Weekly Insights 10 Feb 2022: Omicron-led uncertainty to fade away & higher prices here to stay?

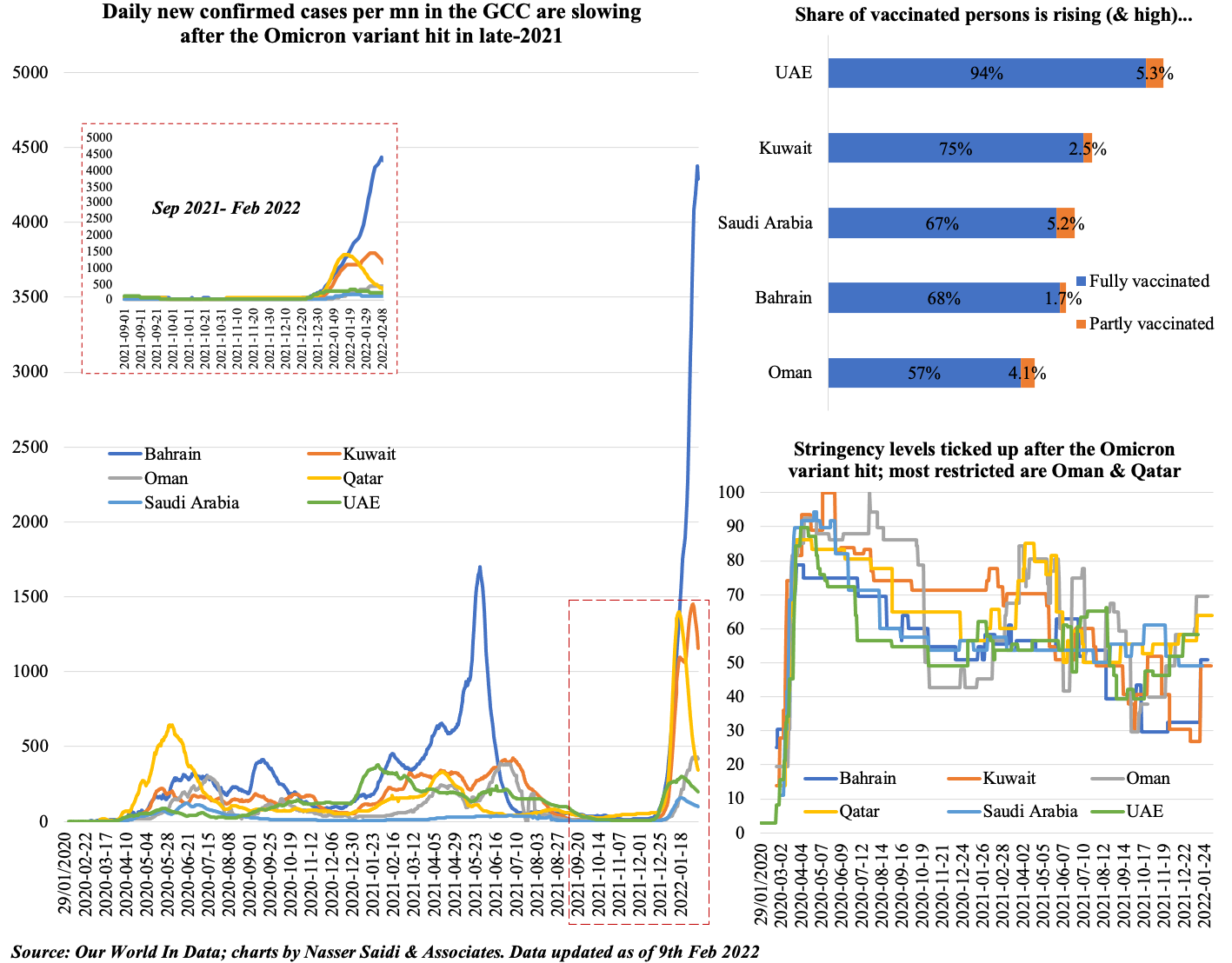

1. Covid19 cases seem to be easing after weeks of increases. Stringency levels remain high in most GCC nations, even as vaccination rates increase

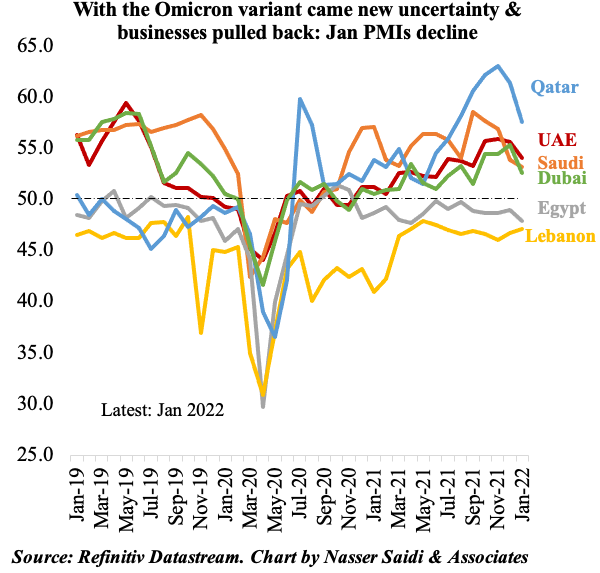

2. GCC PMIs ticked lower in Jan 2022, given the Omicron variant & related uncertainty

- PMI numbers for Jan 2022 have slowed in the Middle East, with the exception of Lebanon. However, in Lebanon the readings are still in contractionary territory and marred with economic and political uncertainty (even though talks with the IMF are underway)

- Input prices continue to rise across the board given the uptick in raw material prices and delayed freight shipments; on the other hand, some nations (like the UAE) witness a decline in output prices as firms aim to boost sales with competitive pricing strategies

- Employment is ticking up, though the Jan readings have shown an easing

- Confidence is pinned on hopes of faster recovery (at both regional and global levels) amid falling Covid cases (& no new deadly variants)

- Easing of restrictions given the fall in cases from recent peaks should support sentiment & be reflected in the next readings (e.g. UAE has announced lifting capacity limits by mid-Feb)

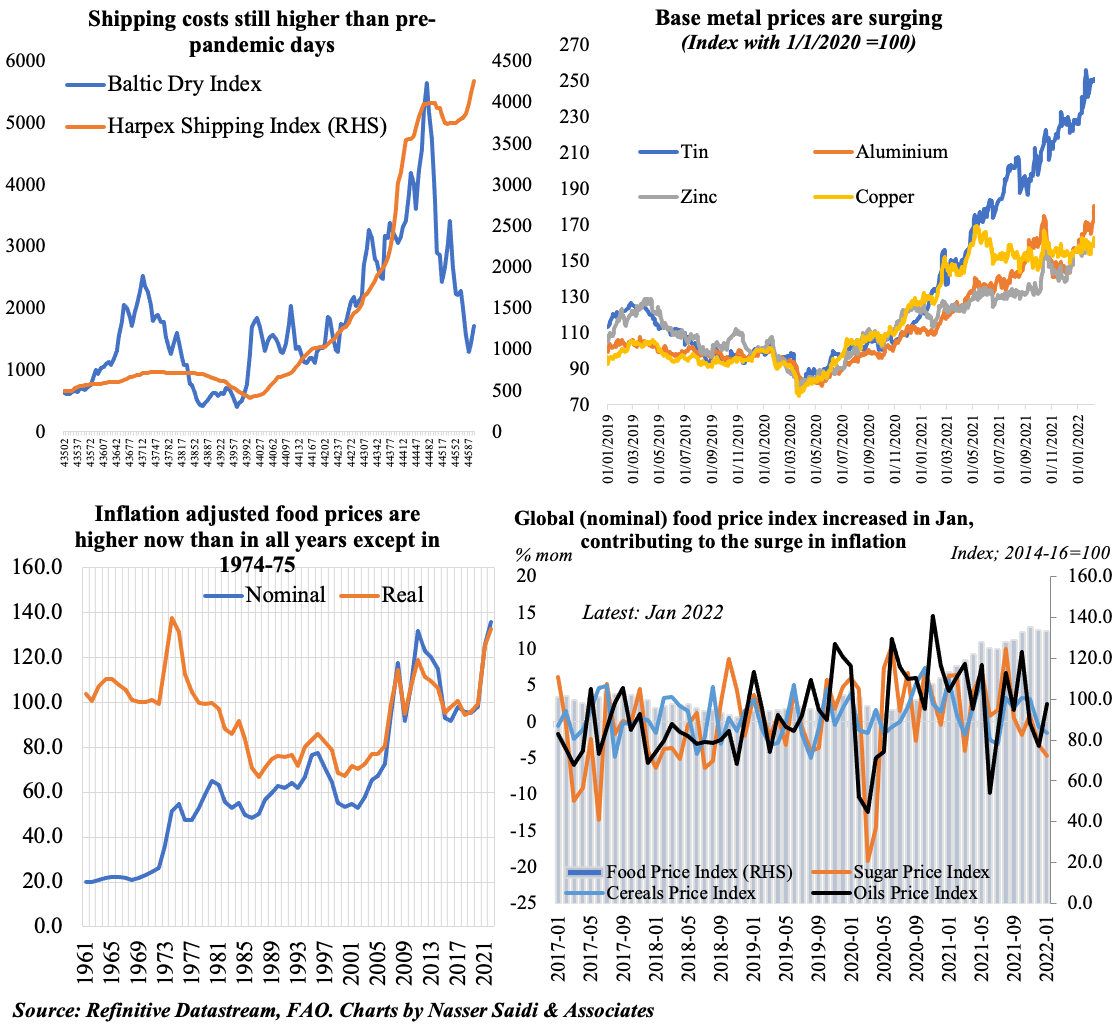

3. Prices of food prices & industrial metals are ticking up alongside oil prices => higher inflation

- Rising shipping costs continue to affect the prices of food commodities & metal prices, given ports congestion, recent lockdowns in Asia, global labour shortages & container shortages

- Global recovery has increased commodity demand, that is adding to price pressures: copper, zinc, aluminium and tin have seen a meteoric rise in prices in the past 2 years

- Oil prices, which are currently at around $90 a barrel, will spillover into food, transport & hospitality prices among others

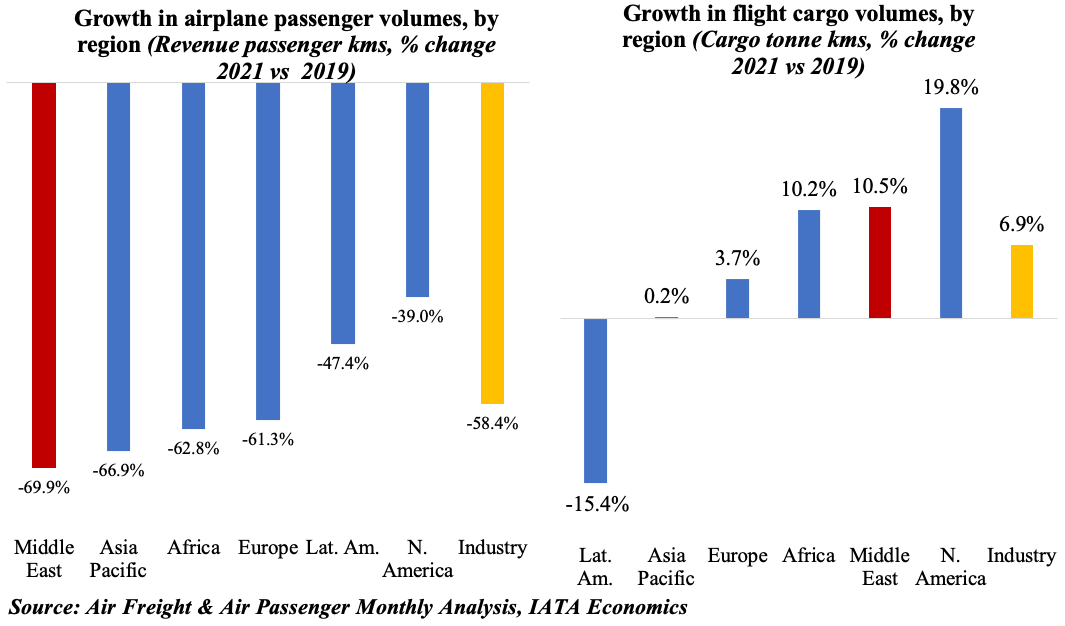

4. The airline industry’s diverse outcomes: vs 2019, cargo traffic increased while air travel contracted

- Air passenger traffic fell by 58.4% compared to pre-pandemic 2019 levels. Regional breakdown shows Middle East the worst affected, with RPKs 70% lower compared to 2019, largely due to limited domestic travel. Furthermore, in terms of routes, the worst off has been intra-Asia travel – unsurprising, given extreme border restrictions

- Only Latin America posted a double-digit contraction with respect to cargo markets. For the Middle East, performance was relatively better (+10.5% vs 2019) and supported by the (fastest growing) Middle East- North America route

- Nations reopening borders despite the ongoing Omicron wave (given vaccination levels) will likely support air travel in 2022, and consequently cargo capacity in passenger flights

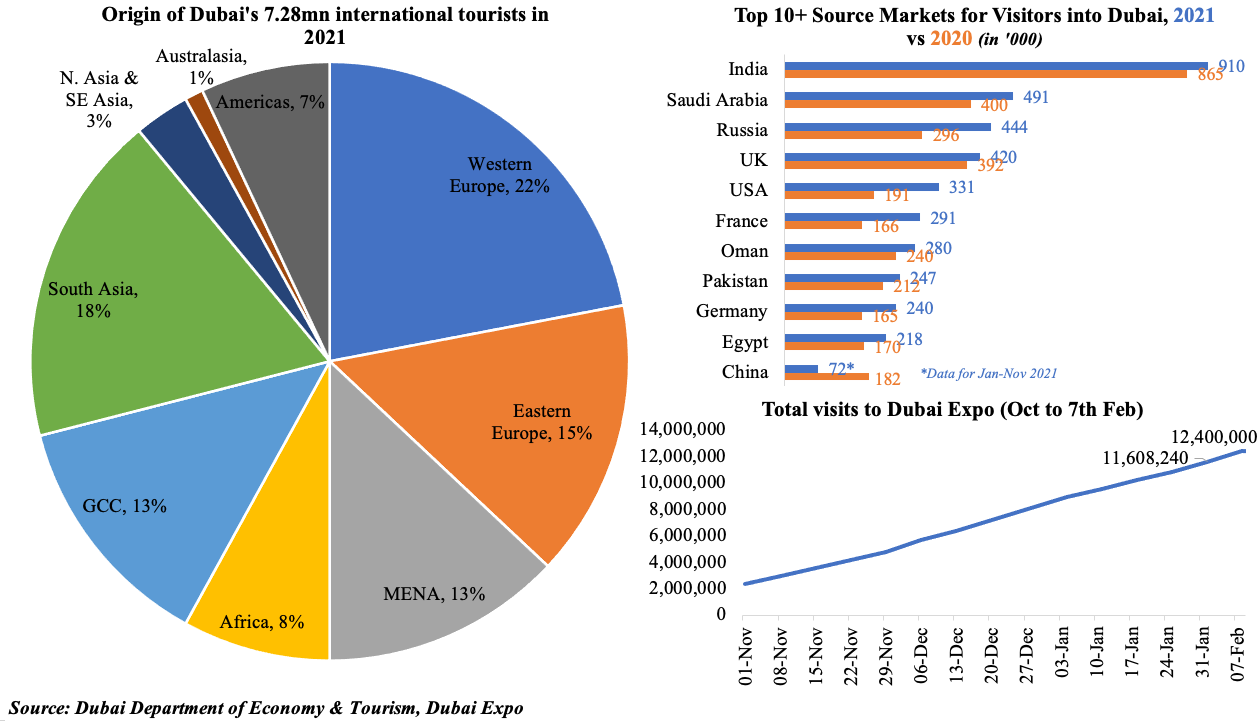

5. Dubai sees a return of tourists, clocking in 7.28mn tourists in 2021; supports Expo footfall

- International visitors into Dubai increased to 7.28mn in 2021 (2020: 5.51mn), but remains a far cry from the 16.73mn visitors pre-pandemic. The top 15 source markets have many familiar names (India, Saudi, Russia, UK). However, both China and Philippines fall out of even the top 20 spots in 2021 owing to internal restrictions (they were 5th and 10th largest source markets in 2019). As a result, N. Asia & SE Asia see a drop in their share of total tourists to 3% in 2021 from 12% in 2019

- The Expo has recorded 12.4mn visits till earlier this week, with past weeks’ witnessing single-digit week-on-week increases (possibly given rise in Covid cases + less number of tourists compared to the New Year holidays). With less than 2 months to go, ticket prices have been slashed and various events/ activities will attract more persons (the easing of restrictions will also help)

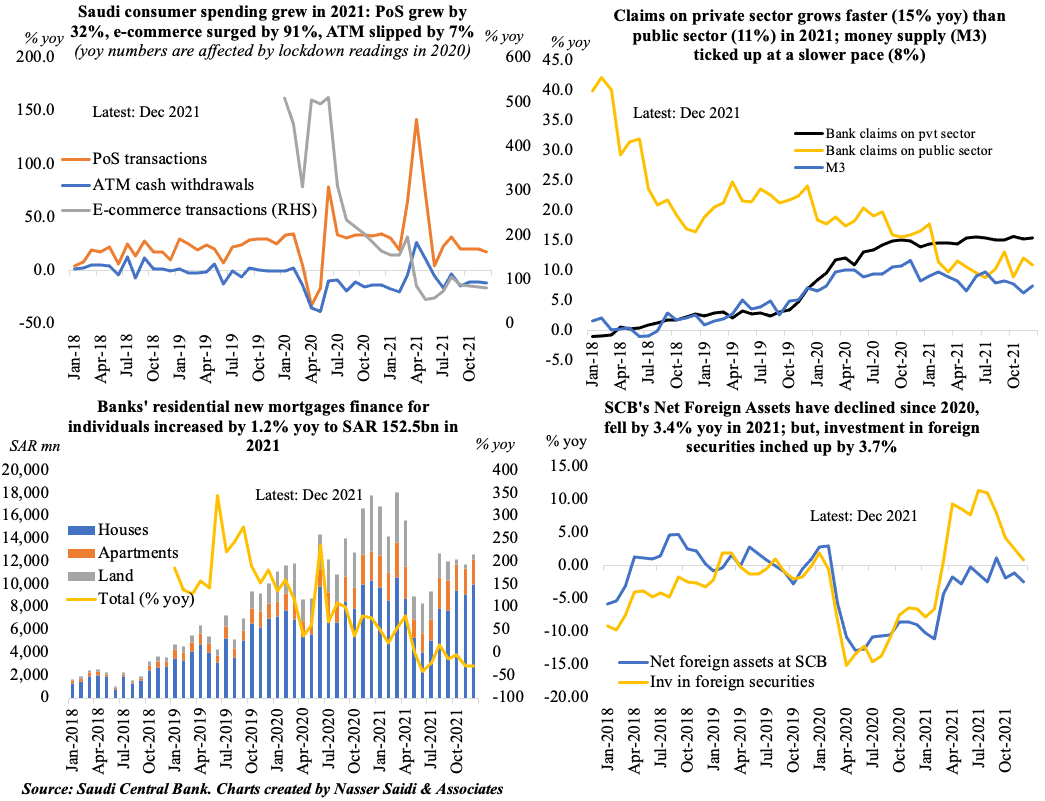

6. Consumer spending in Saudi Arabia inched up in 2021 after the 2020 plunge

- Consumer spending in Saudi: PoS & e-commerce surged in 2021

- Lending has ticked up in 2021; though individual mortgage finance grew by 1.2% yoy, it pales vis-à-vis the surge seen in 2020 (91%)

- SCB’s net foreign assets declined in 2021 (-3.4% yoy)