Weekly Insights 3 Jun 2022: OPEC+ hikes production; Saudi & UAE will benefit from greater windfall

1. OPEC+ hikes Jul-Aug oil production: markets estimate it is insufficient

- At the OPEC+ meeting yesterday, it was agreed to accelerate oil production in July and August by 650k barrels per day (from earlier planned increase of 400k bpd): this is modest and accounts for just over 0.4% of global demand over the two months

- Though increases are to be shared across the OPEC+ member countries, with many countries struggling to meet current targets, it is more than likely that Saudi Arabia and UAE (given spare capacity) will meet the increase, benefiting from a greater windfall.

- The import ban on Russian oil announced by Europe this week means that members will have to look at alternative sources of oil. Russian production has already declined by around 1mn bpd since the war (it was pumping ~10% of global crude supplies prior to the war). Prolonging the war would only cause the situation to worsen

- On the demand side: (a) Russian oil has found buyers in India and China (making their exports relatively “resilient”); (b) China’s emergence from lockdown is expected to nudge demand up; (c) US crude stockpiles have fallen more than expected but as gas prices continue to rise, consumers could demand less (already some evidence of weekly decline in petrol demand, as tracked by the EIA)

- Our read is that the increase in production, in light of the ban on Russian oil by Europe, is unlikely to be sufficient to calm oil markets and drive down prices

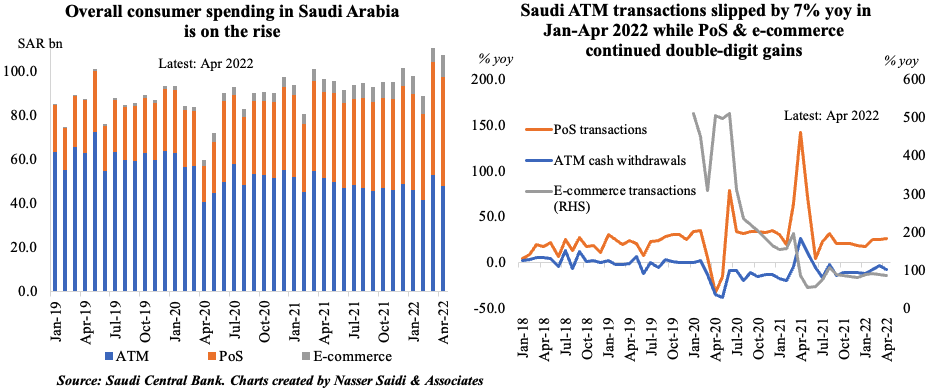

2. Consumer spending in Saudi Arabia has been rising in 2022

- Consumer spending in Saudi Arabia has been rising in 2022, thanks to higher mobility rates amid high vaccination rates and low stringency; there is a visible shift in mode of transactions

- Cash withdrawals from the ATMs have been falling amidst double-digit gains in both PoS and e-commerce

- Point-of-sale transactions in ‘Hotels’ and ‘clothing and footwear’ surged in Apr as the Eid holidays period approached towards end of the month; purchases of ‘electronics’ and ‘construction and building materials’ meanwhile continued on a downward trend as seen in recent months

- Weekly PoS transactions show that the uptick in Eid-related transactions (hotels, clothing, restaurants etc) eased in the later weeks of May

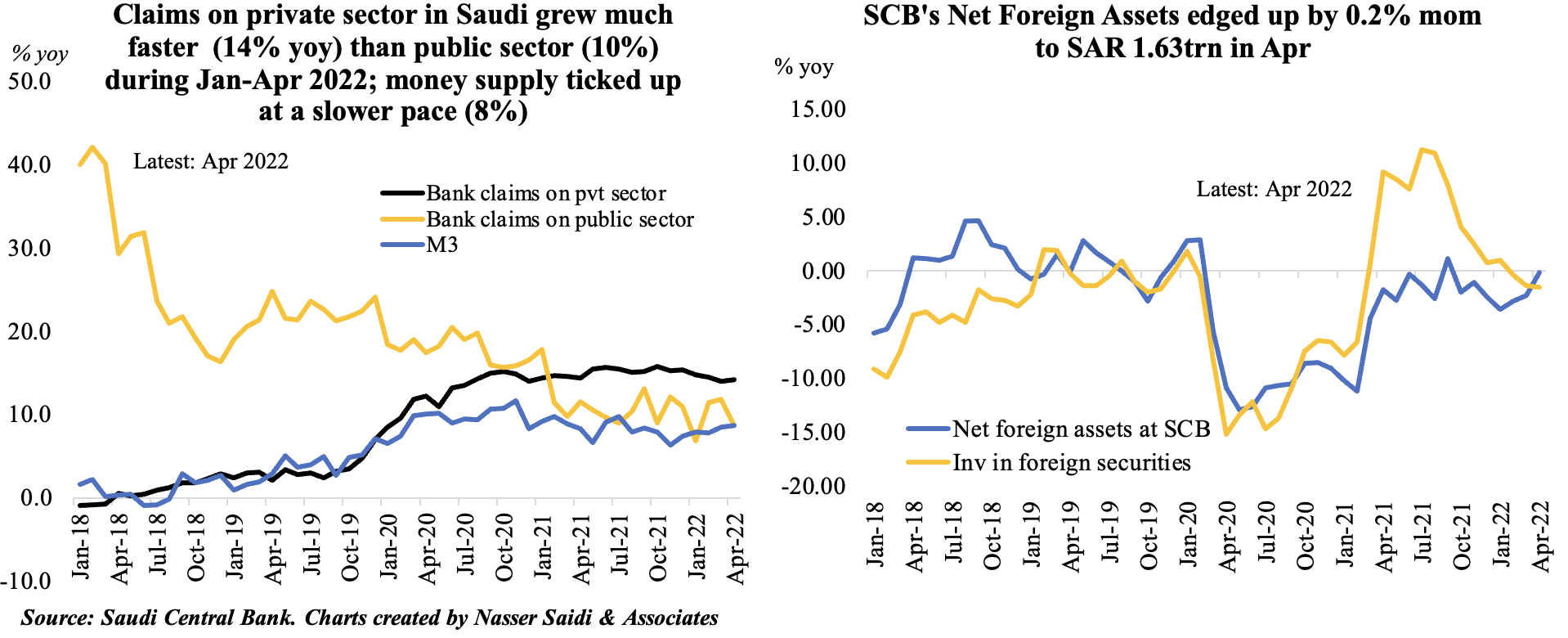

3. Money supply & credit to private sector in Saudi Arabia rise; as does Saibor

- Money supply (M3) in Saudi Arabia rose by 8.7% yoy in Apr, the highest rise in nine months, and by 1.0% mom: it is rising at a slower pace compared to overall credit growth

- Total bank claims on the private sector grew by 14.2% yoy in Apr 2022; credit to the public sector increased by 8.6% yoy, following two months of 11%+ in Feb-Mar. High oil prices meanwhile don’t seem to have translated into a surge in deposits into the banks (yet)

- Separately, Saudi money market rate Saibor has crossed the 3% mark to its highest level in almost 13 years (following the interest rate hikes by the Fed), raising debt service costs for firms with high debt levels

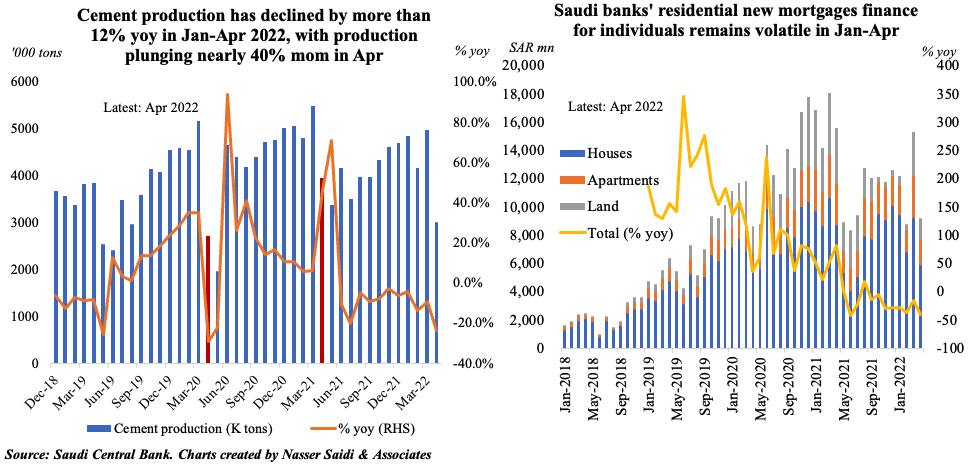

4. Mortgage finance in Saudi Arabia has been volatile in 2022, following a surge in 2021

- Home ownership rates have been increasing in Saudi Arabia, from just 47% in 2016 to more than 60% now. While this move was supported by various initiatives by the government including subsidised mortgages, the increase in demand led to a jump in residential prices (the fastest growth in 5 years).

- Meanwhile, residential new mortgages finance surged in 2021 (mortgages accounted for 49% of retail loans made in 2021 from just 25% in 2019) but has been volatile this year

- Cement production (and sales) continued to trend downwards in Apr: as restrictions ease, and construction picks up pace given the multiple mega-projects in the pipeline (including in NEOM), the cement industry could see better prospects

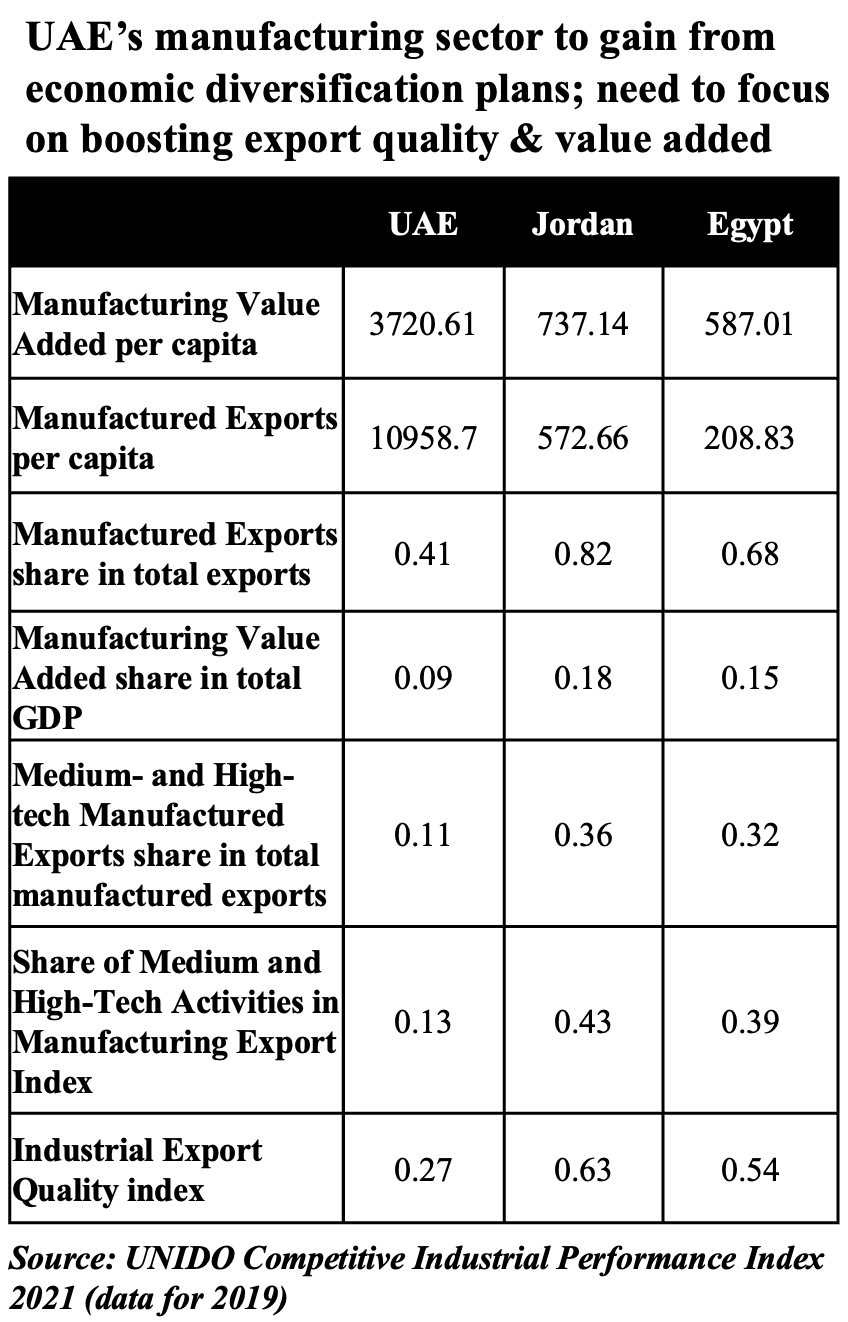

6. The USD 10bn industrial partnership between the UAE, Egypt and Jordan to promote regional economic integration

- The tri-party agreement between the UAE, Egypt and Jordan to form a new industrial partnership is a step in the right direction towards greater regional integration

- Cooperation will reap additional benefits by building up on existing local comparative advantages (like in petroleum, fertilizers, pharmaceuticals & related sectors) while enabling the creation & development of regional supply chains

- Not only would such investments increase value added and productivity, it will also help these nations to integrate into the global supply chain => better trade prospects (increase in exports, reduced costs & maximising firm profits)

- Furthermore, being a capital exporter, UAE can deploy capital and existing technical know-how in the lower-wage cost nations, thereby supporting job creation (and reducing migration), imperative for post-Covid recovery

- The agreement also underscores the need for improved food security in the future: given climate change, and potential water wars in the future, it would be a win-win for all 3 nations to support development of agriculture/ food, especially by tapping technological advancements (AgriTech, vertical farming etc)