Markets

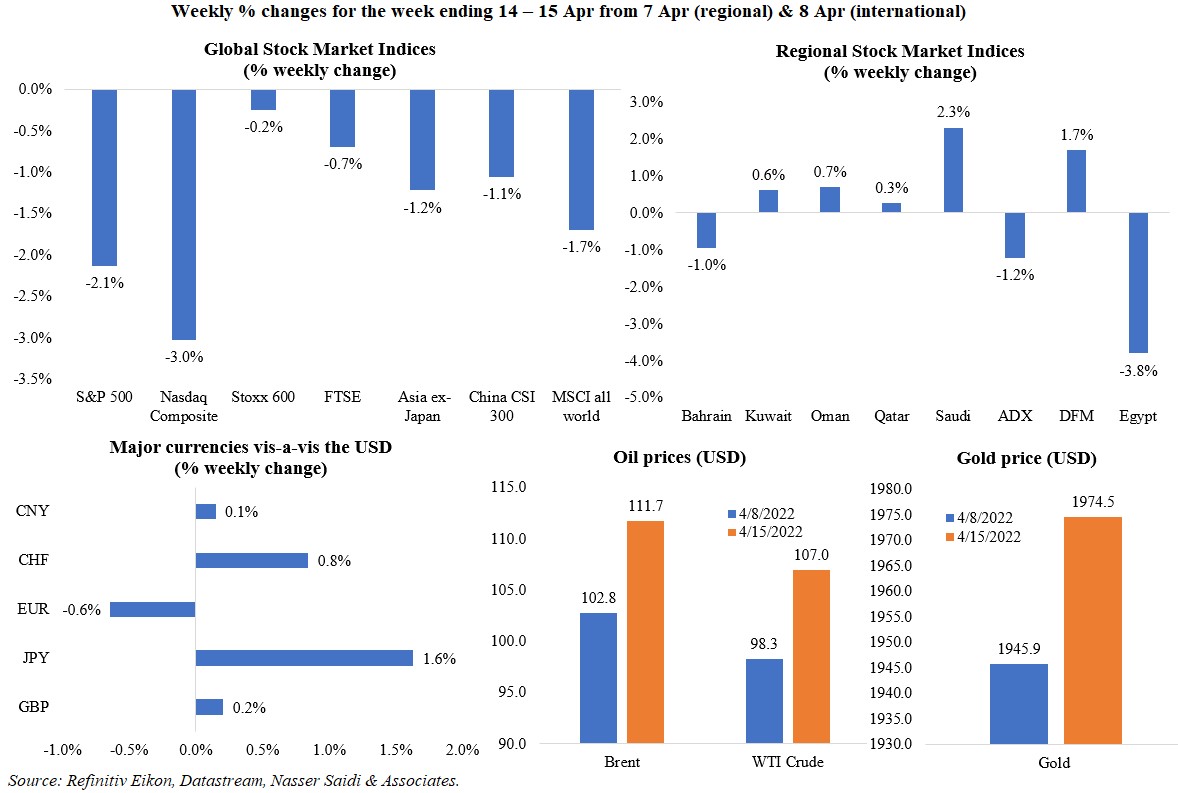

Major global equity markets ended in the red last week, with mixed earnings results and economic data (rising inflation). In the region, Saudi Tadawul and UAE’s DFM gained, the latter supported by DEWA’s IPO; UAE’s ADX fell after news that First Abu Dhabi Bank withdrew its offer for a controlling stake in Egypt’s EFG Hermes (Thursday saw EFG Hermes plunge by nearly 20% – its biggest % decline in more than 5 years). The euro hit a nearly two-year low vis-à-vis the dollar as the ECB decided to leave rates unchanged but cautioned about inflation risks while the yen tumbled to a two-decade low vis-à-vis the dollar given the BoJ’s pledge to continue stimulus measures to support economic recovery (in contrast to tightening signals elsewhere). Oil prices surged by more than 8% from a week ago while gold inched up by around 1.5%.

Global Developments

US/Americas:

- Inflation in the US surged to 8.5% in Mar (Feb: 7.9%), the highest since 1981; while price increases were broad-based, gasoline index was the main driver of prices (+18.3%) followed by food (8.8%). Excluding food and energy, inflation inched up to 6.5% from 6.4% in Feb.

- Producer price index increased to 11.2% yoy in Mar (Feb: 10.3%), largely driven by the increase in energy prices. In mom terms, PPI increased by 1.4% – the largest gain since Dec 2009 when the series was revamped. Excluding food and energy, PPI rose to 9.2% yoy (Feb: 8.7%).

- Retail sales in the US inched up by 0.5% mom in Mar (Feb: 0.8%). Sales at gas stations surged the most (+8.9%) followed by general merchandise stores (5.4%) and hobby and sporting goods stores (3.3%). Excluding autos, retail sales grew by 1.1% (Feb: 0.6%).

- Michigan consumer sentiment index unexpectedly increased to 65.7 in Apr (Mar: 59.4), with the current conditions gauge rising to 68.1 from 67.2. The New York Empire State manufacturing index rebounded to 24.6 in Apr (Mar: -11.8) as new orders and shipments grew (to 25.1 and 35.4 respectively, from negative readings in Mar).

- Industrial production in the US gained by 0.9% mom in Mar, supported by manufacturing output (+0.9%) as output of motor vehicles and parts improved. Capacity utilisation improved to 78.3% from 77.7% the month before.

- Initial jobless claims inched up to 185k in the week ended Apr 8th (prev: 167k), slightly raising the 4-week average to 172.25k. Continuing jobless claims slipped to 1.475mn in the week ending April 1st from 1.523mn the week prior.

Europe:

- ECB left its policy rates unchanged at the latest meeting while confirming the end of its bond buying in Q3. Though warning about inflationary risks, Lagarde called for “close monitoring” of the situation while avoiding any mention of the timing of the rate hike.

- The ZEW economic sentiment for Germany slipped to -41 in Apr (Mar: -39.3) while the current situation reading worsened to -30.8 from -21.4. In the wider eurozone, economic sentiment declined by 4.3 points to -43 in Apr and the current situation fell to a new level of -28.5, down 6.6 points from the month before.

- GDP in the UK edged up by 0.1% between Jan and Feb, easing from 0.8% the previous month. Services sector grew by 0.2% mom while manufacturing production fell by 0.4%. Industrial production declined by 0.6% mom in Feb, following a 0.7% uptick in Jan. Overall, the economy was 1.5% bigger than its pre-pandemic level.

- Inflation in the UK surged to a new 30-year high of 7% yoy in Mar (Feb: 6.2%), with core inflation up to 5.7% from 5.2% the month before. Transport fuel prices accounted for much of the increase, rising by 30.7% yoy, while food prices rose by a decade-high 5.9%. Producer price index for both input and output increased: input prices rose to 19.2% (Feb: 15.1%) while output prices were up 11.9% in Mar (vs Feb’s 10.2%).

- Unemployment rate in the UK inched down to 3.8% in the three months to Feb from 3.9% previously (ILO). Average earning including bonus increased to 5.4% from 4.8%.

- Like-for-like retail sales in the UK dropped by 0.4% yoy in Mar (Feb: 2.7%).

Asia Pacific:

- China’s GDP grew by a better-than-expected 4.8% yoy in Q1 (Q4: 4%).

- Inflation in China ticked up to a 3-month high of 1.5% yoy in Mar (Feb: 0.9%); food prices fell by 1.5% in Mar, narrowing from Feb’s 3.9% fall. Core inflation stood at 1.1%, unchanged from Feb. Producer price index increased to 8.3% in Mar, easing from Feb’s 8.8% rise.

- Exports from China increased by 14.7% yoy in Mar (Jan-Feb: 16.3%) while imports unexpectedly fell by 0.1% – the first decline since Aug 2020 – largely due to delays in freight arrivals and weak domestic demand given the lockdowns. The trade surplus stood at USD 47.38bn in Mar from USD 115.95bn in Jan-Feb. Conditions are likely to worsen in Apr, given the impact from Shanghai’s lockdown, increased port congestions and slow customs clearance.

- Money supply in China grew by 9.7% in Mar (Feb: 9.2%). New loans surged to CNY 3130bn (USD 492bn) in Mar (Feb: CNY 1230bn). New bank lending in rose by 8.7% yoy to a record of CNY 8.34trn yuan in Q1. Outstanding yuan loans grew by 11.4% yoy. Retail sales fell by 3.5% – the first yoy decline since Jul 2020.

- FDI into China expanded by 25.6% yoy in Q1 2022 (Jan-Feb: 37.9%), with investment into hi-tech manufacturing and hi-tech service sector up by 35.7% and 57.8% respectively.

- China’s official unemployment rate increased to 5.8% in Mar, the highest since May 2020.

- Japan’s machinery orders fell by 9.8% mom in Feb, faster than the 2% drop recorded in Jan. Firms have held off on investments given the rise in costs of raw materials and energy.

- The Bank of Korea delivered a surprise rate hike, raising the base rate by 25bps to 1.5%. The bank warned inflation could top 4%, up from its Feb forecast of 3.1%.

- Industrial output in India grew by 1.7% yoy in Feb (Jan: 1.3%), supported by the 0.8% growth in manufacturing output (Jan: 1.1%). Growth in capital goods production slowed to 1.1% (Jan: 1.4%) while both consumer durables and non-durables contracted.

- Retail inflation in India increased to a 17-month high of 6.95% in Mar (Feb: 6.07%), standing above 6% (RBI’s upper limit) for the 3rd consecutive month, and driven by increases in fuel and food prices.

- Singapore’s GDP rose by 0.4% qoq and 3.4% yoy in Q1 2022: this was slower than the 2.3% qoq and 6.1% yoy expansion posted in Q4 2021. Goods producing industries grew by 5.3% yoy in Q1 (manufacturing by 6% and construction by 1.8%) while goods producing industries grew by 3.9%.

- Singapore’s central bank MAS tightened its monetary policy for the third time in 6 months: it not only re-centred the midpoint of the nominal effective exchange rate (SGD NEER) but also slightly increased the rate of appreciation of the policy band (using both tools simultaneously for the first time in 12 years).

Bottom line: The IMF’s World Uncertainty Index was climbing again, given the war in Ukraine, with war-related uncertainty accounting for 40% of the global total. The Cboe Volatility Index (Vix) has remained higher than its historic median of 17.6 for most of this year. With the ongoing Russia-Ukraine war, Shanghai in lockdown and high inflationary pressures, it is no surprise that global economic growth forecasts are being revised down. The IMF’s World Economic Outlook report will be released this week: the MD has already stated that growth forecasts will be downgraded for around 143 countries in both 2022 and 2023, given “a crisis on top of a crisis”. The WTO has slashed global trade growth to 3% this year (from 4.7% previously) because of the impact of the Russia-Ukraine war and warned of a potential food crisis. The World Bank in its latest update to MENA region nations has warned that net importers of fuel and food remained the most vulnerable. Lastly, climate change initiatives seem to be sent to the backseat again: in a major reversal, the US has allowed oil and gas leases to resume on federal land, as Biden battles the rise in pump prices.

Regional Developments

- The World Bank forecasts MENA to grow by 5.2% this year, adding a caveat that it “could end up being optimistic, as has been the pattern over the past decade”. The GCC is expected to grow by 5.9%, supported by the uptick in oil prices, and oil importers by 4%; nations that are net importers of oil and good remain vulnerable, especially so if burdened by high debt-to-GDP ratios. Separately, 11 out of the 17 MENA nations are not expected to exceed their pre-pandemic per capita GDP in 2022. The full report can be accessed at: https://openknowledge.worldbank.org/bitstream/handle/10986/37246/9781464818653.pdf

- Signs of recovery in Bahrain’s economy in Q1 2022, as disclosed by the Finance and National Economy Ministry: value of exports grew by 64.7% yoy; new commercial licenses issued increased by 35.4%; real estate sector transactions grew by 19.6%; average occupancy in 4- and 5-star hotels increased to 55% (vs 43.5% a year ago); mall visitors increased by 26.9%; Bahrain’s equity market reported a 33.3% rise.

- Exports from Egypt increased by 34.5% yoy to USD 3.99bn in Jan while imports declined by 2.2% to USD 6.43bn. This narrowed the trade deficit to USD 2.44bn (-32.3% yoy).

- Current account deficit in Egypt narrowed to USD 3.8bn in Oct-Dec 2021 from USD 4.85bn in the same period a year ago, supported by a recovery in tourism revenues (to USD 3bn from USD 987mn). Trade deficit widened to USD 10.7bn (+1.9% yoy) and net FDI declined by 8% to USD 1.61bn) while net portfolio investment fell to a deficit of USD 6.1bn from a surplus of USD 3.5bn a year ago.

- UAE’s ADQ revealed multiple investment transactions in Egypt’s firms, to support the economy: this includes stakes in the Commercial International Bank, e-payments platform Fawry, logistics company Alexandria Container & Cargo, Misr Fertilizers Production Co., and Abu Qir Fertilizers & Chemical Industries. Reuters reported the value of the transactions at USD 1.85bn, citing sources.

- Cars accounted for 47% of Egypt’s durable goods imports in 2021, reported Al Arabiya. Overall, durable consumer goods imports expanded by 26.6% yoy to USD 7.87bn in 2021.

- Egypt sealed deals to purchase 350,000 tons of wheat last week, the majority of which will come from Europe (240,000 tons from France, 50,000 tons from Bulgaria and 60,000 tons from Russia) and are scheduled for arrival before June 15th. This followed a tender launched on Monday by the General Authority for Supply Commodities. Separately, Egypt has added India to its list of countries from which it imports wheat.

- Unemployment in Egypt stood at 7.4% in 2021, down by 0.5% from 2020, while youth unemployment rate was about 15% (male and female youth unemployment at 10.8% and 35.9% respectively). Egypt’s estimate workforce grew by 3.2% yoy to 29.3mn in 2021.

- Egypt’s government allocated more than EGP 1.1bn for the development of digital skills: under the Future Work is Digital initiative, more than 180k young persons have been trained in web design and development, programming, and digital marketing among others.

- Iraq’s oil minister revealed on Al Hadath TV that the nation was pressured to increase oil output outside of OPEC’s policy on production rises.

- Despite the increase in Russian crude oil imports into India, Iraq still maintains its position in the Indian market given existing contracts with the government and private refineries, reported the state news agency citing the head of Iraq’s State Oil Marketing Organization.

- Credit disbursed by Kuwait’s banks increased a record high level of KWD 43.162bn in Feb (+1.04% mom and 7.87% yoy). Deposits meanwhile grew by 0.38% mom to KWD 45.46bn.

- The volume of Kuwaiti reserves deposited with the IMF increased by 7.9% yoy to KWD 236.5mn at end-Jan 2022; this was however unchanged from end-Dec.

- Lebanon’s government will disburse USD 15.3mn in credit to importers, to temporarily resolve bread shortages; the economy minister revealed that the funds would last only about 2-3 weeks and that another credit line will need to be opened afterwards.

- Visitors into Oman surged to 122,000 in Feb 2022 (vs 23,000 in Feb 2021), bringing the year-to-date total to 230k persons. Arrivals from GCC accounted for 36.9% of the total while visitors from India, France and UK had a share of 12.7%, 4.2% and 4% respectively. Hotel occupancy increased to 52.5% in Feb this year, up from 39.1% a year ago.

- The Oman Investment Authority (OIA) is targeting the privatization more than 30 affiliated companies by 2025, according to the Chairman. He also disclosed that the OIA supported the state budget providing more than OMR 1bn, which come from profits of its companies (and not sale of assets).

- Saudi PIF advanced to 5th among global sovereign wealth funds, ranked by assets (Source: SWF Institute). It follows Kuwait Investment Authority (3rd) and Abu Dhabi Investment Authority (4th) from the region, in a list topped by the Norway Government Pension Fund and the China Investment Corporation.

Saudi Arabia Focus

- Inflation in Saudi Arabia inched up to 2% yoy in Mar (Feb: .6%), driven by increases in transportation and food and beverages costs, up by 4.7% and 3% respectively.

- Saudi Competition Authority approved 49 applications for mergers and acquisitions in Q1 2022 (+88% yoy); it also received 101 applications for economic concentration (includes JVs in addition to M&As) during the quarter (+42% yoy).

- Compared to Jan 2022, Saudi holdings of US treasuries declined by USD 2.7bn to USD 116.7bn in Feb. Saudi is the 18th largest holder of US debt.

- Foreign investors ownership of Saudi stock market increased to SAR 404.26bn, with investors owning shares in 211 of 215 listed firms on Tadawul. Foreign ownership is equivalent to only 3.36% of the total market cap.

- The share of payment transactions in Saudi Arabia using near-field communication increased to 35% in 2021 (2020: 22%). Such payments accounted for 95% of all point-of-sale transactions last year, up from 88% in 2020.

- SAMA issued a license for consumer microfinance operations to Sulfah – this is the third such license issued. Such firms target individuals and small businesses.

- Fitch revised its outlook to “positive” for Saudi Arabia from “stable” previously. The firm forecasts government debt to GDP ratio to remain below 30% until 2025 and expects budget surpluses to the tune of 6.7% and 3.5% of GDP in 2022 and 2023 respectively.

- Saudi Ports throughput increased by 7.18% to more than 74mn tons in Q1 2022. Number of cars reportedly increased by 21.85% to a total of 219,488.

- The number of non-profit organisations in Saudi Arabia has risen to more than 3,400 (+164%) while the number of specialised organisations increased to more than 69%.

- A Saudi Advanced Manufacturing Hub (Saudi AMHUB) strategy was launched in coordination with the World Economic Forum to promote industrial innovation and advanced manufacturing. Consisting of 24 core members, the hub aims to provide practical solutions to the industrial sector in addition to improving operational and financial efficiency.

- Saudi Arabia’s National Housing Co. launched 5,000 new residential villas in Riyadh as part of the Sakani program (launched in 2017 to facilitate home ownership, with a goal to reach 70% home ownership by 2030).

- Health specialities in Saudi Arabia will be localised by 60% while engineering and technical professions related to the health sector will be localised by 30%.

UAE Focus![]()

- UAE Cabinet approved a Digital Economy Strategy, with an aim to double the sector’s contribution to 19.4% of GDP (from 9.7%) in the next decade. The Strategy includes more than 30 initiatives, targeting 6 sectors and 5 new areas of growth.

- The UAE adopted an agreement to link payment systems across the GCC, as part of the recent Cabinet resolutions. No details were provided about the agreement.

- Dubai PMI increased to a 33-month high of 55.5 in Mar (Feb: 54.1), supported by output growth in the travel and tourism as well as the construction sectors (to the highest since Jun 2019). Input and output costs continue to diverge with input costs rising for the 14th consecutive month even as selling prices were reduced (lower charges, promotions) to support sales recovery.

- Abu Dhabi Exchange rebranded and relaunched its Second Market into a Growth Market (with a market cap of AED 62bn or USD 7bn). The Market will target startups, family businesses and early growth companies.

- DEWA IPO: Bloomberg reported that UAE-based investors covered half the total order book, and around 30% were international investors; BlackRock, Vanguard Group and Fidelity Investments were among key investors in DEWA’s USD 6.1bn IPO. DEWA gained almost 18% on the first day of its trading.

- ADQ and Chimera Investments have partnered to set up the UAE’s first SPAC: the SPAC plans to raise AED 367mn (USD 100mn) through an IPO of 36.7mn shares.

- South Korea and the UAE agreed to extend its AED 20bn (USD 5.5bn) currency swap agreement for another 5 years (effective from April 13th).

- Dubai’s Department of Economy and Tourism issued a total of 24,662 new business licenses in Q1 2022, up 58% yoy. The share of professional licenses was 57%.

- The Dubai Multi-Commodities Centre (DMCC) reported that a record-breaking number of 665 firms joined the freezone in Q1 2022 (+13% yoy and 25% rise vs the 5-year average). Specific outreach programs have seen a 34% increase in Chinese firms while quarterly company registrations from Israel and Turkey surged 350% and 100% during Q1. Separately, 16% of company registrations in Q1 were for crypto-related activities.

- Registered members of the Sharjah Chamber of Commerce and Industry grew by 8% to 17,568 in Q1 2022: 1996 new companies joined and more than 15k memberships were renewed, marking the highest since 2018.

- Dubai International Airport remained the busiest for international travellers in 2021, welcoming 29.1mn passengers (+12.7% yoy). Top 10 busiest airports (including domestic travel) globally included 8 from the US and 2 from China.

- Hotel occupancy in Dubai reached a 15-year high of 91.7% in March; average daily rates touched AED 891.46 and revenue per available room (RevPAR) stood at AED 817.9.

- Dubai Chamber of Commerce announced that its paperless strategy had resulted in cost savings to the tune of AED 11mn and having saved 1 mn sheets of paper last year.

Media Review

China’s lockdown & global supply chain paralysis

Can Silicon Valley still dominate global innovation?

https://www.economist.com/business/can-silicon-valley-still-dominate-global-innovation/21808708

ADGM’s FSRA issued a discussion paper on Decentralised Finance (DeFi)

Carbon-linked crypto tokens alarm climate experts

https://www.ft.com/content/ed76933e-43ed-4e72-ac19-ef47a731a595