Weekly Insights 4 Mar 2022: Higher Commodity Prices Spell Trouble for Major Importers; Oil Exporters Benefit

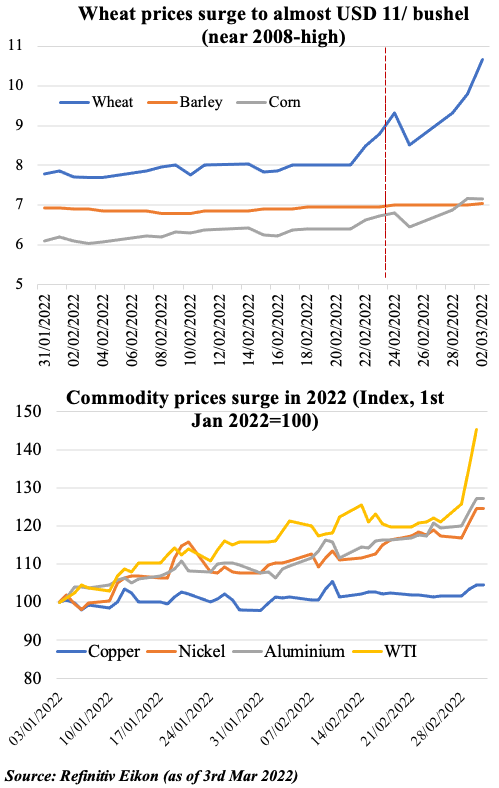

1. Commodity prices driven up by the ongoing war in Ukraine; delays/ disruptions will add to supply worries

As the war intensifies despite the sanctions on Russia, commodity prices are on the rise over supply fears:

Wheat is trading at close to 2008-highs

1. Russia is the top exporter of wheat (10% of global production and 20% of exports) while Ukraine is the 5th largest wheat exporter (10% of exports) & is also a barley and sunflower oil exporter

2. MENA region is one of the largest consumers of wheat, with a heavy reliance on imports. Egypt is one of the largest importers of wheat & bread highly subsidised

Price of global raw materials (tracked by S&P GSCI index) is up 16% this week (highest level since 2008)

WTI rose above USD 116 a barrel; Europe’s natural gas prices and aluminum prices have hit new records; nickel rose to a 11-year high last Thursday

In spite of supply side uncertainty, OPEC+ agreed to raise oil output by only 400k bpd (as agreed previously)

Inflationary pressures are likely to seep into every country as the commodities rally continues

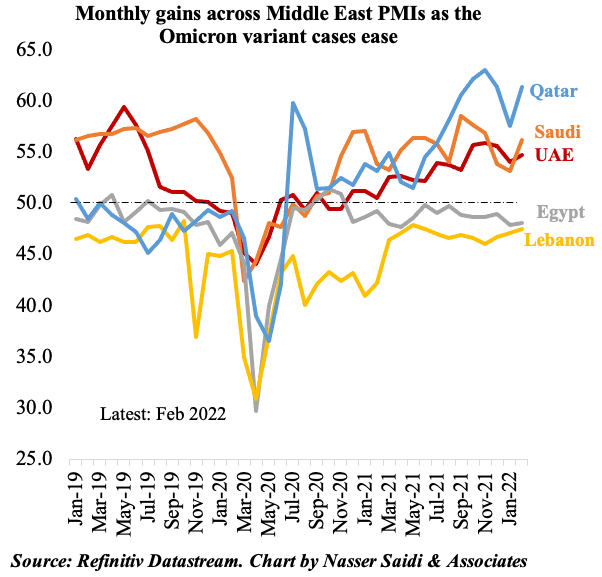

2. Middle East Feb PMIs stage a recovery after Jan’s Omicron-hit restrictions & uncertainty

- PMIs in Feb increased, thanks to an uptick in both output and new orders, supported by strong consumer demand (as Covid cases continue to fall)

- Saudi saw the first uptick since last Sep; in Qatar, Feb saw the biggest mom gain since Jul 2020; in UAE, expectations of a recovery saw firms increase their input purchases (at the fastest rate in 2.5 years)

- Egypt and Lebanon stayed below-50, in contractionary territory. High prices and challenging economic conditions pulled down confidence levels in both nations

- Shipment delays were reported by some respondents, but in general input costs were seen to ease in Feb

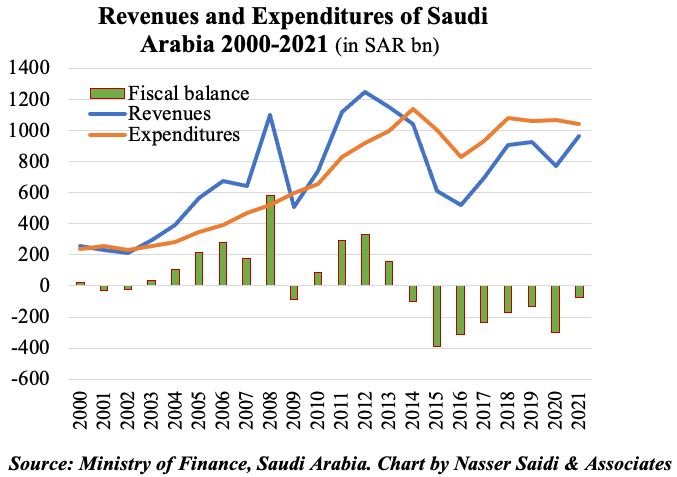

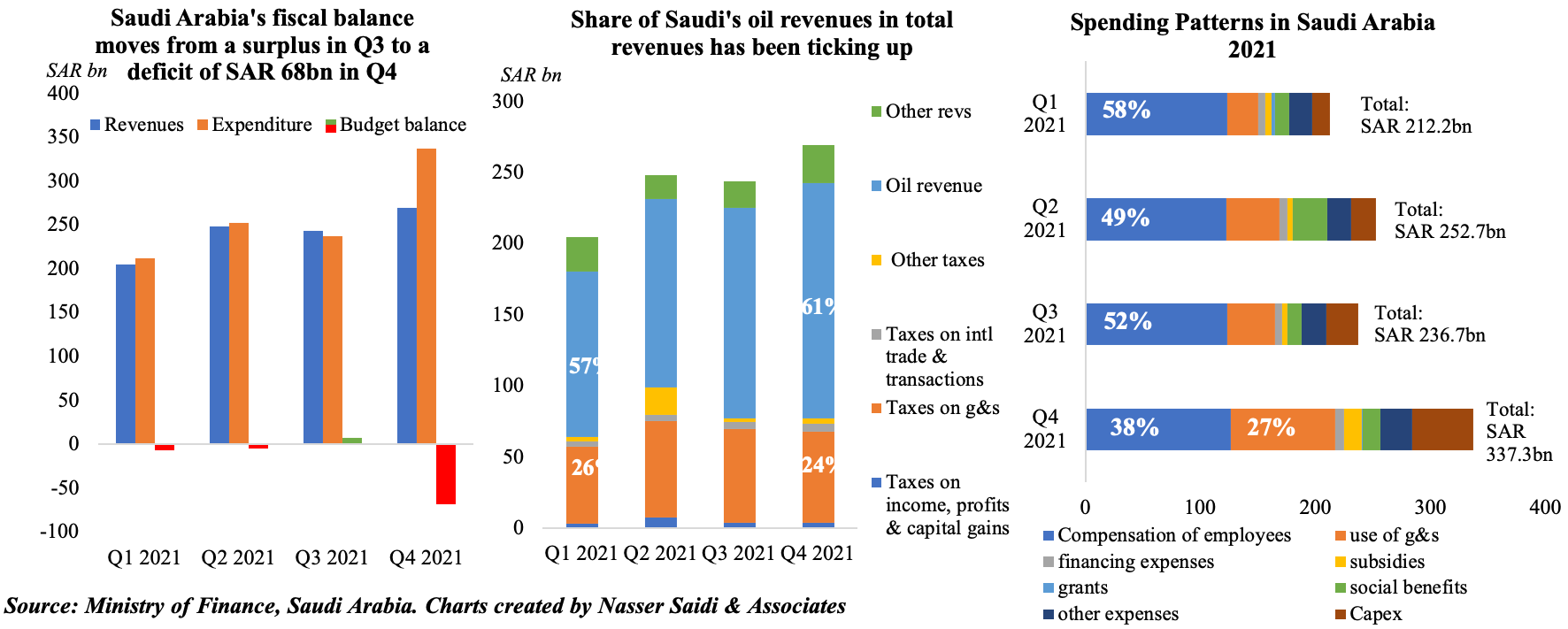

3. Saudi Arabia posts a budget deficit of SAR 73.4bn in 2021

- Saudi Arabia saw a 42.5% qoq surge in spending in Q4, causing the fiscal balance to go into a deficit of SAR 68bn, following Q3’s surplus of SAR 6bn

- Compensation of employees and use of goods & services together accounted for 2/3-rds of Q4 spending; in 2021, compensation of employees accounted for nearly half of total spending (47.7%)

- The share of oil revenues as % of total stood at 61% in Q4 & 58% in 2021; taxes on goods & services was 26% in 2021

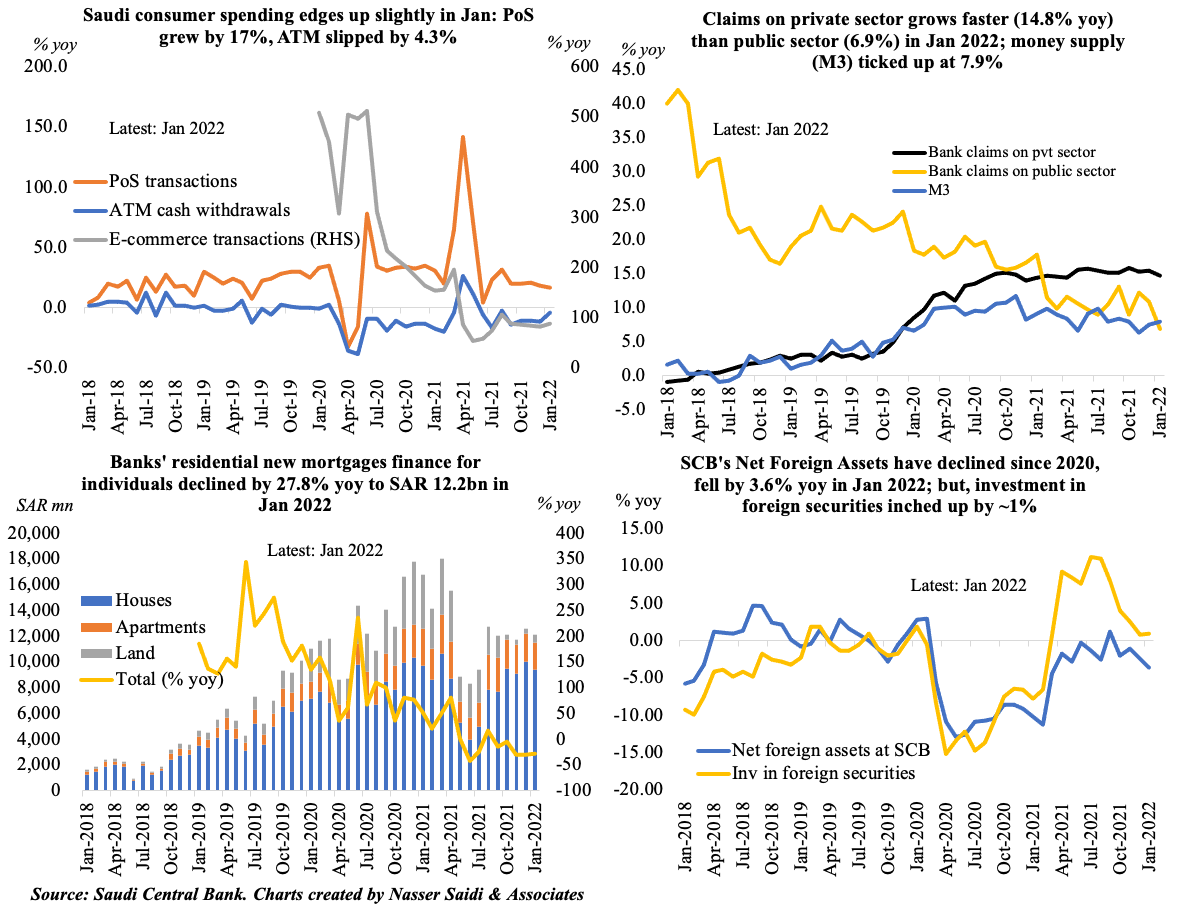

4. Consumer spending ticked up in Saudi Arabia, albeit slowly in Jan 2022

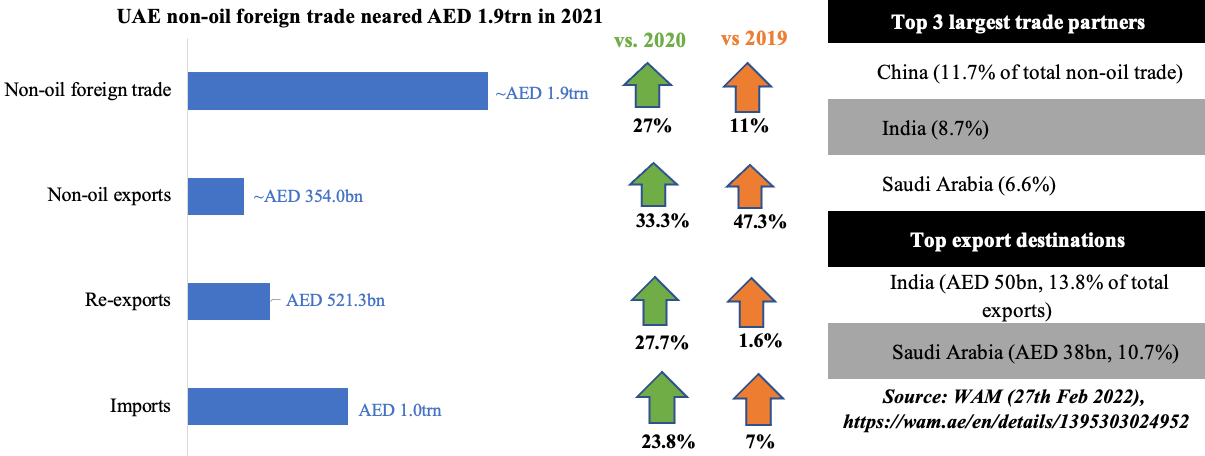

5. UAE non-oil exports touch a record-high AED 354bn in 2021, up 33.3% yoy

- UAE non-oil foreign trade stood at around AED 1.9trn in 2021, 27% higher than 2020 & 11% up from 2019

- Non-oil exports exceeded AED 300bn for the first time ever in 2021, underscoring the diversification efforts of the country and strength of its trade recovery. This will be further boosted by the ongoing trade deals with many emerging trade partners.

- Once again, in spite of the Covid-related slowdown, China emerged the largest trade partner for the UAE, with non-oil trade exhange up by 27% from 2020 and 19.8% from 2019. India was close behind, accounting for 8.7% of total non-oil exports, followed by Saudi Arabia, US and Iraq.

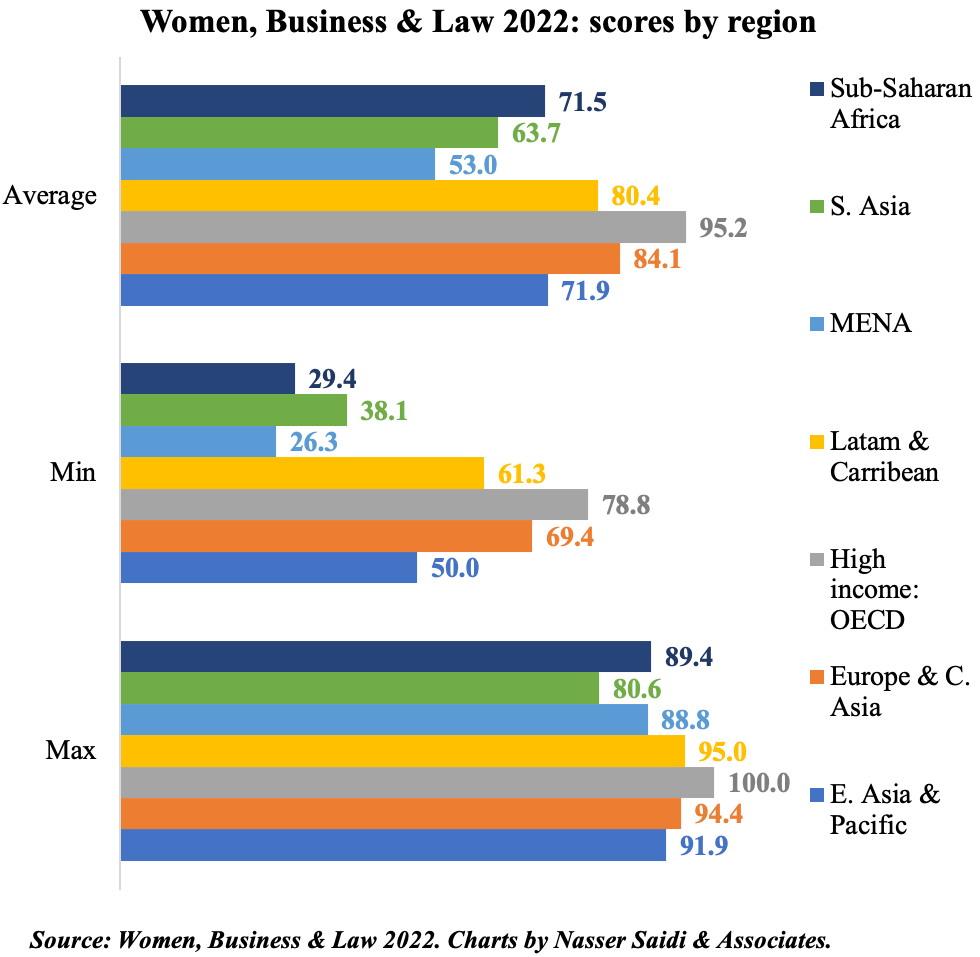

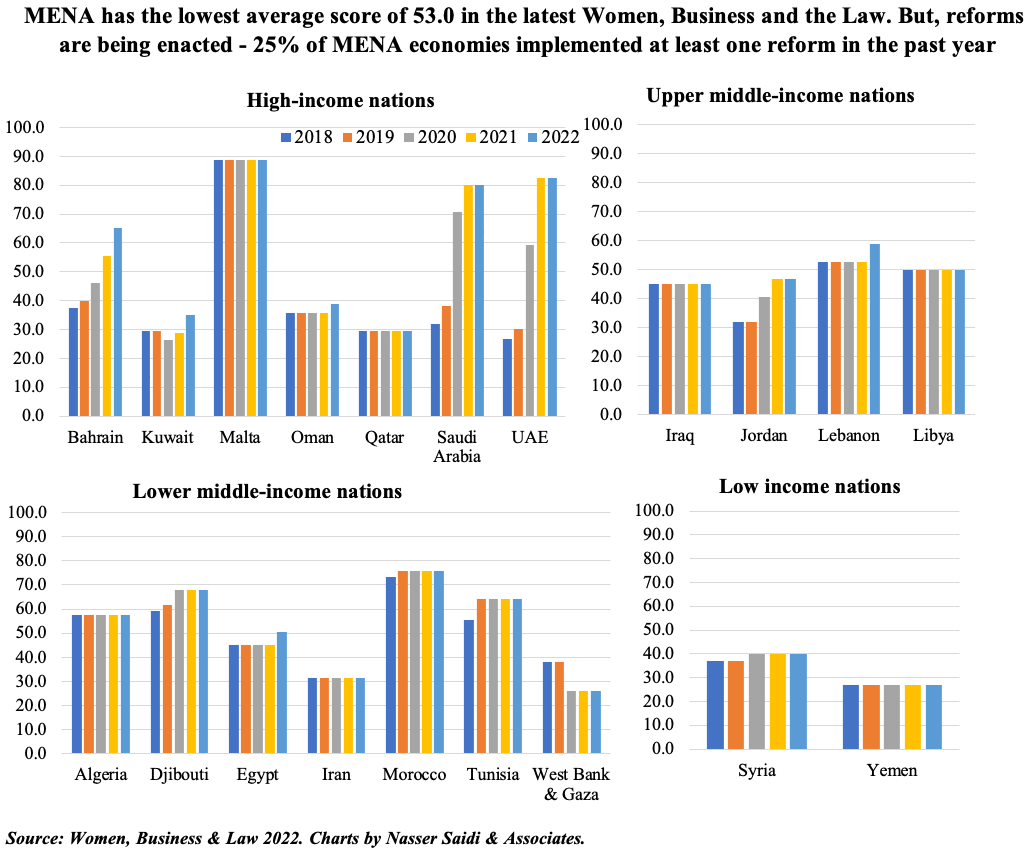

6. Women Business & Law 2022: MENA scores lowest globally

- Global average of the World Bank’s Women, Business and the Law score is 76.5 out of 100, indicating that a typical woman has just three-quarters of the rights of men in the areas measured

- Middle East & North Africa (MENA) region continues to feature at the bottom of all the regional groupings even in 2022 (lowest average score of 53)

- However, the higher-income nations within the MENA region have significantly performed better in the past few years

- Highest score countries Malta & the UAE are much higher than the highest score in South Asia (Nepal)

- However, it is important to note that these scores are based on reforms initiated by nations –might differ significantly with respect to implementation