Weekly Insights 15 Apr 2022: Will War & Inflation derail the global economic recovery?

1. Global food prices rise to record highs: time for MENA to re-think & reorient food security policy

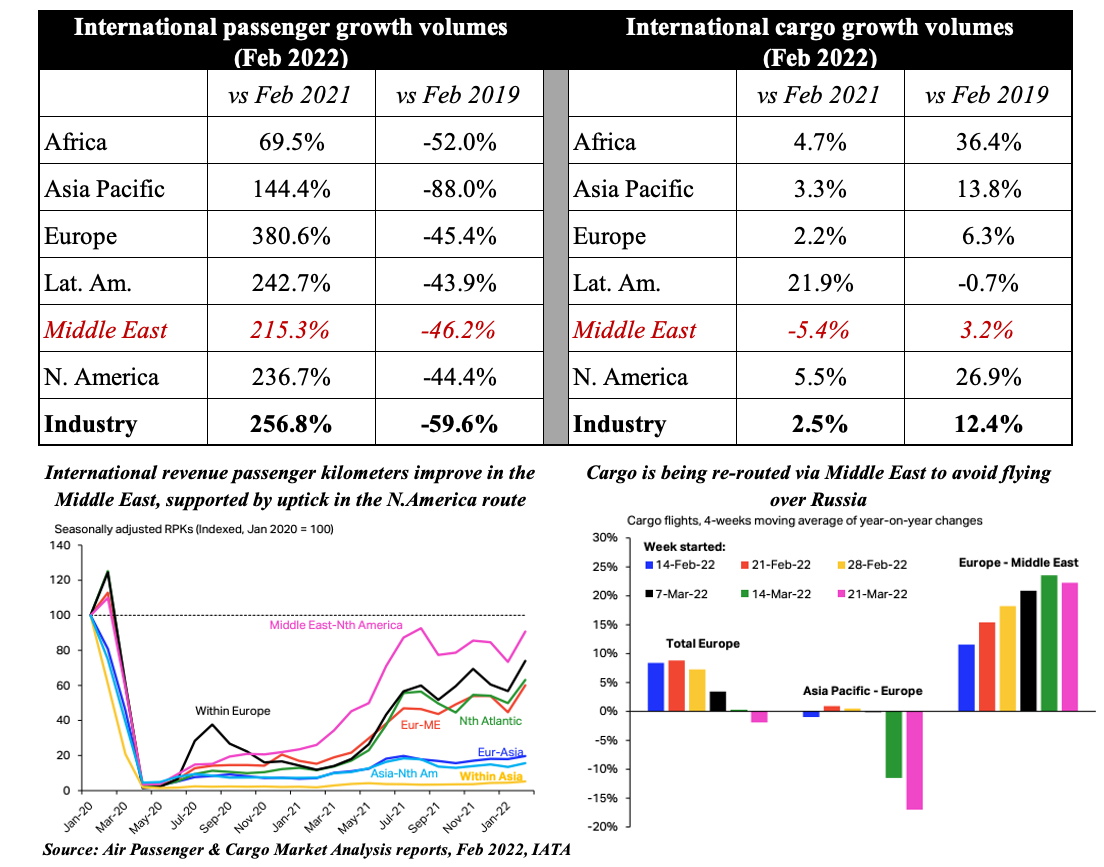

- The Food and Agriculture Organisation (FAO) revealed that its food price index increased by 13% mom to hit a record high in Mar 2022. In yoy terms, prices surged by 31%, driven by cereals (35%) and edible oils (53.5%)

- Covid related food supply disruptions have been exacerbated by the Russia-Ukraine war. It has led to a halt in Ukraine’s exports & planting of crops has been severely reduced

- Ukraine & Russia account for one-third of the world’s wheat and barley exports, and absent a ceasefire, food (and feed) prices could rise even further, leading to food insecurity and malnutrition in relatively poorer nations

- Food insecurity is a pressing issue for the MENA region which have many high food-import dependent nations. Already in 2020, MENA’s share of the world’s acutely food insecure people was 20%, disproportionately high compared to its 6% share of the global population (World Bank)

- The World Food Program highlights the plight of Yemen (civil conflict), Syria (food shortage), Egypt (heavily subsidized bread => strain on public finance) & Lebanon (port blast + economic crisis) among others like Libya & Tunisia

- Bottom line: This is a wake-up call for the region to invest in (a) use of innovative technology (AgriTech, hydroponics, vertical farming); (b) efficiency of importing food & storing it; (c) diversify food suppliers; (d) investments in arable land abroad

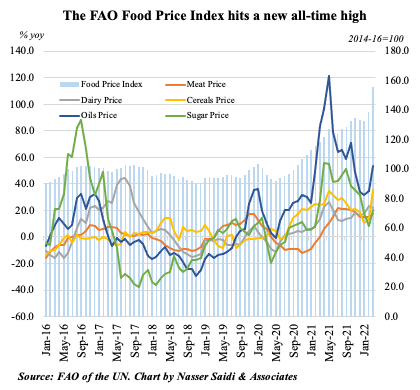

2. Food price inflation is surpassing headline inflation across the Middle East

3. Global trade, still grappling with supply chain/ logistics issues, is also affected by the Russia-Ukraine war

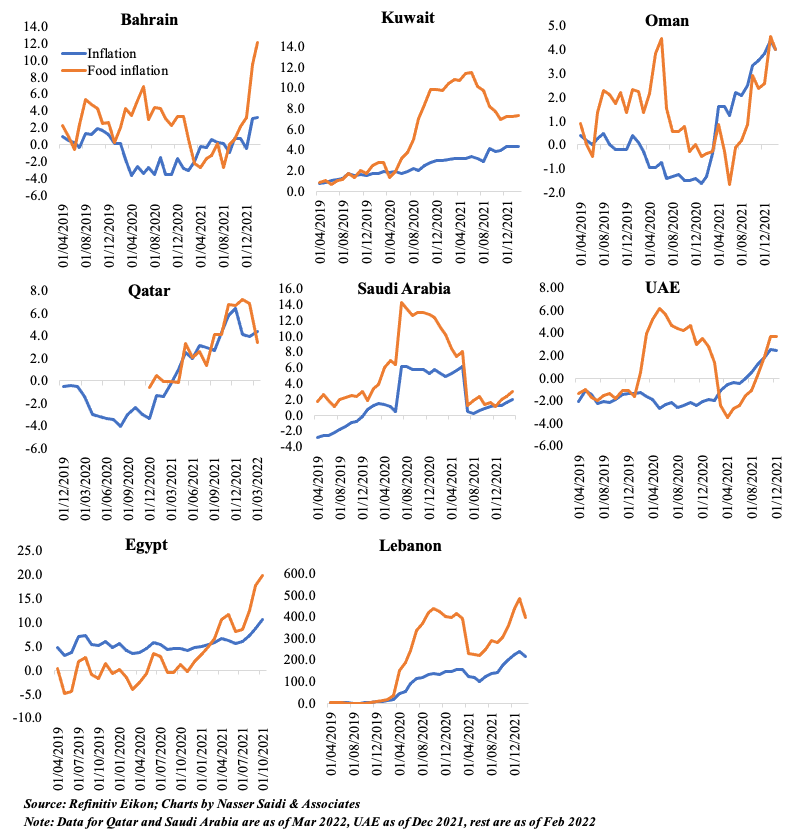

- The WTO downgraded merchandise trade volume growth to 3.0% in 2022 (down from a previous forecast of 4.7%) and by 3.4% in 2023 (April 2022)

- Lockdowns and factory closures in Asia + shortages of raw materials/ inputs + war & related sanctions => pushing prices higher (uptick in input and output price sub-indices in manufacturing PMI; rising food prices) + decline in international trade (new export orders fell to 48.2 in Mar, the lowest since Jul 2020; transport services will be affected, especially container shipping & air transport) => lower economic activity

4. Cargo transport costs remain high & rising

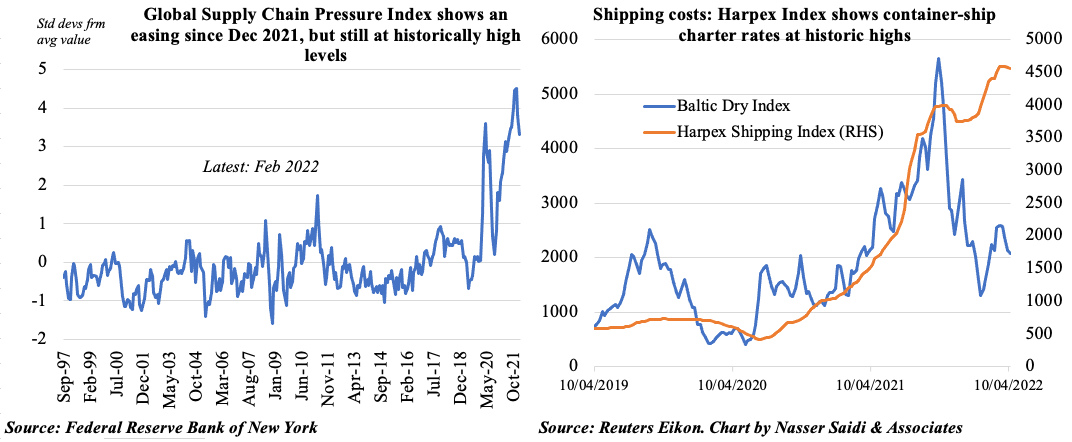

- Supply chain pressures seem to be easing, but the current lockdowns in China and prolonged Russia-Ukraine war could be further disruptive (depending on duration & impact on manufacturing)

- Clarksons Global Port Congestion index is very close to an all-time high and is a key driver of shipping rates

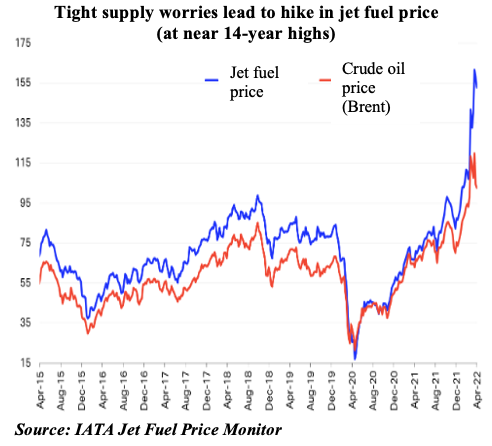

- Shipping costs remain at historic highs, while the alternative of air cargo will likely become more expensive given the recent surge in jet fuel prices

5. Is the Middle East Airline Industry in a “recovery” phase?

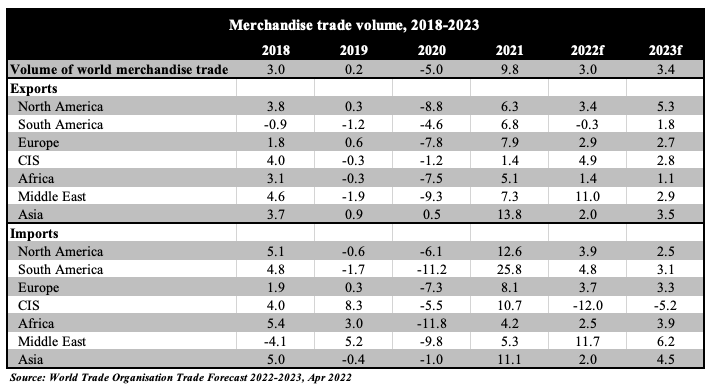

- International passenger growth was up by 215.3% yoy in the Middle East in Feb; but still 46% below pre-Covid levels

- The improvement is driven by its long-haul flights, especially MENA segment, as flights to Europe have not recovered as much; travel restrictions in Asia delays recovery in that segment

- Feb cargo growth data shows Middle East as only region posting a decline compared to a year ago, but recent high-frequency data for Mar shows that region will benefit from the ongoing Russia-Ukraine war – given cargo flights will be redirected to avoid Russian air space