Markets

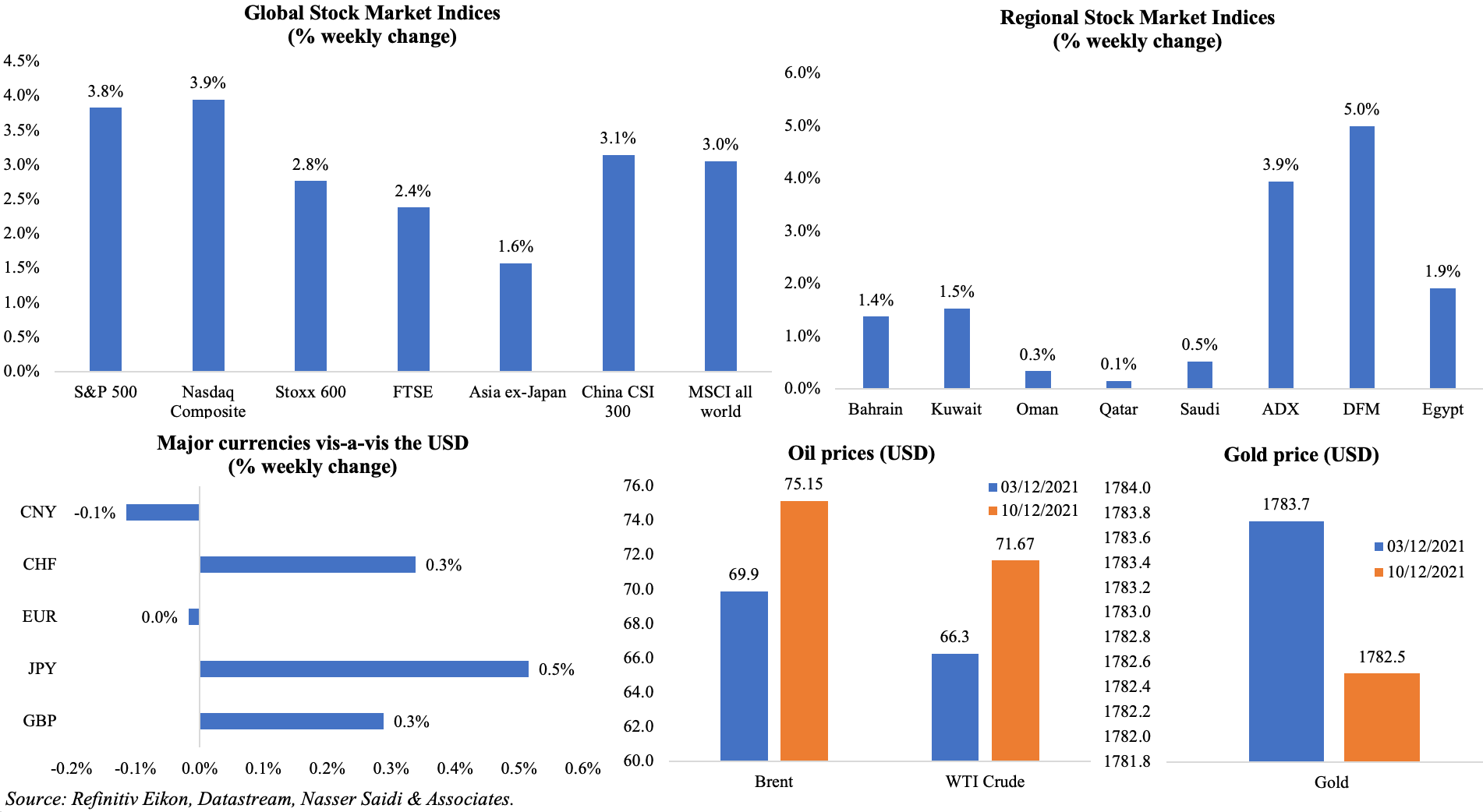

Equity markets are back up: S&P and the MSCI all country index posted their strongest weekly gain since Feb. Europe’s Stoxx was down by 0.3% on Friday on concerns about restrictions following the spread of the Omicron variant (not surprising given the 50k+ new daily cases in France, Germany and the UK), but the index still posted a weekly gain of 2.8%. Regional markets were mostly up with the UAE markets gaining the most given announcements of change in weekend to Sat-Sun as well as the recent IPO push. The yuan slipped off a 3.5-year high vis-à-vis the dollar after PBoC’s efforts to slow its rapid appreciation. Oil prices posted the biggest gain since late Aug as the Omicron variant concerns eased. Gold prices were down by 0.1%.

Weekly % changes for last week (9 – 10 Dec) from 2 Dec (regional) and 3 Dec (international)

Global Developments

US/Americas:

- Inflation in the US increased to a 39-year high of 6.8% yoy in Nov (Oct: 6.2%). The energy index rose 3.5% mom (down from Oct’s 4.8% mom), while the gasoline index jumped 6.1%. Core inflation inched up by 0.5% in Nov (Oct: 0.6%).

- US nonfarm productivity declined by 5.2% in Q3 (Q2: -5%), falling at the fastest pace in more than 60 years. During the quarter, output increased 1.8% while hours worked rose 7.4%; unit labour costs increased to 9.6% vs Q2’s 8.3%.

- US goods and trade deficit narrowed to a 6-month low of USD 67.1bn in Oct (Sep: USD 81.4bn), thanks to a strong rebound in exports (+8.1% to USD 223.6bn). Good trade deficit however widened to USD 83.2bn (Sep: USD 82.9bn).

- JOLTS job openings accelerated to 11.033mn in Oct (Sep: 10.438mn). There were 67 unemployed workers per 100 job openings in Oct 2021, tighter than the roughly 82 unemployed workers per 100 job openings in Feb 2020.

- Initial jobless claims increased to 184k in the week ended Dec 3rd: the previous week’s total was revised up to 227k and the 4-week average slowed to 218.75k from 240k prior. Continuing claims inched up by 38k to 1.992mn in the week ended Nov 26.

Europe:

- The third estimate for Q3 GDP in the euro area grew by 2.2% qoq in Q3 (Q2: 2.2%), supported by household consumption (+4.1% vs Q2’s 3.9%) while gross fixed capital formation fell (-0.9% vs 1.3%). In yoy terms, growth expanded by 3.9%, higher than the preliminary estimates of 3.7% but slower than Q2’s 14.4% record growth.

- The ZEW economic sentiment for Germany slipped to 29.9 in Dec (Nov: 31.7). The current situation also deteriorated, falling to -7.4 in Dec (Nov: 12.5), with “persisting supply bottlenecks weighing on production and retail trade” – this is the first time since Jun 2021 that the reading fell to negative territory.

- The ZEW economic sentiment indicator for the Eurozone increased slightly by 0.9 points to 26.8 in Dec. The current situation indicator however fell to a new level of -3 points, down by 13.9 points vs Nov.

- Exports from Germany rebounded by 4.1% mom in Oct (Sep: -0.7%), while imports grew by 5% (Sep: 0.4%). In yoy terms, exports grew by 8.1% and imports surged by 17.3% (about 13.5% higher than in Feb 2020). Exports to EU countries were up 11.6%, while exports to countries outside the bloc climbed by 4.1%. Trade surplus narrowed to EUR 12.5bn from EUR 12.9bn the month ago.

- Industrial production in Germany rebounded by 2.8% mom in Oct (Sep: -1.1%), with production of capital goods up by 2% and motor vehicles, trailers and semi-trailers rising by 12.6%. Compared to Feb 2020, IP was 6.5% lower.

- German factory orders plunged by 6.9% mom in Oct (Sep: +1.8%). Foreign demand slumped by 13.1% given a 3.2% decline in orders from the euro area and a 18.1% decrease in orders from other countries.

- Sentix investor confidence in the eurozone declined to 13.5 in Dec (Nov: 18.3), the lowest reading since Apr 2021. Lockdowns in Germany and Austria affected assessment of current conditions.

- UK GDP increased by 0.1% mom in Oct (prev: 0.6%), with activity in the food and beverage sector down by 7.5% while construction slumped by 1.8% – this was the first month after the end of the government’s furlough scheme. GDP at end-Oct is only 0.5% below the pre-crisis peak.

- UK industrial production fell for a second consecutive month in Oct, down by 0.6% mom, faster than Sep’s 0.4% drop. Manufacturing production meanwhile stayed flat in Oct while overall output stood 2.1% below pre-pandemic levels.

Asia Pacific:

- An active People’s Bank of China last week not only raised banks’ FX reserve requirements to 9% from 7% (second time this year, previously in June), but also cut the reserve requirement ratio in local currency deposits for banks by 50 bps (releasing CNY 1.2trn worth long-term liquidity). It also cut the rates on its relending facility by 25 bps to support the rural sector and small firms.

- Inflation in China increased to 2.3% in Nov (Oct: 1.5%) – the highest since Aug 2020 – with food prices up by 1.6% (Oct: -2.4%) and non-food prices up by 2.5% (Oct: 2.4%). Producer price index was up by 12.9% in Nov, cooling slightly from Oct’s 26-year high of 13.5%. Prices are still high, coal mining and washing prices surged by 88.8% yoy and oil and gas extraction was up 68.5%.

- China’s exports grew by 22% yoy in Nov, slower than Oct’s 27.1% rise while imports increased by 31.7% (Oct: 19.8%), narrowing the trade surplus to USD 71.72bn. Coal imports in Nov hit its highest level in 2021, while copper imports were the highest since Mar.

- New loans in China increased to CNY 1270bn in Nov (Oct: CNY 826.2bn) – the weakest reading for Nov since 2018. Money supply increased by 8.5% in Nov (Oct: 8.7%) while growth of outstanding total social financing ticked up to 10.1% in Nov (Oct: 10%). Foreign exchange reserves in China increased to USD 3.222trn in Nov (Oct: USD 3.218trn).

- GDP in Japan dropped by 0.9% qoq in Q3, faster than initial estimates of 0.8% drop, as private consumption shrank by a faster 1.3% (vs previous estimate of a 1.1% decline) as did public investment (-2% vs initial estimate of -1.5%). In annualized terms, GDP fell by 3.6% (vs initial estimate of a 3% drop).

- Japan’s leading economic index increased to 102.1 in Oct (Sep: 100.2) while the coincident index increased for the first time in 4 months, rising to 89.9 (+1.2 points from Sep).

- Japan’s overall household spending slipped by 0.6% yoy in Oct, though the pace of fall decline compared to Sep (-1.9%). Spending on overnight stays and eating out continued to decline in yoy terms, while on transportation rose.

- Producer price index in Japan inched up to a 36-year high of 9% yoy in Nov, driven by rising prices for gasoline, electricity and natural gas; PPI rose by 0.6% mom (Oct: 1.4% mom).

- India’s central bank left the repo rate unchanged at 4%, while agreeing to continue with an accommodative stance “till [growth] takes root and becomes self-sustaining”.

- Industrial production in India increased by 3.2% yoy in Oct (Sep: 3.1%). Manufacturing output increased by 2% (Sep: 2.7%) while the mining output surged by 11.4%. Factory output expanded by 20% in Apr-Oct versus a contraction of 17.3% in the same period a year ago.

Bottomline: Soon after the multi-year high inflation numbers come the back-to back central bank meetings – the Fed will start off followed by the Bank of England and the ECB, with Bank of Japan meeting on Friday. While the Fed is likely to be more hawkish, and the ECB on course to end the PEPP, rate hike decisions at the BoE and BoJ might be delayed to better understand the impact of the Omicron variant (travel curbs and other restrictions across Europe might dent demand into the holiday season, with the UK’s latest GDP numbers already show a sharp slowing down). Supply chain problems and rising costs are likely to continue into the New Year, especially if China continues to follow a zero-Covid policy. Any further lockdowns/ restrictions in China will affect production and spillover into the rest of the world leading to slowdowns – the only difference is that countries have learned to adapt.

Regional Developments

- Bahrain’s parliament approved a VAT hike to 10%, expected to start Jan 2022. This move is expected to support the nation achieve a balanced budget by 2024 and is estimated to add BHD 288mn in additional revenues. MPs also approved increasing social welfare and support allowances by 10% from Jan 2022.

- Al Arabiya TV, citing the head of Bahrain’s stock exchange, reported that Bahrain Bourse plans to list in 2022 and also plans to reduce government ownership in publicly traded firms. Separately, the chief executive also stated that five new companies will be listed on the exchange (without providing any further details).

- Saudi Arabia plans investments of USD 5bn in development projects in Bahrain via its funds and entities, according to the Bahrain state news agency.

- Egypt’s businesses reported inflationary pressures and supply shortages as PMI stayed under 50 for the 12th consecutive month. PMI stood unchanged at 48.7 in Nov, with new orders falling at the fastest pace in 6 months while employment declined, and output prices rose to the second quickest in over 3 years.

- Inflation in Egypt declined to 6.2% in Nov (Oct: 7.3%), thanks to a decline in costs of food and beverages (9.3% vs 13.7% in Oct). Clothes and footwear prices were up by 2.2% (Oct: 1.9%), as well as transportation (4.3% from Oct’s 4%), educations (13.9%) and entertainment costs (11.6%).

- Net foreign reserves in Egypt increased to USD 40.909bn in Nov (Oct: USD 40.849bn).

- Egypt’s business sector debts plunged by 77% to EGP 10bn from EGP 44bn three years ago. The 2018 debt value included electricity and petroleum costs as well.

- Egypt is planning to list subsidiaries of the National Services Products Organization (part of the armed forces) Safi (which supplies bottled mineral water) and Wataniya (supplies and distributes petroleum products) after completing their legal restructuring process, revealed the CEO of the sovereign fund.

- During the Kuwait leg of the Saudi Crown Prince’s Gulf visit, the two nations agreed to joint efforts to increase oil production at Khafji and Wafra in the partitioned zone along the border.

- PMI in Lebanon deteriorated further to a 9-month low of 46.1 in Nov (Oct: 46.6), with steep drops in new export orders, new businesses and employment levels.

- Lebanon’s central bank set a new rate for withdrawals from frozen dollar deposits: it was raised to LBP 8000 to the USD (a haircut of around 70%) from LBP 3900 set previously. Furthermore, a withdrawal ceiling was set of USD 3000 per month equivalent in LBP for account holders. This is likely to lead to accelerated depreciation of the LBP and inflation.

- Morocco is expected to grow by 6.3% yoy in 2021, according to the latest estimates from the IMF, supported by the growth of exports, high agricultural output, buoyant remittances and fiscal stimulus measures.

- Oman and Saudi firms signed 13 MoUs worth USD 30bn during the Saudi Crown Prince’s visit to Oman: this covers energy, renewable energy, pharmaceutical sectors and investments in Oman’s Duqm area. The two nations also opened the first direct land crossing (the 725km Omani-Saudi road) which will support movement of persons and trade.

- Qatar approved its 2022 budget: with spending estimated at QAR 204.3bn (USD 56.13bn) and revenues estimated at QAR 196bn (at an average oil price of USD 55 per barrel vs USD 40 in 2021), the country will run a deficit of QAR 8.3bn.

Saudi Arabia Focus

- Saudi Arabia’s PMI dropped to 56.9 in Nov (Oct: 57.7), due to a slowdown in new orders (for the second consecutive month) though output was supported by strong domestic demand. Prices rose as a result of higher raw material costs as well as shipping and fuel prices.

- Tadawul’s chief executive disclosed that the exchange had received 50 applications for IPOs next year and is also considering whether to allow Special Purpose Acquisition Companies (SPACs) to list (no legal framework has been proposed).

- Saudi PIF raised SAR 12bn (USD 3.2bn) through the sale of a 6% stake in the Saudi Telecom Comapny (STC); the final price for the sale was set at 120mn shares at SAR 100 per share.

- The Saudi Tadawul Group opened almost 10% above the listing price in its debut last week (SAR 115.4). The firm’s CEO disclosed that the Group is planning to allocate 70% of its profits as dividends.

- Industrial production in Saudi Arabia grew by 7.7% yoy in Oct, to its highest level since Apr 2020. It showed mining and quarrying growing by 9% yoy, rising for the 6th straight month, dominating the increase in IP.

- Saudi Arabia’s new transport and logistics strategy is expected to generate SAR 550bn in investments by 2030. The government would provide 35% of the investments required.

- Aramco raised the official selling prices for all crude grades sold to Asia for a second consecutive month in Jan.

- Saudi Aramco signed five agreements with French companies, including in the areas of the areas of carbon capture technology, artificial intelligence and local manufacturing as well as an agreement with Gaussin – the latter with an aim to establish a modern manufacturing facility for a hydrogen-powered vehicles.

- Hotel occupancy in Jeddah ticked up during the days of the F1 race, according to STR. Average daily rates jumped to SAR 17077.72 (USD 455.39) on Dec 4th (a day before the race), up from SAR 612.25 the previous week. Occupancy peaked at 89.2% on the day of the race – the highest since Aug 2018.

- The Saudi Citizen Account Programme distributed more than SAR 109bn to about 10.5mn families since it was launched in Dec 2017. The latest deposit amounted to about SAR 1.9mn, according to a press release last Thursday.

UAE Focus![]()

- UAE PMI grew for the 12th straight month, rising to 55.9 in Nov (Oct: 55.7) – the highest reading since Jun 2019. Output (61.6 in Nov, from Oct’s 61.1) and new businesses supported the headline reading, while the employment sub-index was almost flat and sentiment for future output fell.

- The UAE announced a new weekend, with federal government employees working from Mon to half day Friday beginning Jan 2022. Private companies will be allowed to choose their working week. Schools will move in line with the public sector mandate, finishing early on Fridays. Later, Sharjah government announced a 4-day working week for its government employees, with Fri-Sun weekend.

- The Dubai Financial Market will operate its trading hours from Mon-Fri effective Jan 3rd.

- Dubai plans to list Emirates Central Cooling Systems Corporation (Empower) on DFM, according to the media office. Empower is a joint venture between Dubai Electricity and Water Authority and Tecom Investments.

- UAE will allow companies to be created for acquisition or merger purposes, according to the Ministry of Economy. This will be part of amendments to the Commercial Companies Law, which will allow branches of licensed foreign companies to transform into UAE commercial firms and also eliminate nationality requirements for companies’ boards.

- The UAE’s senior national security adviser visited Iran in a move to improving ties between the two nations. UAE is a long-standing trade route for sanctions-hit Iran.

- UAE will implement the In-Country Value programme across all federal entities and 12 national companies by end-2021. The programme encourages local manufacturers to diversify and aims to increase internal demand for local products and services: under the programme 42% of government spending will be redirected to UAE based companies by 2025.

- Visitors to the Expo increased to 5.6mn according to the latest update on Dec 6th. Free entry on National Day and half-price weekday tickets seems to have resulted in an increased footfall. In Nov, 28% of visits were from abroad while six out of 10 visitors have an Expo season pass and the number of repeat visits reached 1.2 million.

- Dubai welcomed 4.88 million overnight visitors in Jan-Oct 2021 (Jan-Sep 2021: 3.85mn). The hospitality sector sold 9.4mn room nights in Jan-Oct, up from 7mn rooms in Jan-Oct 2019.

- UAE’s Etihad Rail will expand to include passenger train services: travel between Abu Dhabi and Dubai will take 50 minutes and from Abu Dhabi to Fujairah 100 minutes. Though no start date was given for the service, it was disclosed that number of passengers would reach more than 36.5mn annually by 2030.

Media Review

The Omicron variant: surging cases but milder symptoms

Green Growth at the End of the Flat World

Macron announces Saudi-French initiative to solve crisis with Lebanon

Digital euro, Swiss franc trials were successful, say central banks

https://www.bis.org/publ/othp44.htm