Weekly Insights 13 Jan 2022: Dubai’s rosy December month amid Omicron fears and rising global food prices

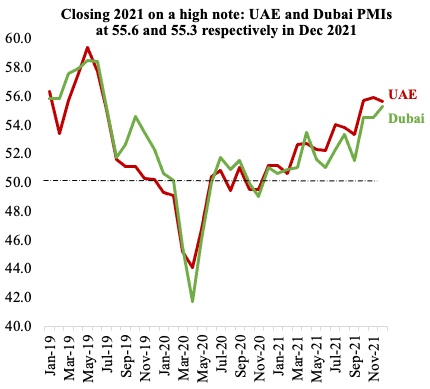

1. Dubai PMI signals an improvement in Dec, in line with high-frequency data

1. Dubai PMI signals an improvement in Dec, in line with high-frequency data

- Non-oil PMI in Dubai increased to 55.3 in Dec (Nov: 54.5), the highest reading since Jun 2019, supported by new order volumes

- Easing of travel restrictions in Dec, tourism demand and the Expo effect supported firms while inflationary pressures are ticking up

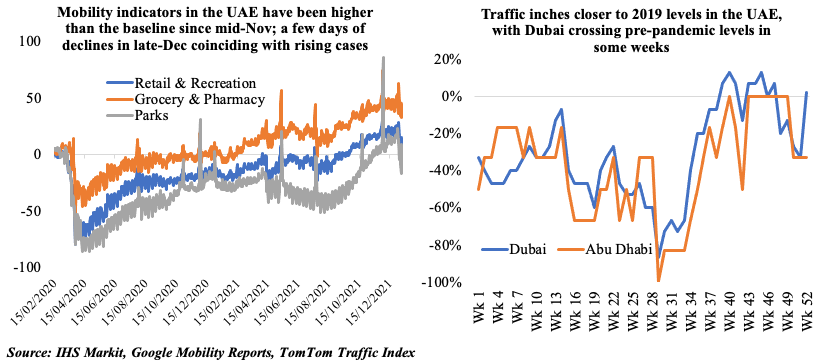

- While mobility & traffic data show a return to pre-pandemic activity levels, readings towards end-Dec showed a dip, in line with the rising number of Covid cases in the country

- The rise in new cases globally (& related restrictions) create more uncertainty for businesses: reflected in the latest Dubai survey, where only 12% of respondents were confident of output expansion over 2022

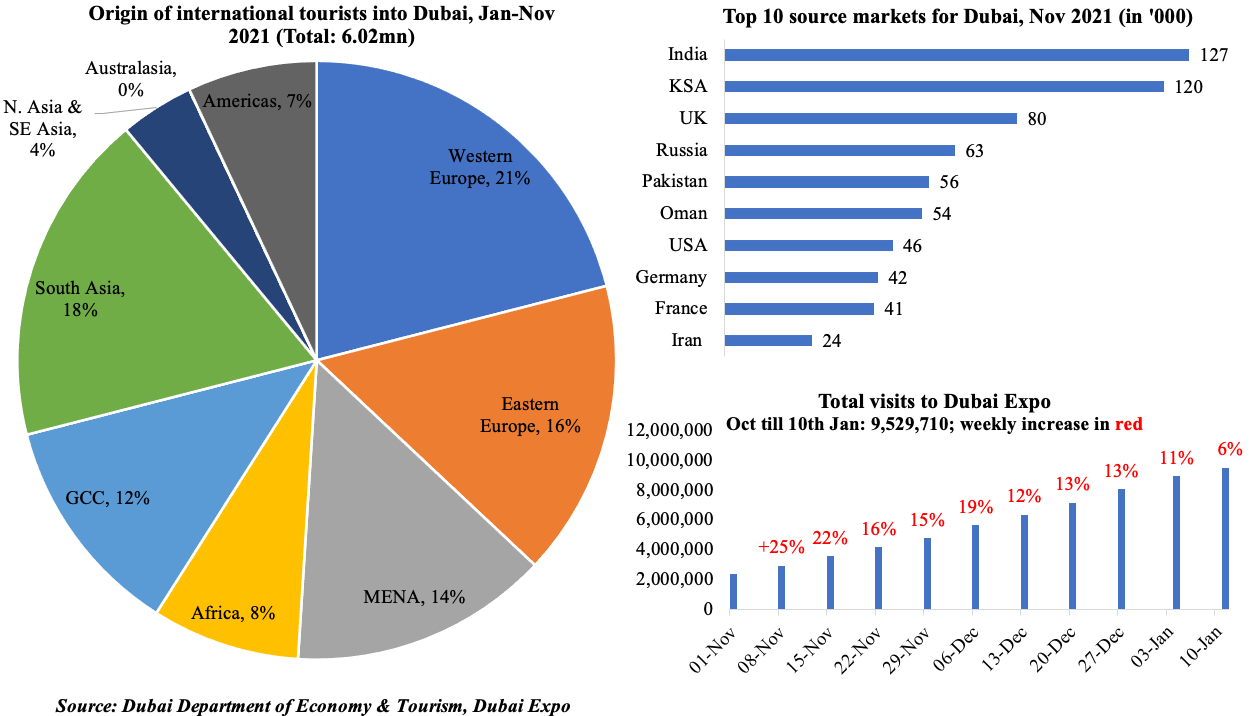

2. Dubai welcomes 6.02mn international tourists in Jan-Nov 2021; supports Expo footfall

- The latest Expo figures place total visits to the mega-event at more than 9.5mn in the period to Jan 10th (just over the halfway mark for the 6-month event). Nearly half the visits (47%) were users of Seasons Passes (allowing multiple entry for the duration of the event) and the number of repeat visits touched 3.5mn

- About 30% of these visits were from international visitors: top nations include India, Germany, France, UK, USA, Russia and Saudi Arabia, which are also among the top source markets for Dubai)

- Dubai welcomed a total of 6.02mn tourists into the emirate in Jan-Nov 2021, surpassing the 5.5mn overseas visitors in full year 2020; but still a far cry from the 16.7mn recorded pre-Covid

- With Dubai continuing to remain open for most tourists, Dec likely to see a further spike: Emirates Airline expected nearly 1mn travelers passing via Dubai during Dec 30th to Jan 10th; data from STR indicate that the average daily rate for Dubai hotels stood at AED 956.01 in Dec 2021 (highest since Jan 2015), with prices on New Year’s Eve rising to the highest ever AED 1963.37

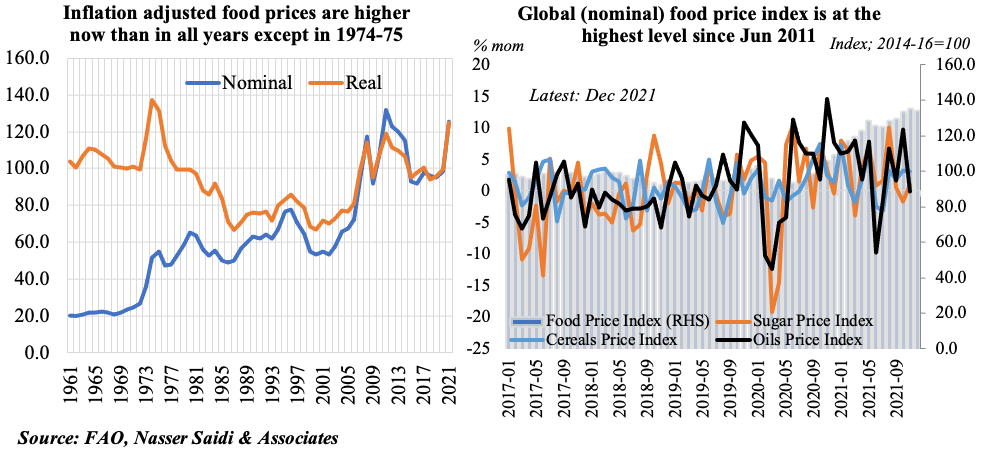

3. The FAO’s Food Price Index reached a 10-year high in 2021

- Food prices reached a 10-year high in 2021, according to the FAO. Interestingly, if we compare real vs. nominal food prices, the only time it was more expensive to buy food was in 1974-75

- Dec saw a slight 0.9% mom decline in FAO Food Price Index, but it was still 23.1% higher in yoy terms

- Rising fuel prices and shipping costs (due to supply chain disruptions and container ship shortages), strong demand amid tight supplies (given extreme weather changes) and labour shortages (during the harvest season) are some factors leading to the rise in prices

- Where food consumption shares are high and food is mostly imported (like in the GCC), high food pass-through tends to increase inflation pressures

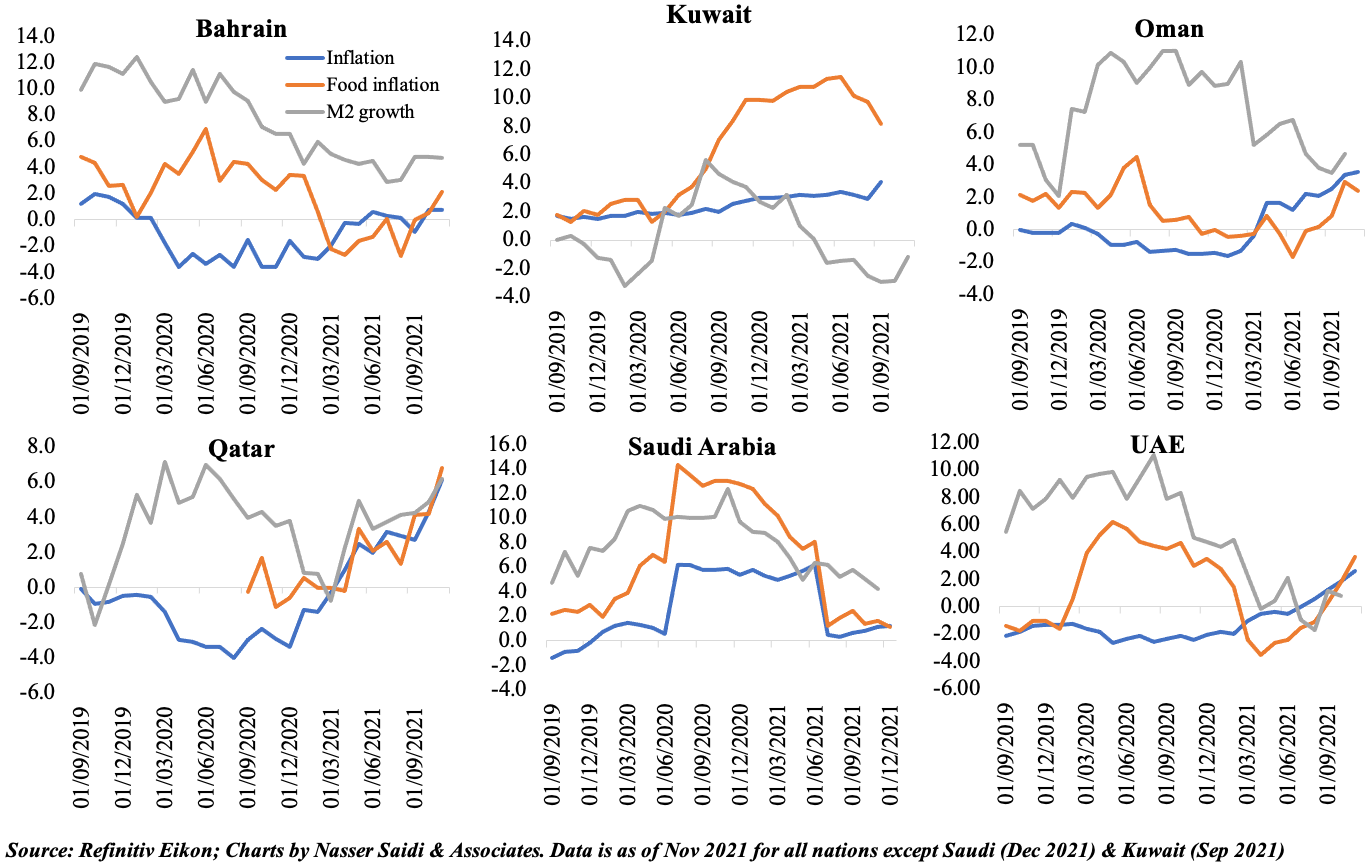

4. In line with the global trend, most GCC nations are witnessing (its mostly imported) food prices rising at a fast pace

(Saudi prices in yoy terms are much lower now given VAT hike from Jul 2020, but ticking up; Bahrain will see a surge from 2022 when VAT is hiked to 10%)

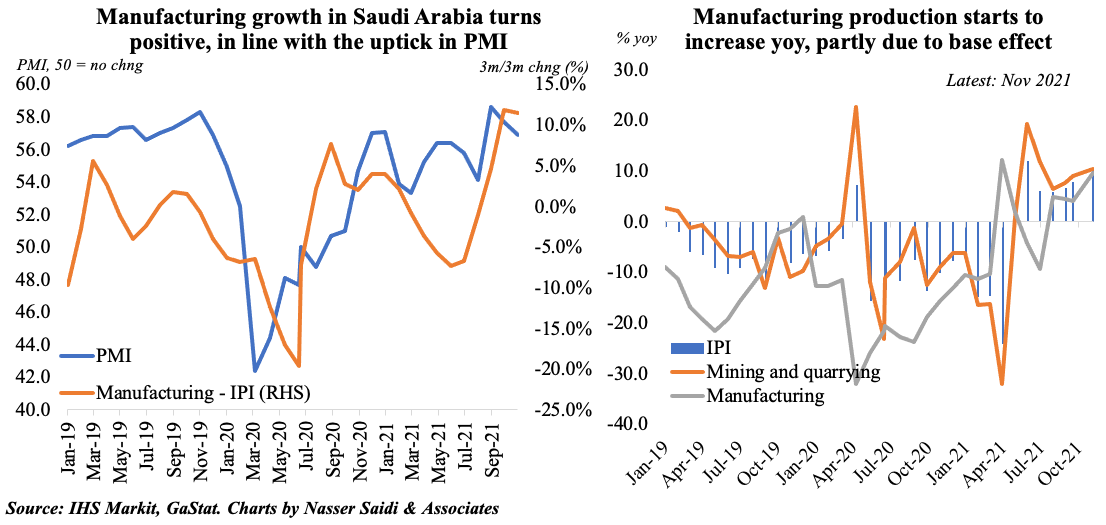

5. Saudi Arabia’s industrial production improves, thanks to an uptick in mining; wholesale prices surge

- Saudi non-oil sector PMI increased to an average of 55.8 in 2021 (2020: 50.2), in spite of falling 3 points to 53.9 in Dec 2021, as Omicron variant spread across the globe increasing uncertainty

- Overall industrial production (IP) increased by 10.3% in Nov: manufacturing grew by 9.7% and mining/ quarrying sector production improved (+10.4%).

- The charts below track three-month-on-three-month changes in the official IP data to remove some volatility. It shows that improvement in non-oil sector is happening faster than in manufacturing – pointing to the strength in recovery of the non-oil, non-manufacturing sectors

- Meanwhile, wholesale prices are rising (Dec: +13.2% yoy), thanks to other transportable goods (+23.4%) which includes basic chemicals (+91.2%) and refined petroleum products (28.9%) and agriculture products (11.4%)