Markets

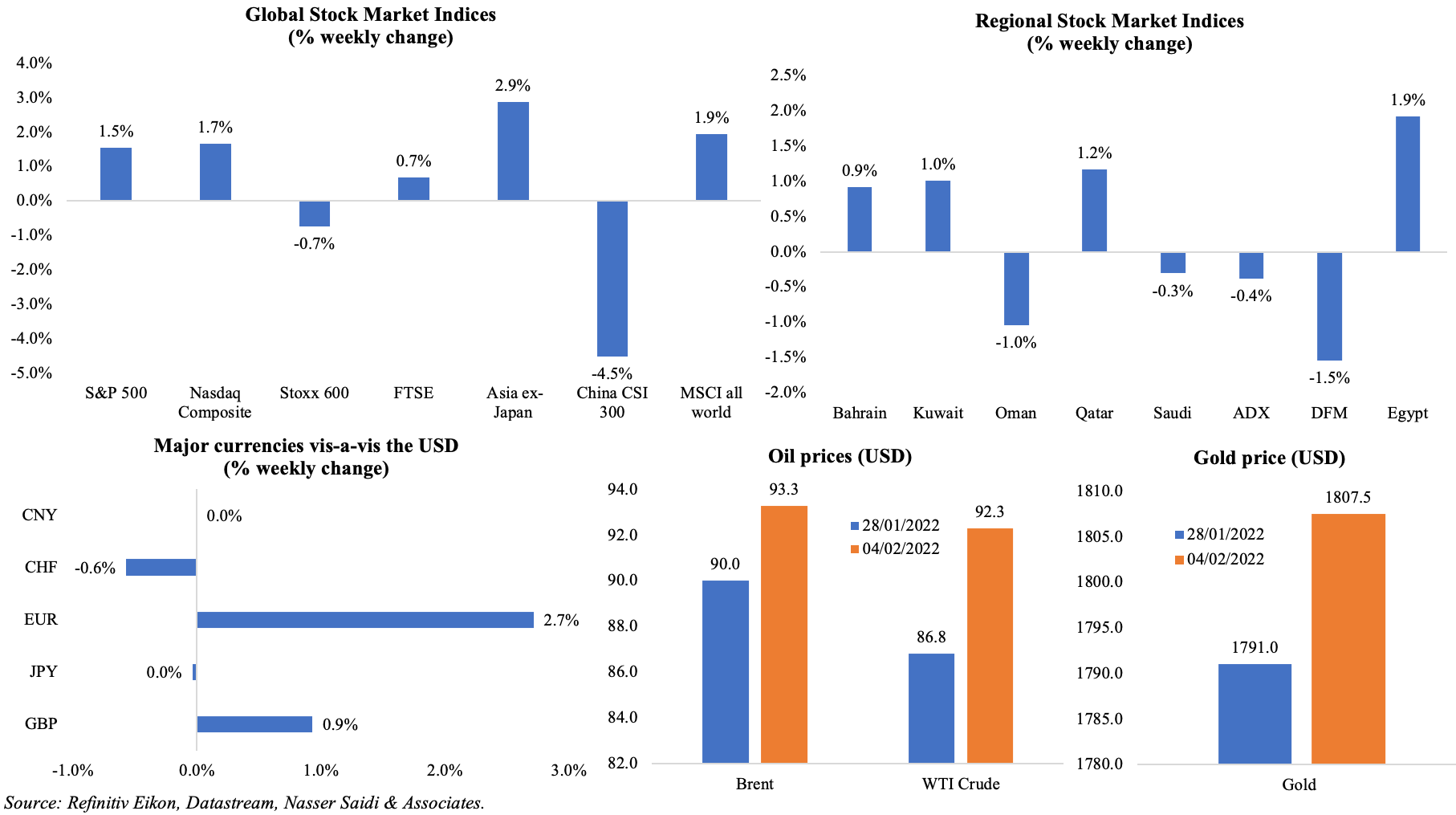

Markets were mixed last week. US markets saw heavy selling after Meta’s earnings report (Meta witnessed the biggest-ever one day crash, losing USD 230bn of market value on Thursday) but regained ground with Amazon’s strong results, thereby posting the biggest weekly gains this year. Stoxx600 lost ground, while FTSE gained from energy stocks’ support. Among regional markets, most Gulf markets ended in the red due to weaker oil prices; UAE markets (that were open on Fri) tipped slightly higher on Fri, but still ended the week lower versus the prior week. Among currencies, the euro surged last week given the ECB’s hawkish shift. Oil prices increased for a 7th consecutive week, rising to new 7-year highs on Friday, while gold gained by 0.9% (though slipping slightly towards end of the week given the dollar’s performance).

Weekly % changes for last week (3 – 4 Feb) from 27 Jan (regional) and 28 Jan (international).

Global Developments

US/Americas:

- Non-farm payrolls increased by a robust and unexpected 467k in Jan (Dec: 510k), with rising Covid cases having a relatively lower impact than expected; even leisure and hospitality industry reported a rise in payrolls by 151k. Unemployment rate inched up to 4%, slightly above Dec’s reading of 3.9% while the average hourly earnings rose by 5.7% yoy (Dec: 5%). Labour force participation rate unexpectedly increased to 62.2%, highest since Mar 2020 (Dec: 61.9%).

- Private sector businesses cut 301k workers in Jan (Dec: +776k), the first job loss since Dec 2020 and the biggest since Apr 2020. Unsurprisingly, leisure and hospitality sector was hit most, registering 154k job losses followed by transportation and utilities (-62k). Small firms cut the most workers (144k), while large and midsized firms cut 98k and 59k respectively. Labour market is experiencing high mobility and turnover.

- JOLTS job openings in the US gained to 10.925mn in Dec (Nov: 10.775mn) – this reading is just below the record highs posted in Jul, and erases most of Nov’s decline.

- Initial jobless claims dropped to 238k in the week ended Jan 28th, lower than the previous week’s upwardly revised 261k; the 4-week average was up to 255k. Continuing claims declined by 44k to 1.628mn in the week ended Jan 21st.

- Non-farm productivity rebounded at a 6.6% annualized rate in Q4 after falling at a 5.0% rate in Q3 while unit labour costs rose by just 0.3%. Productivity increased 1.9% in 2021, slowing from 2.4% growth in 2020.

- Factory orders fell by 0.4% mom in Dec (Nov: 1.8%): shipments of manufacturing goods rose by 0.4% (Nov: 0.7%) while inventories were up by 0.3%. Orders for non-defense capital goods, excluding aircraft, inched up by 0.3%.

- Chicago PMI unexpectedly increased to 65.2 in Jan (Dec: 64.3), the highest reading in 3 months. Separately, Dallas Fed manufacturing business index moderated to 2 in Jan (Dec: 7.8), with the production index at an 8-month low of 16.6 while new orders held steady at 20.

- ISM manufacturing PMI declined to 57.6 in Jan (Dec: 58.8), the weakest growth since Sep 2020, as new orders eased to 57.9 (Dec: 61) while employment inched up to 54.5 (Dec: 53.9) and prices paid jumped to 76.1 (Dec: 68.2).

- Markit manufacturing PMI in the US dropped to 55.5 in Jan (Dec: 57.7) – the slowest upturn in 15 months. While staff shortages were cited (due to Covid19 related absenteeism), price pressures eased and outlook for future output increased to a 14-month high. Non-manufacturing PMI meanwhile fell to 59.9 in Jan, the lowest reading since Feb 2021, and from 62.3 in Dec.

Europe:

- ECB left policy rates unchanged, but in its hawkish comments acknowledged that inflation would remain “elevated for longer”. Lagarde stated that assets buys would have to end before raising borrowing costs (suggesting an acceleration in winding down QE bond purchases).

- GDP in the euro zone increased by 0.3% qoq and 4.6% yoy in Q4, falling from Q3’s 2.2% growth, according to preliminary estimates. Stronger qoq expansions in Spain, France and Italy more than compensated for the contractions in Germany and Austria. This brings full year GDP growth to 5.2% in the euro zone and wider EU – fastest expansion since 1971.

- Inflation in the euro zone inched up to a new record-high of 5.1% in Jan (Dec: 5%). Core inflation (excluding food and fuel prices) slowed to 2.5% from 2.7% the month before.

- Producer price index in the euro zone increased to a record-high 26.2% yoy in Dec (+2.9% mom), largely due to energy prices (+7% mom and 73.4% yoy). Excluding energy, producer price was up by 0.5% mom and 10% yoy.

- EU Markit manufacturing PMI stood at 58.7 in Jan, lower than the preliminary estimate of 59 but higher than Dec’s 58, with input price inflation at the lowest in 9 months amid faster upticks in production, new orders and employment. Services PMI inched down to 51.1 in Jan (from Dec’s 53.1), as Covid19 restrictions negatively affected activity and selling price inflation touched a series high.

- Germany’s manufacturing PMI stood at a 5-month high of 59.8 in Jan (Dec: 57.4), with output momentum picking up following a slow H2 2021 amid “a further easing of supply chain pressures and a slowdown in the rate of inflation of goods producers’ costs to a nine-month low” amid job creation at a 6-month high. Services PMI rebounded to 52.2 in Jan after the drop in Dec (48.7) as the “drag on growth from the hotels and restaurants category eased” though input cost inflation ticked up to a near-record high.

- Factory orders in Germany grew by 2.8% mom in Dec (Nov: 3.6%), supported by gains in consumer goods orders (5.3%), intermediate (4.1%) and capital goods (1.8%). External orders fell by 3% but was more than offset by a surge in domestic orders (+11.7%).

- The harmonized index of consumer prices in Germany rose to 5.1% yoy in Jan, easing from Dec’s 5.7% reading.

- Germany’s retail sales tumbled by 5.5% mom in Dec (Nov: 0.8%), dragged down by non-food sales (-7.7%) while sales of food, beverages and tobacco and online shopping fell by 1.4% and 5.7% respectively. Retail sales in the EU slipped by 3% mom in Dec (Nov: 1% mom), with nations with the most restrictive Covid19 measures posting the largest drops (e.g. Germany, Netherlands).

- Unemployment rate in Germany eased for a 4th consecutive month to 5.1% in Jan (Dec: 5.2%), with the number of unemployed falling by 48k to 2.345mn (the lowest since Mar 2020). Separately, in the euro area, unemployment rate eased to 7% in Dec (Nov: 7.1%); youth unemployment rate fell to an all-time low of 14.9% down from 15.4% the month before.

- The Bank of England hiked the main Bank Rate by 25bps to 0.5% – the first back-to-back increase since 2004 – even as four officials voted for a bigger rate hike to fight inflation. Inflation forecast was raised to an April peak of 7.25% (From the 6% predicted earlier in Dec).

- Manufacturing PMI in the UK eased to 57.3 in Jan (Dec: 57.9), as new orders growth slowed amid high staff absenteeism and flat exports. It outpaced services sector PMI at 54.1 (which ticked up from a 10-month low of 53.6 in Dec), but nearly one-in-three survey respondents reported higher average prices charged when compared to Dec.

Asia Pacific:

- China NBS manufacturing PMI eased to 50.1 in Jan (Dec: 50.3), with output growing (50.9) amid contractions in new orders (49.3), foreign sales (48.4) and employment (48.9). Non-manufacturing PMI also declined in Jan, a 5-month low of 51.1 (Dec: 52.7), with new orders dropping for the 8th consecutive month (47.8) and new export sales at 46 (Dec: 47.7).

- Caixin manufacturing slipped to 49.1 in Jan (Dec: 50.9), a 23-month low, with new orders and output shrinking the most since Aug and new export orders falling at the steepest rate since May 2020, as China continues its zero-Covid approach and restrictions.

- Japan’s manufacturing PMI rose to 55.4 in Jan (Dec: 54.3), the quickest improvement since Feb 2014, thanks to rising output and new orders (from both domestic and international markets).

- Industrial production in Japan increased by 2.7% yoy in Dec (Nov: 5.1%). In mom terms, IP fell by 1% after rising by 7% the month before. The ministry expects industrial output to jump by 5.2% and 2.2% in Jan and Feb.

- Retail trade in Japan inched up for a 3rd consecutive month, rising by 1.4% yoy in Dec (Nov: 1.9%), driven by fuel sales (23.3%) and non-store retailers (7.1%) while sales of machinery and motor vehicles fell by 8.6% and 8% respectively.

- Unemployment rate in Japan fell to 2.7% in Dec (Nov: 2.8%). Job to applicants ratio inched up to 1.16 (i.e. 116 job openings for every 100 job seekers) from 1.15 the month prior.

- In its latest budget, India’s fiscal deficit is expected at 6.4% of GDP in 2022-23, with nominal GDP rising by an estimated 11.1% during the fiscal year. Also revealed were plans to launch a digital rupee using blockchain technology (starting 2022-23) as well as taxing income from virtual digital assets (at 30%).

- India’s manufacturing PMI slipped to 54 in Jan (Dec: 55.5), with raw material scarcity, inflationary pressures and rising cases affecting businesses. Factory orders and international sales slowed, and overall level of business confidence tumbled to a 19-month low.

- Retail sales in Singapore inched up by 2.3% mom and 6.7% yoy in Dec (Nov: 2.2% yoy), supported by food and beverages sales (7.4% yoy) as dine-in restrictions were eased.

Bottomline: The OPEC+ meeting saw delegates agree to raising oil production target by 400k bpd for Mar, but the group stayed clear of the geopolitical issues (partially the reason for the hike in prices). Meanwhile, the JP Morgan Global Manufacturing PMI slowed to a 15-month low of 53.2 in Jan 2022, with substantial supply chain delays amid employment rising for the 15th consecutive month. With inflation ticking up in many parts of the world, major central banks are turning hawkish alongside some positive macro data (signaling recovering demand). Anyhow for now, monetary policy divergence is evident between say the US on one end of the spectrum and China on the other end.

Regional Developments

- The second phase of Bahrain’s new airport terminal (launched a year ago) is 80% complete currently and in line to be completed in Q2.

- Egypt’s central bank left policy rates unchanged – deposit rate at 8.25% and lending rate at 9.25% – at the latest meeting.

- Non-oil sector PMI in Egypt slipped to 47.9 in Jan (Dec: 49) – the lowest since Apr 2021 and below the series average of 48.2. Weak demand led to output declining the most in over 1.5 years while new orders shrank, and employment fell. Outlook for future activity improved.

- Egypt’s debt will likely fall below 90% of GDP by end of this fiscal year (Jun 2022), according to the finance minister. Separately, he disclosed that starting March, Egypt aims to float ten state-run companies this year on its exchange, via IPOs and secondary offerings.

- Petrol prices in Egypt was increased by EGP 0.25 (USD 0.016) per litre, and will stay so till Mar. Diesel prices were maintained at the same level (EGP 6.75 per litre).

- According to the Egyptian Ministry of Tourism and Antiquities, 19 new hotel facilities have opened and operated during 2021, adding 3,000 new hotel rooms to total capacity. Furthermore, 4 new hotel projects will open in the next two months adding 600 further rooms.

- The Chairman of Egypt’s Suez Canal Authority (SCA) revealed in an interview with Asharq Bloomberg about plans to establish an investment fund with EGP 2bn in seed capital, with an aim to contributing to the economic sustainable development of facilities at the SCA.

- Iraq pumped 4.16mn barrels per day of oil in Jan, down by 63k bpd from Dec, reported Reuters. This is also lower than the limit of 4.28mn bpd under the OPEC+ agreement.

- Iraq was the top recipient for China’s Belt & Road infrastructure initiative in 2021, receiving USD 10.5bn in financing for projects (including a heavy oil power plant), according to a report by Shanghai’s Fudan University. In yoy terms, investments in Arab and Middle Eastern nations rose by 360% and construction engagement grew by 116%.

- Lebanon’s PMI increased to a 7-month high of 47.1 in Jan (Dec: 46.7) though firms were still reporting lower output volumes in the backdrop of the political and economic environment. Overall input costs increased given the weakness of the LBP.

- Oman, in its bid to refinance the USD 2.2bn loan taken last year, started raising a USD 3.5bn 7-year loan (that could go up to USD 4bn), reported Reuters.

- Private investments into Oman’s Duqm Special Economic Zone surged to a total of OMR 3.6bn as of end-Jan, with almost 431 projects in various stages of development/ operation. According to the Deputy Chairman of the Public Authority for Special Economic Zones and Free Zones, Omanisation averages 22% in the zone, while at Port of Duqm it stands at 85%.

- Oman and the Saudi Fund for Development have signed three deals to finance projects to the tune of USD 244mn, including towards developing infrastructure in the SEZ in Duqm.

- Qatar will not be able to completely replace EU’s gas need without diverting supplies from other parts of the world, revealed Qatar’s minister of state for energy. It is thought that only 8-10% of Qatar’s LNG is available to divert to Europe and it would take longer to ship to Europe.

- Negotiations have begun for a GCC-UK trade deal, and this could be concluded before end of the year, revealed Bahrain’s Industry, Commerce and Tourism minister in an interview with Bloomberg.

- The US administration has restored sanctions waivers to Iran, allowing Russian, Chinese and European companies to carry out non-proliferation work, as talks to revive the nuclear deal reach the final stretch.

Saudi Arabia Focus

- Saudi Arabia’s non-oil private sector PMI decelerated for a 4th consecutive month in Jan, slowing to 53.2 (Dec: 53.9) – the lowest since Oct 2020. Output sub-index slipped to 56 in Jan (Dec: 57.3), new export orders contracted for the first time since Mar and employment remained subdued.

- Saudi PIF was assigned an A rating (with entails low default risk expectations) with a stable outlook by Fitch Ratings. Separately, the PIF disclosed stakes of more than 5% in two Japan-listed gaming firms (Capcom Co and Nexon Co) with combined holdings worth around USD 1.2bn.

- Government deposits in Saudi Arabia posted the biggest monthly fall in 6 years, with it down by SAR 74.7bn (USD 19.9bn) in Dec. Separately, the central bank’s total assets fell by 2.3% mom to SAR 1.85trn.

- Remittances from Saudi Arabia increased by 2.79% yoy to SAR 153.87bn in 2021 – this is the highest amount since 2015. This happened in spite of a 17.3% yoy decline in remittances in Dec (to SAR 11.1bn).

- Saudi Central Bank licensed a new payment fintech firm called Waslah al-Dafa (Paylink) to provide e-commerce payment services. Total of 15 payment companies have been licensed by SAMA in addition to 8 firms that have received initial approval.

- The Wall Street Journal reported that Saudi Aramco is planning to list more shares, targeting a stake sale of about USD 50bn, also stating that it is still in the planning stage. This could include a Tadawul listing as well as a secondary listing in London, Singapore, or other exchanges.

- Saudi Arabia’s Nomu exchange will list two new companies – Gas Arabian Services and Obeikan Glass Co – on Feb 7th.

- Saudi Aramco raised prices for all crude grades it sells to Asia in Mar by 60 cents a barrel compared to Feb, reflecting firm demand in the region.

- Saudi Arabia launched investments to the tune of USD 6.4bn in future technologies, revealed the minister of communications and information technology. He also disclosed that the tech and digital market in the country stands at around USD 40bn – the largest in the region.

- Digital arm of NEOM announced a USD 500mn hyper-scale data centre, as part of a USD 1bn investment by the city in AI-based products: it is expected to be operational in H1 2021. Separately, NEOM is targeting production of a total output of over 600,000 tons by 2030 with the help of an innovative food sector.

- Saudi Arabia’s citizens will need to take the Covid19 booster shot to be able to travel abroad, in effect from Feb 9th.

UAE Focus![]()

- UAE’s non-oil private sector PMI eased to 54.1 in Jan (Dec: 55.6) – the slowest since Jul – with output slipping to 59.6 (Dec: 62.7) and employment falling close to 50 while new orders continued to increase. Output prices were reduced for the 6th consecutive month even as purchasing costs rose for the 14th straight month.

- Inflation in the UAE has been rising: headline and food increased to5% and 3.7% respectively in Dec, partly due to higher raw material prices and rising wages (a global phenomenon and not limited to the UAE).

- Dubai GDP recovered in Q1-Q3 2021, growing by +6.3% yoy, following the plunge in 2020, with accommodation and food sector posting the sharpest recovery (34%) followed by real estate (23.3%). Wholesale & retail trade accounted for the largest share of GDP (25%) while together, real estate and construction contributed 16% to the economy.

- The UAE will impose a federal corporate tax of 9% from Jun 2023, applicable on companies with profits in excess of AED 375,000. This move will diversify & broaden tax receipts and help reduce the nation’s dependence on oil revenues (and hence push greater economic diversification). Businesses are exempt from paying taxes on capital gains and dividends received from shareholdings. In this backdrop, Dubai is considering a reduction in government fees on commercial activities: it will come as a welcome relief, supporting ease of doing business.

- The UAE’s new labour rules came into force from Feb 2nd. These changes support labour mobility (renewable 3-year contracts vs permanent, no non-competing clauses, 180 days till residency visa expires after job loss), while also supporting work structures in a post-Covid world (flexible working, part-time work, job sharing, remote work) and prohibiting gender-based discrimination (promote equal rights for women, extended maternity leave).

- Abu Dhabi Ports Group, that operates industrial cities and free zones and majority owned by ADQ, will list on Abu Dhabi securities Exchange on Feb 8th.

- Dubai added 98 economic activities in 2021, reported the Business Registration and Licensing sector at the Department of Economy and Tourism, bringing the total to over 2200 activities (+88% yoy). These included specialized activities like green hydrogen production, artificial intelligence, gaming services and 3D printing among others.

- UAE’s ADNOC announced the first gas discovery in Abu Dhabi’s offshore blocks – which indicates between 1.5 and 2 trillion standard cubic feet of raw gas in place.

- Dubai’s government media office revealed plans to reduce carbon emissions by 30% by end-2030, in line with the broader UAE strategy.

- UAE raised fuel prices by more than 10% mom in Feb: diesel prices were up by 12.5% to AED 2.56 while depending on the grade of petrol the hike was between 10.9%-11.5%. Prices in Feb are the highest since fuel prices were liberalized in Aug 2015, and will reflect in upcoming inflation numbers.

Media Review

The End of Free Lunch Economics

https://www.project-syndicate.org/commentary/end-of-free-lunch-economics-by-raghuram-rajan-2022-01

Learning from 1918 Pandemic

https://www.nytimes.com/2022/01/31/opinion/covid-pandemic-end.html

Bahrain eyes tourism boom as mega projects provide blueprint for prosperity

Lebanon’s savers to bear burden under new rescue plan (with Dr. Nasser Saidi’s comments)