Markets

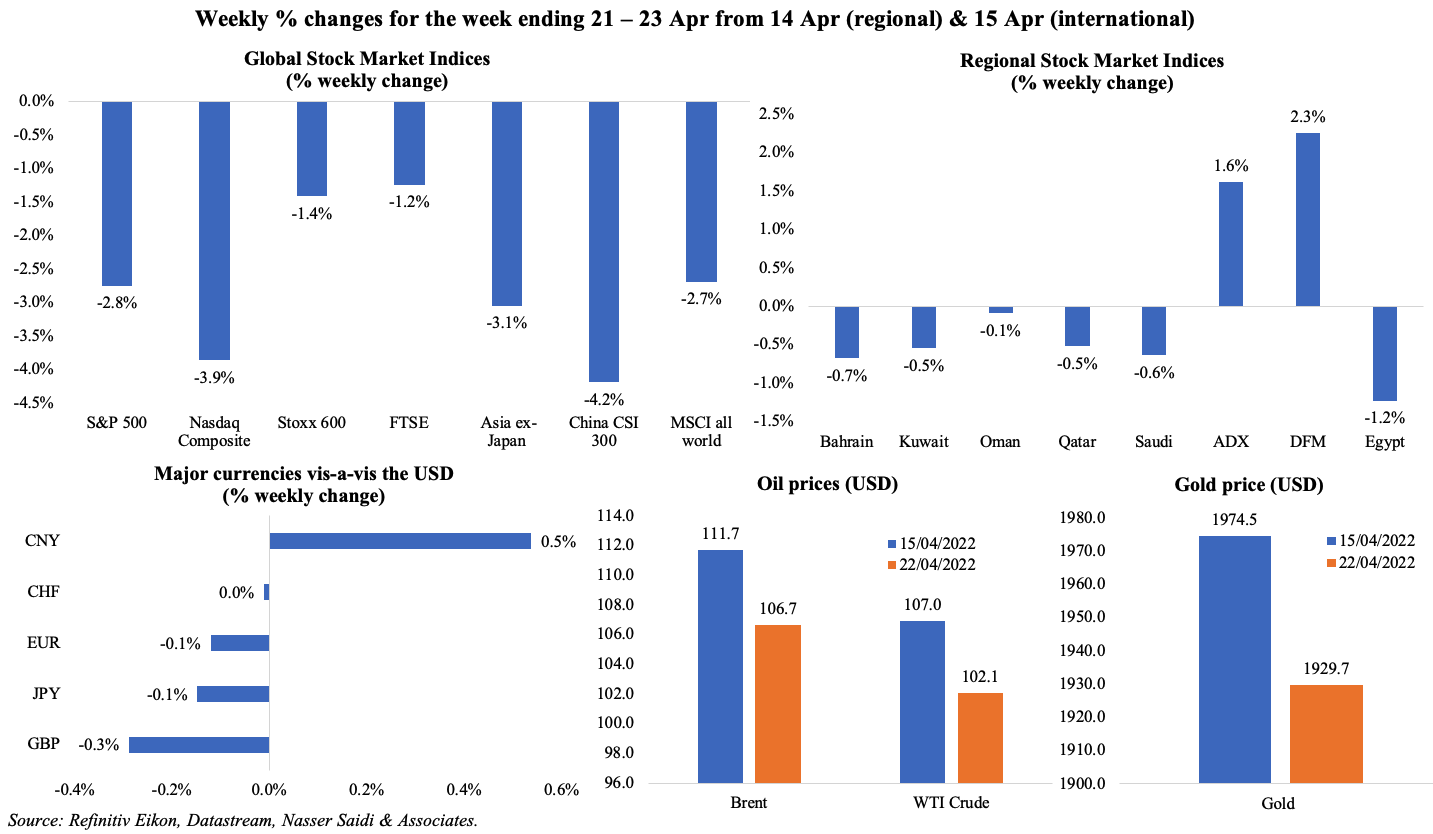

Major global markets ended in the red again last week: in the US, S&P 500 dropped the most in 7 weeks, while tech stocks fell more given some worse-than-expected earnings results (most notably Netflix); Covid outbreaks and lockdown fears led to a plunge in Chinese markets. In the region, UAE was the sole bright spot while lower crude prices led most other markets lower. The dollar surged on expectations of upcoming rate hikes, the pound sterling dropped to an 18-month low (on weak retail, consumer confidence and flash PMI readings) and Japanese yen fell to a 20-year low of 129 versus the greenback last week, as the Fed and BoJ policies diverge. Oil prices fell nearly 5% on growth concerns and possibility of extended lockdowns in China.

Global Developments

US/Americas:

- Fed’s Beige Book noted an acceleration in spending (among both retail and non-financial firms) and “solid overall” manufacturing activity while a tight labour market, higher input costs and rising inflation pose challenges.

- Philadelphia Fed manufacturing survey showed activity slowed to 17.6 in Apr (Mar: 27.4), dragged down by new orders (fell to 17.8 from 25.8) while prices-paid index rose to the highest reading since Jun 1979.

- S&P flash manufacturing PMI climbed to a 7-month high of 59.7 in Apr (Mar: 58.8) while overall composite output index slipped to 55.1 (Mar: 57.7) given a softer rise in services sector output as prices increased significantly.

- US building permits ticked up by 0.4% mom to 1.873mn in Mar. Housing starts also inched up slightly by 0.3% to 1.793mn in Mar, even as single-family housing starts dropped by 1.7%. The 30-year fixed-rate mortgage averaged 5.0% during the week ended Apr 14th, the highest since Feb 2011 (previous week: 4.72%), according to data from Freddie Mac.

- Existing home sales fell by 2.7% mom to 5.77mn in Mar, the lowest level since Jun 2020, as the median existing house price jumped 15% yoy to an all-time high of USD 375,300 in Mar.

- Initial jobless claims slowed to 184k in the week ended Apr 15th (prev: 186k), slightly raising the 4-week average to 177.25k. Continuing jobless claims slipped by 58k to 1.417mn in the week ending April 8th, clocking in the lowest since Feb 21, 1970.

Europe:

- France’s Macron beat Le Pen to win a second term: the CAC 40 slid earlier today, reflecting similar moves across the rest of Europe, as China’s lockdown concerns and upcoming interest rate hikes overshadowed Macron’s win.

- Inflation in the Eurozone was revised down slightly to 7.4% yoy in Mar from 7.5% previously, still at a record high; of this, 4.36 ppts was due to energy prices, 1.12 ppts from services and 1.07ppt from food, alcohol and tobacco. Core inflation stood at 2.9% yoy in Mar.

- Preliminary estimates of German manufacturing PMI slowed to a 20-month low of 54.1 in Apr (Mar: 56.9), as firms reported supply disruptions and weaker demand for goods. Services PMI improved, rising to an 8-month high of 57.9 (Mar: 56.1).

- Preliminary manufacturing PMI in the eurozone edged down to a 15-month low of 55.3 in Apr (Mar: 56.5) while the services PMI rose to 57.7 from 55.6 last month supported by easing of Covid19 restrictions. A near-record rise in firms’ costs as well as prices charged for goods and services rising “at an unprecedented rate” suggests further increase in inflation.

- Producer price index in Germany jumped by 30.9% yoy in Mar (Feb: 25.9%): this was the sharpest increase since data series began in 1949.

- Industrial production in the eurozone rebounded by 2% yoy in Feb (Jan: -1.5%), supported by an increase in durable (2.7%) and non-durable consumer goods (1.9%) while capital goods production fell by 0.1%.

- Trade deficit (seasonally adjusted) in the eurozone widened to EUR 9.4bn in Feb (Jan: EUR 7.7bn). Exports rose by 0.8% mom while imports grew at a faster 1.5%.

- Consumer confidence in the eurozone unexpectedly improved in Apr: down to -16.9 from -18.7 the month before. This was the first increase after six straight months of declines.

- UK’s preliminary manufacturing PMI inched up to 55.3 in Apr (Mar: 55.2) as orders almost stalled while services PMI eased to 58.3 from Mar’s 62.6 reading on weaker demand.

- Retail sales in the UK fell by 1.4% mom in Mar, following an upwardly revised 0.5% drop in Feb, pulled down by non-store retailing (-7.9%) and food sales (-1.1%). Excluding fuel, sales tumbled by 1.1% mom (Feb: -0.9%).

- The GfK consumer confidence plunged to a near all-time low of -38 in Apr (lowest was in 2008: -39).

Asia Pacific:

- China’s PBoC left interest rates unchanged at the latest scheduled meeting. Separately, he central bank chief stated that its accommodative monetary policy is “in a comfortable range” and that the apex bank “stands ready to support SMES with more instruments, if needed”.

- Inflation in Japan accelerated to 1.2% yoy in Mar (Feb: 0.9%), on rising material and energy costs. Excluding fresh food, prices were higher by 0.8% (Feb: 0.6%), the sharpest rise since Jan 2020, while inflation excluding food and energy dropped by 0.7% (Feb: -1%).

- Preliminary estimates of Japan’s manufacturing PMI slipped to 53.4 in Apr (Mar: 54.1) and services PMI moved into expansionary territory (50.5 from 49.4).

- Japan’s exports grew for the 13th consecutive month in Mar, rising by 14.7% yoy, and imports accelerated at a faster pace of 31.2%; trade deficit narrowed to JPY 412.4bn, remaining in deficit range for the 8th consecutive month.

- Industrial production in Japan rebounded by 2% mom in Feb, following the 2.4% drop in Jan. The uptick was supported by production of motor vehicles (15.5%) and transport equipment (14.8%). Capacity utilisation improved as well, gaining by 1.5% (Jan: -3.6%).

- India’s wholesale inflation surged to 14.55% in Mar (Feb: 13.11%) – a 4-month high and the second highest WPI print in the current 2011-12 series.

Bottom line: The IMF revised its global economic growth forecast down to 3.6% in 2022 and 2023 (2021: 6.1%), with the ongoing Russia-Ukraine war and rising inflation key drivers of the downgrade in the growth forecasts, amid monetary policy tightening and withdrawal of pandemic stimulus. This week, in addition to earnings from major US firms (Alphabet, Amazon, Apple and Meta), the Bank of Japan meets and is widely expected to remain dovish (the yen is already tumbling, given divergence of its policy from the Fed). Flash manufacturing PMI in Europe has seen multi-month lows and suggests higher inflation readings in the near-term; China’s extended lockdowns will exacerbate supply woes (one in 5 container ships is stuck at ports worldwide now), adding on to further price rises.

Regional Developments

- Bahrain is planning to double its contribution to the Future Generations Reserve Fund, reported Bloomberg. The plan is to set aside USD 1, 2 and 3 from every barrel of oil exceeding USD 40, 80 and 120 respectively.

- Bahrain’s FDI surged by 5.6% yoy to BHD 12.6bn (USD 33bn) in 2021, according to a report by the Information & eGovernment Authority. FDI inflows, at BHD 663.9mn, were dominated by financial and insurance activities (65%), followed by manufacturing; origin of the investments was Cayman Islands (41.3%), followed by Kuwait and Saudi Arabia.

- Moody’s affirmed Bahrain’s B2 ratings and upgraded outlook to “stable” from negative previously, citing “an easing of downside risks”.

- Egypt’s primary fiscal surplus stood at 1.46% of GDP in 2020-21, revealed the finance minister. Part of the surplus was used to finance interests of the public debt, helping to reduce total deficit to 7.4% of GDP. Increased public spending on social programs ticked up overall expenditures by 10% to a record high EGP 1.6trn (USD 86bn).

- Egypt reached a USD 373mn funding agreement with the Arab Monetary Fund.

- Egypt’s Suez Canal Economic Zone signed a deal (worth USD 3bn) to produce up to 350k tonnes of green energy to supply ships. Construction of the project will begin in 2024 and commercial operations in 2026.

- About 82,000 new cars in Egypt are being converted to use natural gas during this fiscal year (+48% yoy), disclosed the minister of petroleum and mineral resources. Currently there are 440k gas-powered vehicles in Egypt.

- Iran’s natural gas sector is seeking investments worth USD 80bn to boost production, according to Bloomberg. According to the oil minister, Iran might have to import fuel for some time as it would take time to raise production to required levels even post- lifting of sanctions.

- Iraq’s average oil exports stand at 3.4mn barrels per day, according to the head of SOMO.

- Saudi ministry of finance disclosed that USD 50mn had been disbursed to Jordan, as part of the fourth installment of Saudi’s grant to Joran – part of the agreement made in 2018.

- Annual inflation in Lebanon surged to 208% yoy in Mar, with transportation costs up 489%, health costs up by 441% and food and beverages rising by 390%.

- Maternal deaths have tripled in Lebanon, according to UNICEF: between 2019 and 2021, this increased from 13.7 to 37 deaths per 100k live births. The UNICEF report also highlighted the diminishing quality of services as some 40% of the doctors (specializing in women and children) and some 30% of the midwives have left the country, thereby drastically reducing access to basic healthcare.

- Oman’s sovereign wealth fund split its assets into local and foreign portfolios: the “national development portfolio” will manage local assets of more than 160 Omani firms while the “generation portfolio” will target achieving the highest returns for future generations.

- Bilateral trade between Oman and Iran touched a record high USD 1.336bn in the last fiscal year (ended Mar 20th), up 53% yoy. Exports to Oman surged by 63% to USD 716mn.

- Qatar Energy was in talks to understand interest from buyers while considering further expansion of its LNG capacity, reported Bloomberg. Talks centred around whether it should expand a project initiated in 2021 to build 6 gas liquefaction plants.

- Qatar aims to maintain a 6-month reserve for staple commodities, revealed the chief executive of the agricultural arm of the sovereign wealth fund. Total grain capacity will be increased to above 300k tonnes.

Saudi Arabia Focus

- The IMF revised growth forecast for Saudi Arabia upwards to 7.6% this year, before easing to 3.6% in 2023. This was largely due to the increase in oil production alongside more non-oil output growth. Inflation is estimated at 2.5% and 2% in 2022 and 2023 respectively.

- Saudi Cabinet approved an agreement signed with Egypt on investments by the Public Investment Fund in Egypt.

- Saudi Arabia was the top supplier of oil to China in March – though, at 6.858mn tonnes, shipments were down by 13% yoy. Shipments from Russia (in second place) was down by 14% to 6.39mn tonnes.

- Crude oil exports from Saudi Arabia increased by 4.4% mom to 7.307mn barrels per day in Feb, the highest level since Apr 2020, according to official data. Crude oil production also rose to 10.225mn bpd – the highest level in nearly two years.

- Saudi’s Capital Market Authority approved Aramco’s request to increase its capital to SAR 75bn through bonus shares issuance (1 bonus share for every 10 existing shares).

- Saudi Arabia’s Amwaj International plans to start book-building next month (for 4 days starting May 22nd), aiming to float 10% of its capital on the parallel market Nomu.

- Saudi Arabia issued SAR 9.98bn (USD 2.6bn) worth of SAR-dominated Sukuk in Apr.

- The head of the National Debt Management Center in Saudi Arabia disclosed that the sovereign fund is planning to issue international green bonds in the near future.

- Saudi EXIM Bank, Monsha’at and the international Islamic Trade Finance Corporation signed a tripartite Memorandum of Understanding to provide support for Saudi SMEs via financial facilities, training, capacity building and consultancy.

- Saudi Arabia plans to invest USD 100mn to establish the Tourism Support Fund, in collaboration with the World Bank. The Kingdom has invited donor countries and private sector to become part of the fund.

- Saudia disclosed that it operated over 40k flights in Q1 2022 (+44% yoy), transporting 5.1mn passengers (+75%), supported by the various entertainment and cultural events held during the quarter.

- The Red Sea Development Co. announced plans to use biofuels to operate all its tourist facilities, with the German firm MAN energy solutions chosen to supply 25 sets of biofuel generators with a total production capacity of 112 MW.

- Saudi Arabia will be able to produce the cheapest green and blue hydrogen globally, according to a study commissioned by KAPSARC. The cost of producing blue and green hydrogen is estimated to be around USD 1.34 and USD 2.16 per kilogram (vs between USD 3-5 per kilo in Europe, for green hydrogen). Including the cost of delivering via the Suez Canal, average cost of delivered hydrogen will average between USD 3.5-4.50 per kilo (depending on the carrier used).

UAE Focus![]()

- UAE announced the launch of the Dirham-denominated Treasury bonds, with an initial auction size of AED 1.5bn (USD 408.4mn); first auction date is expected in May, and initial periodic auctions will include tenures of 2, 3 and 5 years. The Ministry of Finance will represent the issuer and collaborate with the Central Bank to issue and pay out the T-Bonds.

- The latest visa reforms rolled out by the UAE, to come into effect from Sep this year, will support the growth of the non-oil sector and boost SMEs as the nation moves away from a reliance on sponsors: this includes 10 types of entry visas and new residency visas of up to 5 years. A job exploration entry visa to explore job opportunities (to latest graduates of the best 500 universities), visitors can stay for 60 days (vs 30 currently, not applicable to all nationalities), male children can be sponsored till age of 25 (instead of 18), and skilled professionals earning more than AED 30k monthly could apply for Golden Visa.

- Unemployment rate in Dubai stands at just 0.5% in spite of reporting an increase in its population by over 100k since 2020 to 3.5mn in Apr.

- The number of VAT registrants in the UAE grew by 2.42% qoq to 367,157 at end of Q1 2022 while the excise tax registrants grew by 3.02% to 1398.

- UAE’s sovereign wealth fund, Abu Dhabi Investment Authority, signed a USD 24.1mn deal to acquire a 10% stake in India’s HDFC Capital (a provider of affordable housing project finance). About 235,019 shares were sold at USD 102.64 per share.

- ENOC has no immediate plans for an IPO, reported Meed, citing a company spokesperson, though it will list in the near future given its alignment with the UAE’s national agenda.

- Abu Dhabi National Oil Co and Austria’s chemical producer Borealis plan to float 10% of their plastics joint venture Borouge and are targeting a USD 2bn IPO by end-Q2, reported Bloomberg.

- Sales of marine fuel in the UAE’s Fujairah marine refuelling and oil storage hub rose 13% in Mar – this was the first monthly rise since Oct when sales had touched a record high.

- Sharjah Economic Development Department disclosed that total number of licenses climbed by 7% to 17,509 in Q1 2022. Industrial licenses issued increased by 20%, while professional licenses issued grew by 18%.

- Property purchases in Dubai by Russian nationals surged by 67% in Q1 2022, according to a report by brokerage Betterhomes. Buyers from UK topped the list, followed by India, Italy, Canada and Russia. Total property transactions in Dubai stood at nearly 18k in Q1 2022, with a sales value of about USD 11.7bn.

- Careem Pay rolled out a digital wallet to UAE customers: this will allow customers to use QR codes, payment links to their phone number to send, request or receive money (without adding as a beneficiary or giving IBAN details); any UAE bank account can receive money from the wallet.

- The Abu Dhabi National Exhibitions Company (ADNEC), a subsidiary of ADQ, disclosed that it added AED 2.4bn (USD 653bn) to the Abu Dhabi economy in 2021 (both direct and indirect impact).

Media Review

Cheap Indian wheat faces quality checks, high freight cost for Egypt export

Saudi bets big on AI developing local capabilities to disrupt economy

https://www.arabnews.com/node/2066621/business-economy

Emmanuel Macron wins a second term as France’s president

https://www.economist.com/europe/2022/04/24/emmanuel-macron-wins-a-second-term-as-frances-president

Crypto industry’s Super Bowl ad blitz comes up short

https://www.ft.com/content/feb76586-065e-41a7-9903-de5e62aec2fd