Weekly Insights 29 Apr 2022: Insights from the IMF Regional Economic Outlook for the MENA region (GCC focus)

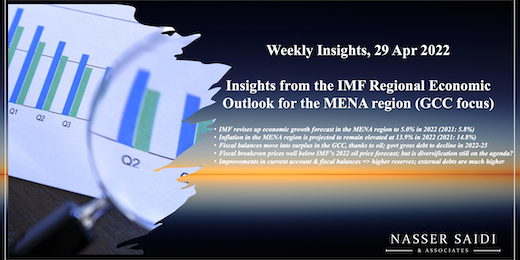

1. IMF revises up economic growth forecast in the MENA region to 5.0% in 2022 (2021: 5.8%)

- Note that MENA growth upgrade happened alongside a downward revision of global growth by the IMF to 3.6% in 2022 and 2023 (2021: 6.1%). The ongoing Russia-Ukraine war and rising inflation are key drivers of the downgrade in global growth forecasts, amid monetary policy tightening and withdrawal of pandemic stimulus

-

Growth recovery is uneven across the MENA region, with the oil exporters reporting the fastest growth (5.4%) versus the oil importers (4.0%)

- Oil exporters in general are expected to benefit from high rates of vaccination (resulting in greater mobility and rising domestic demand) and higher oil prices (allowing them to register budget and current account surpluses this year)

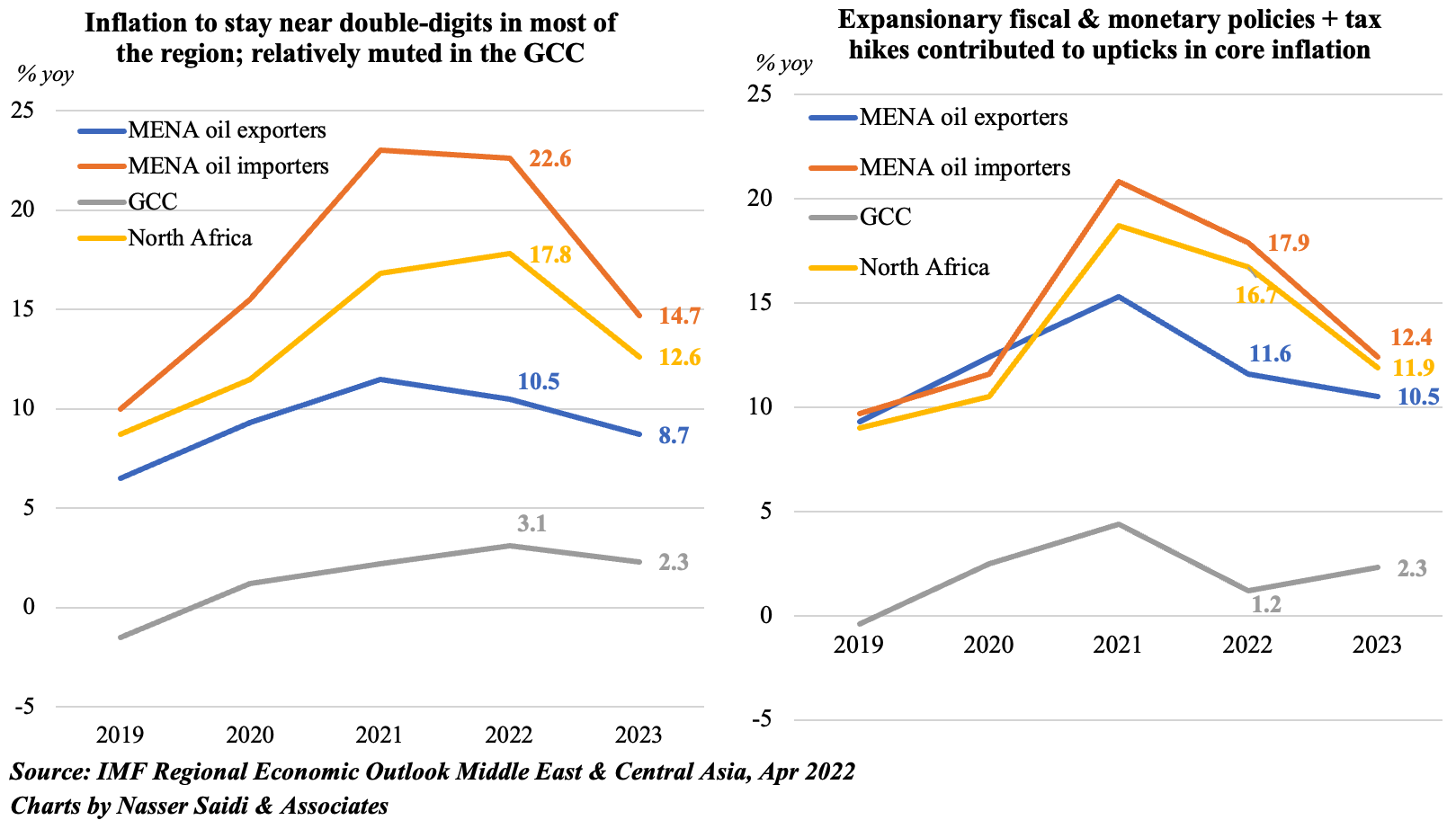

2. Inflation in the MENA region is projected to remain elevated at 13.9% in 2022 (2021: 14.8%)

-

Higher food & energy prices are driving up inflation. In relative terms, inflation in the GCC remains muted: lower weight of food in the CPI baskets is one of the reasons, but core inflation has been much higher given strong demand recovery and spillovers from expansionary policies followed during Covid; going forward, a stronger dollar will help keep imported inflation in check

-

In some cases, exchange rate depreciation (e.g. Algeria, Iran, Lebanon) and expansionary monetary and fiscal policies also contributed to the uptick in inflation

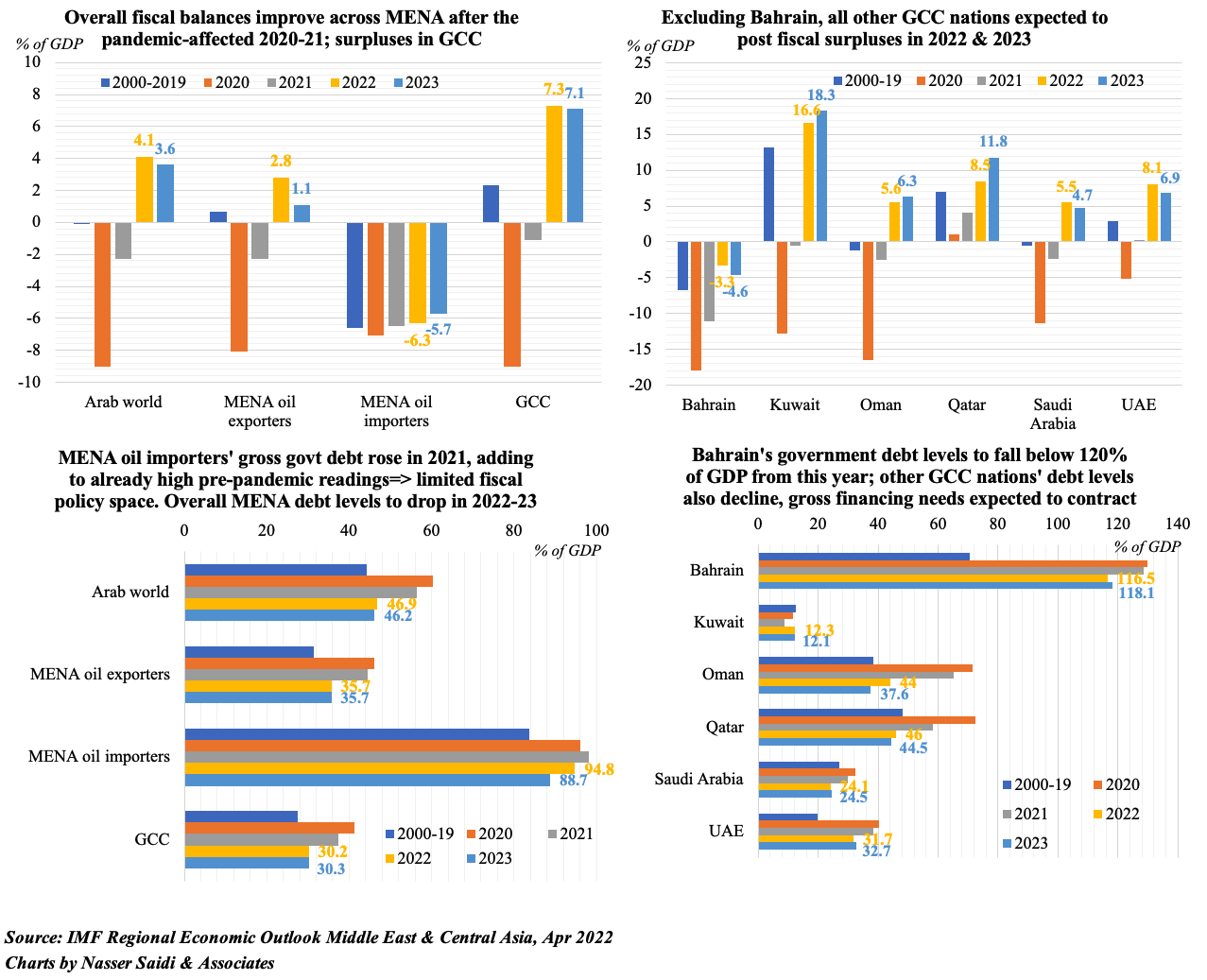

3. Fiscal balances move into surplus in the GCC, thanks to oil revenues; govt gross debt to decline in 2022-23

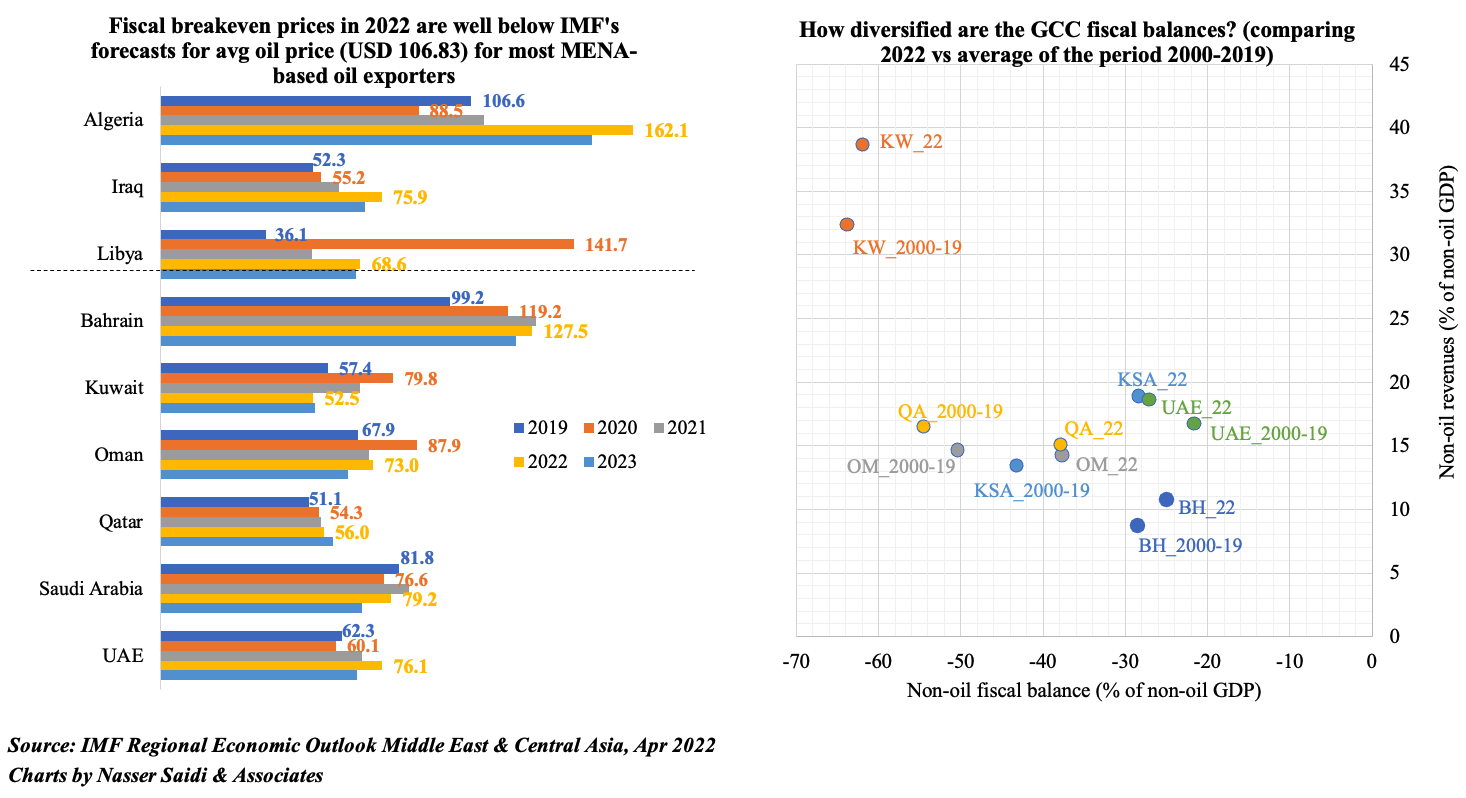

4. Fiscal breakeven prices well below IMF’s 2022 oil price forecast; but is diversification still on the agenda?

-

Fiscal breakeven prices (i.e. oil price needed to maintain a balance budget) remain lower than the current oil price for most oil exporting nations (Bahrain and Algeria are the outliers)

-

The chart on the RHS (below) shows a scatterplot with non-oil fiscal balance (as % of non-oil GDP) on the X-axis and non-oil revenue as % of GDP on the Y-axis. Other than UAE, all others have improved non-oil fiscal balance in 2022 compared to the 20-year average (2000-19). Non-oil revenues as % of GDP have increased in 2022 (vs the average in 2000-19) across all GCC nations (especially given the rollouts and/or hikes of taxes)

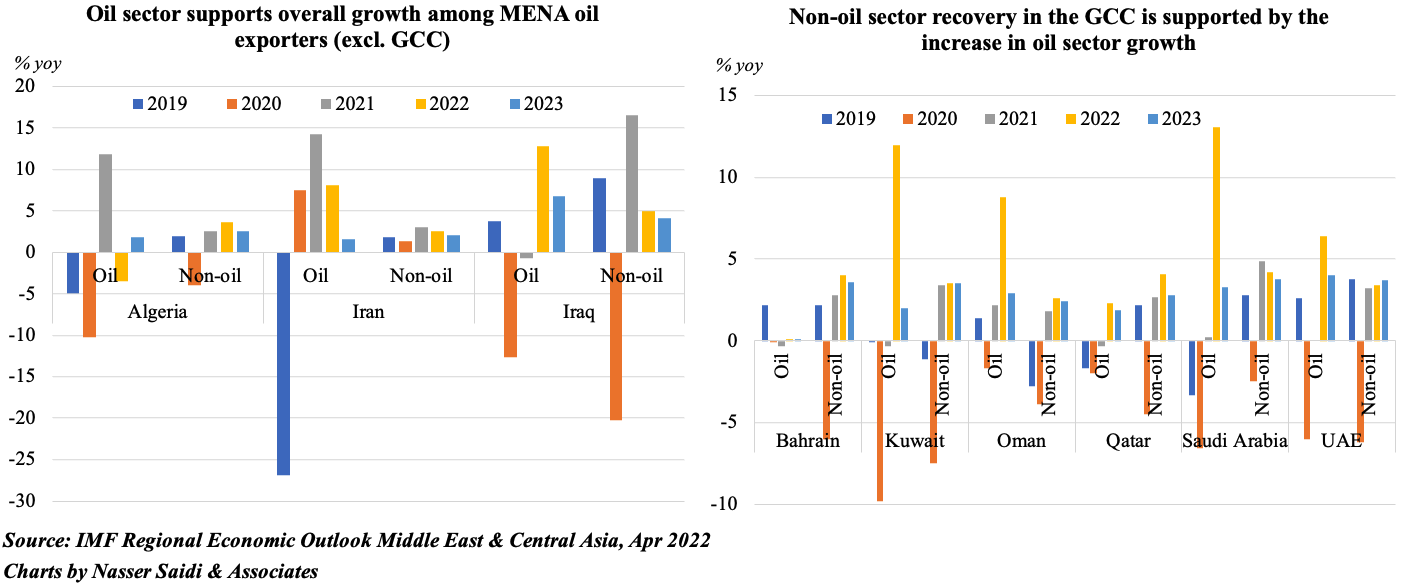

5. Improvements in current account & fiscal balances => higher reserves; external debts are much higher

- In the GCC and wider oil exporting nations, higher oil prices will help increase fiscal buffers & also widen current account surplus. Recent steps to deepen domestic capital markets (especially in Saudi and UAE) + debt management strategies will help manage capital flows. Together, fiscal & current account surpluses plus increased capital inflows will increase official reserves

- GCC external debt levels grew by an average 28.7% in 2021; improvements in economic activity will lead to a decline in 2022; some nations (Bahrain, for example) could be vulnerable to shocks. Current higher oil prices should be used to reduce debt burdens

- GCC should continue with fiscal reforms (revenue generating & expenditure reducing) for long-term sustainability