Markets

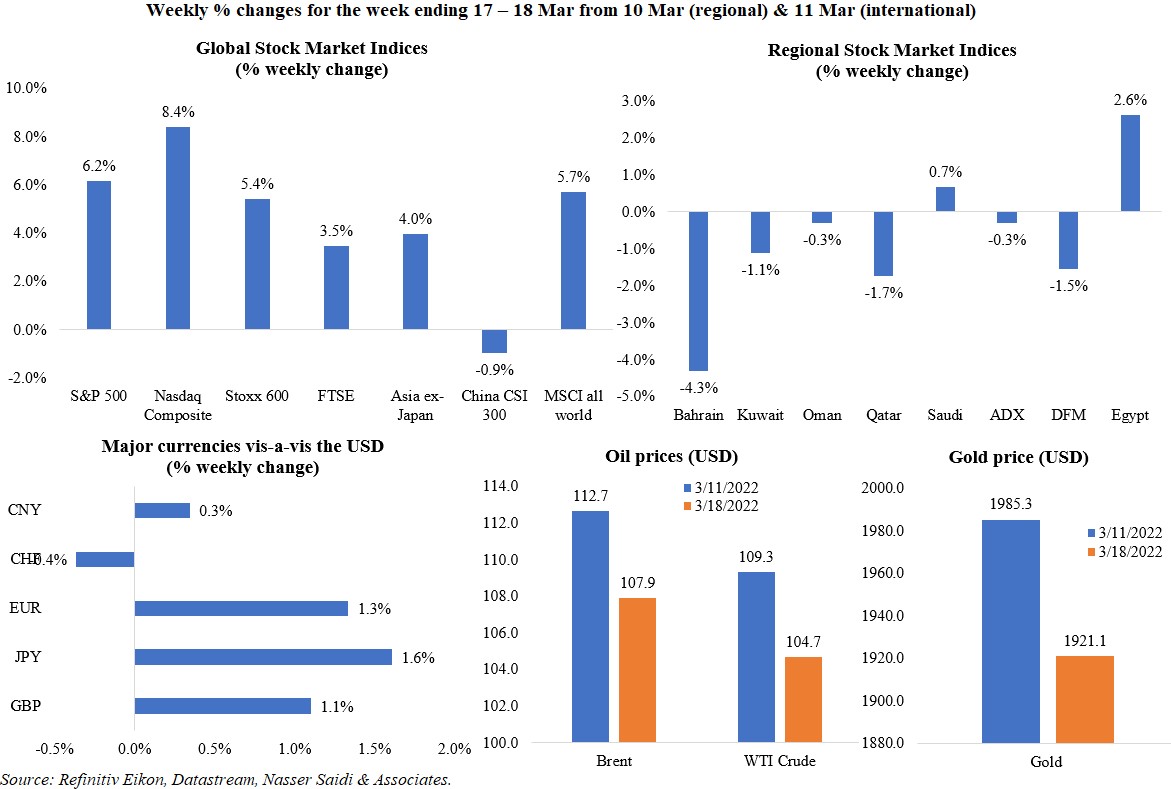

Global markets mostly gained as investors calmed down after a Russian bond payment (thereby avoiding a sovereign default) amid major central banks tightening monetary policy (and Fed’s aggressive rate hike plans). While negotiations are ongoing in the Russia-Ukraine conflict, there was sufficient focus also on the call between US President Joe Biden and his Chinese counterpart Xi Jinping. That no surprises came from the latter discussions supported US markets (which had the best week since Nov 2020), especially the tech-heavy Nasdaq. Regional markets were mixed: lower oil prices sent indices down, with financial and industrial stocks dragging down UAE’s DFM while Egypt gained by around 2.6% from the week before. The dollar hit a fresh 6-year high versus the yen, oil posted losses for the 2nd consecutive week (highly volatile week, given tight supplies) and gold prices dropped by 3.2% (the biggest weekly decline in nearly 4 months).

Global Developments

US/Americas:

- The Fed hiked policy rate by 25bps, as expected, the first rate increase since Dc 2018 and indicated that rates will be hiked at each of the six remaining meetings through 2022 and three more next year. The labour situation was labelled “tight to an unhealthy level” and the Fed “expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting”.

- Initial jobless claims declined by 15k to 214k in the week ended Mar 11th, the lowest since Jan 1st and taking the 4-week average down by 8,750 to 223k. Continuing claims slipped to 1.419mn in the week ended March 4th from 1.49mn the previous week.

- Producer price index in the US increased to 10% in Feb – this is the fastest yoy increase since data collection was started in 2010; in mom terms, it ticked up by 0.8%, slower than the 1% uptick in Jan. Excluding food and energy, PPI eased to 8.4% in Feb (Jan: 8.5%).

- Industrial production in the US gained by 0.5% mom in Feb (Jan: 1.4%). In yoy terms, IP increased by 7.5% yoy – the biggest gain since Jun 2021. Capacity utlisation improved to 77.6% from 77.3% the month before.

- The New York Empire state manufacturing index fell to -11.8 in Mar (Feb: 3.1), the lowest level since May 2020 as both new orders and shipments declined and unfilled orders increased. In contrast, the Philadelphia Fed manufacturing survey showed an improvement in Mar, rising to 27.4 from Feb’s reading of 16. Both current shipments and new orders indices rose to the highest since Nov 2021 and employment index rose to highest-ever 38.9.

- Building permits in the US slipped by 1.9% mom to 1.859mn in Feb – but remained at high levels. Housing starts rebounded by 6.8% mom to a seasonally adjusted 1.769mn in Feb, with single-family starts accelerated by 5.7% to 1.215mn. Separately, a measure of single-family homebuilders confidence fell to a 6-month low in Mar, with a gauge of future sales at the lowest since Jun 2020.

- Existing home sales fell by 7.2% mom to 6.02mn in Feb (Jan: 6.49mn), the lowest reading in 6 months. The inventory of unsold existing homes stands at 1.7 months of supply, and median sales price is up 15% yoy to USD 357,300.

- Retail sales in the US grew by 0.3% mom in Feb, easing significantly from Jan’s upwardly revised 4.9% gain. Gasoline sales posted the largest increase of 5.3% and excluding this, retail sales fell by 0.2%. Sales at non-store retailers declined by 3.7% and at food stores by 0.5%.

Europe:

- Inflation in the euro area increased to a record high of 5.9% in Feb (Jan: 5.1%), above initial estimates of 5.8%; energy prices rose the most (32%) followed by food (4.2%) and non-energy industrial goods (3.1%). Core inflation picked up to 2.7% in Feb (Jan: 2.3%).

- Industrial production in the euro area fell by 1.3% yoy in Jan, reversing Dec’s 2% gain, dragged down by production of capital goods (-8.4%). In mom terms, IP remained flat.

- German wholesale price index nudged up to a record high of 16.6% yoy in Feb (Jan: 16.2%), driven up by the increase in prices of raw materials and intermediate products.

- The ZEW survey showed German economic sentiment plummet to -39.3 in Mar (Feb: 54.3): this is the biggest drop in expectations since the survey began in Dec 1991. The current situation indicator worsened to -21.4 (Feb: -8.1) and expectations for inflation rate jumped by 107.7 points to 70.2.

- The ZEW economic sentiment index in the euro zone also slumped, falling to -38.7 in Mar from Feb’s 48.6. The situation indicator currently stands at -21.9 points, 22.5 points lower than in Feb.

- Bank of England raised interest rates by another 25bps to 0.75%, hiking rates at back-to-back meetings for the first time since 2004. The apex bank also raised its inflation forecast to a 7.25% peak in Apr.

- UK ILO unemployment rate inched down to 3.9% in the 3 months to Jan – the lowest since early 2020 and down from the previous reading of 4.1%. Average earnings excluding bonus stood at 3.8% in the 3 months to Jan.

Asia Pacific:

- The People’s Bank of China left its one-year medium-term lending facility loans policy rates unchanged.

- FDI into China increased by 37.9% yoy in Jan-Feb 2022, with investment into the services and high-tech industries sectors rising by 24% and 73.8% respectively.

- Fixed asset investment into China grew by 12.2% yoy in Jan-Feb (2021: 4.9%) – this is the steepest growth since Jul 2021. Infrastructure and property investment grew by 8.1% and 3.7% respectively in Jan-Feb 2022.

- Industrial production in China accelerated by 7.5% yoy in Jan-Feb (Dec: 4.3%), posting the fastest pace of increase since Jun 2021. Retail sales expanded by 6.7% in Jan-Feb, partly thanks to the Lunar New Year holidays, and after a marginal 1.7% rise in Dec.

- The Bank of Japan left policy rates unchanged and maintained a dovish stance, stating that while inflation could move around 2% from next month, there’s no reason to tighten as this is driven by higher costs of commodities (cost-push).

- Inflation in Japan inched up to 0.9% in Feb (Jan: 0.5%), the highest since Apr 2019, with food prices rising at the fastest pace in 4 years (2.8% in Feb vs Jan’s 2.1%). Excluding fresh food prices increased by 0.6% (Jan: 0.2%) – this was the 6th consecutive month of increase and the most in 2 years. Excluding both food and energy prices fell by 1%, slower than Jan’s 1.1% drop. Energy and electricity costs surged by around 20% in Feb – the fastest pace since 1981. Separately, a government survey showed that consumers’ 1-year inflation expectations touched 2.67% in Mar (Feb: 2.43%) – the highest since comparable data was available in 2014.

- Exports from Japan increased by 19.1% yoy in Feb, led by car and steel exports, while imports surged by 34% (mostly energy-related). This caused trade deficit to narrow to JPY 668.3bn from the previous month.

- Industrial production in Japan fell by 0.5% yoy in Jan (Dec: -0.9% yoy); in mom terms, IP declined by 0.8%, lower than the initial estimated drop of 1.3% and 1% dip in Dec. Motor vehicles led the fall (-17.3%).

- Japan plans to invest USD 42bn in India over the next 5 years, according to the former’s PM. In the financial year 2019-20, India’s exports from Japan amounted to USD 3.94bn while India’s imports from Japan stood at USD 7.93bn.

- India WPI inflation accelerated to 13.11% in Feb (Jan: 12.96%; Feb 2021: 4.83%), recording double-digit growth for the 11th consecutive month. Consumer prices ticked up to 6.07% in Feb (Jan: 6.01%), breaching the RBI’s inflation target.

- India’s exports grew by 25.4% yoy in Feb and imports grew at a faster pace of 35.64%. The trade deficit narrowed to USD 20.88bn in Feb from Jan’s USD 21.19bn, but remains much wider than USD 13.12bn deficit in Feb 2021. Compared to Feb 2020, exports and imports are higher by 27% and 44.6% respectively.

- India expects its oil imports from the US to rise by 11% yoy this year. This will make the US the 4th largest supplier of India’s oil, following Iraq (23%), Saudi Arabia (18%) and the UAE (11%).

Bottomline: Even as diplomatic talks continue with no solution in sight (yet), the Vix index (“fear gauge”) has edged much lower. Multiple options are being explored to address fears of oil supply shortages –neutral-stanced India is planning to buy Russian oil directly (at deep discounts, under a rupee-rouble arrangement), the West is studying the easing of restrictions on Iran and Venezuela and the IEA set out an ambitious 10-point plan to reduce global oil demand (including car-free Sundays, work from home for up to 3 days a week when possible and avoiding business travel; more: https://www.iea.org/reports/a-10-point-plan-to-cut-oil-use). This week flash PMIs will be released, and if the slump in latest ZEW survey numbers are anything to go by, expect some significantly lower estimates (especially given higher commodity prices).

Regional Developments

- Binance received a crypto-asset service provider license issued by the Central Bank of Bahrain. This allows the company to provide crypto-asset trading, custodial services & portfolio management to customers.

- Bahrain-based Ithmaar Holdings will sell some of its key assets to Al Salaam Bank including ownership stake in both Bank of Bahrain and Kuwait and Solidarity Group Holding, as well as the consumer banking business of Ithmaar Bank.

- Egypt’s central bank raised benchmark interest rates by 100bps in an exceptional central bank meeting this morning.

- As commodity and energy prices rise amid a monetary policy tightening backdrop globally, Egypt and IMF are in talks over a potential loan, reported Bloomberg. Discussions have revolved around either a precautionary and liquidity credit line and/ or a non-financial agreement including rollout of policy reforms.

- Egypt and Saudi Arabia’s PIF signed a joint agreement for the latter to invest in the country. Both sides referred to the “close historical ties” between the two nations, adding that the deal would “strengthen cooperation and expedite the procedures related to investment in Egypt through PIF”.

- Iran’s oil minister revealed plans to raise its oil and condensates exports to 1.4mn barrels per day (bpd) from the current ceiling of 1.2mn bpd. He also stated that plans are in place to raise production capacity of crude and condensates to 5.7mn bpd (from 3.7-4mn bpd).

- In a bid to enhance bilateral cooperation, the Saudi Exports Development Authority organized a trade mission to Jordan. Saudi non-oil exports to Jordan grew by 46.8% yoy to SAR 6.9bn (USD 1.8bn) in 2021.

- Kuwait’s government proposed a gradual increase in the retirement age by three years, starting 2024. A law to be tabled in the Parliament also proposes paying retirees a one-time grant of KWD 3,000.

- The IMF discussions with Lebanon’s authorities are “progressing well” but “extensive work is needed”, according to the IMF’s spokesperson.

- Lebanon’s cabinet approved a plan to reform the beleaguered electricity sector, reported Reuters citing Al Jadeed TV. It reported that a previous plan had been endorsed with amendments, including the creation of a regulatory authority in this year than in 2023.

- Lebanon and Japan signed a technical cooperation agreement with measures relating to intellectual exchange and training as well as Japan’s involvement in contributing to Lebanon’s economic and social development.

- Lebanon’s PM Mikati disclosed that he will not be seeking re-election in the parliamentary election scheduled to take place on May 15th.

- International tourists into Oman have increased following the removal of travel restrictions: in Jan 2022, the number of European visitors surged by 641.5% to 26,571 andGCC visitors were up by 270.6% to 5548 while Asian guests dropped by 3.2% to 9223. Hotel revenues (3-5 star establishments) ticked up by 91.6% to OMR 12.264mn.

- The expected wheat crop production in Oman’s Dhofar region jumped to about 1500 tonnes (up by 3 times from last season), thanks to a 61% increase in cultivated area.

- Germany and Qatar are in talks to negotiate a long-term energy partnership as the former aims to become less dependent on Russian gas. With no LNG terminals, Germany cannot receive direct shipments from Qatar (plans to build 2 LNG terminals was announced recently).

- Qatar’s central bank announced a reduction in the amount allocated for the zero rate repurchase window to QAR 25bn, starting Apr 1st. The apex bank also raised repo rate by 25bps to 1.25%, following the Fed hike.

- In line with the Fed’s 25bps increase, Gulf central banks have hiked rates: SAMA increased both repo and reverse repo by 25 bps to 1.25% and 0.75% respectively; the UAE central bank raised its base rate (the overnight deposit facility) by 25 bps to 0.4%; Kuwait and Bahrain also raised key rates by 25bps.

- The UN received pledges worth only USD 1.3bn out of the USD 4.27bn aid plan sought for Yemen.

- The World Happiness Report 2022 saw three GCC nations feature in the top 25: Bahrain (21), UAE (24) and Saudi Arabia (25). The Middle East also featured among the lowest-ranked: Lebanon (145/146) and Jordan (134). More: https://worldhappiness.report/ed/2022/happiness-benevolence-and-trust-during-covid-19-and-beyond/#ranking-of-happiness-2019-2021

Saudi Arabia Focus

- Saudi Arabia’s GDP rebounded by 3.2% in 2021, the highest growth since 2015, largely supported by non-oil private sector activity (6.1%). GDP grew by 6.7% yoy in the last quarter of 2021, driven by the oil sector (+10.8%) while the non-oil private sector grew at a slower pace (+4.9%). Private consumption and investment contributed the most to GDP growth in Q4 2021.

- The newly launched strategy for the National Development Fund will see more than SAR 570mn being pumped into the economy by 2030, with an aim to achieve a three-fold increase in non-oil GDP to SAR 605bn.

- Inflation in Saudi Arabia clocked in at 1.6% yoy in Feb 2022 (Jan: 1.2%): this is the highest rate since Jun 2021. Prices have been rising across the board, with food and beverages (2.4%), transport (4.3%) and education (6.3%)key drivers of costs. The contribution of food prices to the uptick in inflation has more than doubled since Dec 2021, with the Feb reading a 5-month high.

- Wholesale prices in Saudi Arabia have been registering double digit increases in year-on-year terms since Apr 2021. In Feb, WPI rate was 11.5% (Jan: 12.3%), the lowest since March. In mom terms, WPI ticked up by 0.8% in Feb, much faster than Jan’s 0.1% gain.

- Consumers in Saudi Arabia spent SAR 10.8bn (USD 2.88bn) in the week of March 6-12 via 135.3 transactions, according to SAMA. About SAR 1.57bn was spent on food and beverages, SAR 1.54bn at restaurants and cafes, SAR 1.1bn on various goods and services and about SAR 854.1mn on clothes and shoes among others.

- Crude oil exports from Saudi Arabia grew by 59k barrels per day (bpd) or 0.9% mom to 6.69mn bpd in Jan, according to JODI. This is the highest exports figure since Apr 2020 but is still shy of the 2020 daily average of 7.037mn bpd. Oil production inched up by 1.2% mom to 10.145mn bpd in Jan.

- Saudi Arabia’s Crown Prince stressed the need to maintain the OPEC+ agreement in a call with Japan’s PM while underscoring the need to keep oil markets balanced and stable.

- During the UK PM’s visit to Saudi Arabia, a memorandum of understanding was signed to establish a strategic partnership. There was no agreement regarding an increase in oil production, which was one of the major reasons for the PM’s visit to UAE and Saudi Arabia. Talks for a trade deal are underway: bilateral trade grew by 6.3% yoy to SAR 53.57bn (USD 14.28bn) in the 4 quarters till Q3 2021.

- The Wall Street Journal reported that Saudi Arabia has invited China’s Xi Jinping to visit the Kingdom, with the trip expected to happen as early as May.

- Saudi Arabia is reviewing FoxConn Technology Group’s offer to build a USD 9bn semiconductor manufacturing facility in NEOM, according to a Wall Street Journal report. The report also stated that talks were also underway with the UAE about setting up the project there.

- Saudi Aramco will keep annual cash dividends unchanged at USD 75bn, but shareholders will receive 1 bonus share for every 10 shares owned. The company reported a 124% surge in profit last year to SAR 412bn (USD 110bn) and plans to boost its spending to USD 40-50bn this year (2021 capital expenditure: USD 31.9bn, up 18% yoy). The firm plans to raise crude oil’s maximum sustainable capacity to 13mn barrels per day (bpd) by 2027 as well as increase gas production by over 50% by 2030.

- Tadawul approved the listing of SAR 26.24bn (USD 7bn) worth of government debt instruments; trading of the instruments will start from March 21st.

- Saudi Real Estate Refinance Co has delayed its debut dollar sukuk to Q2 given current market conditions and volatility. The company plans to launch 2 international and 2 domestic debt sales in 2022.

- The Saudi Agriculture Development Fund approved loans with an accumulated worth over SAR 861mn (USD 229mn) to finance working capital. While the loans will be used to import some agricultural products, the goal is to enhance food security and boost agricultural activity in the country.

- Saudi Arabia plans to unveil 60 water projects worth SAR 35bn (USD 9.33bn), disclosed the chief executive of the Saudi Water Partnership Company. The projects are expected to triple the country’s desalination capacity to 7.5mn cubic metres of water a day by 2027 (from 2.54 cubic metres per day in 2021).

- Saudi Arabia announced an increase in public taxi fares: the opening fare has been raised to SAR 6.4 (+16.36%) and the charge for every additional kilometer hiked to SAR 2.1 from SAR 1.8 previously (+16.67%).

UAE Focus![]()

- Dubai, a week after announcing its first law governing virtual assets and establishing a regulator, approved licenses for Binance to “extend limited exchange products and services to pre-qualified investors and professional financial service providers” and FTX Exchange “to trial complex crypto derivatives dedicated to professional institutional investors”. These firms will operate within Dubai’s “test-adapt-scale” virtual assets market model, “which has rigorous regulatory oversight and mandatory Financial Action Task Force (FATF) compliance controls”. Binance will anchor a blockchain technology hub in the Dubai World Trade Centre. (FTX Trading had established FTX Europe the week before, after receiving approval from the Cyprus Financial Market Regulator)

- DEWA announced its intention to list 3.25bn shares or a 6.5% of its issued share capital on the DFM, becoming the first state-owned entity going public since the Nov announcement about plans to list 10 SOEs. DEWA expects to pay a minimum dividend of AED 6.2bn per annum (USD 1.69bn) to be paid out over the next 5 years (twice a year, in Apr and Oct).

- The UAE Ministry of Economy is offering Emirati-owned SMEs AED 100mn in financial support from the Emirates Development Bank. The Ministry is re-launching the National Programme for SMEs, with services including registration for the federal government’s procurement tenders and business services from telecoms to internal audits among others. The number of new commercial licenses registered for Emirati entrepreneurs grew by 26% yoy to 29000 in 2021.

- UAE and Australia intend to start trade negotiations with the aim to sign a bilateral FTA. Bilateral trade stood at USD 6.8bn and two-way investments at USD 16bn in 2020.

- The UAE reiterated its commitment to the OPEC+ agreement amid plans to maintain energy security and the need to stabilise global energy markets: these messages were emphasized as UAE’s officials met with the Japanese and British PMs.

- The Syrian President visited the UAE in his first visit to an Arab State since the war began in 2011 and the UAE stressed that it is “keen to strengthen cooperation” between the two countries. This follows a visit from the UAE foreign minister to Damascus in Nov.

- The UAE foreign minister visited Russia last week, emphasizing the need to cooperate with the country on energy security, while stating it is “ready to engage” in discussions “for a peaceful resolution” to the conflict in Ukraine.

- Sales of marine fuel from the UAE’s Fujairah marine refuelling and storage hub dropped (for a 4th consecutive month) by 5% to 612,000 cubic metres in Feb – the lowest in a year, according to Reuters.

- ADNOC awarded AED 2.4bn (USD 658mn) worth framework agreements for cementing services, as it aims to increase drilling and expand production capacity. More than 65% of the award value is projected to flow back into the domestic economy given ADNOC’s In-Country Value program. Separately, the CEO of ADNOC stated that investments in oil and gas was imperative to “avert disruptions in supply and demand”.

- Dubai Expo announced a milestone of 20mn visits since the start of the Expo in Oct, of which 70% visits were from the UAE. Children visited the Expo more than 2.8mn times, supported by the Expo Schools programme.

Media Review

Hurting from sanctions on Russia, India is losing faith in the West

https://www.bloombergquint.com/gadfly/ukraine-invasion-why-india-is-angry-about-russia-sanctions

The global economy’s growing risks: stagflation, refugees and lockdowns

https://www.ft.com/content/0f7945f5-b269-4d13-9151-c1ac9ec6fddc

Rising prices increase alarm for food security and political stability: UNCTAD

https://unctad.org/news/rising-prices-increase-alarm-food-security-and-political-stability

Three big uncertainties cloud the oil market