Weekly Insights 8 Apr 2022: Indicators point to rebound in UAE growth in 2022

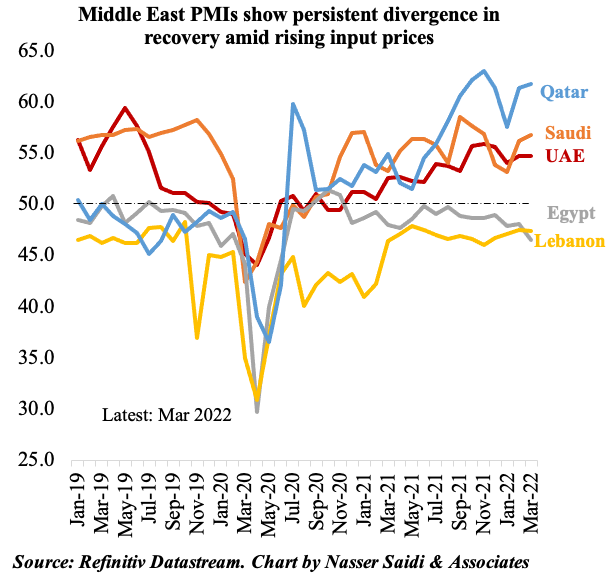

1. Middle East PMIs divergence speeds up; input prices increase at an accelerated pace across

- Continued divergence in PMI readings between the GCC and rest of the Middle East

- Egypt posted the 16th straight month of contraction, worsening in Mar with the impact of the war in Ukraine; the 14% devaluation saw purchase prices rise sharply & sentiment hit the lowest since the series began in 2012

- In Lebanon, as talks with the IMF drag on, both output and new orders fell amid rising operating expenses (given the high cost of USD) and sentiment continues to deteriorate

- Both Saudi Arabia and Qatar PMIs increased in Mar, while UAE remained unchanged

- Saudi output growth accelerated in the fastest pace in over 4 years & new export orders increased; both input and output price inflation ticked up (highest since Aug 2020)

- In the UAE, however, though input prices increased to the fastest since Nov 2018, output charges fell for the 8th consecutive month (in a bid to boost sales). It remains to be seen how long this can be sustained especially given the recent increase in petrol/ diesel prices

- In general, GCC businesses seem to be less affected by the ongoing Ukraine-Russia war (be it external demand or supply chain delays) & are benefitting from the surge in oil and gas prices (which will spillover into non-oil sector growth as well)

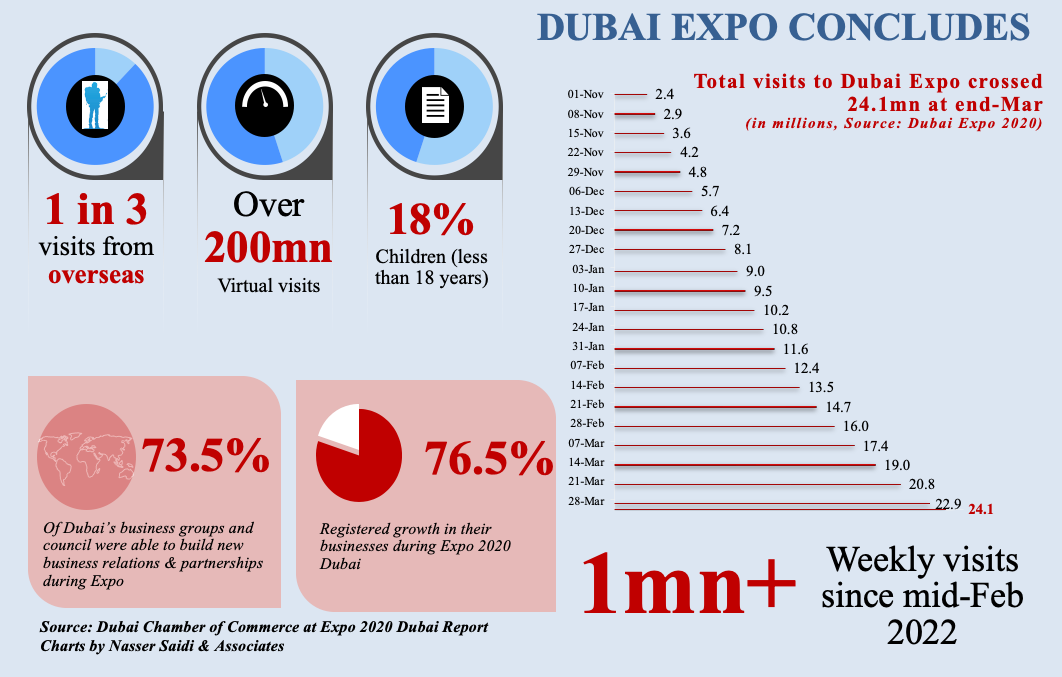

2. Dubai Expo in numbers

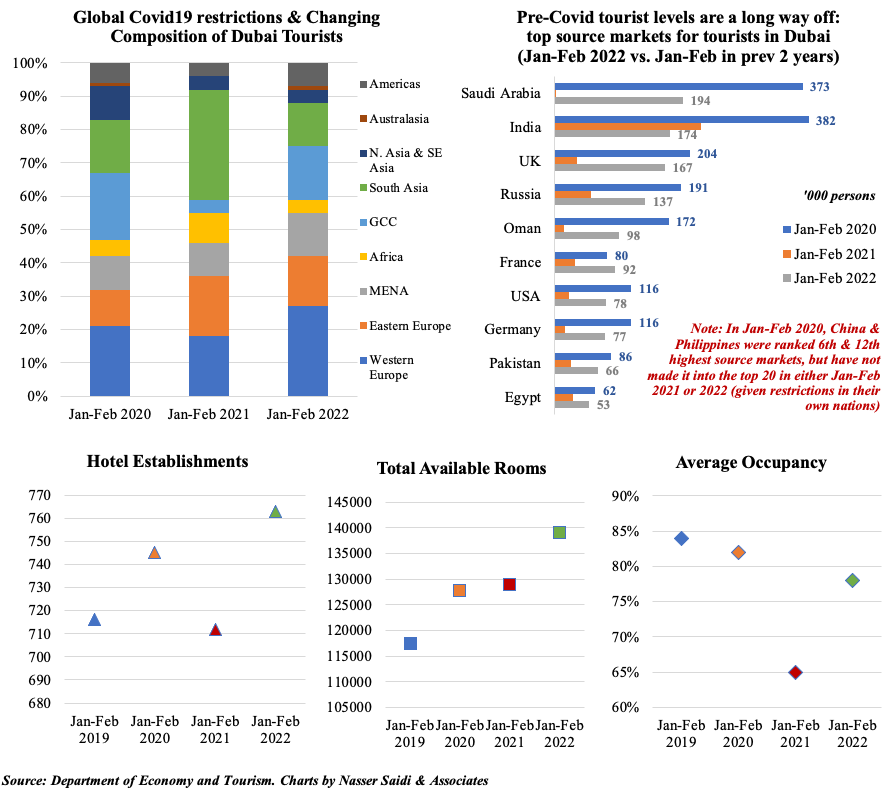

3. Dubai Tourism remains below pre-pandemic levels for now; if current pace is sustained, expect a better 2022

- Dubai clocked in 2.19mn overnight visitors in Jan-Feb this year as global travel restrictions ease. This compares to 7.28mn visitors welcomed in the full year 2021

- Tourist numbers are a far cry from pre-Covid levels, with visitors from China and Philippines relatively negligible last and this year

- Occupancy inched up after the Covid dip & total available rooms increased (the number of relatively lower priced hotels have declined compared to Jan-Feb ‘20)

- Tourists from Europe account for a large share: 42% in Jan-Feb 2022 vs 32% in Jan-Feb 2020 (pre-Covid). Share of SE Asia declined to 4% (vs. 10% in Jan-Feb ‘20) as travel restrictions are still applicable

- Saudi Arabia is the top source market this year; other top source markets remain the same as previous years (India, UK, Russia)

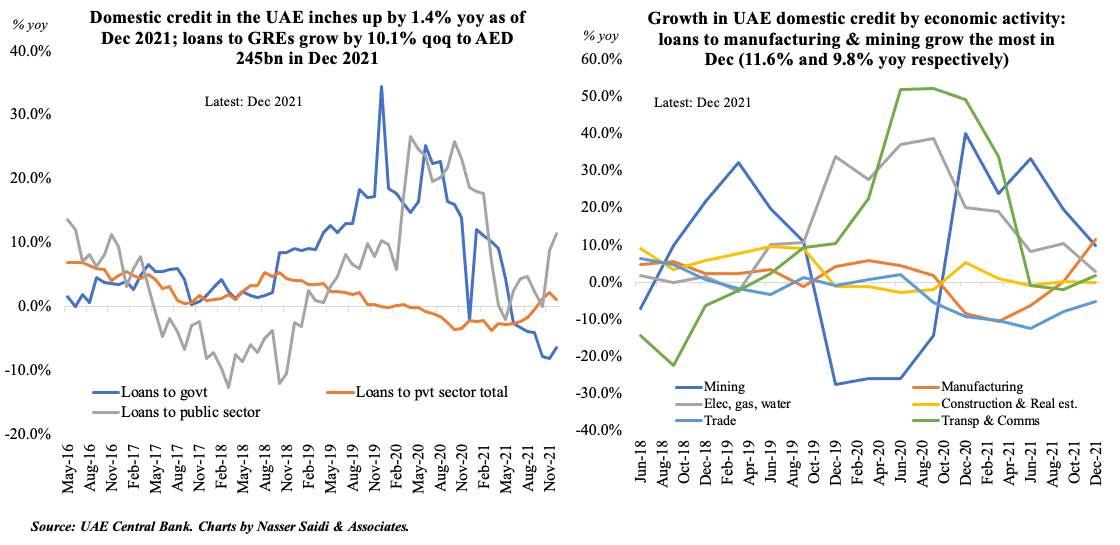

4. UAE credit disbursement improves; lending to manufacturing sector stands out at end-2021

- Credit disbursed by UAE banks increased by 1.4% yoy and 1.0% qoq as of end-Dec 2021. This was supported by a growth in loans to GREs (11.4% yoy and 10.1% qoq) as private sector loan growth remained subdued (1.2% yoy and 0.1% qoq)

- In terms of disbursement by economic activity, loans to both manufacturing and mining sectors improved. In qoq terms, the highest increase was in mining and quarrying (7.9%), followed by manufacturing (7.3%) and transport, storage and communication (7.3%) – in line with UAE’s strategic focus on manufacturing and as both mining and transport sectors rebound after a Covid dip

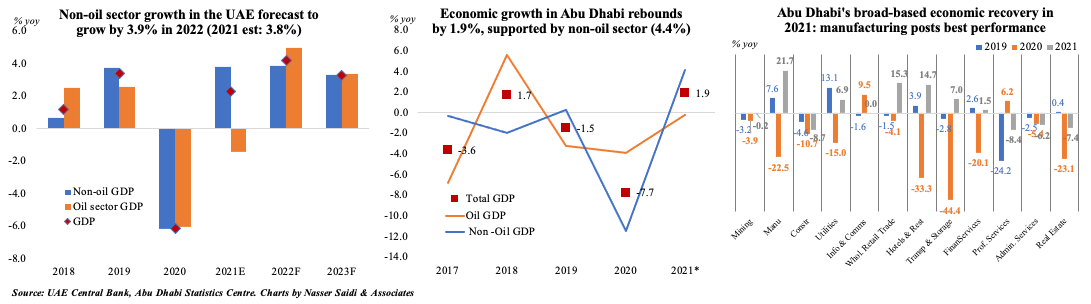

5. UAE central bank forecasts 4.2% growth in 2022 (2021: 2.3%)

- The UAE central bank expects growth to increase to 4.2% this year, thanks to a sustained growth in the non-oil sector (3.9%, following a 3.8% uptick in 2021) alongside a rebound in the oil sector (5% yoy from a 1.4% drop in 2021). The previous slides support the argument of an improvement in sentiment, and economic activity

- The central bank also discloses an increase in both employment and wages in Dec 2021 – by 3.1% and 7.8% yoy respectively. The uptick in employment is a trend likely to be sustained: recent visa policy changes make the country more attractive to high-skilled and creative persons & PMI has shown employment rising for 10 months till Mar 2022

- Abu Dhabi issued its 2021 GDP estimates this week: growth rebounded by 1.9% following the 7.7% drop reported in 2020. Growth was supported by a substantial improvement in non-oil sector activity (+4.4% yoy). Growth rebounded across most sectors, the most notable being manufacturing (21.7% yoy), wholesale and retail trade (15.3%) and accommodation and food (14.7%). Construction and real estate activity remain weakened (-8.7% and -7.4% respectively)