Weekly Insights 24 Feb 2022: UAE trade expansion plans a step in the right direction as global trade recovery gets underway

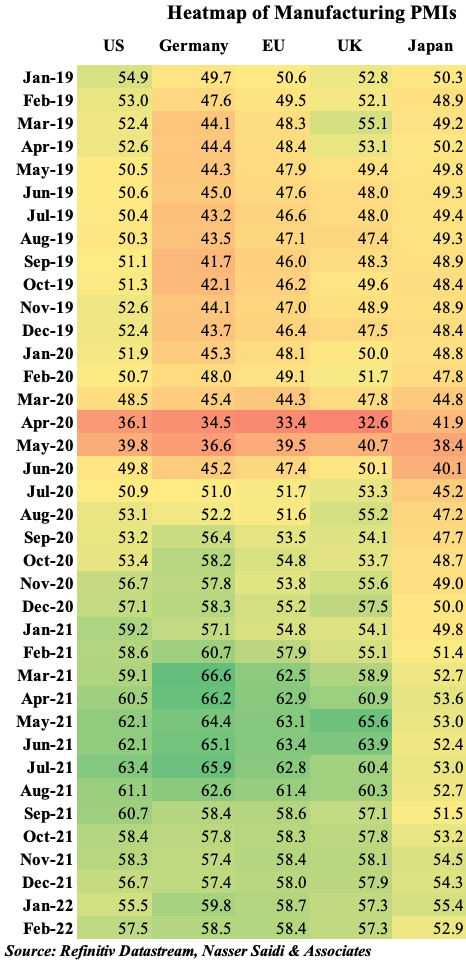

1. Feb flash PMIs remain strong, but inflationary pressures loom

- Manufacturing PMIs in Feb edged down slightly in Europe. However, thanks to a stronger recovery in services PMI (as Covid19 restrictions were lifted), overall composite PMI rose, signalling a “regained momentum”

- From the PMI data, supply delays seem to be easing i.e. weaker increase in input prices. But inflation is ticking up.

- Labour market pressures are building up: jobs are picking up after the Omicron-variant related widespread absenteeism; in the tight labour market, workers are being woo-ed by higher salaries & better benefits (including generous social safety nets) and in many cases, the right hybrid work arrangements are being considered as key

- Producer prices continue to accelerate (in Germany, producer prices surged by 25% in Jan – the fastest pace since 1949). These are being passed to the consumer => higher CPI

- Rising wages & energy bills led to a rise in prices charged for goods and services in the eurozone (highest since 2002) & inflationary pressures are bound to rise in the coming months, putting pressure on central banks

- For now, firms seem to have dealt with the Omicron wave better than previous variants. Orders are picking up (reflecting strong demand), but inflation is the main worry.

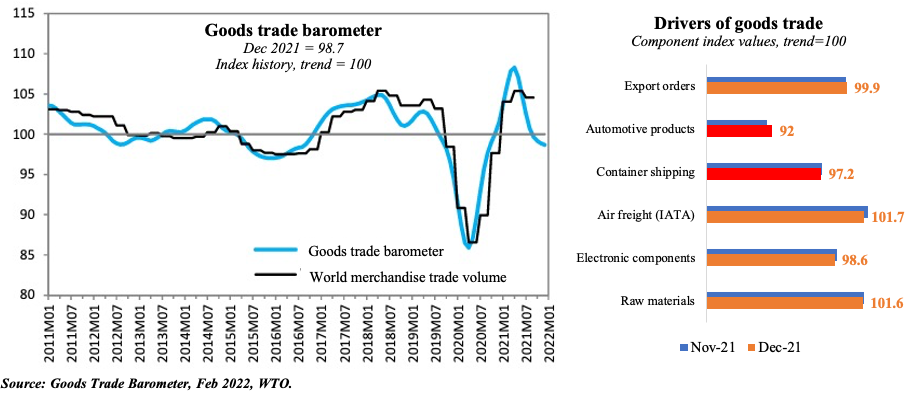

2. WTO goods trade barometer shows easing supply pressures, but index remains below baseline value of 100

- The WTO’s Goods trade barometer signaled a “possible turning point for trade”; this is in line with the UNCTAD’s recent estimate that world trade in goods remained strong in 2021 and that trade in services finally returned to its pre-COVID-19 levels.

- Many sub-indicators within the goods trade barometer remained close to the baseline value in Dec 2021 including export orders, air freight and raw materials (i.e. easing supply pressures amid rising demand).

- However, container shipping dropped lower indicating that port congestion is an ongoing issue. The Kiel Institute’s trade indicator (Feb 2022) shows that more than 10% of all goods shipped worldwide are still stuck in traffic jams and that freight volumes in the Red Sea, the most important maritime trade route between Europe and Asia, are around 10% below the level that would normally be expected.

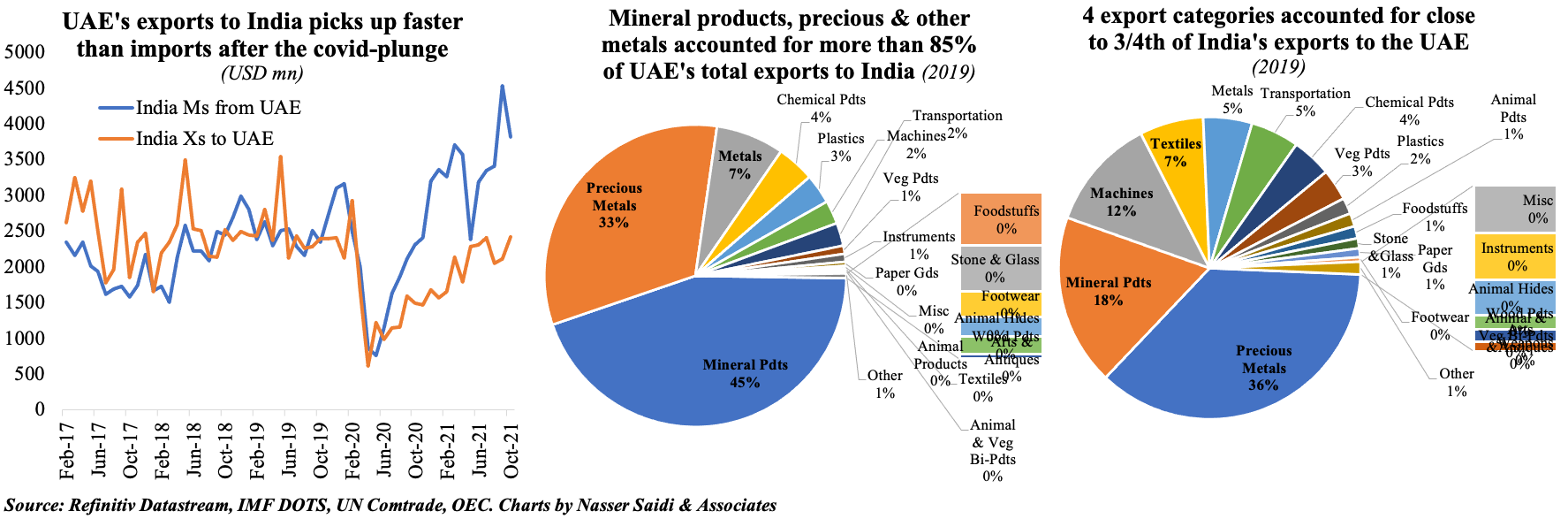

3. UAE starts on its ambitious trade expansion plans with the Comprehensive Economic Partnership Agreement (CEPA) with India

- The UAE-India trade deal is expected to boost bilateral non-oil trade to USD 100bn in the next 5 years. India was the UAE’s second largest trade partner in 2019 (pre-Covid); UAE is India’s 3rd largest trade partner

- The deal is expected to boost economic growth, exports, investments & job creation in both nations. Under the deal, businessmen can apply for government contracts in the two nations. India can additionally benefit from UAE’s role as a gateway into Africa and the wider Middle East

- Customs tariffs will be removed on nearly 80% of India’s exports to the UAE once the FTA is in place. Given the importance of precious metals/ jewellery, India has given duty concessions on gold imported from the UAE, while Indian exporters will get zero duty access to the UAE market for jewelry

- Other areas of cooperation include climate action, education, food security & financial services (for which MoUs have been signed)

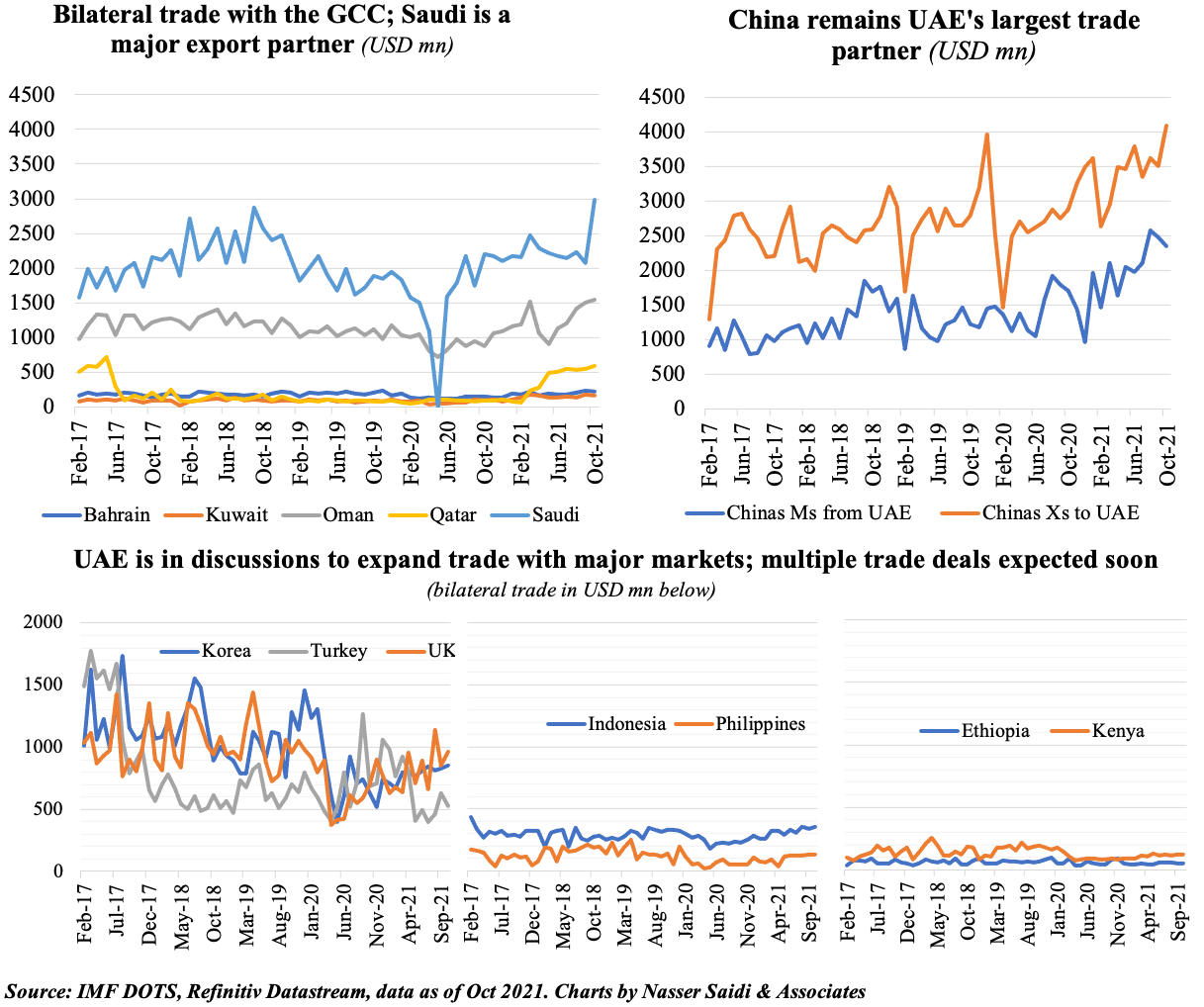

4. … and in the offing are a few others like Indonesia, Philippines, Turkey

- GCC-China FTA discussions started in 2004, was suspended in 2009 & resumed in 2016

- Discussions with the UK are also proceeding under the wider GCC umbrella

- UAE, in its bid to expand trade and investment relations, is seeking CEPA agreements with several countries including Indonesia, Israel, South Korea and Turkey (to name a few)

- A trade and investment deal with Indonesia could be signed in March; one with Israel is not too far off either

- Turkey’s President visited in Feb to initiate trade talks & left after signing 13 MoUs

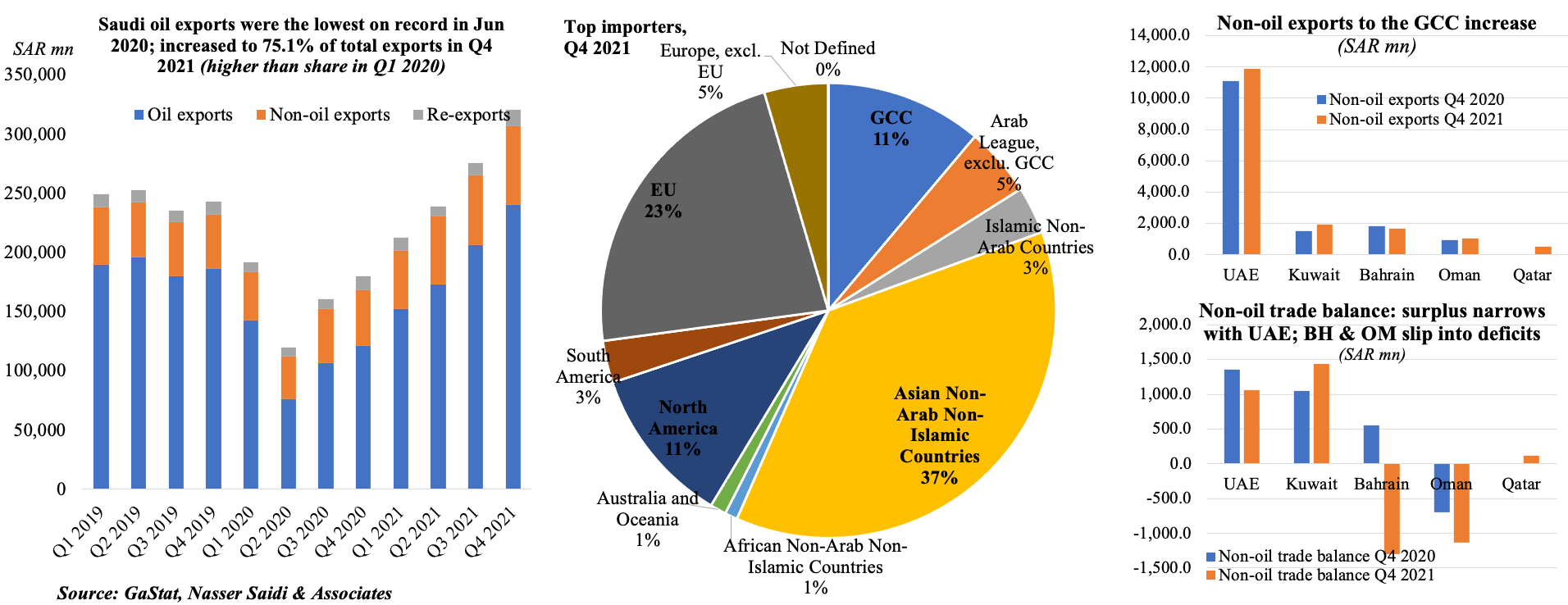

5. Oil exports continue dominating in Saudi Arabia, accounting for 75.1% of total in Q4 2021

- Oil exports continue to dominate overall trade in Saudi Arabia; it accounted for just over 3/4th of total trade in Q4 2021 (more than its share in Q1 2020). Ratio of non-oil exports to imports increased to an average 47.3% in 2021 from 39.5% in 2020

- Asian, non-Arab, non-Islamic nations dominate as top destination for Saudi exports. In terms of partners, China, US, UAE, India and Germany rounded the top 5 destination partners in Q4 2021, togther accounting for almost 50% of total Saudi exports

- Non-oil exports to the GCC nations in Q4 last year increased in all except Bahrain. Non-oil trade balance swung to deficit in Bahrain, deficit widened in Oman while surplus narrowed in UAE

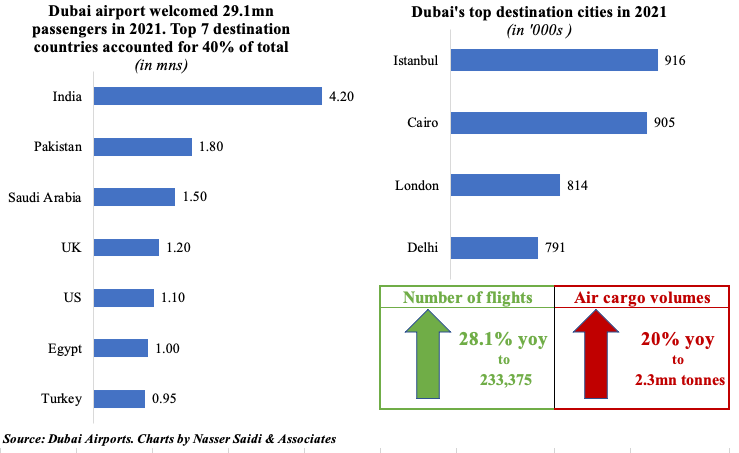

6. Dubai Airport retained world’s busiest for international travel title in 2021

- Dubai retained its title as the world’s busiest for international travel for the 8th consecutive year, with 29.1mn passengers in 2021 (up 12% yoy). However, this is miles away from the pre-pandemic of 86.4 million in annual traffic in 2019.

- Meanwhile, London Heathrow reported just 19.4mn passengers in 2021 – the lowest since 1972

- Interestingly, just over 70% of Dubai’s airport passengers represent arrivals versus pre-pandemic times when around half of all passenger figures were transiting through Dubai – an indication of how closed borders still were in 2021

- In 2021, the top 7 destination nations accounted for 40% of total passengers

- In Q4, the airport handled 11.8mn (+77% qoq), accounting for 40% of 2021 total: this was the first time since Covid hit that quarterly traffic was > 10mn passengers

- In Dec alone, 4.5mn passengers passed through the airport (38% of Q4 numbers)