Markets

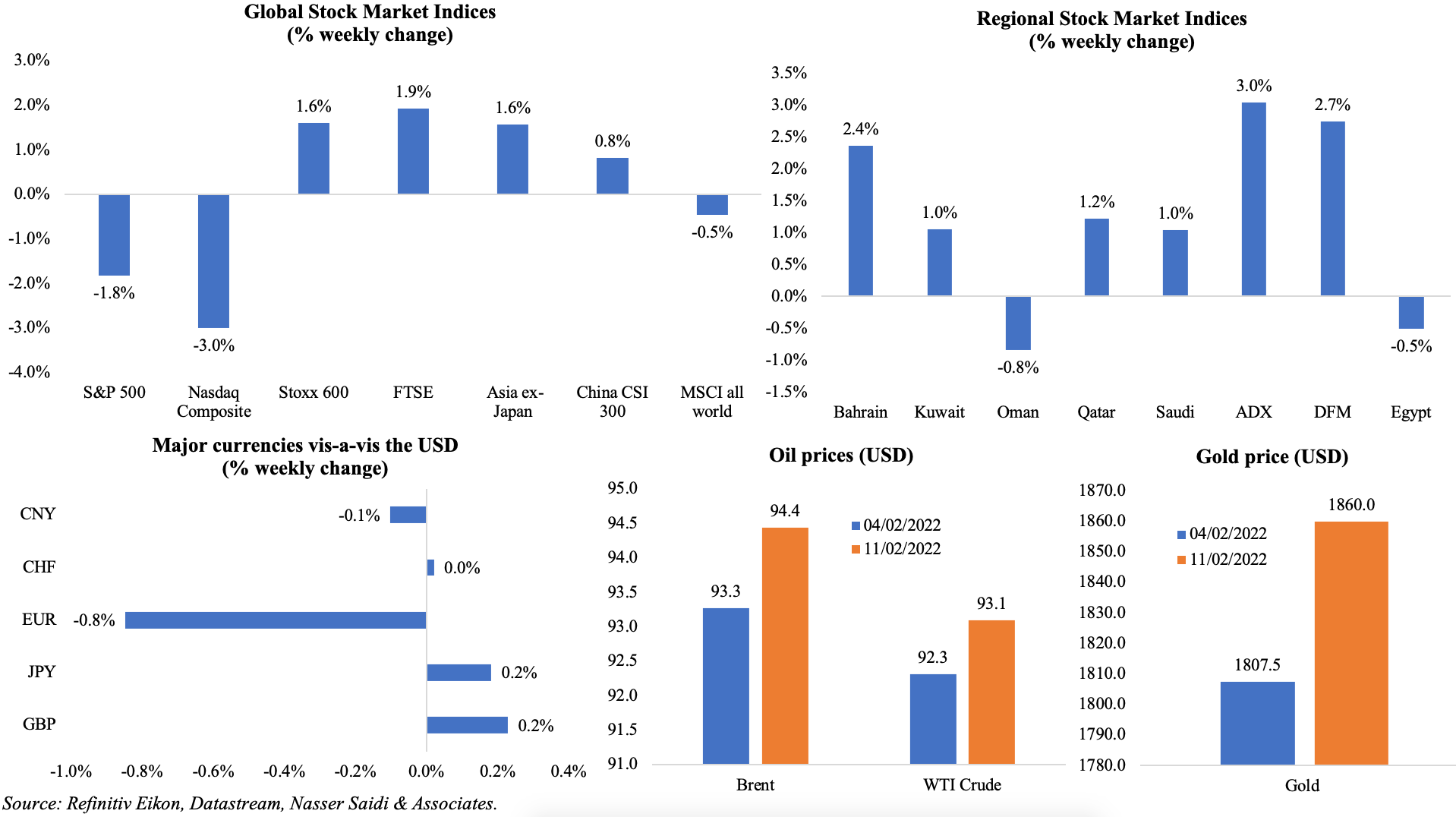

Markets in the US dropped after high inflation reading increased pressure on the Fed to raise rates more aggressively; St. Louis Fed President called for a full percentage point of interest rate hikes over the next 3 meetings). However, though tech stocks were affected negatively, Stoxx600 ticked up higher, posting its best performance since late-Dec. Both MSCI emerging market and all world shares closed slightly lower. Higher oil prices supported the uptick across the Middle East equity markets; ADX rose by 3%, supported by the listing of AD Ports while both DFM & ADX benefited from news of upcoming removal of Covid19-related capacity restrictions in the UAE. The euro was the weakest last week, following the ECB President’s dovish statement that raising rates would hurt the economy. Oil prices are up at 7-year highs thanks to fears of a Russian invasion and concerns over crude oil supplies; gold price is up 3% from last week.

Weekly % changes for last week (10 – 11 Feb) from 3 Feb (regional) and 4 Feb (international).

Global Developments

US/Americas:

- Inflation in the US accelerated to a 40-year high of 7.5% yoy in Jan (Dec: 7%); both food and energy prices were up by 0.9% mom, contributing the most to the overall 0.6% mom uptick in Jan. Core inflation also rose to 6% (5.5%): used cars prices were up by 40.5% yoy and housing costs rose by 4.4%.

- US goods and services trade deficit widened to USD 80.73bn in Dec (Nov: USD 79.33bn). This brought the overall trade deficit to a record high of USD 859.1bn in 2021 (+27% yoy) as goods imports hit an all-time high of USD 2.9trn while exports surged by 23.3% to a record USD 1.8trn.

- US reported a budget surplus of USD 119bn in Jan, from Dec’s USD 21bn deficit: this is the first surplus recorded since Sep 2019 and the largest since Apr 2019 (two months with the highest tax collections). The surplus was due to a 21% rise in individual withheld income and payroll taxes.

- Michigan consumer sentiment fell to 61.7 in the first half of Feb, the lowest since Oct 2011, and following Jan’s 67.2. Current economic conditions fell to 68.5 (lowest since Aug 2011) while the consumer expectations sub-index slipped to 57.4 (lowest since Nov 2011).

- Initial jobless claims fell to 223k in the week ended Feb 4th, lower than the previous week’s upwardly revised 239k; the 4-week average eased to 253.35k. Continuing claims stood at 1.621mn in the week ended Jan 28th.

Europe:

- Industrial production in Germany declined by 4.1% yoy and 0.3% mom in Dec. Production grew by 3% yoy in 2021 but was 5.5% lower than pre-pandemic 2019.

- Germany’s trade surplus narrowed to EUR 6.8bn in Dec (Nov: EUR 10.8bn), with exports gaining by 0.9% mom while imports expanded by 4.7% mom. For full year 2021, exports grew by 14% to EUR 1375.5bn and imports rose by 17.1% to EUR 1202.2bn. US and China were top destinations for German exports while China was the largest source of imports.

- Sentix investor confidence in the euro zone improved in Feb, rising to 16.6 from 14.9 in Jan; the current conditions index was up to 19.3 in Feb (Jan: 16.3) while the expectations index stood at 14 – the highest reading since Jul 2021.

- UK GDP increased by 1% qoq and 6.5% yoy in Q4, supported by a surge in health spending which offset Omicron-related weakness in other sectors; full year growth rebounded to 7.5% in 2021 (2020: -9.4%). Output in Q4 was 0.4% below its pre-pandemic level.

- Industrial production in the UK grew by 0.3% mom in Dec (Nov: 0.7%) while manufacturing grew by 0.2% (0.7%). Overall output was 2.6% below Feb 2020 level.

- UK’s like for like retail sales jumped by 8.1% yoy in Jan (Dec: 0.6%); food sales declined by 0.5% as customers returned to restaurants while non-food retail sales increased by 6.5%.

Asia Pacific:

- China’s Caixin services PMI slipped to 51.4 in Jan (Dec: 53.1), as new order growth eased, employment dropped for the first time since Aug 2021 and foreign sales shrank most in 15 months. Sentiment was at a 16-month low, with the recent Covid19 outbreaks and restrictions.

- Money supply in China grew by 9.8% in Jan (Dec: 9%) to CNY 243.1trn. New loans hit a record high, more than tripling to CNY 3980bn in Jan from Dec’s CNY 1130bn. Growth of outstanding total social financing grew to a 6-month high of 10.5% in Jan (Dec: 10.3%).

- Japan’s leading economic index improved to 104.3 in Dec (Nov: 103.2). The coincident index however eased to 92.6 from 92.8 the month before.

- Overall household spending in Japan edged down for a 5th consecutive month, down by 0.2% yoy in Dec though easing from Nov’s 1.3% drop, with demand struggling to recover. Real wages posted their biggest monthly fall in 19 months in Dec.

- Current account balance in Japan fell into a deficit of JPY 370.8bn in Dec (Nov’s surplus of JPY 897.3bn) – this was the first current account deficit since Jun 2020, largely due to the rising fuel costs (which raised imports value by 44.8% vs exports 18.7% rise). For the full year 2021, current account surplus was down 2.8% yoy to JPY 15.4trn.

- India held interest rates unchanged at its latest RBI meeting (repo rate at 4% and reverse repo at 3.35%), with the governor revealing that low interest rates and “enormous liquidity” in the system were a concern. Real GDP growth is projected at 7.8% in 2022-23 versus expected growth of 9.2% this year while estimating inflation at 4.5% in 2022-23.

- Industrial output in India fell to a 10-month low of 0.4% yoy in Dec, dragged down by manufacturing output (-0.1%); capital goods and consumer durables declined sharply by 4.6% and 2.7% respectively.

- Fuel consumption in India fell by 3.7% mom and 0.2% yoy to 17.61mn tonnes in Jan, with the recent surge in Covid cases likely limiting demand during the month. With the slowing of cases and removal of major restrictions on mobility, demand is likely to tick up.

Bottomline: With inflation ticking up to multi-year highs, this week’s inflation numbers from UK, China and Japan will be closely watched (Citi inflation surprise indices have shown most countries so far missing inflation forecasts on the upside), as will be the release of Fed minutes – which will offer key insights into when and how quickly the Fed balance sheet might be reduced. In the backdrop are talks ongoing to salvage Iran’s 2015 nuclear deal amid the bubbling Ukraine crisis.

Regional Developments

- Bahrain introduced a new permanent residency visa to attract “investors, entrepreneurs and highly talented individuals” and retain residents: those who’ve lived in the country for five years, earning a salary of at least BHD 2000 per month would qualify for the visa, which will be renewed indefinitely.

- Bahrain’s GFH Financial Group plans to submit the application for listing in the Saudi market this year, revealed the company’s CEO.

- Egypt is estimated to grow by 5.5% in the fiscal year 2021-22, up from 3.3% in the previous year, according to the World Bank. External debt touched USD 137.9bn (or 34% of GDP) at end-Jun 2021, while fiscal deficit to GDP is estimated to drop to 6.8% in 2022-23.

- Inflation in Egypt accelerated to 7.3% in Jan (Dec: 5.9%), the highest since Aug 2019, driven by food & beverages (12.4%), transportation (4.9%) and housing and utilities (4.7%).

- Net international reserves in Egypt touched USD 40.98bn at end-Jan (Dec: USD 40.934bn), according to the central bank. Reserves stood at USD 45.5bn pre-pandemic.

- Egypt’s natural gas exports will likely rise to 7.5mn tonnes by end of the current fiscal year, according to the petroleum minister. In 2022-23, gas exploration is likely to add 450mn cubic feet to gas production per day and 17,200 barrels per day of gas condensates.

- The UAE has allocated USD 10bn to invest in Egypt (mostly the ports), disclosed the head of Abu Dhabi Ports.

- Reuters reported that Iran’s crude oil exports have risen above 1mn barrels per day for the first time in almost 3 years – mostly shipments to China. Indirect talks on reviving the nuclear deal restarted last Tuesday.

- Iraq’s electricity minister discussed with Qatar’s energy minister the option of Qatar supplying gas to Iraq to address its power shortages, including logistics issues related to the transport of gas to Iraq’s ports.

- Net foreign assets of the Central Bank of Kuwait fell by almost KWD 390mn (USD 1.29bn) to KWD 1.79bn at end-2021 – this is the largest annual decline since 1992. In Dec, NFA fell by KWD 821mn – the second biggest monthly drop after Mar 2021.

- Kuwait raised Mar official selling prices to Asia: the Kuwait Export Crude will be priced at USD 2.55 a barrel, up 75 cents from the month before.

- The IMF discussions with Lebanon concluded last week when the former called for “targeted and timebound actions across five different pillars” to enhance transparency and accountability. These include fiscal reforms that ensure debt sustainability, restructuring of the financial sector, reforming state-owned enterprises (particularly the energy sector) and strengthening government, anti-corruption and anti-money laundering as well as countering the financing of terrorism frameworks as well as a credible monetary and exchange rate system. Though progress was made with respect to agreeing on reform areas, the IMF leader stated that “more work is needed to translate them into concrete policies”. (https://www.imf.org/en/News/Articles/2022/02/11/pr2233-lebanon-imf-staff-concludes-virtual-mission)

- Oman’s Barka Desalination Co closed Phase I of its IPO and set an allotment price of 145 baisas (USD 0.38), the top of the indicated range. Phase II, which will be open to retail investors, opened on 8th Feb and will close today (14th Feb 2022).

- Qatar’s Expo pavilion received over 800k visits since it opened on 1st Oct 2021.

- The IEA, in its latest monthly report, stated that oil market risks could be reduced “if producers in the Middle East with spare capacity” (referring to Saudi Arabia and the UAE) pumped more crude “compensate[ing] for those running out”. In Jan, the gap between output and the monthly target widened to 900k barrels per day.

- According to the latest PwC global CEO survey, 82% of regional business leaders expect an improvement in global growth this year, with Egypt and Saudi Arabia cited as the two top markets for revenue growth (37% and 27% respectively). Furthermore, more than half of Middle East’s CEOs are planning double-digit investments in digital transformation.

Saudi Arabia Focus

- Saudi GDP grew by 6.8% yoy in Q4 2021, according to flash estimates, supported by a 10.8% uptick in the oil sector and non-oil sector growth at 5%. This brings overall growth in 2021 to 3.3%, rebounding from the 4.1% contraction registered in 2020.

- Four percent of Saudi Aramco shares (worth USD 80bn) were transferred to the PIF, revealed the government. Saudi Aramco revealed that the transaction was a private one between the government and state fund and that this move would not affect the number of issued shares nor the company’s operations or governance framework.

- Industrial production in Saudi Arabia grew for the 8th consecutive month, rising by 11.2% yoy in Dec – the second highest growth rate in the last 3 years.

- Inflation is expected to accelerate slightly in Q1 2022, as per SAMA forecasts, given the pickup in domestic demand and the rise in global inflation rates.

- Saudi Arabia is targeting oil production capacity to touch 13.5mn barrels per day by 2027, reported Time magazine citing the energy minister.

- Spending on digital transformation in Saudi Arabia is expected to reach SAR 12bn (USD 3.19bn) a year, according to a senior official at the Digital Government Authority. Investments span areas of cloud computing, new emerging technologies, and open source government software.

- Cargo volume at Saudi ports grew by 5% yoy to 25 million tons in Jan.

- The PIF, by buying AED 140mn worth of new shares, will take a controlling stake (55%) in interior design and specialty contractor Depa (which is listed on Nasdaq Dubai).

- Sukuk issuances in Saudi Arabia surged by 37% yoy to USD 36.9bn in 2021, according to S&P Global Ratings. Total global sukuk issuances slowed to USD 147.4bn in 2021 (2020: USD 148.4bn)

- Saudi Arabia’s minister of human resources and social development disclosed that about 400k Saudi citizens joined the private sector for the first time in 2021, bringing the total number of Saudi employees to 1.95mn last year.

- Moody’s assigned an A1 long-term issuer rating to Saudi PIF, citing its strong fundamental credit strengths and the ‘very high’ level of interdependence between the Kingdom and PIF.

- Saudi Arabia issued a license to Hong Kong-based global container firm Orient Overseas Container Line to operate in Saudi ports.

UAE Focus![]()

- UAE’s Abu Dhabi Ports, which raised AED 4bn, listed on Abu Dhabi’s stock exchange last week: the share price surged by 17% on its first day of listing. Prior to the listing, news broke that IHC had taken a 7.4% stake in the Group.

- Dubai’s non-oil PMI slowed to 52.6 in Jan (Dec: 55.3) with slower expansions in wholesale and retail and travel and tourism sectors while construction output expanded (to the strongest since mid-2019). Supply chain challenges and rise in purchasing prices persisted in Jan.

- UAE’s central bank has given in-principle approval to a new digital banking platform Wio: ADQ and investment holding company Alpha Dhabi own a combined 65% stake in the bank, while the other shareholders are Etisalat (25%) and First Abu Dhabi Bank (10%). The beta version is expected to launch soon, to serve SMEs.

- Dubai plans to attract 50 MNCs within 3 years, part of the Dubai International Chamber’s 3-year strategy; further, the Chamber will also support 100 Dubai-based companies with international expansion.

- Dubai-listed Shuaa Capital filed with the US SEC to launch a USD 100-200mn SPAC listing on the Nasdaq. It is in the process of receiving the required regulatory approvals.

- DP World reported a 9.4% increase in container volumes in 2021, handling 77.9mn containers. Q4 growth rates moderated due to Covid19, inflation and supply chain issues.

- Abu Dhabi’s Emirate Global Aluminum plans to construct its first and the biggest aluminum recycling plant of its kind in the UAE; it expects an accumulated production capacity of 150,000 tons annually.

- Business licenses issued in the emirate of Ras Al Khaimah grew by 36% yoy to 1749 in 2021. Of these commercial sector licenses accounted for 53% of the total (921, up 30%).

- UAE will lift Covid19-related restrictions given the slowdown in number of cases, and venues can operate at maximum capacity by mid-Feb.

Media Review

Labour v capital in the post-lockdown economy

Waning stockpiles drive widespread global commodity crunch

https://www.ft.com/content/d4766d00-75ee-4382-9373-f326c89630e1

The Return of Global Inflation

SPACs may reshape Gulf financial markets (with Dr. Nasser Saidi’s comments)