Markets

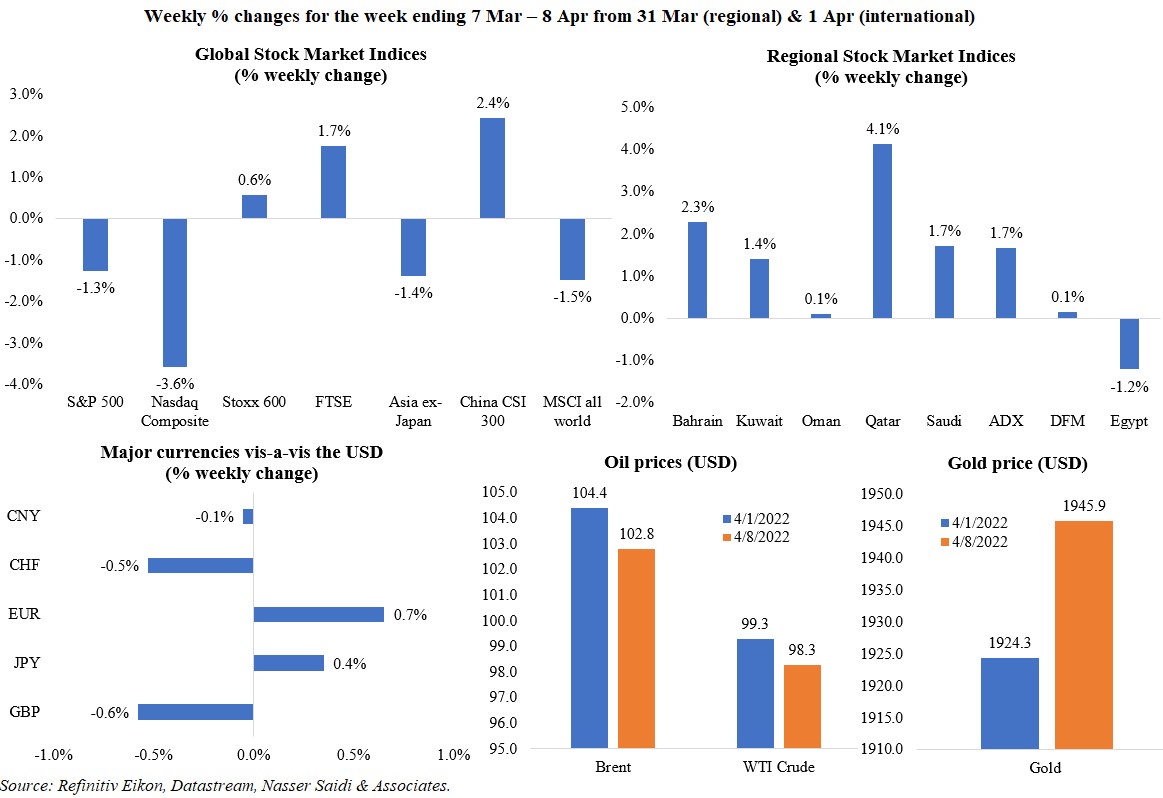

Global markets painted a mixed picture last week: US markets dipped given hawkish comments in the FOMC minutes; in Europe, equities gained, driven by banking stocks (supported by expectations of upcoming rate hikes); world stocks declined given ongoing geopolitical risks amid growing inflationary pressures. In the region, Qatar gained most while UAE’s ADX and DFM gained a combined AED 22bn in the first week of Ramadan (with ADX breaking the 10,000 barrier for the first time), while Egypt dropped by 1.2% compared to a year ago. The dollar index touched the 100-mark last week – the highest since May 2020. Gold price gained while oil prices declined after news that IEA members will release 60mn barrels of strategic reserves over next 6 months.

Global Developments

US/Americas:

- The FOMC minutes revealed that the Fed agreed to reduce the balance sheet, to the tune of USD 95bn a month most likely starting this May. The meeting minutes also indicated potential rate hikes of 50bps in the coming meetings especially in the backdrop of intensifying inflationary pressures.

- US factory orders fell by 0.5% mom in Feb (Jan: 1.5%), posting the first decline since Apr 2021. Durable goods orders declined by 2.1% due to transportation equipment (-5.3%) while non-durable goods orders rose by 1.2%.

- Goods and services trade deficit in the US inched down by 0.1% mom to USD 89.2bn in Feb. Overall exports grew by 1.8% to a record USD 228.6bn, with petroleum exports at a record high of USD 20.3bn and exports of services increased to USD 69.9bn, supported by a USD 1.2bn rise in travel.

- ISM Services PMI increased to 58.3 in Mar (Feb: 56.5), thanks to a rebound in employment (54 from 48.5), improvements in new orders (60.1 from 56.1) and business activity (55.5 from 55.1) while prices paid inched up to 83.8 (Feb: 83.1).

- Initial jobless claims dropped to a more than 53-year low of 166k in the week ending Apr 1st (prev: 171k), bringing the 4-week average down by 8k to 170k. Continuing jobless claims inched up by 17k to 1.523mn in the week ending March 25th.

Europe:

- Composite PMI in Germany was revised up to 55.1 in Mar from a preliminary reading of 54.6 but lower than Feb’s 55.6. This was aided by an improvement in the services PMI component (which ticked up to 56.1) versus an 18-month low in manufacturing PMI (56.9).

- Composite PMI in the eurozone climbed to 54.9 in Mar, easing from Feb’s 5-month high of 55.5, supported by a recovery in services PMI (to 55.6). Sentiment dropped to the lowest in 17 months.

- Producers price index in the eurozone jumped to 31.4% yoy in Feb (Jan: 30.6%).

- German exports grew by 6.4% mom and imports by 4.5% in Feb, widening the trade surplus to EUR 11.5bn. China remained Germany’s biggest foreign trade partner: exports to China rose by 6.4% mom to EUR 9.5bn.

- German factory orders declined by 2.2% mom in Feb (Jan: 2.3%), falling for the first time in 4 months, dragged down by a slump in foreign orders.

- Industrial production in Germany expanded by 0.2% mom in Feb, slower than the upwardly revised 1.4% growth in Jan. Excluding energy and construction, IP grew by only 0.1% in Feb. Compared to pre-Covid levels, production was 3.8% lower.

- Retail sales in the eurozone increased by 5% yoy in Feb (Jan: 8.4%); in month-on-month terms, sales inched up by 0.3% following a 0.2% rise in Jan.

- Eurozone’s Sentix investor confidence plunged to -18 in Apr (Mar: -7) – this is the lowest level since Jul 2020. The current conditions index fell to -5.5 in Apr (Mar: 7.8) while the expectations index fell to -29.8, its lowest since Dec 2011.

Asia Pacific:

- Caixin services PMI in China plummeted to a 25-month low of 42 in Mar (Feb: 50.2), with both output and new orders shrinking the most since Feb 2020 and export sales falling at the fastest pace in 22 months.

- The preliminary reading of Japan’s leading economic index slipped to 100.9 in Feb (Jan: 102.5), the lowest reading since Sep 2021. The coincident index inched lower by 0.1 points to a 3-month low of 95.5. Rising Covid19 cases and increasing supply chain disruptions are dragging down the overall readings.

- Japan’s overall household spending grew by 1.1% yoy in Feb, rising for a 2ndconsecutive month but easing from Jan’s 6.9% gain. Real wage growth stagnated in Feb with the uptick in consumer prices offsetting gains in nominal wage growth.

- The Reserve Bank of India left policy rates unchanged (repo rate at 4% and reverse repo at 3.35%) but indicated a gradual rise in rates later this year. The inflation forecast was hiked to 5.7% for the fiscal year 2022-23 (from 4.5% earlier) while growth forecast was lowered to 7.2% (from 7.8% previously).

- Singapore’s PMI inched down to 50.1 in Mar (Apr: 50.2) but remained in expansionary territory for the 21st consecutive month. The input prices index, at 51.9, touched the highest reading since Oct 2013.

- Retail sales in Singapore fell by 1.2% mom and 3.4% yoy in Feb, ending 5 months of consecutive gains. Excluding motor vehicles, retail sales fell 1% mom.

Bottomline: A data-heavy week, with inflation numbers from the US and China topping the list amid multiple central bank meetings including the ECB, Canada and New Zealand. This, in the backdrop of UN reporting that global food prices rose to record highs given the war in Ukraine. France’s Presidential election “risks” were lowered after last night’s count showed Macron leading (27.41% of votes vs Le Pen’s 24.03%); the Apr 24th runoff could show a narrower margin. Meanwhile in Shanghai the lockdown has been further extended (so far, this lockdown has not resulted in a further increase in freight rates from the city).

Regional Developments

- Bahrain’s hosting of the Formula 1 Grand Prix over the days Mar 17-22 supported recovery in tourism in Q1 2022. The race weekend saw 98k persons turnout during the period and 35k persons in attendance on the day of the race (a record high).

- The Government Land Investment Platform in Bahrain is looking to attract private investors to bid, develop and provide services in government owned land. Currently, 17 projects are available for partnership with various ministries including the Finance and National Economy Ministry.

- Egypt’s PMI stayed below-50 for the 16th consecutive month in Mar, with the reading down to 46.5 from Feb’s 48.1. Sharp declines were registered in both output (44.6 from 46.1) and new orders (45.1 from 47.3) sub-indices amid evident inflationary pressures (input prices climbed to 58.6 from 54.5 and purchase costs were up to 59.1 from 55.9).

- Annual urban inflation in Egypt surged to 10.5% in Mar – highest in nearly 3 years and up from 8.8% in Feb. Core inflation stood at 10.1% in Mar (Feb: 7.2%), highest since Jun 2018. Food prices were up by 19.8&: 11% rise in bread and grain prices while cooking oil prices surged by 36.2%. Overall annual inflation in Egypt touched 12.1% in Mar.

- Egypt’s net foreign reserves fell by nearly USD 4bn to USD 37.082bn in Mar, according to the central bank. About USD 5bn was to be deposited by Saudi Arabia at the central bank by end-Mar.

- Egypt’s sovereign wealth fund’s agreement with the Abu Dhabi Development Holding Company (ADQ) includes stakes in listed and unlisted firms, reported Al Arabiya. Further details are expected to be released within days.

- Wheat imports into Egypt from Russia increased by 24% yoy to 479,195 tonnes in March, reported Reuters. Wheat imports from Ukraine however was down by 42% to 124,500 tonnes. Separately, Egypt’s government aims to supply as much as 6mn tons of local wheat this year. A cabinet spokesperson revealed a week ago that the nation’s strategic wheat, sugar and veg oils and rice reserves were enough for 2.6, 5.6 and 5.9 months respectively.

- Iraq pumped 4.15mn barrels per day of oil in Mar, about 22k bpd short of its OPEC+ production quota. This was lower by 112k bpd from Feb.

- Oil exports from Iraq touched 3.244mn bpd in Mar; the nation’s oil minister disclosed that exports of more than 3.3mn bpd can be secured from Iraq’s southern ports.

- Iraq will allow all food imports for 3 months, in a bid to support food security. The trade ministry plans to allocate 2mn tonnes of wheat to strategic reserves – this would be sufficient for 6 months.

- Kuwait raised its domestic gasoline price for 98-octane by 35 Kuwaiti fils per litre (to 235), effective April 1st for a 3-month period. Prices of other types of fuel remain unchanged.

- Kuwait’s government resigned three months after it was formed – the third resignation in the past year and a half and delaying multiple reforms (including the public debt law).

- The IMF have reached a Staff Level Agreement with Lebanon, conditional on reforms: five key highlighted pillars include restructuring the financial sector, implementing fiscal reforms alongside restructuring of external public debt to ensure debt sustainability, reforming state-owned enterprises, strengthening governance and anti-corruption, as well as establishing a “credible and transparent” monetary and exchange rate system. Given parliamentary elections in May, it seems unlikely that any reforms can be passed till the new Parliament is sworn in and a new government is formed.

- PMI in Lebanon edged down to 47.4 in Mar (Feb: 47.5): weak demand and low purchasing power dragged down output and new orders growth, while price pressures intensified.

- Lebanon’s central bank has an estimated 286 tonnes of gold reserves, valued at USD 17.5bn at end-Feb, according to the governor.

- Oman posted a budget surplus of OMR 210mn (USD 547mn) at end-Feb, with public revenue rising to OMR 1.918bn (+75.6% yoy). Net oil revenues surged by 81.4% to OMR 1.094bn while gas revenues were up by 116.6% to OMR 509mn.

- Production of crude oil and oil condensates in Oman grew by over 8% yoy to 61mn barrels in Feb while total exports of crude oil rose by 18.3% yoy.

- Qatar’s PMI inched up to 61.8 in Mar (Feb: 61.4). Separately, Qatar’s foreign exchange reserves grew by 2.6% yoy to QAR 210.5bn (USD 57.82bn) in Mar, according to the official news agency.

Saudi Arabia Focus

- Saudi Arabia’s non-oil private sector activity strengthened in Mar, with PMI inching up to 56.8 (Feb: 56.2). Among the sub-components, output index posted the highest growth since Dec 2017 (62.4 from 60.4) and new orders grew to the strongest since Nov while employment fell below-50 for the first time in a year. Both input and output prices accelerated to the highest since Aug 2020.

- Real GDP in Saudi Arabia is forecast to grow by 7.4% in 2022, according to the ministry of finance, driven by an increase in oil GDP.

- Industrial production in Saudi Arabia grew by 22.3% yoy in Feb – the highest rate recorded in the past 3 years. This is the 10th consecutive month of growth.

- SAMA has called to stop the opening of online accounts for institutions or individuals: starting Apr 10, accounts can be opened only through branches, reported Okaz daily. There are also limits on daily electronic transfers and holding of international transfers for 24 hours. These decisions are to be implemented to reduce the incidence of fraud according to SAMA.

- The value of point of sales transactions in Saudi Arabia fell by 10.8% mom to SAE 38.9bn (USD 10.4bn) in Feb – the biggest monthly drop since Feb 2021. In yoy terms, however, value of PoS transactions remained strong, rising by 25.2% in Feb (Jan: 16.9%).

- An increase in oil exports (16.5% qoq to USD 64bn) boosted Saudi Arabia’s current account surplus to USD 26.6bn in Q4 2021. Net FDI touched USD 1.92bn in Q4, up from Q3’s USD 1.75bn net inflows.

- Saudi Aramco Base Oil Co (also called Luberef) is planning to raise more than USD 1bn from an IPO, reported Bloomberg. The firm produces 1.2mn tonnes a year of base oils (like lubricants).

- Saudi construction services firm Ladun Investment Co. issued its IPO prospectus, potentially floating 5mn shares or 10% of its capital on the parallel market Nomu.

- Banks and finance companies in Saudi Arabia extended loans worth SAR 200.3bn to the MSME sector in Q3 2021, up 14% yoy.

- Saudi EXIM Bank approved loans worth SAR 5.5bn (USD 1.46bn) in Q1 2022, to support Saudi exports and lead to greater diversification. The bank has also signed 5 MoUs with an aim to open more credit lines to support Saudi exporters.

- The Saudi Ministry of Industry and Mineral Resources disclosed that 8 local and international companies have qualified for an exploration license at Riyadh’s Al-Khunayqiyah site.

- Owners of vacant land in Saudi Arabia have been asked to fence their plots before 1st of July, to avoid being fined SAR 100 (USD 26.6) for every square meter.

- Saudi Arabia’s Agricultural Development Fund approved loans worth SAR 434mn (USD 115mn) to finance working capital: it was approved during the current fiscal year’s first board meeting.

- ICT spending in Saudi Arabia is expected to rise by 2.3% yoy to USD 32.9bn in 2022, according to International Data Corp. The sector had expanded by 8% between 2019-2021.

- With easing of Covid restrictions, Saudi Arabia announced that up to 1mn people can join the Hajj pilgrimage this year. Last year Hajj pilgrimage was limited to just 60k domestic participants, compared to 2.5mn pre-pandemic.

UAE Focus![]()

- UAE GDP grew by 3.8% in 2021, tweeted the UAE’s PM and Ruler of Dubai.

- Non-oil sector in the UAE expanded by 7.8% in Q4, the central bank disclosed in its Quarterly Economic Review, bringing the full year growth to 3.8% in 2021. Non-oil sector growth is expected to nudge up to 3.9% in 2022 while oil sector accelerates by 5% (2021: -1.4%). The apex bank forecast 2.7% average inflation in 2022, after posting an average 3.3% in Q1 this year.

- Abu Dhabi’s non-oil sector GDP grew by 4.1% in 2021, with overall real GDP expanding by 1.9%, according to the Statistics Centre Abu Dhabi. Growth was highest in agriculture, forestry and fishing (23.1%), followed by manufacturing (21.7%) and human health and social work (19.7%).

- UAE PMI remained unchanged at 54.8 in Mar: while output and new business continued to rise, input costs picked up at the fastest rate since Nov 2018. Domestic sales were the main driver of growth, but overall output charges are still falling – a decision firms will need to rethink in the backdrop of higher input costs (and declining profit margins). Employment sub-index ticked up for the 10th consecutive month, rising to 50.6 from 50.1.

- Industrial exports from the UAE surged by 48.7% yoy to AED 116bn in 2021, according to the Minister of Industry and Advanced Technology. He credited the In-Country Value Programme as one of the key achievements of the ministry in addition to securing AED 1bn in finance for industrial sector companies (via the Emirates Development Bank).

- The Dubai Electricity and Water Authority (DEWA) is set to raise AED 22.32bn (USD6.1bn) from its IPO, after an indicative price range of AED 2.25-2.48 was set. A tweet from Dubai’s deputy ruler revealed that DEWA had attracted AED 315bn of demand for the IPO, from SWFs, private funds and 65k individual investors.

- UAE developer FAM Holding, with an aim to list on the Abu Dhabi Securities Exchange’s second market, converted the firm into a joint-stock company with USD 13.6mn capital. Separately, Dubai school operator Taleem (which operates 17 schools in Dubai and Abu Dhabi) is in preliminary discussions with banks regarding an IPO, reported Reuters.

- Binance was awarded in-principle approval from ADGM to establish as a crypto asset service provider.

- The Dubai International Financial Center (DIFC) launched a venture studio platform (named the Studio Launchpad) with an aim to launch over 200 new ventures over the next 5 years – of which over 100 will be scale-ups and 10 to potentially gain unicorn status.

- UAE’s IHC will invest AED 7.3bn (USD 2bn) in three of India-based Adani Group’s companies -Adani Green Energy, Adani Transmission and Adani Enterprises.

- Abu Dhabi issued 25,427 new licenses in 2021, up 21.5% yoy, according to the Abu Dhabi Department of Economic Development. Renewed business licenses also ticked up, rising by 15.8% yoy to 83484. New licences for foreign Investors grew from only 6 in 2020 to 273 in 2021 while virtual licenses (launched in Q4) for non-resident foreign investors touched 11.

- The Dubai Gold and Commodities Exchange (DGCX) registered a total trading volume of USD 15.74bn in Mar, led by a spike in demand for the DGCX’s G6 currency futures contract.

- According to the Dubai Land Department, at least 1,415 apartments and villas worth AED 2.96bn (USD 805mn) were sold to buyers in Dubai during the week ending April 8th.

- The UAE requires AED 2.5trn (USD 671.1bn) in investments to achieve its net-zero ambitions, according to a Standard Chartered report. Emerging markets region together require an additional AED 350trn to meet the targets.

- Abu Dhabi is set to ban single-use plastic bags starting June with plans to phase out by 2024, reported Bloomberg. The emirate also plans to stop single use styrofoam cups, plates, and food containers.

- UAE’s energy minister reiterated that the OPEC+ mission was to stabilise markets and squeezing out any partner would only raise prices further.

Media Review

IMF reaches Staff-Level Agreement on Economic Policies with Lebanon

Web3 is yet to take off despite the hype

https://www.ft.com/content/16eaf1b9-08fb-4454-a4eb-ac662cdd8590

Can Silicon Valley still dominate global innovation?

https://www.economist.com/business/can-silicon-valley-still-dominate-global-innovation/21808708

First Global Bank Stress Test Highlights Increased Financial Resilience: IMF

Development Economics Goes North: Dani Rodrik