Markets

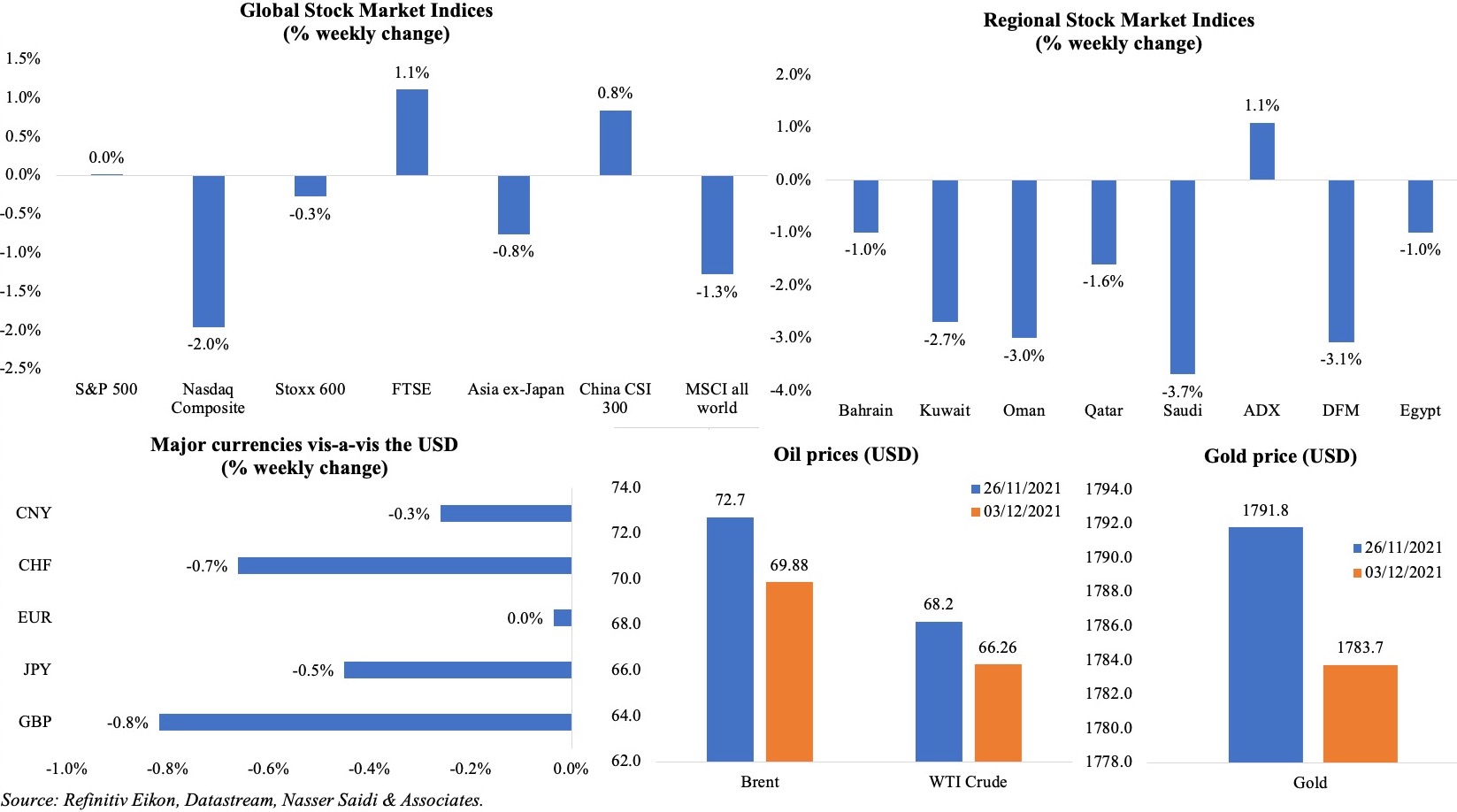

Equity markets were very volatile last week, with worries about the Omicron variant alongside Fed’s recent hawkish turn (Powell surprised markets by stating it was a good time to retire the word transitory and that “the risks of higher inflation have moved up”); markets have wiped off USD 5.4trn off global equity valuations from the Nov peak (https://on.ft.com/3dq9osI). Tech heavy Nasdaq closed lower after the disappointing US jobs report, while the China-US tensions (and tech regulation) came into the limelight again with Didi planning to delist from New York and list in Hong Kong instead. Europe’s Stoxx600 was down by 0.3% and the MSCI all world index fell by 1.3%. Among regional markets, most markets ended in the red; Saudi Tadawul slumped by 4.5% on Sunday posting the biggest single day fall in nearly two years. Safe-haven currencies – Japanese yen and Swiss franc– gained towards the end of the week. Oil prices fell for the 6th straight week on worries of fall in global oil demand if the Omicron variant spreads.

Weekly % changes for last week (4 – 5 Dec) from 25 Nov (regional) and 26 Nov (international)

Global Developments

US/Americas:

- US non-farm payrolls disappointed, with a gain of just 210k in Nov, following a 546k gain in Oct. Unemployment rate declined sharply to 4.2% in Nov, from 4.6% in Oct, even as labour force participation rate increased to 61.8% (Oct: 61.6%) – the highest level since Mar 2020. Jobs in the leisure and hospitality sector grew by just 23k and the sector remains 1.3mn jobs below the pre-pandemic levels on Covid concerns.

- Private sector added 534k jobs in Nov from a downwardly revised 570k hike in Oct. As always, the leisure and hospitality sector led the gains (136k) while the professional and business sector added 110k jobs.

- Initial jobless claims increased to 222k in the week ended Nov 26th: the previous week’s total was revised down further to 194k 4-week average slowed to 238.75k from 251k the week prior. Continuing claims fell by 107k to 1.956mn in the week ended Nov 19, still above pre-pandemic levels of 1.7mn.

- The Fed beige book reported that economic activity grew at a modest to moderate pace in most Fed districts. However, businesses cited “widespread” price hikes and “persistent difficulty in hiring and retaining employees” as the labour shortage continued.

- Factory orders grew by 1% mom in Oct, from an upwardly revised reading of 0.5% in Sep. Orders for non-defense capital goods climbed by 0.7%.

- Pending home sales increased by 7.5% mom in Oct, reversing the decline from Sep. However, housing inventory at end-Oct stood at 1.25mn units, representing a low 2.4-month supply, and is down 0.8% mom and 12.0% yoy.

- Dallas Fed manufacturing business index dropped to 11.8 in Nov (Oct: 14.6) though demand for goods remained strong – new orders index rose to 19.6, and the growth rate of orders index climbed to 16.8. Raw materials prices index hit a new series high and the finished goods prices index, at 42.2, exceeds its historical average of 7.6.

- S&P Case Shiller home price indices eased in Sep, for the first time since May 2020: prices were up by 19.1% yoy in Sep, but down from Aug’s 19.6% rise.

- Chicago PMI fell to 61.8 in Nov (Oct: 68.4) – the lowest reading since Feb 2021 – as the new orders index fell to 58.2 (Feb’s reading) while inventories jumped to the highest since fall 2018 (59.6) and the employment sub-index declined to 51.6.

- ISM manufacturing PMI inched up to 61.1 in Nov (Oct: 60.8), supported by the uptick in new orders (61.5 from 59.8) and employment (53.3 from 52) while prices paid slowed to 82.4 (Oct: 85.7). Services PMI grew to a record-high of 69.1 in Nov (Oct: 66.7): new orders stayed unchanged at a record-high 69.7 while employment ticked up to a 7-month high of 56.5.

- Markit manufacturing PMI slipped to an 11-month low of 58.3 in Nov (Oct: 58.4): New sales growth continued to outpace production growth while input costs rose at the fastest pace on record in Nov (given supplier delays and shortages). Services PMI eased to 58 in Oct (Sep: 58.7) but was higher than the flash estimate of 57 and the series average of 54.8.

Europe:

- Core CPI in the eurozone increased to 2.6% in Nov (Oct: 2.0%), touching the highest rate since Mar 2002. The headline inflation rate rose to 4.9% from 4.1% the month before, driven by an increase in energy prices (27.4%). Producer price in the eurozone increased by 21.9% yoy in Oct (Sep: 16.1%) – the largest ever yearly increase. These record high rises add pressure on ECB to reduce stimulus.

- Inflation in Germany, measured by the harmonized index of consumer prices, increased to 6% yoy in Nov (Oct: 4.6%). Energy prices were the main culprit of the uptick, rising by 22% yoy but costs of food, services and rents were also up by 4.5%, 2.8% and 1.4% respectively.

- The euro area’s Economic Sentiment Indicator eased by 1.1 points to 117.5 in Nov with the employment expectations gaining by 1.7 points to 117.5 (the highest since Jan 2018). The European Commission’s consumer confidence in the euro area dropped to -6.8 (Oct: -4.8).

- Eurozone’s manufacturing PMI inched up to 58.4 in Nov (Oct: 58.3), but lower by 0.2 points from the preliminary estimate; output price inflation touched a fresh record high. The services PMI (up by 1.3 points to 55.9) outperformed manufacturing for a 3rd consecutive month, thereby supporting the composite PMI to rise to 55.4 from Oct’s 6-month low of 54.2. Business confidence weakened to a ten-month low in Nov.

- Manufacturing PMI in Germany slipped to a 10-month low of 57.4 in Nov (Oct: 57.8); supply issues continue with 59% of surveyed businesses reported longer lead times on inputs (vs. long-run average of around 16%). While there was a slight increase in services PMI (to 52.7 from 52.4), the 4th Covid wave is dampening confidence and inflationary pressures remain strong with new highs in both input cost and output prices. Services supported the uptick in composite PMI by 0.2 points to 52.2 from the previous month’s 8-month low. Business confidence was the weakest since Oct 2020, given concerns about the pandemic, a loss of confidence among service providers and rising inflation.

- German unemployment rate eased to 5.3% in Nov (Oct: 5.4%). The number of unemployed fell by 34k to 2.428mn, bringing the total jobless level to the lowest since Mar 2020.

- Retail sales in Germany fell by 0.3% mom and 2.9% yoy in Oct (Sep: -0.6% yoy). Eurozone’s retail sales grew by 0.2% mom and 1.4% yoy in Oct (Sep: 2.6% yoy).

- UK’s manufacturing PMI climbed to 58.1 in Nov (Oct: 57.8), thanks to domestic orders while new export businesses fell for the 3rd consecutive month (given lower demand from China and disruptions to trade with EU). Robust rebound in export sales supported services PMI in spite of a dip in the headline reading to 58.5 (Oct: 59.1) while input costs and prices charged increased at record rates.

Asia Pacific:

- China’s NBS manufacturing PMI improved to 50.1 in Nov (Oct: 49.2), with output rising to 50.2 while new orders, export sales and employment stayed below 50 though falling at slower rates. Non-manufacturing PMI edged down slightly to 52.3 from 52.4 the month before, though new export orders shrank for the eighth straight month (47.5).

- Caixin manufacturing PMI in China slipped below 50 in Nov, falling to 49.9 from 50.6 in Oct. This is the second time the index has slipped into contractionary territory since Apr 2020. Export sales and employment remained under-50 for the 4th month in a row while new orders fell; the one silver lining was that output grew for the first time in 4 months.

- Japan’s manufacturing PMI moved up by 1.3 points to 54.5 in Nov, posting the strongest pace of growth since Jan 2018, supported by quick pace of growth in both output and new orders. Input price inflation was pushed to the highest since Aug 2008. Services PMI showed the strongest rise in activity in 27 months, as the reading jumped to 53 (Oct: 50.7) and new orders moved to growth for the first time since Jan 2020.

- Retail trade in Japan rebounded by 0.9% yoy in Sep (Aug: -0.5%). In mom terms, it ticked up by 1.1% (Aug: 2.8%)

- Unemployment rate in Japan inched down to 2.7% in Oct (Sep: 2.8%). the number of unemployed remained 1.82mn people in Oct – a yoy decrease of 320k persons or 14.9%. Jobs to applicant ratio slowed to 1.15 from 1.16.

- Industrial output in Japan grew by 1.1% mom in Oct – rising for the first time in 4 months – supported by auto production (+15.4%). However, in yoy terms, industrial production fell by 4.7% yoy in Oct (Sep: -2.3%).

- India’s Q3 GDP increased by 8.4% yoy in Jul-Sep 2021, with agriculture and industry rising by 4.5% and 5.5% respectively.

- Manufacturing PMI in India rose to 57.6 in Nov (Oct: 55.9), above the long-run average of 53.6, with businesses citing “strengthening demand, improving market conditions and successful marketing” for increased sales. Services PMI inched down to 58.1 in Nov (Oct: 58.4), with input costs rising at the second-strongest since late-2011.

- Singapore PMI eased to 52 in Nov (Oct: 52.3): private sector output rose for the 12th straight month while foreign demand growth surged to a record rate.

- Retail sales in Singapore grew by 0.7% mom and 7.5% yoy in Oct, supported by mobile phone sales. Excluding motor vehicles, retail sales grew by 11.4% yoy.

Bottomline: As the world assesses the effects from the fast-spreading Omicron variant, OPEC+ went ahead with an oil output hike last week, adding 400k barrels per day in Jan. It however left the door open for a meeting prior the scheduled one on Jan 4th should the market demand it (for e.g. if the Omicron variant and related restrictions drive down demand for oil sharply). Separately, global manufacturing PMI has increased for 17 consecutive months, with the Nov reading at 54.2. Only 4 of the 30 nations tracked – China, Brazil, Mexico and Myanmar – posted a contraction. But supplier delays and input shortages continued while inflation pressures remain elevated, calling into question monetary policy moves from the major central banks. Monetary tightening would hurt emerging market nations that are still recovering from the previous Covid19 hit.

Regional Developments

- The GCC will grow at 2.6% yoy this year, according to the World Bank’s latest update, thanks to rebounds in both the oil and non-oil sectors. It highlighted the large public sector wage bills as a threat to the fiscal stance and a potential drag on private sector growth. More: https://thedocs.worldbank.org/en/doc/3811022f45f220da3ebf3bf669529ec2-0280012021/original/Gulf-Economic-Update-Dec2.pdf

- Bahrain’s Economic Development Board launched the investment platform invest.bh allowing investors to access investment opportunities, covering industrial, infrastructure, tourism and housing projects.

- Egypt’s non-oil commodity exports surged by 40% to USD 29.7bn in Jan-Sep 2021 while imports grew by 16% yoy to USD 61bn. Exports to the G20 nations crossed USD 14bn while EU states exports touched USD 9.6bn. As for imports, China (16%), Saudi Arabia (8%) and Germany (7%) accounted for the top source nations.

- Egypt’s exports to Spain increased by 66.7% yoy to USD 937.5mn in Jan-Aug 2021. Value of Spanish investments in the country grew by 12.5% to USD 24.3mn in Q1 of the fiscal year 2020-2021. Remittances from Spain dropped by 15.2% to USD 13.9mn in 2019-2020.

- Over the next 4 years, Egypt plans to increase exports to Africa to USD 15bn from USD 5bn a year, according to the minister of planning. This is in line with the nation’s strategy to raise global exports to USD 100bn annually.

- Egypt’s Financial Regulatory Authority approved a draft amendment to the Capital Markets Law that adds four new financing tools – social bonds, sustainable development bonds, ESG bonds, and gender equality and women’s empowerment bonds.

- The ministry of planning and economic development reviewed targets of Egypt’s tourism sector for the current fiscal year: investments in the sector is estimated to surge by 64% yoy to EGP 8.5bn in 2021-2022.

- Egypt authorized on Pfizer’s Covid19 vaccine for children aged 12-15, lowering the minimum age for eligibility to receive the vaccine.

- The IMF expects Iraq’s non-oil sector and overall growth to rebound by 12% and 3.6% respectively this year, alongside significant improvement in both fiscal and external current account balances (from double-digit deficits in 2020).

- The Oman Investment Authority announced 13 national projects last week, valued together at a total of OMR 3.5bn. This covers key sectors including energy, food security, manufacturing, mining, health and tourism services.

- GCC’s listed firms’ financial earnings increased to a record high USD 55.5bn in Q3 2021, up 23% qoq and more than double in yoy terms, according to a Kamco Invest report. Profits were highest in the energy sector (+19% qoq) followed by banking and transportation sectors.

- The WHO disclosed that seven Eastern Mediterranean nations have vaccine coverage of less than 10%, making them a high-risk setting for potential future variants.

Saudi Arabia Focus

- FDI inflows into Saudi Arabia increased by 56% yoy to USD 1.4bn in Q2 2021. In H1 2021, FDI grew by 33% yoy (excluding Aramco’s USD 12.4bn infrastructure deal) and is already above targets for the year, according to the investment minister.

- Saudi Arabia’s net foreign assets declined by 3.3% mom and 2% yoy to SAR 1.63bn in Oct. Separately, government reserves dipped by 15.6% yoy and 0.3% mom to SAR 354.6bn.

- Real estate loans to Saudi individuals increased by 7.2% yoy to SAR 412.6bn in Q3, according to SAMA data. Together, both retail and corporate customers were provided with SAR 533.4bn in loans by Saudi banks in Q3.

- Bank lending to the private sector in Saudi Arabia grew by SAR 24.1bn or 1.2% mom to SAR 2trn in Oct. Credit disbursed to SMEs slowed in Q3: loans to SMEs grew by 12.9% to SAR 186.2bn in Q3 (Q2: 25.3%).

- Saudi Arabia issued licenses to 16 fintech firms in Q3 2021, 13 of whom work in payments and electronic wallets while the other 3 are in the insurance and finance sector.

- The Ministry of Industry and Mineral Resources issued 60 new industrial licenses in Oct, with a volume of investments surpassing SAR 1.5bn (+0.18% mom). Food products industry firms obtained 10 licenses followed by 7 for non-ferrous metal products manufacturing. The industrial sector contributed to the employment of 8,630 workers in Oct.

- By launching 100 projects and 34 initiatives, Saudi Arabia’s Heritage Commission plans to create opportunities for private investments into the sector.

- Saudi Electricity Co will transfer the ownership of its subsidiary Saudi Procurement Co to the government as part of a wider restructuring of the electricity sector.

- S&P introduced a national credit rating scale for Saudi Arabia and will identify the creditworthiness of local loan takers.

UAE Focus![]()

- The French President’s visit to the UAE resulted in the signing of multiple agreements: UAE ordered 80 Rafale fighter jets and 12 military helicopters, to be delivered from 2027 onwards; Abu Dhabi state holding company ADQ signed an investment agreement worth EUR 4.6bn with the French ministry of economy and finance; sovereign wealth fund Mubadala agreed to invest EUR 1.4bn (USD 1.58bn) in French funds.

- Petrol and diesel prices will inch down by 1.0-1.4% mom in Dec, according to the UAE’s fuel price committee.

- Visitors to the Expo totaled 4.77mn as of Nov 28th: multiple promotions including the November Weekday Pass resulted in attracting more guests; a new Festive Pass valid till end-Dec along with National Day celebrations is likely to clock in a good reading in Dec as well.

- Hotel occupancy rates in the UAE surged to 78.8% in Oct, the highest Oct reading since 2015, according to CBRE. Dubai’s hotels posted the highest occupancy rates (80.7%), while hotel room rates and revenue per available rooms jumped by 13.6% and 44.9% in UAE.

- Real estate deals in Dubai touched AED 3.2bn (USD 871mn) from 1186 deals in the last week of Nov, with the highest value transaction at AED 60mn for land sold in Island 2.

- ADNOC’s board approved plans for the company to spend AED 466bn (USD 127bn) between 2022 and 2026; one-third of the funds will be directed towards the local economy.

- UAE signed an agreement to invest up to USD 6bn in Kazakhstan’s energy sector: it will explore three new power generation projects in Kazakhstan including one PV power plant, a wind farm and a combined cycle gas power plant.

- Dubai private school enrolments are climbing to pre-pandemic levels: data show 289,019 pupils were enrolled in 215 schools at the start of the new academic year, up from 279,191 for the 2020-21 term. This compares to 295,148 children studying at 208 schools in 2019-20.

- UAE updated Green Pass Protocol on the Al Hosn app: starting from Dec 5th, a negative PCR test validity will be reduced to just 14 days instead of the current 30 after which the status will turn grey (restricting access to many public places).

- UAE approved over 40 new laws and legislative amendments, in its largest ever legislative reform: this includes a Law on Commercial Companies that will allow for SPVs and SPACS supporting the listing of companies as well as M&As as well laws like Crime and Punishment Law, the Online Security Law and Electronic Transactions and Trust Services among others.

Media Review

The race to decipher Omicron: FT’s Big Read

https://www.ft.com/content/e742a4bf-3e72-4551-bf72-df73cb35436f

Can the Fed Overcome Its Transitory Policy Mistake?

Iran nuclear talks break, Europe, U.S. dismayed by Iranian stance

Leaving Lebanon: Crisis Has Most People Looking for Exit

https://news.gallup.com/poll/357743/leaving-lebanon-crisis-people-looking-exit.aspx