Weekly Insights 3 Feb 2022: UAE’s reforms-paved road to recovery

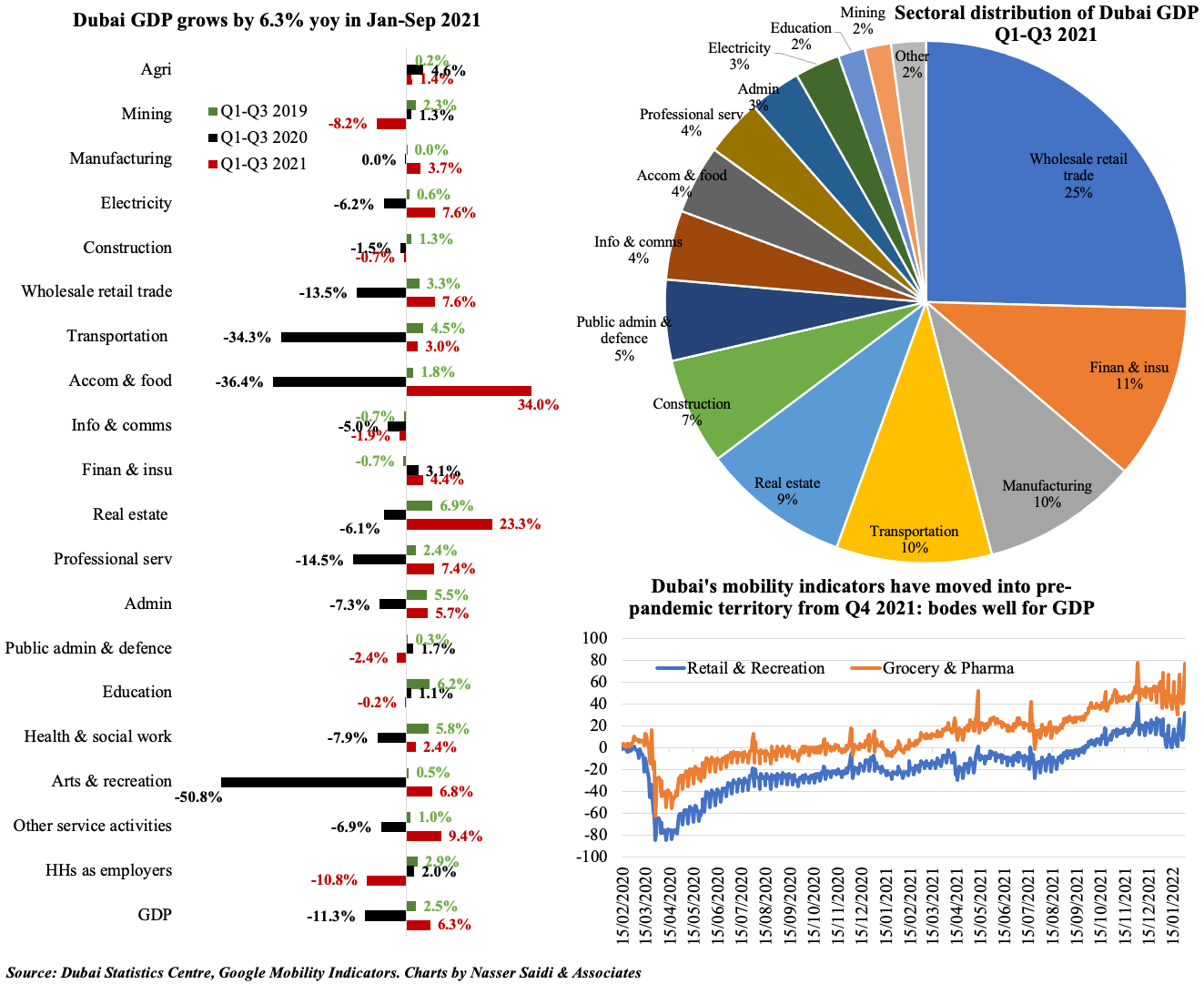

1. Dubai GDP recovers in Q1-Q3 2021 (+6.3%), following the plunge in 2020

- Accommodation & food sector posted the sharpest recovery (+34% yoy) followed by real estate (23.3%)

- Wholesale & retail trade accounted for the largest share of GDP (25%) while together, real estate and construction contributed 16% to the economy

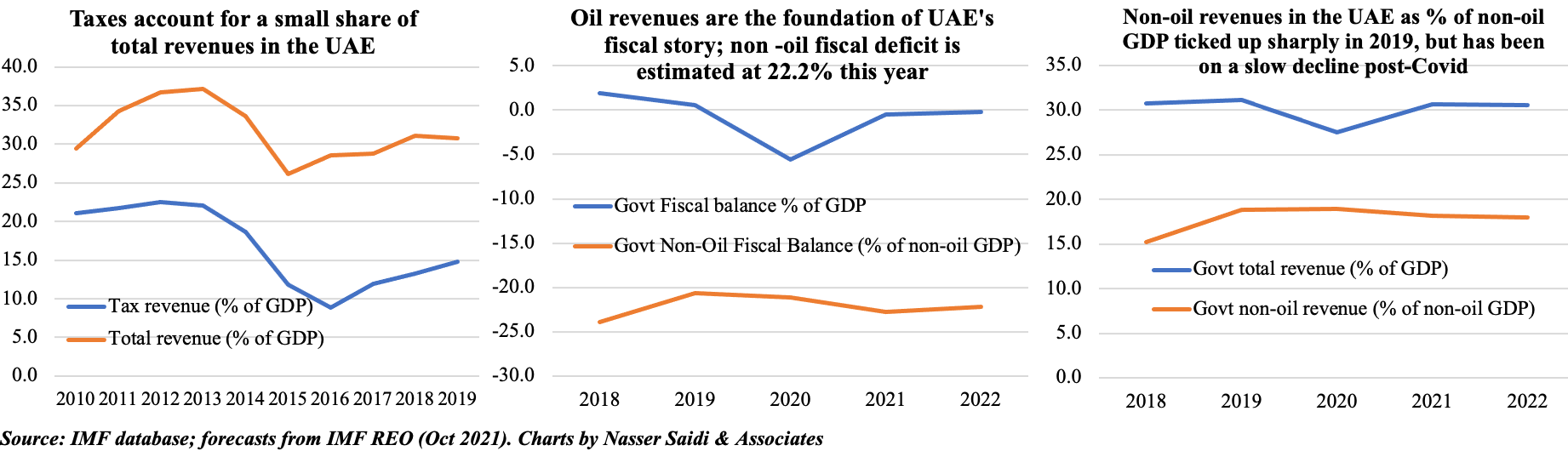

2. UAE’s corporate tax proposal of 9% will boost tax revenue & increase transparency

- The UAE will impose a federal corporate tax of 9% from Jun 2023, applicable on companies with profits in excess of AED 375,000. This move will also allow UAE to increase tax transparency & prevent the nation from being considered a non-compliant corporate tax haven and home to ‘hot money & financial flows’

- The corporate tax rate is competitive compared to other jurisdictions and its collection will add to UAE’s coffers: tax revenue collected accounted for just 15% of GDP in 2019 (supported by the rollout of VAT and excise taxes a year+ prior). This move will diversify & broaden tax receipts and help reduce its dependence on oil revenues (& hence push greater economic diversification).

- For firms this tax would be an added cost, and might be passed on to consumers: so, Dubai considering to reduce government fees on various activities will come as a welcome relief, supporting the ease of doing business

- This comes on the heels of an agreement in Oct 2021 of a 15% global minimum tax, backed by 136 nations and jurisdictions (UAE is one of the nations; negotiations were led by the OECD) for companies with revenues above EUR 750mn. Details of this global rollout and implementation are yet to be disclosed.

3. UAE’s recent labour reforms increases its attractiveness as a destination for young & skilled workforce

- New Labour rules came into force in the UAE from 2nd Feb 2022.

- These changes support labour mobility (renewable 3-year contracts vs permanent, no non-competing clauses, 180 days till residency visa expires after job loss), while also supporting work structures in a post-Covid world (flexible working, part-time work, job sharing, remote work) and prohibiting gender-based discrimination (promote equal rights for women, extended maternity leave)

- Along with earlier positive reforms (like long-term and remote working visas), this will further enhance UAE’s attractiveness as a destination for both young and skilled workforce to “live, work and play”

- According to the UAE central bank’s (in-house) data, both employment and average salary remained roughly flat in Q3 2021, and higher than pre-crisis month of Feb 2020 – which suggests that the labour outflow seen during the earlier months of Covid19 has already been compensated for

- However, structural changes would further enhance growth of the non-oil private sector:

- Reduce fragmentation of labour markets: introduce steps to encourage citizens to join the private sector workforce

- Invest in curricula that support job readiness

- Encouraging research and innovation, invest in & promote STEM (among others)

4. Latest in supporting the UAE’s Capital Market Development: SPACs regulatory framework

- The latest in the spate of capital markets reforms/ changes in the UAE is the approval of the first special purpose acquisition company (SPAC) regulatory framework in the GCC.

- SPACsS are also being discussed elsewhere in the region: Egypt is planning a SPAC listing by this month, while Saudi is studying if there is demand from investors as well as issuers.

- SPACs are corporations formed for raising capital (or investment) with the purposed of combining with a private company. It allows for start-ups/ early-state and later-stage growth firms that want financing to raise capital: this process can be cheaper than and less time-consuming than an IPO route

- Recent SPACs globally have been focused on firms/ sectors that can be labelled “disruptive” (e.g. assurance technology, biotech etc) which might involve high capital requirements with limited guarantees on revenue/ viability

- UAE’s regulatory framework gives it a first mover advantage in attracting listings from the region; offers potential as a global SPAC destination if the UAE maintains a good track record (learning from other regulators “mistakes”), if the US/ Europe increase scrutiny on SPACs

- Listing of SPACs will allow for diversification of sectors on the UAE exchanges (away from the concentration on banks and real estate firms). Given the UAE’s prominence in the start-up ecosystem in the region, SPACs are an obvious next step to support the development of these companies

- This move will also aid in the development of liquid and deep capital markets. While the SPACs framework is another reform in addition to earlier announcements of listing of state-owned firms in Dubai and incentives to encourage new listings in DFM/ ADX, a sufficient pipeline is needed to enable a successful rollout & provide a stamp of approval to the UAE’s framework

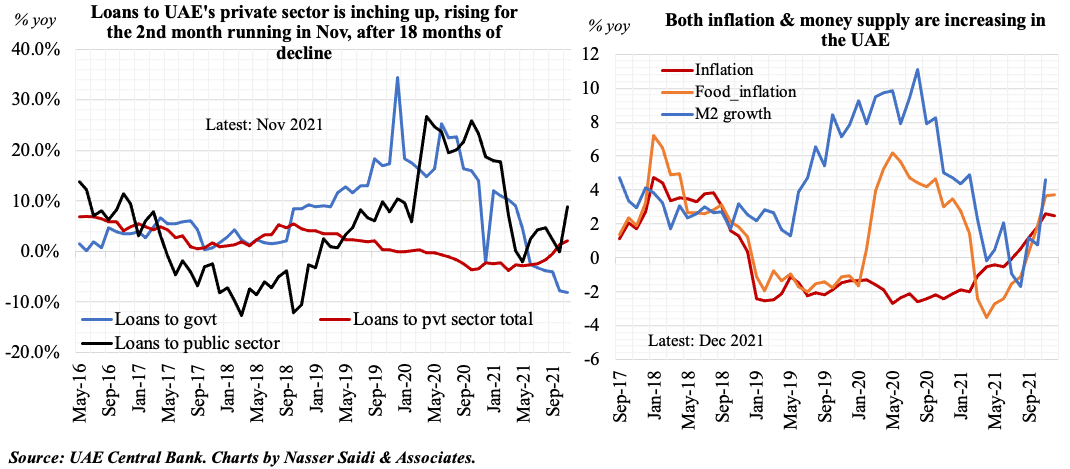

5. Loans to UAE private sector growth for the 2nd consecutive month in Nov; inflation is ticking up

- Overall domestic credit disbursed in the UAE inched up by 2.2% yoy in Nov 2021, following the 1.3% rise in Oct. This follows 18 months of yoy declines in credit growth

- Inflation in the UAE has been rising (both headline and food, by 2.5% and 3.7% respectively in Dec), partly due to higher raw material prices and rising wages (a global phenomenon and not limited to the UAE). In the recent months, money supply has also been rising (by 4.6% in Nov 2021, but not at the pace during Mar-Dec 2020 when it averaged 8.4%). This needs to be tracked closely in the coming months, as an inflationary spiral is the last thing needed as the economy is on its way to recovery