in 2020 (2019: 3.8%). Total direct gross value added generated by tourism activities plummeted by 51.4% yoy to SAR 27.8bn in 2020. The number of tourism establishments increased in 2020 despite Covid19, with food and beverage activity accounting for 79.1% of total firms and about 2/3-rds of total employees.

- Bilateral trade between US and Saudi Arabia increased by 22% yoy to SAR 92.5bn in 2021, thanks to a surge in non-oil exports (72% to SAR 9.1bn); meanwhile, oil exports to the US grew by 46% to SAR 28.5bn.

- While apartment prices in Riyadh increased by 20% last year, the transaction volumes and deal values across Saudi Arabia have declined in Q1, according to Knight Frank. Total deals values were down by 2% to SAR 40.4bn (USD 10.77bn).

- Saudi Arabia’s Ma’aden signed an initial agreement with US-based GlassPoint to build the world’s largest solar-powered steam plant at Ma’aden’s Alumina refinery: this will help reduce carbon emissions by over 600k tons annually, roughly a 50% reduction.

- Saudi Arabia’s Saline Water Conversion Corp. will open six desalination plants by 2024 in a phased manner, starting with two late this year.

UAE Focus![]()

- UAE’s non-oil sector PMI increased to a 5-month high of 55.6 in May (Apr: 54.6), thanks to a jump in output sub-index (by one point to 62.5) and rise in employment sub-index (to 50.7 from 49.9) while input costs rose at the quickest rate since Nov 2018. Firms are still absorbing the rising costs and not passing it on to consumers: it remains to be seen how long this pattern can be sustained (at the cost of firms’ profitability).

- Abu Dhabi-based petrochemicals company Borouge attracted demand of more than USD 83.4bn for its USD 2bn IPO: this is the largest listing to date on ADX. Institutional investors placed orders of about USD 65.5bn, including USD 570mn in cornerstone investments. On its first day of trading, shares gained by more than 22% to settle at AED 3.0.

- UAE has signed a free trade agreement with Israel, with an aim to increase bilateral trade to above USD 10bn (2021: USD 1.2bn). Tariffs will be removed or reduced on 96% of the goods traded between the two nations including on food, medicine, diamonds and jewellery among others.

- Profits of the Investment Corporation of Dubai rose to AED 10.1bn in 2021, thanks to the 24.5% increase in revenue (to AED 169.4bn) supported by higher oil and gas prices.

- France’s finance minister disclosed that the country is in talks with the UAE to replace Russian oil purchases.

- Adnoc will purchase three additional newly built LNG vessels, each with a capacity of 175,000 cubic meters, to respond to growing demand; delivery is scheduled for 2025 and 2026. The current fleet capacity stands at 137,000 cubic meters.

- Reuters reported that Abu Dhabi’s Masdar and Egypt’s Infinity Energy are set to buy a majority stake in African renewables firm Lekela Power: the deal could be worth close to USD 1bn.

- UAE and three South Korean firms have signed an agreement to build a USD 1bn green hydrogen and ammonia production plant in the UAE (with a production capacity of 200k tonnes of green ammonia). To be built in two phases in the KIZAD Industrial Area, the first phase will involve production of 35,000 tonnes before scaling up to full capacity.

- Crypto.com received a provisional Virtual Asset MVP License approval from Dubai’s Virtual Assets Regulatory Authority (VARA). This will allow the company to offer a range of crypto products and services.

- Ajman Free Zone reported a 45% growth in its e-commerce sector year-to-date.

- UAE’s state news agency reported that the country has achieved vaccination of “100% of the targeted categories”.

Media Review

World Bank: more work to be done for GCC economies to break away from oil

https://www.arabnews.com/node/2093316/business-economy

Europe’s economy grapples with an acute energy shock

Focus on Crypto regulations; digital money

https://www.ft.com/content/f4b2fa1a-4057-4b10-9f3b-efa57e6bcbac