Markets

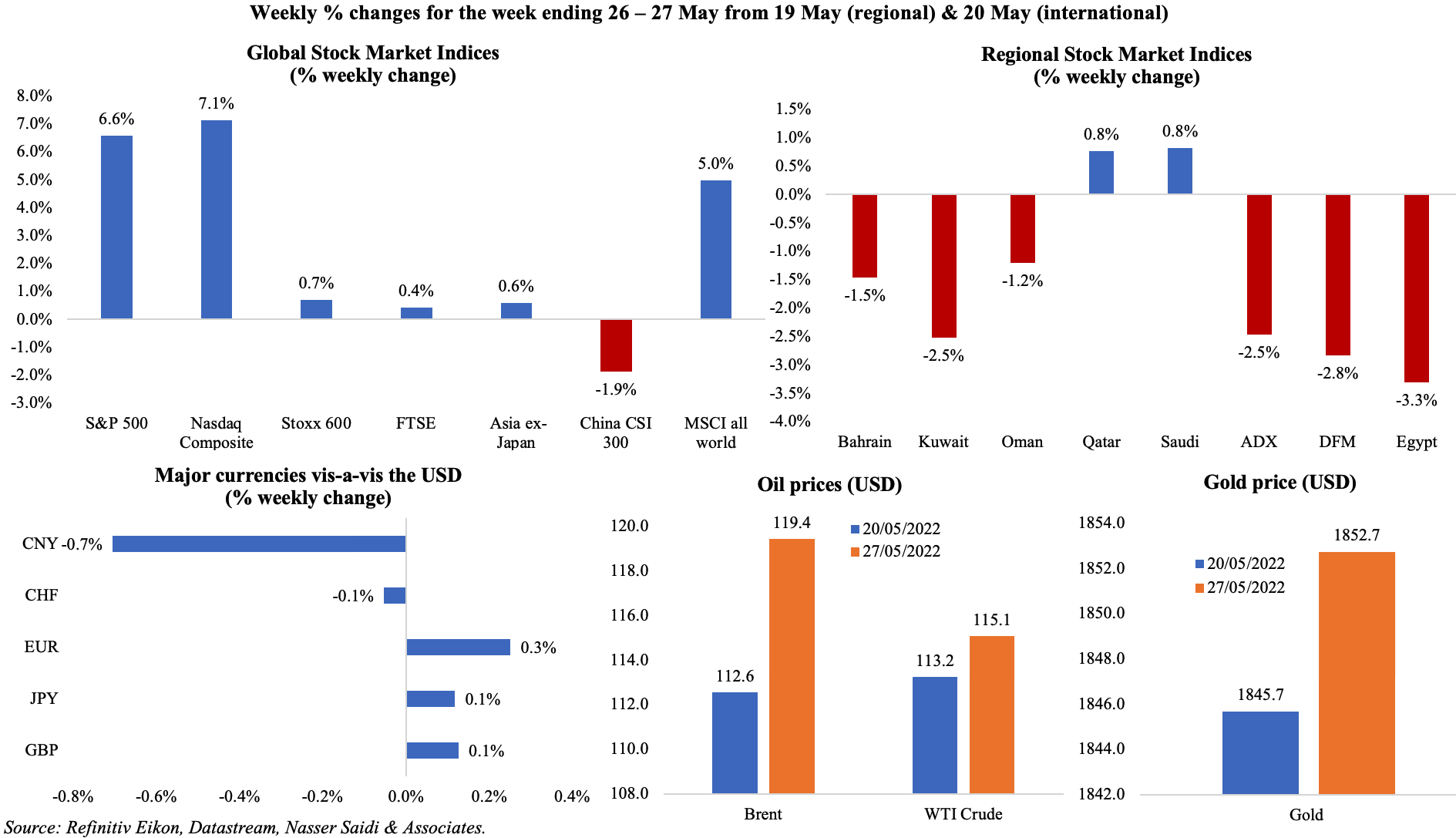

US equity markets recovered after a 7-week losing stint (thanks to strong retail and tech earnings), while European shares and UK’s FTSE indices posted the best weekly gain since mid-March (the latter supported by banks and retailers). Regional markets were mostly down, though Saudi recorded its first weekly gain in 3 weeks. The dollar weakened last week and looks poised to post a monthly drop in May (after 5 months of gains) while the euro rebounded to a 1-month high; the yuan is not far off its weakest levels since 2020. Oil prices were near 3-month highs ahead of the OPEC+ meeting this week while gold price also closed 0.4% higher than the week before.

Global Developments

US/Americas:

- US GDP contracted at a 1.5% annual pace in Q1, worse than the previous estimate of a 1.4% drop, given downward revisions to both private inventory and residential investment though consumer spending was revised upwards (+3.1% from the previous estimate of 2.7%).

- Personal income increased by 0.4% mom in Apr, with wages accounting for most of the increase. Personal spending grew by 0.9%, thanks to a 0.8% gain in goods spending (motor vehicles, clothing) while services outlays rose by 0.9% (spending on housing, utilities, eating out). The savings rate dropped to 4.4% – the lowest since Sep 2008 (Mar: 5%).

- The headline Personal Consumption Expenditures (PCE) price index increased by 0.2% mom in Apr – the smallest gain since Nov 2020, and a sharp reduction from Mar’s 0.9% rise. Core PCE rose by 4.9% yoy, posting the smallest gain since Dec 2021; it was up 0.3% mom.

- Durable goods orders inched up by 0.4% mom in Apr (Mar: 0.6%), supported by a rebound in orders for transportation equipment (0.6%). Non-defence capital goods excluding aircraft, a proxy for business spending, was up by 0.3% (Mar: 1.1%).

- Flash US manufacturing PMI slipped to 57.5 in May (Apr: 59.2); costs pressures remained high with input costs rising at the sharpest pace since Nov 2021.

- Richmond Fed manufacturing index slipped to -9 in May (Apr: 14): this is the first negative reading since Sep 2021 and the lowest since May 2020. The decline was a result of the decline in shipments sub-index (-14 from 17) and new orders (-16 from 6).

- Chicago Fed national activity index increased to 0.47 in Apr (Mar: 0.36), with production and consumption related indicators rising from Mar while employment slowed slightly.

- Michigan consumer sentiment index was revised down to 58.4 in May, from a preliminary estimate of 59.1. This was the lowest reading since Aug 2011.

- New home sales fell by 16.6% mom and 26.9% yoy to an annualised rate of 591k in Apr, as mortgage rates increased (from 4.88% at the beginning of the month to 5.41% at the end). Pending home sales fell by 3.9% mom in Apr, falling for the 6th consecutive month to the lowest level in nearly a decade.

- Initial jobless claims slipped to 210k in the week ended May 20th (prev: 218k), while the 4-week average edged up slightly to 206.75k. Continuing jobless claims increased by 31k to 1.346mn in the week ending May 13th – remaining much below the 1.7mn average in 2019.

Europe:

- GDP in Germany grew by 0.2% qoq and 3.8% yoy in Q1: while both household and government spending held steady and exports declined, investments supported growth. Construction investment grew by 4.6% qoq and machinery and equipment investments rose by 2.5%.

- Germany’s Ifo business climate index inched up to 93 in May (Apr: 91.9), with the institute stating, “currently no observable signs of a recession”. Current assessment improved to 99.5 from 97.3 the month before while expectations nudged up by just 0.1 points to 86.9.

- The preliminary German manufacturing PMI inched up to a 2-month high of 54.7 in May (Apr: 54.6) while services PMI slipped to 56.3 from 57.6 the month before.

- Eurozone’s preliminary manufacturing PMI slipped to an 18-month low of 54.4 in May (Apr: 55.5); services PMI also declined to 56.3 from 57.7 the month before. Manufacturing new orders fell for the first time since Jun 2020, in contrast with further solid growth of new business inflows into the service sector.

- Preliminary manufacturing PMI in the UK slumped to a 16-month low of 54.6 in May (Apr: 55.8). Services PMI also dipped in May, falling to a 15-month low of 51.8, down from 58.9. The latest rise in total new business was the weakest since the recovery from lockdowns.

- UK announced a 25% windfall tax on oil and gas producers’ profits while also rolling out a GBP 15bn package of measures to help with the cost of living – this includes discounts on energy bills and payments to low-income households.

Asia Pacific:

- China’s cabinet announced a slew of measures to support the economy, as some cities (including Shanghai from June 1st) return to normalcy: this includes broadening of tax credit rebates, postponement of social security and loan repayments in addition to the rolling out of new investment projects among others.

- Japan’s preliminary manufacturing PMI slipped slightly to 53.2 in May (Apr: 53.5), as both output and new orders eased; raw materials shortage and China’s lockdown restrictions lengthened delivery times to the most since Apr 2011.

- Japan’s leading economic index was revised lower to 100.8 in Mar from the preliminary estimate of 101.0 (but higher than Feb’s 100.1); coincident index inched up to 97.5 from 97.

- Tokyo CPI eased to 2.4% yoy in May (Apr: 2.5%). Excluding food and energy prices were up by 0.9%. Excluding fresh food, CPI rose by 1.9% – gaining for the 9th straight month and close to the 2% target set by the BoJ.

- Japan is opening its doors to tourists again: visitors from 98 nations can enter as part of tour groups starting June 10th, though some may have to quarantine.

- South Korea central bank raised its base rate by 25bps to 1.75% – the 3rd 25bps hike this year and taking the base rate to its highest level since Jun 2019.

- Singapore’s Q1 GDP increased by 0.7% qoq and 3.7% yoy, slightly higher than the advance estimates. The MTI has maintained its 2022 GDP growth forecast within the 3%-5% range, while stating that it was likely to fall within the lower half of the estimate.

- Inflation in Singapore rose to 5.4% yoy in Apr, the fastest pace since Apr 2012; core inflation rose at its fastest pace in a decade (+3.3%), driven by higher inflation for food (4.1% from Mar’s 3.3%) and utilities (19.7% in Apr).

- Industrial production in Singapore increased by 2.2% mom and 6.2% yoy in Apr; excluding the volatile biomedical manufacturing, IP grew by 7.7% yoy.

Bottom line: The flash manufacturing PMI readings showed slowing growth in major developed economies; China will be watched to understand how its persistent lockdowns have affected demand and supply: some cities starting to come out of months-long lockdowns from June will likely lift sentiment. Meanwhile, central banks will be scrutinising jobs report (in the US) and inflation (in the EU) to assess the pace of rate hikes and monetary tightening. Lastly, OPEC+ meets this week – while the G7 have urged a boost in oil output, it seems unlikely that the OPEC+ benefiting from the oil price windfall will increase by more than what was previously committed.

Regional Developments

- Bahrain plans to attract 14mn visitors annually by 2026, disclosed the Minister of Industry, Commerce and Tourism, with targeted strategies to attract tourists from key markets like India, China and the US. The aim is to double tourism sector’s contribution to GDP to 11.4%.

- While the number of real estate transactions in Bahrain grew by 19.26% yoy in Q1 2022, it is substantially below the 2019 readings (with 10% fewer transactions), according to CBRE.

- Binance Bahrain received a Category4 license as a crypto-asset service provider from the central bank. This will enable the firm to provide the full range of crypto-asset exchange services to customers.

- Egypt’s planning minister disclosed that the economy grew by more than 5% in Jan-Mar 2022 and expects overall growth in the 2021-22 fiscal year (ends Jun) to be around 6%.

- With an aim to replenish its wheat reserves, Egypt plans to buy six million tonnes of domestic wheat this year, two-thirds more than in either of the previous two years. Reuters reported that local farmers have to sell 60% of crop to the state and though government procurement prices have increased (22% yoy), these are well below international rates. The finance minister was cited stating (early last week) that there was sufficient wheat to last till end-2022.

- Saudi-based International Islamic Trade Finance Corporation doubled its credit limit to Egypt to USD 6bn from USD 3bn, disclosed the supply minister. This would alleviate pressure on the central bank to provide dollar funding for both wheat and petroleum imports.

- Egypt’s New and Renewable Energy Authority plans to dedicate up to 5,200 sq km for clean energy projects initiated by both private and public sector firms, reported Daily News Egypt.

- Moody’s affirmed Egypt’s “B2” long-term foreign and local currency issuer ratings on economic resilience, privatization strategy and prospects of attracting FDI, but changed the outlook to negative from stable on rising inflation, debt affordability and social risks.

- Iraq expects currency reserves to top USD 90bn by end-2022, stated the finance minister, thanks to higher oil prices. Reserves were at USD 70bn in Apr.

- Applauding Jordan’s strong reform progress, the IMF mission has recommended that the country receive an extra USD 165mn as part of the Extended Fund Facility programme, raising the funding disbursed this year to USD 550mn.

- Consumer prices in Kuwait rose to 4.4% yoy in Q1 2022, with core inflation ticking up at a faster rate of 4.7%. Food prices were up by 7.2%, while prices of education, clothing and transport were up by 19%, 5.7% and 4.8% respectively.

- The Central Bank of Kuwait issued bonds and Tawarruq with an accumulated value of KWD 240mn (USD 792mn); maturity period will be 3 months, with a rate of return at 1.625%.

- Kuwait plans to start building the world’s largest petroleum research center by end-2022, tweeted the oil ministry. The project, estimated to cost USD 120mn, is expected to have 28 labs.

- Moody’s affirmed the Government of Kuwait’s long-term local and foreign currency issuer ratings at A1 and outlook at stable.

- Lebanon’s pound traded at a record low of more than 35,000 to the dollar on Thursday (26 May). Despite elections and a new parliament, its first session is yet to be held given disagreement over the choice of speaker: this does not bode well for future decision making progress to revive the country from its deep current economic and financial crisis.

- Inflation in Lebanon remains in triple- digits for the 22nd consecutive month: inflation stood at 206% yoy in Apr, rising 7.1% mom. Prices of transportation (492% yoy), health (431%), utilities (409%) and food and beverages (375%) have all contributed to the surge.

- The Association of Banks in Lebanon rejected the financial recovery roadmap that was passed by the cabinet.

- Oman’s external funding requirements for the year have already been met, reported Reuters, citing a presentation for investors from the finance ministry.

- Oman announced that all covid-related restrictions and protective measures have been lifted (including its mask mandate) with Covid cases having fallen to some 20 cases daily (from over 1000 earlier in the year). This will support tourist flows and raise revenues for the tourism and hospitality sectors.

- Qatar Investment Authority has a 19% stake in Russian oil giant Rosneft: the sovereign investment fund cannot exit (given restrictions) and has “to really assess where to stand on those opportunities” because of the Ukraine crisis, according to one of the CIOs.

- Qatar Airways will reconsider an IPO after the World Cup 2022 is over, according to the CEO. No further details were provided though.

- Gulf airlines will operate more than 180 daily flights to Qatar during the World Cup duration, revealed the CEO of Qatar Airways. Qatar expects to attract 1.2mn visitors during the period, and this airline service would ease accommodation pressure in Doha.

- The World Bank expects GCC economies to grow by 5.9% this year, driven by both the oil and non-oil sectors. Among the nations, Saudi Arabia is forecast to grow the most (7%), followed by Kuwait (5.9%) and Oman (5.6%).

- In its inaugural Google Impact Report, it was disclosed that the Google ecosystem services helped add USD 3bn and USD 3.25bn respectively into UAE and Saudi Arabia economies. Furthermore, its Android Developer System helped support around 50k jobs in the UAE.

- WEF’s Travel and Tourism Development Index 2021 saw the UAE move into the top 25 ranks, followed by Saudi (33) & Qatar (43). Enabling environment sub-index is the most supportive while the overall score is dragged down by the demand drivers sub-index.

Saudi Arabia Focus

- Thanks to the surge in oil prices, Saudi oil exports rose to their highest level in at least 6 years, recording more than SAR 100bn in March. Non-oil exports have been rising (avg 35% yoy in Q1) but have been outpaced by oil exports (85% yoy in Q1). UAE remained the leading destination for non-oil exports from Saudi, followed by China and India.

- Saudi Arabia plans to use its 2022 oil windfall to support diversification efforts, according to the minister of economy and planning: he stated that it could be via “replenishing reserves, paying off debt or investing in unique transformational projects through our wealth fund”.

- As part of its Fiscal Sustainability Programme, currently in its final stages of design, Saudi Arabia is planning to ensure that its reserves don’t fall below a certain percentage level of GDP, likely to be in the double digits. The finance minister also stated that the nation will “ultimately” consider lowering VAT rates (which stands at 15% now).

- Tadawul-listed companies posted a 5th consecutive quarter of positive results in Q1: total profits of these firms increased by 73% yoy to SAR 184.71bn in Q1. Sector-wise, energy (80%), materials (52%) and banks (22%) posted the most improved performance.

- Saudi oil refinery output grew by 16.6% yoy and 2.8% mom to 2.83mn barrels per day in Mar, according to JODI data. In terms of exports, though it grew by 34.2% yoy to 1.4mn bpd, in month-on-month terms, it declined by 12.2%.

- Bloomberg reported that Saudi Arabia’s Al Othaim family has postponed its IPO plans to sell shares of its mall business to the public.

- Total assets of the Saudi Public Investment Fund in the locally listed companies amounted to about SAR 855.91bn (divided among 22 local companies), following the acquisition of 625mn shares of the Kingdom Holding Company, reported Saudi Gazette.

- Saudi Arabia has invited firms to submit prequalification documents for the Umm Ad Damar Exploration License site worth an estimated USD 533mn. The site (with an area of over 40 sq. kms) will include copper, zinc, gold, and silver deposits, according to the ministry of industry and mineral resources.

- Saudi Arabia is finalising an extension of the USD 3bn deposit to Pakistan, revealed the finance minister. The deposit was made last year to support with reserves, and a joint statement on May 1st this year revealed the possibility of a further extension of this support.

- Saudi Arabia’s electric vehicle assembly plant will likely to be one of three in the country, divulged the investment minister (while speaking at Davos) though no details were given.

- Saudi ports’ cargo throughput volumes grew by 24.28% yoy to 20.47mn tonnes in Apr; general cargo surged by 30.42% to 0.847mn tons.

- The Container Port Performance Index 2021 ranks Saudi Arabia’s King Abdullah Port top among 370 global ports (from 2nd in the previous edition), while Jeddah Islamic Port and King Abdulaziz Port rank 8th and 14th globally (from 55th and 88th in the previous edition). More: https://thedocs.worldbank.org/en/doc/66e3aa5c3be4647addd01845ce353992-0190062022/original/Container-Port-Performance-Index-2021.pdf

- Saudi Arabia’s assistant minister of tourism disclosed that 15mn tourists visited the country in Q1 2022, thanks to a massive growth in entertainment and agri-tourism. Separately the CEO of the Saudi Tourism Development Fund disclosed that the sector is expected to create a million jobs by 2030.

- Saudi’s historic city of Al Ula disclosed having received more than 250,000 visitors in the past 12 months. The aim is to attract 1mn visitors by 2025.

- An official from the Saudi foreign ministry stated that no meeting has been scheduled between the foreign ministers of Saudi and Iran. Earlier in the week, Saudi foreign minister stated that though some progress had been made in talks with Iran, it was “not enough”.

UAE Focus![]()

- UAE’s non-oil trade increased by 20.5% yoy to AED 527.5bn by end-Q1: exports grew by 18% yoy to AED 91bn and has doubled over the past 5 years; non-oil imports grew by 25% to AED 292bn during the quarter. Top trading partners included China, India, Saudi Arabia, the US and Iraq among others.

- Reuters reported that Dubai Empower has invited investment banks to pitch for roles (and respond by this week) in its planned IPO for later this year.

- Borouge’s IPO received bids from BlackRock Inc and Fidelity; book building will run until May 30th.

- Abu Dhabi’s first special-purpose acquisition company (SPAC) listed last week, after raising USD 100mn in the share sale.

- UAE, Egypt and Jordan entered into an industrial partnership this week with five sectors of mutual interest identified (for joint investments with an aim to boost sustainable growth) including petrochemicals, metals, minerals and downstream products, textiles, pharmaceuticals and agriculture, food and fertilisers. A USD 10bn investment fund has been allocated to accelerate work on the partnership; it is being managed by holding company ADQ.

- Dubai Chamber of Commerce reported a 55.4% yoy increase in membership in Apr 2022. The value of members’ exports and re-exports grew by 16.7% yoy to AED 20.2bn (USD 5.5bn) during the month.

- The Minister of Energy and Infrastructure disclosed to the Federal National Council (FNC) that about 9500 homes were being constructed through the Sheikh Zayed Housing Programme for UAE citizens. Currently, 86.3% of citizens own their houses – this is one of the highest rates globally.

- UAE won a contract to operate ground services at 3 airports in Afghanistan, after competing with Turkey and Qatar for the contract. This was confirmed by the UAE presidential adviser.

- Dubai attracted 233 creative economy projects last year, with the estimated value of FDI capital exceeding AED 4.9bn. The emirate’s creative economy ranked first regionally and second globally in attracting FDI in 2021, according to the Dubai FDI Monitor.

Media Review

Divergent Recoveries in Turbulent Times in the Middle East & North Africa: IMF webinar

https://www.imf.org/en/Videos/view?vid=6306730894112

Aramco CEO warns of global oil crunch due to lack of investment

With 500,000 jobs and 50 new companies, PIF finds Saudi Arabia a place in the sun

https://www.arabnews.com/node/2091676/business-economy

Don’t Bet on a Soft Landing: Nouriel Roubini

Stimulus cheques have buoyed America’s stock market

Crypto links with banks pose threat to financial stability, says ECB

https://www.ft.com/content/5124fe2d-0f37-4173-89ba-fe9812e09e67