Markets

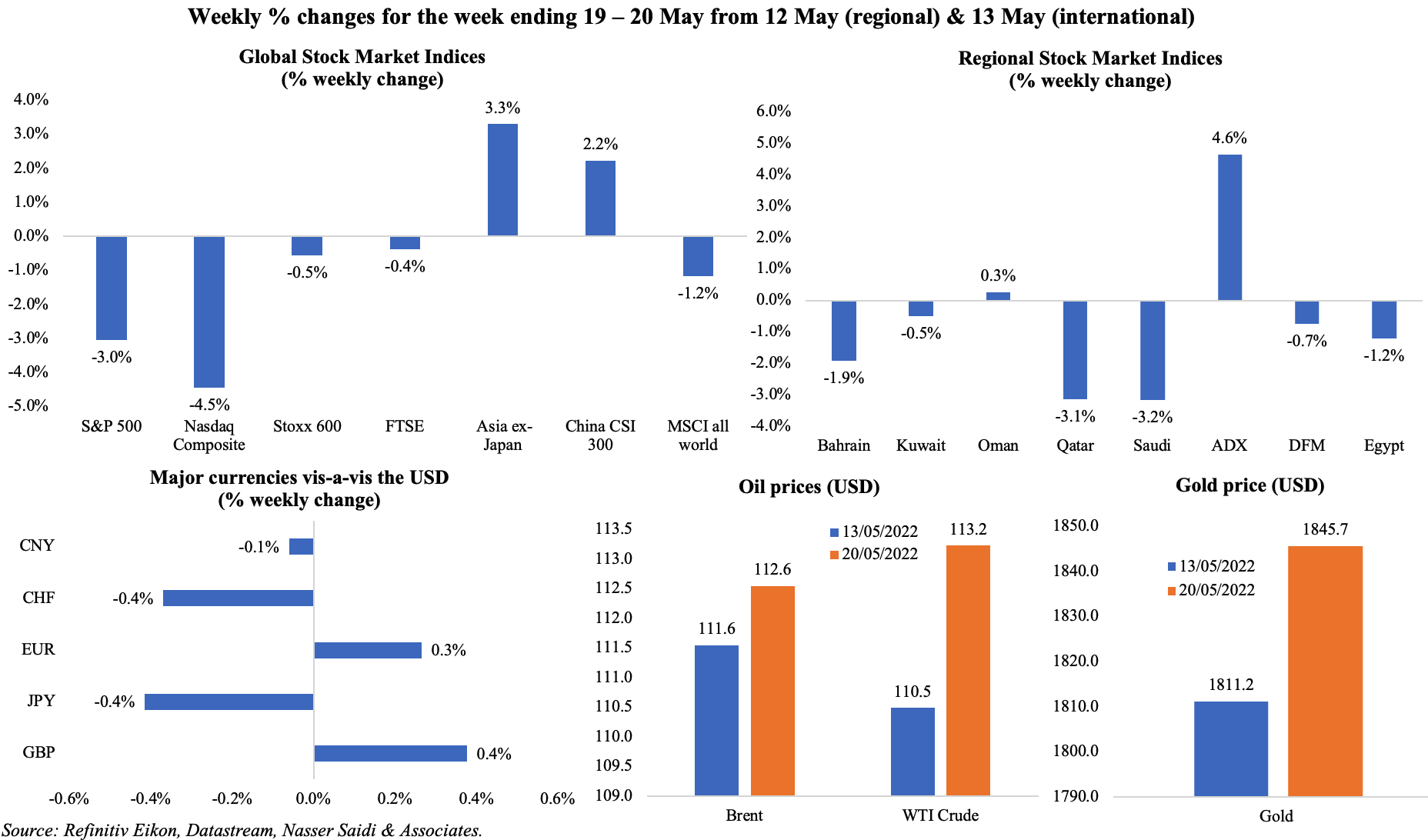

Equity markets had a mixed week: fears of inflation and potential recession is swaying equity market performance. Asian markets performed better than their US and European counterparts, thanks to China’s key lending rate cut to support its economic recovery. S&P 500 recovered slightly after moving into bear market territory on Friday. Among regional markets, most declined during the week, with Abu Dhabi the shining star (supported by gains in International Holding Inc, news of the Borouge IPO and streamlined access for investors). The dollar slipped to a 2-week low last week, posting sharp declines against the JPY and CHF as volatility increased across markets. Oil prices hit an 8-week high early in the week before pulling back later, while closing slightly higher. Gold price gained after 4 consecutive weeks of ending in the red.

Global Developments

US/Americas:

- US industrial production grew by 1.1% mom in Apr (Mar: 0.9%), with manufacturing output rising by 0.8% (production at auto plants increased by 3.9%, slower than Mar’s 8.3% gain). Capacity utilisation increased to 79.2% in Apr, the highest reading since Apr 2007.

- NY Empire State manufacturing index declined to -11.6 in May (Apr: 24.6), as new orders declined (-8.8 from Apr’s 25.1) and shipments slipped (-15.4 from 34.5).

- Philadelphia Fed manufacturing survey fell sharply to 2.6 in May (Apr: 17.6), the lowest reading in two years, with slowdowns across many categories including inventories (3.2 from Apr’s 11.9) and employment (25.5 from 41.4) while new orders edged up to 22.1 (Apr: 17.8).

- Retail sales in the US inched up by 0.9% mom in Apr (Mar: 1.4%), driven by receipts at auto dealerships (rebounded by 2.2% following Mar’s 1.6% dip), sales at bars and restaurants (2%) and clothing stores (0.8%) among others.

- Building permits in the US fell by 3.2% mom to a 5-month low of 1.819mn in Apr, largely due to a 4.6% drop in permits for single-family housing (to the lowest since Oct 2021). This was also reflected in the housing starts data: overall starts slipped by 0.2% mom to 1.724mn in Apr, owing to a 7.3% plunge in single-family housing starts.

- Existing home sales fell for a 3rd consecutive month in Apr: sales slipped by 2.4% mom to 5.61mn – this is the slowest rate since Jun 2020. Tighter supply has kept home prices higher, with the median price rising to a record high of USD 391,200 (+14.8% yoy).

- Initial jobless claims inched up to 218k in the week ended May 13th (prev: 197k), the highest level since Jan, causing the 4-week average to rise slightly to 199.5k. Continuing jobless claims slipped by 25k to 1.317mn in the week ending May 6th, the lowest level since Dec 1969.

Europe:

- The latest estimate for euro area’s Q1 GDP shows a slight upward revision: GDP expanded by 0.3% qoq and 5.1% yoy (prev estimate: 0.2% and 5%). The number of employed persons in the eurozone increased by 0.5% qoq and 2.6% yoy (Q4: 0.4% qoq and 2.1% yoy).

- Consumer confidence in the euro area edged up to -21.1 in May (Apr: -22). In the EU, consumer sentiment declined by 0.4 points to -22.2.

- Wholesale price index in Germany jumped by 23.8% yoy in Apr (Mar: 22.6%), rising at a record rate for the 3rd consecutive month. Prices surged across many categories: wholesale trade of mineral oil products (+63.4% yoy), wholesale trade of solid fuels (70.9%), grain, unmanufactured tobacco, seeds etc. (56.3%) and metals and metal ores (55.7%).

- Producer inflation in Germany rose to 33.5% yoy in Apr (Mar: 30.9%), hitting a new record high for the 5th straight month, driven by energy prices (+87.3% yoy). Excluding energy, producer prices were up by 16.3%.

- Trade deficit in the euro zone widened to EUR 17.6bn in Mar (Feb: EUR 11.3bn), the largest trade deficit on record (since 1999). The deficit in energy trade almost tripled to EUR 128.7bn in Q1 2022 while trade deficit with Russia more than quadrupled to EUR 45.2bn.

- The eurozone recorded its first current account deficit in a decade in Mar: it recorded a deficit of EUR 1.57bn in Mar, following a surplus of EUR 15.73bn in Feb.

- Inflation in the UK accelerated to a 40-year high of 9% yoy in Apr (Mar: 7%), with energy and fuel costs the biggest contributor to the rise alongside food prices. Core inflation also inched up to 6.2% (Mar: 5.7%).

- Producer price index in the UK also ticked up: on the input side, prices surged by 18.6% yoy in Apr – the highest since records began; output price was up by 14% (Mar: 11.9%) – the highest since Jul 2008. Retail price index grew by 11.1% yoy and 3.4% mom in Apr.

- ILO unemployment rate in the UK edged lower to 3.7% in the 3 months to Mar, the lowest reading since 1979 and from 3.8% in the previous period. There are now fewer unemployed people (1.257mn) than job vacancies (a new record of 1.295mn). Average earnings including bonus increased by 7% in the 3 months to Mar (prev period: 5.6%), but wage growth was 1.4% in real terms (i.e. accounting for inflation).

- UK’s GfK consumer confidence fell to -40 in May (Apr: -38), the lowest since records began in 1974. The drop results from rising prices limiting consumers’ spending ability.

- Retail sales in the UK surprisingly rebounded by 1.4% mom in Apr (Mar: -1.2%), supported by an increase in supermarket sales; food and drinks store sales volumes rose by 2.8% and 8.4% respectively. In yoy terms, sales fell by 4.9% (Mar: 1.3%). Compared with Feb 2020, shoppers had bought 4.1% more goods but spent 13% more (thanks to rising costs).

Asia Pacific:

- The People’s Bank of China unexpectedly lowered the benchmark 5-year loan prime rate to 4.45% from 4.6%. The PBOC kept the one-year LPR unchanged at 3.7%. Earlier last week, the authorities allowed a further cut in mortgage loan interest rates for some home buyers.

- China’s fixed asset investment grew by 6.8% yoy to CNY 15.35trn in Jan-Apr (Q1: 9.3%). During the same period, fixed-asset investment from the private sector increased 5.3% yoy to CNY 8.69trn. Investment into the high-tech manufacturing and high-tech services sectors jumped by 25.9% and 13.2% respectively.

- The impact of widespread lockdowns was reflected in Chinese data for Apr: Industrial production fell by 2.9% yoy in Apr (Mar: 5%) – this was the largest decline since Feb 2020. China also processed 11% less crude oil in Apr, with daily throughput the lowest since March 2020 and power generation fell 4.3%, the lowest since May 2020. Retail sales plunged by 11.1% yoy, posting the biggest contraction sicne Mar 2020.

- Japan’s preliminary GDP shrank by 0.2% qoq and 0.4% yoy in Q1. In annualised terms, GDP was down by 1%. Japan has yet to return to pre-pandemic output levels (it is still 0.7% below pre-Covid level in 2019), with Q1 affected by economic restrictions given the surge in Omicron variant cases.

- Inflation in Japan increased to 2.5% in Apr (Mar: 1.2%); excluding food and energy, prices were up by 0.8% (the first positive figure since Jul 2020) and excluding fresh food, prices rose by 2.1% (Mar: 0.8%) – this was the highest since Mar 2015. To ease the impact of higher prices, the government approved a JPY 2.7trn (USD 21bn) fiscal spending program, including gasoline subsidies and cash handouts to low-income families.

- Exports from Japan increased for the 14th consecutive month in Apr, rising by 12.5% yoy, while imports grew at a faster pace of 28.2%. The trade deficit widened to JPY 839.2bn from JPY 414.1bn the month before. Exports to China fell by 5.9% in Apr, the biggest drop since 2020 and imports from China fell the most since Sep 2020.

- Japan producer price inflation ticked up to a 41-year high of 10% yoy in Apr (Mar: 9.7%), affected by the Russia-Ukraine war and a weaker yen.

- Wholesale prices in India surged to a record-high of 15.08% in Apr (Mar: 14.55%): this is the 13th consecutive month of double-digit inflation and edging up continuously. Core WPI (excluding food and fuel) rose to a 4-month high of 11.1%.

Bottom line: With runaway inflation recorded across many markets and lockdowns having a substantial painful impact on China’s growth (various data indicators released last week), recession talks are gaining ground. Even stock markets are likely to be affected: corporate margins will be affected by rising input prices, as pointed out in many retailer earnings reports. On the other hand, food security issues are rearing its ugly head as the Ukraine-Russia war continues. In this backdrop, the Russian rouble became the best performing currency this year, after it closed at the highest level in 5 years last week (as more European nations complied with paying for natural gas in the Russian currency). Global debt surged to a record USD 305trn Q1 2022, according to the IIF: this amounts to more than 348% of global GDP but is about 15 ppts below the peak in Q1 2021 due to higher nominal income growth.

Regional Developments

- Bahrain’s national origin exports surged by 62% yoy to BHD 478mn in Apr, with top 10 partners accounting for 83% of total value. The US (BHD 110mn), Saudi Arabia (BHD 84mn) and UAE (BHD 43mn) were the top recipient countries.

- Bilateral trade between Bahrain and Germany grew by 31.2% yoy to EUR 624.6mn in 2020. Bahrain’s imports from Germany rose by a third to EUR 499.7mn in 2020, while Bahraini exports to Germany reached EUR 124.9mn.

- Inflation in Egypt climbed to 13.11% in Apr – the highest since May 2019– as a result of higher wheat prices (given Russia-Ukraine war) and currency depreciation. Citing the increase in prices, the Central Bank of Egypt hiked interest rates by 200bps on Thursday: deposit rate increased to 11.25% from 9.25% and the lending rate was hiked to 12.25% from 10.25%.

- Egypt expects to reach a new agreement with the IMF “within months”, disclosed the PM.

- Egypt’s government has identified USD 9bn in assets that would be privatised and another USD 15bn that would begin preparations to be monetised. He also stated that the plan is to raise private investment to 65% of the total within 3 years, from 30% currently. He also disclosed that the government would publish details of the sectors from which it would withdraw completely / partially by end of the month.

- US investments in Egypt surged to USD 24bn in the financial year 2021-22, up from USD 9bn in the financial year 2020-21.

- Unemployment rate in Egypt declined to 7.2% in Q1 (Q4: 7.4%); labour force edged up by 0.8% qoq to 29.895mn in Q1. Separately, a report released by the Ministry of Planning and Economic Development showed that the total number of employed Egyptians grew by 3.7% yoy to 27.1mn during 2021. During the year, both male and female unemployment slipped: former to 5.6% (from 6% in 2020) and latter to 16% (from 17.7% in 2020).

- Egypt expects revenues from Suez Canal to reach about USD 7bn by end of the current fiscal year, revealed the finance minister. Tourism revenues are also estimated to rise to USD 10-12bn by end of Jun 2022.

- Egypt will be exempt from the ban India placed on wheat exports (as domestic prices hit record highs). Egypt’s government had agreed to buy half a million tonnes of wheat from India and India is expected to honour letters of credit that were already issued in addition to requests to meet food security needs.

- IMF forecasts Iraq GDP to rise to 10% in 2022, supported by a boost in oil output. Non-oil GDP is expected to expand by 5% this year, following a 20% uptick in 2021 (a result of an accommodative fiscal stance and central bank’s stimulus measures). Headline inflation is projected to rise to 6.9% in 2022 given higher food prices.

- Iraq aims to increase its oil production to 6 million barrels per day by end of 2027, according to the oil minister.

- Current wheat reserves in Iraq are sufficient for four months, according to a spokesperson from the trade ministry, as 800,000 tonnes was bought from local farmers.

- Kuwait’s trade surplus with Japan surged by 82.7% yoy to JPY 82bn (USD 638mn) in Apr, rising for the 13thconsecutive month.

- According to a financial recovery plan passed by Lebanon’s cabinet on Friday, the government foresees cancelling “a large part” of its central bank’s foreign currency obligations to commercial banks, to reduce the deficit in BDL’s capital. In addition, the plan also includes unifying the official exchange rate, a full audit of the BDL’s forex financial standing by Jul and dissolving non-viable banks by Nov among others. The Parliament, which will convene in the coming weeks, need to pass multiple laws for the IMF bailout discussions to progress.

- Lebanon’s telecommunications sector will begin using the central bank’s Sayrafa exchange platform for phone services, including calls and mobile data. This implies a surge in prices in the coming months: it has been charged till now at LBP 1500 and will switch to LBP 23,900 to the dollar.

- An agreement has been reached by Oman and Iran to revive a long-delayed project to lay an undersea pipeline to carry gas to Oman. The initial deal was signed in 2013, with the project valued at USD 60bn over 25 years.

- Oman’s state energy company OQ is considering an IPO of its gas pipelines network, reported Reuters. There are no plans to float the parent company, though local listings are being explored for some of its downstream and upstream assets.

- South Korean steel making company Posco Group started work on a green ammonia project (with a potential capacity of 4 GW) in Oman, reported MEED. The project is part of at least 10 hydrogen and green ammonia projects that are being planned in Oman.

- Qatar hopes to start sending liquefied natural gas to Germany in 2024, revealed the former’s deputy PM.

- Qatar’s sovereign wealth fund plans to invest USD 5bn in Spanish projects: investments will be mainly in technology and environmental projects, to be implemented within 2-3 years.

- Reuters reported that Qatar Energy sold four cargoes of al-Shaheen crude loading in Jul at the highest premiums in two months.

- Assets under management in the Middle East grew by 52% over the past three years, rising to USD 35bn by Q3 2021, according to Preqin. UAE accounts for about 57% of AUMs in the region as of Q3 2021, followed by Saudi Arabia (24%) and Bahrain (13%). Venture capital fund-raising accounted for, on average, about 41% of capital raised annually and 46% of total capital (USD 3.7bn) since 2017.

Saudi Arabia Focus

- Saudi Arabia posted a budget surplus of SAR 57.5bn in Q1 2022, the highest quarterly figure in 6 years, thanks to a surge in oil prices. Both oil and tax revenues increased in Q1 2022, though the latter’s increase of 13.9% yoy pales in comparison to oil revenues 57.6% surge. Compensation of employees accounted for almost 60% of overall spending in Q1.

- Saudi Arabia’s public debt increased by 2.1% qoq to SAR 958bn (USD 256bn) at end-Q1 2022. This was driven by higher domestic issuances (SAR 52.6bn) as well as lower principal repayments (SAR 32bn).

- An increase in food and transport costs (+4.6% yoy each) contributed to anuptick in Saudi consumer price inflation in Apr (2.3% from Mar’s 2%); prices at restaurants and hotels also accelerated (3.22% from 2.9%). Wholesale prices posted double-digit increases for the 13th consecutive month: prices rose by 10.7% in Apr though easing from Mar’s 12%; agricultural and fishery product prices rose by the most (+18.7%)

- Saudi Arabia’s crude oil exports fell about 1% mom to 7.235mn barrels per day (bpd) in Mar. Production meanwhile rose to 10.3mn bpd – the highest level in about 2 years. Separately, the energy minister stated that the nation is on track to raise production capacity to over 13mn bpd by end-2026 or start of 2027.

- Reuters reported that China’s crude oil imports from Saudi Arabia surged by 38% yoy in Apr, touching the highest monthly volume since May 2020.

- Bloomberg reported that Saudi Aramco plans to offer a 30% stake in its trading arm, Aramco Trading Co., in an initial public offering.

- The Public Investment Fund launched the Saudi Coffee Company: an investment of nearly SAR 1.2bn is expected to grow the national coffee industry and enable the Saudi coffee bean to become a global product.

- In addition to owning companies that are developing hydrogen, PIF plans to establish a new hydrogen company, revealed the fund’s governor at a regional forum on ESG.

- Saudi PIF took a 5.01% stake in Nintendo: this investment adds to stakes acquired previously in other video game companies like Nexon, Capcom and Koei Tecmo.

- PIF reduced its ownership of US equities by 22% qoq to USD 43.6bn at end-Q1 2022. PIF cut its stake in three companies: Visa Inc., Plug Power, and Walmart during this period.

- Prince Alwaleed bin Talal signed an agreement to sell 16.87% of his investment firm Kingdom Holding to the PIF.

- Real estate e-transactions in Saudi Arabia touched 79,000 since the service was launched in Mar 2020, with the value exceeding SAR 11bn (USD 2.9bn). The operation can be completed within 60 minutes, as the electronic agreement on sale terms does not require a notary’s certification.

- Cement sales from 17 Saudi cement factories fell by 39% mom to 3 million tons in Apr 2022. Cement production and sales fell by 14% yoy and 12% respectively in Jan-Apr 2022.

- Occupancy levels at Riyadh’s hotels stood at 72.2% in Feb, with average daily rate of a hotel room at SAR 652.09 (USD 173.81). Revenue per available room, at SAR 471.01 in Feb, was the second-highest rate in the pandemic era (highest: Dec 2021).

- Saudi Arabia extended a deposit given to the central bank of Yemen in 2018; the final instalment of USD 174mn was also paid.

- Lucid Motors signed agreements to build an electric vehicle production factory in Saudi Arabia: financing and incentives of up to USD 3.4bn will be provided to Lucid over the next 15 years to build and operate the manufacturing facility.

- Saudi Electromin announced the rollout of electric vehicle charging points across the nation: it includes 100 locations powered by a customer-centric mobile application

- Value of virtual asset transactions in Saudi Arabia was worth around USD 20bn in 2021 with over 800,000 Saudis using digital currencies, according to MD of BitOasis. About 45% of trading activity was done by 25-34 year olds while 35-44 year olds account for another 30%.

UAE Focus![]()

- Dubai PMI eased to 54.7 in Apr (Mar: 55.5), with both output index and new orders remaining strong. Though costs burdens increased (fuel and material prices), firms shied away from passing on these costs to consumers in a bid to remain competitive. Employment dropped for the first time in 5 months and though optimism for future activity inched up in Apr, it remained below historical trend.

- Investing in Abu Dhabi bourse became simpler with a new streamlined process that allows investors registered with other UAE stock markets (licensed by the Securities and Commodities Authority) to trade on Abu Dhabi Securities Exchange (ADX) without going through a complicated process. However, corporate entities still need to provide articles of incorporation along with a list of authorised signatories.

- Borouge, a speciality plastics firm that produces polyolefins, plans to list on Abu Dhabi Securities Exchange. The firm is a JV between ADNOC and its Austrian chemicals partner Borealis. The firm plans to list 10% of the company: an offer price of AED 2.45 (USD 0.66) has been set for its IPO, implying a valuation of USD 20bn. The offer, which began today (May 23) will run till May 28.

- ADNOC announced three oil discoveries: discovery in Bu Hasa includes 500mn barrels of oil from an exploration well in the field; the discovery in Abu Dhabi’s Onshore Block 3 stand at around 100mn barrels of oil; the third discovery is around 50mn barrels found in the Al Dhafra Petroleum Concession.

- Non-oil bilateral trade between UAE and Germany grew by 10.5% yoy to USD 9.5bn in 2021.

- UAE’s unemployment insurance scheme, effective from early 2023, will be applicable for both expats and citizens. By paying a minimum of AED 40 to a maximum of AED 100 per year into an insurance scheme, those who lose jobs will be eligible to receive 60% of their basic salary or up to AED 20k each month.

- UAE’s start-up culture is improving: according to the UAE’s Minister of State for Entrepreneurship and SMEs, around 5% of all graduates are starting their own business soon after graduating (compared to just 1.5% a few years back).

- Tourism in Dubai surged in Q1 2022: visitors more than doubled to 3.97mn in the quarter compared to 2021, with Oman and Saudi accounting for 1/5th of visitors during the quarter. Revenue per available room surged in Q1 2022 (to USD 534) as occupancy inched closer to pre-covid levels (82% in Q1 2022 compared to 84% in Q1 2019 and 86% in Jan 2020). Dubai Tourism CEO expects tourist numbers to be closer to 2019 levels by end-2022.

- Dubai reported 6,983 real estate sales transactions worth AED 18.2bn in Apr, the highest ever for the month since 2009. In line with the improved performance in last few quarters, new real estate project announcements in Q1 grew: more than 20 projects were announced comprising upwards of 6500 residential units.

- Dubai Airport announced its busiest quarter since 2020 in Q1 2022, receiving 13.6mn passengers (+140% yoy and 15.7% qoq). The Dubai Airports CEO was quoted stating that traffic may reach pre-pandemic levels in 2014.

- The Tribunal hearing disputes related to Dubai World has been dissolved: the tribunal will continue to review pending cases and claims until Dec 13th and all future cases would be handled by specialised courts.

Media Review

Saudi crown prince signals family unity as succession looms

“Jobs Undone: Reshaping the Role of Governments Toward Markets and Workers in the Middle East and North Africa”: World Bank report

https://openknowledge.worldbank.org/bitstream/handle/10986/37412/9781464817359.pdf

Factbox: What is the make-up of Lebanon’s new parliament?

https://www.reuters.com/world/middle-east/what-is-make-up-lebanons-new-parliament-2022-05-17/

Russian crude production plunges by nearly 9% in April