Markets

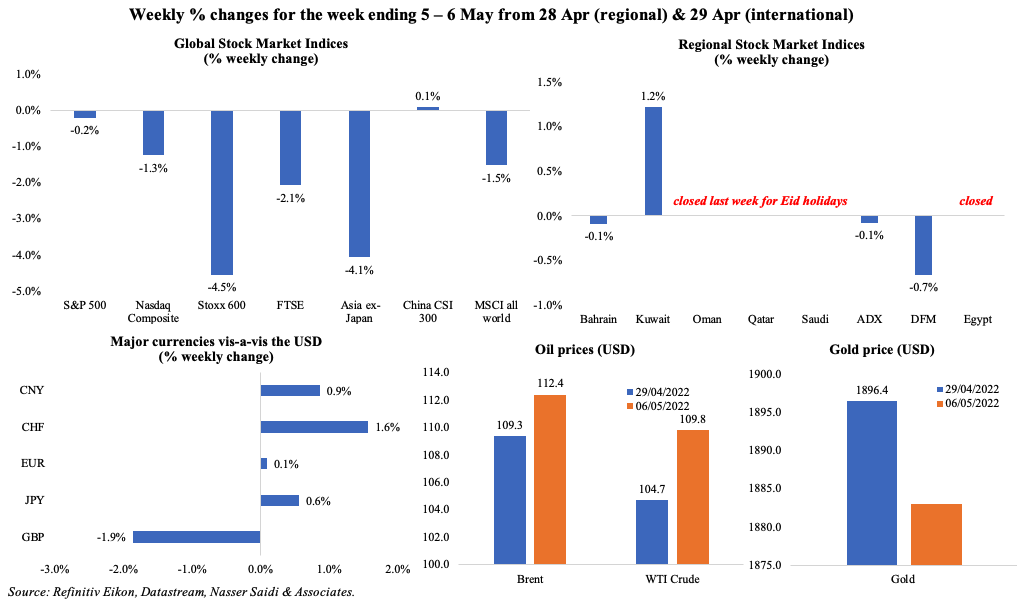

Major global markets again ended in the red last week: though markets cheered the Fed hike initially, heavy selling afterwards meant that both S&P 500 and Nasdaq posted a 5th consecutive weekly decline (worst streak since Jun 2011 and Nov 2012 respectively); declines were also seen across pan-European Stoxx 600, MSCI all world and even emerging market stocks. Regionally, many markets were closed for Eid holidays, but gained as markets reopened yesterday. The BoE’s recession warning pushed the GBP to a 2-year low while the dollar continued to surge (touching a two-decade high during the week); the CNY closed at 6.6651 on Fri (from 6.608 the week before), and after the disappointing export numbers this morning it has crossed the 6.7 per dollar mark. Oil prices increased for the second consecutive week, as EU tweaked its sanctions plan and OPEC+ stuck to its modest monthly increase in production. Gold price declined by 1.7% compared to a week ago.

Global Developments

US/Americas:

- The Fed raised its benchmark policy rate by 50bps for the first time since 2000 – a strong signal of similar hikes in upcoming two meetings. This was also the first time since 2006 that the Fed has implemented back-to-back rate hikes. Furthermore, the Fed will pare back its USD 9trn balance sheet by shrinking its portfolio of Treasuries and agency mortgage-backed securities (moving much more quickly than earlier following the global financial crisis).

- Non-farm payrolls accelerated by 428k in Apr, identical to Mar’s reading, with leisure and hospitality leading the gains (+78k jobs). Average hourly earnings increased by 0.3% mom and 5.5% yoy in Apr while labour force participation rate eased slightly by 0.2ppts to 62.2% (the first decline since Mar 2021). Unemployment rate remained unchanged at 3.6%.

- The US private sector added 247k jobs in Apr (Mar: 479k), with large and medium-sized firms hiring 321k and 46k workers respectively while small companies cut 120k employees.

- Job openings in the US increased to a record high 11.549mn in Mar (Feb: 11.3mn) and 4.5mn persons quit their jobs voluntarily in Mar (a series high) raising the quits rate to 3%.

- Non-farm productivity plummeted by 7.5% in Q1 (Q4: 6.3%), posting the fastest decline since 1947. Unit labour costs surged by 11.6% in Q1 versus a 1% gain in Q4: this was the biggest gain since Q3 1982.

- S&P Global manufacturing PMI increased to a 7-month high of 59.2 in Apr, though slower than the flash estimate of 59.7 (Mar: 58.8), on upturns in output, new orders and new export orders. Services PMI stood at 55.6 in Apr, much higher than the flash estimate of 54.7, credited to the loosening of Covid19 restrictions which in turn boosted consumer spending. Exports of services grew at the fastest rate since data were first collected in 2014.

- ISM manufacturing PMI declined for the 2nd consecutive month in Apr to 55.4 (Mar: 57.1), the lowest reading since Jul 2020, as new orders slipped (53.5 from 53.8) as did employment (50.9 from 56.3) amid an easing in manufacturing prices paid (84.6 from 87.1).

- Factory orders in the US rose by 2.2% mom in Mar (Feb: 0.1%), as orders for motor vehicles and parts rebounded (3%) and shipments of manufactured goods increased (2.3%). Non-defense capital goods (excluding aircraft), a proxy for business spending, gained by 1.3%.

- US trade deficit widened to a record-high USD 109bn in Mar (Feb: USD 89.8bn) as imports surged (+10.3% to USD 351.5bn). US exports also hit a record high of USD 241.7bn.

- Initial jobless claims increased to 200k in the week ended Apr 29th (prev: 181k), slightly raising the 4-week average to 188k. Continuing jobless claims slipped by 19k to 1.384mn in the week ending April 22nd, the lowest level since Jan 1970.

Europe:

- Manufacturing PMI in Germany slipped to a 20-month low of 54.6 in Apr (Mar: 56.9), as both output and new orders fell into contractionary territory for the first time since Jun 2020 amid “intensification of cost pressures”. Services PMI ticked up to at 57.6 – the highest since Aug 2021 – and from Mar’s 56.1. Both sectors recorded a rise in employment, as well as increases in price pressures.

- Eurozone reported a decline in manufacturing PMI to a 15-month low of 55.5 in Apr (Mar: 56.5), with production “weighed down by ongoing and severe supply chain disruptions”. Composite PMI rose to 55.8 (Mar: 54.9), supported by sharp increase in services activity (services PMI: 57.7 from Mar’s 55.6) as new order growth accelerated to an 8-month high.

- Producer price index in the eurozone jumped by 5.3% mom and a record-high 36.8% yoy in Mar, thanks to rising energy costs (104.1% yoy); excluding energy, PPI rose by 13.6% on more expensive intermediate goods.

- Germany’s exports fell by 3.3% mom in Mar (Feb: 6.2%) while imports grew by 3.4% causing the trade deficit to narrow to EUR 3.2bn from EUR 11.1bn the month before. Exports to EU states stood at EUR 66.6bn in Mar while imports were worth EUR 56.7bn. Compared to Feb, exports to the Russian Federation plunged by 62.3% to EUR 0.9bn while imports declined by 2.4% to EUR 3.6bn.

- Factory orders in Germany plummeted by 4.7% mom in Mar, following Feb’s 0.8% dip. The main factor for the drop was a 6.7% decline in export orders while orders from outside eurozone fell even more (13.7%). Separately, industrial production fell by 3.9% mom in Mar (Feb: 0.1%); industry, excluding energy and construction, saw output fall 4.6% in Mar.

- Inflation seems to be dampening spending growth. Retail sales in Germany unexpectedly declined by 0.1% momand 2.7% yoy in Mar. Retail sales in the eurozone fell by 0.4% mom in Mar, with Spain reporting the sharpest fall (4%).

- The number of unemployed in Germany fell by 13k in Apr to a seasonally adjusted 2.287mn, with unemployment rate stable at 5%. Jobless rate in Germany stands at 2.9%, the lowest rate since Eurostat records started in 1991. Unemployment rate in the eurozone eased to 6.8% in Mar from 6.9% before.

- The European Commission’s economic sentiment indicator in the euro area eased to 105 in Apr (Mar: 106.7). Consumer confidence in the eurozone slipped to a 2-year low of -22 in Apr (Mar: -21.6). Industrial confidence inched down to 7.9 in Apr, from 9 the month before.

- The Bank of England increased policy rate by 25bps to 1%, the highest level since 2009. The committee also decided not to start monthly sales of the GBP 875bn of assets built under the QE programme. The BoE forecast that the economy would contract by 1% in Q4 2022 and that rising energy bills could push inflation to 10.2% in Q4 2022 (the highest in 40 years).

- Manufacturing PMI in the UK increased to 55.8 in Apr, up from the preliminary reading of 55.3 and from Mar’s 12-month low of 55.2. New order stayed above-50, but was at its weakest in 15-months as foreign demand weakened (including from the EU given post-Brexit issues of customs checks, higher shipping costs and longer delivery times). Confidence dropped to a 16-month low.

Asia Pacific:

- Exports from China grew by just 3.9% yoy in Mar – the slowest rate since Jun 2020, driven by lockdowns in multiple cities including in Shanghai – while imports remained flat (weak demand). Even if production resumes this month, significant catch-up time to full capacity means that trade is likely to remain weak for a few months.

- China’s Caixin services PMI tumbled to 36.2 in Apr (Mar: 42), the second-steepest decline on record (the index had hit 26.5 in Feb 2020). New business stood at 38.4 (Mar: 45.9) while employment declined for the 4th straight month. Composite PMI slumped to 37.2 (Mar: 43.9).

- Japan’s manufacturing PMI eased to 53.5 in Apr (Mar: 54.1), but slightly higher than the preliminary reading of 53.4. Job creation fell to a 9-month low while output price inflation surged to a new series record and input prices jumped at the fastest pace since Aug 2008.

- Inflation rate in Tokyo increased to 2.5% yoy in Apr (Mar: 1.3%), the fastest growth since Oct 2014. Excluding food and energy, prices inched up to 0.8% (Mar: -0.4%) while excluding fresh food, prices were up by 1.9% (Mar: 0.8%) – the fastest gain since Mar 2015.

- Manufacturing PMI in South Korea inched up to 52.1 in Apr (Mar: 51.2), as output returned to above-50 and domestic demand boosted new orders. Price pressures continue, with output prices rising at a record pace while input prices rose at the fastest in 5 months.

- The Reserve Bank of India announced a surprise 40bps increase to the repo and reverse repo rates – the first in nearly 4 years – at an unscheduled meeting citing “persistent and spreading inflationary pressures”; this was accompanied by an increase in the cash reserve ratio by 50bps to 4.5%.

- Singapore PMI inched up to 50.3 in Apr (Mar: 50.1), thanks to higher factory output and stronger new orders.

- Retail sales in Singapore rebounded by 8.7% yoy in Mar (Feb: -3.5%), with growth broad based ranging from computer equipment (27.3%) to wearing apparel and footwear (25.8%) and furniture (15.6%) among others. Excluding motor vehicles, retail sales grew by 13.4%.

Bottom line: Global manufacturing PMI fell to a 22-month low of 52.2 in Apr, with manufacturing output slipping to contractionary territory (48.5) given the drop in China’s production volumes due to tightened Covid restrictions; excluding China, global manufacturing output ticked up to 53.2. In contrast, Kiel Trade Indicator data shows that global trade inched up by 2.1% mom in Apr in spite of the war in Ukraine and China’s restrictions though highlighting congestion in container shipping (11% of all goods shipped globally stuck). OPEC+ stuck to its existing plan of a modest increase in production in Jun, by 432k barrels per day (Reuters reported that the meeting was wrapped up in 15 minutes, with no discussions about sanctions on Russia). Meanwhile, inflation continues to be the major talking point as central banks across the globe rolled out rate hikes (Fed’s 50bps hike, an unscheduled meeting and 40bps hike in India, a surprise hike from Australia, Chile’s bigger-than-expected 125bps hike and expected increases in Brazil – for the 10th consecutive time – and UK). As data from China indicates its rising economic struggles (China’s PMI and export readings), chatter is strong about recession worries (e.g. BoE’s warnings). Investors will closely watch US inflation numbers this week to see if there’s any slowdown in the pace of increase.

Regional Developments

- Gulf central banks raised main interest rates, most mirroring the 50bps hike by the Fed (except Kuwait which raised rate by 25bps), given its currency basket, including the USD.

- Bahrain’s central bank issued new crowdfunding rules (for both equity and financing-based funding) to enable its use as alternative source of funding for new businesses and startups. The new rules cover principles governing the conduct of operations by the platform, rules related to offers and disclosures, avoiding conflicts of interest, as well as separating client money from platform operators to ensure the safe operation of the activity.

- Moody’s upgraded the outlook for Bahrain’s banking system to stable from negative given the improvement in operating conditions. The firm expects net profit to continue to improve and core capital to remain broadly stable while the existing stock of problem loans is estimated to be fully covered by provisions (110.3% as of Dec 2021).

- Egypt’s PMI stayed in contractionary territory but inched up to 46.9 in Apr compared to Mar (46.5), supported by only construction. Overall new business fell for the 8th straight month amid weak domestic orders and decline in new export sales.

- Egypt’s government is planning for private sector participation in state-owned assets to the tune of USD 10bn annually for 4 years, reported the state TV quoting President Sisi. He also ordered the government to list army-owned firms before year-end.

- The planned offering of shares in state companies in Egypt will be delayed till Sep, according to the Public Enterprise Minister. No further details were provided.

- Suez Canal reported an increase (6% yoy) in monthly revenue to a record high USD 629mn in Apr. The number of ships passing through grew by 6.3% to 1929 vessels.

- The Egypt Fintech landscape report 2021 found that 50% of the fintech founders in the nation are aged between 25-35. Furthermore, 24% of those surveyed have already expanded regionally and internationally.

- Iraq exported 101.4mn barrels of oil in Apr, according to the oil ministry, raising USD 10.55bn in revenues; exports averaged 3.4mn barrels per day (bpd). Iraq’s total crude output including Kurdistan fell to 4.148mn bpd in Mar 2022 from 4.26mn bpd in Feb.

- Lebanese expat citizens (estimated at nearly 200k eligible voters) began voting in a parliamentary election on Sunday; voters in Lebanon will cast ballots on May 15th. The highest number of diaspora voters are in Australia, Canada, US, Germany and the UAE.

- The volume of FDI in Oman grew by 7.7% yoy to OMR 17.08bn (USD 44.2bn) by end-Q4 2021. FDI inflows reached OMR 11.22bn, with UK, US, UAE, Kuwait and China the top investing nations. Oil and gas extraction attracted the most FDI in 2021 (+15% yoy to OMR 11.8bn) followed by the financial intermediary sector (down by 1.8% to OMR 1.45bn).

- The Oman Power and Water Procurement Company disclosed that it had achieved savings of over OMR 280mn in 2020 due to improvements in gas utilization (thanks to fuel efficiency measures and moving away from energy intensive technology).

- Mergers and acquisitions (M&A) in MENA grew by 11% yoy to USD 21bn in Q1 2022, according to Refinitiv. UAE recorded the highest deal activity in terms of volume with 303 transactions, while Saudi Arabia attracted the most M&A capital, worth USD 4bn and healthcare was the most active sector accounting for 1/4th of overall M&A activity.Inbound M&A fell 42% to USD 1.9bn in Q1, while outbound M&A doubled in volume from last year to USD 8.8bn.

Saudi Arabia Focus

- Saudi Arabia’s flash GDP estimates for Q1 2022 placed overall growth at 9.6%, the highest in a decade.This was supported largely by the oil sector (20.4%) amid growth in non-oil (3.7%) and government (2.4%) sectors. If confirmed, this would be the highest growth rate recorded since 2011. In qoq terms, overall GDP was up by 2.2%, aided by oil (2.9%) and non-oil (2.5%) sector activity while government services slipped (-0.9%).

- PMI in Saudi Arabia eased to 55.7 in Apr (Mar: 56.8), with the rate of new order growth the softest recorded since Jan. Purchasing activity and inventories rose at the sharpest rate since Dec 2017 as firms preferred to build stock levels in light of costs concerns. Only 9% of survey respondents gave a positive forecast for their output prospects in the next 12 months (vs 15% on average in 2021).

- Saudi Arabian Mining Co received an approval from the Capital Market Authority to double its capital (to SAR 24.6bn) by issuing bonus shares.

- Claims on the private sector in Saudi Arabia grew by 2.1% mom to SAE 2.13trn in Mar: this is the highest mom increase since Mar 2021. Claims on the government sector grew by a modest 1% mom.

- The outstanding balance of real estate loans provided by Saudi banks grew by 33% yoy in 2021. Specifically, the value of real estate loans to individuals increased by 41.5% to SAR 446bn while loans to corporate clients increased by 8.7%.

- Saudi Central Bank data disclosed that 13 bank branches and 81 ATMs were closed in Q1 2022. This is a continuation of a trend: the number of bank branches declined by 124 between 2017 and 2021 while ATMs saw a 10% drop during this period.

- Remittances from Saudi Arabia grew by 31.3% mom to SAR 14.7bn in Mar 2022: this is the highest volume since Jul 2020. Point of sale transactions also grew by 31.2% mom to SAR 51bn (potentially higher spending ahead of Ramadan).

- The Islamic finance industry in Saudi Arabia has nearly SAR 3trn (USD 799.7bn) in total assets, according to a senior SAMA official, which is approximately 28% of global Islamic financial assets. Lending by Saudi’s Islamic banks grew by a record 17.9% in 2021.

- The Saudi Central Bank plans to launch the second phase of the instant payment system Sarie later this year, according to Al Eqtisadiah. This phase will include four main services covering payment request service, account verification service, bundled payment service and one that enables the participation of financial technology companies in Sarie.

- Fitch revised the outlook on Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), to “positive” from “stable”; PIF’s rating was affirmed at “A”.

- Commercial licenses issued by the Ministry of Municipal and Rural Affairs and Housing in Saudi Arabia declined by 31% yoy to 238,800 in 2021. About 37% of the licenses were for the wholesale trade and retail sector.

- The Ministry of Industry and Mineral Resources disclosed a goal to attract investments worth USD 32bn to its mining and minerals sector through 9 new projects: towards this end, the Ministry has secured USD 4bn for a steel plate mill complex and USD 2bn for a electric vehicle battery metals plant. Furthermore, 145 applications for exploration licenses from foreign firms are currently being reviewed.

- Saudi Arabia is planning to launch its first national strategy for protecting intellectual property soon, according to a senior official from Saudi Authority for Intellectual Property (SAIP). The number of submitted patent applications and trademark registrations grew by 11% and 26% yoy respectively in 2021, revealed SAIP. Separately, the Office of the US Trade Representative has taken Saudi Arabia off its Priority Watch List in its annual Special 301 Report, after Saudi Arabia tightened up its IP enforcement procedures.

- The participation rate of women working in Saudi Arabia’s tech start-ups stood at 28% in Q3 2021, according to a report from Endeavor: this compares to just 17.5% in Europe. New commercial licenses issued to women rose to 139,754 in 2021: this is up 112% from 2015.

- Saudi Arabia’s Tourism Development Fund approved six strategic tourism projects worth SAR 1.5bn, reported Argaam.

- JLL MENA’s “KSA Real Estate Market” report showed that about 4k and 2k residential units were completed in Riyadh and Jeddah respectively in Q1 2022 (with 45k and 9k more expected to be delivered in the rest of the year). Similar increase in stock is expected across retail, office and hospitality as well.

- In a bid to become more environmentally friendly, Saudi Arabia signed an agreement with Lucid Motors to purchase a minimum of 50,000 electric vehicles (EVs) and upto 100k EVs over a 10-year period. Lucid plans to set an EV manufacturing plant in the country, with a capacity of producing upto 150k EVs every year.

- Saudi Arabia’s King Abdullah Port was labelled the second fastest growing globally by Alphaliner (a maritime transport data solution provider), with its ranking rising by 10 places to 73rd. Its thoroughput grew by 30.6% yoy to 2.81mn twenty-foot equivalent units in 2021.

- The number of worshippers in the Grand Holy Mosque’s third expansion reached about 19mn during Ramadan.

UAE Focus![]()

- UAE’s non-oil PMI fell slightly to 54.6 in Apr (Mar: 54.8): output and new orders expanded, but the latter’s growth softened to a 3-month low. Exports ticked up, with foreign new businesses posting the fastest increase since Jan 2021. Rising inflationary pressure is an ongoing concern, with panellists citing higher fuel charges and raw material prices. While average output prices rose for the first time in nine months, it was only marginally overall.

- Bank deposits in the UAE ticked up by 0.3% mom to AED 1.98trn at end-Feb 2022, according to the central bank.Money supply (M2) grew by 0.4% while gross banks’ assets declined by 0.2% to AED 3.2trn at end-Feb.

- UAE’s finance ministry will issue the first tranche of federal treasury bonds today (May 9th) with the central bank acting as issuing and payment agent.

- Dubai announced a new AED 370mn (USD 100.7mn) VC finance fund to support start-up projects in the emirate. The fund, to be overseen by the DIFC, will be launched in Jun 2022, and “aims to reinforce Dubai’s status as a leading fintech innovation hub”. It will run for 8 years and is estimated to create up to 8k jobs in addition to contributing up to AED 3bn to GDP.

- Dubai FDI Results & Rankings Highlights Report 2021 published by Dubai FDI revealed that Dubai attracted 618 FDI projects in 2021 with the value of FDI capital flows at AED 26bn (+5.5% yoy) and jobs created from such projects surged by 36% to 24,868. Dubai was ranked 1st globally and regionally in Greenfield FDO projects attraction. Dubai also attracted 43 Headquarters FDI projects in 2021, top-ranked in the region and second globally behind Singapore.

- London attracted USD 764mn of investments into 114 financial and professional services projects in 2021, overtaking Dubai and Singapore (which attracted 104 and 103 such projects), according to a report published by the City of London Corporation.

- Dubai Electricity and Water Authority plans to invest AED 40bn (USD 11bn) in capital expenditure over the next 5 years. Of this AED 16bn will be spent on boosting its electricity and water network, AED 12bn on existing independent power production projects and AED 3bn on district cooling services.

- Dubai Free Zones Council, during its latest meeting, disclosed that the free zones are on track to contribute AED 250bn (USD 68bn) to Dubai GDP by 2030.

- Dubai issued 18,013 e-Trader licenses between Mar 2017 and end-Mar 2022: of these 13,671 are professional licenses and rest commercial. In Q1 2022, 1605 licenses were issued.

- Dubai’s Virtual Assets Regulatory Authority announced that it would establish a metaverse HQ in “The Sandbox” (the 3rd largest metaverse based on the Ethereum blockchain and is backed by SoftBank). MetaHQ will be used to engage global virtual asset service providers to initiate applications, welcome new licensees and share expertise among others.

- The value of real estate transactions in Dubai touched AED 55.51bn in Q1 2022 from 20539 transactions. March alone saw a total of 8399 transactions (+83% on an annualised basis), worth AED 22.58bn (+109%). Abu Dhabi reported 3304 real estate deals worth AED 11.3bn in Q1.

- Abu Dhabi-listed Yahsat secured a contract worth AED 28.3mn (USD 7.7mn) from the UAE government to provide satellite communications for its public platforms.

- The Jebel Ali free zone started construction of its Logistics Park to meet the rising demand for warehousing units. The Park covers a total leasable area of more than 46,000 square metres (of which 87% will be allocated to warehousing and the remaining space for office facilities) and is scheduled for completion next year.

- Aldar Investment acquired a 70% equity interest in Abu Dhabi Business Hub, valued at USD 136mn, to launch Aldar Logistics, its new logistics real estate arm. The initial focus will be on the UAE market after which expansion plans include entry into Saudi Arabia and Egypt.

- Consumer spending in the UAE grew by 14% in Q1 2022, according to a study from Majid Al Futtaim. The report finds that online retail spending has tripled in Q1 versus Q1 2019 while e-commerce accounted for 11% of all retail spending in Q1, up from 5% pre-pandemic.

- UAE’s General Pension and Social Security Authority paid AED 87.74mn (USD 23.7mn) in pension and social security for citizens working in the private sector last year.

- UAE completed construction of the country’s first waste-to-energy plant in Sharjah, enabling the emirate to become the region’s first zero-waste city. The project will be capable of producing 30MW of low-carbon electricity, enough to power 28,000 homes in Sharjah.

Media Review

Why NOPEC, the bill to crush the OPEC, matters

https://www.reuters.com/world/us/why-nopec-us-bill-crush-opec-cartel-matters-2022-05-05/

Qatar scores as World Cup host but may not net long-term goals

Rystad Energy: $2.5trn in cash to flow from oil and gas sector to government coffers in 2022

Inflation & Stagflation:

The Fed Does Not Deserve All the Inflation Blame: https://www.project-syndicate.org/commentary/us-federal-reserve-inflation-blame-by-kenneth-rogoff-2022-05

The Gathering Stagflationary Storm: https://www.project-syndicate.org/commentary/world-economy-stagflationary-perfect-storm-by-nouriel-roubini-2022-04

Bill Gates explains “How to Prevent the Next Pandemic”

https://www.economist.com/culture/bill-gates-explains-how-to-prevent-the-next-pandemic/21809103