Weekly Insights 25 Nov 2021: Will Inflation Derail Current Pace of Global Economic Recovery?

1. Preliminary PMIs for Nov are mostly up: but, the pace is slowing. Higher costs are being passed on to consumers: brace for continued inflation

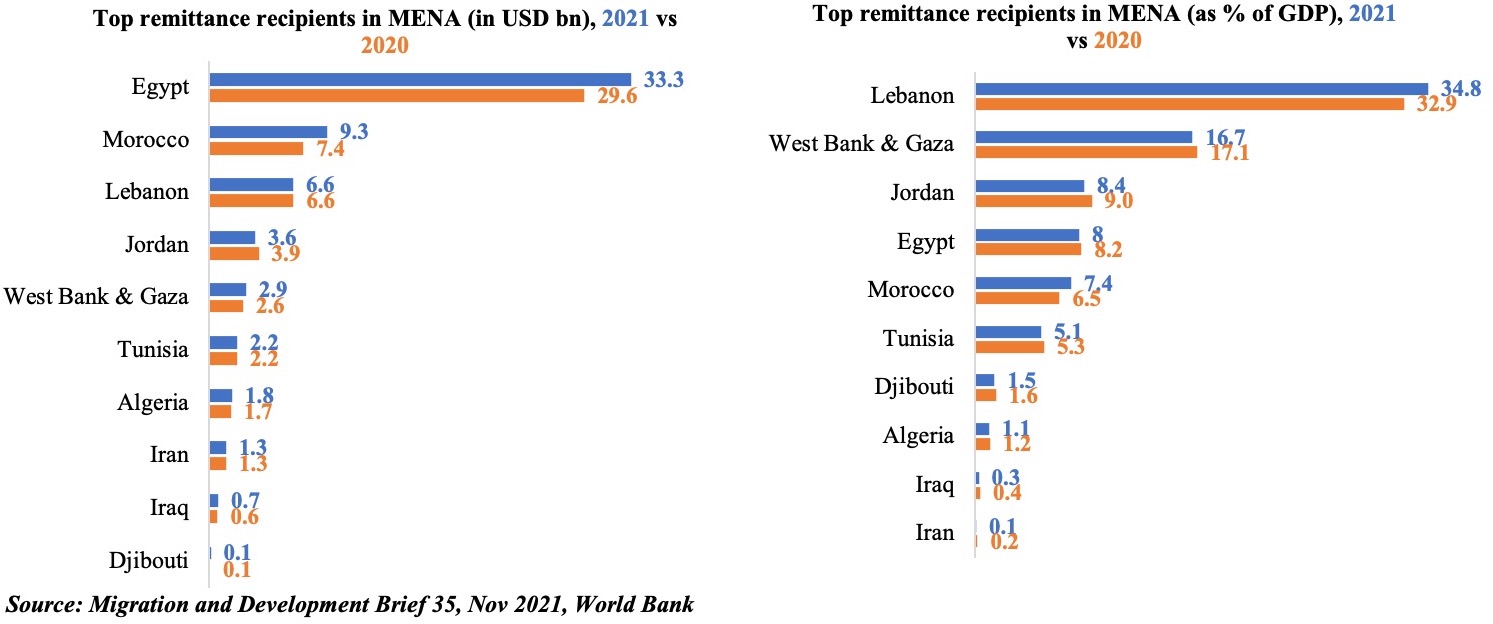

- The preliminary PMI data (Nov) are out for select countries. The main messages are: (1) the pace of growth is easing; (2) inflation continues to be a concern given supply chain bottlenecks (though retail sales data seem to suggest strong demand and early “holiday season” shopping sprees); (3) given that higher costs are being passed on to consumers, (core) inflation will continue to tick up.

- Other than Germany, all other PMI readings have edged up in Nov (table below). The eurozone has performed better than expected; but the survey was conducted prior to the resurgence of Covid cases (compared to a week ago, numbers are up by 30% in Germany, 59% in Spain and 83% in France vs UK’s 8% rise, as per FT’s analysis on data from national health ministries – the rollout of and uptake of booster shots seem to have helped the UK). So, the final reading might be tweaked in places that have introduced new restrictive measures.

- South Korea became the latest central bank to hike rates this morning, raising its interest rate by one percentage point to 1% (this is its 2nd hike, over concerns of inflation and rising household debt). New Zealand also raised rates for the second time yesterday – rates are up to 0.75%.

2. Food & raw material prices have been on the rise; shipping costs too!

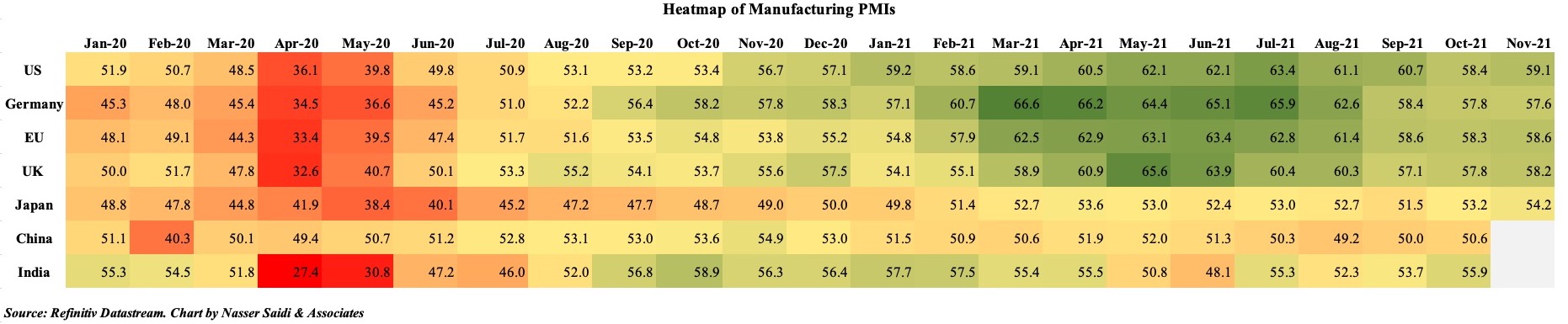

- Not only have food prices been on the rise globally, but also metal and industrial input prices

- The increase in shipping costs will result in further inflationary pressures. An UNCTAD report found that a sustained uptick in freight rates will likely raise global consumer prices by an additional 1.5% between now and 2023. Furthermore, import-dependent developing nations will likely bear the brunt of these higher shipping costs (More: https://unctad.org/system/files/official-document/rmt2021_en_0.pdf)

- Sea-Intelligence forecasts that it could take up to 30 months for the rates to return to normal

- While high value products can be sent via air freight, it tends to be more expensive. But the speed will partially support meeting peak season demand, especially as capacity in the belly of passenger aircraft improves (Sep showed the least decline in such capacity since the start of the crisis)

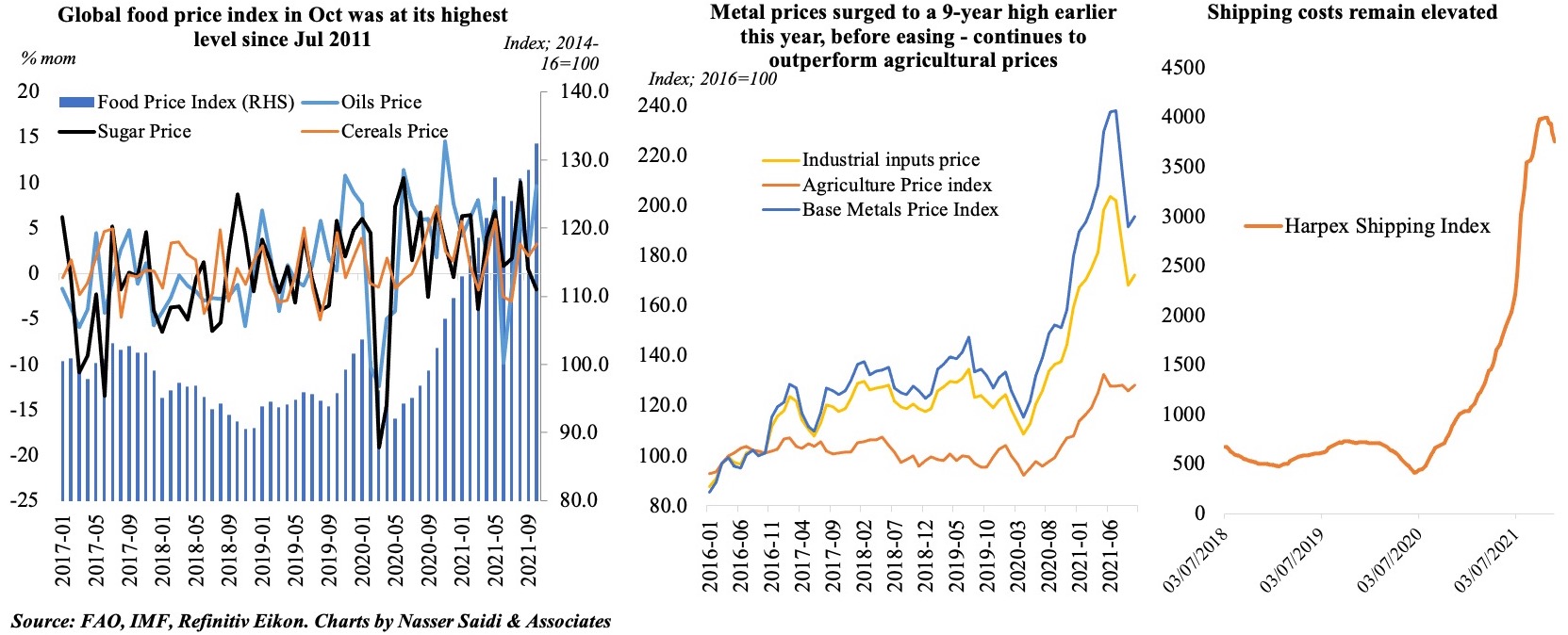

3. Global trade to grow by 10.8% in 2021 (WTO), with large regional disparities; air freight indicator remains above trend

- Middle East is projected to have one of the weakest recoveries on both the exports & imports side

- Oil-dependent exporting nations have only partially recovered losses from 2020

- The Goods Trade Barometer, a leading indicator, dropped to 99.5 in Sep – likely a combination of disruptions in production, supply chain issues and a potential ”tapering” of import demand

- All drivers of goods trade declined in Sep compared to the previous period. Air freight remains above trend, as exporters used it as an alternative (as highlighted in the previous slide)

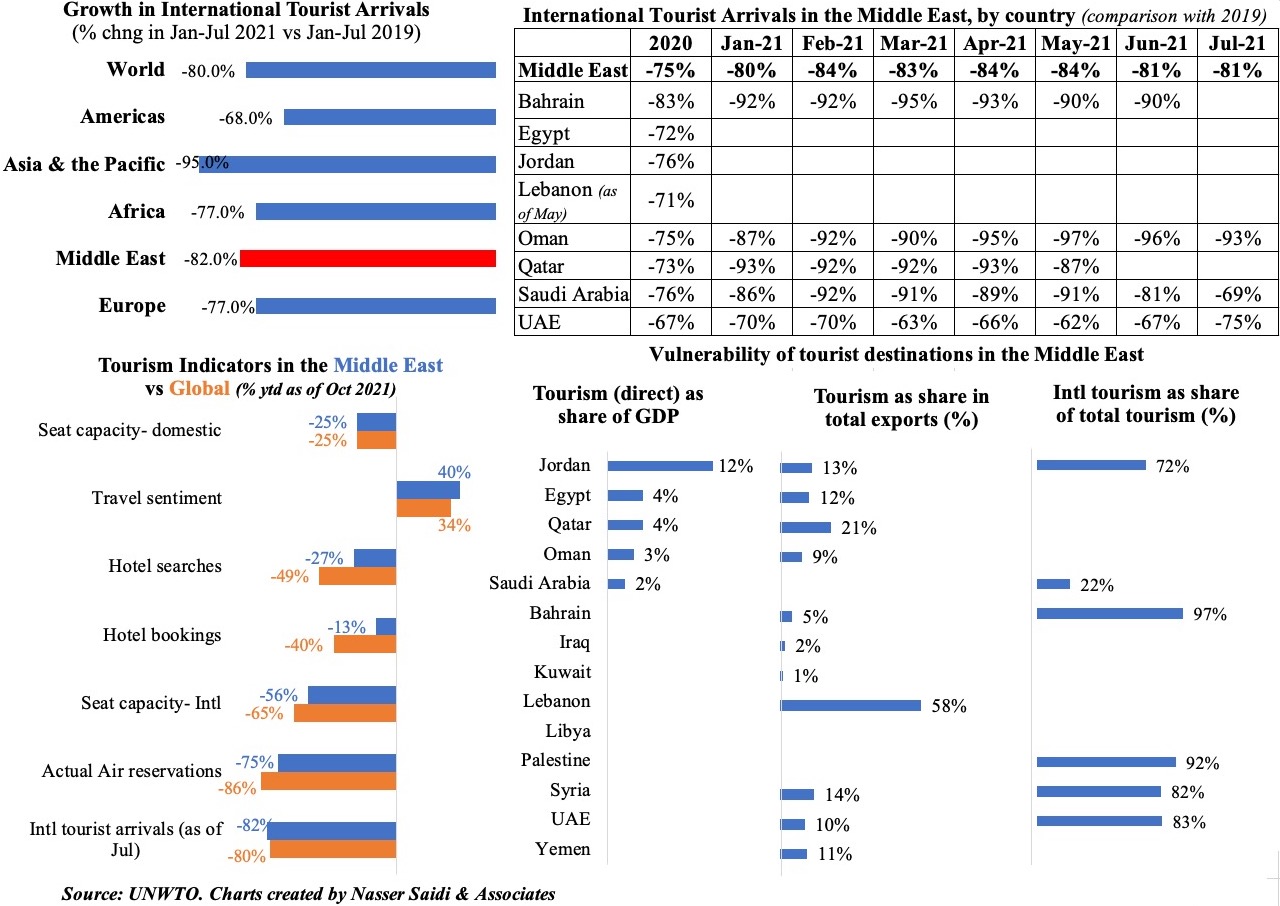

4. Persistent weakness in international travel =>Middle East’s tourism-dependent nations will take longer to recover

5. Remittances rise in MENA during 2020 and 2021, supported by recovery in the GCC & EU nations

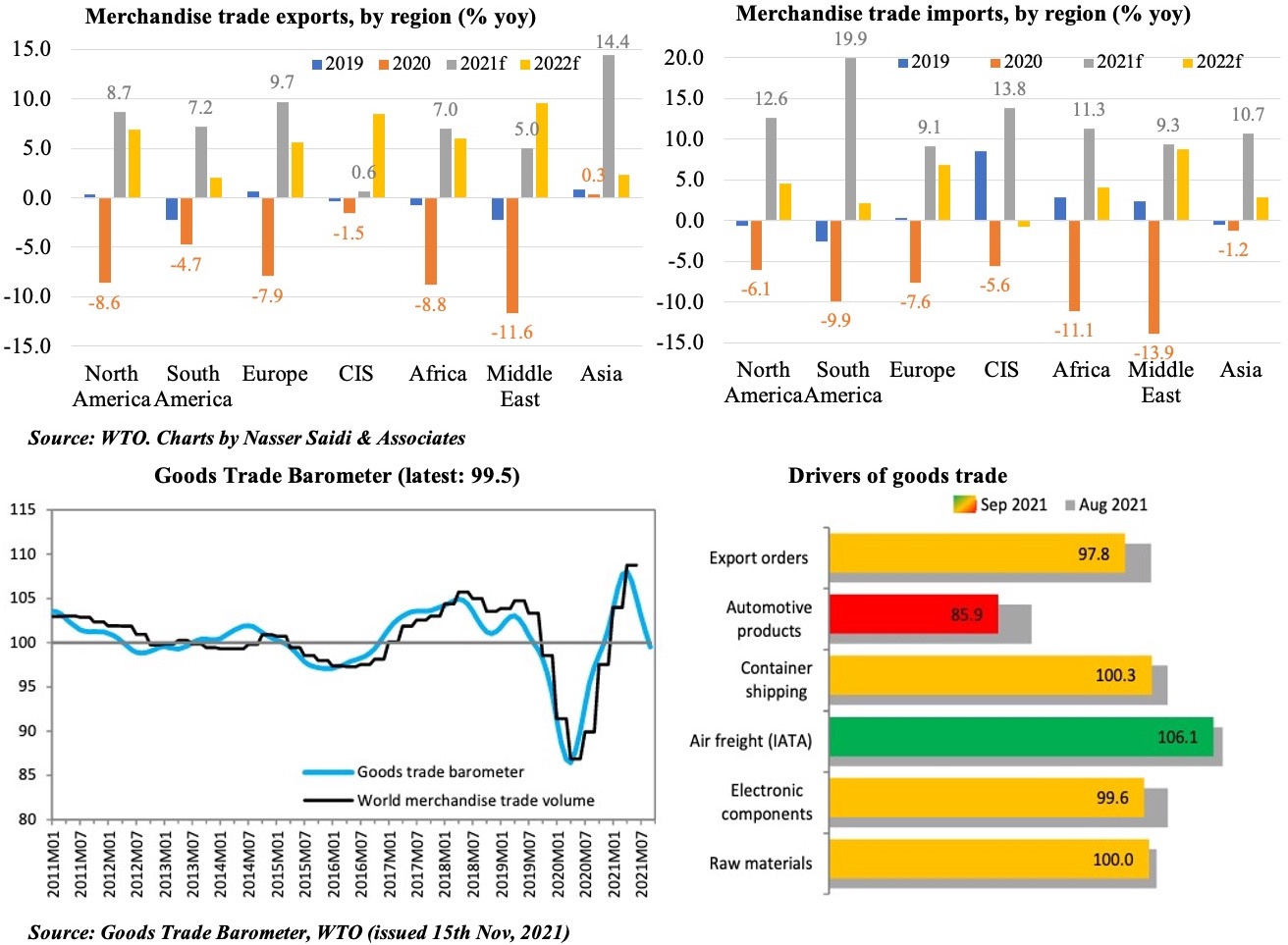

- The latest World Bank report estimates a resurgence in remittance flows to USD 774bn globally in 2021 – also posting the strongest growth (+6.5% yoy) since 2018. Remittance flows to low-and middle-income regions (excluding China) is more than 50% higher than FDI & more than threefold official development assistance flows!

- Remittances into the MENA region’s low- and middle-income countries grew by an estimated 9.7% to USD 6.2bn this year. A recovery in the GCC and EU (e.g. France, Spain) has aided this increase (till H1 2021)

- Egypt emerged as the top remittance recipient in the MENA region (by value), given its strong ties to the GCC and other Arab nations. Morocco’s remittances are supported by US, Saudi and France (14%, 12% and 10% respectively). Lebanon, West Bank and Gaza and Jordan are more dependent on remittances (% of GDP) to support domestic consumption and also to increase international reserve levels

- (by value), given its strong ties to the GCC and other Arab nations. Morocco’s remittances are supported by US, Saudi and France (14%, 12% and 10% respectively). Lebanon, West Bank and Gaza and Jordan are more dependent on remittances (% of GDP) to support domestic consumption and also to increase reserve levels