Weekly Insights 27 May 2022: Subdued trade and recovery in tourism as Covid takes a backseat

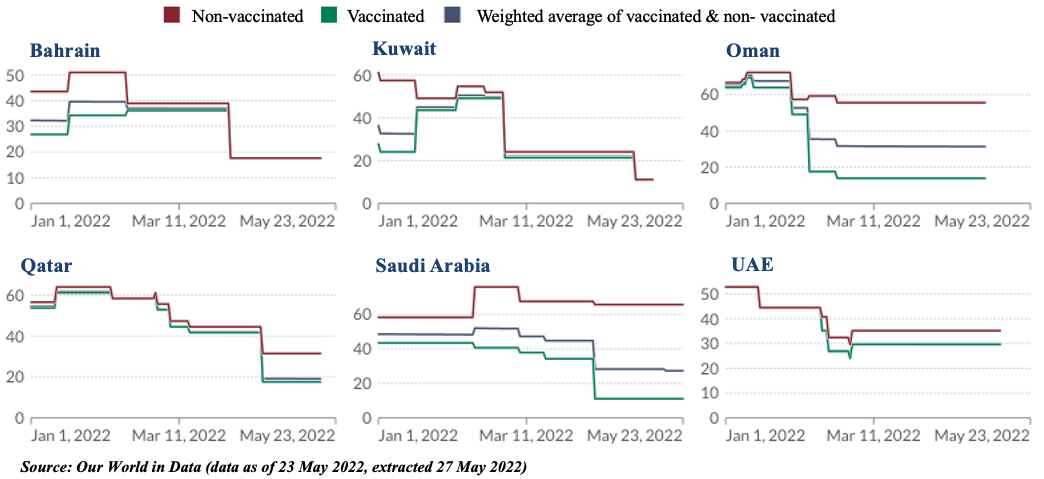

1. Oman removes all Covid19 restrictions

- Oman on Sunday removed all Covid-19 related measures and restrictions (including its mask mandate) with Covid cases having fallen to some 20 cases daily (from over 1000 earlier in the year)

- It will support with tourist flows and raise revenues for the tourism and hospitality sectors (similar to entry pre-pandemic: no vaccination, testing, quarantine requirements)

- This is yet to be reflected in the Oxford Stringency Index (below)

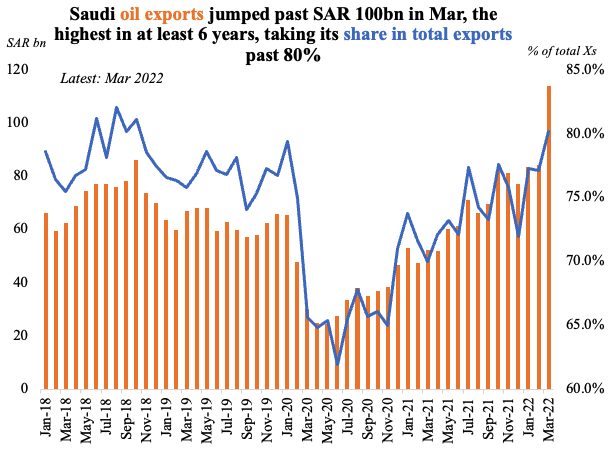

2. Value of crude exports from Saudi Arabia stands at ~$1bn a day

- Thanks to the surge in oil prices, Saudi oil exports rose to the highest in at least 6 years

- Non-oil exports have been rising (avg 35% yoy in Q1), but is constantly outpaced by oil exports (85% yoy in Q1)

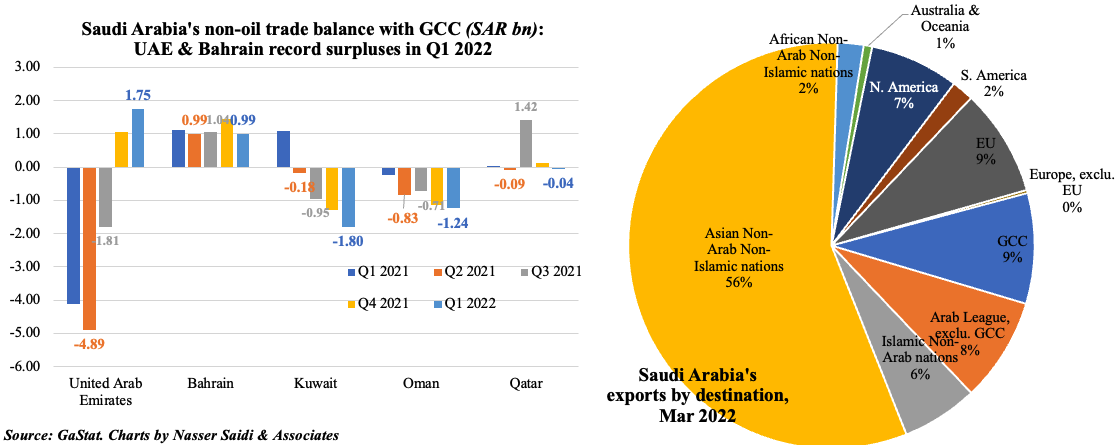

- UAE and Bahrain ran non-oil trade surpluses in Q1, while deficit has widened with rest of GCC

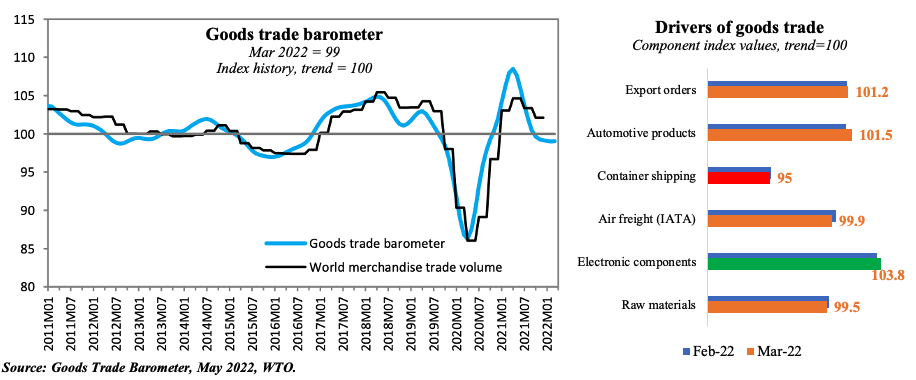

3. WTO’ s Global Goods Trade Barometer shows weakness in global trade & Ukraine war & supply chain issues bite

- The Russia-Ukraine war has heightened geopolitical tensions; together with China’s lockdown measures, this is likely to increase supply chain pressures, resulting in a slight slowdown in global trade in the near-term

- There has been a slight improvements in export orders, electronic components and automotive products, but both container shipping & air freight have been negatively affected (detailed in next point)

- The WTO’s Apr forecast of 3% growth in global trade this year is looking rather optimistic in this backdrop; furthermore, as inflation continues to rise, there is a reduction in consumers’ purchasing power, resulting in weaker global demand

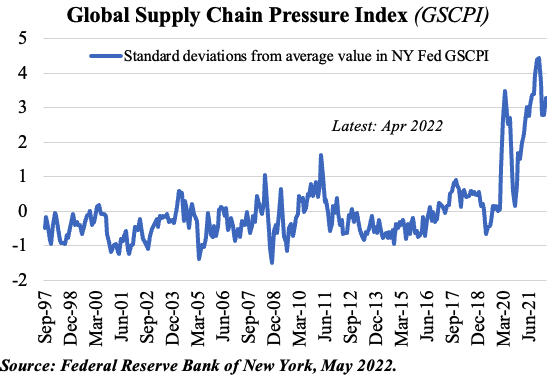

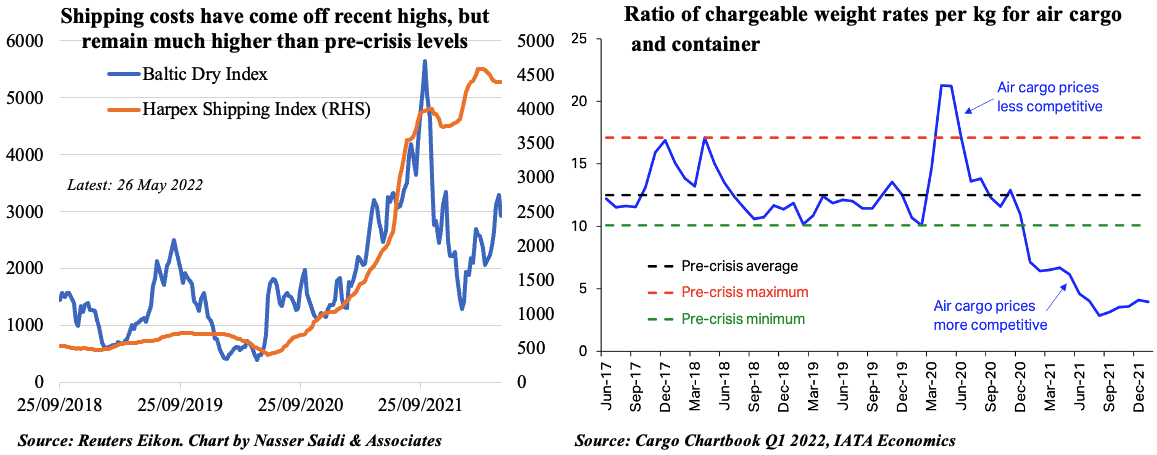

4. Shipping and cargo prices

- Unsurprisingly, Fed’s supply chain pressures index increased for the first time this year in Apr

- It is estimated that nearly one-fifth of all container ships globally are currently waiting outside a congested port => higher processing times + longer delays => driving up shipping costs

- For now, air cargo prices are still cheaper than freight, but with the surge in jet fuel prices (100%+ yoy), this competitive edge is likely to mellow

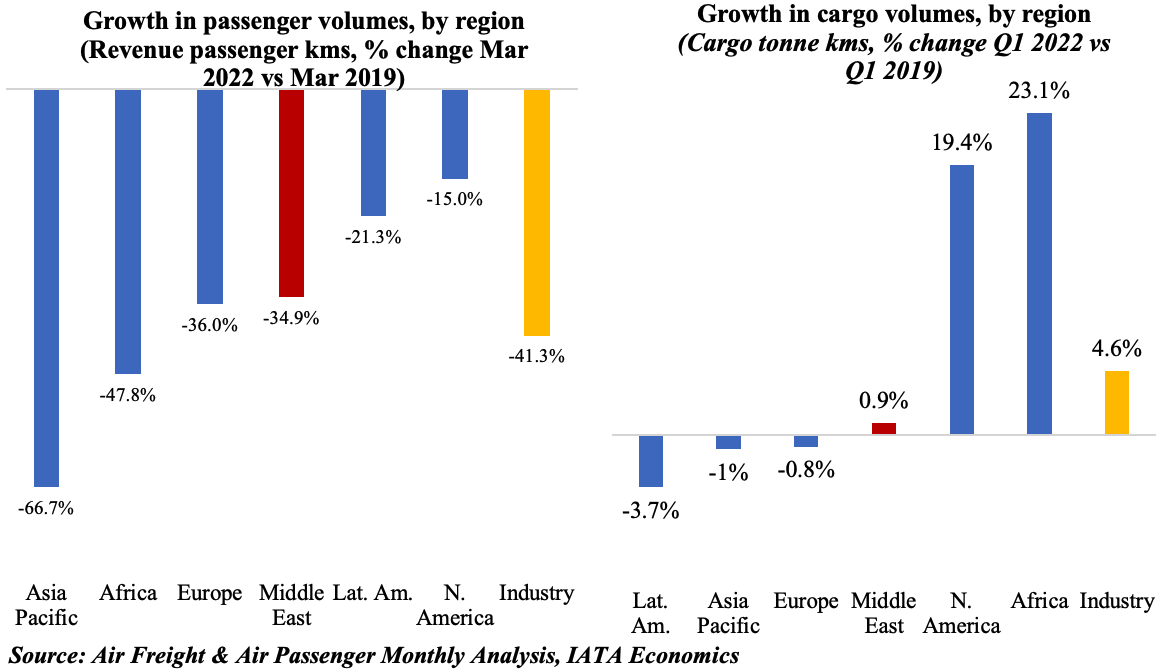

- The Russia-Ukraine war has had a limited impact on air travel; global recovery is underway (+76% yoy but -41.3% vs Mar 2019). Lockdown in China has seen a substantial decline in domestic travel; international travel remains restrictive in key markets like China and Japan, but is recovering elsewhere in Asia. A recovery story is underway in the Middle East: +245.8% yoy increase in Mar 2022 (Feb: 218.2%)

- The recovery in cargo movements seen in 2021 is no longer visible: air cargo volumes fell to a 16-month low in Mar; regions with greater linkages to China/ Asia are seeing a visible decline in air cargo transport (Middle East has seen a 6.9% drop in Q1 – the sharpest decline among all regions; but vs 2019, it was up by 0.9%)

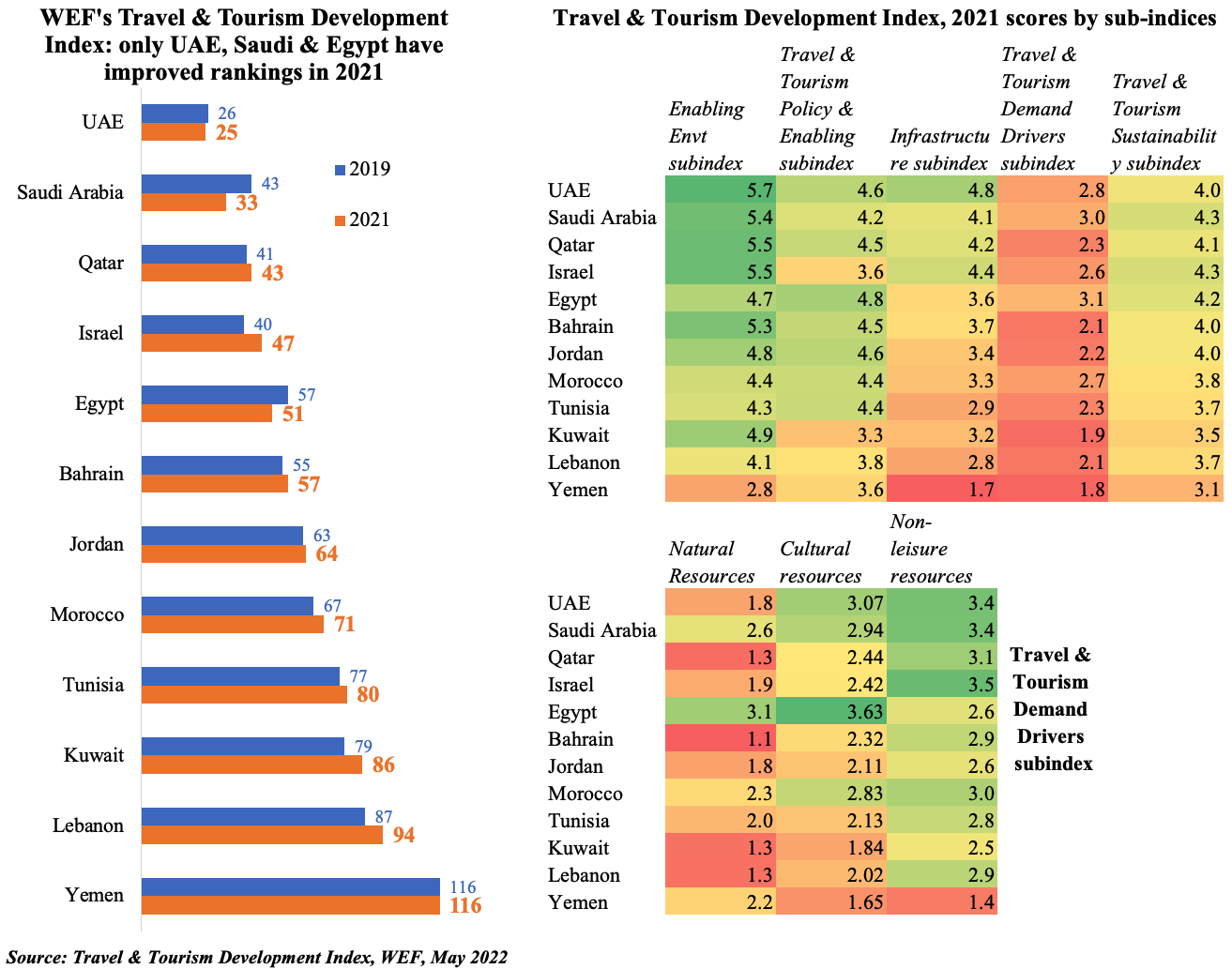

6. WEF’s Travel & Tourism Development Index show UAE & Saudi top MENA region rankings

- WEF’s Travel and Tourism Development Index 2021 saw the UAE move into the top 25 ranks, followed by Saudi (33) & Qatar (43)

- Enabling environment sub-index is the most supportive while the overall score is dragged down by the demand drivers sub-index

- UAE scores highly (score is on 0-7 scale) on enabling environment (safety, ICT, business envt etc) and infrastructure (air, ground, port, tourist services)

- The “reasons to travel” or demand drivers offers much scope for improvement, especially as it captures how these resources are promoted as opposed to existing heritage

More: https://www.weforum.org/reports/travel-and-tourism-development-index-2021/in-full

7. Bottomline

- While Covid has taken a backseat in most nations, geopolitical tensions have been heightened by the Russia-Ukraine war (partly raising food & oil prices)

- Given its importance in global value chains, ongoing lockdowns in China is causing supply delays => higher shipping & cargo costs => constraining global trade

- Together with higher oil prices, this is leading to rise in inflationary pressures => to curtail runaway prices, central banks are raising rates

- Higher prices + interest rates = lower spending by consumers = slowing consumptions => drag on growth (+ slowing trade)

- Middle East’s oil and food importers have declining strategic reserves => raising food poverty, widening inequality => potential social unrest in vulnerable nations

- According to UNWTO, tourist arrivals into the Middle East were still 63% below 2019 levels in Jan 2022 (but recovering from the sharper 79% and 74% drop reported in 2020 and 2021 respectively)

- Removal of Covid-related restrictions would improve tourism outlook (most recently Oman), but China’s travel restrictions will leave a slight dent in some Middle East markets (like UAE, Egypt)