Markets

Update as of 8am, 22 Feb 2022: Asian equity markets slipped in early morning trade (Nikkei is down almost 2%, Topix around 1.7% and Kospi about 1.4%) with the escalation in Ukraine-Russia tensions. Other markets are likely to mirror this drop when open. The risk of war has driven up oil prices to above USD 95 a barrel.

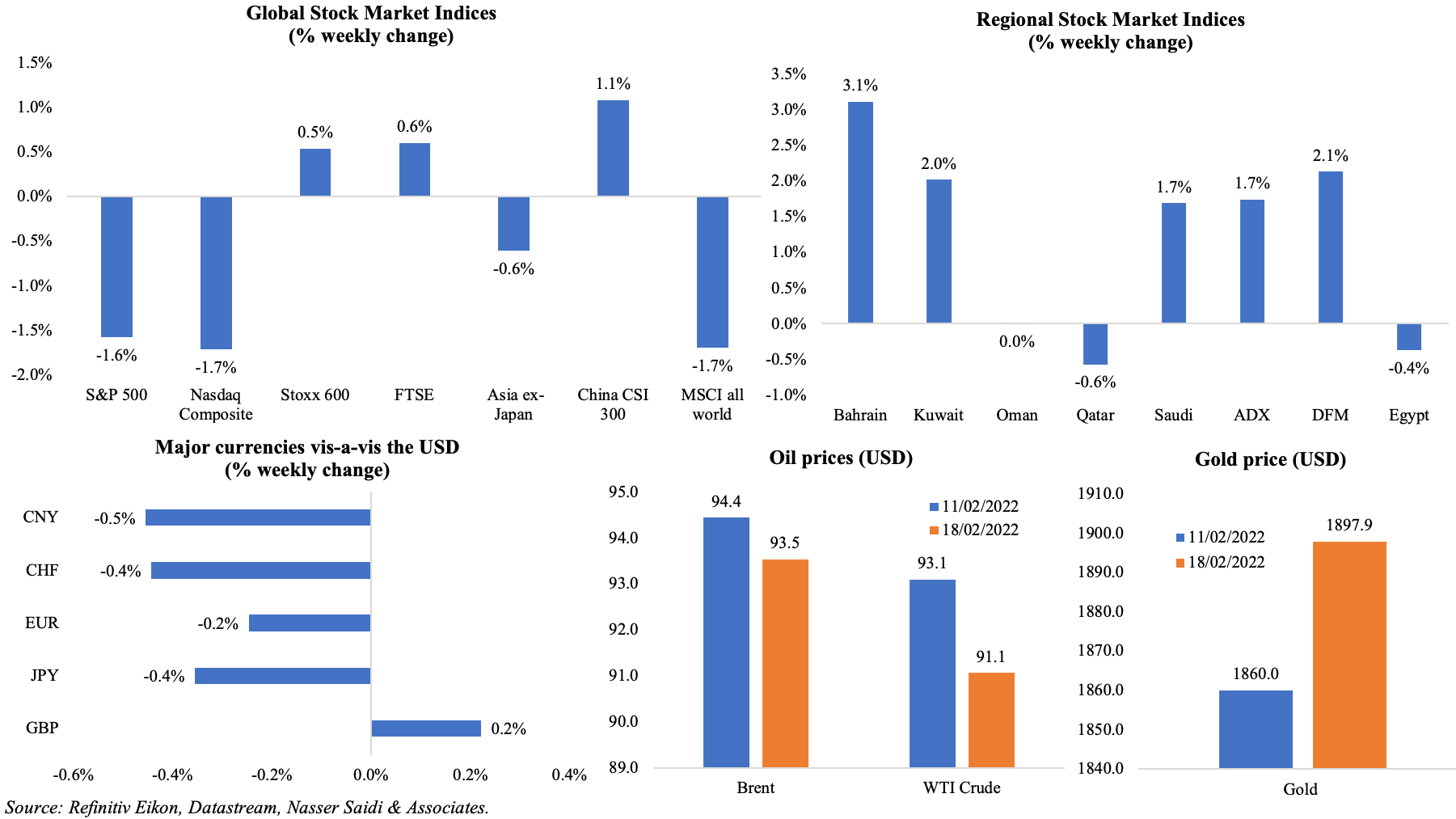

Global equity markets were mixed last week with US stocks in the red for the second consecutive week while European and Asian markets performed relatively better; MSCI’s all world index slipped from a week before. The Vix volatility index remained above its long-term average last week, surging towards 30. In China, regulatory moves (like warning against using the metaverse for illegal fund-raising and guidelines to online food delivery platforms to reduce service fees) led to a decline in tech stocks while its real-estate developers gained thanks to an easing of home-purchase down-payments. Oil prices above USD 90 supported markets in the Middle East with Bahrain benefiting from news of the removal of Covid19 related restrictions; earlier in the week, Abu Dhabi’s index hit a record high and Saudi was at a 16-year high. Among currencies, it seems likely that the safe haven currencies USD, JPY and CHF will find support. The ongoing geopolitical situation in Ukraine kept oil prices high (rising to the highest level since 2014 last week, though closing lower versus a week ago) and gold price was supported by the metal’s safe haven status.

Weekly % changes for last week (17 – 18 Feb) from 10 Feb (regional) and 11 Feb (international).

Global Developments

US/Americas:

- The Fed minutes showed that officials agreed it was time to raise rates; given the strength of the economy amid higher inflation it was deemed that raising rates quicker than once a quarter (which was seen in the 2015 tightening cycle) could be a possibility. “Many” officials were of the view that labour market conditions were “already at or very close to those consistent with maximum employment”.

- US producer price index increased to a near-record high of 9.7% yoy in Jan while excluding food and energy, prices were up by 8.3%. Both core and headline PPI yoy readings were 0.1 percentage point lower than the record levels hit in Dec 2021.

- NY Empire State manufacturing index increased to 3.1 in Feb (Jan: -0.7), with new orders and shipments holding steady alongside an increase in employment. The Philadelphia Fed manufacturing index slipped to 16 in Feb (Jan: 23.2), given declines in general activity, new orders and shipments.

- Retail sales in the US rebounded by 3.8% mom in Jan, from Dec’s 2.5% drop, supported by spending at non-store retailers (+14.5%) and department stores (+9.2%) while sales fell slightly at restaurants and bars.

- Industrial production in the US increased by 1.4% mom in Jan, reversing Dec’s 0.1% fall. The increase was driven by a 9.9% uptick in utilities while manufacturing output gained by 0.2% (though motor vehicle and parts production dipped by 0.9%).

- Building permits in the US inched up by 0.7% mom in Jan to 1.899mn – the highest since 2006. Housing starts dropped by 4.1% mom to a seasonally adjusted annual rate of 1.638mn. Input prices are soaring (softwood lumber prices were up by 25.4% in Jan following Dec’s 21.3% rise) raising costs and leading to delayed projects. Furthermore, rising mortgage rates could also slow demand for housing.

- Existing home sales in the US increased by 6.7% mom to 6.5mn units in Jan. Inventory of unsold existing homes fell to a new all-time low of 860k at end-Jan, equivalent to 1.6 months of the monthly sales pace, also an all-time low.

- Initial jobless claims increased to 248k in the week ended Feb 11th from the previous week’s upwardly revised 225k; the 4-week average eased to 243.25k. Continuing claims eased to 1.593mn in the week ended Feb 4th.

Europe:

- GDP in the euro zone increased by 0.3% qoq and 4.6% yoy in Q4, according to Eurostat, confirming the first estimates released end-Jan. Annually, GDP grew by 5.2% in the eurozone.

- Trade deficit in the eurozone widened to EUR 9.7bn in Dec (Nov: EUR 1.8bn), the highest since Aug 2008. Imports grew by 36.7% yoy in Dec, driven by higher energy costs and a 53% increase in imports from China. Overall trade surplus fell by 45% to EUR 128.4bn in 2021.

- Industrial production in the eurozone inched up by 1.2% mom in Dec (Nov: 2.4%), supported by an increase in capital goods (+2.6%), intermediate goods (0.5%) and non-durable goods (0.4%) production. Both energy and durable consumer goods production saw a decline during the month (0.8% and 0.3% respectively).

- Consumer confidence in the eurozone dropped to -8.8 in Feb (Jan: -8.5), falling for a 5th consecutive month, on rising inflationary pressures and geopolitical tensions.

- German ZEW survey showed an improvement in the economic sentiment to 54.3 in Feb (Jan: 51.7) while the current situation rising by 2.1 points to -8.1. The eurozone showed a decline in economic sentiment to 48.6 in Feb (Jan: 49.4) and the current situation reading stood at 0.6 (up by 6.8 points).

- Inflation in the UK inched up to a 30-year high of 5.5% in Jan (Dec: 5.4%), driven up by prices of energy, fuel, food and second-hand cars. Core CPI rose to 4.4% from 4.2% in Dec. Retail price index increased to 7.8% yoy in Jan (Dec: 7.5%).

- ILO unemployment rate in the UK remained unchanged at 4.1% in Q4 while the number of people claiming jobless benefits fell to 31.9k in Jan. Average earning excluding bonus grew by 3.7% yoy in the 3 months to Dec (Nov: 3.6%).

- Retail sales in the UK rebounded by 1.9% mom and 9.1% yoy in Jan as the impact of the variant receded. This is 3.6% higher than their pre-pandemic levels.

Asia Pacific:

- Inflation in China increased by 0.9% yoy in Jan (Dec: 1.5%), the lowest reading since Sep, as prices of food dropped by 3.8%. Producer price index eased to 9.1% from 10.3% in Dec, recording the lowest reading since July, potentially a reflection of the government’s efforts to reduce energy costs and raw materials prices.

- China’s FDI grew by 11.6% yoy to CNY 102.28bn in Jan. Inflows into the services industry grew by 12.2% to CNY 82.3bn while flows into the high-tech industries surged by 26.1%.

- Japan’s GDP rebounded by 1.3% qoq in Q4, or an annualized rate of 5.4%, supported by private consumption (+2.7% qoq) and exports posted a 1% rise. The full year growth stands at 1.7% – the first expansion in 3 years – following 2020’s 4.5% drop.

- Industrial production in Japan increased by 2.7% yoy in Dec, following an increase of 3.5% in Nov.

- Exports from Japan increased by 9.6% yoy and imports surged by 39.6% yoy causing trade deficit to widen to an 8-year high of JPY 2191bn in Jan (Dec: JPY 583.3bn). Exports were slower due to a decline in car exports while imports were higher given surging shipments of petroleum, coal and LNG.

- Japan’s machinery orders increased by 3.6% mom in Dec, remaining in positive territory for the 3rd consecutive month. Core machinery orders grew by 5.1% yoy in Dec (Nov: 11.6%).

- Japan’s inflation slowed to 0.5% yoy in Jan (Dec: 0.8%). Excluding food and energy prices fell by 1.1% yoy, sharper than the 0.7% dip in Dec. A BoJ official stated that while CPI may exceed 1%, it will remain below the BoJ ‘s 2% target.

- India’s trade deficit stood at USD 17.42bn in Jan, as exports grew by 25.28% yoy and imports were up by a slower 23.54%. During the Apr 2021-Jan 2022 period, the trade deficit widened to USD 159.87bn, versus USD 75.87bn in the same period a year ago.

- GDP in Singapore grew by 2.3% qoq and 6.1% yoy in Q4, slightly higher than previous published estimates. The government expects growth to range between 3-5% this year.

- Singapore’s 2022 budget revealed a hike in GST to 8% from 1st Jan 2023 and further to 9% from 2024 as well as an increase carbon tax from the current SGD 5 per tonne of emissions to SGD 25 per tonne from 2024 (in a bid to achieve net zero emissions “by or around mid-century”). Taxes were raised for high-income earners, property, and luxury cars.

Bottomline: While tensions over Ukraine are still bubbling away, this week’s flash PMIs will give an insight into economic performance after the easing of Covid related restrictions (after Omicron) – while PMIs in Europe may be higher vs Jan, it is our view that labour shortages and inflationary pressures are likely to be reflected across nations. UNCTAD’s latest trade update showed a 25% increase in global trade to a record high USD 28.5trn in 2021, thanks to strong domestic demand recovery, and trade in services also ticked up to just above pre-pandemic levels. But, so long as countries like China and Hong Kong follow the zero-Covid policy, supply chain pressures are unlikely to fade away fully. Also watch out for the Reserve Bank of New Zealand’s policy meeting this week – the bank is most likely to hike rates for the 3rd time.

Regional Developments

- Bahrain cancelled PCR testing and quarantine measures for all passengers arriving in the country. Separately, it was disclosed that 80% of the population (close to 1.2mn persons) had received two doses of the vaccine while 65.5% had taken the booster shot as well.

- Egypt grew by 8.3% in Q2 of the fiscal year (Oct-Dec 2021), bringing the H1 growth to 9%, revealed the PM at a news conference. It is expected that growth will surpass 6% this current fiscal year (that ends in Jun 2022).

- Overall balance of payments showed a marginal surplus of USD 0.1bn in Q2 2021 versus a deficit of USD 3.5bn in Q2 2020, according to the Central Bank of Egypt. Current account deficit widened to USD 5.1bn (Q2 2020: USD 3.8bn) while tourism revenues surged by 473%.

- Unemployment in Egypt fell to 7.4% in Q4 2021, with 2.2mn persons unemployed. In the quarter, female unemployment rate (17.8%) was almost 3 times that of male unemployment rate (5.2%). Some 29.7mn persons were employed in Q4 2021 (+0.9%).

- Trade deficit of Egypt narrowed by 63.1% yoy to USD 1.19bn in Nov, largely due to the surge in exports (+80.6% yoy to USD 4.48bn) while imports dropped (-0.5%).

- Egypt’s holdings of US treasury bonds inched up by 0.1% yoy to USD 2.244bn in Dec though it declined from the previous month’s USD 2.249bn.

- The Fintech Act, approved in Egypt, will help the Financial Regulatory Authority (sole licensor and regulator of fintech firms) regulate various digital non-banking financial solutions, including robo-advisory, nano-finance, insurtech and tech-enabled consumer finance among others.

- Egypt‘s approved Unified Budget Act will increase transparency regarding public finances and requires the government to present annual medium-term budgets and tax strategies to the House of Representatives in addition to setting spending limits for ministries.

- Egypt disclosed that UAE-based Dragon Oil had made its first oil discovery in the Gulf of Suez – with estimated reserves at 100mn barrels, the field is one of the largest in the area in the past 20 years. About 45-50mn barrels can be extracted in less than a year, according to Egypt’s petroleum minister.

- Bloomberg reported that Egypt’s sovereign wealth fund is planning a USD 1.5bn green powered desalination plant to avoid future water shortages. This project’s build, own, operate and transfer system is being considered with with UAE-based Metito Holdings, Scatec, and Orascom Construction.

- Boursa Kuwait aims to list 8 market makers in an effort to expand trading, according to the CEO; in addition, family-owned firms are rearranging their investments with an aim to list in 2 years. By end-2022, bond market and commercial instruments will also be announced.

- Kuwait’s central bank tweeted last week that virtual assets are not a suitable alternative to currency since they are neither issued by a country nor regulated by central banks.

- Many Covid19 restrictions have been lifted in Kuwait including a ban on foreign travel; unvaccinated persons will be allowed to enter shopping malls, theatres and banquet halls by presenting a negative PCR test. Unvaccinated tourists are required to take a PCR test ahead of travel into the country and quarantine for 7 days after arrival.

- Kuwait’s Jazeera Airways plans to increase its fleet to 60 planes by 2025, from 17 currently. The company’s Chairman disclosed during an interview with CNBC Arabia that the airline has liquidity of KWD 50mn – to be used in investments and dividends.

- Lebanon approved the allocation of LBP 360bn to hold parliamentary elections in May 2022: this would be the first since protests in Oct 2019.

- Oman welcomed 652k tourists in 2021: this was lower by 25.4% compared to 2020 and by 81.4% versus 2019.

- Mergers and acquisitions in the MENA region surged in 2021, according to EY: number of transactions grew by 66.5% yoy to 661 while value of transactions increased by 16.2% to USD 99bn. UAE saw the highest number of transactions (303) while Saudi Arabia attracted most capital (USD 47.4bn). Egypt meanwhile clocked in 118 deals worth USD 7.7bn.

- Startups in the MENA region raised USD 247mn from 46 deals in Jan 2022, reported Wamda and Digital Digest. Bahrain secured the highest funding (USD 110mn), followed by Saudi Arabia (USD 55.6mn), Egypt (USD 33mn), UAE (USD 24.4mn) and Iraq (USD 15mn).

Saudi Arabia Focus

- Net foreign assets in Saudi Arabia fell by USD 17.5bn during the Dec-Jan period; NFA stood at USD 429.7bn in end-Jan, according to central bank data.

- Inflation in Saudi Arabia inched up to 1.2% yoy and by 0.2% mom in Jan: transport prices were up by 4.9% yoy, largely given the 34.5% increase in gasoline prices.

- Saudi Arabia approved a license for a local digital bank: the PIF-backed D360 Bank will be established with a capital of SAR 1.65bn (USD 440mn).

- Saudi government issued SAR 13.18bn (USD 3.5bn) in its SAR-denominated sukuk program for Feb: it was divided into 2 tranches of SAR 7.5bn (maturing in 2030) and SAR 5.6bn (maturing in 2034).

- Saudi Parts Center Co. will start trading on the Saudi stock exchange’s parallel market Nomu from today (Feb 21st): direct listing of 3mn shares was released on Jan 23rd.

- Saudi Arabia will introduce options trading on single stocks “soon”, further liberalizing the exchange, reported Bloomberg.

- Saudi Arabia topped holders of US treasury bonds in the region, with USD 119bn in Dec 2021 (+14% yoy) and from USD 116.5bn in Nov. Saudi residents increased their exposure to US stocks: value of securities held grew by 3.5% yoy to USD 319.4bn at end-Dec.

- Saudi PIF held nearly USD 56bn worth US- listed stocks as of Dec 2021, up from USD 43.4bn at end-Sep, mostly due to the increase in value of Lucid holdings (USD 38.6bn in Dec).

- Saudi Arabia’s foreign minister disclosed the nation’s plans for a fifth round of direct talks with Iran in spite of a “lack of substantive progress” in earlier sessions.

- Saudi crude oil exports averaged 6.22mn barrels per day (bpd) in 2021, down by 6.6% yoy, according to JODI. This is the 3rd consecutive year of declines, following 5.3% yoy and 4.6% in 2020 and 2019 respectively.

- Investments in startups in Saudi Arabia grew by 770% yoy to a record high of SAR 2bn, according to a Saudi Venture Capital Impact Report. The number of investors in Saudi startups jumped to 76 in 2021 from just 26 three years ago.

- The number of Saudi citizens in the labour market exceeds 1.9mn currently, according to the minister of human resources and social development. “Economic participation” of citizens stands at 50% now versus the aim of reaching 60% by 2030.

- Next steps have been announced in the licensing process for the Khnaiguiyah project Saudi Arabia’s largest mining site: prospective investors can submit an expression of interest and complete a pre-qualification questionnaire which needs to be completed by Mar 14th. The 3 stages – which includes qualification, proposal and auction – will be completed in Q2 this year.

- Saudi Arabia’s AlUla, which has been designated by the UNESCO as a World Heritage site, is preparing to receive 250k visitors in 2023, according to the CEO for the Royal Commission for AlUla. The aim is for 50% of the energy required for AlUla to come from sustainable sources by 2035.

- Saudi Tourism Authority has signed a MoU with Emirates airline to boost travel into various destinations in Saudi Arabia including Riyadh, Jeddah, Madinah and Dammam.

- Saudi Fund for Development launched infrastructure projects worth USD 137mn in Djibouti. The projects include drinking water supply infrastructure and housing units in addition to the upgrade of road infrastructure.

- The Saudi pavilion at the Expo 2020 welcomed 3mn visitors since it opened in Oct – this is almost a quarter of all Expo visits (which stands at just over 12mn).

UAE Focus![]()

- The IMF commended UAE’s “swift and substantial policy action” during the Covid19 crisis, in its latest Article IV report. Non-oil growth is forecast to rise to 3.4% this year and non-oil output gap is expected to close by 2026. While oil prices current rise will improve fiscal and external balances, the IMF called attention to the elevated downside risks (partly Covid-related uncertainties to tightening financial conditions and increasing costs of debt service). Download the report using this link: https://bit.ly/3JJOqUa

- Industrial exports from the UAE surged to AED 120bn (USD 32.6bn) from 220 factories in 2021, according to the Ministry of Industry and Advanced Technology. About AED 248mn was disbursed in 2021 towards financing priority sector projects. The national ICV programme – which includes 45 public entities and 13 major national institutions and companies – saw AED 41.4bn circulated back into the local market in 2021.

- The UAE and India signed a Comprehensive Economic Partnership Agreement, with an aim to double non-oil trade to USD 100bn in the next five years. The deal sees elimination of tariffs on key commodities (like aluminium, steel and petrochemicals among others) while also allowing businessmen to apply for government contracts in both nations. Not only would the deal lead to greater trade and investment flows, but also result in job creation (especially skilled labour). India would also benefit from UAE’s highly efficient transport, logistics and vast international ports

- Philippines and the UAE agreed to start negotiations on a bilateral trade and investment pact last week. Bilateral trade between the two nations grew by 35.7% to USD 951mn in 2021.

- Turkey and the UAE signed 13 cooperation agreements including in investment and defense, during the visit of the Turkish President to the UAE (the first in a decade). Separately, the Abu Dhabi Securities Exchange signed a technology support deal with Borsa Istanbul, in line with the former’s strategy to “increase liquidity, enhance market efficiency and drive the sustainable growth” of the market.

- UAE is planning to issue federal licenses for virtual asset service providers by end-Q1 this year, reported Bloomberg; legislation is in the process of being amended to allow for VSAPs to set up. Already, the freezones DMCC, ADGM and Dubai Silicon Oasis Authority respectively have 22, 6 and 1 licensed VASPs.

- The UAE will allow co-operative associations (mainly supermarkets and retail businesses) trade their shares on the local financial markets, according to a Cabinet decision. This will help such businesses raise new capital, expand their portfolios and improve competitiveness.

- In the backdrop of recent Houthi attacks, the UAE’s energy minister reiterated that the country’s energy infrastructure was well-protected against attacks and has diversified its electricity infrastructure and has spare capacity. Speaking at another event, the minister stated that UAE had saved USD 191bn by “going green” or using alternative sources of energy.

- Abu Dhabi’s ADNOC disclosed that contracts worth AED 7.1bn had been signed to boost drilling activities in the country. More than 80% of the value of the agreement is expected to be redirected to local businesses through ADNOC’s domestic value-added program.

- The DIFC revealed a 16% increase in its revenues to AED 897mn in 2021, surpassing the pre-pandemic levels by 7%, as the free zone recorded 996 new company registrations (+36%). Total active registered firms stood at 3644 in 2021 (+25%) while financial and innovation related firms grew by 23% to 1124.

- Property prices in Dubai rose by 33.4% yoy to an average of AED 1575 per square foot in Jan; transactions volumes and residential activity slipped by 24% and 13% respectively while off-plan sales expanded by almost 4 times.

- Abu Dhabi recorded 14,958 real estate sales and mortgage transactions in 2021, worth a total of AED 71.5bn. Yas Island, Reem Islands and Saadiyat accounted for the best performing areas, with deals worth AED 4.1bn, AED 3.2bn and AED 2.5bn respectively.

- The number of food and beverages firms in Dubai grew by 11% yoy in 2021, revealed the general manager of Dubai Industrial City in a CNBC Arabia interview. Separately, a report from the Dubai Chamber of Commerce showed that food and beverage trade in the UAE increased to USD 20.2bn in Jan-Sep 2021, with imports accounting for the largest share (USD 12.8bn). UAE’s F&B imports, exports and re-exports grew at a CAGR of 0.6%, 7.5% and 6.0%, respectively from 2011 to 2020.

- Abu Dhabi airport expects to handle 10.7mn passengers in 2022, double that of 5.26mn passengers in 2021. While overall passengers fell by 5.5% yoy in 2021, the majority of the traffic (2.43mn or 46% of total traffic) passed through in Q4 2021.

Media Review

Green investing: the risk of a new mis-selling scandal

https://www.ft.com/content/ae78c05a-0481-4774-8f9b-d3f02e4f2c6f

UAE corporate tax may dilute competitive edge, as Saudi Arabia steps up

Supergrids in MENA: Taking renewable energy to the world

Saudi Arabia: 28,000 women apply for 30 train driver jobs

https://www.bbc.com/news/world-middle-east-60414143

How Chinese firms have dominated African infrastructure