Markets

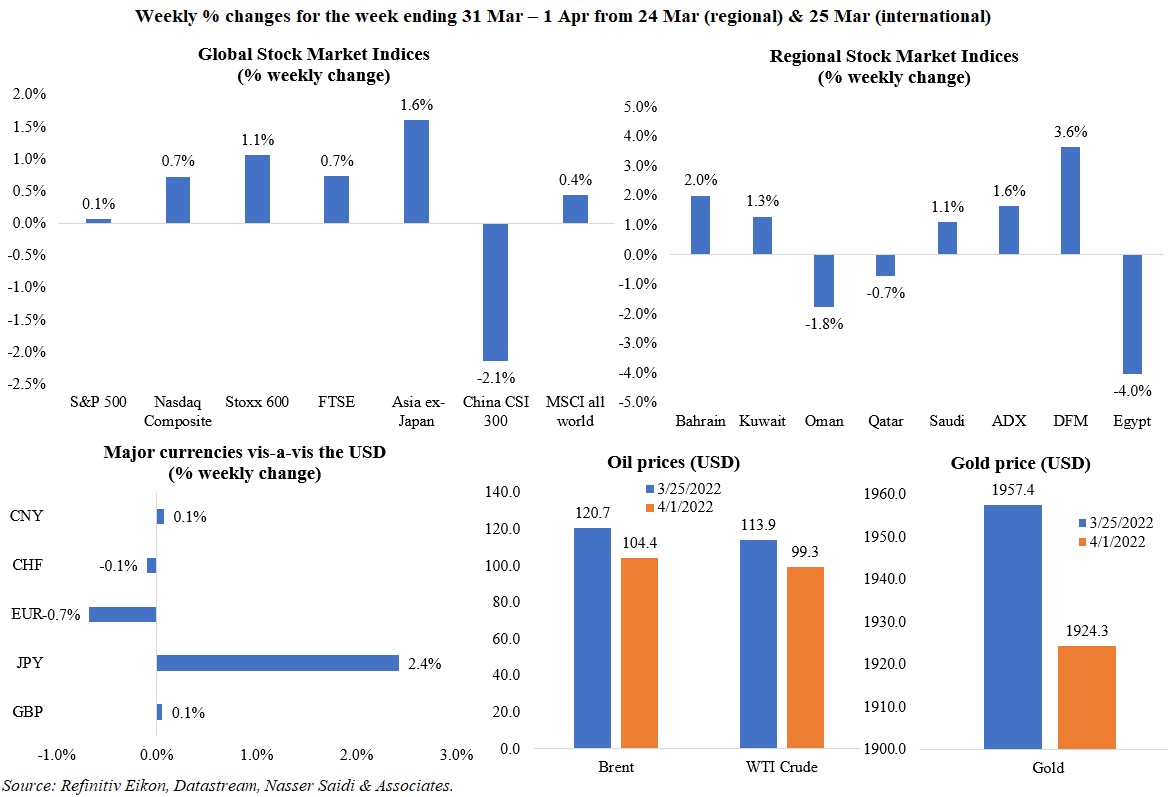

Global markets were mostly up except for China where the recent lockdowns (even in its financial capital) are leading to higher uncertainty alongside fears of potential US delistings absent greater disclosure of financial information. However, the S&P 500 posted its first quarterly loss since the beginning of the pandemic (though rebounding in Mar). Most regional markets gained from the week before: Dubai performed well given the interest in DEWA’s IPO and later news about the increase in offered shares, while Saudi Tadawul touched its highest level in 16 years on Tuesday, The euro has been weighed down by worries about the fallouts from the ongoing war in Ukraine, while the yen hit a 7-year low on Monday, and was down by more than 5% ytd. Oil prices declined by about 13% last week, after the announcement of the largest ever release of US strategic oil reserves as well as the 2-month truce in military operations in Yemen.

Global Developments

US/Americas:

- Non-farm payrolls in the US increased by 431k in Mar from an upwardly revised Feb reading of 750k, marking the 15th consecutive month of expansions. The average hourly wage earnings were up by 5.6% in Mar and labour force participate rate ticked up to 62.4%. Unemployment rate fell to 3.6% from 3.8% the month before, nearing the historic low of 3.5% seen earlier in Feb 2020.

- JOLTS job openings in the US slipped to 11.266mn in Feb (Jan’s upwardly revised 11.283mn), with quits increasing to 4.35mn (+94k from Jan) and the ratio of available workers to job openings at 0.6 – the lowest on record.

- Initial jobless claims rose to 202k in the week ended Mar 25, with 4-week average falling to 208.5k. Continuing claims declined, by 35k to 1.307mn in the week ended Mar 18.

- The private sector added 455k jobs in Mar (Feb: 486k), with the services sector adding 377k jobs (within which leisure and hospitality saw the biggest jump – 161k).

- The final estimate shows that GDP grew at a 6.9% annualised pace in Q4, revised down slightly from the previous estimate of 7% growth. PCE price index surged to 6.4% in Feb (the largest rise since 1982) while core PCE jumped to 5.4% (the biggest gain since 1983).

- Personal income in the US inched up by 0.5% mom in Feb (Jan: 0.1%) while personal spending was up by 0.2% (Jan: 2.7%). Inflation continues to eat into purchasing power, with real disposable income falling for a 7th straight month (-0.2% in Feb from -0.4% in Jan).

- ISM Manufacturing PMI slowed to 57.1 in Mar (Feb: 58.6), as new orders plunged (to 53.8 from 61.7) while prices paid by manufacturers increased (87.1 from 75.6) and employment gained (56.3 from 52.9).

- S&P Global manufacturing PMI increased to 58.8 in Mar (Feb: 57.3) – the strongest growth in 6 months. Both output and new orders were higher thanks to both domestic and foreign demand. Output expectations for the next 12 months stood at the highest since Nov 2020.

- Goods trade deficit in the US narrowed to USD 106.6bn in Feb (Jan: USD 108.9bn), but still close to the record high registered in Jan. Exports increased by 1.2% to USD 157.2bn, supported by a 6.3% surge in consumer goods shipments. Imports meanwhile rose by just 0.3% to USD 263.7bn, as both motor vehicle and food imports fell by 9.9% and 3% respectively.

- The Dallas Fed manufacturing business index slipped to 8.7 in Mar (Feb: 14) as new orders dropped to 10.5 (the lowest in over a year and from 23.1 in Feb). In contrast, the Chicago PMI inched up to 62.9 in Mar (Feb: 56.3).

- S&P Case Shiller home price index accelerated by 19.1% yoy in Jan (Dec: 18.6%). Tight supply and strong demand are outweighing rising mortgage rates (which started to climb in Jan and now stands close to 5% from 3.25% at end-2021).

Europe:

- Headline inflation in Germany jumped to 7.6% yoy in Mar (Feb: 5.5%), as indicated by the Harmonised Index of Consumer Prices. The main driver for inflation was energy prices, which were up by 39.5%; in mom terms, overall prices were up by 2.5% from 0.9% in Feb. Earlier in the week, the government’s council of economic advisers forecast inflation to average 6.1% this year, more than three times the ECB’s target, before falling to 3.4% in 2023.

- Preliminary readings of inflation in the Eurozone showed an acceleration to 7.5% in Mar (Feb: 5.9%). Core CPI increased to 3% from 2.7% the month before.

- Manufacturing PMI in Germany slipped to an 18-month low of 56.9 in Mar (Feb: 58.4), weighed down by the Ukraine war (lowering export demand), supply side worries and rising prices. Meanwhile, similar factors led to a downward revision in manufacturing PMI in the Eurozone to 56.5 in Mar (Feb: 58.2), but employment expanded again.

- German retail sales grew by 0.3% mom and 7% yoy in Feb.

- Unemployment rate in Germany remained unchanged at 5% in Mar, with the number of unemployed falling by 18k in Mar (vs Feb’s 33k drop).

- Germany’s GfK consumer confidence survey fell sharply to -15.5 in Apr (Mar: -8.5): this is the lowest since Feb 2021.

- Eurozone Economic Sentiment Indicator slipped to 108.5 in Mar (Feb: 113.9), lowest in 12 months, “due to plummeting consumer confidence” and intensifying inflationary pressures.

- Consumer confidence in the eurozone was confirmed at 18.7 in Mar – the lowest since May 2020 – with consumers’ intentions to make major purchases falling to a 13-month low. Business climate in the euro area declined to 1.67 in Mar (Feb: 1.79).

- Unemployment in the eurozone eased to a record low of 6.8% of the workforce in Feb (Jan: 6.9%): this is the lowest since records began in 1998.

- UK GDP accelerated by 1.3% qoq and 6.6% yoy in Q4, as per the latest upwardly revised estimates (previous: 1% qoq gain). On an annualized basis, GDP in 2021 jumped by 7.4%, a massive rebound from the 9.3% drop in 2020.

Asia Pacific:

- China’s NBS manufacturing PMI contracted to 49.5 in Mar (Feb: 50.2), the first dip since last Oct, with both export orders and employment dropping at steep rates. Non-manufacturing PMI posted a sharper drop as it fell to 48.4 from Feb’s 51.6 -this was the first decline since Aug 2021, as both new orders and export orders shrank (to 45.7 and 45.8 respectively) while employment contracted to 47.1 (from 48).

- Caixin manufacturing PMI slipped to a 25-month low of 48.1 in Mar (Feb: 50.4), with both output and new orders declining the most since Feb 2020 and exports sales falling at the fastest pace in 22 months. However, employment rose for the first time since Jul 2021.

- Industrial production in Japan rebounded by 0.1% mom and 0.2% yoy in Feb (Jan: -0.8% mom and -0.5% yoy), thanks to a bounce back in the production of automobiles (+10.9% mom after a 17.3% plunge). The Ministry of Economy, Trade and Industry estimates IP to expand by 3.6% and 9.6% in Mar and Apr, based on survey estimates.

- Japan’s Tankan large manufacturing index slipped to 14 in Q1 (Q4: 17), receding for the first time in 7 quarters on concerns about inflation and the Ukraine crisis. Non-manufacturing index eased to 9 from 10 the prior quarter.

- Manufacturing PMI in Japan inched up to 54.1 in Mar – higher than the preliminary estimate of 53.2 and Feb’s 52.7. Output inched up to just above 50 while new export sales fell at the sharpest pace since Jul 2020 (given lockdowns in China) amid rate of job creation posting a 5-month low.

- Unemployment rate in Japan fell to 2.7% in Feb (Jan: 2.8%). The number of unemployed dropped by 30k to 1.88mn while the jobs to applicants’ ratio inched up to a 22-month high of 1.21 in Feb (Jan:1.2).

- Retail trade in Japan fell by 0.8% mom and yoy in Feb (Jan: 1.1% yoy and -0.9% mom). Large retailer sales nudged up by 0.1% in Feb (Jan: 2.6%).

- India’s fiscal deficit accelerated to 82.7% of the 2021-22 target in the period Apr-Feb (Apr-Jan: 58.9% of the target), largely due to transfers made to the states in Feb.

- Growth in India’s eight infrastructure sectors increased to a 4-month high of 5.8% yoy in Feb, boosted by a low base. Production of crude oil, refinery products and fertiliser are still lower than pre-Covid levels.

- India and Australia signed an economic pact, reducing duties on more than 85% of goods exported to India. This agreement is expected to almost double bilateral trade to USD 50bn over the next 5 years (currently it stands at around USD 27bn): Australia is one of the top 15 trading partners for India.

Bottomline: PMI data indicate that supply chain issues and rising prices amid the war in Ukraine is dampening demand and confidence of European businesses. Meanwhile in China, where all PMI indices were below the 50-mark, it is the prolonged lockdowns that are denting business confidence. This was also evident from Japan’s PMI where though the headline index expanded, export orders fell (given links with China) and till date, China seems to be unwavering in its zero-Covid policy. Separately, reeling from the effects of inflationary pressures, volatile asset prices and rising interest rates, global fundraising in capital markets reached only USD 2.3trn in Q1 – this was the smallest since 2016 and down from USD 3.2trn+ in Q1 2021, according to Refinitiv. This week’s Fed minutes should shine a light on how aggressive the Fed is willing to be regarding rate hikes and how quickly it plans to rein its USD 9trn balance sheet. Lastly, even as the world is coming to terms with the war in Ukraine, comes news of political turmoil in both Pakistan and Sri Lanka. In the backdrop of the domestic economic and financial crisis, Sri Lanka’s central bank chief resigned (less than 7 months after taking up this role) after the resignation of all Cabinet ministers.

Regional Developments

- Bahrain’s GDP grew by an estimated 2.2% in 2021, revealed the finance ministry, also forecasting a growth of 4.1% this year. Earlier in the week, a cabinet statement states that real GDP was up by 4.3% yoy in Q4, with non-oil and oil sectors growing by 4.2% and 4.7% respectively.

- Bahrain’s public sector employees will be allowed to work from home for 2 weeks during Ramadan. It is not applicable to those in security, civil aviation, and other vital sectors.

- Support from the GCC flows into Egypt: Saudi Arabia deposited USD 5bn into the central bank and also signed an agreement to encourage investments in Egypt by the Saudi sovereign wealth fund (which is estimated to attract USD 10bn in investments). Egypt and Qatar agreed to sign investment deals worth USD 5bn (in an agreement by the ministers of foreign affairs).

- To soak up excess liquidity, Egypt’s two biggest state banks (National Bank of Egypt and Banque Misr) sold EGP 303bn (USD 16.57bn) in special certificates of deposit introduced in the week of the devaluation of the EGP at a yield of 18%.

- Sovereign Fund of Egypt signed an agreement with the Norwegian Investment Fund and Norway’s Scatec Corp to develop green hydrogen and renewable energy projects in Africa.

- France (the EU’s biggest wheat exporter) will ensure that Egypt receives the necessary wheat supplies in the coming months, revealed the French finance minister during an official visit to Cairo.

- The value of Iraq’s oil exports touched USD 11.07bn in Mar, the highest revenue since 1972, having sold 100,563,999 barrels, according to the oil ministry. In Feb, revenues touched an 8-year high of USD 8.5bn from daily exports of 3.3mn barrels of oil.

- Kuwait supports the OPEC+ decision to raise output by about 432k barrels per day in May. This will increase Kuwait’s output to 2.695mn barrels of oil per day. Separately, Japan’s industry minister disclosed plans to support Kuwait increase crude oil production via the government owned Nippon Export and Investment Insurance by insuring a syndicated loan. The syndicated loan, expected to reach USD 1bn, will be extended to Kuwait Petroleum Corp. Mizuho Bank, Sumitomo Mitsui Banking Corp. and MUFG Bank are making the loan, along with HSBC and JPMorgan Chase.

- Kuwait sovereign wealth fund’s exposure to Russia and Ukraine amounted to just 0.29% of the total investments of its main long-term investment fund. The Kuwait Investment Authority held cash worth 13% of its total assets at end-2021.

- The UAE’s AD Ports Group and Kuwait General Administration of Customs signed a MoU to establish a new virtual trade corridor between the two nations. With this process in place, both authorities will be able to access pre-arrival information for international cargo movements and promoting pre-clearance of goods while cross-validating information significantly faster.

- Lebanon’s Cabinet approved the draft capital control law: this long-delayed decision still needs to be ratified by the Parliament. Unfortunately, the draft law will lead to increased dollarization and boost the FX black market, without providing protection to depositors from arbitrary haircuts and forced conversion into Lebanese Lira.

- The central bank of Lebanon’s latest circular allows banks to purchase an unlimited amount of US dollars on the Sayrafa exchange platform until end-Apr.

- Oman’s finance ministry expects to repay loans worth OMR 2.85bn by end-Apr, thanks to higher oil revenues. The nation expects to reduce its public debt to OMR 119.46bn.

- Non-oil exports from Oman surged by 91% to OMR 5.792bn in 2021, given demand from its key destination markets. Non-oil exports to UAE and Saudi grew by 71.3% (to OMR 575mn) and 14.8% (to OMR 566mn) respectively while those to the US jumped 86% (to OMR 632mn)

- The Muscat Stock Exchange lifted the ceiling on foreign ownership of listed firms to attract more international investors.

- S&P upgraded Oman’s long-term foreign and local currency sovereign credit rating to ‘BB-’ from ‘B+’, while also revising the outlook to “stable”, citing higher oil prices, increase in hydrocarbon production and the rollout of the fiscal reform programme.

- Oman disclosed that only 10% of its citizens opted to take the booster dose against Covid19. It was also revealed that unvaccinated persons accounted for 90% of recent deaths in the country.

- Qatar’s foreign minister stated that no new investments will be made in Russia until there is “a better atmosphere and more political stability”.

- A 2-month truce has been declared in Yemen: the truce will allow some flights to operate from Sanaa airport and allow for fuel imports into Houthi-held areas, according to the UN envoy.

- The World Bank President stated that 300mn jobs need to be created in the MENA region to achieve development goals.

- Dubai attracted 57% of scale-up funding in the MENA region, as per a report released by the Dubai Chamber of Digital Economy. Overall scale-ups in the region raised USD 9.1bn, equivalent to 0.12% of the region’s GDP. Number of scale-ups touched 587 in 20211 (up from 139 in 2020), of which UAE was home to 251.

Saudi Arabia Focus

- FDI into Saudi Arabia increased to USD 19.3bn in 2021, up 257% yoy, as per the National Investment Strategy report released last week. The massive jump was thanks to a USD 12.4bn infrastructure deal Aramco closed with a global investor consortium in Q2 2021; in H2 2021, FDI grew by 23.7%.

- Saudi Arabia issued a record 4400 investor licenses in 2021 thanks to the government’s efforts to improve investment environment & efforts to attract regional HQs; around 3386 licenses were issued in H1 2021 (347.9% yoy). Wholesale & retail dominate investment licenses (44% of licenses in H2 2021), followed by manufacturing (16%) and construction (15%).

- IPO activity in Saudi Tadawul surged by 250% in Q1 2022: the value of initial share sales reached as high as USD 3.4bn from USD 280mn during Q1 2021. Nomu meanwhile recorded seven IPOs raising USD 608mn collectively this year.

- Net foreign assets fell for the 3rd straight month, down by 1.2% to SAR 1.59trn in Feb, according to SAMA data.

- SAMA issued permits to three new fintech firms (Bwatech, Rabet and Malaa) to operate under its regulatory sandbox. This brings the total number to 35.

- Unemployment in Saudi Arabia slipped to 11% in Q4 among Saudi citizens (Q3: 11.3%) and 12.6% a year ago. Unemployment among Saudi females inched up in Q4 vs Q3.

- Total number of Saudi citizens in the labour market reached about 2.25mn last year (+28.51% yoy). An average of 1367 Saudi were hired per day last year, reported Okaz/Saudi Gazette.

- The Global Entrepreneurship Congress, held in Riyadh last week, saw a total of SAR 25.17bn (USD 6.71bn) worth of agreements and MoUs signed. This included the messaging platform Unifonic raising USD 125mn in the largest funding round closed by a Saudi startup. At the GEC event, Saudi Arabia’s Kafalah Fund signed 10 agreements and memorandums of understanding worth SAR 6.3bn to finance SMEs.

- Internet penetration in Saudi Arabia reached more than 98% in end-2021, according to a report released by the Communications and IT Commission. Purchase of goods and services topped the use of the internet (70%+) while download of apps/ programs and games were also among top choices (at 63% and 55.5% respectively).

- The Public Investment Fund and STC Group signed a JV to establish a new company focused on the Internet of Things.

- Aramco announced that it will partner with NEOM’s ENOWA Energy, Water and Hydrogen Co in its Hydrogen Innovation and Development Centre (HIDC), in cooperation with research institutions, to produce and adopt clean and carbon-free synthetic fuels.

- ACWA Power has developed the world’s largest reverse osmosis desalination plant: located in Saudi Arabia, the SAR 2.6bn project is expected to supply 600,000 cubic meters per day for about 1mn homes. It is also the largest plant of its size in the private sector with a 100% Saudi workforce.

- The number of Umrah visitors increased by 11.61% yoy to 6.5mn in 2021, with over 3mn Saudi nationals. Some 58,745 pilgrims performed Hajj in the Islamic year 1442 H (2021), according to the Administrative Record Data of the Ministry of Hajj and Umrah – it was limited only to citizens and residents with the country given Covid19 restrictions.

UAE Focus![]()

- The UAE wants to double the economy 2031 and hopes to attain a growth rate of 5-6% this year, according to the Minister of Economy.

- Foreign direct investment (FDI) into the UAE increased by 4% yoy to USD 20.7bn in 2021, revealed the Minister of Economy in a TV interview.

- Dubai Electricity and Water Authority (DEWA) doubled the size of its IPO, from a float of 6.5% to 17% (equivalent to 8.5bn shares), implying it could raise around USD 5.7bn. Of this 7% will be reserved for new (and unnamed) strategic investors. Separately, Moody’s has affirmed the ratings of DEWA including Baa2 long-term issuer ratings and Baa2 Baseline Credit Assessment, while the outlook remains stable.

- Abu Dhabi plans to list 13 new companies on the Abu Dhabi Exchange by the end of this year, according to the head of Abu Dhabi Department of Economic Development. This includes 4 companies outside the UAE, and the listings are expected to support ADX reach a market value of AED 3trn (USD 816.86bn).

- Bloomberg reported that the UAE supermarket chain Lulu Group is planning an IPO in 2023, potentially opting for multiple listings across the region’s exchanges, with the firm having asked global banks to pitch for potential listings roles.

- UAE developer FAM Holding plans to list its shares on the Abu Dhabi Securities Exchange (ADX) Second Market and use the proceeds for expansion. The firm, which operates primarily in the Northern Emirates, has an investment portfolio worth AED 2bn and 5,750 residential apartments in the UAE.

- Abu Dhabi Global Market, in cooperation with AirCarbon Exchange, announced that the “world’s first fully regulated” carbon trading exchange and clearing house will be launched this year. ADGM will regulate carbon credits and offsets as emission instruments, allowing for corporates to trade and finance carbon credits like conventional financial assets.

- Negotiations for a free trade agreement between the UAE and Israel concluded, according to officials from both nations. Bilateral trade has touched USD 600-700mn since ties were established in 2020. No timetable was given when the agreement would come into effect.

- The UAE and Colombia completed the first phase of a Comprehensive Economic Partnership Agreement and are expected to finalise the deal in three months, according to WAM. Non-oil bilateral trade was valued at AED 991mn in 2021 and trade exchange with the UAE accounted for 40% of Colombia’s trade with the region in 2020.

- Expo 2020, which wrapped up on March 31st, saw 24.1mn visits during the 6-month period; one-third of the visitors were from overseas, with India, Germany, Saudi Arabia, UK, Russia, France and the US the most popular source nations. Separately, the Dubai Chamber of Commerce found that more than 76% of surveyed 287k companies saw increase in growth during the Expo: about 73.5% entered new partnerships during the Expo and nearly 71% leveraged the networking and business matching services provided by the Chamber during the Expo.

- Petrol prices in the UAE have been increased by 50 fils to range between AED 3.55-3.74 (USD 0.97 to USD 1.02), depending on the grade, in Apr 2022. This hike will spillover into almost all sectors, contributing to higher inflation and raising the overall cost of living.

- Mubadala is pausing investments in Russia, which accounts for less than 1% of its portfolio, according to the CEO.

- Emirates Development Bank stated that it had contributed AED 1.91bn to UAE’s GDP over the past 12 months, having provided direct and indirect financing to 1350 SMEs and mobilising more than AED 332mn of capital to SMEs via its new credit guarantee platform.

- Etihad Credit Insurance, the UAE’s federal export credit agency, revealed that support to non-oil trade exporters surged by 128% yoy to AED 11.4bn (USD 3.1bn) last year. The agency issued 6,620 revolving credit limits in 2021 (+229% yoy) and the value of exposure it had underwritten rose to AED 5.6bn (+266%).

- Dubai, with its law governing virtual assets and a related regulatory authority, is attracting more crypto firms, with crypto exchange Bybit and platformcom establishing a presence. Bybit has received an in-principle approval to conduct a “full spectrum of virtual asset business” and intends to move its HQ to Dubai from Singapore while Crypto.com announced plans to establish a regional base in Dubai. (Singapore enacted a cryptocurrency consumer protection law in mid-Jan banning all crypto-related ads and ATMs in public spaces to curb consumer speculation in digital assets).

- The President of Emirates Airlines expects the company to return to profit by next year, revealing that the firm has been cash-positive since Oct. He also stated that the airline will continue to fly to Russia until “the state, our owner” tells it not to.

- The foundation stone was laid for UAE’s first ever electric vehicle manufacturing facility: the AED 1.5bn sustainable industrial facility in Dubai Industrial City is expected to produce 55,000 cars per year and create more than 1000 jobs.

- Dubai Autodrome disclosed that the 2021-22 motorsport season recorded a contribution of AED 17.9mn (USD 4.87mn) to the UAE tourism and economy sectors.

- Dubai Municipality disclosed that the emirate had imported 7.9mn tonnes of food in 2021 spanning 286,673 food shipments and over 1.7 million food products. Separately, Dubai Customs revealed that Dubai’s external food trade grew by 11% yoy to AED 57bn in 2021: exports and re-exports increased by 11.3% (to AED 10.8bn) and 10% (to AED 7.9bn) respectively while imports were up by 11% (to AED 38.2bn).

- The UAE’s energy minister reiterated that the OPEC+ mission was to stabilise markets and squeezing out any partner would only raise prices further.

Media Review

Feeling the Heat: Adapting to Climate Change in the Middle East and Central Asia

Energy security and green transition not mutually exclusive

https://www.arabnews.com/node/2053251/business-economy

Big Tech is rushing to build VR and AR headsets

Is the New Stagflation Policy-Proof?

Shanghai Lockdown tests the limits of zero-Covid policy

https://www.ft.com/content/11d1f525-6253-4238-b0f6-500f508ec073