Markets

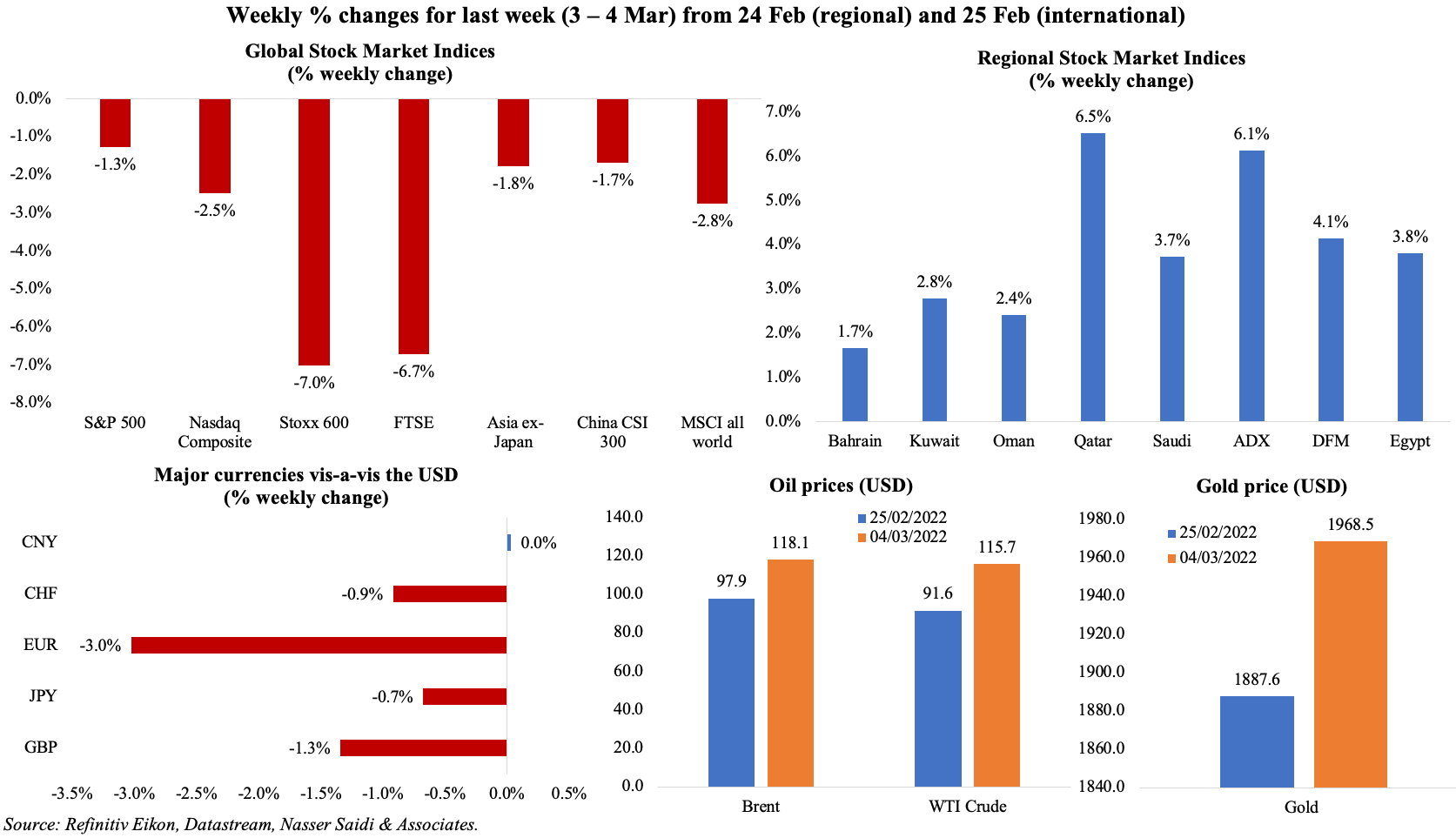

Global markets were mostly down compared to the week before, on escalating geopolitical tensions which dominated headlines. European markets tanked to near 1-year lows and net outflows from the region’s equity markets hit USD 6.7bn in a single week (the highest in 5 years). Asian shares hit 16-month lows amid a surge in safe-haven assets (like government bonds and gold) while oil prices (both Brent and WTI) crossed the USD 130 mark. Regional equity indices were boosted by higher oil prices, as Abu Dhabi posted its biggest weekly gain since Jan 2021 and Aramco shares touched a high of SAR 45 before closing lower. The euro slipped below USD 1.1 for the first time in almost 2 years while also posting a new 7-year low vs the CHF.

Global Developments

US/Americas:

- Non-farm payrolls accelerated to 678k in Feb (Jan: 481k), supported by hiring in the leisure and hospitality (+179k) as well as the education and health services (+112k) sectors. Unemployment rate declined to 3.8% from 4% in Jan before while the labour force participation rate inched up to 62.3% (Jan: 62.2%). The annual rate of growth in average hourly earnings slowed from 5.7% to 5.1%.

- The private sector in the US hired 475k workers in Feb (Jan’s upwardly revised 509k), because of increases in leisure & hospitality (170k) and trade, transportation & utilities (98k) among others; large companies added 552k jobs while small firms cut 96k.

- Initial jobless claims fell to 215k in the week ended Feb 25th (the lowest level since Jan 1st) from the previous week’s upwardly revised 233k; the 4-week average eased to 230.5k. Continuing claims clocked in at 1.476mn in the week ended Feb 18th, with its 4-week moving average (at 1.54mn) posting the lowest level since April 4th, 1970.

- Fed Beige book states that the economy expanded at a “modest to moderate pace” in Jan-Feb amid the omicron surge. Firms expect “additional price increases over the next several months”, and all 12 Fed districts reported supply chain issues and low inventories (both restraining growth) amid “scattered signs” of improving labour supply.

- Non-farm productivity was left unrevised at 6.6% annualized rate in Q4, while unit labour costs were revised upwards to 0.9% from the previous estimate of 0.3%.

- Factory orders in the US increased by 1.4% mom in Jan, from an upwardly revised 0.7% gain in Dec. Orders for non-defense capital goods (excluding aircraft) grew by 1%.

- Goods trade deficit widened again to a record high USD 107.6bn in Jan (Dec: USD 101.4bn), as imports rose by 1.7% (led by food and motor vehicles) and exports dropped by 1.8% (weighed down by consumer goods and motor vehicles among others).

- Chicago PMI eased to 56.3 in Feb (Jan: 65.2), the lowest reading since Aug 2020, with new orders and supplier deliveries posting the largest declines. In contrast, Dallas Fed manufacturing business index surged to 14 in Feb (Jan: 2), the highest reading since Oct.

- ISM manufacturing PMI increased to 58.6 in Feb (Jan: 57.6), supported by new orders (61.7 from 57.9) while employment eased (52.9 from 54.5) and prices paid slipped (to 75.6 from 76.1). The ISM non-manufacturing PMI fell to 56.5 in Feb, the lowest in a year, and the 3rd straight monthly decline (Jan: 59.9).

- Markit manufacturing PMI touched 57.3 in Feb, lower than the preliminary reading of 57.5, but higher than Jan’s 55.5. Output and new orders expanded, contributing to the uptick, while expectations for the year ahead was the strongest since Nov 2020.

Europe:

- Preliminary Harmonised Index of Consumer Prices (HICP) in the eurozone showed an acceleration in Feb, up to 5.8% (Jan: 5.1%), due to a 32% jump in energy costs and a 4.1% uptick in food costs. Core HICP also rose, to 2.7% from Jan’s 2.3%. HICP in Germany climbed to 5.5% in Feb (Jan: 5.1%).

- Producer price index in the euro area increased to 5.2% in mom in Jan (Dec: 3%). In yoy terms, PPI hit a new record high of 30.6% in Jan (Dec: 26.3%) as energy prices jumped by 85.6% and intermediate goods costs were up by 20.2%.

- Germany’s Markit manufacturing PMI was 58.4 in Feb, lower than Jan’s 5-month high of 59.8, as absenteeism (due to Covid infections) affected staff availability amid acceleration in new orders and new export orders growth. Services inched up to 55.8 in Feb (Jan: 52.2), supporting the rise in composite PMI to 55.6 (posting the strongest growth in 6 months).

- Manufacturing PMI in the eurozone inched down to 58.2 in Feb from Jan’s 58.7, dragged down by the lengthening in suppliers’ delivery times gauge amid growth in both output and new orders. Composite PMI, at 55.5 in Feb, was above Jan’s 11-month low of 52.3, thanks to a faster rise in services PMI (to 55.5 from 52.3).

- Exports from Germany fell by 2.8% mom in Jan, and imports fell by a larger 4.2%, causing the trade surplus to widen to EUR 9.4bn (Dec: EUR 8.1bn). Monthly exports and imports were 4.0% and 17.8% higher respectively than the pre-pandemic level (Feb 2020).

- Unemployment rate in Germany slipped to 5% in Feb, down from Jan’s 5.1% and a new low since Mar 2020. Unemployment in the euro area also declined, falling to a record low 6.8% (Jan: 7%). Youth unemployment rate also fell – to 13.9% in Feb from Jan’s 14.2%.

- Retail sales in the eurozone rebounded by 0.2% mom in Jan (Dec: -2.7%). Sales of non-food products increased (+0.2%), sales of food, drinks and tobacco were flat while sales of auto fuel dropped (-1.3%). In yoy terms, retail sales jumped 7.8%.

- Manufacturing PMI in the UK climbed to a 3-month high of 58 in Feb (Jan: 57.3), signifying strong domestic demand amid relaxed Covid19 restrictions though export orders fell (due to a combination of Brexit and delivery delays).

Asia Pacific:

- China’s NBS manufacturing PMI inched up to 50.2 in Feb (Jan: 50.1), as new orders expanded for the first time in 7 months (50.7) and output rose for the 4th consecutive month (50.4). Non-manufacturing PMI climbed to 51.6 from a 5-month low of 51.1 in Dec though new orders dropped for a 9th consecutive month (47.6); employment contracted the least in 7 months (48).

- Caixin manufacturing PMI moved into expansionary territory in Feb, rising from Jan’s 49.1 reading, thanks to upticks in output (expanding for the 3rd time in 4 months) and new orders (grew the most since Jun 2021) and as the pace of decline in employment eased. Caixin services PMI slipped to 50.2 in Feb (Jan: 51.4) as new orders fell for the first time in 6 months and new export orders and employment fell for the 2nd consecutive month.

- Manufacturing PMI in Japan fell to 52.7 in Feb (Jan: 55.4), dragged down by pandemic-related restrictions and supply chain disruptions. Output shrank while input price inflation accelerated to the fastest since Aug 2008, due to higher raw material prices.

- Industrial production in Japan fell by 1.3% mom and 0.9% yoy in Jan. The global semiconductor crunch continues to play havoc, and output in the auto industry slumped by 17.2%. Meanwhile the ministry assessment states that output at factories and mines are “showing signs of upward movement”.

- Unemployment rate in Japan edged up to 2.8% in Jan (Dec: 2.7%) given the impact of the Omicron variant. Jobs to applicants ratio inched up to a 21-month high of 1.2 (Dec: 1.17).

- Japan’s retail trade slumped for a second consecutive month in month-on-month terms, with sales down by 1.9% mom in Jan following the 1.2% drop in Dec as Covid infections dragged on retail activity. In yoy terms however, retail sales grew by 1.6% – rising for the 4th straight month.

- GDP growth in India slowed in Oct-Dec, with the nation growing by 5.4% compared to the previous quarter’s 8.5% rise. Overall growth in the fiscal year 2021-22 is estimated at 8.9%, a tad lower than the 9.2% growth projection in Jan.

- Infrastructure output in India grew by 3.7% yoy in Jan, slower than 4.1% uptick in Dec. In the period Apr 2021-Jan 2022, infrastructure output grew by 11.6% yoy.

- India’s fiscal deficit widened to INR 9378bn in Jan, accounting for 58.9% of the annual budget target for 2021-22. Fiscal deficit is projected at 6.9% in the year ending Mar 2022.

- Retail sales in Singapore increased by 11.8% yoy in Jan (Dec: 6.7%), supported by rise in spending ahead of the Chinese New Year. In month-on-month terms, sales fell in Jan: overall by 2.5% and by 2.1% excluding motor vehicles.

Bottomline: Global manufacturing PMI inched up to 53.6 in Feb (Jan: 53.2), thanks to “faster increase in production, new business and employment”, but the “rosy” outlook will likely be negatively affected by the current geopolitical turmoil. OPEC+ agreed to stay with the gradual oil output rise (400k bpd in Apr) last week. Oil prices have since then jumped on worries about supply disruptions: these surges will be reflected in input costs (& subsequently output prices) shortly, leading to further increases in global inflation. Oil price is already up by about 25% in 2 weeks, and any US or EU ban on Russian oil will further complicate matters.

Regional Developments

- A spanner into the ongoing Iran nuclear deal negotiations: Russia has demanded that its trade with Iran will be exempted from the US sanctions (imposed after the Ukraine invasion). If the other nations do not agree to this (highly likely), Russia could decide to veto the nuclear deal. Separately, Iran’s oil minister disclosed that should the negotiations end favourably, the country can reach maximum oil production capacity in “less than one or two months”.

- Bahrain and the US signed 6 agreements spanning industry, logistics, information technology and space sciences during the Crown Prince’s visit to the US. A partnership between the Information & eGovernment Authority and Microsoft and an agreement with Cisco pertaining to government data network infrastructure were also signed.

- More than 4.9 million vehicles crossed King Fahad Causeway (connecting Bahrain and Saudi Arabia) in 2021: this implies that a vehicle crossed every 20 minutes.

- PMI in Egypt remained below the 50-mark in contractionary territory in Feb, but increased to 48.1 from Jan’s 9-month low of 47.9. Both output and new orders remained sub-50 with weak sales reported due to a decline in client demand. Overall confidence fell to its lowest level in the series history, with just 11% of firms reporting a positive outlook for the upcoming year.

- Egypt’s finance ministry disclosed that the government plans to issue sukuk, Eurobonds and green bonds to fund public projects. The ministry also revealed its plans to double its contribution to government-backed green investments in the next financial year to 30% of all public investment.

- The Suez Canal has witnessed a 15% surge in the transit of wheat and gas ships, reported Al Arabiya, citing the head of the Suez Canal Authority. Separately, the transit fees for ships using the Suez Canal was raised by 5-10% starting March 1st.

- Reuters reported that China’s purchases of Iranian oil have risen to record levels in recent months (700k barrels per day in Jan), higher than a 2017 peak (of 623k bpd) before US sanctions were imposed.

- Iraq pumped 4.18mn bpd of oil in Feb, up just 13k bpd from Jan, and about 15k short of its allowance as part of the OPEC+ deal. Upgrade works at Gulf ports, maintenance and protests have led to outages and halted production.

- Jordan and Saudi Arabia’s Chambers of Commerce and Industry entities have signed a bilateral agreement eyeing trade relations in excess of USD 1bn. Saudi Arabia is currently the second-largest commercial partner for Jordan.

- Jordan’s state airline Royal Jordanian is looking for government support via a JOD 200mn (USD 282.49mn) equity injection, according to the CEO.

- About 242,000 citizens and expatriates traveled out of Kuwait during the national holidays, reported Al Anba daily, with Turkey one of the most preferred travel destinations.

- Lebanon’s deputy PM stated that an IMF delegation could visit in the second half of this month to continue discussions related to the aid programme.

- PMI in Lebanon rose to the highest in 8 months, posting a reading of 47.5 in Feb (Jan: 47.1), with some optimism on the “resumption of government meetings”. But, absent an agreement with the IMF and rollout of essential reforms, it remains unlikely that this uptick can be sustained.

- Oman posted a budget surplus of OMR 18mn (USD 47mn) in Jan 2022, thanks to oil revenues (which almost doubled to OMR 554mn vs Jan 2021). During the month, revenues were up by more than 85% to OMR 803mn and spending was up by 9.59%.

- A Royal Decree in Oman allows for the set up of three free zones – Muscat International Airport Free Zone, Sohar Airport Free Zone and Salalah Airport Free Zone – in a bid to support the private sector attract investments. Free zones in Oman, as of 2020, had more than 800 companies, employing close to 36k workers and had attracted over OMR 7.3bn in investments.

- Oman has extended the PPP program to the education sector, launching a competitive process for procuring 42 schools to be developed and operated on behalf of the Ministry of Education.

- Qatar PMI stood at 61.4 in Feb, rising 3.8 points from Jan’s 57.6 – this was the biggest monthly gain since Jul 2020. The jump was supported by expansions in output, new orders and backlogs of work while employment rose for a 17th consecutive month.

- Abu Dhabi’s Mubadala and the Qatar Investment Authority were holding on to Russian assets, reported Bloomberg. Mubadala has at least USD 3bn worth of exposure and QIA has a 19% stake in Rosneft.

- Middle East’s travel and tourism sector are likely to increase to USD 246bn this year, according to the World Travel and Tourism Council. This will still be 8.9% lower than pre-pandemic levels.

Saudi Arabia Focus

- Saudi Arabia’s non-oil private sector PMI jumped to 56.2 in Feb (Jan: 53.2), reversing 4 months of declines, thanks to increases in output (61.4 from 53.6), new orders (growing at the fastest rate in 3 months) and employment (>50 for the 11th consecutive month). However, while domestic demand rose, export orders fell below the 50-mark.

- Saudi public debt posted its first quarterly decline since Q1 2017. In Q4 2021, external debt fell to SAR 379.3bn (Q3: SAR 387.8bn) largely due the repayment of external debt (SAR 20.7bn). Domestic debt also declined by SAR 1.8bn to SAR 558.7bn in Q4, causing overall public debt to slip to SAR 938bn (Q3: SAR 948.3bn).

- Saudi Arabia posted a fiscal deficit of SAR 73.4bn (USD 19.6bn) in 2021. There was a 42.5% qoq surge in spending in Q4, causing the fiscal balance to go into a deficit of SAR 68bn, following Q3’s surplus of SAR 6bn. Compensation of employees and use of goods & services together accounted for two-thirds of Q4 spending. The share of oil revenues as a percentage of total stood at 61% in Q4 & 58% in 2021.

- The Public Investment Fund (PIF) published its green finance framework, paving way for the raising green debt. The proceeds of such sales will go towards projects in renewable energy, energy efficiency sustainable water management, clean transport, green buildings and pollution prevention. The Fund also plans to publish allocation and impact reports annually when such debt is outstanding.

- Aramco’s shares touched the highest level of SAR 45 last Thursday, before closing at SAR 44.3, supported by the ramp up in oil prices. This brought the total market value of the company to around USD 2.3trn.

- Saudi Arabia will set up its first electric vehicle manufacturing plant in the country. The plant will produce up to 150k EVs every year and will be set up by Lucid Group. This move will support the target of ensuring electric vehicles comprise 30% of the total in Riyadh by 2030.

- A new destination for mountain tourism, Trojena, was launched as part of NEOM’s tourism development project. This is the third development project announced following the Line and OXAGON, and is expected to be completed by 2026.

UAE Focus![]()

- Non-oil private sector activity in the UAE improved in Feb, with PMI rising to 54.8 (Jan: 54.1), supported by strong demand. The year-ahead outlook for business activity rose to a 4-month high and was the second highest since mid-2020.

- UAE’s non-oil trade totaled AED 16.14trn over the past decade, according to the Minister of State for Foreign Trade. He also stated that investment is expected to rise by AED 550bn to AED 1 trn within 9 years. Non-oil exports during 2012-2021 exceeded AED 2.154trn – an annual growth rate of 12%.

- UAE non-oil foreign trade stood at around AED 1.9trn in 2021, 27% higher than 2020 & 11% up from 2019. Non-oil exports exceeded AED 300bn for the first time ever in 2021, underscoring the diversification efforts of the country and strength of its trade recovery. This will be further boosted by the ongoing trade deals with many emerging trade partners.

- The Dubai Government announced a new end-of-service savings scheme for expats working in the public sector, in addition to the existing gratuity scheme. Under this scheme, which will be introduced in phases, a series of investment mechanisms will be offered in line with employees’ preferences.

- UAE central bank approved the creation of 5000 jobs for UAE nationals in the banking and insurance sectors by the end of 2026.

- DIFC launched an AI, coding license in cooperation with the UAE AI office. The license will also provide an opportunity to get a Golden Visa for employees of these firms.

- Bloomberg reported that the Dubai Roads and Transport Authority selected Goldman Sachs, Bank of America and Emirates NBD as banks part of its IPO offering. No indication was provided regarding the valuation.

- Nasdaq Dubai latest bond listing was the Capital Bank of Jordan: the USD 100mn bond is the first by a Jordanian bank. There were 30 bond and sukuk listings worth up to USD 23.1bn at the exchange in 2021; bond issuances touched a record high 14, valued at USD 11.2bn.

- Reuters reported that the Abu Dhabi Investment Authority cut dozens of jobs as part of its AED 1bn cost saving program, mainly at the senior management level.

- The Financial Action Task Force (FATF) included the UAE in its “grey” liste. where jurisdictions are subject to increased monitoring. The authorities have made major changes to its AML regime and in combating financing of terrorism since its 2020 assessment, but more progress needs to be shown in the implementation of the action plan according to FATF. More: https://www.fatf-gafi.org/publications/high-risk-and-other-monitored-jurisdictions/documents/increased-monitoring-march-2022.html

- Dubai’s Mashreq bank has stopped lending to Russian banks, reported Reuters: its exposure was mainly short-term or one-year loans to banks, according to sources.

- The number of registered private sector workers in the UAE touched 4,903,612 at end-2021, excluding free zones, as per data from the Ministry of Human Resources and Emiratisation. The number of registered private firms totalled 373,966 (+6.6% yoy).

- The 256-km long railway link between Abu Dhabi and Dubai has been completed, according to the UAE media office.

- DEWA’s 19 EV charging stations at the Expo 2020 have provided 87,772 kilowatt hours of electricity during Oct-Dec via 3681 charging transactions. This translates to approximately 415k kms travelled in eco-friendly vehicles.

- Etihad Airways announced net loss of USD 476mn in 2021 – this is the 6th consecutive year of loss for the airline and compares to a loss of USD 1.7bn in 2020. Losses narrowed thanks to higher cargo revenues (+49% to USD 1.73bn) and lowering operating costs (-USD 110mn).

- Dubai private schools will not be allowed to hike fees in the 2022-23 academic year, according to the KHDA. Enrolment at Dubai’s private schools inched up by 5.8% since Feb 2021 (there are now 215 private schools in the emirate).

Media Review

Why oil prices might still climb higher

https://www.ft.com/content/a2bc0bbe-f43e-4927-8bd8-94c48e4fcdfc

Turning off Russia’s tap

https://www.project-syndicate.org/bigpicture/turning-off-russias-tap

Western sanctions have rocked Russia’s financial system

Ukraine crisis throws Egypt’s wheat purchases into doubt

KSA, UAE lead military R&D spending in GCC to build domestic capacity

https://www.arabnews.com/node/2035756/business-economy