Markets

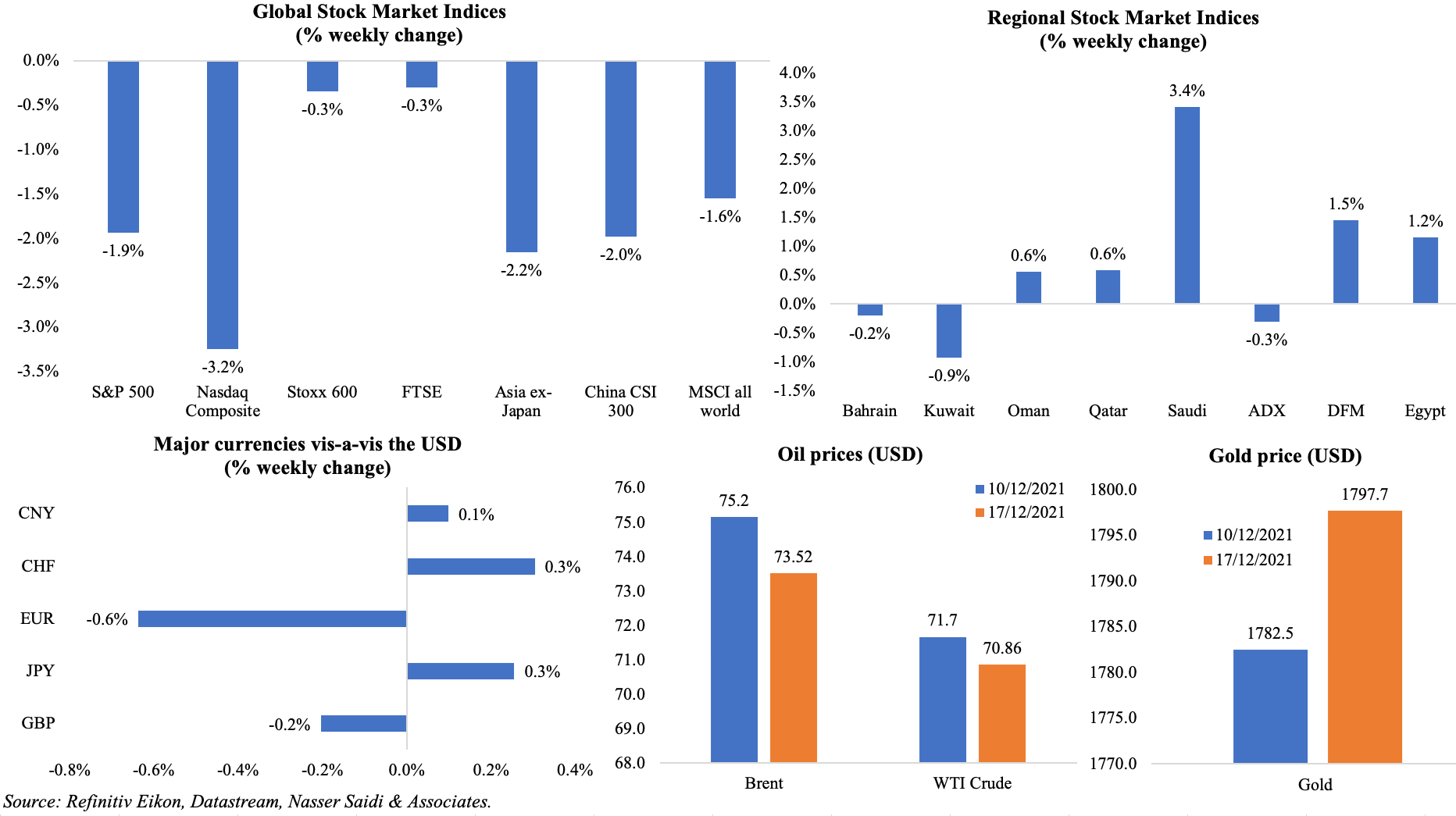

Global equity markets dropped as Omicron rapidly spread, raising questions about demand recovery, while major central banks turned up the hawkish mode. US equities posted a sharper decline than Europe/ UK and the MSCI world was down by 1.6% from a week ago. Regional markets closed on Thursday on a high note, with Saudi and Dubai markets gaining while Abu Dhabi posted its first weekly loss in 7 weeks. The dollar gained towards end of last week, while both the euro and GBP lost ground after booking gains earlier in the week. Oil prices fell on possibility of lower demand amid rising supply, while gold posted its first gain in 5 weeks.

Weekly % changes for last week (16 – 17 Dec) from 9 Dec (regional) and 10 Dec (international)

Global Developments

US/Americas:

- Fed announced plans to reduce its monthly bond purchases (to USD 60bn starting in Jan, with further reductions in 2022) and ending in March 2022; three rate hikes are likely in 2022 with two more in both 2023 and 2024.

- Producer price index in the US increased to 9.6% yoy in Nov (Oct: 8.8%), the fastest on record; excluding food and energy, PPI increased to 7.7% from 7% in Oct. The 0.8% mom gain in headline PPI was driven by services (+0.7% mom). Non-residential construction input prices increased by nearly 25% in the 12 months through Nov.

- Retail sales in the US ticked up by 0.3% mom in Nov (Oct: 1.8%) – the fourth consecutive month of gains. Results were mixed: receipts at auto dealerships dipped 0.1% (Oct: +1.7%) and sales at electronics and appliance stores fell 4.6% while sales at service stations grew by 1.7%, at restaurants and bars by 1% and at clothing stores by 0.5%.

- Housing starts in the US accelerated by 11.8% mom to an 8-month high of 1.679mn in Nov. Building permits inched up by 3.6% mom to 1.712mn in Nov.

- Philadelphia manufacturing survey slumped to 15.4 in Dec (Nov: 39), as new orders fell 33.7 points to 13.7 and the shipments index fell 16.8 points to 15.3.

- Industrial production in the US increased by 0.5% mom in Nov (Oct: 1.7%), the highest reading since Sep 2019. Manufacturing index climbed by 0.7% mom to the highest level since Jan 2019 (Oct: +1.4%) thanks to the increase in production of durables (0.8%), nondurables (0.5%), and other manufacturing such as logging and publishing (0.8%).

- Markit preliminary manufacturing PMI in the US slowed to a 12-month low of 57.8 in Dec (Nov: 58.3), alongside a severe deterioration in input delivery times. Services PMI slowed to 57.5 (Nov: 58) but recorded the steepest-ever increase in input prices.

- Initial jobless claims increased to 206k in the week ended Dec 10th, with the previous week’s total revised up to 188k. The 4-week average slowed to 203.75k, posting the lowest level since Nov 1969, and from 219.75k in the prior week. Continuing claims slowed to 1.845mn in the week ended Dec 3.

Europe:

- The ECB left its benchmark interest rates unchanged and at the press conference highlighted the “need to maintain flexibility and optionality in the conduct of monetary policy”. Bond-buying under the Pandemic Emergency Purchase Programme (due to end Mar 2022) will be cut next quarter, while bond buys under the Asset Purchase Programme will be ramped up

- Industrial production in the Eurozone rebounded by 1.1% mom in Oct, after two months of contraction, supported by gains in capital goods output (+3%) and durable consumer goods (+1.7%). In yoy terms, IP growth slowed to 3.3% from 5.1% the month before.

- Inflation in the eurozone was confirmed at a record 4.9% yoy in Nov, with more than half the increase due to the jump in energy prices.

- Wholesale price index in Germany jumped to a record 16.6% yoy in Nov (Oct: 15.2%), mainly due to cost of raw materials and intermediate products.

- Producer price index in Germany ticked up by 19.2% yoy in Nov (Oct: 18.4%), posting the biggest increase in producer costs since Nov 1951. The increase was across the board, ranging from energy costs (49.4%) to intermediate products (19.1%) to capital and non-durable consumer goods (3.6% and 3.7% respectively).

- The preliminary reading of the Markit Composite Output Index in the Eurozone fell to a 9-month low of 53.4 in Dec (Nov: 554.), given the sharp decline in services PMI (53.3 in Dec from 55.9 in Nov) due to the slowdown in tourism and recreation activity. Manufacturing PMI eased to 58 in Dec (Nov: 58.4), but there was evidence of an easing of supply constraints.

- Germany’s Markit manufacturing PMI inched up to 57.9 in Nov (Oct: 57.4), but new orders growth slowed to an 18-month low and as a result business optimism improved. With the current Covid19 wave, services PMI slowed to a 10-month low of 48.0 (Nov: 52.7), also resulting in the Composite Output index falling to an 18-month low of 50.

- German Ifo readings eased in Dec, with the current pandemic wave affecting sentiment: business climate index slowed to 94.7 in Dec (Nov: 96.6) while the current assessment and expectations stood at 96.9 and 92.6 respectively (Nov: 99 and 94.2). Services sector and trade saw business climate readings nosedive and assessment of the current situation worsening.

- The Bank of England raised interest rates to 0.25% from 0.1% at the latest meeting, with 8 members voting to hike, and the governor citing “evidence of a very tight labour market” and “more persistent inflationary pressures” as driving the decision. The QE programme will also end as planned at end-Dec.

- Inflation in the UK soared to a 10-year high of 5.1% in Nov (Oct: 4.2%); core CPI rose to 4% (Oct: 3.4%), recording the highest level since 1992 and twice the central bank’s target. Petrol prices surged and used car prices increased by 3.1% mom. PPI core output in the UK also increased in Nov, rising to 7.9% from Oct’s 7.1%. Retail price ticked up to 7.1% in Nov (Oct: 6%), the highest since Mar 1991.

- Markit manufacturing PMI in the UK eased to 57.6 in Dec (Nov: 58.1), with new orders from abroad falling for the fourth consecutive month and many respondents citing Brexit related trade difficulties. Services PMI fell to 53.2 (Nov: 58.5), and business optimism in the sector posted its lowest for 14 months.

- ILO unemployment rate in the UK inched down to 4.2% in the 3 months to Oct (Sep: 4.3%). The claimant count rate dropped to 4.9% in Nov (Oct: 5%) while vacancies hit a record 1.219mn in three months to Nov. Average earnings in the UK moderated: excluding bonus, wages were up by 4.3% in the 3 months to Oct from 5% the month before.

- Retail sales in the UK grew by 1.4% mom and 4.7% yoy in Nov, with clothing sales rising (+2.9%) to the highest level since the start of the pandemic. Overall, volumes were 7.2% higher compared to Feb 2020. Excluding fuel, sales rebounded by 2.7% yoy (Oct: -2.1%).

- Company insolvencies in the UK increased to 1674 in Nov, the highest level since Jan 2019, as companies bore the brunt of rising costs and supply chain constraints.

Asia Pacific:

- Industrial production in China increased by 3.8% yoy in Nov (Oct: 3.5%), thanks to a recovery in energy production. Retail sales grew by a slower-than-expected 3.9% in Nov (Oct: 4.9%): online sales rose by a slower 13.2% pace in Nov (Oct:6%).

- FDI into China increased by 15.9% yoy in Jan-Nov to CNY 1.04trn (Jan-Oct: 17.8%). Inflow into the services sector jumped by 17% while high-tech industries were up by 19.3%. Fixed asset investment in China increased by 5.2% in Jan-Nov, slowing from the 6.1% reported in Jan-Oct: investment eased in manufacturing (13.7% from 14.2% in Jan-Oct) and real estate (+6% from 7.2% in Jan-Oct).

- China’s urban unemployment rate ticked up to 5% in Nov (Oct: 4.9%), with jobless rate for youth (16–24 year-old) at a high 14.3%.

- The Bank of Japan announced a scaling back of its economic support while leaving interest rate unchanged. Support to SMEs will be maintained till Sep while the corporate bond and commercial paper purchases will be wound up by the Mar 2022 deadline.

- Japan Tankan large manufacturing index remained unchanged at 18 in Q4, though the outlook edged down to 13 (Q3: 14). Sentiment was down among manufacturers owing to production cuts, shortages of parts and the pandemic. Non-manufacturing index and outlook both jumped in Q4, to 9 and 8 respectively (from the previous quarter’s 2 and 3 readings).

- Industrial production in Japan fell by 4.1% yoy in Oct, easing from Sep’s 4.7% drop. In mom terms, IP rebounded by 1.8% (Sep: -5.4%) – the first increase since Jun – supported by motor vehicles (15.9% vs -28.1%) and production machinery (4.2% vs -3.3%) among others.

- Exports from Japan rose for the 9th consecutive month by 20.5% yoy in Nov (Oct: 9.4%), supported by an increase in shipment of cars (+4.1%). Imports surged by 43.8% (Oct: 26.7%) to JPY 8.32trn (the largest yen amount since Jan 1979) causing the deficit to widen to JPY 954.8bn (the biggest since Jan 2020).

- India’s wholesale price inflation increased to a record high of 14.23% in Nov (Oct: 12.54%), driven by by the increase in manufacturing (+11.9%) and food prices (+6.7%). Consumer price inflation stood at 4.9% in Nov (Oct: 4.48%), with food inflation rising to a 3-month high of 1.87% and housing costs rising to 3.66% (Oct: 3.54%).

Bottomline: As the year draws to a close, the pandemic seems far from over, with fresh restrictions and full lockdown announced in Netherlands till mid-Jan. Inflation has led major central banks to act – Norway raised rates for the second time this year while the BoE surprised markets with a hike, as the Fed and BoJ committed to reduce pandemic era asset purchase stimulus measures. The Fed’s monetary policy tightening will have spillover effects and capital outflows from emerging markets where raising rates to ease inflation will result in lower growth. Furthermore, China’s zero-Covid policy is likely to be hard to continue, and if it does could result in further strains on supply chains (resulting in greater inflationary pressure on producer prices). Will 2022 be different? Unless the vaccination pace improves drastically (especially in low-income nations) and the new variant is rapidly brought under control, the global economy could see brakes applied on growth at least in Q1 next year.

Regional Developments

- The Central Bank of Egypt kept its interest rates unchanged last week: the lending rate at 9.25% and deposit rate at 8.25% has been held steady since Nov 2020. Furthermore, the apex bank unveiled a new set of rules to support pandemic hit SMEs: includes increasing loan periods, restructuring outstanding installments, and grace periods for repayments.

- Egypt expects growth of 6-7% in Q2 of the current financial year (i.e. Oct-Dec 2021), according to the Planning Minister. Separately, it was disclosed that the country had invested EGP 130bn (USD 8.3bn) in infrastructure projects over the last 7 years.

- The CEO of Egypt’s Sovereign Fund disclosed that Egypt’s first green hydrogen plant will be operational by next Nov.

- Egypt’s Suez Canal revenues hit USD 571.3mn in Nov, the highest ever recorded in Nov, according to the head of the Suez Canal Authority. The Canal also recorded the largest monthly net tonnage in Nov, at5mn tonnes.

- The Minister of Trade and Industry disclosed that Egypt’s exports increased by 24.5% yoy to USD 25.9bn in Jan-Oct 2021 and that the contribution of industrial production to GDP touched 17% during the fiscal year 2019-2020.

- Egypt is “ready” to join the JP Morgan Government Bond Index-Emerging Markets by end of Jan 2022, reported CNBC Arabia, citing the finance minister. This will enable foreign investors and funds invest in Egypt’s local currency debt instruments. Also, given the green bond issuance last year, Egypt will also join the JP Morgan ESG Index.

- Negotiations with Iran have been suspended after the 7th round, with the US stating that the talks have “not [been] going well”. There is no clear indication when talks will resume.

- Iraq’s foreign currency reserves increased to USD 64bn from USD 48bn a year ago, with devaluation and higher oil prices supporting the rise in reserves. The central bank governor also revealed that preliminary talks were underway with the IMF for a possible loan.

- The Kuwait Oil Company awarded USD 2.1bn worth oil contracts during May-Oct 2021.

- Lebanon’s financial sector losses amount to an estimated USD 68-69bn, according to Lebanese officials; this was the same gross figure presented by the government last year when negotiations broke down. The IMF spokesman stated separately that “considerable progress” had been made in identifying losses.

- The Banque Du Liban stated that it would temporarily sell US dollars to commercial banks at the rate on its Sayrafa foreign exchange platform (around 22,300 last Thursday, compared to 26,000 on the parallel market); furthermore, depositors could use Lebanese pounds they had withdrawn to buy back dollars but at the Sayrafa rate, effectively a 70% haircut on their original dollar deposit but without any legal sanction.

- Oman’s budget 2022 estimates deficit to decline to 5% of GDP, aided by an increase in oil revenues. Of the deficit around OMR 1.1bn will be covered by external and domestic borrowings (rest to be drawn from reserves). Oil revenues account for about 68% of the estimated revenue of OMR 10.58bn next year (on the basis of oil price at USD 50 per barrel, up from the USD 45 forecast for this year) while spending is up by 11.2%.

- The Qatar Central Bank disclosed that it would gradually be reducing the support stimulus programmes given that the local financial and banking system was stable and domestic liquidity high.

- A GCC Statistical Centre report places GCC growth at a cumulative 3.1% yoy in 2021, rebounding from 2020’s 5.2% drop. The rise in oil output will contribute to higher growth rates, in addition to the non-oil economy which is estimated to grow at 3.4% this year. Inflation is estimated to rise to 2.1% in 2021 from 1.2% in 2020, driven by costs of imported raw materials and consumables. Furthermore, net foreign assets held by GCC central banks inched up by 0.2% to USD 655bn in H1 2021, with Saudi topping the list (USD 442bn).

- Saudi Arabia and the UAE ranked 12th and 14th respectively in AT Kearney’s Global Retail Development Index: retail sales in the two nations touched USD 119bn and USD 71bn respectively. The average spending on e-commerce per household in the UAE touched USD 2,554, twice the global average of USD 1,156 and four times the average in the region.

Saudi Arabia Focus

- Saudi Arabia reported a growth of 7% yoy in Q3, thanks to a 9.3% rise in oil sector activity while pace of non-oil activity eased (6.3% in Q3 vs 9% in Q2). Unsurprisingly, mining and quarrying activities account for close to half of overall economic activity, followed by manufacturing (12.2%) and financial services (11.8%). Net exports, household consumption and investment were main contributors to GDP growth in Q3.

- Saudi Arabia’s 2022 budget sees the country post a budget surplus (SAR 90bn) after 8 consecutive deficit years. Spending is estimated at SAR 955bn next year (-5.9% yoy) and spending cuts will continue into 2022 and 2023 before it increases slightly in 2024. Total revenues are projected at SAR 930bn this year while expenditures stand at SAR 1.02trn. Various diversification efforts have led to an estimated 18.2% yoy increase in non-oil revenues this year (excluding profits from government investments).

- Oil exports from Saudi Arabia increased to 8.26mn barrels per day (bpd) in Oct, the highest since Apr 2020 (Sep: 7.84mn bpd).

- Saudi Arabia’s holdings of US Treasuries fell by USD 8bn to USD 116.5bn, the lowest level in 4 years.

- Inflation in Saudi Arabia increased for the 3rd consecutive month in Nov, rising to 1.1% yoy, largely due to the higher transport costs (5.7%) and education costs (4.8%). Inflation is estimated at 3.3% in 2021 and will fall to 1.3% on average next year.

- Saudi Crown Prince launched the Jeddah Central Project: with an investment of SAR 75bn, about 5.7mn sqm of land will be financed by PIF and local and international investors. Developed in three phases, the first phase will be completed by end-2027, and overall this project will result in a total value added of SAR 47bn by 2030.

- Saudi PIF invested SAR 84bn (USD 22.4bn) locally in 2021 and will invest another SAR 150bn (USD 40bn) locally in 2022, according to the Crown Prince. Furthermore, the SWF’s governor revealed that PIF plans to invest up to SAR 1trn in the domestic economy by 2025.

- According to the finance minister, Saudi Arabia is estimated to grow by 7.4% next year given the rise in oil prices, and that GDP could reach SAR 3.62trn (~USD 1trn) up from SAR 3.2trn this year. Separately, the minister stated that VAT will be reviewed once the government’s financial position improves. He also revealed that the budget does not expect to receive dividends from PIF in the near future and that it will not be receiving additional fund transfers from the central bank.

- Saudi Arabia’s investment minister revealed that the nation plans to attract SAR 1.8trn in foreign investment over the next 9 years. He also reiterated that 44 international companies have received permission to establish regional HQs in Riyadh.

- Saudi Arabia’s energy minister of disclosed that SAR 380bn (USD 101bn) will be invested in renewable energy projects through 2030, and a further SAR 142bn in energy distribution.

- The minister of tourism revealed that SAR 500mn would be spent towards training citizens in the tourism industry with an aim to have 1 in 10 Saudi jobs in tourism by end-2022.

- The minister of sport stated that Saudi had received revenues of SAR 1.8bn (USD 480mn) in from the Saudi major football league over 2020-2021.

UAE Focus![]()

- The UAE will extend its Targeted Economic support Scheme through Jun 2022 to support economic recovery. This includes measures related to banks’ capital buffers, liquidity and stable funding requirements. The Tess programme to support new lending and financing will continue until June 30, 2022.

- Dubai PMI remained unchanged at 54.5 in Nov, but the rate of sales growth was at a 28-month high thanks to the travel and tourism sector. The construction sector however was dragged down by weak demand and supply side constraints. Employment levels dropped slightly for the first time since May.

- Dubai is setting up a dedicated court to handle commercial disputes in the digital economy focusing on dispute resolution in “complex technical fields”.

- The latest Expo figures place total visits to the mega-event at more than 6.3mn. This includes regular visits from schools in UAE as well as multiple visits from a single person.

- Bilateral trade between UAE and Russia is estimated to reach USD 4bn in 2021; this compares to USD 3.3bn recorded in 2020.

Media Review

FT’s biggest market moments of 2021

https://www.ft.com/content/55ea538a-e792-45a4-82a1-bf02e382e719

2021’s biggest stories were covid-19 and America’s presidential transition

Stuck in the middle? UAE walks tightrope between U.S, Israel and Iran

https://www.reuters.com/world/stuck-middle-uae-walks-tightrope-between-us-israel-iran-2021-12-12/

Economic Prospects and Policy Challenges for the GCC Countries – 2021

IMF: Global debt reaches a record USD 226trn in 2020

https://blogs.imf.org/2021/12/15/global-debt-reaches-a-record-226-trillion/

https://blogs.imf.org/wp-content/uploads/2021/12/eng-global-debt-blog-dec-8-chart-110-1024×953.jpg