Weekly Insights 27 Jan 2022: IMF revises down global growth forecasts; MENA region growth supported by oil producers

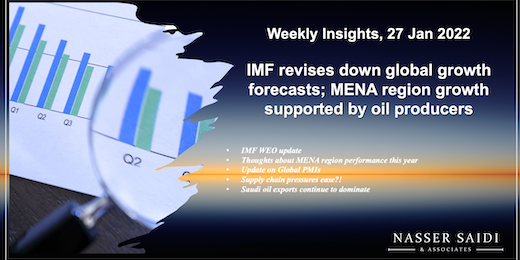

1. IMF revises growth forecast for this year to 4.4%, lower due to downgrades for the US & China

- The IMF factors in that Omicron will weigh on economic activity in Q1 2022, thereby affecting supply disruptions and causing higher inflation amid a backdrop of record debt and uncertainty

- The Middle East & North Africa region is expected to grow by 4.4% in 2022, slightly higher than the 4.1% in 2021, thanks to the economic recovery among oil exporters (Saudi Arabia is estimated to grow by 4.8% from 2.9% in 2021)

2. MENA region to grow at 4.4% this year; but, with divergent prospects

- Recovery will depend on vaccination pace as well as the recovery of Covid19 hit sectors (tourism, hospitality, trade)

- GCC nations will benefit from the recovery in oil prices, given the increased production levels, in line with the OPEC+ decisions. The rise in oil prices will also support overall fiscal balances, though fiscal consolidation is being undertaken in a few (e.g. Oman, Saudi Arabia)

- Oil importing nations are likely to growth by 4%+ this year, with Egypt the brighter spot among them. Given ongoing reforms, Egypt is expected to grow by 5.6% in 2022

- The financial sector has been quite resilient during the pandemic, supported by the fiscal and monetary stimulus measures rolled out by governments in the region. Many have extended few policies (like loan deferrals) till mid-2022, allowing for a gradual withdrawal of support. Potential vulnerabilities once support is withdrawn include non-performing loans, deteriorated asset quality etc.

- Labour was severely hit during the pandemic and recovery to pre-pandemic levels will take longer in the MENA region. The more imported labour-dependent GCC nations had seen a significant outflow during the early months of the pandemic have seen a reversal in fortune, thanks to multiple incentives (including longer-term visas, changes to labour laws etc).

- Risk factors: emergence of other Covid19 variants + supply chain disruptions (due to China’s zero-Covid policy) & resultant inflation + more aggressive tightening from the Fed (risks to global financial conditions, reverse capital flows) + rising geopolitical tensions + social unrest + climate-related risks

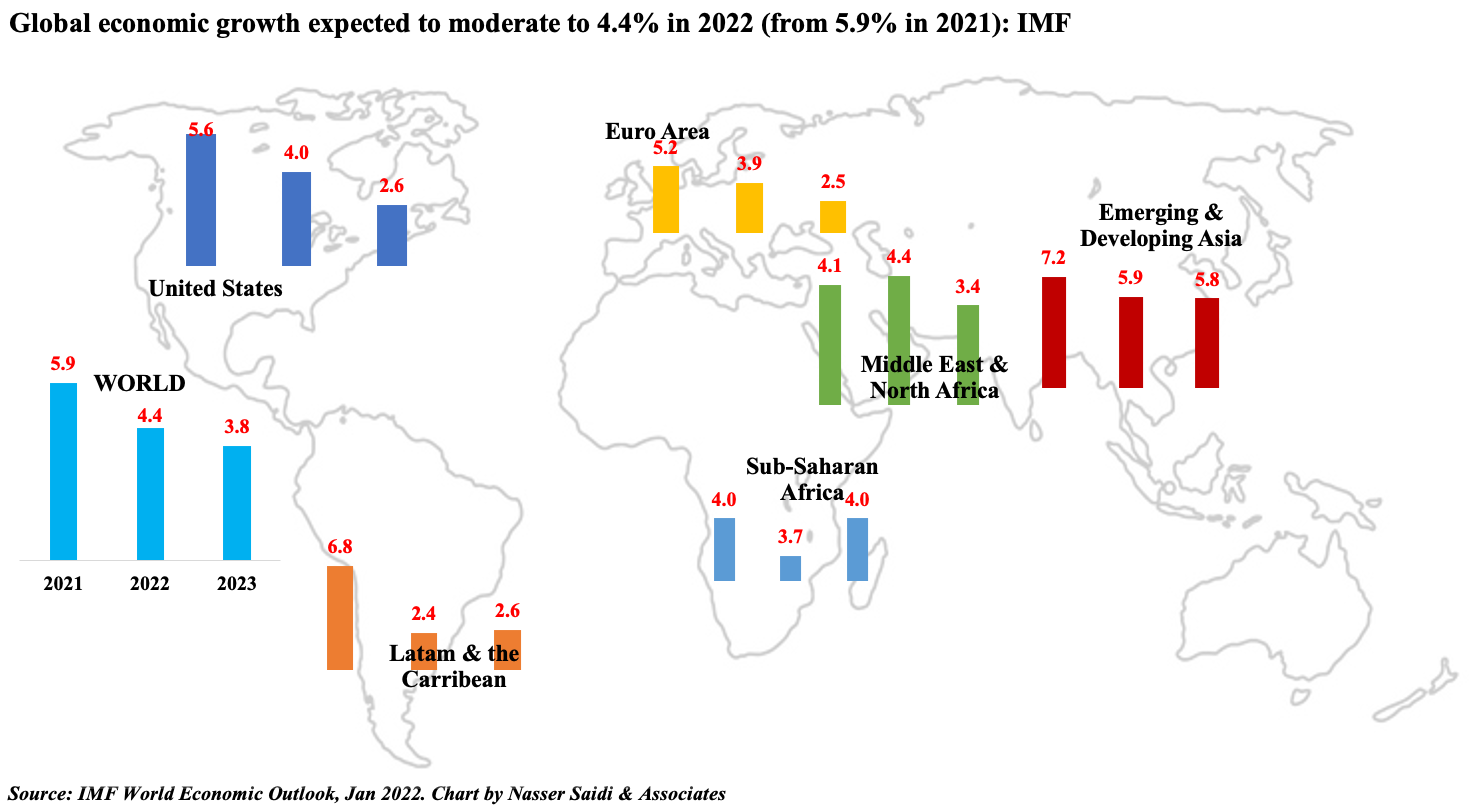

3. Global preliminary manufacturing PMIs

- The Omicron variant seems to have affected manufacturing PMIs in Jan substantially less when compared to services sector (given restrictions on face-to-face meetings, gatherings + staff absences due to Covid/ close contacts)

- Fewer supply shortages and easing shipping delays seem to have improved perception of manufacturers; except in the US and UK, all others have seen a slight uptick in the preliminary PMI reading for Jan 2022

- Inflation however looks on track to increase further in the coming months, given the input and output prices tracked.

- With Covid19 cases having peaked in many European nations, easing of restrictions (in many cases gradual) are underway & will likely support a recovery in economic activity by Feb-Mar 2022.

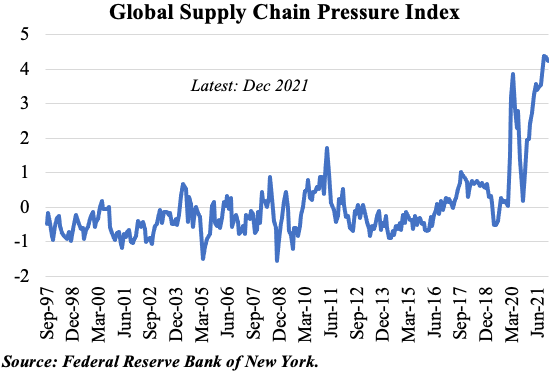

4. Supply Chain Pressures seem to be easing from previous highs

- The Fed’s Global Supply Chain Pressure Index shows that though above pre-pandemic levels, there has been signs of an easing

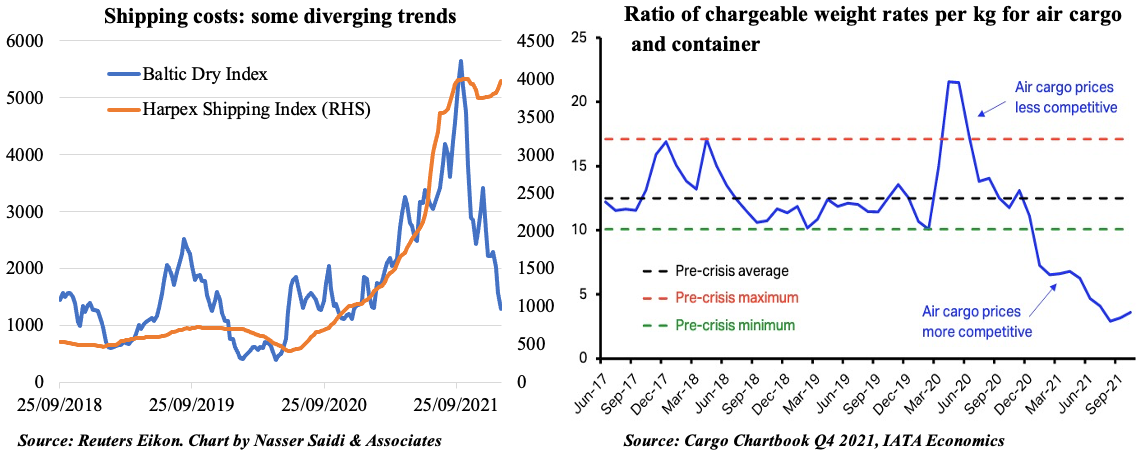

- Baltic Dry Index (tracks cost of shipping raw materials) has come down significantly though Harpex index (which tracks container shipping rates) is rising again (after a few weeks of decline) after Omicron hit

- Average price to move air cargo is about 3-5 times higher than ocean now (vs 13-15X pre-pandemic)

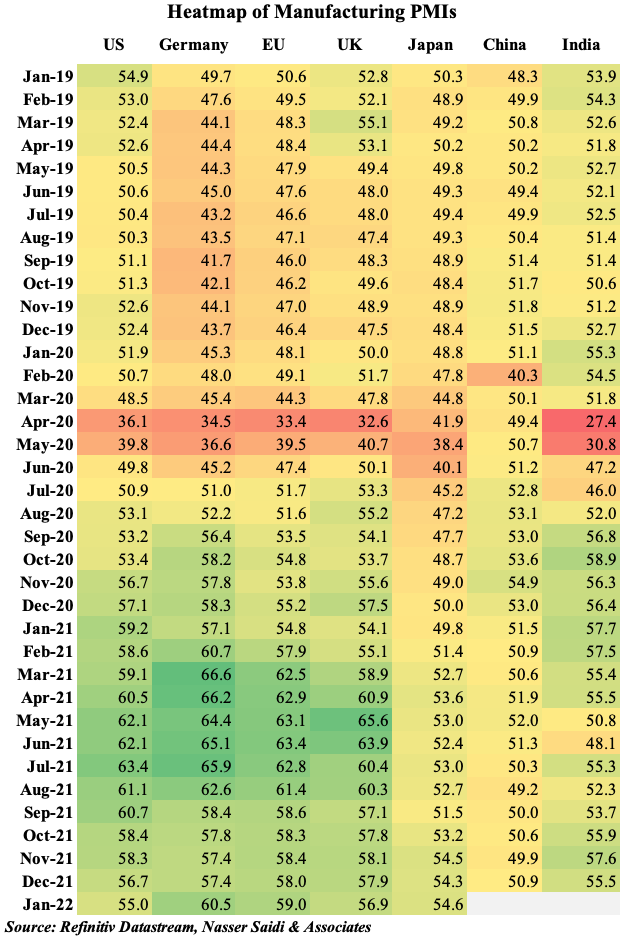

5. Saudi non-oil exports grew by 26.1% in Nov 2021; China largest trading partner

- Oil exports continue to dominate overall exports from Saudi Arabia: it stood at 75.8% in Nov 2021 vs just 65% in Nov 2020. Oil exports grew by 112.8% yoy in Nov

- Non-oil exports growth in Nov was supported by the exports of chemicals or allied industries: accounting for 34% of non-oil exports, this segment’s growth surged by 70.6% yoy

- China, India and Japan were the largest importing nations, receiving 17.2%, 11.6% and 9.6% of Saudi’s total exports in Nov

- Among the non-oil trade with the GCC nations, visible improvements were seen in UAE and Kuwait