Markets

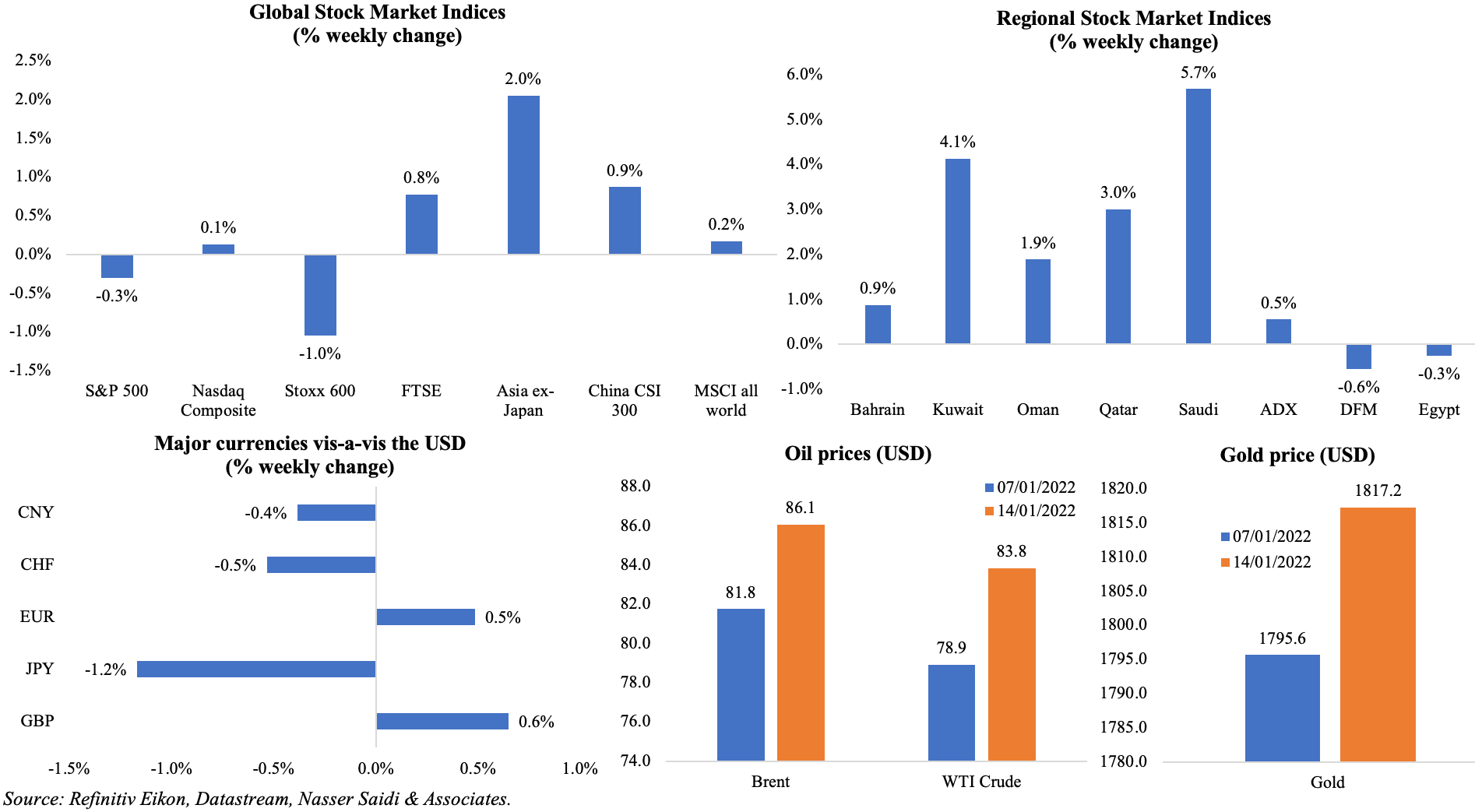

US equity markets had a disappointing week, weighed down by Covid disruptions and surging inflation amid relatively disappointing results from large US banks. Stoxx 600 fell by 1% from the previous week, dragged down by tech stocks and given hawkish comments from a few central bank officials. Relatively, Asian markets performed better than a week ago, but technology shares mirroring US performance pushed Korean and Nikkei markets down. Regional markets were mostly up except for the UAE where markets (which were open on Friday, given the new weekend) reacted to Fed officials signaling a March rate hike. Sterling stands out among currencies, after a seemingly easing Covid19 surge and expectations of a rate hike come Feb. Oil prices have climbed for four weeks straight, given supply constraints and worries about Ukraine; Brent closed the week at USD 86.1 (inching closer to the 2018 peak of USD 86.74). Gold price also increased, rising by 1.2%, but remains lower than its Jan peak.

Weekly % changes for last week (13 – 14 Jan) from 6 Jan (regional) and 7 Jan (international).

Global Developments

US/Americas:

- Inflation in the US jumped to 7% yoy in Dec (Nov: 6.8%), the largest gain since Jun 1982, thanks to the increase in energy prices (+29.3%). Core CPI jumped by 5.5% (Nov: 4.9%). Prices were higher across most categories: food (+6.3%), new vehicles (+11.8%), used cars and trucks (+37.3%), shelter (+4.1%) and medical care (+2.5%) among others.

- Budget deficit in the US narrowed to USD 21bn in Dec (Nov: USD 191bn) – this is the smallest monthly deficit in 2 years, thanks to an increase in tax receipts (+41% yoy to USD 487bn). Total deficit stands at USD 378bn in the first three months of fiscal year 2022, 34% down from the USD 573bn deficit clocked in the same period a year ago.

- Producer price index increased by 0.2% mom in Dec (Nov: 1.0%) – the smallest gain since Nov 2020. Goods prices dropped by 0.4%, reflecting the declines in food and energy prices while services prices were up by 0.5%. Core PPI rose by 0.5% in Dec (Nov: 0.8%). In year-on-year terms, PPI was up by 9.7% – the highest increase since 2010.

- Industrial production in the US slipped by 0.1% mom in Dec (Nov: 0.7%), dragged down by manufacturing (-0.3%) and motor vehicles and parts (-1.3%). Capacity utilization stood at 76.5%. Industrial production rose, in year-on-year terms, by 3.7% in Dec and output was 0.6% above the pre-pandemic level.

- Retail sales in the US declined by 1.9% mom in Dec (Nov: 0.2%), the largest fall since Feb 2021. Online sales dropped by 8.7% and clothing store sales fell by 3.1% while auto sales were down by 0.4%. Excluding autos, retail sales inched down by 2.3% compared to a 0.1% rise in Nov. Retail sales are 19.2% above their pre-pandemic level.

- The Michigan consumer sentiment index dropped to 68.8 in Jan (Dec: 70.6) – the second lowest in 10 years. Sentiment dropped by 9.4% among households with total incomes below USD 100k while those above showed an improvement in sentiment (+5.7%).

- Initial jobless claims increased by 23k to an 8-week high of 230k in the week ended Jan 7th, partly due to the Omicron wave, while the 4-week average stood higher at 201.75k. Continuing claims dropped by 194k to 1.559mn in the week ended Dec 31 – the lowest reading since the week ending Jun 2, 1973.

Europe:

- Real GDP in Germany grew by 2.7% yoy in 2021, rebounding from the 4.6% drop in 2020. Growth was 2% lower in 2021 than in 2019 i.e. pre-Covid levels have not yet been reached.

- Germany’s wholesale price index slowed in Dec: WPI surged to 16.1% yoy, slower than Nov’s record 16.6% rise. For the full year 2021, wholesale prices increased by 9.8%, the most since 1974, given the spikes in mineral oil products (32%) and metals and metal ores (44.3%).

- Industrial production in the euro area rebounded by 2.3% mom in Nov, supported by production of non-durable consumer goods (+3.2% from Oct’s -4.5%) and capital goods (+1.5%). IP declined by 1.5% yoy in Nov (Oct: 0.2%), after 8 consecutive months of growth.

- Sentix investor confidence unexpectedly rose to 14.9 in Jan (Dec: 13.5), supported by the uptick in current conditions to 16.3 (Dec: 13.3) while expectations slipped to 13.5 (Dec: 13.8).

- Unemployment in the eurozone declined to 7.2% in Nov (Oct: 7.3%), the lowest level since Mar 2020. The number of unemployed decreased by 222k to 11.829mn while the youth unemployment rate fell to 15.5% (Oct: 15.8%).

- GDP in the UK expanded by 0.9% mom in Nov (Oct: 0.2%), surpassing its pre-pandemic level for the first time. This was prior to the spread of Omicron and related restrictions on social gatherings. Index of services grew by 1.3% and construction industry grew by 3.5%.

- Industrial production in the UK increased by 1% mom in Nov (Oct: -0.5%), posting the strongest increase since Mar, supported by the gain in manufacturing (1.1% from Oct’s 0.1%).

- Goods trade deficit in the UK eased to GBP 11.337bn in Nov (Oct: GBP 11.807bn). According to the ONS, imports from non-EU nations were higher than from EU countries for the 11th straight month, with the gap the widest in Nov.

Asia Pacific:

- GDP in China grew by 4% yoy in Q4, the slowest pace in 18 months, bringing the full year growth to 8.1%. Growth was supported by industrial production while consumption weakened.

- The People’s Bank of China cut the one-year policy loans rate by 10 basis points to 2.85%.

- China’s inflation slipped to 1.5% yoy in Dec (Nov: 2.3%), as food prices fell by 1.2% (the second drop in 3 months) while non-food inflation eased to 2.1% (Nov: 2.5%). In mom terms, inflation stood at -0.3% from 0.4% in Nov. Producer price index also eased to 10.3% in Dec (Nov: 12.9%), the lowest reading since Aug. For the full year 2021, PPI stood at 8.1%.

- China’s trade surplus widened to a record high USD 94.46bn in Dec (Nov: USD 71.72bn) after exports growth slowed in Dec (rising by 20.9% yoy compared to Nov’s 22%), while import growth slowed sharply (up by 19.5% vs Nov’s 31.7%). For the full year 2021, trade surplus stood at USD 676.43bn – the highest since records started in 1950.

- Money supply growth in China increased by 9% yoy in Dec (Nov: 8.5%). New loans eased to CNY 1130bn in Dec (Nov: CNY: 1270bn); in 2021, banks extended a total CNY 19.95trn in new yuan loans (1.6% yoy). FDI into China grew by 14.9% in 2021 (Jan-Nov: 15.9%). Retail sales grew by just 1.7% yoy in Dec.

- Japan’s coincident index increased to 93.6 in Nov (Oct: 89.8) and the leading economic index inched up to 103 from 101.5 – both readings the highest since Jul, supported by surge in vaccinations and an easing of supply chain disruptions.

- Wholesale price inflation in Japan rose by 8.5% yoy in Dec (Nov: 9.2%), recording the 10th month of growth and the second-highest increase on record. Wholesale prices were up 4.8% in 2021, the highest since comparable data became available in 1981.

- Current account surplus in Japan narrowed by 48.2% yoy to JPY 897.3bn in Nov (Oct: JPY 1180.1bn) – the smallest current account surplus since Jan. Trade balance however posted a deficit of JPY 431.3bn following Oct’s surplus of JPY 166.7bn, as imports surged by 44.9% to JPY 7.88trn (the highest level since Jan 2014).

- Consumer price index in India rose to a 6-month high of 5.6% in Dec, thanks to increases in food and beverage prices (4.5% from 2.6% in Nov) and clothing (8.3% from 7.9%) among others. Wholesale price inflation meanwhile cooled slightly to 13.56% in Dec, from Nov’s record high 14.23%.

- Industrial output in India grew by 1.4% yoy in Nov (Oct: 4%), posting the smallest gain since Mar 2021. Manufacturing production was up by just 0.9% (Oct: 3.1%) while mining and electricity production also slowed to 5% and 2.1% respectively (from 11.5% and 3.1%).

- The Bank of Korea hiked its benchmark rate by 25bps to 1.25% at its latest meeting in a bid to restrain inflation. This is the third hike since last Aug and the interest rate is back to pre-pandemic levels. The governor stated that the bank’s policy remains accommodative.

Bottomline: Inflation readings (both consumer and wholesale prices) are rising across the globe (US, Germany, Japan). While supply chain disruptions are partly the reason for the uptick in inflation, China’s zero Covid19 policy could result in this continuing into 2022, especially given recent port closures and resulting congestion (more in the Media section). In this backdrop, the Bank of Japan meets this week, a few days after Korea raised rates for the third time. The BoJ is unlikely to raise rates this time round – Reuters reported policymakers are debating how soon rates can be hiked – but it is expected that it will raise its inflation forecasts for the year.

Regional Developments

- Inflation in Egypt inched up to 5.9% yoy in Dec (Nov: 5.6%), still within the central bank’s 5-9% target range. Core inflation increased to 6% from 5.8% the month before.

- Egypt secured a USD 3bn loan, with equal parts green and Islamic financing, arranged jointly by a group of Gulf banks including UAE’s Emirates NBD and First Abu Dhabi Bank.

- Egypt’s Suez Canal’s expansion plans are expected to be finished by Jul 2023, according to the chairman of the Suez Canal Authority. Separately, it was disclosed that the Canal aims to have a 15% share of global energy trade by 2040, up from 8% in 2019 from “adopting flexible marketing policies”.

- Iraq plans to boost exports by almost 250k barrels per day (bpd) from Q2, after upgrades to capacity. The completion of the installation of new pumping stations will allow Basra’s operational crude export capacity to increase to 3.4-3.45mn bpd from 3.2mn bpd currently.

- Lebanon should not fear a US sanctions law, according to the US Ambassador to Lebanon, on its plans to import energy from other Arab states (as it will transit via Syria).

- Lebanon’s central bank announced on Friday that it plans to boost the pound’s value by easing restrictions on dollar purchases after the currency hit a record low. It removed a ceiling related to bank purchases of dollars using the official Sayrafa exchange rate platform.

- France’s foreign minister disclosed that the UAE would join the Saudi-French fund established to support the Lebanese people. No details have been given on the fund, how it would work or how much was being pledged.

- Oman and the UK signed a Sovereign Investment Partnership deal aims to increase high-value investment into both nations, including the identification and support of commercial investments in areas like clean energy and technology.

- Oman’s largest desalination company (owner of Oman’s largest operating water desalination plant Barka IWP) will offer 40% of its share capital to the public through an IPO. This will be Oman’s first IPO in three years and will list on the Muscat Stock Exchange.

- Qatar grew by 2.6% yoy and 4% qoq in Q3 2021, according to the statistics authority. Mining and quarrying GDP declined by 0.7% yoy in Q3 while the non-mining and quarrying sector grew by 4.7%. Accommodation and food services activities continued to recover, growing by 29.8% in Q3, as did transportation and storage (29.7%) and manufacturing (6.1%).

Saudi Arabia Focus

- Inflation in Saudi Arabia touched 1.2% yoy in Dec (Nov: 1.1%), thanks to higher transportation costs (7.2%), vegetable prices (6.3%) and education costs (4.8%) among others.

- Wholesale price inflation in Saudi Arabia increased to 13.2% in Dec (Nov: 12.5%), the highest since June. Costs increased in basic chemicals (+91.2%), refined petroleum products (28.9%), agriculture and fishery products (11.4%), metal products, machinery and equipment (8.6%) as well ores and minerals (4.1%).

- The Saudi investment minister disclosed that a new investment law was being prepared to address the needs of investors, with the target being attracting USD 3trn of investment into the country in the next 9 years. Saudi issued 478 new foreign investor licences in Q1 2021, the highest number since records began in 2005.

- Industrial production in Saudi Arabia increased to 10.3% in Nov, thanks to the improvement in mining and quarrying production (10.4%) while manufacturing grew by 9.7%.

- Saudi Arabia plans to auction up to 3 mining licenses in 2022, revealed the mining minister. Bidding process for the Khnaiguiyah mines (where zinc and copper deposits are estimated at around 26mn tonnes) is expected to start by end of Q1 or early Q2. The ministry also plans to introduce a system for auctions for new reserves of minerals as part of its new mining law.

- Saudi Arabia’s wealth fund plans to invest USD 10bn in e-commerce and renewables global stocks this year, reported Bloomberg. PIF plans to double its assets to reach USD 1trn by 2025.

- NEOM’s CEO disclosed at the Future Minerals Forum that the first phase of its green hydrogen project will be ready in 2025.

- The investment minister of Saudi Arabia revealed that 8,000km of railway will be built across country; currently, there is about 3,650 km of track on the Saudi rail network, on 3 lines. This will help jump-start its investment in the infrastructure sector as well.

- Saudi Arabian Mining Co (Ma’aden) is aiming for carbon neutrality by 2050, revealed the governor of the PIF (who is also the chairman of Ma’aden). The company is also planning to create a subsidiary for investments abroad.

UAE Focus![]()

- Non-oil PMI in Dubai increased to 55.3 in Dec (Nov: 54.5), the highest reading since Jun 2019, supported by new order volumes (at a 29-month high). Easing of travel restrictions in Dec, tourism demand and the Expo effect supported firms while inflationary pressures are ticking up. Outlook for future activity slipped: only 12% of respondents expect an expansion in output over 2022.

- UAE Cabinet approved executive regulations for labour relations, different types of work (flexible, freelance etc), and protecting industrial property rights alongside 13 agreements to encourage investment and avoid double taxation.

- The UAE Ministry of Economy disclosed that it received 2,428 patent applications last year, up from 1,917 requests in 2020. The UAE expects a 20% increase in the number of patent applications in 2022, supported by a new industrial property law.

- The UAE-UK free trade negotiations are nearing agreement, revealed a British MP during an interview with the Emirates News Agency. The UAE is the UK’s largest trading partner in the Gulf and its 25th largest trading partner globally.

- Abu Dhabi’s department of culture and tourism have set a fee cap of AED 1000 for tourism business licenses (90% lower than earlier overall costs) annually to support the sector.

- UAE Mohammed bin Rashid Al Maktoum Solar Park’s first project in its fifth phase increased its total capacity to 330 megawatts from 300MW given the use of latest photovoltaic technologies. The fifth phase with a total investment of AED 2.05bn (USD 559mn) is 60% complete, according to DEWA.

- Dubai welcomed 6.02mn visitors in Jan-Nov 2021, surpassing the 5.5mn overseas visitors in full year 2020, according to Dubai Economy and Tourism. It is still a far cry from the 16.7mn recorded pre-Covid. Average occupancy in the 743 hotel establishments in the emirate stood at 66% during the period Jan-Nov 2021.

- STR data shows that average daily rate for Dubai hotels stood at AED 956.01 in Dec 2021 (highest since Jan 2015), with prices on New Year’s Eve rising to a record high AED 1963.37.

- Value of property transactions in Dubai surged to a 12-year high of AED 151.07bn in 2021, up 110.19% from 2020 and 90.10% from 2019.

Media Review