Weekly Insights 13 May 2022: Despite inflationary pressures, GCC economic activity shows improvement

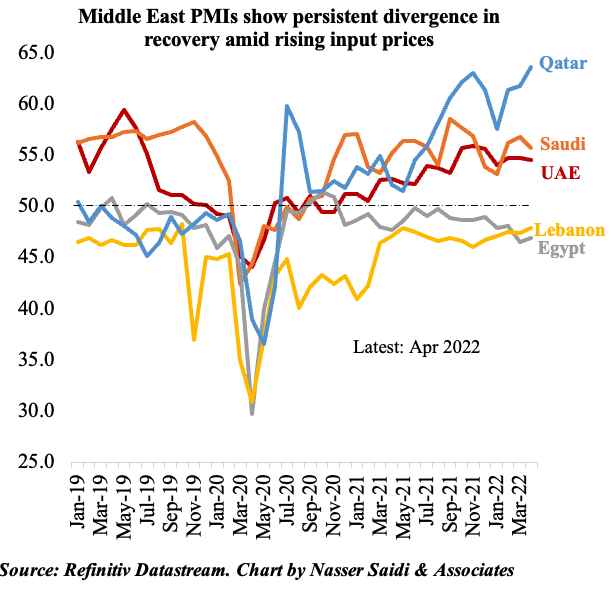

1. PMIs in the GCC remain in expansionary territory while Lebanon & Egypt stay below-50

- PMIs in Saudi Arabia and UAE eased slightly in Apr, but both output and new orders expanded. In UAE, foreign new businesses posted the fastest increase since Jan 2021

- Given rising inflationary concerns, firms increased their purchasing activity and inventories rose. Panelists across the board have cited higher raw material and fuel prices as ongoing concerns

- Businesses in the UAE had been reluctant to pass on costs to consumers. However, in Apr average output prices rose for the first time in 9 months, though it was marginal

- In both Egypt and Lebanon, overall PMI readings stayed below-50 but inched up in Apr and inflationary pressures continued to persist (also lowering business confidence)

- Egypt saw a marked decline in output and new businesses, while jobs were cut at the fastest pace in a year. The only bright spot was construction. Firms were reluctant to pass on costs to the consumers in a bid to sustain demand

- Lebanon’s PMI rose to an 11-month high, though political instability, high operating costs and weak purchasing power dragged down activity. Unfavourable exchange rates added further pressure on prices on top of global circumstances

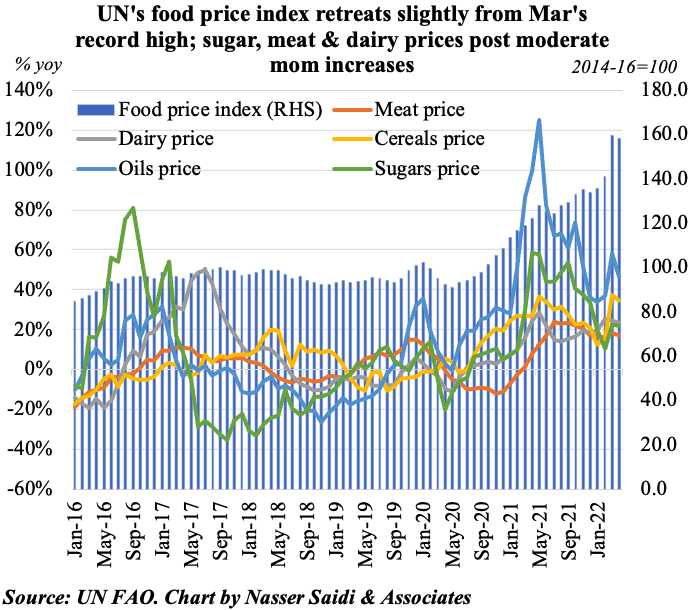

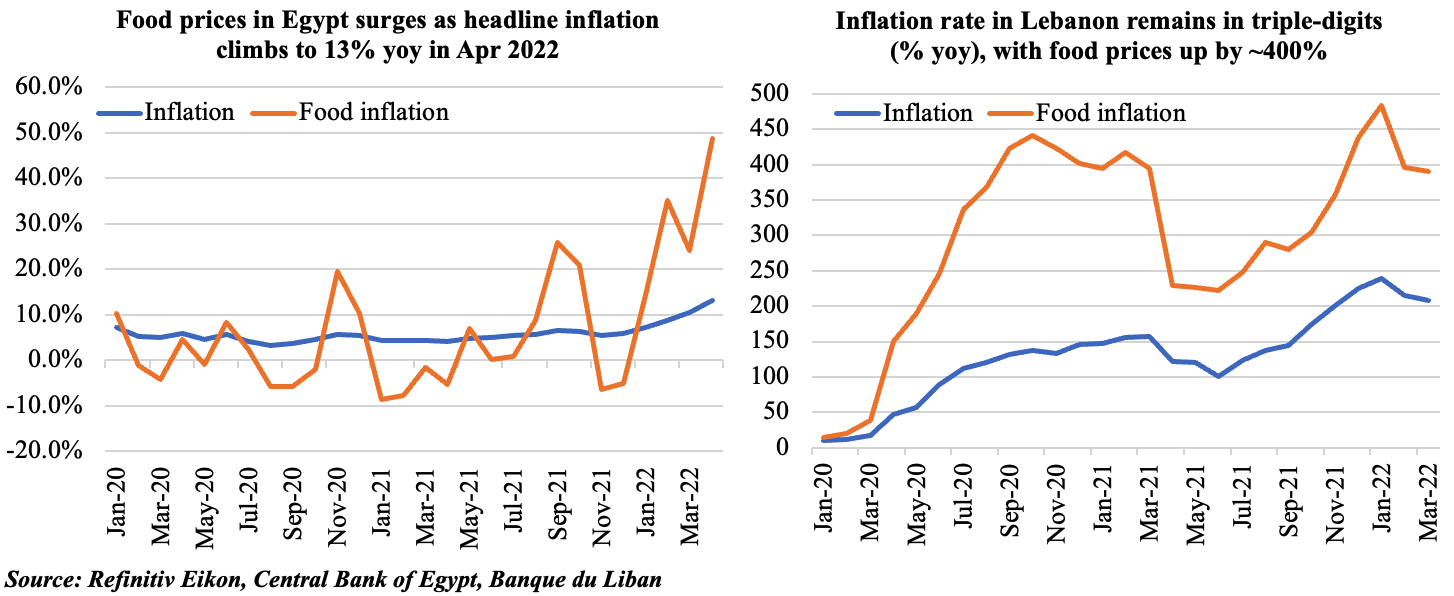

2. Global food prices ease in Apr but is close to record-highs; inflation still high in Lebanon & Egypt

- Higher global food prices, caused partly due to disruptions owing to the Russia-Ukraine war, are mirrored in both Egypt and Lebanon. Egypt and Lebanon are dependent on Ukraine for more then 3/4th of wheat supplies

- In Egypt, inflation stood at 13% in Apr; but even core inflation has been rising (11.9% yoy from Mar’s 10.1%). This is likely to trigger another interest rate hike when the central bank meets next week

- The World Bank approved a USD 150mn food security loan to Lebanon: not only have food prices gone up more than 11-fold but the LBP has also lost more than 95% of its value

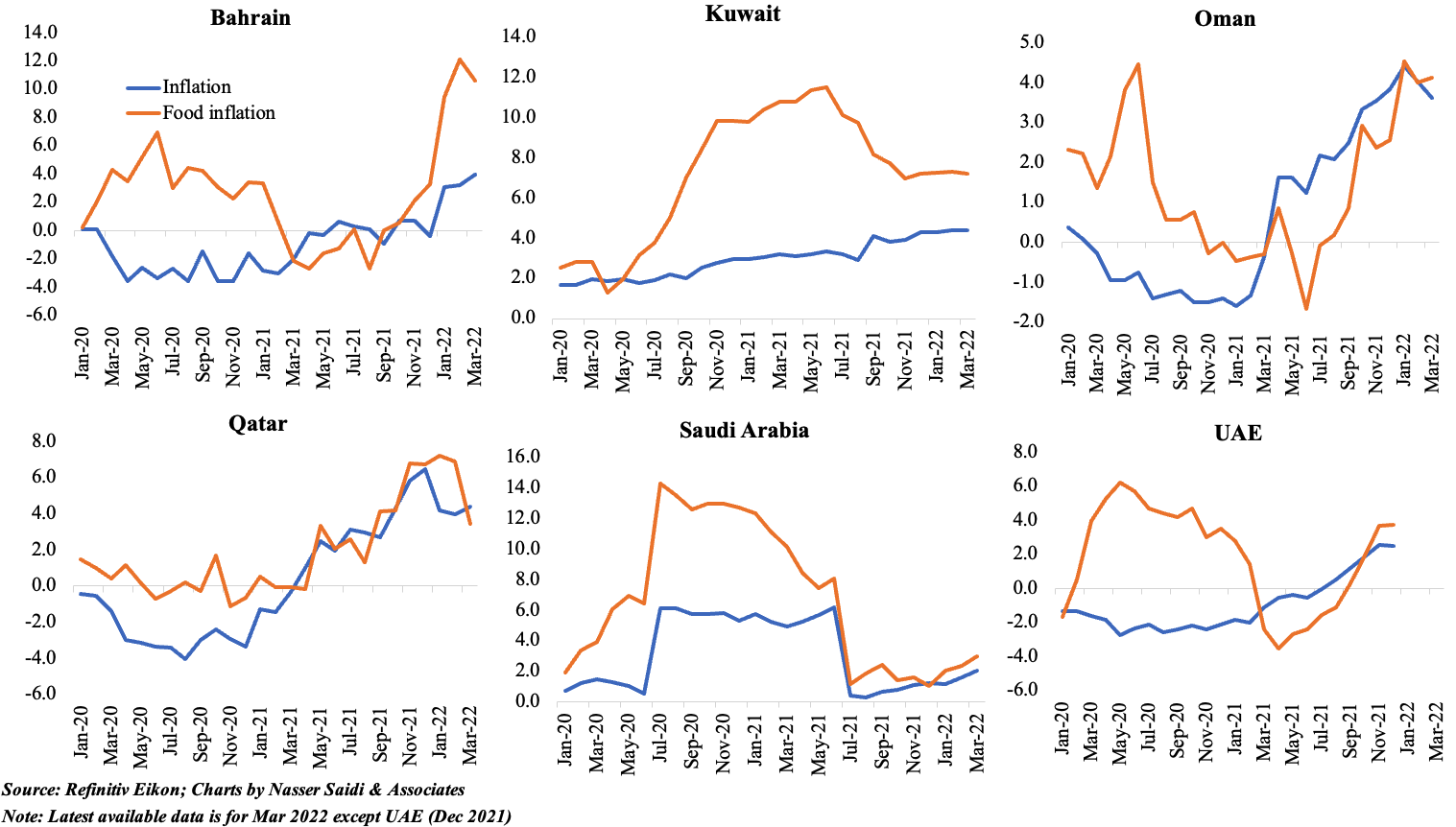

3. Higher imported food prices & supply chain disruptions are causing GCC inflation to rise (many touching decade-highs); weightage of food in GCC baskets are lower vs rest of MENA

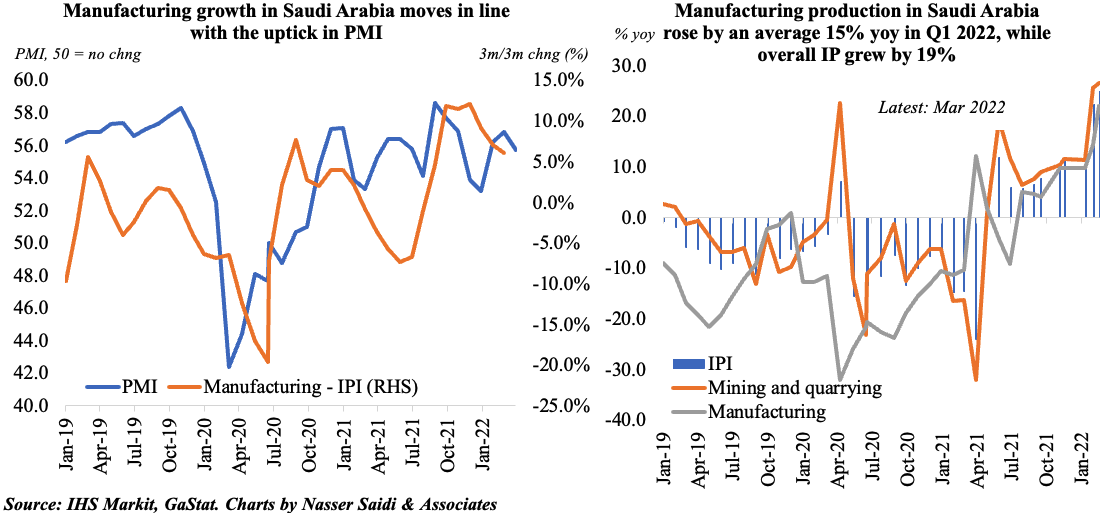

4. Industrial production in Saudi Arabia jumps thanks to the surge in mining/ quarrying sector production

- Saudi non-oil sector PMI posted an average of 55.5 in Jan-Apr 2022, in spite of a low 53.2 reading in Jan, as Omicron variant spread across the globe increasing uncertainty

- Overall industrial production (IP) increased by 19.3% in Q1 2022: manufacturing grew by 15.3% and mining/ quarrying sector production surged (21.2%)

- The charts below track three-month-on-three-month changes in the official IP data to remove some volatility. It shows that improvement in non-oil sector is happening faster than in manufacturing – pointing to the faster recovery of the non-oil, non-manufacturing sectors