Weekly Insights 25 Mar 2022: Two divergent tales – relief for commodity producers & rush to the IMF for Egypt

Weekly Insights 25 Mar 2022: Two divergent tales – relief for commodity producers & rush to the IMF for Egypt

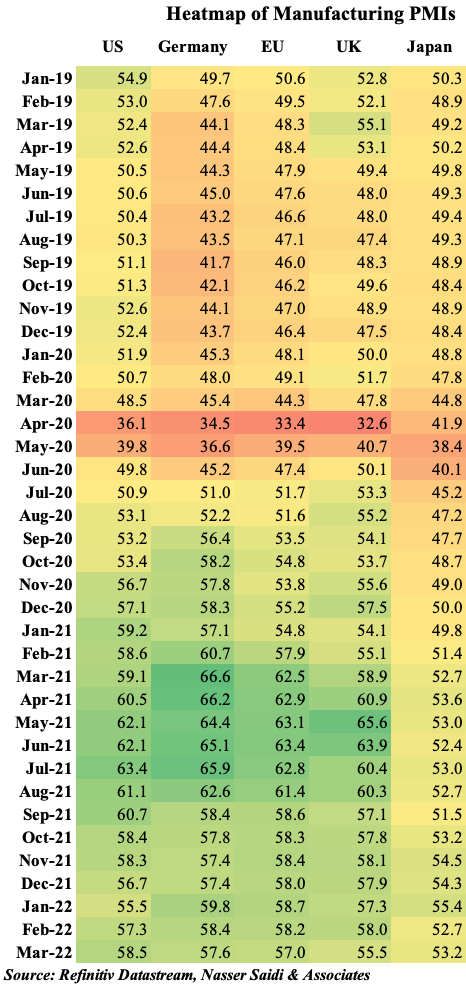

1. Flash manufacturing PMIs for March decline in Europe

- Flash manufacturing PMIs in Europe have declined in Mar, given its relatively higher exposure to Russia and Ukraine (be it gas or agriculture imports), portending potential recession.

- By contrast, though the conflict has heightened uncertainty (especially increasing strains on supply chains), the headline readings in the US and Japan ticked up (supported by pent-up demand)

- Services sector activity has been ticking up faster than manufacturing, given the ongoing easing of Covid restrictions (and anecdotal evidence of return to offices, resumption of in-person events etc.)

- With the pace of demand increasing at a much faster than supply, selling prices are likely to remain elevated in the near term (alongside supplier delays). Rise in global food and commodity prices will be reflected in higher inflation readings, leading to an increase in cost of living (amid monetary policy tightening)

- Not only are current supplies of wheat & barley exports affected, a long-drawn out conflict will also adversely affect crop growing (which traditionally starts in spring)

- Overall, uncertainty related to the Russia-Ukraine conflict (which has entered the 2nd month) is likely to result in slowing pace of economic growth if not recession in the coming quarters.

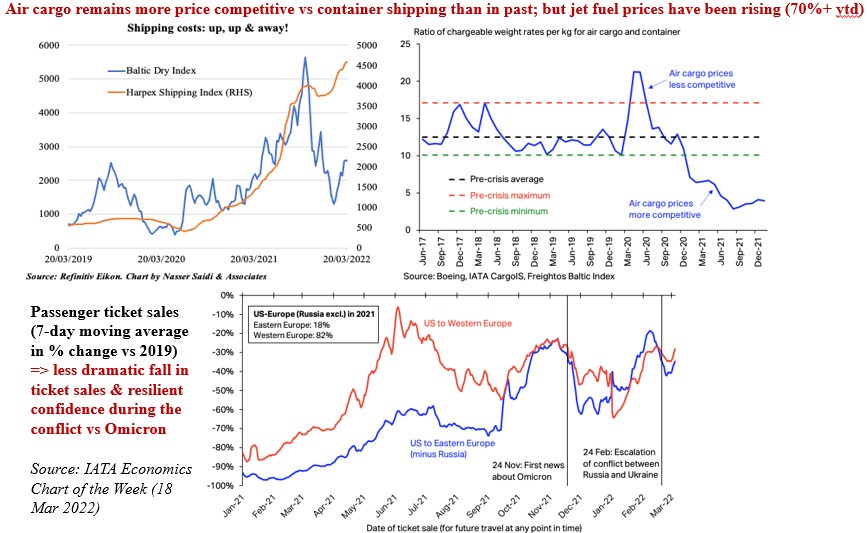

2. Rising shipping & cargo costs add inflationary pressure; air travel recovery seen in spite of the Russia-Ukraine conflict

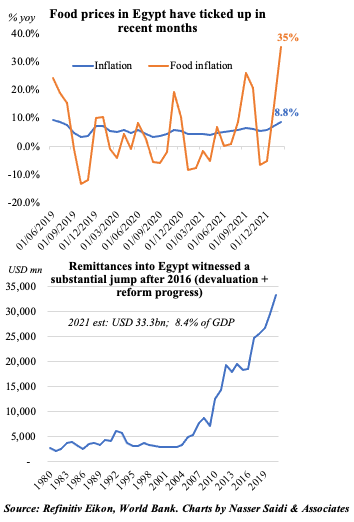

3. Egypt’s inflationary spike leads to a 100bps interest rate hike; an IMF programme will provide support

Egypt has been severely affected by the ongoing Russia-Ukraine conflict.

- Rising inflation, in line with the global increase in food prices

- Egypt is the world’s biggest wheat importer; as a share of wheat imports, Egypt imports 60%+ from Russia and more than 20% from Ukraine. This raises issues of food security especially given the history of food riots prior to the Arab Spring;

- Wheat is heavily subsidized in Egypt meaning that the state absorbs the rise in prices => higher spending, widening deficits;

- Tourism: both Russia and Ukraine are two important source markets for Egypt. Around 1.46mn Ukrainians had visited Egypt in 2021 (2nd most popular destination after Turkey) while 125k Russian tourists had visited Egypt in the first two weeks of 2022

Monday’s rate hike by 1% has turned real interest rate positive; this, along with allowing the pound to depreciate by 14% will attract FDI and remittance inflows. Last year, remittances into Egypt stood at USD 33.3bn, making it the top recipient in MENA

The government also announced a EGP 130bn economic relief package, which will work in its favour for the requested IMF support to implement a “comprehensive support programme”

Egypt had previously received funds from the IMF in 2016 a USD 12bn loan over 3 years (agreed to devalue EGP and undertake extensive economic reforms) and USD 8bn in 2020

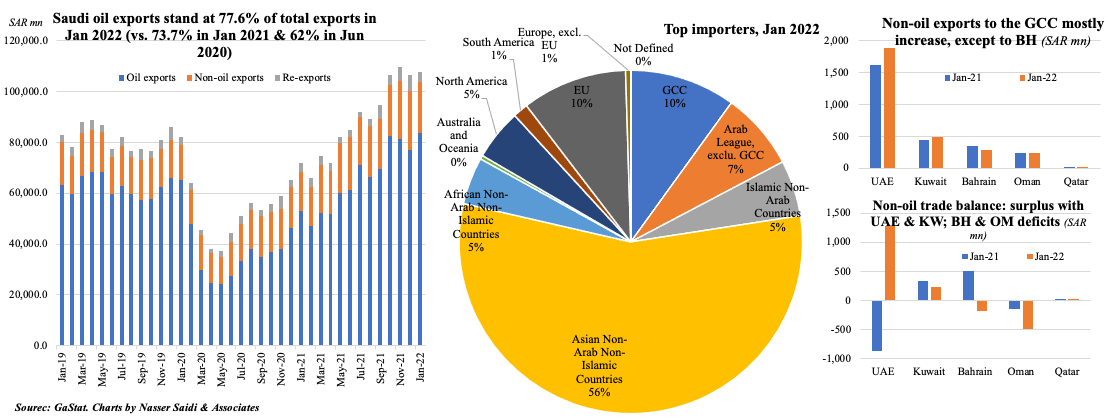

4. Saudi Arabia’s non-oil exports increase, but at a slower pace than oil, given the surge in oil prices

- Growth in oil exports from Saudi Arabia has been outpacing non-oil exports growth; ratio of non-oil exports to imports increased to 46.5% in Jan (Jan 2021: 39.4%). But Oil exports still account for more than ¾-th of overall exports (a far cry from the lowest reading of 62% in Jun 2020

- China is Saudi Arabia’s main trading partner, followed by India, South Korea, US and the UAE. Interestingly, UAE was the top recipient of Saudi Arabia’s non-oil exports in Jan 2022, with transport equipment & parts the largest product (34.6% of overall non-oil exports sent to the UAE)

- Non-oil exports to most GCC nations increased in Jan 2022 (except for Bahrain). Non-oil trade balance swung to deficit in Bahrain and deficit widened in Oman while UAE moved to a surplus in Jan 2022

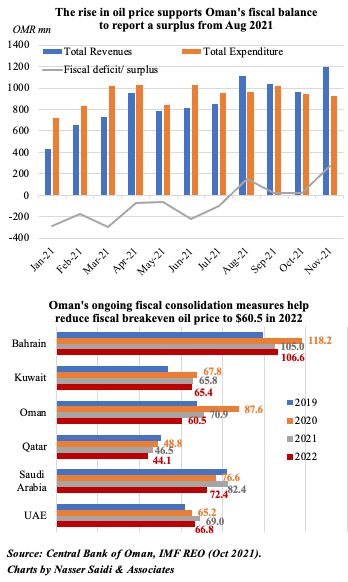

5. Oman’s fiscal balances improve, supported by higher oil prices & fiscal consolidation measures

- The surge in oil prices has helped Oman post fiscal surpluses from Aug 2021. In Jan-Nov 2021, net oil revenues (after transfers to Reserves) was 1.5 times higher than in Jan-Nov 2020

- The Sultan yesterday stated that any additional oil revenues would be used to settle public debt first and the rest would be allocated to development projects. Furthermore, an additional spending of OMR 200mn (USD 520mn) was announced to the 2022 budget, bringing total expenditure to OMR 1.1bn. In Jan 2022, a budget deficit of USD 3.9bn was forecast for 2022 by the Ministry of Finance (at an estimated oil price of USD 50)

- Oman’s rollout of the medium-term fiscal plan including consolidation measures (lower wage bill from mandatory retirements, introduction of VAT, easing electricity subsidies, lower capital spending) will help increase surpluses and reduce its debt

- The IMF projects Oman’s fiscal breakeven price at USD 60.5 this year, one of the lowest among GCC (a far cry from the second-highest reading of USD 87.6 in 2020)