Weekly Insights 16 Dec 2021: Strong Prospects for GCC Growth & Fiscal performance

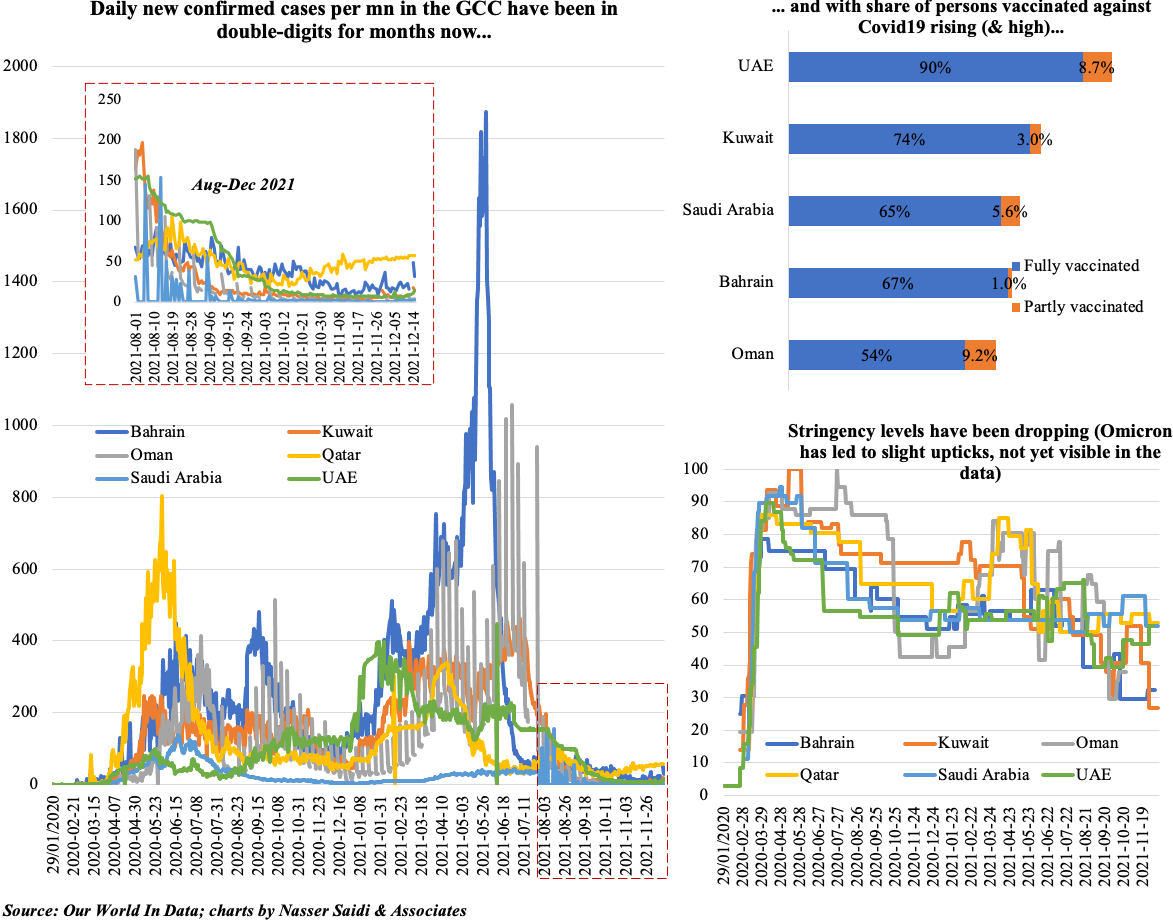

1. Supportive of recovery, Covid19 cases on the decline in the GCC; vaccination pace is strong & stringency levels are down.

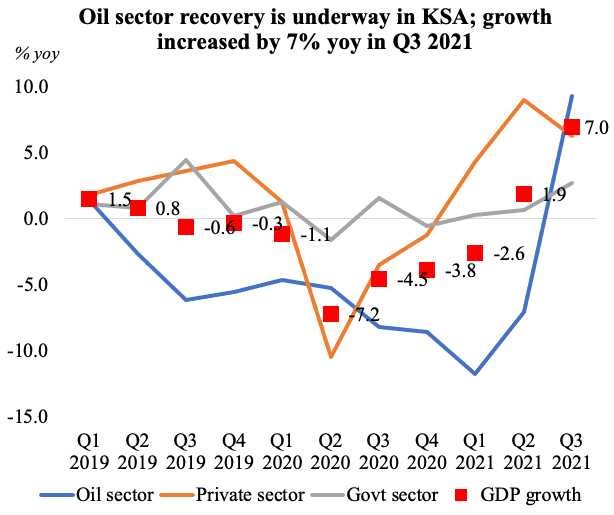

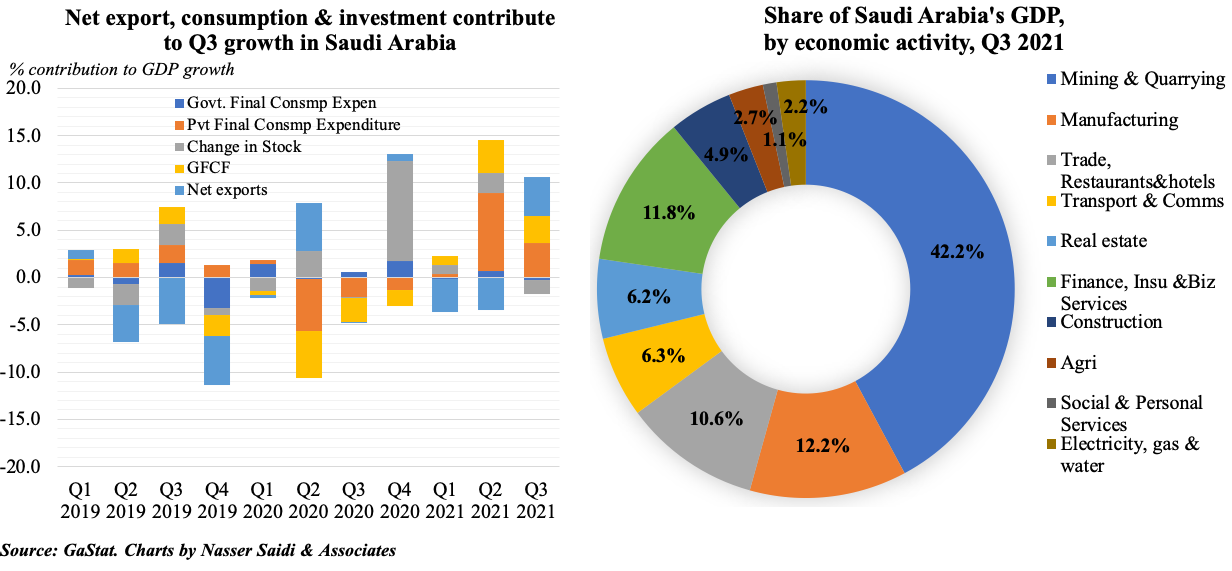

2. Oil price hike & rising production levels support growth recovery in Saudi

- Saudi Arabia reported a growth of 7% yoy in Q3, thanks to a 9.3% rise in oil sector activity while pace of non-oil activity eased (6.3% in Q3 vs 9% in Q2)

- Unsurprisingly, mining and quarrying activities account for close to half of overall economic activity, followed by manufacturing (12.2%) and financial services (11.8%)

- Net exports, household consumption and investment were the main contributors to GDP growth in Q3

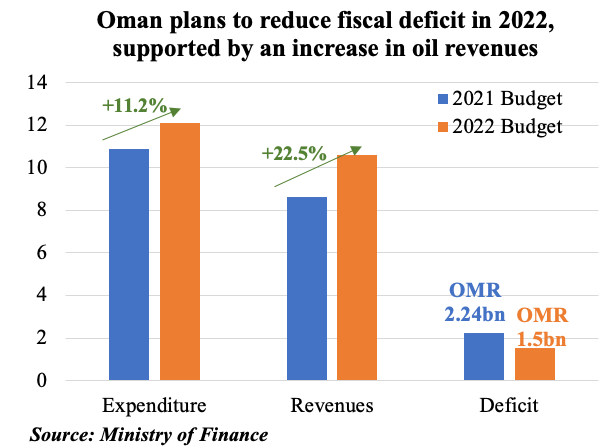

3. Saudi, Oman 2022 fiscal performance will be supported by an increase in oil revenues

- Oman’s budget 2022 estimates deficit to decline to 5% of GDP, aided by an increase in oil revenues. Of the deficit around OMR 1.1bn will be covered by external and domestic borrowings (rest to be drawn from reserves)

- Oil revenues account for about 68% of the estimated revenue of OMR 10.58bn next year (on the basis of oil price at USD 50 per barrel, up from the USD 45 forecast for this year) while spending is up by 11.2%

- Recent fiscal reforms will enable Oman reduce its public debt to 75% of GDP in 2022 (below previous estimate of 86%)

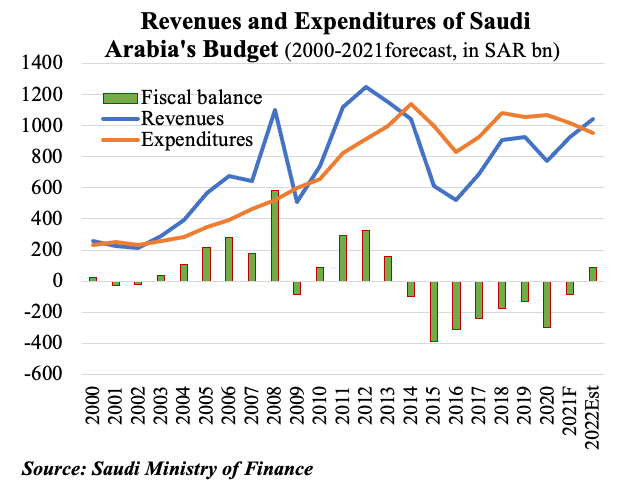

- Saudi Arabia’s 2022 budget sees the country post a budget surplus (SAR 90bn) after 8 consecutive deficit years

- Spending is estimated at SAR 955bn next year (-5.9% yoy); spending cuts will continue into 2022 and 2023 before it increases slightly in 2024

- Debt levels are expected to shrink to 25.4% by 2024

- Total revenues are projected at SAR 930bn this year while expenditures stand at SAR 1.02trn; various diversification efforts have led to an estimated 18.2% yoy increase in non-oil revenues this year (excluding profits from government investments)

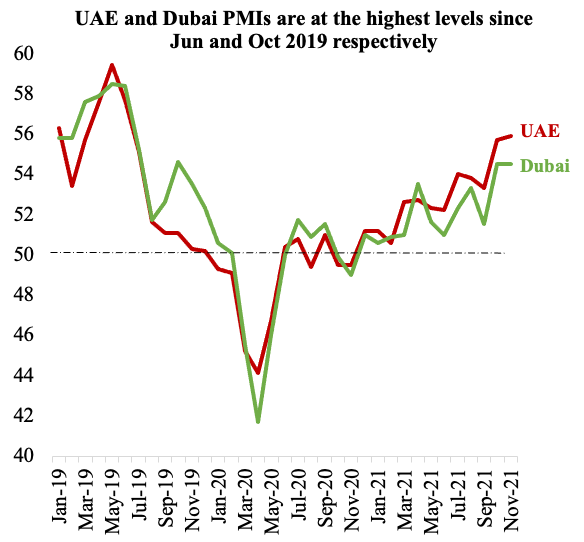

4. Forward looking indicators bode well for UAE growth

- Non-oil PMI in Dubai and UAE have signalled an increase in business activity: Nov saw the highest PMI readings since Oct & Jun 2019

- Expo visits, high vaccination rates and limited restrictions have definitely supported consumer & business sentiment

- But, there have been concerns: struggling construction industry (with supply side constraints), firms continuing to offer discounts to gain new customers (and not passing on the costs), jobs not growing in tandem with activity (esp in Dubai); future outlook expectations more subdued in Dubai (potentially concerns about post-Expo period)

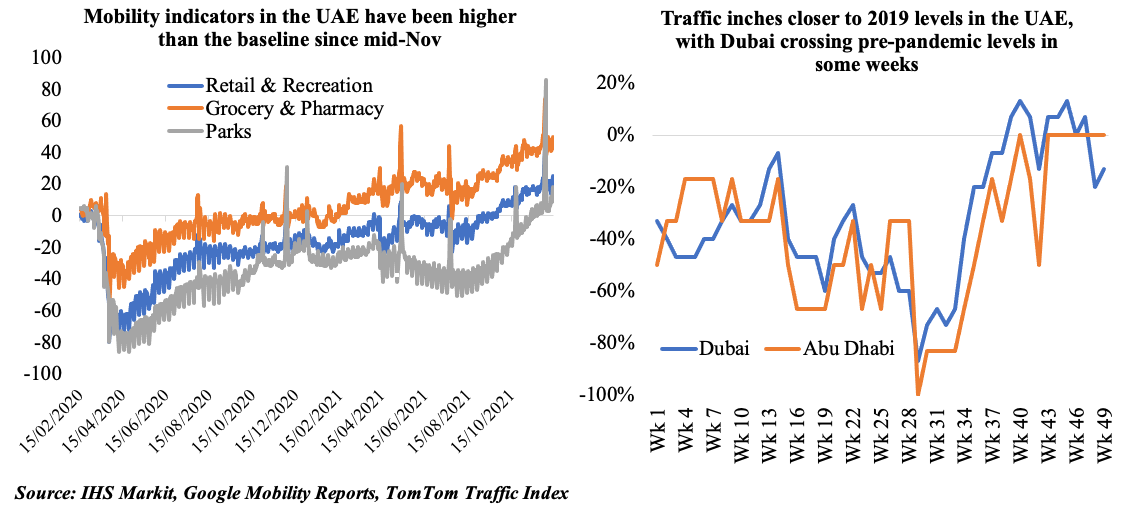

- Mobility & traffic data show a return to pre-pandemic activity levels (more so in Dubai than in Abu Dhabi)

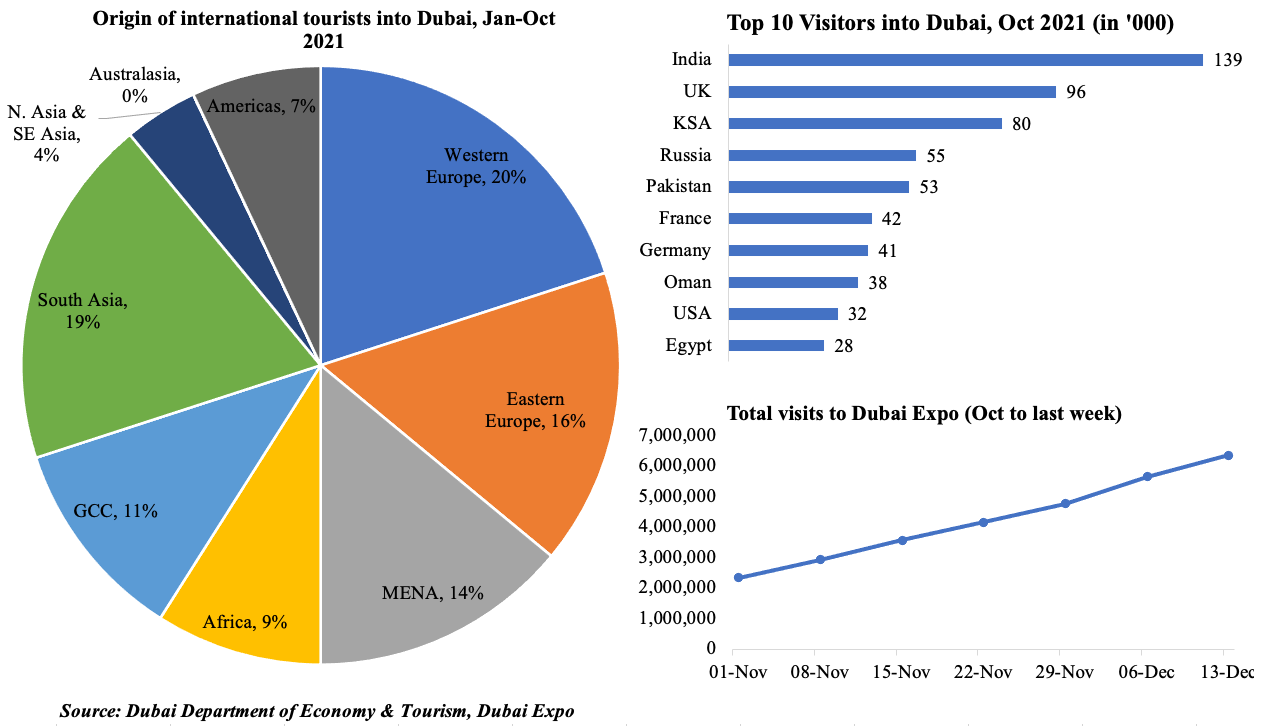

5. Dubai Expo has been a crowd-puller so far

- Disclosed every Monday, the latest Expo figures place total visits to the mega-event at more than 6.3mn. A few caveats: this includes regular visits from schools in the country as well as multiple visits from a single person

- The Expo hosted a total of 10,461 events in Oct-Nov. During this time, 28% of visitors were from outside the UAE. The top international visitor nations included India, France, Germany, Saudi Arabia, and the UK – reflective of the visitors into Dubai (data is available till Oct 2021)

- Being open to tourists still while many other nations have restricted entry, Dubai is likely to attract more visitors during the winter break: will likely be reflected in the Expo figures (given lineup of events at the venue, ticket promotions, offers etc).