Markets

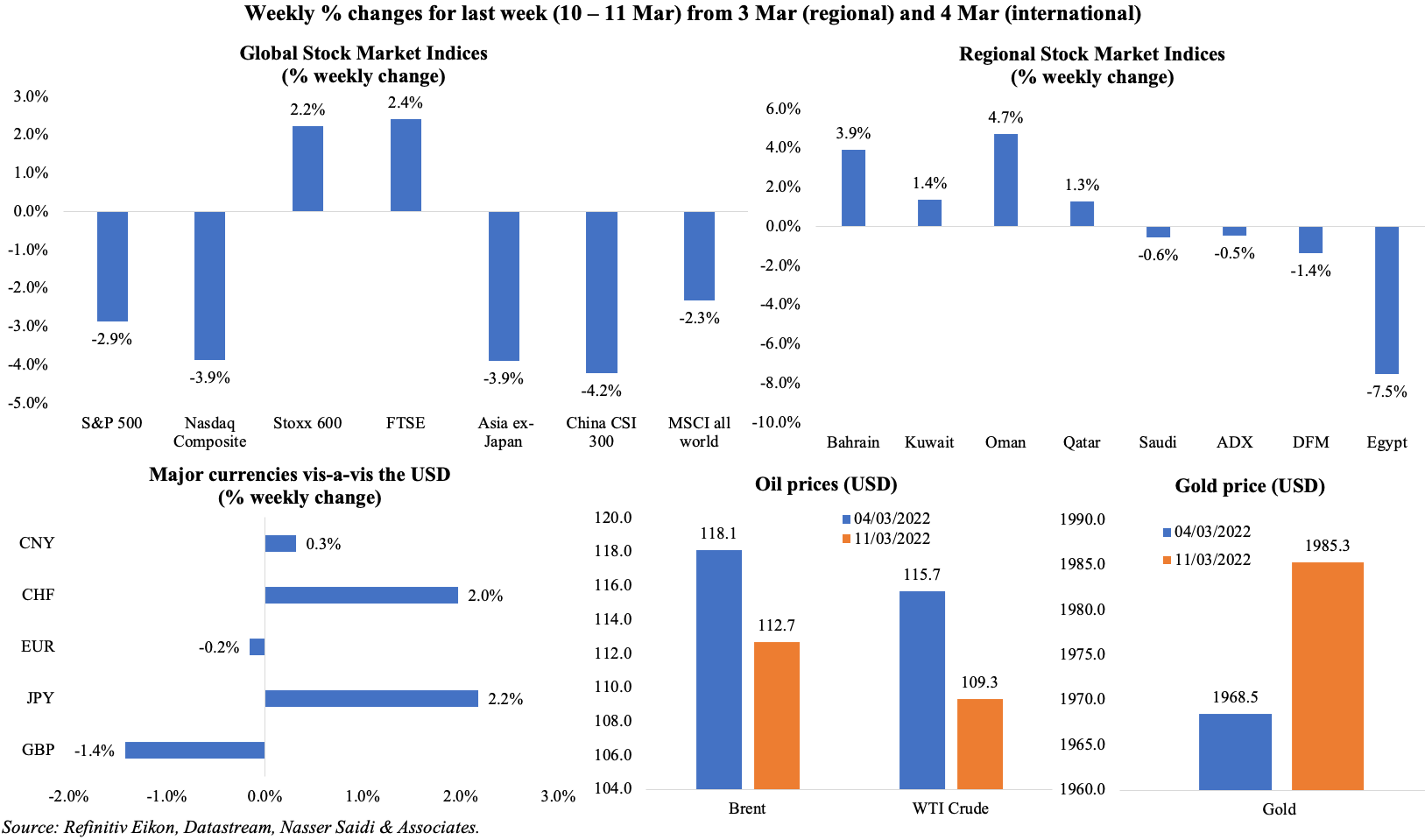

Global markets had a rough week, with markets mostly down as the Ukraine war continues and as investors prepared for an interest rate hike from the Fed this week. Stoxx600 and FTSE posted weekly gains, after 3 consecutive weeks of losses. In the region, all oil exporting nations gained except for Saudi Arabia and the UAE – which was open on Fri and closed lower. The dollar strengthened touching a 5-year high versus the Japanese Yen while the euro dropped. Oil prices had a volatile week, posting the biggest single day decline (since early days of Covid) mid-week, and ending lower between 5%-5.5% compared to a week before. Gold continued its safe-haven rally, up close to 1%.

Global Developments

US/Americas:

- Inflation in the US surged to a new 40-year high of 7.9% yoy in Feb (Jan: 7.5%), thanks to higher gasoline and food costs (up by 6.6% mom and 1% mom respectively). Core CPI climbed to 6.4%, the largest yoy increase since Aug 1982, and from 6% the prior month.

- Budget deficit in the US totaled USD 475bn in Oct-Feb, down by more than half compared to a year ago; deficit in the month of Feb was lower by -30.2% yoy to USD 217bn. Revenues were up by 26% during the Oct-Feb period while spending declined by 8%.

- Trade deficit in the US widened to a record high of USD 89.7bn in Jan (Dec: USD 82bn), as imports increased by 1.2% to USD 314.1bn while exports dropped by 1.7% to USD 224.4bn. Imports of food, capital and consumer goods posted record-highs while crude oil imports jumped by USD 935mn. Exports were dragged down by a decline in exports of consumer goods.

- JOLTS job openings slipped slightly to 11.263mn in Jan (Dec: 11.448mn) while workers voluntarily leaving jobs (or quits) also dropped to 4.25mn – the lowest since Oct. Quits rate as a share of labour force declined to 2.8% from 3% in the prior two months.

- Initial jobless claims increased to 227k in the week ended March 4th from the previous week’s upwardly revised 216k; the 4-week average inched up to 231.25k. Continuing claims clocked in at 1.494mn in the week ended Feb 25th, slightly higher than the 1.469mn the prior week.

Europe:

- The ECB left rates unchanged as expected but quickened its plans for a reduction in its asset purchase plans (reduce bond purchases to EUR 40bn in Apr, EUR 30bn in May and EUR 20bn in Jun). The ECB also raised its inflation forecast to 5.1% this year (from 3.2% before) citing “exceptional energy price shocks” due to the ongoing war.

- Eurozone GDP grew by 0.3% qoq and 4.6% yoy in Q4, confirming previous estimates. Investments added 0.7 ppts to growth, while inventories and government spending added 0.3 and 0.1 points. Employment in the eurozone increased by 0.5% qoq and 2% yoy in Q4.

- German factory orders inched up by 1.8% mom in Jan, supported by the jump in foreign orders (+9.4%) – mostly non-EU nations (+17%) – and as domestic orders sank by 8.3%. Industrial production in Germany increased by 2.7% mom and 1.8% yoy in Jan. However, the war in Ukraine will play havoc with this positive picture, given the rise in energy prices and impact on the auto sector (given the supplier network in Ukraine). Compared to pre-pandemic levels, IP is still lower by 3%.

- Retail sales in Germany jumped by 2% mom and 10.3% yoy in Jan, partially recovering from the Dec slump and despite Covid-related restrictions.

- Sentix investor confidence in the eurozone plummeted to -7 in Mar (Feb: 16.6) – this is the lowest level since Nov 2020. An expectations index crashed to -20.8 in Mar (Feb: 14), posting the biggest drop in the index’s history.

- GDP in the UK increased by 0.8% mom in Jan (Dec: -0.2%), taking the 3month-on-3month growth rate to 1.1%. This monthly measure puts GDP 0.8% higher than pre-pandemic level; however, if the extra spending on healthcare was excluded, output would be 1.2% below pre-pandemic levels.

- Industrial production in the UK grew by 2.3% yoy in Jan, faster than Dec’s 0.4% gain. Manufacturing also grew, rising by 3.6% yoy (Dec: 1.3%).

- Trade deficit widened to a record high of GBP 16.159bn in Jan (Dec: GBP 2.337bn) – the most since 1996, as imports from the EU surged and exports to the bloc fell by GBP 3bn. Changes to the measurement of trade flows between UK and EU partly accounted for the drop in exports. Non-EU trade balance jumped to GBP 13.65bn from GBP 7.876bn.

- Like-for-like retail sales in the UK increased by 2.7% yoy in Feb, with non-food like-for-like retail sales rising by 6.9% in the 3 months to Feb.

Asia Pacific:

- Inflation in China inched up by 0.6% mom (the most in 4 months) and 0.9% yoy in Feb (unchanged from Jan, lowest since Sep 2021). Food prices dropped by 3.9% yoy while non-food prices rose 2.1%. Producer price index eased to 8.8% in Feb (Jan: 9.1%) – the lowest reading since Jun – supported by government measures to control prices and secure supply.

- China’s exports and imports grew by 16.3% yoy and 15.5% in Jan-Feb, widening the trade balance to USD 115.95bn. Exports to Russia surged by 41.5% during the period while imports rose by 35.8%. China’s trade surplus with US widened by 16.7% yoy to USD 59.8bn.

- Foreign exchange reserves in China declined slightly by 0.24% mom to USD 3.214trn in Feb (Jan: USD 3.222trn). Money supply in China increased by 9.2% yoy in Feb (Jan: 9.8%). New loans extended by banks stood at CNY 1230bn in Feb, sharply lower than the record CNY 3980bn in Jan. Outstanding yuan loans grew by 11.4% yoy, the least since May 2002.

- China doubled the permitted daily trading band for the renminbi’s exchange rate with the rouble, allowing the currency cross to trade 10% in either direction.

- Q4 GDP in Japan was revised downwards in its latest estimate: Japan’s GDP expanded by an annualized 4.6% (vs preliminary estimate of 5.4%) and up by 1.1% qoq in Q4 (Q3: 1.3%). The revision was due to a downgrade in private consumption (to a 2.4% gain from an initial estimate of 2.7%) and spending in the service sector (to 3.1% from 3.5% previous estimate).

- Current account deficit in Japan worsened in Jan, widening to JPY 1188.7bn: this was the largest figure since the start of 2014 and more than three times the previous month’s JPY 370.8bn deficit.

- The leading economic index in Japan slipped to 103.7 in Jan (Dec: 104.7), given ongoing supply chain disruptions. The coincident index slipped to 94.3 from 94.8 as the Omicron variant derailed recovery.

- Producer price index in Japan increased to 9.3% in Feb (Jan: 8.9%), the steepest growth since data became available in 1981, pushed higher by crude oil and other materials prices. Prices of petroleum and coal products jumped by 2%, as did electricity, city gas and water charges (+27.5%), steel products (24.5%) and chemical products (12.3%).

- Overall household spending in Japan expanded by 6.9% yoy in Jan, after posting a 0.2% drop in Dec – this was the first rise in spending since last Jul.

- Industrial production in India grew by 1.3% yoy in Jan, following Dec’s 10-month low of 0.4%. Manufacturing output rebounded by 1.1% (Dec: -0.9%).

Bottomline: In the backdrop to the war in Ukraine, the Fed meets this week and is expected to raise interest rates by 25bps. The Fed is pinning its hopes on the hike to slightly dampen inflation (at 7.9% in Feb) though the conflict has sent commodity prices surging. The World Bank estimates that a 10% rise in oil price that persists for several years can cut growth in commodity-importing developing economies by a tenth of a percentage point. And with Russia-Ukraine negotiations dragging on with no solution in sight, at this stage, a global recession is emerging as a strong possibility, a stagflation scenario. Add to this, China is shutting down various cities including Shenzhen and Changchun given new Covid cases – these restrictions will hit many company operations including Toyota, Apple supplier Foxconn, Huawei and Volkswagen among others, adding to further global supply disruptions/ delays.

Regional Developments

- Bahrain-origin exports from surged by 93% yoy to BHD 387mn (USD 1.018bn) in Jan, with the top 10 destinations accounting for 76% of total value. Saudi Arabia (BHD 70mn), the US (BHD 69mn) and the UAE (BHD 30mn) were the top three destinations. Imports grew by 10% to BHD 449mn, with China, Australia and UAE taking the top three spots.

- Bilateral trade between Bahrain and the EU reached BHD 411mn by end-2021.

- The Bahrain FinTech Ecosystem Report disclosed that the number of fintechs in Bahrain has increased to over 120 – having doubled since 2018. The report can be downloaded at: https://www.bahrainfintechbay.com/publications

- Inflation in Egypt jumped to 8.8% yoy in Feb: this was the highest since Jun 2019, and up from Jan’s 7.3%. Food prices were a major driver, rising by 4.6% mom in Feb, and vegetable prices rose by much higher (+17.2%). Core inflation also increased to 7.2% yoy (Jan: 6.3%).

- Egypt’s first fintech fund is being launched by three banks – National Bank of Egypt, Banque Misr, and Banque du Caire – with a capital of over EGP 1.3bn.

- The Central Bank of Egypt expects to launch an online services project “Know your Customer” by end of this year that would allow opening of bank accounts online without visiting the bank. An Instant Payments Project, to be launched in 2 weeks, will allow electronic transactions to be completed in real time.

- Egypt is considering importing wheat from EU nations in 2022, according to the deputy supply and internal trade minister. He also revealed that existing reserves and availability from local harvest will be sufficient for 9 months. In 2021, Russia and Ukraine accounted for 50% and 30% of the nation’s supply respectively. Wheat costs in the country have risen by 17% because of the war – relatively modest compared to other markets reporting close to 48% hike.

- Egypt imposed a three-month export ban on green wheat, cooking oil, and corn, reported local newspaper Ahram, citing the Minister of Trade and Industry.

- Egypt signed a green energy deal with ACWA Power, to purchase wind energy of 1,100 megawatts from the latter at a cost of over USD 1.2bn.

- JP Morgan expect a devaluation of the Egyptian pound, estimating that the EGP was currently more than 15% overvalued.

- Iraq was reportedly hosting another round of talks between Iran and Saudi Arabia last week, according to a Reuters report. This would be the 4th round of talks hosted by the country.

- With a few outstanding issues remaining, the Iran nuclear deal negotiations have been “paused” due to “external factors”. Earlier, the US disclosed that the nation has no intention of offering Russia any leeway with respect to sanctions to achieve a deal with Iran.

- The banking sector in Kuwait accounted for about 46% of job opportunities for Kuwaiti citizens, working out to 16,650 jobs, reported Al Anba daily.

- Kuwait’s energy minister disclosed that the country has new strategies in place to provide adequate electricity in the summer months and is “ready” to meet peak demand.

- Lebanon’s financial system’s losses, estimated at USD 69bn in Sep, is expected to expand to USD 73bn, according to the deputy PM. He stated the state’s contribution to plugging the hole would be “limited” to ensure public debt sustainability; also though the government had agreed with the IMF on the need to protect small depositors, the ceiling for defining a small depositor has not yet been agreed upon.

- The central bank of Lebanon denied that operations had been halted on the official foreign exchange platform.

- The CEO of the Muscat Stock Exchange disclosed that Oman plans to list 35 state-owned firms in the next 5 years, listing 1-2 oil firms this year. The Exchange has raised the limits of foreign ownership in joint stock companies to 100%; currently foreign trading represents 14.5% of the total trading in the Muscat Stock Exchange.

- Foreign investors can buy property in Oman with a First-Class Residency Card. Expat investors who buy housing units valued between OMR 250-500k will receive a first-class residence card, while those who own homes valued below OMR 250k will receive a second-class residence card.

- The IMF expects Qatar GDP to grow by 3.2% yoy in 2022, driven by higher energy prices, strong domestic demand and ahead of hosting the FIFA World Cup 2022. Downside risks highlighted includes new strains of the virus, geopolitical tensions, and energy market volatility. More: https://www.imf.org/en/News/Articles/2022/03/07/pr2263-imf-staff-completes-2022-article-iv-mission-to-qatar

- Germany and Qatar discussed bilateral cooperation, including energy and corporate investments. Germany plans to make the nation independent of Russian coal and oil in less than a year. Qatar meanwhile plans to raise LNG production capacity to 126mn tonnes a year by 2025 from 77mn tonnes currently.

- Real estate sales in the GCC surged to USD 137.4bn in 2021, rising by almost 52% yoy, according to a report by Kamco Invest. The average value per transaction in GCC bottomed out at USD 207k in 2021 and was only 7.1% lower than the 2017 average.

- Up to 16k volunteers from the Middle East stand ready to fight alongside Russia against Ukraine, disclosed Russia’s defence minister at a meeting of Russia’s Security Council.

- Wamda reported that investment funding in MENA surged by 51% mom and 134% yoy to USD 375mn in Feb, with the logistics sector raising the most funding (USD 120mn). Saudi Arabia accounted for 58% of the funding in Feb, followed by the UAE (USD 77.6mn) and Egypt (USD 70mn).

Saudi Arabia Focus

- SAMA extended the Guaranteed Financing Programme scheme for MSMEs till March 14th, 2023. The central bank stated that the Guaranteed Financing Program benefited over 13,000 contracts with a total financing value of more than SAR 11bn (USD 3bn).

- Saudi Arabia’s industrial sector attracted more than SAR 81bn in investments last year, disclosed the industry minister.

- Foreign investment licenses issued in Saudi Arabia surged by 250% yoy to 4431 in 2021. The National Transformation Program also disclosed that in 2022, 44 international companies had chosen Riyadh as their regional headquarters.

- Bids have been invited by Saudi Zakat, Tax and Customs Authority for the development of a key logistics zone project on a 1mn square metre area at Jadeedah Arar port. The project project grants Saudi Arabia access to the Iraqi market and is expected to boost bilateral trade and economic exchange.

- Saudi Arabia awarded two renewable energy projects (Al Rass and Saad), valued at SAR 2.5bn, with a total capacity of 1000 MW.

- Saudi Aramco’s JV with China is to develop an integrated refinery and petrochemical complex in Saudi’s northeast area, expected to be operation in 2024. The plant will allow Aramco to supply upto 210k bpd of crude oil feedstock.

- According to the investment minister, tourism (spanning religious, domestic and international) is expected to contribute 15% of Saudi Arabia’s USD 1.86trn GDP by 2030, attracting close to 100mn visits yearly and around 500k hotel keys (mostly new).

- Saudi Arabia’s national defense company plans to add 1,500 employees this year, according to the CEO. As of end-2021, there were 2500 employees of whom 22% were female.

- The number of females employed at Saudi banks has been rising: the highest percentage was at Riyad Bank (27.3%), followed by Gulf International Bank (27%) and Saudi Investment Bank (23.7%).

UAE Focus![]()

- Dubai PMI climbed to 54.1 in Feb (Jan: 52.6), driven by new orders sub-index and with travel and tourism sector posting its strongest growth since Jun 2019 as travel restrictions eased.

- Dubai’s Ruler announced that the emirate had adopted its first law governing virtual assets and established a regulator (Virtual Assets Regulatory Authority or VARA) to oversee the sector. The law did not specify which assets would come under this, but it will apply across all of Dubai other than in the DIFC. WAM reported that it is prohibited for any person in the emirate to engage in activities without authorisation from VARA, while any person wishing to practise virtual asset activities must establish a presence in Dubai to conduct business. More: https://www.wam.ae/en/details/1395303028189

- The DFSA, regulator of the DIFC, published a regulatory framework consultation paper overseeing crypto tokens. This covered cryptocurrencies as well as hybrid utility tokens but excludes from its regulatory scope utility tokens, NFTs and central bank digital currencies. The consultation paper can be accessed at: https://dfsaen.thomsonreuters.com/sites/default/files/net_file_store/CP143_Regulation_of_Crypto_Tokens.pdf

- UAE’s energy minister reiterated the nation’s commitment to the OPEC+ agreement, after the UAE Ambassador to US tweeted that the UAE favours an increase in oil production and would encourage OPEC+ to increase output further. The latter statement saw oil record its biggest one-day fall since early-Covid days, but subsequently prices pushed back up.

- Dubai Electricity & Water Authority (DEWA), which was expected to announce its intention to float last Monday, delayed the announcement.

- Sharjah budget is expected to post a deficit of AED 9.2bn in 2022, estimated at 7% of GDP and compares to 8.8% of GDP in 2021, according to the finance department. Sharjah’s debt will likely exceed 60% of GDP and 800% of government revenue over the next three year

- Net income of UAE’s major lenders increased by 48.6% yoy to AED 37.8bn (USD 10.8bn) in 2021, supported by higher operating income (+5.2%) and lower loss provisions (-30.1%), according to Alvarez & Marsal.

- Dubai property developer Damac delisted from the Dubai Financial Market on March 7th. The firm’s revenues fell by 37% yoy to AED 3bn in 2021, posting a net loss of AED 531mn.

- Agricultural production in Abu Dhabi grew by 12% yoy to AED 13.7bn in 2020, growing at a CAGR of 6.5% for the period 2017-2020. The sector’s contribution to GDP stood at 1.1% in 2020 compared to 0.8% in previous years.

- The Dubai Chamber of Commerce revealed that over 27,800 new member firms joined in 2021, up 66.8% yoy. The total number of firms have increased to over 287k. Last year alone, the value of exports and re-exports of Dubai Chamber members amounted to AED 227bn while a total of 669,922 certificates of origin were issued.

- With a 76% yoy increase in passenger numbers, flydubai posted a profit of AED 841mn (USD 229mn) in 2021 (2020: loss of AED 712mn).

- DP World declared a 26% yoy increase in revenues to USD 10.8bn in 2021, in spite of supply chain disruptions, “supported by acquisitions and new concessions including Angola, Unico, and Transworld”.

Media Review

What Le Corbusier got right about office space: Undercover economist

https://www.ft.com/content/605c605b-89e2-47af-b908-3d77cb889689

Generation Z faces a tough economy with war, inflation, Covid

The IMF’s Agreement with Argentina Could Be a Game Changer

How much extra oil could OPEC+ pump to cool prices?

https://www.reuters.com/business/energy/how-much-extra-oil-could-opec-pump-cool-prices-2022-03-11/

Why crypto is unlikely to be useful for sanctions-dodgers

Iraq’s youth bulge threatens to buckle its weakened economy

https://www.arabnews.com/node/2040251/business-economy