Weekly Insights 20 May 2022: Rising Oil Prices Benefit Oil Exporters, but Being Food Importers Hurts All

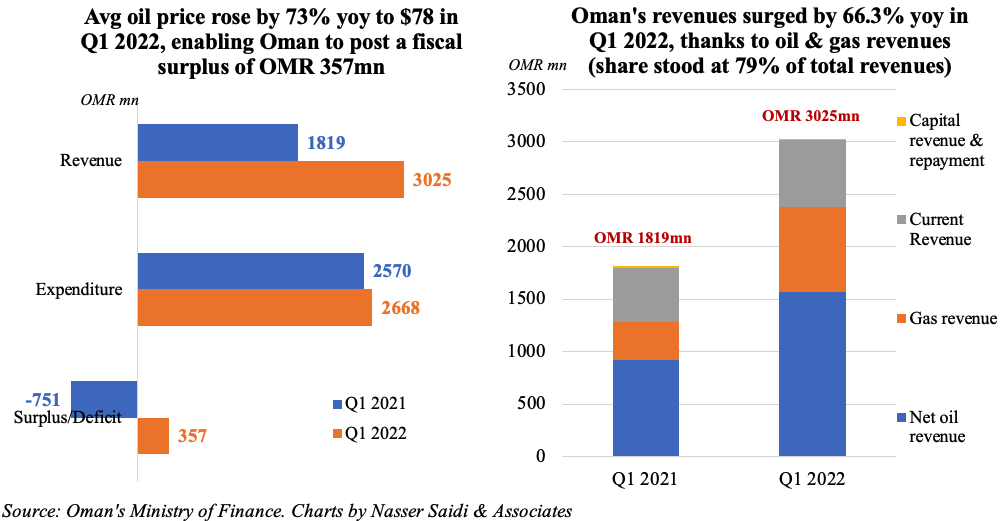

1. Oman posts consistent fiscal surpluses in 2022, supported by higher oil prices; dependence grows

-

Oil price was programmed at USD 50 in Oman’s budget for 2022; in Q1 itself, the average oil price stood at USD 78, thus enabling Q1 revenues to reach 30% of estimates for the full year

-

Unfortunately, dependence on oil & gas for overall revenues is very high, with its share at 79% in Q1. Net oil revenues grew by 70% while gas revenues more than doubled to OMR 819mn in Q1

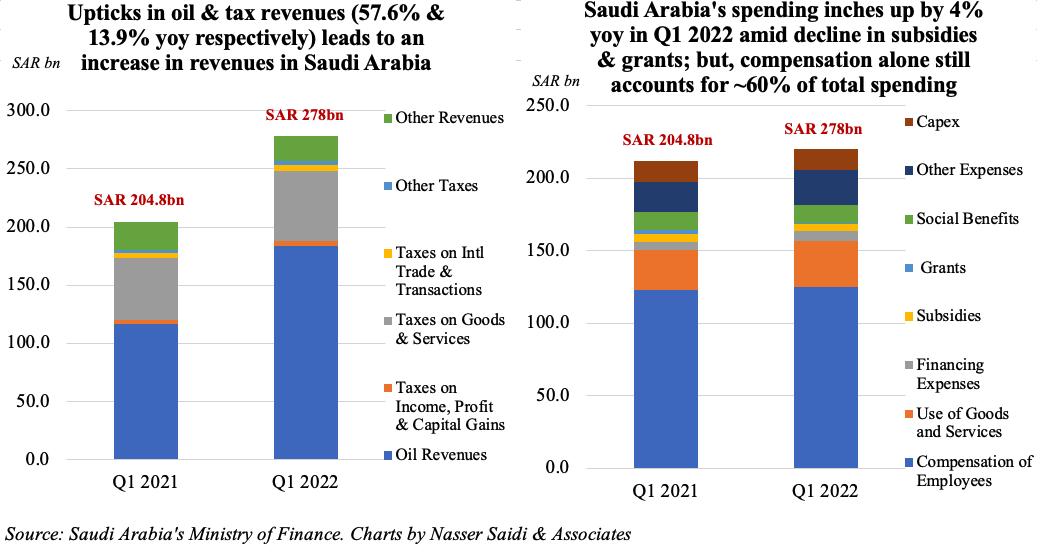

2. Saudi Arabia sees increase in both oil & non-oil revenues, while recording a surplus of SAR 57.5bn in Q1 2022

- Oil price surge helps Saudi Arabia post a budget surplus of SAR 57.5bn in Q1 2022, the highest quarterly figure in 6 years

- Both oil and tax revenues increased in Q1 2022, though the latter’s increase of 13.9% yoy pales in comparison to oil revenues 57.6% surge. Consolidation measures on the spending side still a possibility: compensation of employees accounted for almost 60% of overall spending in Q1

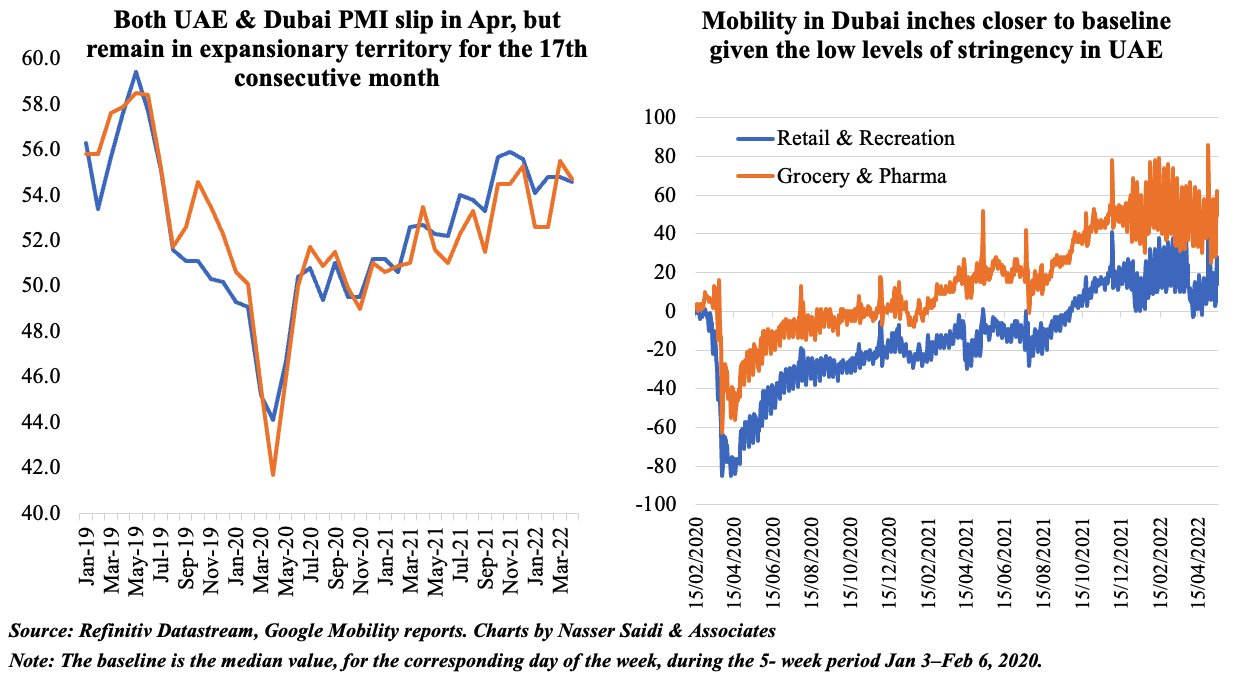

3. Dubai PMI eases slightly in Apr, mirroring UAE data; despite rising fuel & raw material costs, firms choose not to pass this to consumers

- Rise in output and new orders enable Dubai PMI stay in expansionary territory for the 17th consecutive month. Demand continues to increase: mobility shows a consistent improvement, inching closer to the baseline (in line with low stringency levels: 29.63 for vaccinated persons)

- However, as companies adjust to rising costs (in line with global movements), employment numbers dropped for the first time in five months; most firms also absorbed rising costs to remain competitive

- Optimism for future activity inched up in Apr, but remained below historical trend

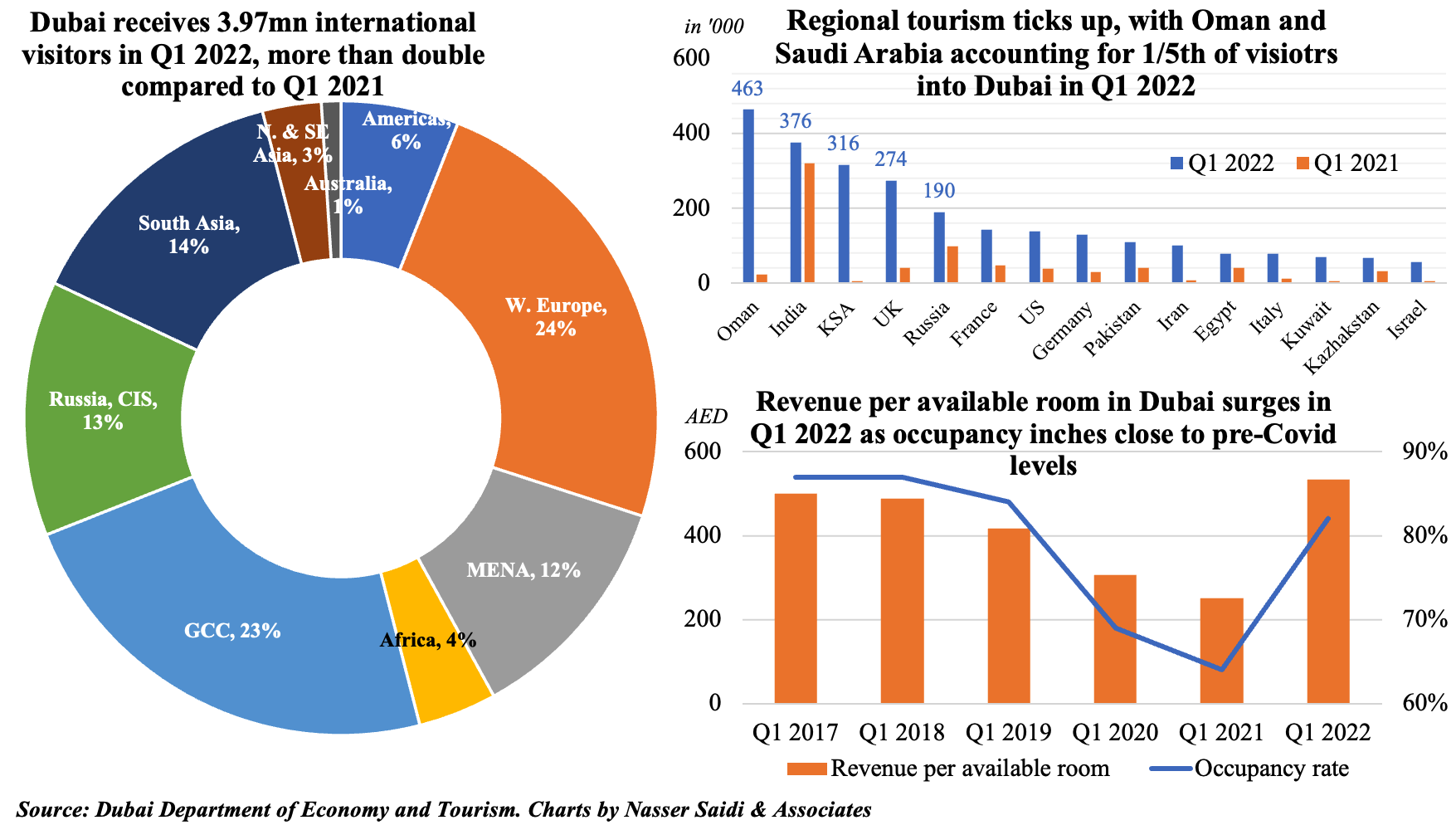

4. Dubai tourism surged in Q1 2022: visitors more than double (vs Q1 2021) with Expo 2020 effect; regional tourism picks up; RevPAR surges

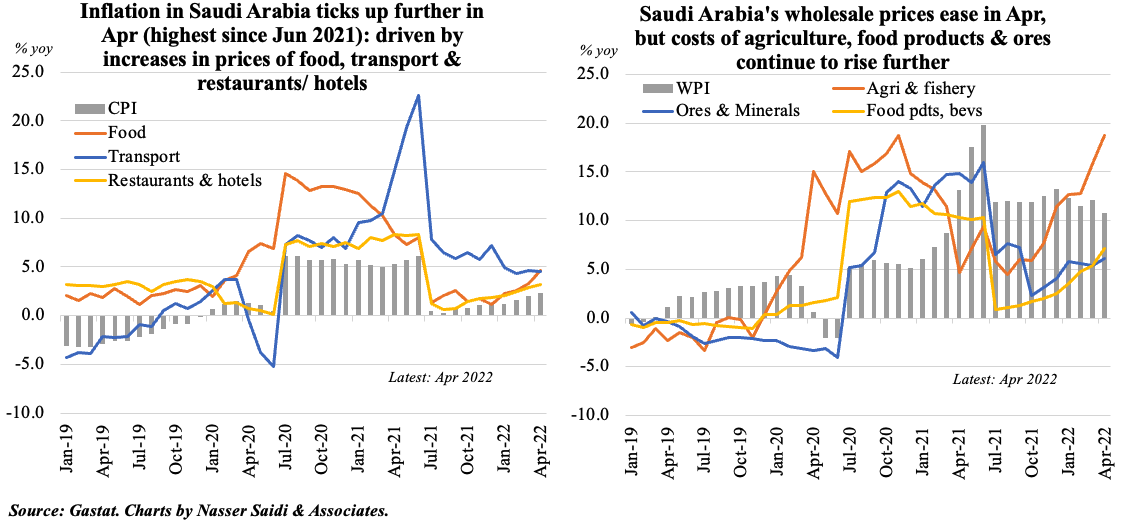

- An increase in food and transport costs (+4.6% yoy each) contributed to an uptick in Saudi consumer price inflation in Apr (2.3% from Mar’s 2%); prices at restaurants and hotels also accelerated (3.22% from 2.9%)

- Wholesale prices posted double-digit increases for the 13th consecutive month: prices rose by 10.7% in Apr though easing from Mar’s 12%; agricultural and fishery product prices rose by the most (+18.7%)

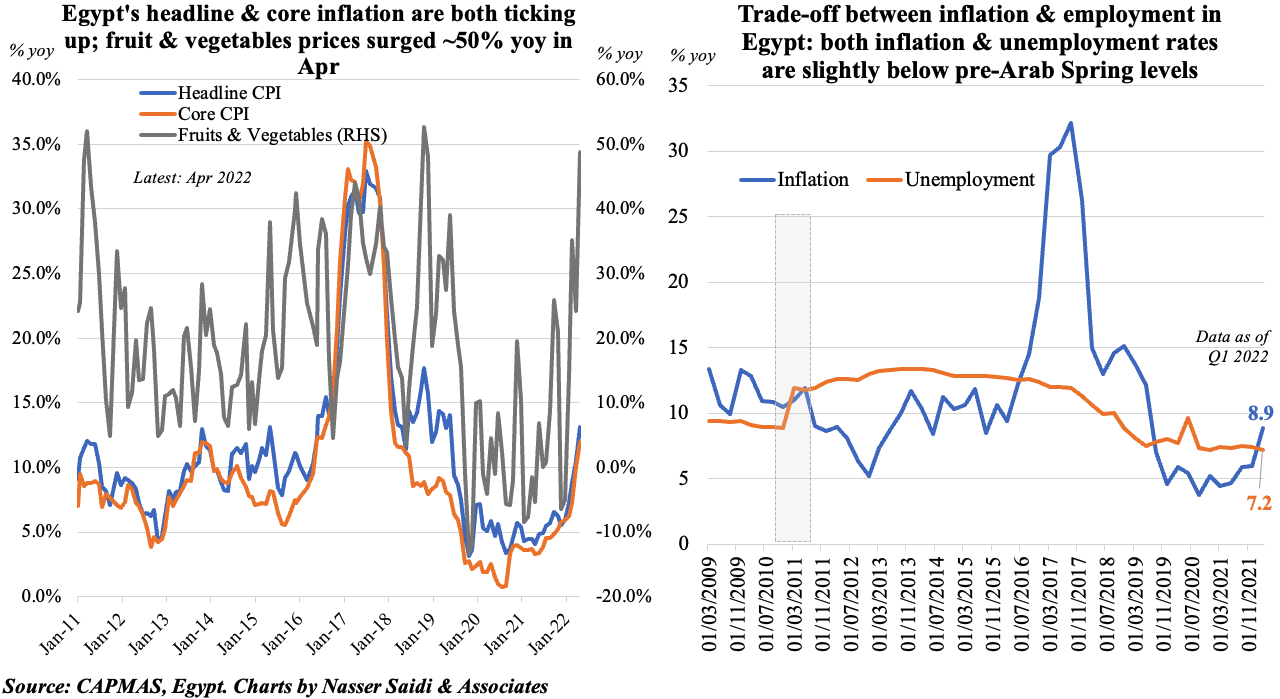

6. Egypt raises interest rates by 200bps to tame double-digit inflation; unemployment at 7.2% in Q1 2022

- Inflation in Egypt climbed to 13.11% in Apr – the highest since May 2019 – as a result of higher wheat prices (given Russia-Ukraine war) and also the currency depreciation. As a result, the Central Bank of Egypt hiked interest rates by 200bps on Thursday

- For now, both inflation and unemployment rates are lower compared to the period prior to the Arab Spring, though inflation is still ticking up (wheat prices are up 53% since start of the year, and rising; China’s zero-Covid policy is playing havoc with supply, shipping costs)